- The Madbouly Cabinet to be sworn in today, state-owned Al Ahram says. (What We’re Tracking Today)

- Egyptian Refining Company fires up boilers after connecting refinery to power and gas. (Speed Round)

- Rising oil prices unlikely to affect Egypt the same way they did Jordan –Templeton’s Khatoun. (Speed Round)

- Uber and Careem now have to charge VAT, remit it retroactively. (Speed Round)

- Listed companies will have to submit FS, auditor’s report to FRA at least a month before general assembly. (Speed Round)

- EEHC signs USD 900 mn syndicated loan, underscoring foreign lenders’ appetite for Egypt. (Speed Round)

- Egypt is safer than the US and the UK, the 2018 Global Law and Order Report finds. (Speed Round)

- There’s a lesson to learn from China’s investments in African infrastructure. (The Macro Picture)

- World Cup kicks off today, Egypt meets Uruguay at 2 pm CLT tomorrow. (Spotlight)

- The Market Yesterday

Thursday, 14 June 2018

Happy Eid, ladies and gentlemen. We’ll see you next on Tuesday.

TL;DR

What We’re Tracking Today

And so it ends. Heading into a four-day Eid weekend, we would like to thank each and every one of you for spending some time with us this past month. We hope that you’re all looking forward to a four day break with family and friends. We’re off on Sunday and Monday (banks and the EGX will be closed) and will be back in your inbox on Tuesday morning.

Enterprise is also taking a day off a week from today. We’re not publishing next Thursday to allow our English and Arabic editorial teams from both the night and day shifts to spend some quality time together and talk about what’s next for Enterprise.

Expect warm weather this weekend in the capital with a high of 41°C tomorrow and Saturday — and cooler weather on the Mediterranean coast. Tomorrow will be hot in Sahel with a high of 37°C, but you can expect sunny skies and temps of 29-30°C Saturday through Monday. Pack sunscreen.

So, when do we eat? For those of us observing, Maghrib is at 6:57 pm CLT today. Eid prayers will be at about 5:18 am CLT tomorrow in Cairo.

The Madbouly Cabinet is expected to be sworn in today, government sources said yesterday, Al Masry Al Youm reports, but we still have no clue who, exactly, is in and who’s out. We’re still seeing the same speculative reports, with the latest from state-owned Al Ahram suggesting that our friends Finance Minister Amr El Garhy and Trade and Industry Minister Tarek Kabil are both leaving government service, as are Local Administration Minister Abu Bakr El Gendy, Health Minister Ahmed Rady, and Agriculture Minister Abdel Moneim El Banna. Some in the local press are also suggesting that the new lineup will see more women ministers.

Fed hikes interest rates by 0.25 bps, hints at two more increases in 2018: The US Federal Reserve’s Federal Open Market Committee decided yesterday to hike key overnight borrowing costs by 0.25 percentage points to a range of 1.75-2%. Noting higher economic growth forecasts, the Fed also hinted at two more potential interest increases this year, foregoing a “pledge to keep rates low enough to stimulate the economy,” Reuters says. “Most people who want to find jobs are finding them. Unemployment and inflation are low…The overall outlook for growth remains favorable,” Fed Chairman Jerome Powell said at a press conference, adding that “steady rate increases would nurture the expansion” as the Fed moves towards its targets for inflation and employment.

Expect weaker EM currencies. Emerging market currencies were falling against the greenback even before the Fed’s announcement, according to the FT. “The probability attached to two more hikes is likely to rise and push the USD higher in tandem,” HSBC Securities USA’s Daragh Maher also tells Reuters. Just last month, the possibility of higher interest rates and a surging USD, coupled with flaring geopolitical tension, helped spark a major sell-off in emerging markets.

