- Biggest FDI since float of the pound: UAE’s Al Ghurair to invest USD 1 bn in sugar agriculture project. (Speed Round)

- A week after its wind announcement, Masdar says it plans to invest in up to 500 MW of solar power generation capacity in Egypt. (Speed Round)

- US hits Egypt, four other Mideast countries with new screening requirements for air cargo. (Speed Round)

- GAFI needs a new boss as Mona Zobaa steps down after barely five months on the job. (Speed Round)

- Uber Eats to launch this year in Cairo and Saudi Arabia. (Speed Round)

- Climate change and rapid population growth are threatening the survival of ancient Egyptian artifacts. (Egypt in the News)

- Egypt ranks near bottom of WEF’s “inclusive development” index on first day of the Davos (self)lovefest. (What We’re Tracking Today)

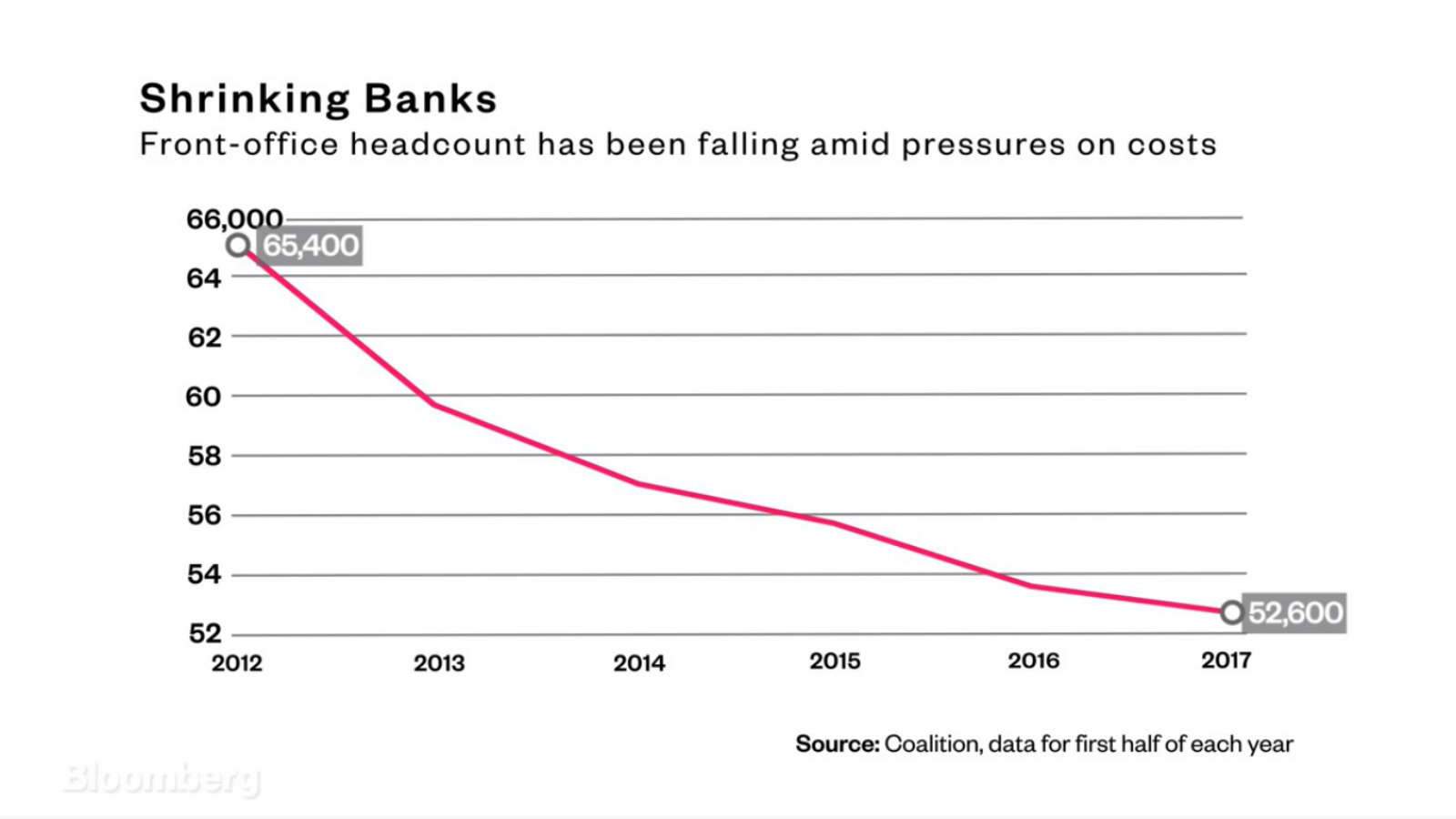

- Could digital platforms spell the end of sales teams in corporate bond issuances? (Worth Reading)

- The Market Yesterday

Tuesday, 23 January 2018

Al Ghurair announces biggest post-float investment in Egypt as Masdar doubles down on EGY renewables

TL;DR

What We’re Tracking Today

The United States has slapped Egypt and four other countries with new screening protocols for air cargo; we have details in this morning’s Speed Round, below.

In an unrelated trade development, US President Donald Trump also imposed yesterday tariffs on imported washing machines and solar panels in what Reuters positioned as “the first of several potential trade restrictions.” Exporters including South Korea have already pledged to contest the sanctions on washers, which start at 20% and run as high as 50% pas the first 1.2 mn imported units.

Otherwise, you can look forward to a day dominated by plenty of chatter about the macro backdrop:

The IMF will report on its second review of Egypt’s economic reform program this afternoon. Based on statements from senior officials following the review and the board’s approval of the USD 2 bn tranche, we expect to hear nothing but positivity and confidence.

The IMF was also positive in its global economic forecast as it released the January update of its World Economic Outlook. The IMF expects global growth for 2018 and 2019 to clock in at 3.9%, an upgrade of 0.2% on the back of global output growth in 2017. “This forecast reflects the expectation that favorable global financial conditions and strong sentiment will help maintain the recent acceleration in demand, especially in investment, with a noticeable impact on growth in economies with large exports,” said the report. The IMF was particularly pleased with the US’ tax reform, which is expected to stimulate further growth.

