- IPO WATCH- CI Capital announces intention to float north of 42% of its shares on the EGX, will use proceeds from subsequent capital increase to fund expansion. (Speed Round)

- Analysts uniformly predicting interest rate cut next week. (What We’re Tracking Today)

- IPO WATCH- B Investments to conclude sale of 27% of shares on 29 March as trading begins on EGX. (Speed Round)

- Arabia Group for Real Estate Investment eyeing IPO by year’s end. (Speed Round)

- Ezdehar Egypt, NBK Capital bidding for controlling stake in Misr Cafe? (Speed Round)

- EBRD looking to acquire non-controlling stake in Wadi Degla Holding. (Speed Round)

- Edita signs agreement with Dislog for Morocco venture. (Speed Round)

- Small-time Israeli company trying to block Egypt-Cyprus gas import agreement. (Speed Round)

- The Market Yesterday

Thursday, 15 March 2018

Tons of IPO + M&A activity — what better way to end a busy week?

TL;DR

What We’re Tracking Today

As we near the central bank’s Monetary Policy Committee meeting a week from today, research houses are guiding their clients to expect an interest rate cut. The sentiment comes on the back of annual urban inflation falling to 14.4% in February from 17.1% in January, inching ever closer to the CBE’s target inflation rate of 13%.

Who’s saying what? EFG Hermes sees the CBE pushing through a second rate cut of 50-100 bps “before the CBE takes a pause to assess the impact of its two rounds of monetary easing on key monetary aggregates. Additional visibility on the next round of energy subsidy cuts … should also provide more guidance on short-term movement in policy rates,” the firm writes. Pharos’ research department sees a cut of 100 bps at the meeting, which should work in favor of highly leveraged companies and the real estate sector. It sees inflation falling another 200 bps by the end of the year. CI Capital’s research team also sees a 100 bps rate cut this month, projecting interest rates to fall 5% by the end of the year. Mubasher sees the MPC cutting rates a sharp 200 bps as the base effect continues to kick in on the inflation side of the equation, saying the pace of inflation only be slightly affected by the projected wave of subsidy cuts in July as these would not be as drastic as the previous round.

Meanwhile, our friends at Pharos Holding announced yesterday (pdf) that they have tapped specialist emerging markets investment bank Exotix USA to act as Pharos’ chaperone partner covering meetings and trades with US clients. Elwy Taymour, Pharos group chairman and co-CEO, said, “We look forward to working with Exotix USA, Inc. in the USA to expand our joint reach to reach new institutional clients, just as the economic turnaround in Egypt is beginning to attract far larger equity flows into the stock market … With the wide footprint which Exotix holds in emerging markets, the working relationship with Exotix allows Pharos to inform a wider client base about the Egyptian capital markets and the economy, through our Research product and in sales within our Brokerage division.”

Our friends at SODIC took home hardware from Cityscape for Best Low to Medium Rise Built Residential Project. The team won for the company’s Forty West project, SODIC said in a press release (pdf). The project, which was launched in 2009, was designed by Boston-based Machado and Silvetti Architects, while Eklego was responsible for interior designs. “Located in the heart of SODIC West, Forty West is recognized for its outstanding design set on a vibrant 2,500 square metre piazza, making it a truly unique destination.”

Elsewhere in the world this morning:

Instability emanating from the White House of late appears to be unsettling global equity markets. The S&P 500 ended 0.6% lower at 2,749, while the Nasdaq index slipped 0.2%, the FT (paywall) reports. The Dow Jones Average fell 1%. Recent events in Washington remained the key driver for equities, as the ousting of Secretary of State Rex Tillerson continued to reverberate around the markets. This has only been aggravated by reports that the Trump Administration is seeking to impose tariffs of up to USD 60 bn on Chinese imports.

…This is looking good for those betting on a rising VIX, as the CBOE Volatility Index jumped 5.38%.

CNBC pundit Larry Kudlow will replace Gary Cohn as The Donald’s top economic advisor. We’ll link to CNBC on this, naturally enough, while the FT and the Wall Street Journal also have coverage.

This comes as the US Senate is about to pass the so-called “Crapo” bill, which Business Insider is dubbing “the biggest rollback of Wall Street regulations since the financial crisis” in its very solid rundown on the proposed changes.

