- Auto part manufacturers eying regional export opportunities with global players. (Speed Round)

- Ismail Cabinet acting fast to legalize Uber, Careem. (Speed Round)

- Egypt, Cyprus moving ahead with plans for LNG import agreement. (Speed Round)

- What’s happening with CFLD’s USD 13.4 bn new capital contracts? (Speed Round)

- Gov’t shores up social protections in the new budget ahead of subsidy cuts in July. (Speed Round)

- UK could reconsider ban on flights to Sharm if Russia lifts its restrictions -sources. (Speed Round)

- US Fed hikes rates 25 bps, signals gradual hike cycle could be longer than previously expected. (What We’re Tracking Today)

- EM bonds may have lost their flavor, but EM equities hit new highs. (The Macro Picture)

- The Market Yesterday

Thursday, 22 March 2018

Automakers eye export opportunities

TL;DR

What We’re Tracking Today

The state IPO program unveiled this week is getting props from IMF Egypt Mission Chief Subir Lall, who tells Al Mal that the listing of state-owned companies will help boost the local capital market.

The US Federal Reserve’s Open Market Committee lifted its benchmark overnight lending rate 25 bps to a range of 1.50%-1.75%, the Fed said in a statement on Wednesday. In its first policy meeting under new chief Jerome Powell, the Fed indicated that inflation should finally move higher after years below its 2% target and that the economy had recently gained momentum. It also raised the estimated longer-term “neutral” rate, a sign the current gradual rate hike cycle could go on longer than previously thought, according to Reuters. The Fed projected US economic growth of 2.7% in 2018, up from the 2.5% forecast in December. Its preferred measure of inflation was expected to end 2018 at 1.9%, unchanged from the previous forecast, but it is seen rising a bit above the target next year.

Our own central bank’s Monetary Policy Committee is set to meet next Thursday to decide on interest rates. With annual urban inflation dropping to 14.4% — the lowest rate since October 2016 — the CBE hinted earlier this week at a possible rate cut by saying that inflation appears under control in the medium-term. Research houses have been unanimous in saying that the CBE might cut interest rates again this month, with differences on the magnitude of the cut ranging from 50-200 bps.

It’s the last weekend of campaigning in the presidential election, with voters due to go to the polls starting on Monday, 26 March. Balloting ends on Wednesday, 28 March, and companies are being asked to give staff sufficient time during the workday to make it to and from their polling station. Results are due to be announced on Monday, 2 April. Look for the poll to continue dominating coverage of Egypt in the international press in the meantime. The two campaigns go into a ‘quiet period’ on Saturday ahead of the start of voting.

No Egyptian universities made the Times Higher Education’s ranking of the top five universities in the Arab world. Egyptian universities took nine of the 32 slots in the ranking, with Beni Suef University topping them in tenth place, followed by AUC. The top five were:

- King Abdulaziz University (KSA)

- Khalifa University (UAE)

- Qatar University

- Jordan University of Science and Technology

- United Arab Emirates University

Global M&A this year crossed the USD 1 tn mark on Tuesday, the fastest it has ever reached that level, according to the Financial Times. Announced transactions totalled USD 4.6 tn this year, up 50% y-o-y and 12% higher than 2007, according to data from Dealogic. Investment bankers have have cut a string of USD 10 bn-plus M&As in 2018. Activity in Japan and the UK has more than doubled from a year ago while German M&A volumes are up fourfold. The rise was buoyed by quickening economic growth and strong business confidence, particularly following the tax cuts passed in Washington last year. Notable transactions this year include: US health insurer Cigna’s USD 67 bn takeover of Express Scripts, German utility Eon’s acquisition of renewable energy group Innogy for EUR 43 bn, and Comcast’s GBP 22.1 bn bid for Sky.

Also in the headlines this morning:

Facebook engineers finished reprogramming the artificial remorse module for Mark Zuckerberg in time for him to say yesterday that “this was a major breach of trust. I’m really sorry this happened. We have a basic responsibility to protect people’s data.” The CEO bot squeezed out the short, declarative sentences after it was revealed earlier this week that data on some 50 mn Facebook users had been misused. The backlash from users and investors alike has been so bad that Zuckerberg sat for an interview with the New York Times yesterday.

ETFs are the flavour of the day in a bull market, but what happens when they get hit with a wave of redemptions in a downturn? That’s the question the Wall Street Journal is asking, taking the example of ETFs that buy securities such as high-yield debt. Read Could ETFs fall into a liquidity jam?

The UAE and Saudi have tried to influence the White House. Shocking? Apparently to the US press, because no US official has ever worked to influence an official in our part of the world. “A cooperating witness in the special counsel investigation worked for more than a year to turn a top Trump fundraiser into an instrument of influence at the White House for the rulers of Saudi Arabia and the United Arab Emirates, according to interviews and previously undisclosed documents,” the New York Times reports.

Sarko took Qaddafi’s coin? Former French President Nicolas Sarkozy was charged by prosecutors with accepting illegal campaign contributions from the Qaddafi regime in Libya in 2007, Bloomberg reports.