Bear market for world’s biggest banks? “More than a dozen of the world’s biggest banks have slipped into a bear market, highlighting risks to the global economy even as equity indices reach new highs and the Federal Reserve prepares to raise interest rates.” Sixteen of the 39 banks deemed “too big to fail” are down more than 20% from their recent peaks in USD terms. (Financial Times)

“Swift turn of fortunes pushes Abraaj to the edge”: That’s the headline atop the latest in the Financial Times on the meltdown of the once high-flying emerging markets private equity group. The piece is a must-read for anyone with an interest in PE, with two key takeaways — one general, and one Abraaj-specific:

General takeaway: Anyone raising funds in (or for) MENA is going to face tougher questioning from folks with capital to allocate. That questioning will be even tougher if you’re a local player trying to raise for PE. Quoth the FT: “A boutique firm executive said: ‘This is impacting us all. Our investors are turning against us and raising new funds is a nightmare.’”

Abraaj-specific takeaway: The problems began when Abraaj moved beyond what it knew best. “The cash crunch emerged after Abraaj’s 2012 acquisition of Aureos Capital launched the Middle Eastern investor on to the global stage. Travel costs took off — including the expense of a private jet until it was sold two years ago — as partners flew between 20 global offices. Management fees have for several years failed to cover costs by mns of USD a year.”

The US could roll out tariffs on as much as USD 50 bn worth of Chinese goods as early as tomorrow, the Wall Street Journal writes. The move “is likely to spark heavy retaliation from Beijing,” the newspaper notes. The Trump administration had suggested back in early April that it was eyeing tariffs on about USD 50 bn worth of Chinese goods. The move is expected even as US Secretary of State Mike Pompeo is due in China today to seek support for The Donald’s talks with North Korea, the Financial Times adds.

Russian President Vladimir Putin is expected to talk ways to boost oil production with Saudi Crown Prince Mohammed bin Salman today when the pair meet in Moscow to watch their respective national teams face off against each other at the World Cup opener, which the FT says could be the tournament’s “worst game ever.” “The world’s largest oil exporters are negotiating how to rework their unprecedented, and successful, [pact] to control oil production as US sanctions on Iran and the collapse of the Venezuelan petroleum industry threaten to send crude skyrocketing,” says Bloomberg. Both countries are working on a plan that could see them collectively pump out an additional 1 mn bbl/d, “although Riyadh prefers a smaller increase.” Analysts are saying that an output increase by the world’s four main oil producers is “inevitable.” The cup, Putin said, is the ultimate networking event for heads of state.

FROM OUR TWITTER FEED:

@eaamalyon, on the best-ever use of Google Translate by a journalist: Great stuff: France press officer says only questions in French to avoid Spanish media asking Griezmann about transfers. Spanish journalist uses google translate app to ask question, French press officer loses it….

@netflix does the right thing: Some fans have noticed that Anthony Bourdain: Parts Unknown was scheduled to come off Netflix US on June 16. As of today, we’ve extended our agreement that will keep Parts Unknown on the service for months to come.

@BenjySarlin on what could be one of the defining images of our time: I’m not sure it’s possible to capture an entire era in one image, but Dennis Rodman running a cryptocurrency grift on live TV from the North Korea summit while wearing a MAGA is a serious nominee

Speaking of The Worm, Trump and Kim: Watch the fake movie trailer that The Donald showed the dude from DPRK, casting the two leaders as superheroes about to save the world (watch, runtime: 4:13).

In other miscellany this morning:

The biggest IPO you’ve never heard of is of a European fintech company called Adyen and valued the company at USD 8.3 bn when shares began trading on Euronext Amsterdam yesterday. The company is a payments processor and counts Netflix, Facebook and Spotify among its clients. It also sells POS systems for physical stores. (CNBC)

Erdogan faces a tight fight to keep power as a poll suggests the 2018 general election getting closer with just 10 days left to go. (Bloomberg | Haaretz | Washington Post)

Legendary emerging markets investor Mark Mobius isn’t big on Saudi Arabia as things stand, saying recently, “We are not necessarily bullish on Saudi stocks, simply because the range of offerings is limited and a number of restrictions are still in place. Many difficulties remain for Saudi market entry.” (Bloomberg)

Antarctica is melting three-times as fast as a decade ago. (New York Times)

This whole electric scooter thing? It’s a bubble, folks. (New York Times)

Apple is closing a hardware loophole that has allowed some police forces and intelligence services to hack iPhones. (Reuters)

Toyota will be investing USD 1 bn in South East Asian ride-hailing app Grab, according to CNN. The move is being hailed as the largest investment by an auto company in the ride-hailing apps space.

