- Gas export hub taking shape, captures imagination of global business press. (Speed Round)

- LEGISLATION WATCH- Bankruptcy Act is now law of the land; government to hold “national dialogue” on pricing of medical services under Unified Healthcare Act. (Speed Round)

- Gov’t to ramp-up local-currency borrowing today to take advantage of lower interest rates. (What We’re Tracking Today)

- INVESTMENT WATCH- Abdul Latif Jameel eyeing return to renewable energy sector; Dubai’s Phanes Group says it is looking at solar opportunities here. (Speed Round)

- INFRASTRUCTURE WATCH- European funding in the pipeline for Cairo Metro Line One, dry ports, desalination plant and Alexandria tram. (Speed Round)

- Abraaj undergoes management restructuring, corporate reorganization following allegations of “misuse” of health fund. (Speed Round)

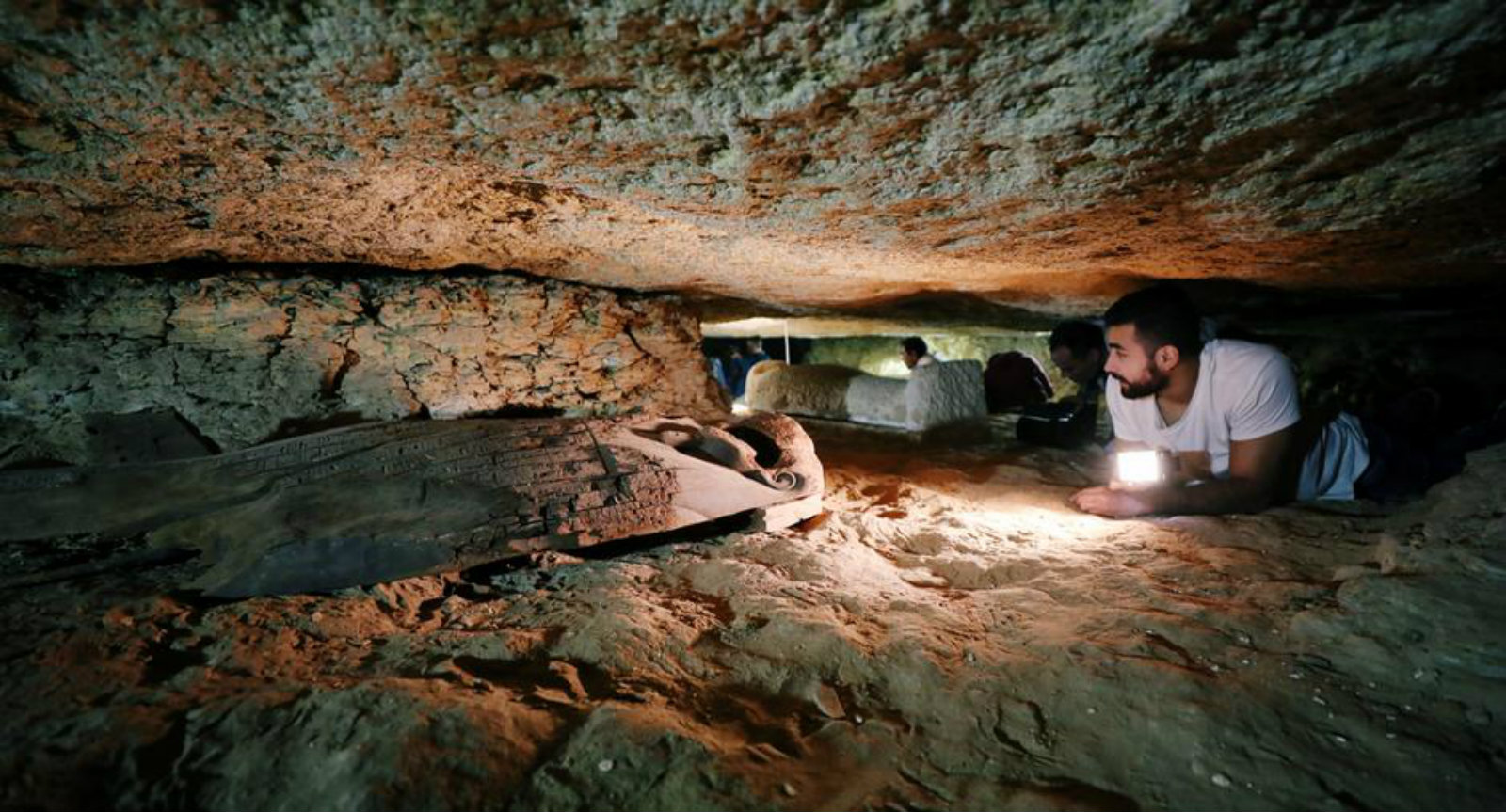

- Discovery of 2,000 year old necropolis tops coverage of Egypt in the international press. (Egypt in the News)

