- Cabinet to announce new EGP 50-60 bn social protection package “within days,” tax breaks for low income earners in the offing. (Speed Round)

- Taxman looking to collect VAT on e-commerce, online ad sales. (Speed Round)

- House general assembly starts budget debate, gives gov’t one-month deadline for strategy to bring small businesses into formal economy. (Speed Round)

- Amendments to Customs Act now with House committee; package includes incentives, white list of importers, crackdown on tourism car rentals. (Speed Round)

- FDI down year on year in 2Q2017-18, exports up. (Speed Round)

- Maersk interested in Egypt opportunities, but appetite is dampened by low volumes, high port fees. (Speed Round)

- Kuwait’s KAMCO taps Zaki Hashem to advise on plans to establish investment bank in Egypt. (Banking + Finance)

- Mo Salah hits the big time in America with his first Sports Illustrated cover. (On Your Way Out)

- The Market Yesterday

Monday, 4 June 2018

Online ad sales, e-commerce could be hit by VAT

TL;DR

What We’re Tracking Today

Annual increase in stock market stamp tax has come into effect: The stamp tax on capital market transactions rose to 0.15% yesterday from 0.125%, Al Mal reports. The levy, which came into effect last year, will rise to 0.175% next year. The Financial Regulatory Authority is debating whether to cut regulatory fees on stock market trades to 0.04% from a present 0.05%, to offset the burden imposed by the annual rise in the stamp tax, sources from the authority told Enterprise last month.

During its first year in effect, the stamp tax earned the government EGP 700 mn in revenues from main market transactions excluding OTC trades, Misr For Central Clearing, Depository & Registry Managing Director Tarek Abdel Bary told Enterprise yesterday.

Apple’s World Wide Developer Conference gets underway today in California with a keynote speech at 10am Pacific time (that’s 7:00pm CLT tonight). You can stream the keynote here. Meanwhile, 9to5Mac has a rundown of what you can expect, namely iterative improvements to iOS 12 as Apple pushes new tentpole features to next year to allow its engineers time to focus on quality. Also: Don’t hold your breath for a lot of new hardware. The conference is front-page news in the global business press this morning. As the Wall Street Journal puts it, Apple’s goal is “fewer [new] features, but fewer bugs.” Also on analysts’ wish list: Improvements to Siri, plans to tackle “device addiction” and a plan to win over HomePod skeptics, the Financial Times adds.

Also for tech types this morning: Microsoft could announce as soon as today that it will acquire GitHub, the popular developer tools platform that allows techies to manage code, among other things. Business Insider broke news of the talks over the weekend, and Bloomberg confirmed the news yesterday.

Many women with early stage breast cancer could be spared chemotherapy “following the publication of a groundbreaking study showing that they derive no benefit from the grueling treatment,” the Financial Times reports. The 10k patient study is front-page news around the world, having suggested that 70% of women “should not be given chemotherapy because it does not improve their survival prospects. They can therefore be treated with hormone therapy alone, which is far milder.” They found that tests of gene activity in tumor samples could identify women who could safely skip chemotherapy in favor of hormone therapy. The caveat: Some women 50 or younger “might benefit from chemo even if gene-test results suggested otherwise,” the New York Times notes.

Yield is not a dirty word: Manulife Financial, the Canadian giant that has “spent years buying stakes in pipelines, power grids and transportation systems … now wants to manage more of these types of assets for other investors,” shifting roughly USD 1 bn in existing infrastructure investments into a new fund that is open to outside clients. … One large European investor committed some USD 1 bn. … Big institutional investors are looking for new ways to generate yield after years of ultralow interest rates and expensive asset prices. More are now turning to investments in pipelines, utilities and roads to generate stable cash flows. Some, like Manulife, are choosing to manage those assets for others for additional revenue,” the Wall Street Journal reports.

Hedgies and Wall Street banks are adding social media to their research menus, the Journal notes this morning, looking at a wave of acquisitions of “alternative data” firms.

The Financial Times’ Jonathan Guthrie writes a withering take on why “bright young things flock to a withering old profession”: Investment banking. Don’t expect revelations, but do expect a chuckle or two.

Regret becoming a banker? Go indulge your inner Walter Mitty with the Financial Times’ Dream Jobs series, which runs occasional profiles of “people who’ve given up the 9-5 to seek new careers — and new lives — on distant shores.” Among them: A management consultant who became an Antarctic guide, an insurance sales rep who is now a motorcycle guide in Vietnam, and an ex-finance guy who became a freediving instructor in Indonesia. Mommy, how do you spell ‘midlife crisis’?

Better still: Go read James Thurber’s original short story, The Secret Life of Walter Mitty, in the 18 March 1939 issue of the New Yorker.