Germany’s Angela Merkel was given a fourth term as chancellor in a very tight vote at parliament, DW reports, ending 171 days of waiting for her to assemble a “grand coalition” with the Social Democrats. She got her government, but can we please tell her she can’t scupper our automotive directive?

The US business press is really trying to make something out of the 10-year anniversary of Bear’s bailout, with the Wall Street Journal writing this morning that “the seeds of instability are germinating again … a big financial-firm collapse in near future is exceedingly unlikely, but another crisis isn’t.”

The UK has ordered the biggest expulsion of Russian diplomats since the height of the Cold War after claiming Moscow used a nerve agent on British soil to kill a former Russian spy and his 33-year-old daughter, BBC reports.

More than 1 mn students from kindergarten to high school walked out of class yesterday in the United States to protest gun violence.

Falling rents in Dubai show “diminished faith” in a property rebound in the emirate, Bloomberg writes.

The stuff of nightmares: Sophia the Saudi Robot is coming to Egypt for the Creative Industry Summit next month, and her video announcement couldn’t possibly be any creepier (watch, runtime: 0:39). She may be the latest and most advanced social robot but Sophia gives us serious “Get Out” vibes.

A weeklong heat wave will begin on Sunday, with temperatures well above the seasonal average, according to the meteorological authority. Our favourite weather app shows the mercury rising to 31°C on Sunday and peaking at 39°C on Friday before cooling to the 20s the following week.

On The Horizon

The newly appointed board of the Financial Regulatory Authority (FRA) will be ratified in the coming days by Prime Minister Sherif Ismail. Once ratified, the board will begin work on issues including setting the executive regulations of the Capital Markets Act, completing the Insurance Act, and drafting legislation that would grant FRA new autonomy.

Cabinet is expected to discuss the executive regulations to the controversial NGO law “within days.” Parliament had signed off on the bill back in 2016. The act has since come under fire from Republican Senators and the US Congress’ human rights commission.

The Arts-Mart Gallery is bringing together visual and performing arts through its second ‘Orchestra In Art’ event, The Three Egyptian Tenors. The show features a full orchestra performing amidst a specially curated exhibition of Egyptian contemporary art. World-renowned conductor Nader Abassi and award-winning Egyptian tenors Hany Abdelzaher, Ragaa Eldin, and Amr Medhat will perform their Italian opera masterpieces at the Arts-Mart Gallery on Friday.

Naeem Holdings’ shares will officially begin trading on the Dubai Financial Market on 25 March. The company had received approval from the Financial Regulatory Authority for its dual listing last month.

The Game Sports Industry Conference — Egypt’s first-ever platform dedicated to the sports industry — kicks off in Cairo on 11 April. The conference, which will bring together industry professionals, leaders, and enthusiasts, will feature discussions on innovation and entrepreneurial thinking in the sports industry, leveraging sports as a marketing channel, and the digital transformation in sports, among others. You can register for the event here.

Enterprise+: Last Night’s Talk Shows

It’s countdown to elections,and as we noted up top, the campaign to get people out and voting is on full gear. Media censorship issues also continues to be a hot topic among the talking heads.

But first, do we really have 6.6 mn state workers in our Jabba the Hutt of a bureaucracy? The nation’s over bloated bureaucracy took center stage on Al Hayah Al Youm. Host Tamer Amin spoke with Deputy Planning Minister Salah El Sheikh on the extent of the problem and difficulty in breaking bureaucratic entanglements. El Sheikh could not verify the number of state workers (which he says is to big to give an accurate accounting), but said the state has around 6.6 mn jobs and functions (watch, runtime: 3:25). We doubt very many of these are vacant.

We now return to your TV yelling at you to get out to vote: Kol Youm’s Amr Adib said Egyptians should share their photos with their families while raising the flags at the polling stations to slam the notions that Egyptians are abstaining from voting (watch, runtime: 12:15). Adib spoke with Egypt’s Ambassador to Kuwait Tarek al-Qoni who reiterated expectations of a high turnout from the Egyptian community there (watch, runtime: 4:51). Not much else is different with the other talking heads.

With the atmosphere being political charged, we shouldn’t be surprised that MPs of parliament’s ICT Committee are once again bringing up the foolish notion of banning Facebook. What is surprising, however, is that the issue appears to have perturbed Adib who said it’s not possible to close domains such as Facebook and that it won’t help. Adib also rehashed Hona Al Asima’s criticisms of the fake news snitching hotline: that is gives too much power to people unqualified to assess media content, and it would open the floodgates to frivolous litigation (watch, runtime: 41:15).

