- Inflation drops to 17.1% in January—are we looking at an interest rate cut on Thursday? (Speed Round)

- As global markets catch their breath, Finance Minister El Garhy is in London tomorrow to kick off eurobond roadshow. (What We’re Tracking Today)

- El Sisi calls for life insurance system covering private-sector workers. (Speed Round)

- Shuaa Capital formally launches in Egypt this week, wants to become “biggest in the region.” (Speed Round)

- Citigroup expects stellar 2018 in MEA investment banking. (Speed Round)

- Saudi’s Elaj Group eyes defunct Siag Pyramids Hotel, will convert it into specialist hospital. (Speed Round)

- M&A WATCH- Ezdehar acquires majority stake in Global Lease, EPPK eyes El Badr Plastics. (Speed Round)

- Civil Aviation Finance Holding Company mulls end-of-year share listing. (Speed Round)

- Easy Group to launch USD 100 mn cosmetics, personal care products factory in Borg El Arab. (Speed Round)

- The Market Yesterday

Sunday, 11 February 2018

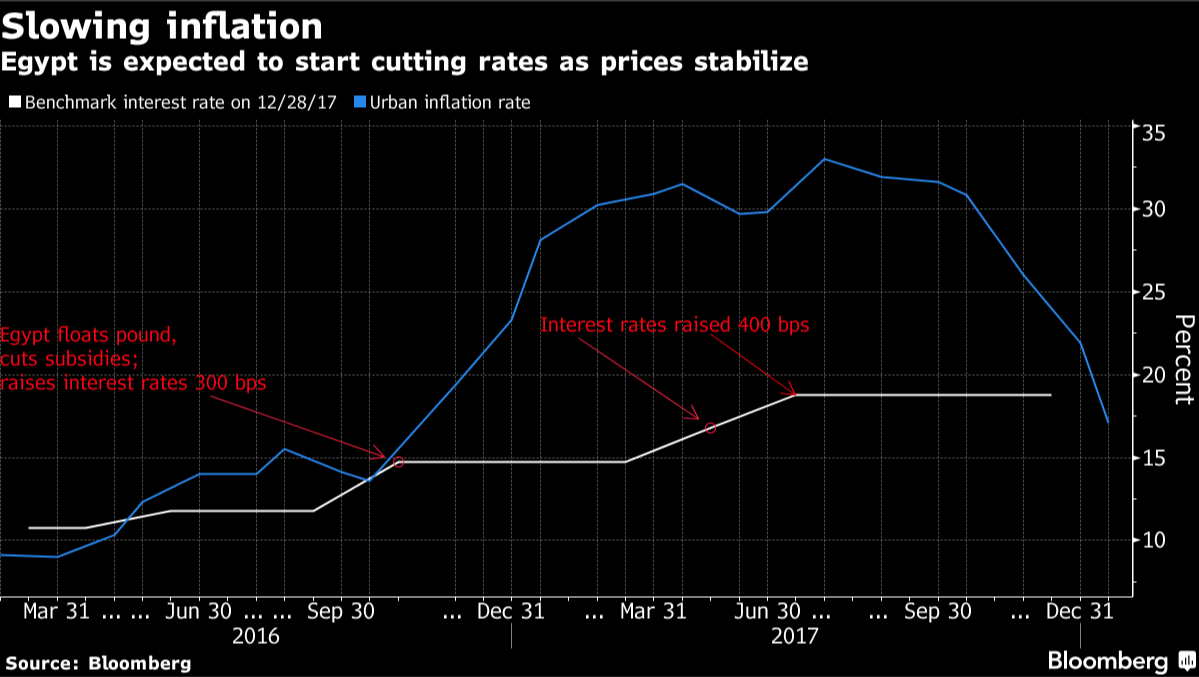

Inflation falls to 17.1% — is an interest rate cut in store this Thursday?

TL;DR

What We’re Tracking Today

It’s an exceptionally packed issue this morning, folks, as a heavy news day on Thursday gave birth to a very busy weekend at home and abroad. Look for worthy news straight all the way down to What We’re Tracking Today.

Finance Ministry delegation headed by Minister Amr El Garhy is heading to London tomorrow to kick off Egypt’s USD 4-5 bn eurobond roadshow, Ahram Gate reports. El Garhy said yesterday that the issuance is contingent on “more stability” in global markets, but that the government hopes to push forward with it “in the next few days.”