- Legendary investor Warren Buffett’s annual letter is out. (What We’re Tracking Today)

- The Market Yesterday

Sunday, 25 February 2018

Egypt as gas export hub still captures the imagination

TL;DR

What We’re Tracking Today

Egypt’s USD 4 bn in eurobonds listed on LSE: The listing of Egypt’s successful USD 4 bn multi-tranche eurobonds on the London Stock Exchange (LSE) was completed last Wednesday, the LSE said in a press release on Thursday. “Despite market volatility, the order book peaked at USD 12.5 bn,” the bourse added. “As a global market, LSE is committed to supporting Egypt’s economic development and growth program through capital raising on our markets,” said LSE CEO Nikhil Rathi. “We are honored to welcome Egypt’s multi-tranche bond listing to our markets, which reflects the City’s ability to provide a deep, liquid and complimentary channel of finance for the development of the country,” he added. “This will send a strong message of global investor support for Egypt’s economic reform programme,” said the UK’s Minister of State for the Foreign and Commonwealth Office and Department of International Development, Alistair Burt.

Proceeds from the issuance have already hit Egypt, Finance Minister Amr El Garhy told Youm7 on Thursday, bringing Egypt’s net FX reserves to around USD 41 bn, banking sources told the newspaper. We’re not getting the math on this one, since the CBE reported earlier this month that reserves in January had reached USD 38.2 bn. Assuming this is not the only source of FX in Egypt this month, the reserves figure is likely larger.

Egypt’s issuance re-opened the market for EM debt, as successful African eurobond issuances underscore. Investors placed USD 14 bn of orders for Kenya’s USD 2 bn eurobond issuance last week Wednesday, Bloomberg notes. Nigeria’s USD 2.5 bn sale, which also followed Egypt’s, landed orders for USD 12 bn. And there’s more to come, apparently, from Cote D’Ivoire and Ghana. “This is a hunt for yield story, it’s very simple,” one banker involved in the Kenya issuance tells the Financial Times. Two factors are bringing sub-Saharan African issuers to the market: refinancing and the funding of infrastructure projects, another banker said.

Gov’t begins extensive local bank borrowing today after interest rate cuts: The Ismail government is increasing its appetite for domestic borrowing following the interest rate cuts with a planned EGP 16 bn T-bill sale today, according to Youm7. Vice Minister of Finance Ahmed Kouchouk had said last week that Egypt will floating more EGP-denominated paper as long-term borrowing costs in Egypt get cheaper. Analysts, including those from Capital Economics, had hoped that falling interest rates might help move domestic credit more towards the private sector, after years of heavy government borrowing that some felt had crowded out the private sector.

Foreign Minister Sameh Shoukry is heading to Brussels and Geneva today for a short visit. Shoukry is set to take part in a meeting tomorrow between the foreign ministers of the Six-Party Arab Committee on Jerusalem and their European counterparts at the EU headquarters in Brussels. He will then head to Geneva to deliver Egypt’s speech at the UN Human Rights Council and the UN-sponsored Conference on Disarmament.

Egypt ranked 117 out of 180 countries in Transparency International’s 2017 Corruption Perception Index, dropping nine spots from the previous year. Egypt’s score also dropped to 32 from 34. The index measures public sector corruption, as perceived by experts and businesspeople, giving scores between 0 (highly corrupt) and 100 (very clean).

Banners, banners everywhere: Campaigning for Egypt’s upcoming presidential election officially kicked off yesterday, AFP reports.

Legendary investor Warren Buffett’s annual letter to shareholders is out, and as usual, it is a model of clear, blunt writing. We’re not certain this year’s letter was written by the legendary, retired Fortune writer Carol Loomis, but her DNA is everywhere to see. Among our favorite passages: “Charlie and I view the marketable common stocks that Berkshire owns as interests in businesses, not as ticker symbols to be bought or sold based on their ‘chart’ patterns, the ‘target’ prices of analysts or the opinions of media pundits. Instead, we simply believe that if the businesses of the investees are successful (as we believe most will be) our investments will be successful as well. Sometimes the payoffs to us will be modest; occasionally the cash register will ring loudly. And sometimes I will make expensive mistakes. Overall – and over time – we should get decent results. In America, equity investors have the wind at their back.” Read the full letter here (pdf).

Chinese automaker Geely, already a presence in Egypt via GB Auto, has added a 10% stake in Mercedes-Benz parent company Daimler to its portfolio, making it the latter’s largest single shareholder. Geely, the most globally ambitious of the Chinese automakers, already owns Volvo and Lotus.

Oil output to rise in 2019? “OPEC and its allies including Russia may next year ease the crude-output curbs that have helped prices recover from the worst crash in a generation, according to Saudi Arabia’s oil minister,” Bloomberg reports.