Workshop on blockchain in capital markets today: Fintech-focused accelerator Pride Capital is hosting a workshop today titled “A Bright Future for Blockchain in Capital Markets” at the Greek Campus. The workshop will feature a discussion with EGX Chairman Mohamed Farid and Henebry Blockchain Consulting CEO Bobby Henebry. To register for a spot in the workshop, tap here if you’re on your mobile and click here if you’re on a computer. You can check out the workshop’s Facebook page for more information on the event or Pride Capital’s LinkedIn page for more on the accelerator. Pride is affiliated with our friends at Pharos Holding, who along with CIB and SODIC we are proud to count as sponsors of Enterprise.

On The Horizon

The Arts-Mart Gallery is bringing together visual and performing arts through its second ‘Orchestra In Art’ event, The Three Egyptian Tenors this coming Friday. The show features a full orchestra performing amidst a specially curated exhibition of Egyptian contemporary art. World-renowned conductor Nader Abassi and award-winning Egyptian tenors Hany Abdelzaher, Ragaa Eldin, and Amr Medhat will perform their Italian opera masterpieces at the Arts-Mart Gallery on Friday. The event is sponsored by our good friends SODIC as part of their drive to promote new cultural and artistic concepts.

Arab leaders will gather in Riyadh on 15 April for a summit, Arab League Secretary General Ahmed Abul Gheit announced yesterday. Saudi Crown Prince Mohammed bin Salman had said that Qatar would be allowed to attend.

The Creative Industry Summit will take place in Cairo from 17-18 April at the Four Seasons Nile Plaza. Some of the issues on the agenda include sports marketing and “how to ride the world cup wave,” and engagement through content marketing.

Enterprise+: Last Night’s Talk Shows

The talking heads fixated almost exclusively on Mother’s Day celebrations yesterday with back-to-back coverage of the “Mothers of the Year” ceremony, during which President Abdel Fattah El Sisi honored 42 women. The drama unfolding over the suspension of Uber and Careem’s services also earned some airtime.

Cabinet spokesman Ashraf Sultan clued in Kol Youm’s Amr Adib to the Ride-Hailing Apps Act after the host repeated the previous night’s calls for the government to step in and shield the ride-hailing apps from the ongoing witch hunt (we have updates in Speed Round, below). After significant pestering from Adib on how these apps managed to operate for so long if they are illegal, Sultan said they had been operating as part of the informal economy and that the government began drafting the Act once the companies proved their worth (watch, runtime: 7:35). Sultan had a similar conversation with Al Hayah Al Youm’s Tamer Amin (watch, runtime: 4:45).

Regular taxi drivers should wake up and smell the coffee and realize that they are responsible for their waning popularity — and should take proactive measures to make their service more appealing than that of Uber and Careem to win back the business they have lost, Amin said (watch, runtime: 5:38). We couldn’t agree more.

Meanwhile, Masaa DMC’s Osama Kamal suggested that the law should be forward-looking and cover water and air transportation. Council of State legislation committee member Abdelrazek Mahran pointed out to the host that the bill — which is already on its way to Parliament — would require significant amendments to accommodate his suggestions. Mahran also suggested that the government is trying to act fast to issue the law in light of recent developments (watch, runtime: 11:20).

News reports that Egypt saw a 39% y-o-y surge in British tourist arrivals this year had Amr Adib bouncing in his chair and proudly pointing to Egypt’s low prices in comparison to Spain and Turkey (watch, runtime: 4:50).

Startup Bermoda trumped competitors Yadoctory and Amgad on the CIB-sponsored Hona Al Shabab contest. Bermoda walked out with EGP 100k in prize funding from CIB, while Yadoctory and Amgad came in second and third, respectively.

Speed Round

Auto parts manufacturers said to be in talks with Renault, Volkswagen to make and export parts to regional assembly facilities: Local auto parts producers are in talks with European car makers, including Renault and Volkswagen, to begin making and exporting parts for production and assembly facilities across the region, Egyptian Auto Feeders Association Development Director Ihab Aboul Enein tells Al Mal. VW has already tapped three Egyptian manufacturers — IDACO, MOBICA, and El Teriak Industrial Group — and talks are ongoing with Renault. A delegation from the French multinational group was in town last week to meet with its local distributor, Egyptian International Motors (EIM), to explore the possibility of assembling cars in Egypt.

Meanwhile, El Assal for Auto Parts will invest EGP 50 mn this year in a local production facility that will make a range of mechanical parts for Kia and Mitsubishi cars, Chairman Mahmoud El Assal also tells the newspaper. The company should finish feasibility and technical studies next month, he says. Kia Motors had signed an agreement with Egyptian International Trading & Agencies last week that will see them invest EGP 4.2 bn over the next five years in a new local assembly line, which Trade and Industry Minister Tarek Kabil said was part of a wave of positive news to the industry as the government pushes ahead with issuing the Automotive Directive some time this year. The bill, which means to encourage assemblers to move further up the value chain into manufacturing, has faced several delays due to the clashing interests of various auto industry players (mainly assemblers and importers). Most recently, the government had been trying to push the minimum local component requirements in the bill.