The death of Egyptian student Mariam Mostafa yesterday in a Nottingham hospital after a violent attack dominated both print media and airwaves. Egypt’s ambassador to the UK Nasser Kamel told Masaa DMC’s Osama Kamal that the Foreign Ministry is pushing for results on the investigation to her case (watch, runtime: 6: 19). Assistant Foreign Minister for Consular Affairs Khaled Rizk tells Al Masry Al Youm= the embassy in London has urged the British authorities to investigate the hospital over medical negligence. Mariam was left in critical condition last month after a group of women violently assaulted her in what was considered a racist attack. A teenage girl arrested over the attack was released on conditional bail as the police investigation continues.

Startup Hood won the CIB-sponsored Hona Al Shabab competition on Hona Al Asema. Hood was awarded EGP 100k in funding from CIB. Tefly and Al7arefa came in second and third place respectively (watch, runtime: 1:45).

Speed Round

IPO WATCH- CI Capital announced today that it plans to sell 246.9 mn ordinary shares, or 43.6% of the company, on the EGX. The IPO will consist of an international offering to global and local institutional investors and a retail offering here in Egypt at a price to be determined following the book-building process, the company said in its intention to float (pdf). The offering is expected to consist of a secondary sale of shares by the CI Capital’s current shareholders, who will use a portion of the proceeds to subscribe a capital increase of up to EGP 1.0 bn in newly-issued shares.

What’s the use of proceeds from the subsequent capital increase? According to the ITF, CI will “(a) expand its existing businesses, including … leasing, microfinance, asset management, and margin lending (b) fund its expansion in new areas of non-banking financial services, (c) strengthen its balance sheet to support new activities including merchant banking and (d) for general corporate purposes.”

The financials: CI Capital reported revenues of EGP 1.85 bn last year, up 33% over 2016. Net profit last year was EGP 251 mn, a rise of 49% year-on-year.

The IPO is expected to take place in 2Q2018, subject to market conditions and regulatory approvals. The offering will be Reg S / 144A compliant, the ITF says, meaning qualified institutional buyers in the US can participate.

Advisors: Jefferies International Limited and CI Capital Investment Banking are acting as joint global coordinators and bookrunners on the IPO. Norton Rose Fulbright was tapped as international counsel to the issuer, while White & Case is the underwriters’ counsel. Matouk Bassiouny will serve as local counsel. HC Brokerage and Pharos Securities Brokerage are acting as placements agents.

IPO WATCH- Our friends at B Investments aim to conclude their sale of 27% of the company’s shares on 29 March: Trading in BPE Holding for Financial Investments (better known as B Investments) shares will begin on 29 March, the company said on Wednesday, according to Reuters. The company is selling 43 mn shares, good for a free float of about 27%. B Investments hopes to raise EGP 460 mn through the IPO, which will be used to fund renewable energy projects and non-banking financial services. Bookbuilding for the private placement of 38,131,554 shares and for the retail offering of 5,000,000 shares will conclude on 25 March. Sigma Capital is the sole coordinator and bookrunner, while Zaki Hashem & Partners are acting as legal counsel to the issuer.

IPO WATCH- Arabia Group for Real Estate Investment is looking to list 20-30% of its shares on the EGX by year’s end, Chairman Tarek Shoukry said, Youm7 reports. The planned IPO is meant to raise the company’s capital to finance future projects and expansions and currently remains under study. The company has also yet to tap an advisor for the transaction.

MENA IPO activity surged 60% y-o-y in volume terms in 4Q2017, with eight transactions for the quarter (six in the GCC alone), according to EY’s Q4 2017 MENA IPO Eye report picked up by the Saudi Gazette. IPO value amounted to USD 2.5 bn in 4Q2017, over ten times the capital raised last year. The UAE led the MENA IPO market in value, having raised USD 2.2 bn in new listings, primarily from transactions by Emaar Development (USD 1.3 bn) and ADNOC (USD 850.9 mn).

MENA IPO activity to gain momentum in 2018: “We expect MENA IPO activity to gain momentum in 2018 bolstered by economic reforms and privatization drive of countries such as Saudi Arabia and Egypt,” said EY’s MENA IPO Leader Gregory Hughes. “This, coupled with improved oil prices, favorable government initiatives and strong investor appetite, is likely to spur more listings in the MENA, especially from leading regional government-entities. The IPO activity in the region is likely to see a mix of local and international floatings. In addition, family-owned, owner managed and private equity-backed businesses are also signaling their intention to go to the market during 2018; this again could include a combination of local and international offerings of different sizes.”