The aggregate growth forecast for the emerging markets and developing economies for 2018 and 2019 is unchanged. Growth in the Middle East, North Africa, Afghanistan, and Pakistan region is expected to pick up in 2018 and 2019, but remains subdued at around 3.5% notes the IMF. You can catch the landing page of the report here, or read the full document (pdf).

The take home message from the IMF forecast, per the Wall Street Journal: “The world’s economies are growing in rare harmony, [and] synchronized expansions tend to be self-reinforcing — they can have staying power.”

It’s day one of the World Economic Forum in Davos. Pity the bn’aires: The heaviest snowfall there in 20 years has seen the Swiss town buried in six feet of snow (that’s just under 183 cm) in the past six days. Folks are showing up late for speeches and (the horror) are having problems landing their helicopters. The program for the gathering is here on the event’s homepage.

What to expect at WEF? An agreement early this morning to end the shutdown of the US government suggests The Donald may well still attend, so there will be the expected gnashing of teeth there. Some are predicting hand-wringing about Big Tech amid calls for tighter regulation of players including Google, Facebook and Amazon. And there will be the usual stuff about the brittleness of the global economic recovery and the future of capitalism, the Financial Times notes in its tee-up. Also look for a flurry of reports competing for attention, Bloomberg notes in its day-one scene setter.

One of those reports is the WEF’s “inclusive development index,” which rates more than 100 countries on “growth, equity and sustainability.” The list is dominated by small, wealthy European nations, with the top five slots going to Norway, Iceland, Luxembourg, Switzerland and Denmark. The list is split into 30 advanced economies and some 77 emerging markets.

Egypt ranks #70 on the EM list, which is led by Lithuania, Hungary and Azerbaijan. We’re one slot behind South Africa and one ahead of Zimbabwe. The landing page for the report is here or you can go read the thing in pdf here.