El Garhy & Co. are on the road as global markets catch their collective breath following a wild week that saw some markets enter correction territory for a time. (A correction is when markets are down 10% from a recent high.) It was the “most turbulent week in years” for US stocks, the Wall Street Journal notes. By the end of the day Friday, the S&P 500 was down 5.2% for the week, the FTSE All-World was down 6.2%, Eurofirst 300 was off 7.2% and investors had retreated to the safety of cash, withdrawing some USD 31 bn from global equity funds last week, the Financial Times reports.

Is it the end of an era for market tranquility? The VIX is back down into the late 20s from a mid-week high of 50, but volatility is back on the menu going forward, the FT argues in its Big Read. Correspondents including former Middle East hand Robin Wigglesworth argue that concern is mounting that last week’s sell-off “is merely the first instalment of a bigger shock.”

Egypt is among the countries in the region that have “a lot of scope for doing better” in terms of spending efficiency, IMF boss Christine Lagarde said at the Arab Fiscal Forum in Dubai yesterday. She urged Arab countries to slash public wages and pull the plug on energy subsidies — and redirect that funding to other areas of greater priority that currently have “big efficiency gaps,” including health and education.

Separately, the IMF’s next review of Egypt’s progress on its economic reform program is scheduled to take place in April, Al Mal reports, citing remarks by El Garhy. The fund will complete its review by May or June, after which the next USD 2 bn tranche is expected to be released.

The House of Representatives is expected to vote on the one-year extension of the Tax Dispute Resolution Act at a plenary session today, Ahram Gate reports. MPs are also expected to vote on legislation governing the work of the National Council for Women. Also today, the committee on SMEs will be meeting to review the executive regulations to the law that established the SMEs Development Authority, the newspaper says.

The Electricity Ministry will unveil its new bill collection strategy at a press conference today, government sources told Al Borsa.The ministry will make payment and smart-meter recharge services available to citizens across the country via Egyptian Post and nine e-payment companies.

Israel and Iran are “lurching toward confrontation” after Israel stuck 12 targets in Syria yesterday (four of them in Iranian) after an Iranian drone penetrated Israeli airspace and an Israeli F-16 Fisher crashed after being fired on by Syrian anti-aircraft missiles. Bloomberg and the FT have more.

The Pyeongchang Winter Olympics have begun. Bloomberg has a medal tracker here. Germany is atop the leaderboard with two gold, followed by the Netherlands and South Korea.

What We’re Tracking This Week

US Secretary of State Rex Tillerson is due in Cairo today ahead of a meeting with Foreign Minister Sameh Shoukry tomorrow, Al Masry Al Youm reports. Talks will focus on bolstering bilateral ties and advancing cooperation on “key regional issues,” according to the State Department. Tillerson is expected to offer US help on counterterrorism and “raise human rights and democracy issues,” the AP says.

Egypt is the first leg of Tillerson’s Middle East tour, which will also take him to Kuwait, Jordan, Lebanon, and Turkey. The trip will reportedly focus mainly on stabilization and reconstruction after Daesh’s territorial defeat.

It’s interest rate week: The central bank’s Monetary Policy Committee meets on Thursday to review rates. It’s the only opportunity for a rate cut (and declaration of victory in the “war on inflation”) ahead of the presidential poll.

Enterprise+: Last Night’s Talk Shows

The Armed Forces’ sweeping anti-terror operation in Sinai over the weekend had the nation’s talking heads buzzing on the airwaves last night.

Hona Al Asema’s Lamees Al Hadidi spoke to Supreme Anti-Terrorism Council member Khaled Okasha, who denied rumors that the military campaign has resulted in civilian casualties. He said it took months to plan, explaining that the military began drafting its strategy in November, after President Abdel Fattah El Sisi gave them a three-month deadline to end terrorism in the country (watch, runtime 1:17). Okasha also denied that Israel has covertly been launching airstrikes in Sinai (watch, runtime 2:04).

Lamees told her viewers that an operation of this scale will likely take a while to complete (watch, runtime 7:37). She also lauded the military for relocating residents from certain hotspots in North Sinai (watch, runtime 4:05).

The host also spoke to Supply Ministry spokesman Mamdouh Ramadan (watch, runtime 1:53) and Assistant Oil Minister Mahmoud Nagi (watch, runtime 2:15), who assured her that Sinai residents will continue to have access to food and oil products during the military campaign.

Security expert and MP Mahmoud Mohy El Din told Masaa DMC’s Eman El Hosary that last year’s attacks on El Rawda mosque in Sinai and on security personnel in El Wahat were the impetus for the operations (watch, runtime 4:59).