Why Qatar is still afloat: A year into the economic embargo, Bloomberg posits that the reason Qatari banks have done so well is because the government and statelet-owned banks have plowed some USD 26 bn in deposits into them since May of last year. Qatar noted the passing of the one-year anniversary of the boycott by declaring it is “stronger than ever,” CNBC says, on the same day that Bloomberg reports that the statelet’s propaganda arm, Al Jazeera, recently slashed dozens of jobs.

Your Ramadan rundown for today:

Bank hours run 09:30 am to 01:30 pm for customers and from 09:00 am to 02:00 pm for employees, CBE announced.

The EGX is running shorter trading hours. The trading session kicks off at 10:00 am, but closes at 1:30 pm. Tap or click here for the full schedule.

So, when do we eat? For those of us observing, Maghrib is at 6:53 pm CLT today. You’ll have until 3:09 am tomorrow to finish your sohour.

We apparently have post-iftar entertainment on the brain this morning, having caught up on all current episodes of Westworld, season two, and finished The Americans. Speaking of which:

The Americans, one of the best shows on television, went out with an (emotional) bang last week. The New York Times has a (spoiler-heavy) interview with show stars Keri Russell and Matthew Rhys. A must-read if you’re a fan of the show.

What to watch if you’re not a fan of mosalsalat? Start with the Times’ list of “What to Watch Now That ‘The Americans’ Is Over,” then check out its list of “TV binges of summer, from Jack Ryan to ‘Better Call Saul.’”

Magnum P.I. is getting a remake on CBS, and the first full trailer is out. Mixed feelings on our end, folks, but we’ll check the series out when it debuts this fall. You can watch the trailer here (runtime: 4:16).

In the mood for a book, not a TV show? Read the New York Times Book Review’s list of 73 summer books, broken down into categories including thrillers, cooking, movies and television, romance, music, sports and more.

Stephen King’s The Outsider isn’t on the NYT list, but should be, whether you’re a fan of his work or not. It’s one of two books King has coming out this year — Elevation, set in Castle Rock, Maine, is due in stores in October.

Food on the brain? We’ve just added Chefs, [Redacted] and Rock & Roll to our to-be-read pile. The tome looks back at the “remarkable evolution of the American restaurant chef in the 1970s and 1980s,” telling the tale of how cooking in a restaurant was transformed from a first job (or last job pre-prison) into a celebrity undertaking.

On The Horizon

The central bank’s monetary policy committee will meet on 28 June.

Saudi Arabia could be upgraded to MSCI emerging markets status this month.

Do you have an idea for a tech-enabled business idea that could make agriculture in Egypt more efficient? The World Bank may have seed funding, access to mentorship, and an accelerator / incubator program for you through its “DigitalAG4Egypt” program. The deadline for submissions is 1 July. Tap or click here for more information.

Enterprise+: Last Night’s Talk Shows

The talk show hosts are off in the corner, stuffing their faces with konafa. We would be, too, if we had a month of paid leave for Ramadan in addition to other vacation time.

Speed Round

The Ismail Cabinet is reportedly days away from announcing a new EGP 50-60 bn social protection package, government sources said yesterday. The package, which is meant to help offset the impact on low income earners of an expected hike in fuel and energy prices at the start of the new fiscal year in July, will include pension and salary increases as well as cash assistance programs, other sources tell Al Masry Al Youm. Finance Minister Amr El Garhy is putting the final touches on the new program now, AMAY adds.

Background: We had heard chatter earlier this month that the government was preparing to unveil a EGP 15 bn social protection package in July, which would include an increase in monthly subsidy card allowances (which has since been denied) and an exceptional wage raise for all state employees. The government rolled out an extensive EGP 85 bn protection package last year before hiking fuel prices by 55%, which included annual and hardship raises of 7% for state bureaucrats.

On that note, the House of Representatives’ Manpower Committee signed off on a 15% pension raise for state employees yesterday, Al Masry Al Youm reports. The committee approved a proposal to award state bureaucrats an exceptional 15% raise (or a minimum EGP 750) on their pensions at the start of the new fiscal year during its first meeting on the bill, which would come into effect as of 1 July, according to Al Mal. In addition to their annual raises, the proposal would award state employees not covered by the Civil Service Act an “exceptional” hardship raise of 10% over their base salaries (or a minimum of EGP 65). It would also award all state employees (whether or not covered by the act) another special raise ranging from EGP 140-160 a month, based on their pay grades.

This comes as we hear that the government intends to raise the threshold for income tax exemptions in FY2018-19, Finance Minister Amr El Garhy said yesterday, Al Shorouk reports. The newspaper suggests that the first EGP 8k per year in salary will be exempt from taxes, while employees earning under EGP 200k a year will receive tax breaks within the 5-80% range. Salary amounts between EGP 30,001-45,000 a year, will get a 45% break, up from 40% currently, while sums in the EGP 45,001-200k will get a 7.5% break, up from 5%, according to the minister.