Our friend Hind El Hafez, the noted jewelry designer and artist, at the group exhibition “Meet Me There.” The exhibition, which features Hind’s latest collection of contemporary art jewelry, is being hosted by the Cairo Artists Collective and runs in Zamalek through Friday, 2 March 2018. The show’s special guest is Hind’s Spanish friend and colleague Estela Saez Vilanova. Want to attend? Pop an email over to info@cairoartistscollective.com for the details.

What We’re Tracking This Week

Government to announce winners of PPP schools tender this week: The Ismail government plans to announce this week the winners of its tender for the development and management of 200 schools under public-private partnership contracts, sources close to the matter had told Al Borsa.

On The Horizon

Our friends at EFG Hermes are hosting their 14th annual One on One Conference in Dubai on Monday, 5 March. The three-day event is the largest investor conference globally focused on frontier and emerging markets and will bring together some 175 companies for discussions on what a year of shifting benchmarks — including oil production cuts and the prospect of US interest rate hikes — mean for emerging frontier markets.

Egypt’s Emirates NBI PMI reading for February will be announced on Monday, 5 March.

Foreign Minister Sameh Shoukry met with an AmCham delegation yesterdayahead of the upcoming annual Doorknock mission to Washington DC.

Enterprise+: Last Night’s Talk Shows

Fees imposed by the Tourism Ministry on umrah travel for this season took over the debate on the airwaves last night. Our read is that the move is fundamentally a bid to control demand for FX heading during the pre-Ramadan season, when demand for foreign exchange rises as importers, manufacturers and retailers stock up on the staples of the holy month.

Tourism Minister Rania Al Mashat spoke to Hona Al Asema’s Lamees Al Hadidi to defend the decision to set a cap of 500k visas for Egyptians and impose a fee of SAR 2-3k on travellers who have recently performed the journey, saying that it means to control the demand for the SAR that the government is committed to providing. She added that the surcharge will be reviewed next year (watch, runtime 7:48).

The head of the Supreme Committee for Hajj and Umrah, Ashraf Shiha, also backed the decision, claiming that it should not affect demand since those who do the pilgrimage frequently represent only about 8-10% of total demand (watch, runtime 6:39). Shiha also told Al Hayah Al Youm’s Tamer Amin that the quota and fees will be subject to increase or decrease next year, depending on the country’s economic conditions, explaining that it burdens the state to cater to the FX demand during umrah season (watch, runtime 3:52).

Tourism industry players are losing their minds, calling in to say that restrictions on repeat pilgrims would be bad for the already-struggling sector. MPs Elham Menshawy and Mohamed Naggar also said they oppose the surcharge.

On Kol Youm, Amr Adib expressed his full support for the decision. He spoke to Endowments Minister Mohamed Mokhtar Gomaa, who said that it’s preferable if people help the poor or contribute to infrastructure projects (that last bit is a new one on us) rather than go on umrah (watch, runtime 4:45). Adib also clarified to his audience that the fees will not be funneled to the Tahya Misr fund but will go to a CBE account created especially for them (watch, runtime 5:41).

Civilian in Sinai struggling to access subsidized food? On Masaa DMC, Eman El Hossary spoke to Food Industries Holding Company head Alaa Fahmy, who reassured her that citizens in North Sinai have access to sufficient food amid the military’s anti-terror campaign, confirming that government outlets are well-supplied (watch, runtime 4:21). The head of the North Sinai’s Doctor’s Syndicate called Lamees to say that Supply Ministry outlets were not in fact widely present in the area. He claimed that people have been queuing up to receive whatever limited commodities they could from the Armed Forces (watch, runtime 13:45).

Lamees also talked to President Abdel Fattah El Sisi’s campaign spokesperson, Mohammed Abu Shuka, who said that Sisi’s program would be announced soon (watch, runtime 47:00) and phoned presidential candidate Moussa Moustafa Moussa to discuss his bid (watch, runtime 10:00). The two also spoke to El Hossary on Masaa DMC (watch here, runtime 7:52) and (here, runtime 3:54).

Speed Round

Egypt might sign an export agreement to ship East Med gas to Europe as early as mid-2018: Egypt will sign a memorandum of understanding with the EU to export gas from the East Mediterranean through its liquefaction plants before mid-2018, said Oil Minister Tarek El Molla at the International Petroleum Week conference in London on Thursday, according to a ministry statement.

Egypt is also closing in on an import agreement with Cyprus and Greece: El Molla said a preliminary agreement to import gas from Cyprus had been reached. Last week, Cypriot Energy Minister Georgios Lakkotrypis said that “Cyprus is close to selling natural gas to Egypt’s liquefied natural gas plants, and we could reach an agreement in the coming weeks.” El Molla also noted that Egypt and Greece are in talks to establish a framework for further energy cooperation.