Free Egyptians back military campaign: Al Hayah Al Youm’s Tamer Amin spoke with Free Egyptians Party head Essam Khalil, who expressed his unwavering support for the military campaign (watch, runtime 4:06). Amin also cheered on the operation, which he said will support El Sisi’s re-election bid (watch, runtime 2:04).

Kol Youm’s Amr Adib, meanwhile, told his viewers that the complete eradication of terrorism is impossible and that the ongoing campaign is meant to contain the insurgency as much as possible (watch, runtime 4:27). He also took note of the country’s naval forces being stationed around Zohr, which he said sends a “clear message” that the gas field is “off limits” to any threats (watch, runtime 49:51).

Back on DMC, El Hosary had a chat with the Egyptian Federation for Construction and Building Contractors’ secretary general, Hisham Yousry, about the government’s plan to set up a life insurance system for private sector workers. The scheme would cover as many as 5 mn employees, according to Yousry (we have more details in Speed Round, below) (watch, runtime 8:14).

Speed Round

Monetary policy victory lap time? Annual inflation dropped to 17.1% in January from 21.9% in December, CAPMAS announced on Thursday, according to Reuters. Core inflation also fell to 14.35% from 19.86% a month earlier. The CAPMAS report notes that vegetable prices dropped by 3.3% m-o-m nationwide, with food overall dropping 0.5% m-o-m.

Finance Minister Amr El Garhy told the press yesterday he sees the rate falling to 10-13% by the end of the year. Inflation levels are expected to decrease gradually over the next three years to reach 7.1% by 2021, a ministry report picked up by Al Borsa says.

Does the drop portend an interest rate cut on Thursday? Not necessarily, Pharos Securities Brokerage Head of Research Radwa El Swaify says. “We believe that there is still a high chance of maintaining rates at this meeting. If we see cuts, it will be within the 0.5-1% range.” She told Bloomberg that she expects a “significant interest rate drop” in 2H2018, as inflation could hit 13% as early as June if the current trend is maintained.

El Sisi calls for life insurance system covering private-sector workers: President Abdel Fattah El Sisi called on Thursday for the establishment of a life insurance scheme for private sector workers, according to a statement from Ittihadiya. El Sisi proposed that workers pay EGP 500-2,500 into the system, and would receive payouts of up to 100x that amount in the event of their death by natural causes or work related incidents. We’re as yet unaware of any legislation in the pipeline to this effect, but we’ll keep our eyes peeled.

Shuaa Capital opening in Egypt, has plans to be the “biggest in the region” in capital markets, CEO Fawad Tariq Khan told Bloomberg’s Tracy Alloway. Shuaa is now focusing on its core business of investment banking, capital markets, asset management, and credit. Shuaa is formally launching its Egyptian office this week as part of its bid to build on the brokerage businesses across the region. “Egypt is an interesting market for us because it’s got all the right macro factors … large population … self sustaining … when you look at the volumes, opportunity over there, we see a lot of opportunity for Shuaa to be over there. Shuaa used to be in Egypt and we’ve been out of the market for a very long time, so I’m very happy to come back … We’re in it for the long term,” Khan told Alloway (runtime 04:09).

Citigroup expects 2018 to be its best year for investment banking in the Middle East and Africa in at least a decade, MEA Head of Investment Banking Miguel Azevedo told Reuters. Citigroup expects growth to be led by Saudi Arabia, but Nigeria, Egypt, and the United Arab Emirates would also be among the top growth drivers as bond sales, mergers and acquisitions and public share sales pick up. “The pipeline in the Middle East and Africa is as good as we have seen since the global financial crisis of 2008 … GDP growth for advanced economies this year is between 2.5 and 3 percent, while for emerging markets it is between 4.5 and 5 percent. For investment banking, the growth should maybe be even more,” Azevedo says. “Egypt’s outlook was also positive after the 2016 currency devaluation and IPOs were slated in sectors such as industrial and manufacturing and financial services and consumer,” he added.

Egypt is doing “extremely well,” Mohamed Alabbar tells CNBC: The Middle East has plenty of development opportunities despite geopolitical tensions and difficulties doing business, Emaar Properties Chairman Mohamed Alabbar told CNBC. “My view is that Morocco is doing well for us, I would say Egypt is doing extremely well; Saudi Arabia with all the restructuring going on, it’s going to be a fabulous opportunity. In the UAE, we still expect to grow 20 percent on an annual basis,” Alabbar says. He is optimistic about the prospects this year, but expressed some caution regarding 2019. “The margins, the opportunities and the growth I’ve been having in the Middle East over the last 20 years — even if you make a mistake, it’s so worth it,” he says.