EXCLUSIVE- The taxman is looking at imposing VAT on online ad buys and e- commerce transactions, sources in government tell Enterprise. The Tax Authority is actively studying the impact of making the online sale of goods and services subject to 14% value-added tax. In parallel, it is looking at ways of charging VAT on online ad sales by both domestic players and global giants such as Google and Facebook. There’s no word on how the tax could be collected from other sellers of programmatic ads.

Background: The potential tax grab is set in the context of a still-under-discussion overhaul of the nation’s tax system that could be implemented as early as FY2019-20. We’re told the authority plans to speak with players in the industry to discuss the best mechanism to impose VAT on both ad buys and e-commerce sales. Still unclear is whether the government plans to subject online ad sales to both VAT and the stamp tax on advertising, a form of double taxation that would be highly corrosive for the nation’s struggling digital publishers as well as legacy outlets struggling with the transition to digital.

Faster resolution of tax disputes are also a priority for policymakers, with sources in government telling us to expect amendments to the Tax Act that would cut penalties on overdue tax payments. The Tax Authority currently has 160k outstanding tax disputes and could net a windfall of as much as EGP 41 bn if they were resolved. The government hopes to bring in EGP 6-7 bn from settling tax disputes this fiscal year, Tax Authority chief Emad Samy told us.

BUDGET WATCH- The House of Representatives’ general assembly is set to continue debating the FY2018-19 state budget today. Discussions kicked off yesterday after the Budget Committee completed its review of the bill, Ahram Gate reports. With the Finance Ministry’s approval, the committee allocated additional amounts to a number of budget items, including EGP 2 bn for the Education Ministry to purchase tablet devices needed for the implementation of its new system at the start of the academic year, as well as EGP 1 bn split evenly between health and education, committee chair Hussein Issa tells Al Mal. The Health Ministry is also receiving an extra EGP 2.6 bn to add its investment budget. You can tap or click here to read our refresher on the new state budget.

The House has given the government a one-month deadline to present a strategy for incorporating small businesses into the formal economy, Al Mal reports. President El Sisi had said last month that all businesses that choose to go legit will be exempt from paying taxes for five years, and will enjoy other incentives including simplified access to social insurance. The Finance Ministry is also reportedly mulling setting a flat tax for SMEs based on the size of their top line as part of the SME Act, Tax Authority sources had previously told us.

House wants to implement “progressive income tax system.” The catch is, we already have one: According to a muddled and confused story in state news agency MENA, the Budget Committee has recommended in its final report that the Ismail government introduce legislation to bring into effect a progressive income tax system as mandated by Article 38 of the constitution. A progressive tax system, MENA says the committee argues, would allow the state to widen its tax base. Fair ‘nuff, but we already have a progressive tax system for individuals, running from 0% to 22.5% at the top end. It’s unclear whether the story is meant to signal potential changes to tax brackets (see our lead story in Speed Round this morning, above), a progressive tax system for corporations, or something else entirely.

LEGISLATION WATCH- Potential amendments to the Customs Act are now with the Planning and Budget Committee for discussion, Al Mal reports, after the House voted to send the bill to committee. The draft law, which had receive the Ismail Cabinet’s sign-off in February, is expected to slash custom duties on capital goods to 2% from a current 5% and expand temporary exemptions for production inputs and packaging equipment. The law also includes provisions that aim to curb customs evasion. The latest draft also includes a host of measures that facilitate the flow of goods through Egypt’s ports, including establishing a “white list” of importers who will benefit from expedited clearance of goods, sources had told us previously. The law would also introduce new tariffs for the tourism sector.

Egypt’s total FDI inflows dropped to USD 3.48 bn in 2Q2017-18, down from USD 3.98 bn in the same quarter last year, according to the central bank’s March statistical bulletin report (pdf). Europe is Egypt’s top investor, accounting for investment of USD 1.96 bn in the period, with the UK, Belgium, and France leading the pack. Investments from the Gulf and Arab world amounted to USD 722.3 mn for the quarter.

This comes as Egypt’s non-oil exports rose 16% y-o-y in 4M2018 to USD 8.6 bn, according to a Trade and Industry Ministry statement. The growth came on the back of improvements in exports across the board, including chemicals, fertilizers, and building materials, as well textiles and agricultural products.

The central bank made a final USD 500 mn payment to the African Export- Import Bank (Afreximbank) last Thursday on a USD 3.7 bn facility it had acquired back in 2016 to boost its FX liquidity and help Egyptian importers through a foreign currency shortage, Al Masry Al Youm reports, citing statements by Afreximbank Vice President for Business Development Amr Kamel. Egypt’s foreign debt obligations stood at USD 82.9 bn at the end of December 2017, or around 36.1% of GDP, up from USD 67.3 bn at the end of December 2016. Egypt plans to retire some USD 12 bn in foreign debt this year, including USD 850 mn owed to international oil companies.