PM Ismail sees last week’s USD 15 bn gas import agreement as part of int’l arbitration compromise: Prime Minister Sherif Ismail appears to see that the agreement signed last week, which would see Alaa Arafa-led Dolphinus Holding import USD 15 bn-worth of gas from Israel’s Delek and Noble, as part of a compromise to withdraw the USD 1.76 bn international arbitration ruling against EGAS, EGPC and East Mediterranean Gas (EMG). “We reached an agreement to receive part of the gas in Egypt via its pipelines and this is part of the resolution to the arbitration,” Ismail told reporters on Thursday, according to Bloomberg. He said an understanding had also been reached with Israeli Electric Company, but declined to give more details. The agreement would also help resolve the USD 1.03 bn arbitration ruling awarded by a Cairo arbitration court to EMG, he added, AMAY reports. “The goal is not the import of gas from Israel. We opened up the Egyptian market. We are strongly seeking to receive Cypriot gas, too,” Ismail also said.

Private-sector solution to arbitration hurdle? This comes as sources close to the agreement told Mada Masr on Friday that Delek and Noble Energy have begun talks with shareholders of EMG to acquire the company. The sources added that the pipeline, which had been used to export has to Israel, would be reversed if the transaction goes through.

Last week’s agreement also opens the door to resolving a USD 270 mn arbitration case with Spanish Egyptian Gas Company (SEGAS), which runs the Damietta liquefaction plant and is 80% owned by Spain’s Union Fenosa, the anonymous sources said. While the status of the case is unclear, High Council for International Arbitration commissioner Judge Moustafa El Bahabety had told Enterprise in 2016 that the case would be resolved soon. Union Fenosa Gas had filed a complaint with the ICC in 2013 alleging that “its state partner had failed to comply with contracts by halting gas supplies in 2012 and not making payments.” The company itself had been pushing to import gas from Israel over the years.

The source also added that last week’s agreement to import 64 bn cubic meters of gas from Israel was only one third of the total amount of gas Egypt plans to import from Israel.

Turkey continues to bully Cyprus, shooting itself in the foot and winning Cyprus support from the US and EU in the process: Now that Egypt, Israel, Cyprus and Greece have finally gotten the ball rolling on gas exports, Turkey is resorting to even more outlandish gunboat diplomacy. Cyprus accused Turkey on Friday for a second time of threatening to use force against a drillship chartered by Eni, according to Reuters. Turkey has vowed to prevent Greek Cypriots from exploring for oil or gas around the ethnically-split island. Ankara’s flexing of muscles led the US and the EU to signal support for Cyprus. The US supports the right of Cyprus to explore for natural gas and develop its resources in its Exclusive Economic Zone, a US State Department spokesperson told Ahval. At the same time, the EU threatened to cancel a summit with Turkish potentate Erdogan next month as a result of the aggression. “These actions contradict Turkey’s commitment to good neighborly relations,” EU President Donald Tusk told reporters in Brussels on Friday, according to Bloomberg.

Egypt’s potential to become the region’s energy hub continues to capture the imagination of the international press. The Financial Times’ Ed Crooks suggests that Egypt is well on its way to being a regional gas hub after the signing of the agreement, which he paints as being as significant as the Camp David Accords.

LEGISLATION WATCH- Bankruptcy Act now the law of the land: The Bankruptcy Act, which passed in the House of Representatives last month, is now officially the law of the land after it was published on the Official Gazette on Thursday. The Act effectively decriminalizes bankruptcy by abolishing prison sentences and allows companies more time and options for restructuring by introducing mechanisms to help settle commercial disputes outside the courtroom and simplify bankruptcy proceedings. Special bankruptcy courts to arbitrate on these cases are now being formed.

LEGISLATION WATCH- “National dialogue” on pricing of medical services under universal healthcare act: The Health Ministry will reportedly begin holding “national dialogue” sessions next month to discuss the pricing of medical services offered under the new Universal Healthcare Act with different stakeholders from the public and private sectors. Sources tell Al Borsa that a ministry committee is almost done putting together a proposed pricing guide that is meant to ensure patients’ access to treatment and set a fair profit margin for hospitals. Implementation of the Universal Healthcare Act, which President Abdel Fattah El Sisi signed into law last month, is expected to begin in July, starting with Canal cities. Health Minister Ahmed Rady had said last week that Cabinet would receive the executive regulations to the act before the weekend.

INVESTMENT WATCH- Is Abdul Latif Jameel returning to Egypt’s renewables sector after a near two-year absence? Saudi conglomerate Abdul Latif Jameel is reportedly among 18 companies bidding on a 600 MW solar power plant in the West Nile area, sources close to the matter told Al Borsa on Thursday. The company was among several pulled out of Benban solar park during the back-and-forth over phase one of the feed-in-tariff program in 2016. Abdul Latif Jameel also reportedly backed away a 200 MW solar plant in Kom Ombo, a 200 MW wind power plant in the West Nile area, and a 250 MW solar plant in the same area.