INVESTMENT WATCH- Saudi Arabia’s Elaj Group is eyeing the defunct Siag Pyramids Hotel in Haram with a view to converting the building into a specialist hospital, unidentified sources close to the matter tell Al Mal. The hotel, which was repossessed in 2010 after its owners failed to repay loans owed to several banks, was most recently valued at around EGP 185 mn, according to the sources. Elaj Group plans to submit a proposal to the lenders to acquire the property after receiving government approval, the sources say. Separately, sources say that the Saudi group recently purchased an EGP 80 mn office building in Nasr City with the intention of also converting it into a specialized hospital. Elaj Group also announced last month its plans to build a EGP 500 mn oncology hospital in Cairo, following an acquisition spree at the end of last year.

M&A WATCH- Ezdehar acquires majority stake in Global Lease Co: Ezdehar Egypt Mid-Cap Fund signed yesterday an agreement with Wadi Degla Holding Company to acquire 60% of the latter’s Global Lease Company, Al Mal reports. Ezdehar’s limited partners include the European Bank for Reconstruction and Development, the CDC Group, Dutch development bank FMO, and Egyptian business leaders. German development bank KfW’s SANAD fund has a 30% stake in Global Lease, while the remaining 10% belongs to CEO Hatem Samir.

M&A WATCH- El Ahram Printing & Packaging (EPPK) is in talks to buy a 32% stake in the El Badr Plastic Company, according to a company disclosure. The two companies are drafting an MoU to greenlight the negotiations. EPPK already owns 0.15% of El Badr through a subsidiary.

The announcement was followed by the revelation that El Nessim for Trading had attempted to raise its equity stake in EPPK to 10% from 7.84% on Thursday. The EGX had blocked the transaction, according to a bourse filing from EPPK (pdf).

IPO WATCH- The Civil Aviation Finance Holding Company (CIAF) plans to list 30% of its shares on the EGX by year’s end to finance its future investments, CIAF Chairman Hassan Mohamed tells Al Masry Al Youm. CIAF, an aircraft lessor, plans to purchase four new airplanes worth USD 70 mn to lease them domestically and abroad this year. The company also plans to invest USD 20 mn throughout 2018 in purchasing new equipment to lease to local airlines. CIAF is currently in talks with several local banks for a USD 50 mn loan to finance the investments it has planned for this year.

Easy Group for Health and Beauty Care is planning to launch a new USD 100 mn factory in the Borg El Arab industrial city in June, company CEO Asser Salama said, according to Al Borsa. The factory, the company’s second, will include production lines for cosmetics, wet wipes, and shampoo. Easy Group is also planning to establish two cosmetics factories in India this year with a combined investment value of USD 20 mn. We’ve been following Easy’s high-quality import-substitute products for some time now and think there’s a very interesting story being written here.

NI Capital, Ayady establish EGP 250 mn company to invest in media: State-owned investment bank NI Capital and state-owned fund Ayady have established a EGP 250 mn company to invest in digital and traditional media, according to an emailed statement (pdf). The new company, Creative Media Ventures (Ebda3), will focus on investing in up-and-coming media companies that have shown rapid growth, according to NI Capital CEO Ashraf Ghazaly.

LEGISLATION WATCH- The Investment Ministry issued amendments to the executive regulations of the Companies Act on Friday, minister Sahar Nasr said in a statement. As we noted last month, the amendments are the most sweeping changes to the regs of the Companies Act in 35 years, with 51 articles being amended. Amendments to the law itself, signed into law by President Abdel Fattah El Sisi last month, allow the formation of single-shareholder limited liability companies and give measures of protection to companies against whistleblowers. Key features of the regs changes include:

- Banning companies from holding onto treasury stocks for over a year. After the year is out, companies must either divest the shares or distribute them to employees as part of a profit-sharing mechanism;

- Limiting share buybacks to 10% of the company’s shares;

- Allowing a weighted voting system when shareholders vote on board members;

- Shareholders can now vote in board elections electronically;

- Facilitating spinning off corporations, by allowing the company greater flexibility in dividing assets and shares;

- Barring sole-proprietorship companies from establishing subsidiaries that are also sole proprietorships.

LEGISLATION WATCH- Can we please get some clarity on when the Automotive Directive might be ready for debate? In the latest update on the Automotive Directive, unnamed government sources tell Al Borsa that the act is expected to be issued some time in 2Q2018 — another delay in estimates on when the law will be out. The hold up appears appears to be the German consultancy hired by the government to advise on the redraft of the act. The source adds that after the Germans are done with it, the redrafted act would then have to receive sign-off from the Ismail Cabinet before it is sent to the Council of State (Maglis Al Dawla) and then to the House of Representatives for discussions and a vote. Industrial Development Authority head Ahmed Abdel Razek had said in December that the final draft of the law would be ready by January.