Speaking of EMs, Bloomberg has come out with its 2018 list of most (and least) attractive emerging markets. Mexico and Turkey appeared to top the list of the most attractive EMs, because their real effective exchange rates are more competitive than the average of the past 10 years. China and India are the least attractive on historically high valuations, and their economic growth is unlikely to be as fast as it has been in the past decade, estimates show. Don’t look for Egypt in here: It was among the four of the 24 MSCI emerging market countries that was excluded for lacking data.

In miscellany this morning:

- Morten Hansen’s Great at Work, which argues that you need to work less (and far more selectively) to achieve more, has made it to the FT’s list of business books of the month of January. We’ve already pre-ordered; it’s due out 30 January.

- Amazon has opened “the store of the future” which features no checkouts. Instead, hundreds of cameras and sensors follow your every move. Not creepy in the least. The New York Times and the FT both have the story.

- Former KPMG execs, including some who had made partner, have been hit with conspiracy charges in the US after being accused of misusing confidential information, the Wall Street Journal reports.

- Elsewhere, the Journal’s takeaway from Milan fashion week is that you should never get rid of your old clothes. They’ll be back in fashion eventually.

Finally: The (blessed) failure of the sand storm to appear yesterday has us questioning the infallibility of the national weather service. Our favourite weather app tells us we’re looking at a high today of 19°C, a 20% chance of a sprinkling of rain on Thursday and a cooler day on Friday, when the daytime high is forecast to be 16°C.

What We’re Tracking This Week

The EGX confirmed in an emailed statement that it will be closed on Thursday to mark the Revolution and / or Police Day, whatever it is that we observe on 25 January. Trading will resume on Sunday. Thursday is a national holiday.

On The Horizon

CI Capital’s 2018 MENA Investor Conference will take place on 30 January.

The 49th Cairo International Book Fair will run from 26 January until 10 February, featuring 848 publishers from 27 countries.

Enterprise+: Last Night’s Talk Shows

The presidential race continued to top discussions on the airwaves last night, making us all the more thankful for a couple nuggets of business-relevant news.

Al Ghurair Group signing a USD 1 bn investment in a vertically integrated sugar plant is reflective of the country’s improving investment climate, cabinet spokesman Ashraf Sultan told Masaa DMC’s Eman El Hosary. Sultan noted that the plant will help to plug Egypt’s sugar supply gap and will eventually open the door for us to export the diabetes-causing stuff. House Economic Committee Chairman Amr Ghallab also piled on the praise, saying the investment will significantly improve the business climate in Minya (watch, runtime: 5:57). We have more in Speed Round, below.

Over on Kol Youm, Supreme Council of Armed Forcesadvisor Khairat Barakat told host Amr Adib that Sami Anan’s presidential bid is illegal because he did not secure SCAF’s approval prior to announcing his intention to run. As we noted earlier this week, Anan needs permission from SCAF to resign his commission to be allowed to run as a civilian. Barakat said that SCAF will decide whether or not to greenlight Anan’s nomination based on “national security considerations” (watch, runtime: 9:36).

The spokesman for Anan’s campaign, Hazem Hosny, was having none of it, telling Adib that Anan should not face any legal issues because he is only a reserve officer and is not on active duty. Hosny reminded Adib that President Abdel Fattah El Sisi was granted the same leave in 2014, and said that SCAF refusing to do the same for Anan would be a clear indication of the institution’s bias. He also denied that Anan has been cooperating with the Ikhwan on his campaign or communicating with the group in any way (watch, runtime: 18:59).

Adib also spoke to Khaled Ali campaign spox Amr Abdel Rahman, who claimed that 400 endorsement forms signed in Ali’s favor have mysteriously gone missing. Abdel Rahman said that his candidate’s presidential bid is facing hurdles in the bureaucracy and the media alike — and lambasted Adib for not giving Ali’s campaign enough airtime on his show (watch, runtime: 9:32).

Al Hayah Al Youm’s Tamer Amin spoke to Immigration Minister Nabila Makram, who said that she is working on a campaign to encourage Egyptian expats to vote. Makram says she has already started with Egyptians residing in the UK (watch, runtime: 10:55).