In related news, the local partner for China’s BYD, Al Amal, said it plans to assemble 600 cars of the company’s S5 model between now and the end of 2018. The first batch of locally assembled vehicles will be made available to distributors by the end of the month, an unnamed company executive tells Al Mal.

LEGISLATION WATCH- Ismail Cabinet acting fast to legalize Uber, Careem: The Ismail Cabinet referred the Ride-Hailing Apps Act to the House of Representatives for review and approval yesterday after having received the final draft from Maglis El Dawla, Al Shorouk reports. This comes one day after the Administrative Court issued a ruling suspending the licenses of ride-hailing apps Uber and Careem. The ruling also banned the two apps and suspended their use of private cars. Taxi drivers had filed a lawsuit last year to shut down the platforms’ operations based on the claim that they were illegally using private cars as taxis and were not legally registered as transportation companies.

White cabs would be included in Uber, Careem fleets: As we noted previously, the draft law reportedly includes provisions that would require these companies to ensure that half of their fleet be made up of white taxis within six months of the law’s issuance. The law would also impose a licensing pricing scheme that favors taxi drivers. All of that is good news for bellowing taxi drivers, less so for those of us who want smoke-free, A/C-included rides from people who aren’t polluting the interior of the car with non-stop babble.

The government is waiting for an official order from the Administrative Court before suspending the licenses of the ride-hailing apps, said Cabinet spokesperson Ashraf Sultan, according to Al Masry Al Youm. If the ruling becomes final, presumably after the appeals process, the government will act immediately to enforce it, he added.

Gov’t mea culpa? Sultan appears to take responsibility for the confusion, saying the government had not issued regulations for ride-hailing apps, something it is keen to rectify now.

The foreign press is continuing to frame the story as part of the global conflict between Uber and local taxi drivers. Bloomberg’s Tarek El-Tablawy and Tamim Elyan tell it as it is, pointing out that taxi drivers are the authors of their own misfortunes, with their not-so-customer friendly approach and refusal to run on meters.

FRA considering new EGX listing regulations that would raise the minimum requirement for free float: The Financial Regulatory Authority (FRA) is considering amending EGX listing regulations to raise the minimum requirement for the number of shares that need to be in free float, Deputy Head Khaled El Nashar said yesterday, Al Mal reports. The proposed amendments would force companies that are already listed to increase their free float to 10% of total shares, up from 5%. Meanwhile, those looking to IPO might have to choose between two options: The first will be to list at least 20-25% of their shares, up from 10% currently; and the second would entail listing a number of shares equivalent to 0.005% of the total freefloat capital in the EGX. El Nashar said that listed companies would be given a fair window to comply with the new regulations, which are still under study, without specifying the time frame.

Egypt, Cyprus moving ahead with plans for LNG import agreement: Cairo and Nicosia appear to be moving ahead in their plans to connect Cyprus’ Aphrodite gas field to one of Egypt’s two liquefaction plants in Idku and Damietta. Cypriot Energy Minister Giorgos Lakkotrypis said yesterday that Turkish “provocations” would not deter his country from pressing ahead with plans for East-Med gas exploration, particularly since it could set a precedent for delivering gas from the region to Europe, the Associated Press reports. Officials from Cyprus and Egypt have made “significant progress” on setting the terms of their agreement for a connecting pipeline and are expecting to hear the EU’s response on their preliminary framework within a few weeks. “We remain committed to both the Egyptian government and also our partners both here in Cyprus and in Egypt to try to find a conclusion in what is a very difficult equation, considering the outside conditions in the market, both in terms of international prices of oil but also in terms of the rather hostile nature of development of the Aphrodite field because of the technical circumstances in the depth of the water,” Lakkotrypis said.

What’s happening with CFLD’s USD 13.4 bn new capital contracts? Talks with China Fortune Land Development Company (CFLD) and the government over the contract to develop 14k feddans in phase one of the new administrative capital appear to be at a critical juncture. The city developer sent its final proposal for the project to the government this month, and Egyptian officials say they are currently studying the offer. “All I can say is that we are in the last stage of negotiations and hoping that this will be settled soon,” Allen Ma, president of CFLD Egypt, told Bloomberg.

Government officials appear to hint at the possibility of further delay: “This is a huge project,” Assistant Housing Minister Khaled Abbas said. “We should take our time to study the project well and ensure it will benefit the country.” Talks on CFLD’s component of the new capital have been plagued by constant delays. MoUs for the project were signed back in 2016, and the last we heard of the project was that contracts would be signed by last December.

Haggling over how sales revenue from the development would be shared appear to be the reason why the talks have dragged on, according to Bloomberg. Investment Minister Sahar Nasr had said last year that the government will retain 60% of revenues from CFLD’s projects.