Indonesia overtakes Egypt as top global wheat buyer this year: Indonesia is set to overtake Egypt as the biggest importer of wheat in the world, the Financial Times reports. Indonesia is expected to import 12.5 mn tonnes for the 2017-2018 marketing year, surpassing Egypt. “Indonesia is now the leading global wheat importer,” according to US Department of Agriculture. The spike in Indonesian wheat imports comes as the country institutes restrictions on the import of corn.

“Extensive strain of gas” discovered off Cypriot coast: President Abdel Fattah El Sisi held a call with re-elected Cypriot President Nicos Anastasiades on Thursday to discuss cooperation “under agreements signed by them or those with Greece,” said a statement from Ittihadiya. Reading between the lines, this is a reaffirmation of the Economic Exclusive Zone (EEZ) demarcation agreement, which Turkey’s foreign minister had called “illegal” a few days earlier. Turkey’s statement came after reports started emerging last week that the consortium was on the precipice of a major discovery at the Calypso reservoir in Block 6 off the coast in Cyprus.

On that front, Eni and Total discovered an extensive strain of natural gas southwest of Cyprus, Cypriot Energy Minister Yiorgos Lakkotrypis said, according to Reuters. “An extensive column of clean natural gas was discovered in … the Cypriot EEZ.” The geology is similar to that at the Zohr supergiant field.

In other East Med gas disputes, Lebanon signed its first offshore oil and gas exploration and production agreements for two blocks, including a block disputed by neighboring Israel, with Total, Eni and Russia’s Novatek, Reuters reports.

The Armed Forces launched a “far-reaching” combined arms offensive on Friday, dubbed “Operation Comprehensive Sinai 2018,” deploying troops and security forces throughout the Sinai, spokesperson of the Armed Forces Col. Tamer El Rifai announced in a televised statement (watch, runtime 2:39).

The operation, which also includes the police service and coast guard, also reaches into areas of the Nile Delta and the Western Desert to tackle the inflow of arms and militant coming from Egypt’s borders with Libya, said El Rifai. Security sources told Reuters on Thursday that the operation, which had been in planning for some time, was unprecedented in its scope, coordination, and size, involving thousands of troops, but did not provide further details.

The operation comes as President Abdel Fattah El Sisi’s end-February deadline for the Armed Forces to clear the Sinai of terrorism approaches. El Sisi had set the deadline following an attack on Sufi El Rawda Mosque in North Sinai, which was the largest terrorist attack in Egypt’s modern history.

Story dominates narrative on Egypt in the international press: Analysis of the story by the foreign press appears to focus on the timing of the operation, coming as it does a month before the elections. “Military successes against the armed groups would bolster his standing and help energise turnout in what could be a lackluster election due to the absence of competition,” Heba Saleh writes for the Financial Times. “Analysts have said the president considers his anti-terrorism stance has won him enough U.S. support to let him dispense with the pretense of a democratic election,” according to Bloomberg. The Washington Post, the Guardian and the Wall Street Journal also have coverage.

Egypt in the News

Military’s Sinai offensive tops coverage of Egypt: The military’s “massive security operation” against militants in the Sinai naturally topped coverage of Egypt in the foreign press this morning, with most seeming to focus on its scale and size. The story was widely picked up by news outlets including The New York Times, VOA, and ABC News, as well The National and Asharq Al-Awsat.

The Economist does a drive-by on Egypt with a tight focus on the economy, rehashing the failings of the nation’s subsidy and price control program. The analysis is spot-on, but the segue into criticism of the upcoming elections feels forced. Either way, a must-read.

The accusations levied against activists of attempting to overthrow the regime are “serious charges,” politician Khaled Dawoud told The Times’ Bel Trew.

Genena “feared for his life”: Former head of the Government Accountability Office Hesham Genena told reporters he feared for his life after an alleged kidnapping attempt, the Associated Press reports. In an interview with Reuters on Wednesday, Genena blamed Egyptian authorities for the assault, which he believes was politically motivated.

‘Alien’ honeybees in Egypt may cause some plants to go extinct: The introduction of invasive bee species into South Sinai’s St Katherine Protectorate region may be killing off some plant species and native bees in the area, researchers from Anglia Ruskin University in England have found, according to The Daily Mail.