M&A WATCH- Ezdehar Egypt, NBK Capital bidding for controlling stake in Misr Cafe? Our friends at Ezdehar Egypt Mid-Cap Fund and NBK Capital Partners are said to be bidding to acquire a controlling stake in instant coffee maker Misr Cafe, sources close to the matter tell Al Mal. Talks are at an early stage and Misr Cafe has received other acquisition offers from local and Gulf firms, according to the sources. The bid comes after Ezdehar Managing Partner Emad Barsoum had said earlier this month that the fund is closing in on a USD 50 mn acquisition of an unnamed industrial company. Arqaam Capital is acting as sell-side advisor, while Matouk Bassiouny is legal counsel to NBK. Misr Cafe, which was established in 1984, was delisted from the EGX in 2007. Abraaj Capital had considered acquiring a controlling stake in the company in 2015, but talks had halted the following year.

M&A WATCH- EBRD looking to acquire non-controlling stake in Wadi Degla Holding. The European Bank for Reconstruction and Development (EBRD) is looking to acquire a non-controlling stake in Wadi Degla Holding Company sometime during 1H2018, unidentified sources tell Al Borsa. Wadi Degla had reportedly been fielding offers from local investors, but stopped negotiations for reasons that remain unclear. The transaction would take the form of both a share sale by existing investors and a subscription to a capital increase by EBRD as part of Wadi Degla’s plans to list on the EGX in the future, the newspaper reports. Al Tamimi & Co is said to be legal advisor to Wadi Degla, while White & Case is acting as the EBRD’s legal advisor.

Packaged snack food producer Edita announced signing a partnership agreement with Morocco’s Dislog Group, according to a company disclosure. The agreement follows an MoU signed between the two companies in December. According to the agreement, Edita and Dislog will start a snack food factory in Morocco under a greenfield investment. Our friend Hani Berzi, Edita’s chairman and CEO, had said in December that “commercial operations will begin in early 2018 with exports of Edita’s products to Morocco, while the second stage will entail the establishment of a state-of-the-art manufacturing facility in 2019 with an initial investment estimated at around USD 10 mn.”

The Supply Ministry is looking into paying bakeries a higher fee for producing subsidized bread, unidentified sources tell Al Mal. Bakeries are required to purchase the raw materials for bread, including wheat and flour, at market price and then receive monetary compensation from the government for the end product. The proposal currently under study would see the ministry pay bakeries EGP 220, up from EGP 180 currently, for every 100 kg sack of flour. Under the current pricing scheme, bakeries are compensated EGP 0.144 per loaf to cover production costs, with a EGP 0.406 profit margin per loaf. Raising the cost of production to EGP 220 would mean bakeries would receive EGP 0.176 per loaf for production costs, alongside their profit margin. Bakeries have been complaining that it is costing them more to produce bread due to the rice prices of raw materials..

Some bit player in Israel with rights to Aphrodite is trying to block a potential gas import agreement between Egypt and Cyprus, Cyprus Mail reports. Israel Opportunity, one of the partners in the Ishai field — located on the Israeli side of Cyprus’ Aphrodite reservoir — has written to the Israeli government urging it to step in and block any potential agreement as it would impact their interests. “Such behaviour will lead to a significant loss of state revenue,” said company Chairman Rony Halman. Israel’s ministry of national infrastructure responded that “development of the reservoir necessitates agreement between the parties on safeguarding the rights of both countries in the reservoir, and a dialogue is taking place with Cyprus on the matter.” Cyprus’ government had brushed off the claim when it was made to them, with government sources stating that the claim is unreasonable since they have officially admitted that the quantity discovered at Ishai is negligible and cannot be recovered.

ELECTION UPDATE- The presidential election gets underway tomorrow when Egyptians living abroad begin casting their ballots at embassies and consulates. Egyptians living in Syria, Yemen, Somalia, Libya, and the Central African Republic will not be able to vote due to instability in those countries, Ahram Gate reports.

President Abdel Fattah El Sisi has urged the voters to head to the polls regardless of whether they’re voting for him or for his rival, according to Ahram Gate. High turnout is important, the president said.