Then there’s the matter of the inconsistent stated value of the investment. CFLD has said last year that it would invest USD 4 bn in the coming four years on the project. But a copy of the proposal obtained by Bloomberg shows that CFLD commits to bringing in FDI worth USD 2 bn in the first five years. The scope of the project was supposed to see the company invest USD 20 bn over 25 years. Talk of that soon disappeared in the press and all we’ve heard for a year now is USD 13.4 bn over 10 years.

Don’t be confused: The CFLD contact is separate from China State Construction Engineering Company (CSEC)’s contract to build the skyscraper district of the new capital, which is at the heart of the new capital’s 1.71 mn sqm central business district. Prime Minister Sherif Ismail broke ground on the district this week; CSEC will spend some USD 3 bn building the district, with USD 2.55 bn in financing coming from Chinese banks and the balance from Egypt’s Housing Ministry.

M&A WATCH- Hassan Allam Holding has reportedly acquired 60% of the Power Generation Engineering and Services Company (PGESCo) for EGP 421 mn, BPE Partners Chairman Hazem Barakat tells Al Mal. The company acquired the stake from existing shareholders including CIB (20%), Saud Consultants (20%), BPE Power (15%) and BPE Partners (5%). Matouk Bassiouny was tapped by Hassan Allam to advise on the transaction, while White and Case LLP advised the shareholders, according to Barakat. The Electricity Ministry is said to hold a 40% stake in PGESCo.

INVESTMENT WATCH- Ibnsina Pharma is looking to invest EGP 150-200 mn over the next five years to increase its market share to 26% from a current 19.3%, Managing Director Omar Abdel Gawad tells Al Mal. The new funds would bring the company’s total investments to EGP 700 mn, a target it had announced at the time of its initial public offering last year. Ibnsina plans to grow its distribution network, adding new government contracts (which earned the company EGP 1 bn in 2017), and growing its portfolio through ongoing talks with international med manufacturers, Abdel Gawad adds. The news comes one day after Ibnsina announced signing contract with Novo Nordisk to distribute over 20 SKUs of its diabetes care, haemophilia and growth disorders products in Egypt.

The Alexandria Mineral Oils Company (AMOC) is still considering options to finance its USD 500 mn oil refinery project, according to a statement to EGX. The company denied reports it has already reached an agreement with international finance institutions, as reported by the Daily News Egypt earlier this week, saying it is still in the feasibility study stage.

Gov’t shores up social protections in the new budget ahead of subsidy cuts in July: In the run up to get the FY2018-19 budget, which would include subsidy cuts, the Ismail Cabinet is getting the message across that it is shoring up the social safety net. Public sector employees will receive a wage increase in the coming period, Prime Minister Sherif Ismail tells Al Masry Al Youm. He also announced that a large number of citizens will be joining the Takaful and Karama social welfare programs. Furthermore, next year’s budget includes increase spending on commodity subsidies for the lowest income citizens. He added that these would be explained further when the government presents the new budget to the House of Representatives, which be around 31 March. The new budget targets a GDP growth of 5.8% and a deficit of 8.4% of GDP.

The UK could reconsider its ban on flights to Sharm El Sheikh if Russia was to lift its restrictions, TTG reports. The report notes that it is “widely accepted” now after the investment made in improving security at the Sharm El Sheikh airport that “it is now considered safe by the Department for Transport (DfT) and the Foreign Office (FCO).” Jonathan Lord MP, co-chairman of the all-party parliamentary group (APPG) had said that “the Egypt APPG still supports strongly the resumption of flights from the UK to Sharm, as outlined in the Commons debate.”

Meanwhile, Egypt’s tour operators have begun preparing tailored travel packages for Russian tourists ahead of the scheduled resumption of direct flights with Russia, Al Shorouk reports. The packages will include trips to Sharm El Sheikh, Hurghada, Luxor, and Aswan, as well as guided tours in Cairo (we’re assuming at attractive, discounted prices). EgyptAir had announced that it will begin operating three weekly flights to Russia as of 12 April. Russian airline Aeroflot, which is set to resume flights as of 11 April, has said it would offer daily flights from 12 June to 2 July to accommodate football fans heading to the World Cup.

Alex Port-led consortium to build USD 450-500 mn multipurpose station: The Alexandria Port Authority (APA) is forming a JV with the Suez Canal Economic Zone (SCZone) and the Land Maritime Transport Holding Company to build a USD 450-500 mn multipurpose facility at the Alex Port, a zombie project from the 2015 Egypt Economic Development Conference that has been killed and resurrected more times than we can count. The project will be partially financed by bank loans, Land Maritime Transport Holding Company Chairman Mohamed Youssef, tells Al Mal. Negotiations with China Harbour have no officially reached a dead end after it refused to cut the project’s price tag.

In related news, Youssef said his company had received five offers to expand the Alex Container and Cargo Handling company’s platforms at the Alex Port for USD 35 mn, a project that should take 18 months to complete. A similar development project is also set to take place at the Damietta Port.