The company has reportedly placed a USD 500 mn bid for the 600 MW West Nile project and is open to forming a consortium to go after, the sources added. Toyota Tsusho, Orascom, a Scatec Solar and Azuri Power consortium, GCL New Energy, a Masdar-Genco consortium, NTPC Limited, and EDRA were among the 18 companies competing with Abdul Latif Jameel for the solar plant tender issued last week.

INVESTMENT WATCH- Phanes Group eyeing potential solar power projects in Egypt worth USD 200 mn: Dubai-based solar energy developer Phanes Group is eyeing new projects in Egypt in the first phase of a plan to invest USD 200 mn in the region’s renewable energy sector, CEO Martin Haupts tells The National in an interview. The company is looking to develop projects with a combined capacity of 150 MW. “‘We’re looking at Egypt from two perspectives — one is we have a number of [agreements] that are advancing in the pipeline and the second round of programs could be interesting once we see how the first phase pans out,’” he said. “‘You have a lot of industry in Egypt, which is good. So we’re looking at the [critical national infrastructure (CNI) segment. It’s interesting and feasible in the country.”

MOVES- Osama El Sheikh submitted his resignation as chairman and CEO of Egyptian Media Group (EMG) after a brief run, Al Shorouk reports. El Sheikh will be succeeded by Tamer Morsi at the Eagle Capital-owned group. Eagle Capital Chairperson Dalia Khorshid said Morsi will bring over 25 years of media and advertising experience to EMG.

MOVES- Khaled Bichara has stepped down from the board of Orascom Telecom and Media Technology, according to a company statement. Bichara currently serves as the chairman of Dada.it and the co-CEO of Accelero Capital.

MOVES- Banque du Caire has appointed Hazem Hegazy as deputy chairman starting March, sources tell Al Masry Al Youm. Hegazy joins Banque du Caire from the National Bank of Egypt (NBE), where he was the head of retail banking and SMEs.

EARNINGS WATCH- The National Bank of Kuwait Egypt reported a 77.07% y-o-y jump in net profit to EGP 1.5 bn in FY2017, according to the company’s earnings release (pdf).

EARNINGS WATCH- Global Telecom Holding (GTH) reported a net loss attributable to shareholders of USD 133 mn in 4Q2017, down from a net profit of USD 7 mn in 4Q2016. GTH’s total revenues decreased to USD 724 mn during the period from USD 768 mn a year earlier.

Four consortia of domestic and Arab investors are competing for contracts to build cooling plants in the new administrative capital with a total capacity of 120k tonnes per day, sources tell Al Borsa. The bidding consortia are Orascom-Engie, Elsewedy-Unicool, Gas Cool-Petrojet, and a Hassan Allam-led consortium. The New Administrative Capital Company for Urban Development is reviewing the offers and will decide on the winning bid within two months, the newspaper says.

Our friends at CIB received the UNDP’s Energy Efficiency Award for being the first organization to use efficient lighting systems across all its branches in Egypt, AmCham announced last week.

INFRASTRUCTURE WATCH- European funding in the pipeline for Cairo Metro Line One, dry ports, desalination plant and Alexandria tram: The Transport Ministry expects to sign in May a EUR 600 mn loan agreement with the European Bank for Reconstruction and Development (EBRD), the European Investment Bank (EIB), and the French Development Agency (AFD) to finance the infrastructure of Cairo Metro Line 1, Al Mal reports. According to the agreement, the National Authority for Tunnels will contribute an additional EUR 100 mn for the project.

The EBRD is also planning to fund six dry ports and a desalination plant in Egypt this year under a plan to invest EUR 1.5 bn in the country in 2018, Managing Director for the Southern and Eastern Mediterranean region, Janet Heckman, told Al Mal, without elaborating.

The Transport ministry will sign a separate EUR 237 mn loan agreement with the EIB and AFD to finance the Alexandria tram project in September. The AFD has also facilitated a EUR 8 mn grant to fund the technical studies for the project, and is expected to sign the contract for the funding next month.

Russian media wants Egypt to get the message that the US doesn’t want us to have Rafale jets: “The US government doesn’t want a country like Egypt to possess such technology," Alexandre Vautravers, an official at the Geneva Center for Security Policy (GCSP), told Russian state-owned outlet Sputnik on Saturday. He is referring to reports, which we noted last week, that suggest a US ban on component sales of the Rafale’s Scalp missiles was behind floundering talks between Egypt and France over the sale of 12 Rafale jets. Vautravers says this is a deliberate move by the US as “this type of missile could influence power dynamics in the whole Middle East and create a problem across the region if it was used against a country like Israel.”