Yahoo Messenger will be shutting down on 17 July, the company said.

Spotlight on the 2018 World Cup

Egypt signs World Cup sponsorship agreement with FIFA

The World Cup kicks off today: The world’s most-watched sports event will kick off in a few hours, with the first match being played between Russia and Saudi Arabia. You can tap or click here for the full World Cup schedule.

Saudi meets Russia at 5pm today.

Egypt meets Uruguay at 2pm CLT tomorrow.

Mo Salah back in training: The star striker returned yesterday to light training with his teammates for the first time since his shoulder injury last month, according to the Egyptian Football Association (EFA). He also took part in individual training supervised by the national team’s physiotherapist (watch, runtime: 01:18). Although the final decision has not been made, Reuters reports that team coach Hector Cuper is “optimistic” that he will make it to Egypt’s first World Cup match against Uruguay tomorrow, which also marks his 26th birthday.

With Salah back on his feet, Egypt is seen as the Arab region’s standard bearer at the World Cup among Arab youth, according to Gulf News. More than a third of young Arabs polled believe Egypt will get further in the championship than Morocco, Saudi Arabia, and Tunisia, and around 11% said they would support Egypt — “making the Pharaohs almost as popular as Argentina (12%).”

Veteran goalkeeper Essam El Hadary is also on track to make history by breaking the Guinness World Record for the oldest player to ever participate in the World Cup.

Meanwhile, Egypt has signed on with FIFA to become an Official Regional Supporter of the 2018 FIFA World Cup in Russia, the Investment Ministry announced in a statement. The “Egypt — Experience & Invest” campaign aims to promote the country as a global investment destination and attract more tourists through social media and on screens broadcasting the World Cup games on Russian streets.

Listen to this: Russian harpist play Egypt’s national anthem

Listen to this: Russian harpist play Egypt’s national anthem: Russian composer Sasha Boldachev played Egypt’s national anthem as part of the festivities in the build-up to the cup (watch, runtime: 01:00).

Looking ahead: The US, Canada, and Mexico will jointly host the 2026 FIFA World Cup after beating a surprisingly strong rival bid from Morocco, BBC reports. “The 2026 tournament will be the biggest World Cup ever held — with 48 teams playing 80 matches over 34 days.”

On The Horizon

White House special adviser Jared Kushner and US Middle East envoy Jason Greenblatt are scheduled to visit Egypt while on a Middle East tour that starts next week, the US National Security Council said yesterday. The officials will also visit Israel and Saudi Arabia to talk over the next stages of Arab-Israeli peace efforts, according to the AP. The US administration is currently finalizing a new plan for Palestinian-Israeli peace “with an eye on a possible release this summer.”

This coming Sunday is father’s day in Canada, Ireland, Mexico, the UK and the United States, among other countries. Not in Egypt, though: Depending on who you ask, Egypt (a) doesn’t have Father’s Day or (b) celebrates it on Thursday, 21 June.

Enterprise+: Last Night’s Talk Shows

Talk shows have been off for the holy month. We’ll be back with our regular report after the Eid break.

Speed Round

Egyptian Refining Company fires up boilers after connecting refinery to power and gas: Qalaa Holdings’ Egyptian Refining Company (ERC) has begun running the USD 4.3 bn Mostorod refinery’s boilers, Qalaa said in a regulatory filing on Wednesday (pdf). The trial runs took place as the refinery was hooked up to electricity and gas, the statement added. The move comes ahead of the launch of trial operations at ERC, which Qalaa Holdings Chairman Ahmed Heikal said would take place in November. Qalaa had said in its most recent earnings statement that the refinery, Egypt’s largest in-process private-sector megaproject, would be up and running by 2019.