Egypt joined 44 other African countries in signing the pan-African Continental Freetrade Zone (CFTZ) agreement in Kigali yesterday. The agreement, whose main objective is “to create a single continental market for goods and services,” would promote infrastructure development among the signatory countries as well as reducing a host of customs duties between them, the Trade and Ministry said in a statement following the signing. These would be completely eliminated in later stages of the agreement, the statement added. The agreement would also reduce travel restrictions for investors and professionals in a number of strategic sectors, including energy, financial services, health, education, ICT, and agriculture, said Trade and Industry Minister Tarek Kabil. The agreement would see trade in the continent increase 22% by 2022, Kabil, who gave a speech on behalf of President Abdel Fattah El Sisi, added.

Trade ministers of the signatory countries will now have to go through another round of talks including the timeframe to implement the pact and policies on investment, competition, and trademark enforcement, Kabil said. He also urged fellow signatory to look into developing policies to help grow the burgeoning e-commerce sector.

Bilateral ties with Rwanda: On the sidelines of the event in Kigali, a Federation of Egyptian Industries delegation agreed to deepen cooperation with Rwanda’s Private Sector Federation and the Rwanda Chamber of Industry, Ahram Gate reports. The Egyptian delegation also discussed the possibility of establishing a logistics center in Rwanda for Egyptian exports including building materials, juices, and medication.

CLARIFICATION- The New Cairo British International School (NCBIS) denies a report published by Ahram Gate that it is being shutdown by the Education Ministry for not obtaining permits from the ministry. In a letter to parents, the NCBIS administration noted that it had not received a warning or any communication from the ministry. What’s more, the school—effectively a parent-owned NGO—is regulated by the Social Solidarity Ministry, not the Education Ministry. The letter notes that Schulz Academy, which was also named in the report as being among the four schools hit by the Education ministry, has similarly not heard from any ministry official. The article in state-owned Ahram Gate quotes the head of the Education Ministry’s private education department, Abir Ibrahim.