The number of passengers traveling to Egypt from German airports rose 69.1% y-o-y in 2017 to 1.39 mn passengers, according to the German Federal Statistics Office. The increase comes as Germany’s outbound tourism reached a new all-time high in 2017, driven in part by a 35.2% boom in air traffic to African countries, including Morocco.

Abraaj undergoes restructuring following allegations of “misuse” of health fund: Emerging markets private equity giant Abraaj Group announced on Friday that it is undergoing a management restructuring and corporate reorganization that will see Omar Lodhi and Selcuk Yorgancioglu promoted to co-CEOs alongside the firm’s founder Arif Naqvi, effective immediately. The reorganization will see the spinoff of Abraaj Investment Management Limited (AIML) from Abraaj Holdings, which will be independently managed. “The fund management business will continue to oversee the operations of all of Abraaj’s funds globally on behalf of leading institutional investors and manage a portfolio of investee businesses across Asia, Africa, Middle East, Turkey and Latin America,” a company statement said.

“AIML has commissioned a comprehensive review of its corporate structure with areas of focus to include governance and control functions. Independent specialist consultants have been retained to carry out this review,” the statement says. This change follows reports first printed in the Wall Street Journal that a number of top investors in the firm’s Abraaj Growth Markets Health Fund had sought an independent review of an alleged delay in deploying capital called by the fund. The firm shot back at the reports (pdf), calling them inaccurate and explaining the delay.

“The key now is to fix the plumbing and the backbone, and that is what we are really focused on doing right now” for the fund management business, Naqvi said in an interview with Bloomberg on Friday. “This has got to be the right time to create the transitionary moment when we create an entity that is fit for purpose going forward,” he added.

Sources confirm North Korea hacked OTMT: North Korea’s hacking units did attack desktop computers and laptops at Orascom Telecom Media and Technology (OTMT), people familiar with the matter tell Bloomberg. Hackers gained access through emails laced with malware that exploits a security hole in Adobe Flash. The vulnerability has since been patched by security experts, the sources added. The anonymous statements appear to confirm reports last week citing cybersecurity firm FireEye that the state had indeed hacked OTMT after a reported business dispute with the company pertaining to its telecom JV with the Kim Jong Un regime Koryolink. The dispute between OTMT and North Korea appears to revolve around the Pyongyang government forming its own competing network to Koryolink. OTMT boss Naguib Sawiris has been under US pressure to divest Koryolink.

The US plans to open its embassy in Jerusalem this May to coincide with the 70th anniversary of Israel’s founding, US State Department spokeswoman Heather Nauert said on Friday. The embassy will initially be comprised of the ambassador and limited staff and will be working out of the US consulate in Jerusalem. The US is in the meantime searching for a permanent site for the embassy. The inauguration of the Jerusalem embassy in May seems to be an acceleration of the initial plan that set the date of the move at the end of 2019, Reuters notes.

Meanwhile, Egypt and Hamas have reportedly reached an agreement to ease restrictions on the Rafah border crossing, The Times of Israel says. The agreement would allow more goods to pass between the two sides to improve living conditions in Gaza, but its implementation is contingent on Israeli approval.

The United Nations Security Council has unanimously adopted a resolution calling for a 30-day ceasefire in Syria to allow aid deliveries and medical evacuations, Reuters reports. The vote came after hundreds of civilians were killed in the past week as the government bombarded the Eastern Ghouta rebel enclave near Damascus.

Egypt in the News

The discovery of a 2,000 year-old necropolis just south of Cairo is topping coverage of Egypt in the foreign press this morning. The site near Minya contains “40 stone sarcophagi, about 1,000 small statues, and a necklace charm,” according to Reuters, which notes that it will take another five years to excavate entirely. The Daily Mail, and USA Today are among those who also carried the story.

The crackdown on dissent and freedoms under President Abdel Fattah El Sisi is like a “shadow” that hangs over Egypt, Orla Guerin writes in a lengthy piece for the BBC that is getting wide attention on social media.

Harassment and assault of Egypt’s women is getting some attention from Saudi outlets, of all places, with Lamiaa Elkholy penning a piece for Al Arabiya that has also been picked up by the Saudi Gazette.

Three Egyptian policemen were able to catch a five-year-old child as he fell from a third-floor apartment balcony in Assiut, saving the boy’s life, the Associated Press reports. The news and the video of the incident are making the rounds in international outlets.

Also worth a quick skim this morning:

- Egypt has become essential to Russia’s endeavours in Syria, particularly in negotiations with different parties in the conflict, Raghida Dergham writes in an opinion piece for The National.

- French philosopher Alain Badiou says elections in Egypt pose a more important question beyond the issue of participation, in an interview with Open Democracy.