M&A WATCH- Mondi in final stages of Suez Bags acquisition: Mondi Paper Sales has nearly finished its acquisition of a 70.1% stake in Suez Bags in a transaction valued at EGP 300-400 mn, Zaki Hashem law office Senior Partner Yasser Hashem tells Al Masry Al Youm. The transaction received regulatory approval and is awaiting security clearance, he said. Mondi had submitted a mandatory tender offer back in February to acquire 7.7 mn shares in Suez Bags at EGP 26.01 per share, which put the transaction at EGP 199.4 mn. The company had originally acquired stake in Suez Bags from Heidelberg Cement subsidiaries Suez Cement and Tourah Cement in a separate transaction. Zaki Hashem and Partners was tapped as legal counsel. Mondi is also in the process of acquiring 100% of the National Company for Paper Products for USD 28.75 mn (c. EGP 500 mn).

INVESTMENT WATCH- Castrol-TAQA engine oil JV to be set up with EGP 20 mn capital: The engine oil manufacturing and distribution joint venture that BP subsidiary Castrol will establish with Qalaa Holdings’ TAQA Arabia will have a capital of EGP 20 mn, Qalaa announced in a regulatory filing yesterday (pdf). TAQA will have a 49% equity stake in the JV. The two companies had announced on Thursday that the JV, named Castrol Egypt Oil, will distribute Castrol products in the country and will target both the commercial vehicle and passenger car markets. TAQA is already the sole distributor of Castrol products in Egypt.

IPO WATCH- Algioshy Steel is planning to float shares on the EGX in an initial public offering next year, Chairman Tarek Algioshy tells Al Masry Al Youm. The company is looking to raise capital to fund expansion plans that include a new EGP 500 mn production line at its Six October plant, according to Algioshy, who says the company is hoping to double its output, of which it exports 30-40%. Algioshy had said in April that the company is in talks with local banks to finance its planned expansion. He had noted then though that the company would focus on satisfying local demand and look towards exports by 2019.

Egyptian quarantine officials agreed yesterday to allow a shipment of Russian wheat to enter the country after first refusing it on the grounds that it had a level of ergot contamination that exceeded legal limits, unnamed port officials tell Reuters. Samples from the stalled grain shipment were reexamined in a Cairo lab and “results indicated ergot levels below the 0.05% threshold.” Authorities had said last week that the 63,000 tonne contained 0.06% ergot. The seller, however, argued that their cargo was up to spec. Russia’s main agricultural agency, Rosselkhoznadzor, also said as much, sending a delegation to Cairo on Saturday to look into the case.

Why traders are watching this case: The Russian shipment was stopped just days after the Higher Administrative Court effectively put to rest talk of a zero-tolerance policy for ergot, which had been a major hurdle for wheat imports in 2016-17. Three other wheat shipments were halted recently amid payment disputes with Dubai-based trader AOS. Mismanagement of wheat policies and delivery disruptions could cost the state an additional EGP 1.4 bn this year.

Maersk interested in Egypt opportunities, but appetite is dampened by low volumes, high port fees: Logistics and transport services provider Maersk is keen on expanding in Egypt and is currently studying opportunities in energy, infrastructure and fuel shipping through its office in Cairo, according to Technical Superintendent Lars Christensen, Al Mal reports. Christensen said the company was engaged in “positive talks” with the government, but that the decision to invest is contingent upon an increase in the volume of cargo handled by Egyptian ports, where numbers dropped by c. 60% over the last two years as port fees were increased. Other ports in the region lowered their fees, and the “significant difference” in cost is making it difficult to attract new lines to Egypt’s ports unless the government decides to slash tolls, Christensen recently told Enterprise. The government has been working to offset higher port fees through discounts and other incentives in order to attract new shipping lines to the Suez Canal area, particularly after an alliance — made up of Yang Ming, Hapag-Lloyd, K Line, Mitsui O.S.K. Lines, and the NYK Group — decided to cease operations at East Port Said in protest to the hike in port fees last year.

EARNINGS WATCH- Orascom Telecom Media and Technology (OTMT) reported a consolidated net loss of EGP 121.5 mn in 1Q2018, down from a net profit of EGP 388.4 mn the year before, according to an EGX filing.

CLARIFICATION- A friend of ours at the Abraaj Group passed on this note after our pickup yesterday of news that the private equity outfit had exited its stake in education play CIRA: “Abraaj invested with the Kalla family in 2014, and after four years and strong performance and growth of CIRA driven primarily by the CEO, Mohamed El Kalla, and the Chairman, Dr. Hassan El Kalla, and their management team, Abraaj exited with a healthy return before any potential IPO so as to avoid IPO-related lockups that would impact the investment IRR.”