The rise in oil prices is unlikely to affect Egypt the same way it did Jordan, Franklin Templeton Emerging Market Equity MD Bassel Khatoun tells Bloomberg in an interview (watch, runtime: 8:36). “Egypt has done a great job at being able to bring down inflation to its lowest level of about 11.6%, which has enabled the central bank to cut [interest] rates,” Khatoun said. He explains that the hikes in energy and electricity prices, which are expected to come at the start of the new fiscal year “have been widely positioned” in the past and that expected economic growth in Egypt should help balance out the impact of higher oil and energy prices.

As for the recent selloff in Egyptian stocks, Khatoun explained that it was “in line with the broader EM selloff where countries that have a higher degree of dependency on external borrowing did sell off.”

IPO WATCH- Three investment banks are reportedly pitching to advise Eastern Tobacco on its sale of an additional 4% stake on the EGX, sources tell Al Mal. Among the three, sources named our friends at Pharos Holding and AAIB’s Arab African Investment Holding. The rival firms have reportedly met with Eastern Company’s parent corporation, the state-owned Chemical Industries Holding Company (CIHC). Public Enterprises Minister Khaled Badawy had told us earlier this week that the CIHC was seeking advisers on the sale, which would take place later this month, after the Eid El Fitr break, making it the first state company to sell shares as part of the state privatization program.

House told hold hearing on privatization program? Meanwhile, the House of Representatives’ Economy Committee is planning to invite members of the Council of Ministers to hearings on the privatization program, parliamentary sources said. Parliament appears to be urging that the program get underway, having insisted in a report on the FY2018-19 budget that the program get started as soon as possible.

Uber and Careem now have to charge VAT on rides, remit VAT retroactive to when tax first came into effect: The Tax Authority issued a directive to that will require ride-hailing apps including Uber and Careem to charge VAT on the potion of revenue that they take from each ride. Under the directive, “Uber and companies like it” will pay a retroactive VAT of 13% from September 2016-June 2017, and 14% VAT from July 2017 onwards. There’s no change in the tax treatment of drivers: According to a copy of the directive, which ran in Al Mal, the driver’s share of revenue from rides will not be subject to VAT. Uber takes a 20% share of the revenue from each ride.

Another day, another FRA regulatory change — this one gives you more paperwork to file ahead of your AGM: The flurry of regulatory changes from the FRA continues. The latest: Listed companies must now submit their full year financial statement and a copy of their auditor’s report to the FRA one month prior to holding a general assembly, FRA Chairman Mohamed Omran said at a press conference on Wednesday, Youm7 reports.

In other news from the FRA: The regulator has apparently rejected Cleopatra Hospitals’ bid to acquire El Nozha International Hospital, according to local press pickups of what appears to be an FRA statement on Wednesday. The FRA offered no rationale for the decision. Some shareholders at El Nozha had mounted a pressure campaign on the FRA back in January in a bid to block the acquisition.

Pharma companies are using higher electricity prices as a pretext to call for higher med prices: Pharma manufacturers are planning on petitioning the Health Ministry to increase the prices of a number of medications, using the upcoming increase in electricity prices as justification, according to Gamal El Leithy, a member of the pharmaceuticals division at the Federation of Egyptian Industries. Electricity Minister Mohamed Shaker had announced on Tuesday that power bills would jump more than 40% for industry as of 1 July. The increases will drive up manufacturing costs, which have already increased over the past few months, El Leithy says. Companies are waiting for the new Cabinet to be formed, at which point they plan on raising the issue with the health minister.

Pharma companies have been lobbying since before the float of the EGP to raise med prices. Companies also proposed alternatives to across-the-board price hikes, suggesting they could cut the retail cost of certain medications and increasing others to balance things out. The Health Ministry last permitted a “limited” price hike in January, but stressed at the time that the move was not a precursor to blanket increases.

El Sisi defends 26% hike in electricity prices: The government spends USD 18.6 bn on subsidies to cover fuel, food and electricity, President Abdel Fattah El Sisi said on Tuesday following the announcement of an average 26% increase in next year’s electricity prices, the Associated Press reports. Each family receives an average of about USD 60 in subsidies, he noted in a speech. El Sisi insisted that it was necessary to continue with reforms, adding that he refuses to delay them any further. "All challenges and difficulties could be easy if we endure them," he said. "We have to pay the price together."