- Egypt’s military campaign in Sinai must be coupled with development and reconstruction efforts to be successful in weeding out terrorism, experts tell VOA News’ Mohamed Elshinnawi.

- The Benban solar power park will provide Egypt with “the clean energy it needs to drive growth and fight poverty,” Sibel Nicholson says in Interesting Engineering.

- An Ikhwan member who had been reported ‘disappeared’ turned up in a Daesh video, according to Arab Weekly.

- Egyptian filmmaker Sam Abbas launched the Arab world’s first LGBTQ-focused film production company, ArabQ, according to The Hollywood Reporter.

New box office champ: Finally, ‘Jumanji: Welcome to the Jungle’ has surpassed ‘Avatar’ as top-grossing Hollywood movie ever in Egypt, Al Arabiya reports.

On Deadline

Egypt’s state media must open up to opposition voices to stop them and the viewers from resorting to foreign media, Emad El Din Hussein writes for Al Shorouk. He looks at the cases of Genena, Anan, and Aboul Fotouh, all of whom, he writes, had no choice but to turn to Qatari media to have their voices heard.

Diplomacy + Foreign Trade

KSA, UAE, Qatari leaders to hold separate meetings with Trump in Washington: The leaders of Saudi, Abu Dhabi, and Qatar are each planning to meet with US President Donald Trump in Washington in March and April, Reuters reports. The separate meetings come as the US attempts to mediate a resolution to the Arab Quartet’s spat with Qatar, which would clear the path for talks on “other strategic concerns like Iran,” according to a US official. It remains unclear whether Trump plans on meeting leaders from Bahrain and Egypt — the other two members of the quartet.

Egypt and Azerbaijan signed on Thursday two separate MoUs to increase the two countries’ investments and trade, according to an Investment Ministry statement.

Investment Minister Sahar Nasr met with Lebanese Prime Minister Saad Al Hariri, according to a ministry statement.

Energy

Oil Ministry to up crude oil output by 10,000 bbl/d in March

The Oil Ministry expects Egypt’s output of crude oil to rise by 10,000 bbl/d to 661k bbl/d before the end of March, EGPC boss Abed Ezz El Regal tells Al Borsa.

Infrastructure

Work on regional ring road to be completed by Ramadan

The new EGP 4 bn regional ring road will be completed before Ramadan starts in mid-May, Transport Minister Hisham Arafat said yesterday, according to Al Borsa. Work has been stepped up to complete the project in time.

Real Estate + Housing

Ibn Sina to develop two projects for EGP 1 bn in 2H2018

Ibn Sina for Hotels and Resorts is planning to develop two projects in 2H2018 with initial investments of EGP 1 bn, Vice Chairman Atef Ibrahim tells Al Mal. The first is an EGP 700 mn residential project in Six October City and the second is an EGP 300 mn hotel in Hurghada.

Tourism

Uzbekistan and Egypt to resume direct flights “soon”

Talks are underway to bring back direct flights between Egypt and Uzbekistan, which had been halted in 2008 due to low demand, Uzbek ambassador in Cairo, Oybek Usmanov Arifbekovich, tells Al Mal. The two sides are also discussing the launch of charter flights between Tashkent and Cairo, Hurghada, and Sharm El Sheikh.

Automotive + Transportation

Mansour Group planning expansion into Iraq and Libya

Mansour Group is reportedly seeking the rights to Opel in Iraq and Libya, a company official said on Thursday, according to Al Mal. Mansour already has Chevrolet dealerships in both countries and has managed to secure other distribution lines in other African countries through other partnerships. Mansour Group also wants to get into importing electric vehicles in Egypt, said Khedr, adding that the company is awaiting government policies on electric car assembly, which it hopes means incentives, and the expansion of electric vehicle infrastructure. Mansour Group managed to snag distribution rights to Peugeot cars from Cairo for Development and Cars Manufacturing and plans to begin selling them in April.

Banking + Finance

Tharwa Capital requests FRA approval for PHD’s EGP 350 mn securitized bonds issuance

Tharwa Capital has requested approval from the Financial Regulatory Authority (FRA) for Palm Hills Developments’ (PHD) EGP 300-350 mn securitized bonds issuance, Tharwa Managing Director Ayman El Sawy tells Al Borsa. PHD had decided last year to delay the issuance until after interest rates drop, and was considering upping the issuance to EGP 1.6 bn. Tharwa had been tapped to manage the issuance back in 2016, while preliminary underwriters for the transactions will be CIB and Attijariwafa Bank.

Banque Misr studies opening new branch in Kazakhstan

Banque Misr is studying the possibility of opening a new branch in Kazakhstan as part of its plans for overseas expansion, Chairman Mohamed El Etreby tells Al Masry Al Youm.