The Macro Picture

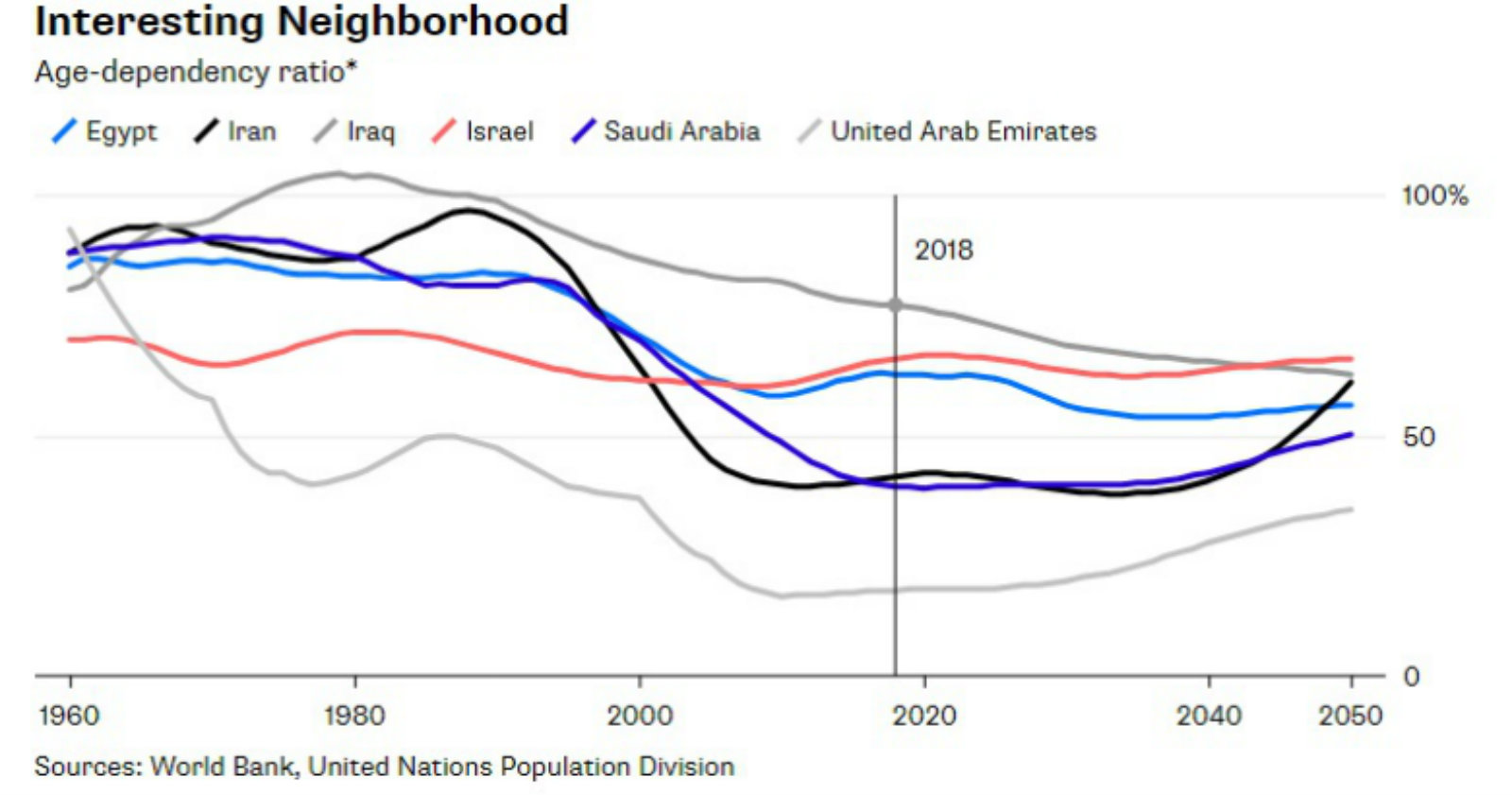

A population boom may not necessarily translate into economic prosperity for African economies, Justin Fox writes for Bloomberg. While African countries theoretically stand to reap the greatest “demographic dividend” in the future as their populations continue to grow, a comparative analysis of the UN and World Bank’s global birth rate and age-dependency ratio projections points to a potentially different scenario: Not only do these economies often struggle to meet the growing needs of their populations, an anticipated overall decline in global birth and fertility rates may mean that the world’s total population could soon begin to shrink, he suggests.“The current total fertility rate of 2.4 children per woman is above the zero-population-growth rate of 2.1, but it’s less than half the rate of 1968…and still falling.”

Egypt, for example, is set to become the world’s 12th most populous nation by 2050, but its age-dependency ratio (which compares the number of those under 15 to those between 15-64 and above) remains at a plateau of just above 50% after 2030 and well into the future.

Image of the Day

Jewelry that once belonged to Egypt’s King Farouk will be sold to the highest bidder at Sotheby’s in London on 6 June, according to Forbes Middle East. The collection includes a Van Cleef & Arpels diamond brooch, tie pins, cufflinks and a diamond purse handle.