The Macro Picture

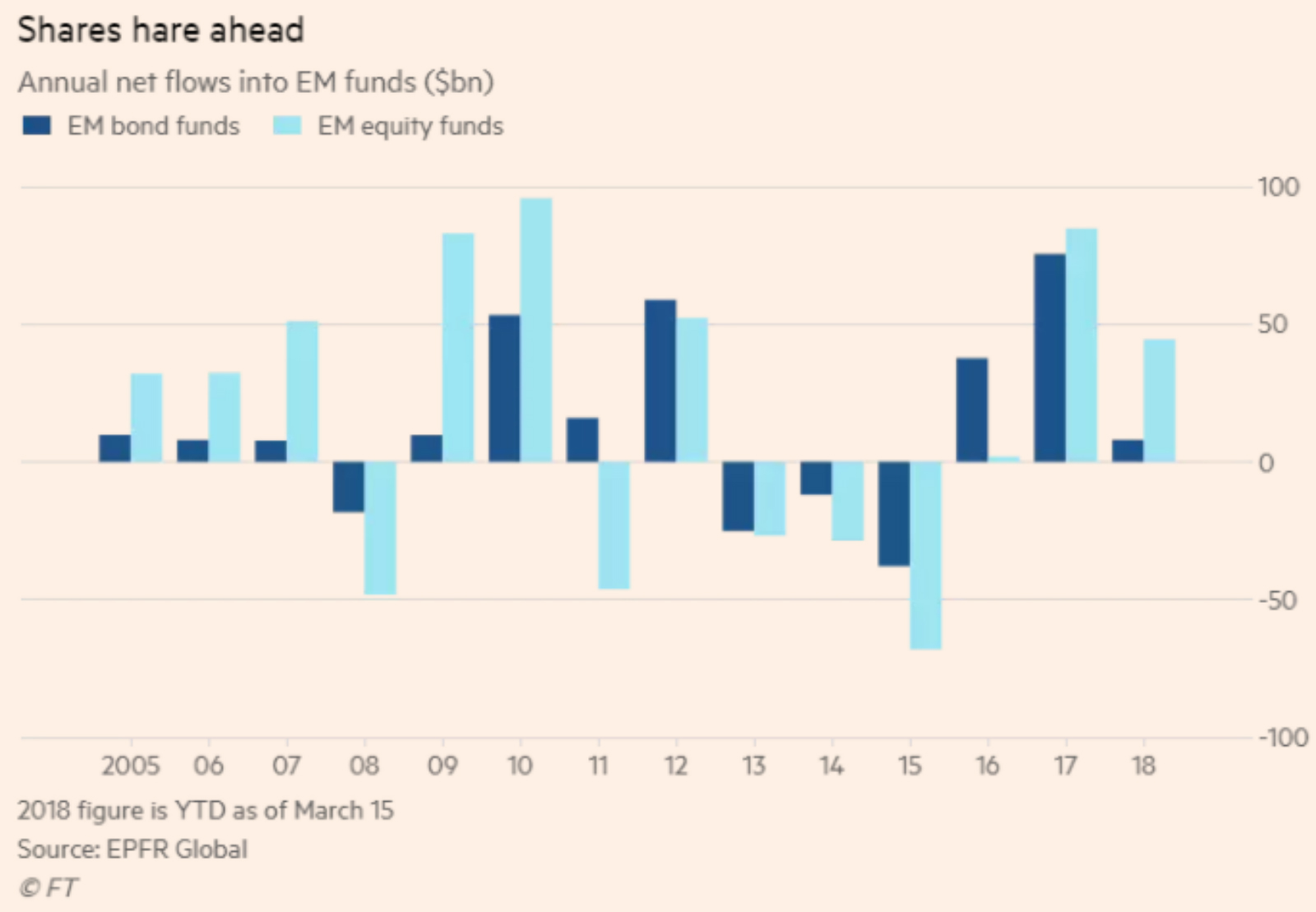

EM bonds may have lost their flavor, but EM equities hit new highs: Emerging market equity funds have made a record-breaking start to the year, with net inflows of USD 44.5 bn as of mid-March, according to figures from EPFR Global picked by the Financial Times. EM equities are up 34% y-o-y, said the head of global emerging market equity strategy at UBS, Geoff Dennis, who likes the outlook for the rest of the year. Cameron Brandt, director of research at EPFR, says that the enthusiasm for EM equities in general had been lifted by greater optimism about the health and growth prospects of the Chinese economy.

US policies appears behind the diminishing appeal of EM bonds. “Bond funds are definitely starting to come under pressure,” after a “great run” since the beginning of 2017, said Brandt. Data from the Institute of International Finance pointed to “a near halt in inflows to EM bond funds” in recent weeks, potentially driven by the Trump administration’s protectionist policies. Both hard and local currency EM bond funds suffered net outflows in February and the first half of March, according to EPFR, with “big” outflows from Asia ex-Japan bond funds and USD 200 mn pulled from Colombian funds.

This comes as the US looks to be ratchet up its brewing trade war with China. US Treasury Secretary Steven Mnuchin said on Wednesday his agency has prepared US investment restrictions on China for President Donald Trump to consider as part of his upcoming announcements on intellectual property actions against Beijing, Reuters reports.

Image of the Day

Mohamed Nofal is leading a group of cyclists pedaling their way to Russia from Giza, where they hope to watch their team play in the 2018 World Cup, Al Arabiya reports. The journey began at the Giza Pyramids on 9 March, with plans to reach Russia on 10 June. Nofal’s route took the group next to Suez, where they caught a ferry to Jordan’s Aqaba, before cycling to Oman to catch a flight to Athens; from there they should make an interrupted trip to Russia. The trip is sponsored by Egypt’s ministries of youth and foreign affairs.

Egypt in the News

President Abdel Fattah El Sisi and the presidential election getting underway next week are in the foreign media’s spotlight this morning. The Financial Times’ Heba Saleh and Andrew England write that El Sisi has stabilized Egypt but critics are warning of growing oppression. Critics fear that El Sisi’s “tough rule” Egypt is experiencing now is just storing up problems for the future as demographic and economic pressures mount. There are also expectations that El Sisi’s “unprecedented crackdown” is setting up the president to remain in power “for the long term,” Human Rights Watch researcher Amr Magdi tells Reuters. However, it is unlikely Egypt will face any consequences from European leaders, who are showing “growing indifference … to the defense of human rights” and are instead focusing on stability, Judy Dempsey writes for the Washington Post.

Egypt’s middle class is “bracing for more hardship” under El Sisi’s expected second term as the government presses on with austerity measures, Arwa Gaballa and Ali Abdelaty write for Reuters. The middle class is currently unlikely to stage large-scale demonstrations against living conditions but “their main grievance that would drive them to do so would be economic hardship.” Meanwhile, Islamist Statelet mouthpiece Al Jazeera is running an infograph-based piece on how Egypt’s economy has fared under El Sisi’s rule by looking at several factors — including inflation, unemployment rates, and remittances.

Others are viewing the situation positively. “For the first time, there is somebody who is making decisions based on the long-term welfare of the country … For a long time, Egyptian governments traded popularity for sustainability,” Qalaa Holdings Chairman Ahmed Heikal says. Heikal also endorsed El Sisi publicly in an op-ed he wrote for Al Shorouk. Egypt’s Coptic Christians are also expected to cast ballots for El Sisi’s performance in the vote as they are thankful to the incumbent president for ousting the Ikhwan from power, according to AFP. However, some activists have pointed out that “the Church does not represent all Christians,” which do not vote in one homogeneous bloc. Meanwhile, Sisi’s only opponent, Moussa Moustafa Moussa, says his campaign is “very serious,” according to the Associated Press.