Diplomacy + Foreign Trade

Sudan and Egypt back to being brothers again…until next time: Sudan’s ambassador to Egypt will return to Cairo “very soon,” Sudan’s Foreign Minister Ibrahim Ghandour said last Thursday, The Associated Press notes. Sudan had recalled its ambassador to Egypt for consultation last month amid souring ties between the two countries. The statement follows a meeting between Ghandour, Foreign Minister Sameh Shoukry, and intelligence officials from both sides, who all agreed on setting a framework for improving ties. On water sharing, both sides committed to the previous resolutions of the tripartite committee on the Grand Ethiopian Dam. They also agreed to uphold water-sharing protocols signed in a 1959 treaty, which Sudan had accused Egypt of violating. Both sides committed to amicably resolving outstanding disputes (hint, hint, trade boycott) and also committed to keeping the media in check, according to a joint statement. Sudan Tribune also has coverage.

Kabil, El Banna to visit KSA to resolve imports ban: Trade and Industry Minister Tarek Kabil and Agriculture Minister Abdel Moneim El Banna are planning to lead a delegation to Saudi Arabia soon to discuss its bans on imports of Egyptian strawberries and peppers over residual pesticides, Al Shorouk reports. Saudi Arabia is the only Arab country with a ban on Egyptian products still in place, Agricultural Exports Council head Abdel Hamid El Demerdash said. The Agriculture Ministry had previously moved to impose stricter regulations on exports to the GCC after the successive bans, and said in July that Egyptian guava exports would be subjected to Global Good Agricultural Practices standards as of this season.

Egypt is in talks with Saudi Arabia and Kuwait to extend the tenor of USD 4 bn in deposits, unnamed government sources tell Al Masry Al Youm on Friday. Saudi and Kuwait each hold USD 2 bn in deposits, which are due in 2018, the source added. The UAE had approved extending USD 2.6 bn in five-year deposits late last year.

Investment Minister Sahar Nasr and the Saudi Fund for Development signed last week two agreements worth EGP 250 mn with EFG Hermes Leasing and Plus Leasing, according to a ministry statement (pdf). The two agreements are geared towards funding SMEs, the Saudi embassy in Cairo said in a statement (pdf).

The EU Parliament issued a number of scathing condemnations on Egypt in a plenary session on Thursday over the use of capital punishment and mass trials being conducted by Egyptian courts. The resolution also came with a denouncement of the “absence of progress” in the investigation into Italian student Giulio Regeni’s murder, ANSA reports.

The border crossing with Gaza was opened temporarily for the first time this year on Wednesday night, The Associated Press reports. The Palestinian embassy in Cairo confirmed the news. As thousands jammed the border crossing, Hamas chief Ismail Haniyeh also arrived in Cairo over the weekend to discuss border security procedures with Egyptian security officials, Al Shorouk says.

Energy

Orascom, Toyota consortium awarded 20-year power production license for wind farm project

The Egyptian Electric Utility and Consumer Protection Agency (Egyptera) has reportedly awarded an Orascom Construction consortium with GD France and Toyota a 20-year power production license for the 250 MW wind farm they’re building in the Gulf of Suez. The consortium, which has reached financial close on the project, will be selling power to the Egyptian Electricity Transmission Company at a feed-in tariff of USD 0.038 per kWh under a power purchase agreement signed last October. The USD 250 mn wind farm is expected to come online next year, sources told Al Borsa

Infrastructure

Housing Ministry, Schneider Electric to develop water and sewage stations

Schneider is angling for government contracts to develop water and sewage treatment plants, Al Mal reports, noting a sit-down between Housing Minister Mostafa Madbouly and Schneider’s Regional Head of North East Africa and Levant, Walid Sheta.

Basic Materials + Commodities

El Sisi inaugurates first phase of 100k feddan greenhouse project

President Abdel Fattah El Sisi inaugurated on Thursday the first phase of the Agriculture Ministry’s project to establish greenhouses spanning 100k feddans in the Hamam area on the North Coast, Al Mal reports. The first phase includes 5,000 greenhouses across 20k feddans and is part of a project first announced in June 2016.

Health + Education

Cleopatra to partner with El Nahda on unit to manage 160-bed hospital in Beni Suef

Cleopatra Hospitals Group’s board of directors approved on Thursday a partnership with El Nahda Company to co-establish a unit to manage and operate a 160-bed hospital in Beni Suef, according to a company statement. The board also approved a EGP 125 mn loan from CIB to finance operations.