Egypt in the News

On a blissfully quiet day for Egypt in the international press, coverage is largely confined to a Lebanese tourist being detained and referred to criminal trial on charges of insulting Egypt. Mona El Mazboh reportedly posted a video complaining about experiencing [redacted] harassment and poor restaurant service during her visit to Egypt, Reuters reports. El Mazboh could face up to five years in prison if she is convicted, one of the lawyers who filed the case against her tell the newswire. You can watch the video here, but we’d suggest you do so with earphones in — neither your fasting boss nor the kiddies need to hear this young lady’s language.

Worth Watching

A blue whale was sighted last week off Egypt’s Red Sea coast for the first time in the Gulf of Aqaba. The Environment Ministry said on Thursday it has deployed teams to track and photograph the 24-30 meter whale, which is one of the world’s protected endangered species. Videos and images went viral on social media over the weekend (watch, runtime: 01:40).

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi met yesterday with Sudan’s intelligence chief in Cairo to discuss “bilateral issues,” according to an Ittihadiya statement. El Sisi had met with Sudan’s foreign minister last week for a similar sit-down ahead of a planned meeting between El Sisi and Sudanese President Omar Al Bashir in October.

Energy

EETC to relaunch tender for Sudan power interconnection project after first round falters

The Egyptian Electricity Transmission Company (EETC) is reportedly relaunching a tender for its power interconnection project with Sudan today after it failed to attract sufficient offers in the first round, an unnamed company source tells Al Mal. One of the two bidders in the first tender failed to provide the EETC with its financial guarantee. The EETC had invited as many as eight local and global players to participate in the tender for the project, including ABB, General Electric, Elsewedy, Schneider, Siemens, and State Grid Corporation of China. Egypt and Sudan were expected to ink the contracts for the USD 60-70 mn project “sometime soon,” Electricity Holding Company boss Gaber El Dessouky had told us last month. Earlier guesses in the local press had put the project’s cost at USD 500 mn. The holding company said it would not seek external financing.

El Molla, Apache delegation discuss potential oil exploration in Western Desert

Apache is set to complete drilling work at its East Bahariya concession within six months of starting in 3Q2018, top executives from the Apache Corporation told Oil Minister Tarek El Molla during a meeting in Cairo yesterday, a ministry statement said. Apache is also planning to participate in other exploration tenders issued by the ministry last month for 11 concession areas in the Nile Valley, Gulf of Suez, and the Eastern and Western Deserts.

NREA, NIB reach EGP 3.4 bn debt settlement agreement

Renewable energy authority reaches EGP 3.4 bn debt settlement agreement with National Investment Bank: The New and Renewable Energy Authority (NREA) has reached an agreement to settle over the course of 10 years some EGP 3.4 bn in debt owed to the state’s National Investment Bank (NIB), NIB Chairman Mahmoud Montasser tells Al Shorouk. The two sides are waiting on the necessary approvals to formally sign the settlement agreement, according to Montasser. The agreement comes as part of the NIB’s drive to settle some EGP 24 bn in debt it is owed by a range of state bodies. The bank is currently closing in on a settlement with the Chemical Industries Holding Company and is inching toward agreements on some EGP 500 mn owed by each of the General Authority for Supply Commodities (GASC) and the Food Industries Holding Company. The National Media Authority is also looking to repay a portion of its debt to NIB — the value of which was not disclosed — by handing over four land plots. The bank had signed last month an EGP 8.7 bn debt settlement agreement with the Cotton & Textiles Industries Holding Company, which may be a prelude to the company selling some of its assets to the private sector to pay off other debts, company CEO Ahmed Moustafa had told us.

XD Egemac lands EGP 700 mn contract for Hawamdia transformer station

XD Egemac landed a EGP 700 mn contract for the Hawamdia transformer station, which is expected to process around 500 kVA of electricity, Chairman Medhat Ramadan said yesterday. The company expects to ink the final agreements for the project in a few weeks’ time. The Arab Fund for Economic and Social Development is partially funding the project with a facility repayable over 15 years at 3.5% interest. The station should be complete within a year.

SES plans EGP 35 mn projects in 2018

Smart Engineering Solutions (SES) is planning to carry out energy projects worth EGP 35 mn this year, Chief Commercial Officer Ahmed Naguib tells Al Shorouk. The company, which specializes in solar power installations, is also looking for a European partner to set up 20 MW-worth of panels at industrial zones around the country. SES has already reached an agreement with the European Bank for Reconstruction and Development to fund some of its planned ventures, including a USD 1 mn financing package to help the company acquire a number of projects it’s currently eyeing, according to Naguib.