…The elections can be viewed as an attempt by El Sisi to win a vote of confidence rather than an actual contest, Clifford D May writes for The Washington Times. He suggests that the international community should separate freedom from democracy and to press El Sisi to take steps to increase the former. “As we should have learned over recent years: Elections alone do not a democracy make. So start with human rights, the most basic being freedom of religion and belief. Next comes the freedom to express one’s beliefs. Before long, establish minority rights without which balloting is a path to majoritarian tyranny which is no better than other forms of tyranny. The journey toward a freer society that, over time, becomes a more democratic society won’t be quick or easy. Nothing guarantees success. But if there’s a better way, I’m not seeing it.”

Egypt’s participation in the 2018 World Cup is also getting a lot of attention in the foreign press. The Associated Press says the team looks “wobbly” ahead of its first warm up games with Portugal and Greece in Zurich, as players seem to be struggling with “Siberia-like” weather, according to The National. Liverpool star Mohamed Salah also got his share of international coverage, with Asharq Al Awsat’s Mashari Althaydi describing him as a “phenomenon” and The Sun noting he may soon not be the only Egyptian in Liverpool, as the club looks to bag Stoke winger Ramadan Sobhi.

Egypt is a “dream come true” for American retirees who want to live exclusively off their Social Security checks, according to personal finance site GoBankingRates. While most Americans would find it difficult to get by in the US on an average security check, there are several countries where the cost of living is low enough to make it work — and Egypt sits pretty at the top of that list. “Of the top 25 countries, Egypt boasts the lowest average monthly housing cost at just USD 157.70, and food and utilities both rank No.2, at USD 105.93 and USD 19.46 respectively.” Color us skeptical on the notion of a foreign retiree getting by on EGP 2,800 a month for rent and EGP 470 each week for groceries, but hey — positive press is positive press, right?

Increased security cooperation with Israel and a USD 15 bn natural gas export agreement compromises Egypt’s traditional role as a mediator in the peace process with Palestine, Maged Mandour suggests in a column for the Carnegie Endowment for International Peace. Yawn.

Oil Price is the latest outlet to note that the gas pact could spur development of the East Mediterranean gas basin.

And Al Qaeda leader Ayman Al Zawahiri has defended the Ikhwan in a new video recording, Al Arabiya reports. Again, yawn.

Energy

Titan Cement Egypt to build USD 8 mn, 8 MW solar power station in Beni Suef

Titan Cement Egypt is planning to invest USD 8 mn to construct an 8 MW solar power station next to its cement plant in Beni Suef, unidentified sources tell Al Borsa. The company plans to connect the station to the national grid and sell surplus energy to neighboring factories. Four solar power companies have presented offers to construct the plant and Titan is currently in “advanced talks” with KarmSolar, which offered to sell the energy produced directly to consumers at a lower feed-in tariff.

Aswan grants land to Solar Installer for 100 MW solar panel factory

The Aswan governorate has allocated a 10k sqm land plot to Solar Installer to establish a solar panel factory in the Allaqi industrial zone in Aswan, Al Borsa reports. Solar Installer had signed a JV agreement with local companies in Benban for the factory.

Infrastructure

Bidding window for Six October dry port to close on 7 April

The bidding window for the Six October City dry port will close on 7 April, sources close to the matter tell Al Borsa. We had noted earlier this month that the deadline was pushed by a month after the state received several extension requests from parties interested in the project, which is said to need an initial investment of USD 100 mn.

Tourism

TPA to launch new promotion campaign next month

The Tourism Promotion Authority (TPA) is set to launch a new three-month promotional campaign in April, TPA head Hisham El Demery said yesterday, Ahram Gate reports. The campaign, which will run on National Geographic and social media, will come in the form of informative videos on Egypt’s tourism and holiday destinations, as opposed to direct advertisements. The content will be geared towards tourists in the UK, Poland, Germany, Czechoslovakia, Belgium, and the Middle East.

Tourism Ministry ratifies Hajj prices and regulations

The Tourism Ministry has ratified the prices and regulations for the upcoming Hajj season, Ahram Gate reports. Prices rose 15% y-o-y.

Other Business News of Interest

Egypt Post and MyUS sign MoU to facilitate online shopping

Egypt Post has signed an MoU with US-based shipping company MyUS to facilitate online shopping to Egypt from the US, Chairman Essam El Sagheer tells Al Shorouk. Customers will be able to pay in cash through Egypt Post’s 4,000 nationwide branch network or via credit or prepaid Easy Pay cards, according to El Sagheer. But we ask, will they actually receive the packages they pay for? The recent experience of at least one of us here suggests otherwise…

Egypt Politics + Economics

Court unfreezes assets of Mubarak-era Agriculture Minister Youssef Wali

The Criminal Court annulled yesterday a 2011 verdict freezing the assets of Mubarak-era Agriculture Minister Youssef Wali and his family, Ahram Online reports. The former deputy chairman of Mubarak’s now-dissolved National Democratic Party has had several corruption cases against him dismissed in the past few years. Other Mubarak-era figures have also been cleared, including steel magnate Ahmed Ezz.