Employers urged to give staff paid time off to vote: The Federation of Egyptian Chambers of Commerce is urging employers to give employees paid leave during the primary 26-28 voting window. Students won’t be getting time off, though: The Education Ministry has already said that only schools hosting polling stations will be shut.

What does Tillerson’s ouster mean for the Arab world? Newly-appointed Secretary of State Mike Pompeo will be taking up his new jobs s the US faces “array of delicate and potentially dangerous” foreign policy issues, the Washington Post says. Among them is the Arab Quartet’s ongoing spat with Qatar, which Trump is hoping to resolve in a May summit with the help of the diplomatically inexperienced Pompeo. Tillerson’s departure is “welcome news” to the Arab world, particularly as he attempted to end the quartet’s months-long blockade on Qatar, according to the New York Times.

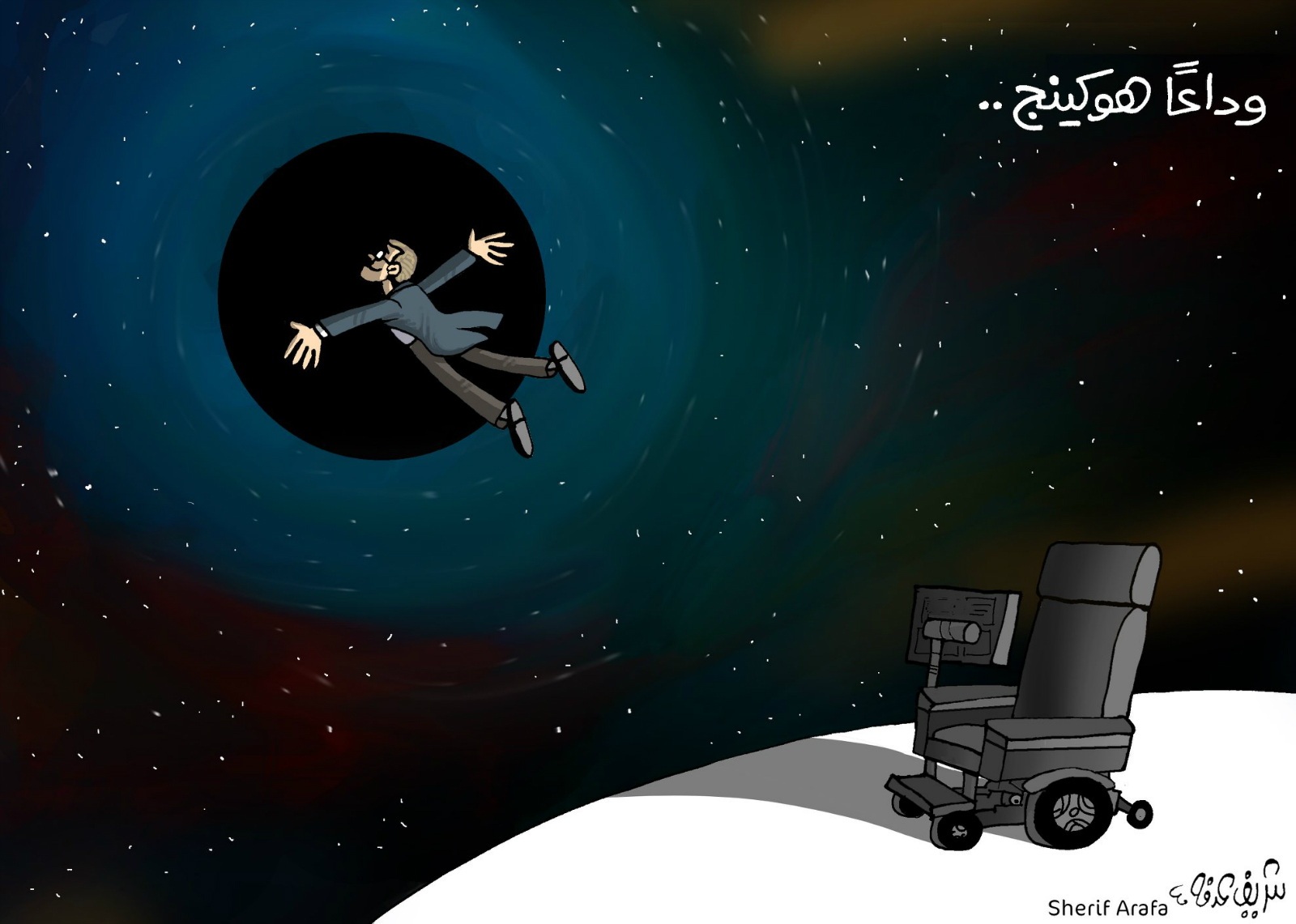

Physicist and cosmologist Stephen Hawking passed away yesterday at the age of 76, after a 55-year battle with Lou Gehrig’s disease. Hawking was “an iconic figure in both the scientific community and in popular culture, known for his keen mind and humor, as well as his striking physical challenges … Among his most important scientific contributions are his singularity theorems, which help explain concepts like the beginning of time,” the Wall Street Journal writes of the University of Cambridge professor. The New York Times also has a lengthy but solid obituary, while Egyptian artist Sherif Arafa paid homage to cosmology’s brightest star with the above illustration.

Egypt in the News

With another slow night on Egypt in the foreign press this morning, the conversation was dominated by the Sinai operation and the elections.

The Western Desert is emerging as a new frontier in the global fight against terrorism, Sudarsan Raghavan writes for the Washington Post. Raghavan says terrorists linked to Daesh and Al Qaeda “are using the desert as both a haven and a crossing point for smuggling fighters, weapons and illicit goods from Libya.” A new group linked to Al Qaeda is emerging in the area and analysts say it is made up of highly trained former Egyptian army officers and soldiers who became radicalized. “Compared to the insurgency in the Sinai, this is not a layman’s insurgency … They have military training and are comprised of former army members, which makes it very hard for counter attacks by the Egyptian army to bring these areas under their control,” explains analyst Hause Waszkewitz.

Meanwhile in Sinai, residents are holding out hope that the peninsula will finally weed out terrorism once development efforts are implemented in the vast governorate, Mohammed al-Hur writes for Asharq Al-Awsat. One tribe leader lauded the government’s recently unveiled Sinai development plan as a promise of “a major change for the people, who have often received promises without action on the ground.”