Meanwhile, State Information Service Diaa Rashwan told Hona Al Asema’s Lamees Al Hadidi that around 530 foreign journalists residing in Egypt are now registered for media coverage of the elections, while an additional 120 will fly in for the occasion (watch, runtime: 4:12).

Lamees also spoke with Union Capital CEO Hany Tawfik about progress on the EGP 150 mn bailout fund for idle small and mid-sized factories. Tawfik explained the details of the fund, including its sources of financing and its procedures for studying companies eligible for funding packages. He noted that banks can issue loans for eligible companies under the CBE’s SME lending initiative (watch, runtime: 21:27).

Speed Round

INVESTMENT WATCH- UAE’s Al Ghurair Group will invest USD 1 bn in a massive sugar cultivation and processing project, which some are already calling the largest foreign direct investment in Egypt since the EGP float. The project will see the company develop 181k feddans of reclaimed desert land west of Minya to grow 1 mn tonnes of beets per year, Investment Minister Sahar Nasr announced in a press conference on Monday. The company will also develop a USD 400 mn sugar production facility, she added, according to Al Masry Al Youm. The project is expected to cover 80% of Egypt’s sugar supply deficit, which runs between 25-30%, said Agriculture Minister Abdel Moneim El Banna. The project is expected to be completed in four years.

Meeting the demands of our collective sweet tooth appears to have become a top economic priority for the government, which on Sunday approved raising the price it pays local farmers for sugarcane to EGP 720 per tonne, up from EGP 700 per tonne. The new price will be applied retroactively to all sales to the government so far this season, Supply Minister Ali El Moselhy announced. The government has purchased 1.2 mn tonnes of sugarcane from farmers during the current harvest season, which runs from January until May. Egypt is forecast to produce around 1 mn tonnes of sugar from sugarcane, in addition to 1.3 mn tonnes from sugar beets, Reuters reports. Domestic consumption stands at around 3 mn tonnes each year.

INVESTMENT WATCH- Masdar plans to invest in up to 500 MW of solar power generation capacity: UAE’s Masdar presented the New and Renewable Energy Authority (NREA) with plans to develop solar power plants with a combined capacity of 500 MW,authority sources told Al Mal. The plants would operate under a build-own-operate framework and will sell electricity to the Egyptian Electricity Transmission Company (EETC) at a price of USD 0.038 per kWh. The move follows the company’s announcement earlier this month of investments in wind power projects, including a partnership with Japan’s Marubeni to invest USD 900 mn in wind parks. Masdar CEO Mohamed Al Ramahi had said last week that the firm plans to develop about 800 MW of wind projects across the country.

US imposes new security protocols on cargo flights from Egypt and four other countries: The US Transportation Security Administration issued an emergency order on Monday that requires new security screening for cargo on flights from five Middle East countries, including Egypt, the Associated Press reports. Jordan, Saudi Arabia, Qatar and the UAE were also named in the order; the countries were identified because of “demonstrated intent by terrorists groups to attack aviation from them,” the TSA statement said. The TSA said most of the requirements of the emergency order are already being carried out voluntarily by airlines in some countries, stopping short of identifying which. National carriers from these countries, including EgyptAir, and their home airports will be affected by the order. All cargo originating from those airports will have to be screened and secured under Air Cargo Advance Screening protocols. Carriers must submit advance air cargo data to US authorities.

The order had caused a bit of confusion when Reuters initially reported that the US had banned cargo on flights from Cairo International Airport to the US. The Civil Aviation Ministry had put out a statement saying that reports of a ban were inaccurate.

Meanwhile, a Russian delegation arrived yesterday to inspect security protocols at Cairo International ahead of permitting direct flights from Moscow, according to Sputnik Arabic which cited sources at the airport. The three-day inspection will focus on Terminal 2, which will host Russian airline Aeroflot’s flights, the sources added. However, sources from the Civil Aviation Ministry tell Al Mal that the delegation was merely here to iron out final procedures before allowing flights and will not involve a security check.