On Your Way Out

Someone decided to take their misogynist ideas too far by celebrating Mother’s Day with a cake adorned with detergents, according to StepFeed. The cake — which is far worse than the awful idea that gifting your mother with kitchen appliances is the best way to celebrate her role — has earned the ire of many on social media despite the traditionally “stricter gender-roles and patriarchal upbringing” of the Arab world. Here’s to hoping that whoever gave their wife/mother this cake was scrubbed out of her life with her favorite cleaner.

Reham Saeed won’t stay down, giving us haunting flashbacks of Night of the Living Dead: The Giza Criminal Court acquitted TV presenter Reham Saeed of incitement for kidnapping children on her show, Sabaya Al Kheir, Al Shorouk reports. The show’s producer was sentenced to one year in prison. Saeed had aired an episode claiming her crew managed to reunite two kidnapped children with their parents, kidnappings which the prosecutors alleged was staged by the show.

Egypt and Italy have launched a new academy to train police personnel from 22 African countries on curbing human trafficking and illegal migration, ANSA reports. The academy plans to train 360 police officers and border officials and equip them to pass on their training to other security personnel. “The training aims to strengthen skills in managing migration flows, investigating migrant trafficking and related crimes, border controls and documentary fraud. Particular attention will be given to protecting human rights and international protection procedures.”

The Market Yesterday

EGP / USD CBE market average: Buy 17.5814 | Sell 17.6786

EGP / USD at CIB: Buy 17.56 | Sell 17.66

EGP / USD at NBE: Buy 17.55 | Sell 17.65

EGX30 (Wednesday): 17,147 (+0.2%)

Turnover: EGP 1.8 bn (57% ABOVE the 90-day average)

EGX 30 year-to-date: +14.2%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 0.2%. CIB, the index heaviest constituent ended down 1.7%. EGX30’s top performing constituents were SODIC up 8.3%, Qalaa Holdings up 6.7%, and AMOC up 6.0%. Yesterday’s worst performing stocks Amer Group down 3.1%, Egyptian Aluminum down 2.4%, and CIB down 1.7%. The market turnover was EGP 1.8 bn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +88.4 mn

Regional: Net Short | EGP -60.0 mn

Domestic: Net Short | EGP -28.4 mn

Retail: 65.4% of total trades | 67.2% of buyers | 63.6% of sellers

Institutions: 34.6% of total trades | 32.8% of buyers | 36.4% of sellers

Foreign: 18.2% of total | 20.7% of buyers | 15.7% of sellers

Regional: 13.7% of total | 12.0% of buyers | 15.3% of sellers

Domestic: 68.1% of total | 67.3% of buyers | 68.9% of sellers

WTI: USD 65.28 (+0.17%)

Brent: USD 69.55 (+0.12%)

Natural Gas (Nymex, futures prices) USD 2.65 MMBtu, (+0.49%, April 2018 contract)

Gold: USD 1,332.70 / troy ounce (+0.85%)

TASI: 7,761.74 (+0.48%) (YTD: +7.41%)

ADX: 4,566.66 (+0.91%) (YTD: +3.82%)

DFM: 3,206.70 (+0.75%) (YTD: -4.85%)

KSE Weighted Index: 409.25 (-0.16%) (YTD: +1.95%)

QE: 8,873.38 (-1.16%) (YTD: +4.11%)

MSM: 4,796.23 (+0.30%) (YTD: -5.94%)

BB: 1,336.43 (-0.34%) (YTD: +0.35%)

Calendar

23 March (Friday): Orchestra In Art gala concert “The Three Egyptian Tenors,” Arts-Mart Gallery, 9:00pm.

28-31 March 2018 (Thursday-Sunday): Cityscape Egypt, Cairo International Convention Centre, Cairo.

02-03 April (Monday-Tuesday): Pharos Holding’s investor conference: In Search for Egypt Alpha, Cairo.

08 April (Sunday): Easter Sunday, national holiday.

09 April (Monday): Sham El Nessim, national holiday.

11 April (Wednesday): The Game Sports Industry Conference, Nile Ritz-Carlton Hotel, Cairo.

17-18 April (Tuesday-Wednesday): Creative Industry Summit, Four Seasons Nile Plaza Hotel, Cairo.

24-25 April (Tuesday-Wednesday): Renaissance Capital’s 3rd Annual Egypt Investor Conference, Cape Town, South Africa.

25 April (Wednesday): Sinai Liberation Day, national holiday.

01 May (Tuesday): Labor Day, national holiday.

02-03 May (Wednesday-Thursday): Cisco Connect Egypt 2018, Nile Ritz-Carlton Hotel, Cairo.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

07 May (Monday): International Data Corporation’s CIO Summit, The Nile Ritz-Carlton Hotel, Cairo.

15 May (Tuesday): Expected date for the start of Ramadan (TBC).

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

06 October (Saturday): Armed Forces Day, national holiday.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25 December (Tuesday): Western Christmas.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.