Regional chaos has given President Abdel Fattah El Sisi an opening to take “aggressive measures” to stabilize Egypt without facing reprimand from the West, David Emeka Ogbogu writes for MarketMogul. “Pushing Sisi into political turmoil or into the hands of America’s adversaries would be disastrous for the West…Cairo knows this and has thus chosen to capitalise on the lack of options that Washington and their allies have.” Egypt is also capitalizing on its journey to becoming a regional gas hub to secure a position as an important economic force. Combined, these political and economic factors have discouraged the West from objecting to Egypt’s internal affairs.

A UK MP is warning Egypt that it has yet to respond to British lawmakers request to visit ousted Islamist president Mohamed Morsi in prison, Anadolu reports. MP Crispin Blunt said that Morsi “is not an ordinary prisoner” and that his allegedly deteriorating health condition lead to “wider consequences.” A group of British parliamentarians had petitioned the Egyptian government last week to review the conditions of Morsi’s detention.

Also worth a quick skim

- Mona Eltahawy says, as an Egyptian feminist, she is not celebrating the rise of Gina Haspel to become the first woman to head the CIA, in a piece for the New York Times.

- Reuters interviewed a belly dancer who donned a beard in one of her shows to protest LGBT abuse in Egypt.

- Egyptian authorities are investigating two religious officials for lashing out at footballer Mohamed Salah during a mosque sermon, according to Gulf News.

- National football team coach Hector Cuper is concerned that Ramadan will interfere with Egypt’s preparations for the World Cup, the AP’s Hamza Hendawi reports.

On Deadline

Ahram Gate’s Ahmed El Berry urges the House to speed up the approval of a new proposed law to regulate the issuing of fatwas [religious advisory opinions], arguing that it would be a main pillar in the fight against extremist ideology and a significant step towards a new religious discourse. Not to mention that such a move would put an end to internationally embarrassing fatwas which have plagued us since 2011.

Worth Reading

Egyptian ballerina Magda Saleh’s life and career, which reached its zenith as a guest star in Russia’s Bolshoi Ballet, can be traced alongside Egypt’s political history, Brian Seibert writes in a profile for the New York Times. Saleh danced her dream role, Giselle, in Moscow in “an East-meets-West tale of Cold War cultural politics, [which] happened long ago, in the 1960s and early ‘70s.” Saleh’s career began during the height of Egypt-Soviet relations, which saw her receive training in Moscow. The shift of political alliances under Anwar Al Sadat led to a sea-change in ballet’s status in Egypt. After trying in vain to fight for restoring the art’s cultural significance, she retired in New York, “regretful that she hasn’t had the opportunity to serve her country as she would have wished.”