Infrastructure

Civil Aviation Ministry issues tender for new terminal at Borg El Arab airport

The Civil Aviation Ministry is currently expecting to receive financial and technical offers in a tender it launched for the development of a new terminal at Alexandria’s Borg El Arab International Airport, Minister Sherif Fathy said yesterday, according to Al Shorouk. The new terminal, which will take around four years to build, is being funded by a USD 150 mn loan from the Japanese International Cooperation Agency and should allow the airport to take in an additional 4 mn passengers, bringing its total capacity up to 5.6 mn passengers per year. Construction work on the terminal began last year.

Transport Ministry breaks ground on first river port in Sohag

Transport Minister Hisham Arafat broke ground on the Sohag river port on Thursday, the second of several river ports the ministry plans to develop along the Nile in Upper Egypt, according to Al Masry Al Youm. The project’s total investment value was not disclosed and it remains unclear if the private sector is involved in its development. We had reported in April that the Transport Ministry was planning to issue a tender for the development of the USD 50-100 mn Qena river port soon. Arafat had said the ministry would launch river port tenders once legislation regulating river traffic and commercial transport is passed. The bill, which the Ismail Cabinet signed off on in August last year, is still before the House of Representatives.

Health + Education

Thanaweya Amma Arabic exam reportedly leaked, posted on Facebook

The Thanaweya Amma Arabic exam was reportedly leaked and posted on a Facebook page known over the past several years for leaking exams, Education Ministry sources said, Al Bawaba reports. Education Minister Tarek Shawki has since refuted the reports, saying that a student had taken pictures of the questions and circulated them among his friends while sitting the exam, but the exam was not leaked ahead of the testing date, according to Al Masry Al Youm.

Tourism

EgyptAir to buy up to 30 new planes in USD 6 bn investment part of its 2022-2025 plan

EgyptAir is looking to buy as many as 30 new planes at a cost of USD 6 bn as part of its 2022-2025 expansion strategy, Chairman Safwat Musallam tells Al Shorouk. The national flag carrier may ask prospective bidders to arrange a loan to finance the sale, which is necessary for EgyptAir as it adds more flights and routes to its lineup. EgyptAir, which is considering adding two new routes to African cities in 2018, received late last year the ninth and final aircraft from Boeing under an EGP 864 mn agreement signed in 2016.

Hurghada receives first flight from Kazakhstan

The Red Sea resort town of Hurghada received its first charter flight from Kazakhstan on Thursday, Chamber of Tourism Companies member Mohamed Shuaira tells Al Shorouk. One flight will operate from Kazakhstan to Hurghada every 10 days until the end of the summer season.

Holy Family Trail to see its first pilgrimage trip on 17 June

The first pilgrimage trip along the Holy Family Trail is scheduled to begin on 17 June, Tourism Minister Rania Al Mashat said yesterday, Ahram Gate reports. The route is expected to take four days to complete.

Telecoms + ICT

DMS appointed Snapchat sales rep. in Egypt, Kuwait

Multimedia messaging app Snapchat appointed Choueiri Group’s Digital Media Services (DMS) to act as its sales representative in Egypt and Kuwait, according to Arabian Marketer.

Automotive + Transportation

Revolta Egypt acquires American agency specialized in sale of used e-vehicles

Revolta Egypt signed an agreement to acquire a US agency specialized in the sale of used electric cars, CEO Mohamed Badawy tells Al Mal without disclosing the value of the transaction. Revolta, which is looking to sell electric vehicles and develop supporting infrastructure, is also in talks with various international lenders over a facility to fund e-car imports, both used and new, he said. Revolta plans to have built 300 electric charging stations across the country by 2020.

SCA announces discounts for ships traveling the US-Asia route until 31 December

Container ships plying the route between the east coast of the United States and ports in South and Southeast Asia via the Suez Canal will be granted discounts of 45-65% on transit fees until 31 December of this year, the Suez Canal Authority (SCA) announced yesterday in a statement carried by Al Mal. Containers must not stop at any other ports on the way to be eligible for the discounts and must provide a detailed itinerary of its trip. The SCA had also announced discounts on port fees ranging from 45-75% for crude oil carriers earlier this year.

Dnata to provide EgyptAir with cargo handling services at DWC

Global air services provider Dnata will be providing EgyptAir with cargo handling services from its facility at Dubai World Central (DWC) as EgyptAir launches its new weekly freighter line between Cairo and Dubai, according to Logistics Middle East.

Banking + Finance

Kuwait’s KAMCO taps Zaki Hashem to advise on plans to establish investment bank in Egypt

Kuwait’s KAMCO Investment Company has reportedly tapped Zaki Hashem & Partners as legal adviser for its plans to establish an investment bank in Egypt, sources tell Daily News Egypt. The plans come as part of efforts to expand in the region as it hopes to “offer its services to as many international customers as possible,” they add. KAMCO had recently appointed Sherif Abdel Aal, a former Pharos investment banker, as managing director and head of mergers and acquisitions.