And speaking of electricity: The Egyptian Electricity Holding Company secured on Tuesday a USD 900 mn syndicated loan agreement, sources in the banking industry tell Reuters. The Finance Ministry announced yesterday (pdf) that it brokered the debt facility, which was coordinated by Credit Suisse and HSBC and will be used to pay off the EEHC’s foreign currency obligations. EEHC had offered lenders a margin interest and bank fees of more than 500 basis points over the London Interbank Offered Rate (Libor), bankers added. The loan was initially marketed to other banks at around USD 700 mn, but given banks’ level of interest, the size was raised to USD 900 mn. The loan is one in a series of facilities which demonstrate international financial institutions willingness to lend large sums to Egypt, the newswire notes. Other loans include USD 600 mn to the National Bank of Egypt and an upcoming USD 500 mn loan to Banque Misr.

The loan comes as Electricity Ministry is planning to hold a tender for the construction of nine transformer stations at a cost of EGP 6.2 bn, according to Electricity Minister Mohamed Shaker.

Egypt is safer than the US and the UK, according to a global ranking by Gallup. The 135-country survey saw Egypt ranked as the safest country in Africa and the Middle East, scoring 88 points on the 2018 Global Law and Order. That’s up from 82 points the previous year. The poll was based on the degree of confidence in police, how safe people felt walking alone at night, and whether they’ve been through a mugging or robbery in the past 12 months. The overall ranking of the MENA region dropped two points, compared to last year.

Yes, Egypt beat out the US and the UK in the ranking. Think of that for a second. The BBC is aghast.

Five safest countries: Singapore, Norway, Iceland, Finland, Uzbekistan. (Yeah, we’re scratching our heads at that last one, too.)

Five least-safe countries: Venezuela, Afghanistan, South Sudan, Gabon and Liberia.

The Macro Picture

The rest of the world needs to follow in China’s footsteps and consider investing in African infrastructure, Investec Group Co-CEO Hendrik du Toit writes for the Financial Times. He argues that default rates on African infrastructure projects are among the world’s lowest, given the strong fundamentals the continent enjoys, which include a booming population and “a wave of innovation and entrepreneurship.” China, now Africa’s largest supplier of equity and debt capital, was quick to realize the endless opportunities and chose over the last two decades to make itself an “integral part” of Africa’s journey towards sustainable development. Today, Chinese companies have c. USD 60 bn in collective investments in projects across major African capitals. China is also the continent’s largest import-export destination, according to Du Toit.

Despite all that, Africa still requires a lot more capital if it’s to continue moving forward. “Estimates put the African infrastructure deficit at about USD 90 bn every year for the next decade. Across the continent, 620 mn people still don’t have electricity; 319 mn people are living without access to reliable drinking water; and only 34% have road access.” Du Toit suggests that investment vehicles such as the Currency Exchange (which hedges against FX risks in emerging markets) and the Emerging Africa Infrastructure Fund (which focuses on funding a wide range of infrastructure projects) “need to be scaled and replicated.”

Egypt in the News

It’s nice to end an exceptionally slow news week for Egypt in the international press with a couple of pieces into which we can sink our teeth (in a good way):

Egypt’s new administrative capital is beginning to take form, but it is still unclear how many people will actually choose to live there, DW says in an audio documentary on infrastructure and development in Africa (runtime 29:55). The documentary notes that the megaproject — one of the biggest launched by the Sisi administration — is meant to attract citizens from all social strata, but there are fears that the price tags on renting or buying a home in the new capital will be too steep for the average Egyptian.

