Could digital platforms spell the end of sales teams in corporate bond issuances?

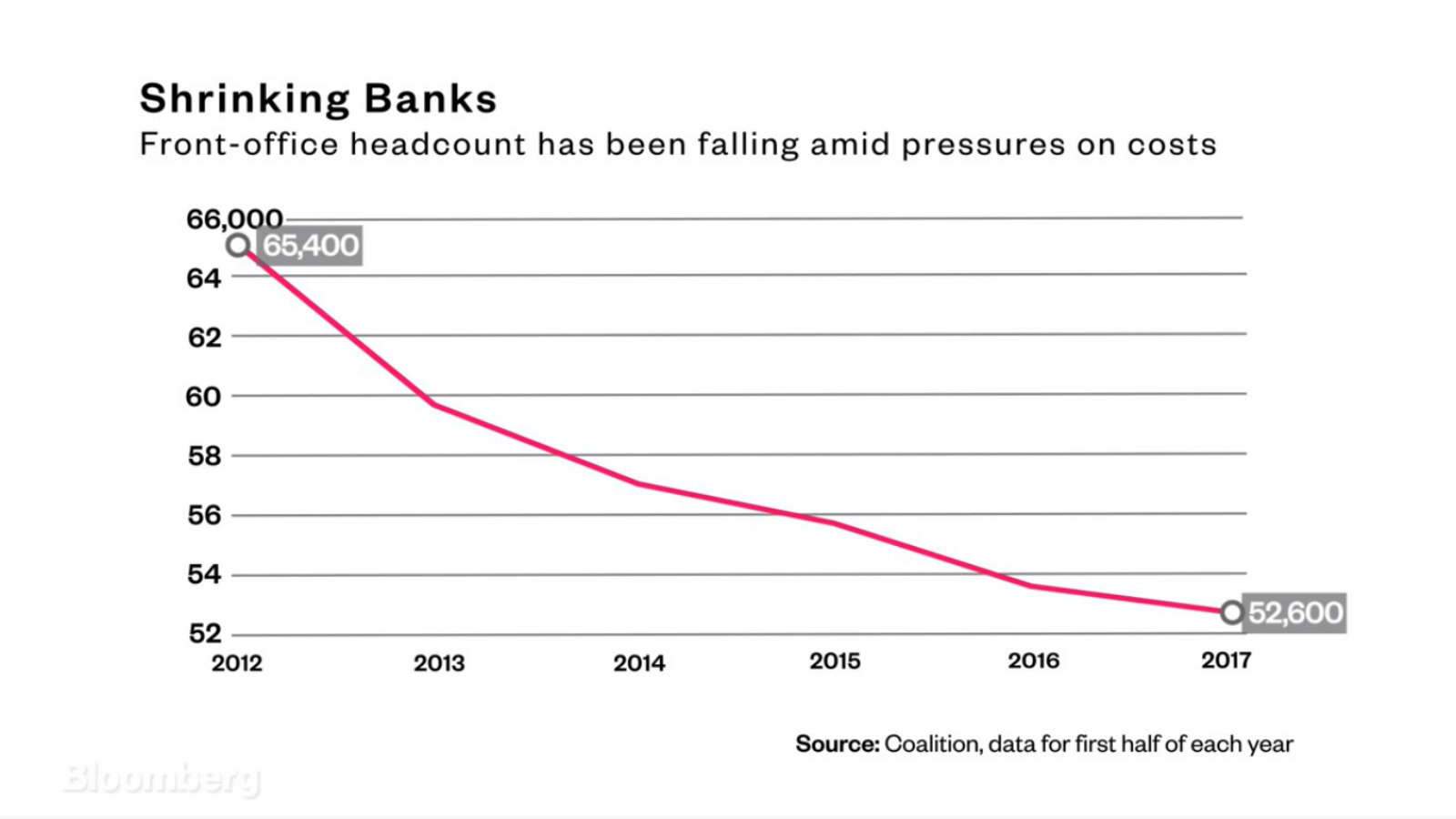

Could digital platforms spell the end of sales teams in corporate bond issuances? Digital platforms are breaking into the traditional cycle that goes into a corporate bond issuance and could potentially wipe out fleets of sales forces at banks, Katie Linsell writes for Bloomberg. Traditionally one of the most robust sources of revenue for the big banks, the system of bond issuances has been called into question for being biased towards large institutions. Digital platforms are increasingly being seen as circumventing this system by bypassing banking sales teams and connecting issuers directly with their investors via a digital platform. Digital platforms offer the added benefit of transparency and record keeping which regulators are increasingly demanding from banks and underwriters. While this shift may not pose an existential threat to traditional sales teams, it could see their revenues shrink, says Linsell.