Real Estate + Housing

Redcon to develop EGP 2 bn projects in New Alamein

Redcon Construction has won EGP 2 bn contracts to build a 42-story tower and a university campus in New Alamein city, CEO Hossam Nassar tells Al Mal.

Tourism

Thomas Cook on track to meet earnings forecast as popularity of Egypt resurges

Thomas Cook said it is on track to meet forecasts for growth in the current fiscal year as it adds more holidays to Egypt and Turkey, according to Reuters. The returning popularity of holidays to Egypt and Turkey would help offset margin pressures Thomas Cook is facing in Spain, the tour operator says. The Group also announced a 10% air capacity expansion for this summer, mostly on routes from Germany, FVW reports.

On The Beach revenue up on increased demand for trips to Egypt

Holiday group On The Beach PLC saw a 23% increase in revenue for the four months to January as demand for holidays in Egypt recovered, according to Proactive Investors. “Customer looking for bargains at destinations in the Eastern Mediterranean drove strong bookings growth for summer 2018 departures.”

Automotive + Transportation

NAT to announce winner of consultancy tender for Alex tram project in April

The National Authority for Tunnels (NAT) will select the winning offer in its consultancy tender for the Alexandria tram project in April, NAT sources say, Al Borsa reports. Five consortia are competing in the tender.

Banking + Finance

Golden Pyramids to issue USD 200-750 mn in bonds

Golden Pyramids Plaza’s EGM approved issuing non-convertible bonds in the range of USD 200-750 mn, according to a bourse announcement. The bonds will be marketed in an institutional offering.

NBE sees inflows of USD 1 bn for January

The National Bank of Egypt’s (NBE) USD inflows stood at USD 1 bn in January, Executive Chairman Hisham Okasha told AMAY. The bank has financed over USD 20 bn-worth of trade and import activities since the 2016 EGP float, he added.

CIB managed securitization bond issuances worth more than EGP 2.2 bn

CIB managed securitization bond issuances worth north of EGP 2.2 bn throughout 2017 and January 2018, a source at the bank said, Al Masry Al Youm reports. These issuances include EGP 200 mn portions of two separate issuances on behalf of Corplease worth EGP 1.148 bn and EGP 1.074 bn.

Banque du Caire to open offices in Kenya and Tanzania

Banque du Caire is planning to launch representative offices in Kenya and Tanzania as part of its international expansion strategy, Chairman Tarek Fayed tells AMAY.

ABE signs transfer agreements with Western Union, MoneyGram, Transfast

The Agricultural Bank of Egypt (ABE) signed agreements with Western Union, MoneyGram, and Transfast to facilitate overseas transfers from Egyptian expats, Vice President Tamer Gomaa said yesterday, AMAY reports. The bank is looking to sign similar agreements with Gulf-based organizations, including Saudi’s Al Rajhi Bank.

Banque Misr partners with Visa and Exxon Mobil to provide electronic payment

Banque Misr and Visa are rolling out electronic payment at 100 Exxon Mobil petrol stations, according to AMAY.

Other Business News of Note

Arafa Holding to expand clothes retail activities

Arafa Holding plans to expand its activities in clothes retail through its subsidiary Euromed for Trading and Marketing, the group’s head of IR Mohamed Talaat tells Al Mal. The company plans to introduce a new fashion line to its Concrete brand targeting the mid-income bracket, he said, without elaborating.

Egypt Politics + Economics

Strong Egypt deputy head Mohamed El Qassas ordered arrested

Prosecutors ordered the 15-day detention of Strong Egypt party deputy head Mohamed El Qassas on charges of spreading false news, according to Ahram Online. His detention is pending investigation, according to El Qassas’ lawyer, who said that 50 others face similar charges. Amnesty International had issued a statement on Friday saying that Qassas was at risk of enforced disappearance and torture.

Sports

Mohamed Salah named top African goalscorer in FIFA poll

Football star Mohamed Salah was named Africa’s top goalscorer with 51% of votes in a FIFA poll on Twitter. Salah is now the fourth African player to score 20+ goals in a Premier League season, according to FIFA. Phil McNulty writes for BBC that Salah is a “humble superstar.”

Human rights activists call on FIFA to change Egypt’s base for the World Cup

Human rights groups called on FIFA to change Egypt’s training base for the World Cup from the Chechen capital of Grozny over leader Ramzan Kadyrov’s heavy human rights violations, according to USA Today.

Fans attend first football match at Port Said stadium since 2012

A “restricted crowd of 10,000 people” were allowed yesterday to attend the first football match at the Port Said stadium since the 2012 Port Said massacre, Reuters reports.