Trouble at GAFI? General Authority for Investment and Free Zones Managing Director Mona Zobaa announced she has stepped down in a statement on Monday picked up by Al Mal. Zobaa, who was appointed only in August of last year, was tight-lipped about the reasons she stepped down. It is unclear at present who might succeed her.

NMC Healthcare signs O&M contracts to manage Dar Al Fouad, As-Salam hospitals: UAE-based hospital operator NMC Healthcare signed operation and management (O&M) contracts with Emirates Healthcare Group to manage the latter’s two Egyptian hospitals, Dar Al Fouad and As-Salam, according to the Emirates News Agency. The two hospitals have a combined capacity of 860 beds. NMC should take in revenues of c. USD 2 mn in the first year of the agreement, the site suggests.

NMC also announced yesterday two separate acquisitions worth a combined USD 207 mn, Reuters reports. NMC acquired a 70% stake in Emirati cosmetic surgery provider CosmeSurge for USD 170 mn, in addition to an 80% stake in Saudi Arabia’s Al Salam Medical Group for USD 37 mn. The two transactions are expected to be complete in 1Q2018 and 1H2018, respectively.

Uber will launch is Uber Eats service in Cairo and Riyadh sometime this year, according to a company statement. “The expansion comes on the back of Uber Eats success in the UAE, where orders grew by 169% in the 2nd semester of 2017 only, and the number of restaurants opening their doors on the app increased twofold, to more than a thousand active today,” Uber says. The company is “partnering with national and local restaurants to bring the convenience of the Uber Eats app to more people in the region … [Uber is] doubling down on creating a localised version of the app that meets the needs of the Arabic speaking population,” says Nic Robertson, General Manager, Uber Eats Middle East and Africa.

Hurghada continued to reign supreme as the premier destination spot for German tourists in December, growing 55% m-o-m, German tourism outlet FVW reports. Arrivals had jumped 72% in November. The Red Sea getaway held a 21% market share of all bookings for the ten largest destinations traveled by Germans.

EARNINGS WATCH- Heliopolis Housing reported a 55% y-o-y decline in net profit after tax to EGP 59.2 mn in 1H2017/18, down from EGP 132 mn during the same period last year, according to a regulatory filing (pdf). The company explained that the dip in profit came as it paid for an EGP 63 mn plot of land it purchased from the Egyptian Contracting Company in Obour.

Abu Qir Fertilizers reported a 14.38% y-o-y increase in net profit after tax to EGP 1.24 bn in 2017, up from EGP 1.09 bn in 2016, according to a filing with the EGX disclosure (pdf).

Mohamed bin Salman’s self-styled corruption crackdown is nearing its target of USD 100 bn, as settlement talks with officials, princes, and businessmen caught up in the “anti-corruption probe” appear to be winding down, Bloomberg reports. Authorities have already agreed to drop charges against about 90 suspects, who were released, Attorney General Sheikh Saud Al Mojeb said in a separate interview at the Ritz-Carlton late on Sunday. About 95 people were still at the hotel, including five weighing settlement proposals, with the others reviewing evidence presented against them, he said.

Egypt in the News

Topping coverage of Egypt on a ridiculously slow news day in the foreign press is still Ethiopia’s refusal to accept World Bank mediation in its dispute with Egypt on the Grand Ethiopian Renaissance Dam.

Climate change and rapid population growth are threatening the survival of ancient Egyptian artifacts, according to a piece by UN Environment. “Increasingly erratic weather that many largely attribute to climate change is eating away at the ancient stones. At the same time, booming population growth is complicating preservation efforts. After surviving thousands of years of war, invasion, and cannibalization for building materials, the splendours of ancient Egypt might have finally met their match… The effects of climate change will only get more intense, experts say, possibly requiring some tricky decisions about the viability of maintaining vulnerable historic sites.”

Queen Nefertiti never actually ruled Egypt, claims Joyce Tyldesley, an Egyptologist from The University of Manchester, according to Phy.org. Nefertiti “wasn’t born a royal, and for a non-royal woman to become king would have been unprecedented. Her daughter Meritaten, however, was indeed born a royal – and so is a more likely candidate for pharaoh, if anyone is,” Tyldesley says.