United Bank to contribute EGP 570 mn to EGAS loan

The United Bank of Egypt is planning to contribute EGP 570 mn to an EGP 3 bn loan arranged by the National Bank of Kuwait (NBK)-Egypt for EGAS, as it looks to connect more homes to the natural gas grid, Chairman Ashraf El Kady said yesterday, according to Al Masry Al Youm.

Other Business News of Note

El Nasr Housing employees to sue five state officials over Uptown Cairo dispute with Emaar

The tired saga of Emaar vs. El Nasr Housing continues as employees of state-owned El Nasr Housing and Reconstruction have filed a lawsuit against five state officials, including the minister of justice and public enterprises, for damages they claim to have suffered as the result of a board decision to accept a EGP 100 mn settlement agreement with Emaar Misr. The plaintiffs claim Emaar owes El Nasr more than EGP 1 bn in compensation for a dispute related to land in the Uptown Cairo project, Al Shorouk reports.

Arab Contractors wins EGP 192 mn contract to build hypermarket in New Thebes

Arab Contractors has won a contract to develop a EGP 192 mn hypermarket and mall in New Thebes in Luxor, Chairman Mohsen Salah said in a statement picked up by Al Shorouk. The company has also signed contracts for infrastructure projects that are together worth nearly EGP 450 million in Qena and New Aswan.

Sports

Al Ahly signs EGP 400 mn television broadcast contract

Al Ahly football club sold four years of broadcasting rights to its matches to Presentation Sports in a EGP 400 mn agreement, marking a EGP 230 mn increase over the previous contract, Al Mal reports.

On Your Way Out

Mo Salah hits the big time in America with his first Sports Illustrated cover. The football star — whose recovery from his shoulder injury seems to be going well — graces one of four covers of the 4 June 2018 edition of the iconic US sports magazine. Other covers include players from Mexico, Iceland and England as SI ramps up its World Cup coverage. The Salah story is here: After Remarkable Rise, Mohamed Salah Shoulders Egypt’s World Cup Hopes.

The Market Yesterday

EGP / USD CBE market average: Buy 17.85 | Sell 17.95

EGP / USD at CIB: Buy 17.84 | Sell 17.94

EGP / USD at NBE: Buy 17.8 | Sell 17.9

EGX30 (Sunday): 16,675 (+1.6%)

Turnover: EGP 669 mn (41% below the 90-day average)

EGX 30 year-to-date: +11.0%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 1.6%. CIB, the index heaviest constituent ended down 2.6%. EGX30’s top performing constituents were Amer Group up 3.2%, Telecom Egypt up 2.9% and CIB up 2.6%. Yesterday’s worst performing stocks were Global Telecom down 1.0%, AMOC down 0.6%, and Eastern Co was flat. The market turnover was EGP 669 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -68.1 mn

Regional: Net Long | EGP +4.3 mn

Domestic: Net Long | EGP +63.8 mn

Retail: 42.7% of total trades | 43.9% of buyers | 41.5% of sellers

Institutions: 57.3% of total trades | 56.1% of buyers | 58.5% of sellers

Foreign: 33.6% of total | 28.5% of buyers | 38.7% of sellers

Regional: 15.8% of total | 16.1% of buyers | 15.5% of sellers

Domestic: 50.6% of total | 55.4% of buyers | 45.8% of sellers

WTI: USD 65.87 (+0.09%)

Brent: USD 76.66 (-0.17%)

Natural Gas (Nymex, futures prices) USD 2.96 MMBtu, (-0.07%, July 2018 contract)

Gold: USD 1,297.10 / troy ounce (-0.17%)

TASI: 8,329.55 (+2.06%) (YTD: +15.27%)

ADX: 4,566.05 (-0.85%) (YTD: +3.81%)

DFM: 2,987.25 (+0.78%) (YTD: -11.36%)

KSE Premier Market: 4,710.03 (+0.42%)

QE: 8,930.98 (+0.57%) (YTD: +4.78%)

MSM: 4,602.08 (-0.10%) (YTD: -9.75%)

BB: 1,265.65 (-0.01%) (YTD: -4.96%)

Calendar

14 June (Thursday): 2018 World Cup kickoff match between Russia and Saudi Arabia, Moscow, Russia.

15 June (Friday): Egypt’s first 2018 World Cup match against Uruguay, Yekaterinburg, Russia.

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

19 June (Tuesday): Egypt plays against Russia at 2018 World Cup, St. Petersburg, Russia.

25 June (Monday): Egypt plays against Saudi Arabia at 2018 World Cup, Volgograd, Russia.

28 June (Thursday): CBE’s Monetary Policy Committee meeting.

1 July (Sunday): Application deadline for the DigitalAG4Egypt Challenge.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): Egypt Defence Expo, Egypt International Exhibition Center, New Cairo

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.