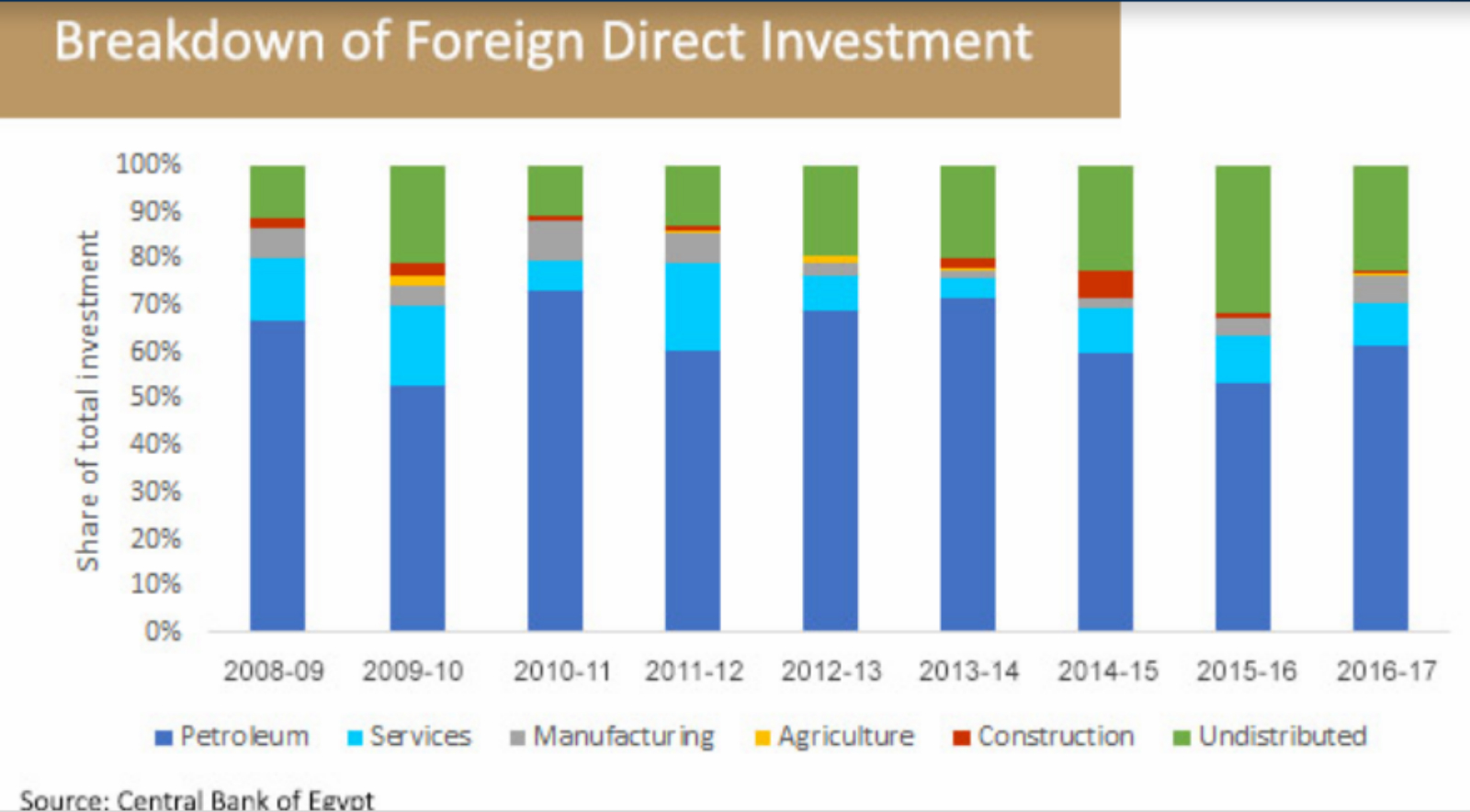

Carnegie Endowment says the government isn’t doing enough to improve FDI: The Carnegie Endowment for International Peace is taking a short-term view when it comes to how foreign direct investment has responded to the economic reform measures. “After eighteen months of turbulent economic changes, foreign investors have shown remarkably little appetite for long-term investment in the Egyptian economy,” writes Brendan Meighan. He notes that FDI has and continues to fall short of the USD 10 bn target set out by the government, citing CBE data showing FDI in the non-oil sector falling to USD 3.07 bn in FY2016-17, from USD 3.2 bn in FY2015-16. Meighan is dismissive of the government’s line that investors are waiting for the effects of reform to take place before committing to long-term investments, even though the reform process hadn’t really started until November 2016.