Also worth a quick skim this morning:

- Border forces killed an Israeli man on the border between Egypt and Israel during an attempt to smuggle illegal substances, YNet reports. The story also gets a shout in Haaretz.

- There are more arrests of members of the LGBTQ community in Egypt and “world leaders remain largely silent,” according to Human Rights Watch.

- The government is using “defamation campaigns to target its opponents as a tactic to silence and discredit any critical voices,” Esraa Abdel Fattah writes for Open Democracy.

Worth Reading

Could digital platforms spell the end of sales teams in corporate bond issuances? Digital platforms are breaking into the traditional cycle that goes into a corporate bond issuance and could potentially wipe out fleets of sales forces at banks, Katie Linsell writes for Bloomberg. Traditionally one of the most robust sources of revenue for the big banks, the system of bond issuances has been called into question for being biased towards large institutions. Digital platforms are increasingly being seen as circumventing this system by bypassing banking sales teams and connecting issuers directly with their investors via a digital platform. Digital platforms offer the added benefit of transparency and record keeping which regulators are increasingly demanding from banks and underwriters. While this shift may not pose an existential threat to traditional sales teams, it could see their revenues shrink, says Linsell.

Diplomacy + Foreign Trade

Egypt has received a formal invitation from Russia to take part in the Syrian National Dialogue Congress in Sochi scheduled for late this month, TASS reports. Foreign Affairs Ministry spokesperson Ahmed Abu Zeid says the conference “will discuss the mechanism for achieving a political solution to put an end to the crisis in the country… Egypt’s stance in favor of a political solution in Syria, which should preserve the Syrian state, its unity and meet the aspirations of people in that country who continue to be affected by the scourge of the war and destruction.”

Foreign Minister Sameh Shoukry met with his counterparts from the Arab Quartet during meetings for the Coalition to Restore Legitimacy in Yemen in Riyadh on Monday, according to an official ministry statement. The four sides also discussed Qatar and continued to press the 13 demands made of Qatar as the prerequisite to normalizing relations. Shoukry separately met with his Saudi Foreign Minister Adel Al Jubeir ato discuss boosting Saudi investments in Egypt. Shoukry’s meeting with his Jordanian counterpart Ayman Safadi primarily focused on US Vice President Mike Pence’s visit to the region and the Jerusalem issue.

On that front, Pence announced that the US will move its embassy to Jerusalem in 2019, Bloomberg reports. "In the weeks ahead, our administration will advance its plan to open the United States Embassy in Jerusalem, and that United States Embassy will open before the end of next year,” he said.

House of Representatives Speaker Ali Abdel Aal met with Bahraini Prime Minister Khalifa bin Salman Al Khalifa on Monday, according to The Bahrain News Agency. Abdel Aal, who is leading a House delegation trip there, called for Bahrain to expand their investments in Egypt given recent economic reforms.

This comes as South Korea sent its own parliamentary delegation to Cairo, meeting with members of the House Planning and Budget Committee yesterday to discuss strengthening military cooperation between the two countries, Ahram Gate reports. South Korean MP Kyung Dae-Soo urged cooperation in military production and development, as well potential investments in Egypt’s natural resources. The delegation also discussed Egypt’s participation in the 2018 Winter Olympics in South Korea.

President Abdel Fattah El Sisi met with the head of France’s foreign intelligence service Bernard Emie in Cairo yesterday to discuss ongoing conflicts and challenges in the MENA region, according to an Ittihadiay statement. Ways to boost international counterterrorism efforts also came up during the discussion.

Health + Education

FEI’s pharma division asks Health Ministry to “correct skewed pricing of meds”

Emboldened by last week’s “limited” price hike, the Federation of Egyptian Industries’ (FEI) pharma division has submitted a formal request to the Health Ministry to move meds prices once again, division member Mohy Hafez tells Al Borsa. According to Hafez, the division does not necessarily want to see the ministry raising prices across the board again, but rather wants some meds’ prices to be lowered and others raised to restore the balance.