Diplomacy + Foreign Trade

EU countries including Germany, Finland, and Denmark voiced their concerns about Egypt’s human rights record yesterday during a UN OHCHR’s general debate. The countries accusations included restricting civil society and the systemic silencing of the media. This came as UN human rights experts strongly condemned on Tuesday a decision by the Egyptian prosecutor to seek the death penalty for photojournalist Mahmoud Abou Zeid (a.k.a Shawkan), who was arrested while covering anti-government protests in 2013.Egypt’s UN Ambassador Alaa Youssef rejected “unfounded allegations” made by the EU countries.

The US is reportedly in talks with Egypt to include tech products and leather-made goods as part of the Qualified Industrial Zones (QIZ) agreement between Egypt, the US, and Israel, sources tell Al Shorouk. Most of Egypt’s exports through the QIZ agreement are textiles and ready-made clothes.

Egyptian companies signed USD 130 mn worth of agricultural export contracts at the Fruit Logistica trade show in Berlin last month, according to a Trade and Industry Ministry statement.

Energy

SDX announces oil discovery in West Gharib

SDX Energy announced making an oil discovery at its Rabul 5 Well in the West Gharib Concession. SDX controls 50% of working interest and is joint operator in the well. “Further evaluation of the discovery is ongoing, after which the Company expects the well to be completed as a producer and connected to the central processing facilities at Meseda.” CEO Paul Welch says, “We have further drilling activity planned for the concession over the coming months and we firmly believe that these activities will enable us to increase output from the licence and achieve our ambitious production plans for 2018.”

Basic Materials + Commodities

Beheira to launch agricultural “commodities exchange” in September

Beheira is on track to launch its agricultural commodities exchange in September, the exchange’s project manager tells Al Masry Al Youm. President Abdel Fattah El Sisi had ordered the establishment of the exchange, which resembles more a market than the CME, last year as part of his strategy to spur development in the Western regions of Egypt.

GASC launches global wheat tender for April delivery

The General Authority for Supply Commodities (GASC) issued a tender yesterday for an unspecified amount of wheat for delivery by 15-25 April, Ahram Gate reports.

Tourism

Egypt’s occupancy rates expected to rise significantly in five years, Colliers says

Hotel occupancy rates across Egypt are expected to rise significantly as the hotel sector stabilizes over the next five years, Colliers International’s Christopher Lind said at the Cityscape Egypt Conference, according to Daily News Egypt. The company foresees Cairo occupancy to increase to 69%, while Hurghada’s occupany is expected to reach 61%. Sharm El Sheikh’s occupancy is projected to hit 51%, while Alexandria will see an occupancy increase to 71%.

Egypt among top summer 2018 destinations for German tour operators

Egypt is one of a few Eastern Mediterranean top destinations for summer 2018 as announced by German tour operators, tourism portal FVW reports. The double-digit increase in Eastern Mediterranean destination trends, comes after Germans topped the list of tourist arrivals in Egypt in 2017 with 1.23 mn tourists.

Egypt sees 60% surge in 2017 Chinese tourist arrivals

The number of Chinese tourists visiting Egypt jumped 60% y-o-y in 2017 to c. 287k, Chinese Ambassador to Egypt Song Aiguo said yesterday during a press conference at the embassy, Al Borsa reports.

Telecoms + ICT

ITIDA to host forensic lab to combat intellectual property theft

The government is setting up a specialized digital forensic lab for intellectual property to combat software piracy that will be hosted at the Information Technology Industry Development Agency (ITIDA). The lab “is mainly designed to resolve business software and internet-based piracy cases. It authentically recovers data from digital devices and unearths new fraud techniques.” The cabinet is preparing a data protection and privacy law draft and it has already agreed on cyber-crime law and awaits the Parliament’s approval to be enacted.

Other Business News of Note

Oriental Weavers plans to acquire assets worth EGP 147.6 mn this year

Oriental Weavers is planning to acquire assets worth EGP 147.6 mn this year, Al Borsa reports, without providing further details on the nature of these assets. The company had previously announced that it intends to invest around EGP 480 mn in 2018 to purchase new looms and spinning machinery.

