- EBRD just loaned a crisp USD 325 mn to Egypt’s banks. (Speed Round)

- Businesses need to help middle- and upper-income staff keep pace with inflation, says CIB’s Ezz Al Arab; we see inflation running at c. 80% for white collar staff. (Speed Round)

- Nine out of 10 economists see central bank leaving interest rate on hold tomorrow. (What We’re Tracking This Week)

- White House considering Mohamed El Erian for Federal Reserve Vice Chair. (What We’re Tracking Today)

- Global wheat market braces as court ruling suggests zero-tolerance policy for ergot could make a comeback. (Speed Round)

- Natural Gas Act executive regs coming in days; talks with Aramco on refining in Egypt are underway. (Speed Round)

- New SMEs law to offer tax and non-tax incentives, could eliminate interest on loans for registered businesses. (Speed Round)

- IPO WATCH- EFG Hermes expects Banque du Caire to IPO in 1H2018. (Speed Round)

- M&A WATCH- FRA rejects ADM’s counter offer for NCMP. (Speed Round)

- The Market Yesterday

Wednesday, 15 November 2017

We think white collar inflation is running at c. 80% — you need to look at wages and productivity

TL;DR

What We’re Tracking Today

White House considering Mohamed El Erian for Federal Reserve Vice Chair: The White House is considering Allianz’ chief economic adviser and Egypt’s favourite economic whiz Mohamed El Erian for vice chairman of the Federal Reserve, sources confirmed to CNBC on Tuesday. El Erian replace Stanley Fischer, who vacated his seat in October, and would, if nominated and confirmed, serve alongside Fed Chair-designate Jerome Powell. “The search process has just begun and the vice chair announcement is not likely this year,” said CNBC’s source, who is familiar with the discussions. "El Erian would bring to the Fed Board deep understanding of financial markets and the interaction of policy with markets, as well as a global perspective often missing from Fed policy debates," Krisha Guha, head of global policy and central bank strategy at Evercore ISI, said in a note. Guha described El-Erian as likely to be "slightly hawkish" on monetary policy, meaning he may favor higher rates and a faster runoff of the Fed’s balance sheet. The Wall Street Journal also has the story.

Libya is on the agenda for Foreign Minister Sameh Shoukry today as he meets with his Tunisian and Algerian counterparts in Cairo.

No fluffy stuff for you this morning — other than to note that the idea of toymakers Hasbro and Mattel merging has to both delight and terrify the ‘80s kid inside many of us — as there’s just too much news. Onward.

What We’re Tracking This Week

It’s interest rate week: The central bank’s Monetary Policy Committee will meet on Thursday to review key interest rates. The meeting comes as inflation inched down fractionally in October, but nine out of 10 economists polled by Reuters believe the decreased is not yet substantial enough to warrant a change in interest rates from their current 18.75% for deposits and 19.75% for lending. CI Capital’s Hany Farahat tells the newswire that he sees the MPC cutting rates by 100 bps in its December meeting “after inflation figures of the current month drop to the high teens following the adjustment of the base effect.” Pharos’ Angus Blair recommended, however, that rates are cut this month since inflation seems to be on a steady comedown. “Cuts in the interest rate will subsequently improve private sector sentiment and investment and help to boost employment, and which will also help to bring down the government’s interest payments and meet its budget deficit target,” he said.

The US embassy in Cairo and its consulate in Alexandria are hosting activities aimed at engaging young Egyptians with an interest in entrepreneurship from 13 to 19 November as part of Global Entrepreneurship Week.

Enterprise+: Last Night’s Talk Shows

The airwaves served up an array of topics last night, including concerns over the Grand Ethiopian Renaissance Dam (GERD) talks and Egypt’s fuel subsidy bill.

The government is sticking to its plans to completely lift fuel subsidies within 4-5 years, but subsidies will remain at their current levels for the remainder of the fiscal year, Oil Minister Tarek El Molla told Hona Al Asema’s Lamees al Hadidi. The state budget has allocated EGP 27.5 bn for fuel subsidies per quarter, but actual spending on these subsidies in 1Q2017-18 came in at EGP 23.5 bn. El Molla said the EGP 4 bn difference is due to a drop in domestic consumption of petroleum and diesel, which has offset the increase in international oil prices. El Molla had said earlier this week that fuel subsidy costs rose 68% y-o-y in 1Q2017-18.

El Molla also announced that the government will be paying USD 750 mn to international oil companies before the end of December.

El Molla also elaborated on talks with Saudi Aramco to refine a portion of its monthly crude oil shipments in Egypt (we have full coverage on that in the Speed Round).

The government is also looking to begin exporting natural gas in 2019, by which time Eni’s Zohr, BP’s Atoll, and several other gas fields will be online (watch, runtime: 18:26).

President Abdel Fattah El Sisi and Ethiopia’s Prime Minister will meet in Cairo in December to discuss the stalemate on the GERD, Foreign Affairs Ministry Spokesperson Ahmed Abu Zeid told Lamees. In the meantime, Egypt is working on rallying international support for its position to Ethiopia and Sudan in future negotiations. Abu Zeid noted that talks have thus far been carried out on both the technical and political levels, but the lack of agreement between the three countries on the technical side has made it necessary to ramp up the political effort (watch, runtime: 7:02). As we noted earlier in the week, Sudan and Ethiopia have both rejected ratifying the impact studies on the dam.

Kol Youm’s Amr Adib provided color commentary on the GERD issue, saying it’s time for parliament to question Prime Minister Sherif Ismail and the irrigation and agriculture ministers. He also called for a campaign to rationalize water consumption, specifically asking men to use no more than a cup of water while shaving their beards (watch, runtime: 1:44).