Real Estate + Housing

ODH considering North Coast project

Orascom Development Holding (ODH) is assesing two land plots on the North Coast to acquire one of them for a coastal development project, IR Director Sara El Gawahergy tells Al Mal. Both land plots are over 400 feddans in area and ODH will be looking to partner with a state-owned or private company to partner in the project with.

St. Regis Cairo to open in March

The St. Regis Cairo Hotel is set to be opened in March, sources close to developer Qatari Diar told Al Mal. The hotel was developed using a USD 1 bn investment with the sources saying the cost increased from the initial USD 560 mn projected. Contractor delays delayed the project’s development and drove up the cost. Sources added that Qatari Diar is now prioritizing the St. Regis launch and will complete the residential and administrative development on site after.

Tourism

Nile cruise shut down after 31 people suffered from food poisoning

Tourism authorities shut down the famous Nile cruises from Aswan to Luxor after 31 people were poisoned on one such cruise in Luxor on Sunday, according to The Egypt Independent. Tourism Minister Rania El Mashat ordered an investigation into the incident.

Other Business News of Note

IDA warns 26 1,000 factories project investors of withdrawing land plots over delays

The Industrial Development Authority (IDA) has warned 26 investors in New Cairo’s 1,000 factories projects it would withdraw their allocated land plots over delays in completing construction, the head of the Association of Investors for Small and Medium Enterprises (AISME) Hesham Kamal tells Al Borsa. The warnings come after IDA gave the uncommitted investors two three-month ultimatums to address their delays, which they blame on the impact of the EGP float, according to Kamal.

GE executives discuss new investments with Nasr

GE CEO for MENA and Turkey Nabil Habayeb said that the company was eyeing new investments in Egypt at a meeting with Investment Minister Sahar Nasr, according to a statement on the Ministry’s Instagram account. Nasr urged GE to direct more investments into the Suez Canal, Al Galala, and New Alamein.

Careem driver’s death sparks fears of possible strike

Careem’s management met with drivers in a bid to head off a strike after a driver was killed during an apparent armed robbery, PR Director Rana Ghanem told Al Mal. Drivers had threatened to strike to pressure the company to adopt security measures including requiring passengers to add their national ID numbers and photos to the app before they can summon a ride.

Legislation + Policy

No decision on beginning to enforce stock market capital gains tax -El Monayer

The Finance Ministry has not issued a decision to restart enforcing capital gains taxes on stock market transactions, Vice Minister of Finance Amr El Monayer told Al Masry Al Youm. The ministry is now preparing for the implementation of the tax and is putting in place new mechanisms for that, El Monayer added, without disclosing any details. This will allow for the direct enforcement of the tax, once the decision to implement it is made, he says.

Egypt Politics + Economics

NEC dismisses most of Khaled Ali’s complaints as invalid

Only one complaint filed by presidential candidate Khaled Ali with the National Elections Commission (NEC) may have merit, NEC Spokesperson Mahmoud El Sherif said at a press conference yesterday. In the only instance in which it found grounds, the NEC said it will look into whether Egyptian consulates abroad allowed citizens to sign endorsements for candidates on non-standard forms. Ali’s campaign has said it is struggling to secure the minimum of 25,000 voter endorsements it needs to file his nomination papers before the 29 January deadline, alleging irregularities at government offices at which citizens are required to register as nominators.

Former Supply Minister cleared of corruption charges in wheat corruption scandal

The Prosecutor General has closed its investigation into allegations of corruption in the 2016 wheat harvest swirling around former Supply Minister Khaled Hanafi, according to a memo from the Prosecutor General’s office. The memo, which said the investigation had been closed since December 2017, cleared Hanafi of charges he had misused public funds.

On Your Way Out

Egyptian Streets founders Mohamed Khairat and Mostafa Amin have made Forbes’ annual 30 under 30 list in Europe. Forbes lauds Egyptian Streets’ success since it was founded in 2012.

The Antiquities Ministry is going to document petroglyphs across the country, according to an official ministry statement. The project will document rare and hard to reach inscriptions in the rock in places like the Eastern Desert and the Sinai by taking high-definition pictures and noting coordinates. The project aims to help with preservation and the potential restoration of the archaeological sites.