The argument is a wind-up to what we see as Meighan’s central point: The government and the armed forces hold too much control of the economy. Letting go of key sectors of the economy will unlock FDI, he suggests, dismissing in the same breath the government’s privatization program.

Also worth a quick skim: Archaeologists from Yale University unearthed 3,500 year old rock art depicting bulls, donkeys and sheep in Egypt’s Eastern Desert, the Associated Press reports.

Worth Reading

National Geographic is coming to grips with its racist past, publishing a full on mia culpa that its coverage had been racist for decades. Dedicating its April issue entirely to the subject of race, the publication asked University of Virginia’s African history professor John Edwin Mason to dig into 130-year archive and investigate its coverage of people of color in the US and abroad. “What Mason found in short was that until the 1970s National Geographic all but ignored people of color who lived in the United States, rarely acknowledging them beyond laborers or domestic workers. Meanwhile it pictured ‘natives’ elsewhere as exotics, famously and frequently unclothed, happy hunters, noble savages — every type of cliché,” writes Susan Goldberg, Nat Geo’s editor-in-chief.

Worth Watching

A welcome addition to Abdel Moneim Riad Square? The world’s largest indoor rainforest, the UK’s Eden Project in southwest England, is looking to develop new indoor rainforest sitesaround the world with the aim of educating us about sustainability and the environment, according to CNN. The ecopark, which opened seventeen years ago in Cornwall, is built on a disused clay pit the size of 30 football pitches and consists of two massive transparent biomes that house more than 3,000 species of plants. The project is slated to open in China in 2020, and will be built on environmentally damaged land originally used for salt production and prawn breeding (watch, runtime: 3:29).

Energy

Subsea 7 wins “sizeable” contract for West Delta Deep Marine project

Burullus Gas Company has awarded an engineering, procurement, installation and commissioning contract to Subsea 7 for the offshore West Delta Deep Marine Phase 9B project, Subsea announced, according to Oilfield Technology. Subsea did not disclose the value of the contract, saying only that it is “sizeable,” which it defines as ranging between USD 50-150 mn. “The scope includes connecting six new wells into existing subsea facilities using umbilicals and flexible flowlines. Project management and engineering work has already commenced at Subsea 7’s office in Cairo, Egypt and Paris, France.”

Health + Education

Gov’t to tender phase two of the PPP schools program in mid-July

The government plans to issue a tender for the second wave of schools to be built and managed in partnership with the private sector in mid-July, said the head of the Education Ministry’s PPP office Amany El Far. The second phase of the program will see the ministry tender 100 plots of land for 100 schools, up from 54 plots in phase one, she tells Al Mal. Education Minister Tarek Shawki had said earlier this month that at least 18 private companies have expressed interest in developing schools under phase two. The government is looking to set up 200 schools under PPP. Five companies had already won tenders to build 21 schools as part of phase one of the project, on which work is expected to begin as soon as the Cabinet signs off on tender results.

Tourism

Belgian summer bookings to Egypt through Thomas Cook up almost twofold this year

Thomas Cook’s summer bookings to Egypt from Belgium are up 90% y-o-y this year, head of the company’s Egyptian partner Sky Max Hossam El Shaer tells Youm7. The increase comes on the back of Thomas Cook’s promotion of Egypt’s beach destinations. Egypt has now become one of the top five destinations for tourists around the world, according to El Shaer.

Automotive + Transportation

Cairo Capital wants to distribute China’s GAC Motor with an eye towards manufacturing parts

Cairo Capital for Tourism Transport is in talks with China’s GAC Motor to become the licensed distributor of its buses in Egypt, Chairman Mohamed Hassan tells Al Mal. The company plans to sell an initial 1,000 buses and establishing an after-sale and maintenance center in Nasr City during the first year of the proposed partnership. This will be followed by establishing assembly lines in Egypt for the bus line’s parts and components once the long-awaited Automotive Directive is launched, he adds. A Chinese delegation is set to visit Egypt next month to close the agreement.