On Your Way Out

The Ministries of Agriculture, Endowments, and Water Resources have joined forces to launch a nationwide campaign promoting water conservation, the Agriculture Ministry said in a statement. The campaign will focus on the rationalization of irrigation water and reducing the consumption of drinking water by spreading awareness through schools, mosques, and youth centers. The Agriculture Minister will also promote the use of probiotic seeds.

Two Egyptian entrepreneurs have caught Lonely Planet’s eye with their scratch map travel journal. Khaled Mounir and Amr Mashaly started Wanderkit as a domestic travel journal but have since gone global, adding a world (scratch) map, space to take notes, and QR codes that can be scanned for instant information on a place.

The Market Yesterday

EGP / USD CBE market average: Buy 17.6092 | Sell 17.7092

EGP / USD at CIB: Buy 17.56 | Sell 17.66

EGP / USD at NBE: Buy 17.58 | Sell 17.68

EGX30 (Thursday): 14,921 (-0.8%)

Turnover: EGP 1.1 bn (2% BELOW the 90-day average)

EGX 30 year-to-date: -0.7%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session down 0.8%. CIB, the index heaviest constituent closed down 1.0%. EGX30’s top performing constituents were GB Auto up 7.5%; EFG Hermes up 1.3%; and Egyptian Iron and Steel up 1.1%. Thursday’s worst performing stocks were Abu Dhabi Islamic Bank down 3.6%; Abu Qir Fertilizers down 3.0%; and Porto Group down 2.9%. The market turnover was EGP 1.1 bn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +29.8 mn

Regional: Net Long | EGP +49.7 mn

Domestic: Net Short | EGP -79.5 mn

Retail: 48.8% of total trades | 46.0% of buyers | 51.6% of sellers

Institutions: 51.2% of total trades | 54.0% of buyers | 48.4% of sellers

Foreign: 25.4% of total | 26.8% of buyers | 24.0% of sellers

Regional: 10.4% of total | 12.7% of buyers | 8.1% of sellers

Domestic: 64.2% of total | 60.5% of buyers | 67.9% of sellers

WTI: USD 59.2 (-3.19%)

Brent: USD 62.79 (-3.12%)

Natural Gas (Nymex, futures prices) USD 2.58 MMBtu, (-4.19%, March 2018 contract)

Gold: USD 1,315.7 / troy ounce (-0.25%)

TASI: 7,403.15 (-0.19%) (YTD: +2.45%)

ADX: 4,599.47 (+0.08%) (YTD: +4.57%)

DFM: 3,325.62 (-0.85%) (YTD: -1.32%)

KSE Weighted Index: 410.3 (+0.2%) (YTD: +2.21%)

QE: 8,893.27 (+0.06%) (YTD: +4.34%)

MSM: 5,006.62 (+0.7%) (YTD: -1.82%)

BB: 1,333.02 (-0.25%) (YTD: +0.1%)

Calendar

08-11 February (Thursday-Sunday): Furnex & the Home international trade fair, Cairo International Convention Center.

10-12 February 2018 (Saturday-Monday): Third Africa STI Forum, Cairo.

12-14 February 2018 (Monday-Wednesday): Egypt Petroleum Show 2018 (EGYPS), New Cairo Exhibition Center.

19-20 February 2018 (Monday-Tuesday): The Banking Tech North Africa, The Nile Ritz-Carlton, Cairo

17-21 February 2018 (Saturday-Wednesday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

05 March (Monday): Egypt’s PMI reading for February released.

05-07 March (Monday-Wednesday): EFG Hermes’ One on One Conference 2018, Atlantis, The Palm, Dubai, UAE.

28-31 March 2018 (Thursday-Sunday): Cityscape Egypt, Cairo International Convention Centre, Cairo

08 April (Sunday): Easter Sunday, national holiday.

09 April (Monday): Sham El Nessim, national holiday.

24-25 April (Tuesday-Wednesday): Renaissance Capital’s 3rd Annual Egypt Investor Conference, Cape Town, South Africa.

25 April (Wednesday): Sinai Liberation Day, national holiday.

01 May (Tuesday): Labor Day, national holiday.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

15 May (Tuesday): Expected date for the start of Ramadan (TBC).

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday. (Look for possible Monday off given the first day falls on a Friday.)

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday

11 September (Tuesday): Islamic New Year (TBC), national holiday.

06 October (Saturday): Armed Forces Day, national holiday.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25 December (Tuesday): Western Christmas.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC)

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC)

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.