The Market Yesterday

EGP / USD CBE market average: Buy 17.66 | Sell 17.76

EGP / USD at CIB: Buy 17.65 | Sell 17.75

EGP / USD at NBE: Buy 17.65 | Sell 17.75

EGX30 (Monday): 15,243 (-0.6%)

Turnover: EGP 1.3 bn (16% ABOVE the 90-day average)

EGX 30 year-to-date: +1.5%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 0.6%. CIB, the index heaviest constituent closed down 1.3%. EGX30’s top performing constituents were Eastern Co up 1.3%; Elsewedy Electric up 1.1%; and Sidi Kerir Petrochemicals up 0.6%. Yesterday’s worst performing stocks were Amer Group down 3.0%; Egyptian Iron & Steel down 3.0%; and Orascom Telecom Media & Technology down 2.6%. The market turnover was EGP 1.3 bn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +49.9 mn

Regional: Net Long | EGP +34.3 mn

Domestic: Net Short | EGP -84.2 mn

Retail: 60.1% of total trades | 57.9% of buyers | 62.3% of sellers

Institutions: 39.9% of total trades | 42.1% of buyers | 37.7% of sellers

Foreign: 23.7% of total | 25.6% of buyers | 21.7% of sellers

Regional: 14.3% of total | 15.6% of buyers | 13.0% of sellers

Domestic: 62.0% of total | 58.8% of buyers | 65.3% of sellers

WTI: USD 63.49 (+0.19%)

Brent: USD 69.25 (+0.93%)

Natural Gas (Nymex, futures prices) USD 3.25 MMBtu, (+1.92%, February 2018 contract)

Gold: USD 1,334.3 / troy ounce (+0.09%)

TASI: 7,480.89 (-0.43%) (YTD: +3.52%)

ADX: 4,629.24 (-0.15%) (YTD: +5.25%)

DFM: 3,501.33 (-0.31%) (YTD: +3.89%)

KSE Weighted Index: 420.21 (+0.7%) (YTD: +4.68%)

QE: 9,211.02 (+0.72%) (YTD: +8.07%)

MSM: 4,989.09 (+0.21%) (YTD: -2.16%)

BB: 1,334.89 (-0.08%) (YTD: -0.24%)

Calendar

22-23 January (Monday-Tuesday): Arqaam Capital Egypt Investors Conference 2018, The Vineyard Hotel, Cape Town, South Africa.

25 January (Thursday): 25 January revolution / Police Day, national holiday.

29-30 January (Monday-Tuesday): Seamless North Africa, The Nile Ritz-Carlton, Cairo.

30 January-01 February (Tuesday-Thursday): CI Capital’s MENA Investor Conference, Four Seasons Nile Plaza, Cairo.

05 February (Monday): Egypt’s Emirates NBI PMI reading for January announced.

12-14 February 2018 (Monday-Wednesday): Egypt Petroleum Show 2018 (EGYPS), New Cairo Exhibition Center.

19-20 February 2018 (Monday-Tuesday): The Banking Tech North Africa, The Nile Ritz-Carlton, Cairo

17-21 February 2018 (Saturday-Wednesday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

05-07 March (Monday-Wednesday): EFG Hermes’ One on One Conference 2018, Atlantis, The Palm, Dubai, UAE.

28-31 March 2018 (Thursday-Sunday): Cityscape Egypt, Cairo International Convention Centre, Cairo

08 April (Sunday): Easter Sunday, national holiday.

09 April (Monday): Sham El Nessim, national holiday.

24-25 April (Tuesday-Wednesday): Renaissance Capital’s 3rd Annual Egypt Investor Conference, Cape Town, South Africa.

25 April (Wednesday): Sinai Liberation Day, national holiday.

01 May (Tuesday): Labour Day, national holiday.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

15 May (Tuesday): Expected date for the start of Ramadan begins (TBC).

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday. (Look for possible Monday off given the first day falls on a Friday.)

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday

11 September (Tuesday): Islamic New Year (TBC), national holiday.

06 October (Saturday): Armed Forces Day, national holiday.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25 December (Tuesday): Western Christmas.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC)

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC)

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.