Other Business News of Note

Victory Link, Lebanon’s MDIC establish new e-payment JV

Digital solutions firm Victory Link and Lebanon’s Management and Development International Company (MDIC) will establish a new e-payments platform, with plans to invest EGP 100 mn in Egypt over the next two and a half years, COO Ahmed Ibrahim tells Al Mal. The new JV, which will officially begin operations by the year’s end, aims to offer its solutions through 10,000 service points nationwide, increasing up to 50,000 over the next five years. The company has already received regulatory approval, he adds.

On Your Way Out

Sixteen Egyptians will study at top global universities this fall after winning Qalaa Holdings Scholarships that provide them with a full ride to pursue graduate studies abroad provided they agree to return to Egypt after graduation. This year’s class of 16 scholars brings to 184 the number of scholarships awarded since the program began more than a decade ago. This year’s scholars will attend institutions including Harvard, Cambridge and Cornell, where they will study everything from epidemiology to public health, journalism, astrophysics, marketing and petroleum engineering.

Mansour Nasser became the final fatality of last November’s El Rawda mosque attack after succumbing yesterday to injuries sustained during the attack, Al Shorouk reports. His death raises the death toll from the attack to 312.

The Market Yesterday

EGP / USD CBE market average: Buy 17.80 | Sell 17.90

EGP / USD at CIB: Buy 17.77 | Sell 17.87

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Wednesday): 16,178 (+1.5%)

Turnover: EGP 812 mn (25% BELOW the 90-day average)

EGX 30 year-to-date: +7.7%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 1.5%. CIB, the index heaviest constituent ended up 1.2%. EGX30’s top performing constituents were Madinet Nasr Housing up 4.7%, Ezz Steel up 3.7% and Emaar Misr up 3.4%. Yesterday’s worst performing stocks were Egypt Aluminum down 3.7%, GB Auto down 0.9%, and ACC down 0.8%. The market turnover was EGP 812 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +120.4 mn

Regional: Net Short | EGP -8.2 mn

Domestic: Net Short | EGP -112.2 mn

Retail: 44.4% of total trades | 39.7% of buyers | 49.1% of sellers

Institutions: 55.6% of total trades | 60.3% of buyers | 50.9% of sellers

Foreign: 27.5% of total | 34.6% of buyers | 20.5% of sellers

Regional: 11.6% of total | 11.1% of buyers | 12.1% of sellers

Domestic: 60.9% of total | 54.3% of buyers | 67.4% of sellers

WTI: USD 66.66 (+0.03%)

Brent: USD 76.74 (+1.13%)

Natural Gas (Nymex, futures prices) USD 2.96 MMBtu, (-0.10%, July 2018 contract)

Gold: USD 1,303.10 / troy ounce (+0.14%)

TASI: 8,270.46 (+0.32%) (YTD: +14.45%)

ADX: 4,633.20 (-2.13%) (YTD: +5.34%)

DFM: 3,051.14 (-0.90%) (YTD: -9.46%)

KSE Premier Market: 4,809.97 (+0.61%)

QE: 9,080.24 (-0.88%) (YTD: +6.53%)

MSM: 4,596.05 (-0.05%) (YTD: -9.87%)

BB: 1,295.86 (+0.62%) (YTD: -2.69%)

Calendar

14 June (Thursday): 2018 World Cup kickoff match between Russia and Saudi Arabia, Moscow, Russia.

15 June (Friday): Egypt’s first 2018 World Cup match against Uruguay, Yekaterinburg, Russia.

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

19 June (Tuesday): Egypt plays against Russia at 2018 World Cup, St. Petersburg, Russia.

25 June (Monday): Egypt plays against Saudi Arabia at 2018 World Cup, Volgograd, Russia.

28 June (Thursday): CBE’s Monetary Policy Committee meeting.

1 July (Sunday): Application deadline for the DigitalAG4Egypt Challenge.

23 July (Monday): Revolution Day, national holiday.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.