Legislation + Policy

House ICT Committee looks to enforce harsher punishment for defamation, copyright infringement

The Cyber Crimes Act, currently with the House of Representatives’ ICT Committee, punishes those guilty of online defamation and libel with jail time, Al Borsa reports. The legislation currently mandates a prison sentence of up to one year, but members of the committee, including its deputy chair, would like this increased to three years. The committee voted to approve three articles of the act today which allow the government to block websites if it deems it a danger to national security, according to Egypt Independent. Separately, the committee is looking to amend Egypt’s copyright laws to impose harsher penalties for pirating television shows and movies, committee head John Talaat said, Al Mal reports. According to Talaat, the government is wary of imposing harsher penalties since piracy is widespread in Egypt and many citizens are unaware that it is illegal.

Egypt Politics + Economics

Supreme Court ruling on Tiran and Sanafir is now law

The Supreme Constitutional Court’s ruling to dismiss all legal challenges to Egypt’s transfer of the Tiran and Sanafir Island was published yesterday in the Official Gazette (pdf). MPs had signed off on the agreement last June, a week before it was ratified by President Abdel Fattah El Sisi.

Finance Ministry settles 260 cases of tax evasions

Finance Minister Amr El Garhy signed off on settling 260 tax and customs evasion cases, according to a ministry statement. The statement does not provide further details on the cases or the value of the settlements.

National Security

Egypt’s submarine fleet does not make Israeli commander happy -JPost

A senior Brigade Commander in Israel’s navy says Egypt’s growing submarine fleet does not make him happy, JPost reports as part of another expose related to Prime Minister Benjamin Netanyahu’s corruption case dubbed Case 3000. The unnamed commander says “[Egypt] bought a different model of submarine. I will always seek sea superiority over everyone. I don’t want others to have submarines – certainly not ones on our level. Their fleet does not make me happy, but I can still sleep well at night.”

On Your Way Out

London-based Egyptian e-learning platform Knowledge Officer has raised USD 833.5k from UK and US angel investors Ian Hurlock from Fox and Abdullah Al Shaheen, according to Wamda. The startup, which creates personalized and evolving learning paths for professionals based on their career goals, has gained 1,000 users since its launch in January 2017.

The Market Yesterday

EGP / USD CBE market average: Buy 17.57 | Sell 17.66

EGP / USD at CIB: Buy 17.55 | Sell 17.65

EGP / USD at NBE: Buy 17.55 | Sell 17.65

EGX30 (Wednesday): 16,882 (-0.6%)

Turnover: EGP 2.0 bn (74% ABOVE the 90-day average)

EGX 30 year-to-date: +12.4%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.6%. CIB, the index heaviest constituent ended down 0.8%. EGX30’s top performing constituents were Elsewedy Electric up 9.6%, Ezz Steel up 2.3%, and Abu Dhabi Islamic Bank up 0.8%. Yesterday’s worst performing stocks GB Auto down 5.0%, SODIC down 4.6%, and Madinet Nasr Housing 4.2%. The market turnover was EGP 2.0 bn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +89.0 mn

Regional: Net Short | EGP -40.8 mn

Domestic: Net Short | EGP -48.2 mn

Retail: 46.2% of total trades | 48.4% of buyers | 43.9% of sellers

Institutions: 53.8% of total trades | 51.6% of buyers | 56.1% of sellers

Foreign: 33.5% of total | 35.8% of buyers | 31.3% of sellers

Regional: 13.7% of total | 12.7% of buyers | 14.7% of sellers

Domestic: 52.8% of total | 51.6% of buyers | 54.0% of sellers

WTI: USD 61.02 (+0.10%)

Brent: USD 64.92 (+0.05%)

Natural Gas (Nymex, futures prices) USD 2.74 MMBtu, (+0.22%, April 2018 contract)

Gold: USD 1,326.90 / troy ounce (+0.10%)

TASI: 7,775.42 (-0.03%) (YTD: +7.60%)

ADX: 4,519.12 (-0.41%) (YTD: +2.74%)

DFM: 3,167.22 (+0.02%) (YTD: -6.02%)

KSE Weighted Index: 410.84 (+0.26%) (YTD: +2.35%)

QE: 8,750.32 (-0.58%) (YTD: +2.66%)

MSM: 4,894.60 (-0.11%) (YTD: -4.01%)

BB: 1,360.53 (-0.04%) (YTD: +2.16%)

Calendar

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.