Other Business News of Note

SCZone to resolve all investment disputes in Ain Sokhna by year’s end, says Mamish

The Suez Canal Zone (SCZone) has approved investment dispute settlements with three companies operating in Ain Sokhna, according to a statement. The approvals will be referred to the Ismail Cabinet’s investment dispute resolution committee for sign-off before being ratified. The SCZone expects to resolve all outstanding investment disputes by year’s end, according to SCZone chief Mohab Mamish.

Egypt passes WTO’s fourth Trade Policy Review

Egypt has passed the World Trade Organization’s (WTO) fourth review of trade policies and practices that took place on 20-22 February, the Trade and Industry Ministry said in a statement. The review looked at economic development in the years since the last review in 2005.

Egypt Politics + Economics

Ministries to move to new administrative capital 1H2019

Government offices will be moved to the new administrative capital in 1H2019, Planning Minister Hala El Said said yesterday, according to Al Mal.

National Security

Chief of Staff attends final stage of France-Egypt “Cleopatra 2018” naval exercise

Egypt and France concluded the Cleopatra 2018 joint naval exercise in the Red Sea yesterday, an Armed Forces’ statement said.

On Your Way Out

VOA News put together a photo gallery of tourists flocking to Aswan’s Abu Simbel temple last Thursday for the twice-annual Sun Festival, during which a beam of sunlight shines on the statues of King Ramses II, Queen Nefertari, and god Amun Re.

The Market Yesterday

EGP / USD CBE market average: Buy 17.64 | Sell 17.74

EGP / USD at CIB: Buy 17.62 | Sell 17.72

EGP / USD at NBE: Buy 17.59 | Sell 17.69

EGX30 (Thursday): 15,319 (+0.5%)

Turnover: EGP 1.3 bn (15% ABOVE the 90-day average)

EGX 30 year-to-date: +2.0%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 0.5%. CIB, the index heaviest constituent closed up 1.2%. EGX30’s top performing constituents were Abu Dhabi Islamic Bank up 7.1%; Abu Qir Fertilizers up 4.2%; and Amer Group up 3.5%. Thursday’s worst performing stocks were Egypt Aluminum down 2.3%; Egyptian Iron & Steel down 1.7%; and Palm Hills down 1.7%. The market turnover was EGP 1.3 bn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -42.5 mn

Regional: Net Short | EGP -35.6 mn

Domestic: Net Long | EGP +78.1 mn

Retail: 57.8% of total trades | 54.7% of buyers | 60.9% of sellers

Institutions: 42.2% of total trades | 45.3% of buyers | 39.1% of sellers

Foreign: 23.0% of total | 21.3% of buyers | 24.7% of sellers

Regional: 16.5% of total | 15.1% of buyers | 17.9% of sellers

Domestic: 60.5% of total | 63.6% of buyers | 57.5% of sellers

WTI: USD 63.55 (+1.24%)

Brent: USD 67.31 (+1.39%)

Natural Gas (Nymex, futures prices) USD 2.63 MMBtu, (-0.34%, Ma 2018 contract)

Gold: USD 1,330.3 / troy ounce (-0.18%)

TASI: 7,525.22 (+0.26%) (YTD: +4.14%)

ADX: 4,579.6 (-0.09%) (YTD: +4.12%)

DFM: 3,286.54 (+0.03%) (YTD: -2.48%)

KSE Weighted Index: 410.14 (+0.39%) (YTD: +2.17%)

QE: 9,096.36 (-0.25%) (YTD: +6.72%)

MSM: 4,972.01 (-0.31%) (YTD: -2.5%)

BB: 1,351.81 (+0.01%) (YTD: +1.51%)

Calendar

05 March (Monday): Egypt’s PMI reading for February released.

05-07 March (Monday-Wednesday): EFG Hermes’ One on One Conference 2018, Atlantis, The Palm, Dubai, UAE.

07-11 March (Wednesday-Sunday): ITB Berlin Convention, Berlin, Germany.

28-31 March 2018 (Thursday-Sunday): Cityscape Egypt, Cairo International Convention Centre, Cairo.

08 April (Sunday): Easter Sunday, national holiday.

09 April (Monday): Sham El Nessim, national holiday.

24-25 April (Tuesday-Wednesday): Renaissance Capital’s 3rd Annual Egypt Investor Conference, Cape Town, South Africa.

25 April (Wednesday): Sinai Liberation Day, national holiday.

01 May (Tuesday): Labor Day, national holiday.

02-03 May (Wednesday-Thursday): Cisco Connect Egypt 2018, Nile Ritz-Carlton Hotel, Cairo.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

15 May (Tuesday): Expected date for the start of Ramadan (TBC).

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

06 October (Saturday): Armed Forces Day, national holiday.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25 December (Tuesday): Western Christmas.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.