And surprisingly, it was Adib, and not Lamees, also took who noted Mohamed El Erian is being considered for Fed Vice Chairman by the White House (watch, runtime: 2:53).

Over on Al Hayah Al Youm, Ittihadiya spokesperson Bassam Rady discussed the state land seizures of illegally occupied plots. He told host Tamer Amin that the government intends to reprice land plots to investors reasonably when selling it back to them (watch, runtime: 5:27).

Speed Round

The European Bank for Reconstruction and Development just loaned a crisp USD 325 mn to Egypt’s banks to drive SME lending, export growth and the expansion of banks into Africa.

CIB signed an agreement for a USD 100 mn subordinated loan with the European Bank for Reconstruction and Development (EBRD). CIB says the loan qualifies to be included in its tier 2 capital as per the new modifications to central bank regulations. The loan carries a 10-year maturity and will not cause any dilution to equity. CIB says the additional funds will raise its capital ratio to 18.05% from 16.95% and support its future growth plans.

CIB’s growth plans include Africa: Reuters also has the story, quoting CIB boss Hisham Ezz Al Arab as noting that, “CIB will partly use the new funds to back its regional expansion in Africa. The bank received approval from the Central Bank of Egypt about two weeks ago to expand across Africa and is looking at opportunities in countries such as Kenya, Rwanda, Tanzania, and Uganda, said al-Arab. ‘There are a lot of synergies and relations between Egypt and those markets.’”

Among the other banks landing packages from the EBRD:

- Banque Misr is getting a USD 75 mn loan from the EBRD to support the growth and development of SMEs. “The EBRD credit line to Banque Misr will increase the availability of funding for SMEs by reaching out to new clients and regions outside the Greater Cairo region and Alexandria.”

- EBRD is extending a USD 40 mn trade facility to Emirates NBD Egypt under its trade facilitation programme. “Through the facility, the EBRD provides guarantees in favour of international commercial banks, covering the commercial payment risk of the transactions undertaken by Emirates NBD Egypt.”

- Alex Bank is getting a USD 30 mn financing package under a “green economy financing facility” for Egypt from the EBRD and European Investment Bank (EIB). The EBRD will provide a financing facility of up to USD 15 mn for on-lending to private companies for energy-efficiency and renewable energy projects and the EIB is expected to join the facility with an additional USD 15 mn in financing at a later stage.

- The Arab African International Bank (AAIB) is getting a USD 30 mn loan to support SMEs. The funding will help AAIB further expand its SME lending and will contribute to increased access to finance for small businesses in Egypt.

- QNB Al Ahli is offered a senior loan of USD 20 mn for lending to local SMEs. “The loan is the first under the EBRD’s new Egypt Women in Business programme which aims to strengthen the role of women in the economy. It provides access to finance through credit lines to local banks as well as business advice, training and support for women entrepreneurs and women-led businesses.

- EGBank will also receive USD 20 mn to support export/import activity. The amount should allow the bank “to issue guarantees in favor of international commercial banks, covering the commercial payment risk…The EBRD will also provide cash financing for pre-export and post-import financing.”

- Al Ahli Bank of Kuwait-Egypt is getting USD 10 mn under the EBRD’s Trade Facilitation Programme. Through the facility, the EBRD provides guarantees in favour of international commercial banks covering the commercial payment risk of the transactions undertaken by ABK – Egypt.

In related news, industrial gas manufacturer Gulf Cryo is in talks with the bank for USD 15 mn in funding to help finance 50-60% of their three-year expansion plans in Egypt, country Managing Director Amr El Sahn tells Al Mal. Gulf Cryo will spend EGP 400 mn in the next three years to expand operations at their 6 October and 10 Ramadan City facilities.

Also coming out of the EBRD event yesterday: EBRD has committed EUR 15 mn to a fund of Mediterrania Capital Partners that will invest in SME opportunities in Egypt, Morocco and Tunisia. The commitment could rise to as much as EUR 35 mn as the fund reaches final close, EBRD said.

Want to keep growing your business? One of the most important things business you can do is help your middle- and upper-income staff keep pace with inflation. And one of the most important things staff can do in return is deliver productivity gains. It’s a thesis we would agree with wholeheartedly even if we didn’t consider CIB Chairman and Managing Director Hisham Ezz Al Arab a friend.

Middle-, upper-income staff are being squeezed, even as state has protected low-income families and the working poor: Speaking with CNBC yesterday, Ezz Al Arab said noted that the government has done “an outstanding job protecting people under the poverty line and the [working] poor æ protecting low-income families. The ones who are being really impacted by the reforms are the middle class and the upper class. We saw the clear impact on their spending behaviour … it changed.”

Businesses, Ezz Al Arab suggests, need to protect their people: “For the middle class and the upper class, it’s a matter of time before income and productivity start to catch up to pre-reform levels.” It’s a pattern similar to that which we saw after the reforms of the early 1990s, he notes, saying that it was a while “before the ‘Crocodile on the Nile’ [rebound] affected the average income of society.”

Another wave of raises coming in the banking sector: Banks “will not compensate 100% for the price changes, but at least we voluntarily and aggressively raised average wages by about 20% last year, and I think there is another wave that is going to happen. That increase, by the way, [must be] matched by an increase in productivity as well, because the dangerous part is to raise wages with no increase in productivity, that puts you in a vicious cycle. Banking profits improved in the first half of 2017 and by the end of 2017 or early 2018, you’ll see another [salary] increase. I’d guess you will see over the coming 3-4 years we’ll catch up on productivity and income growth.”

Inflation this year has run at north of 80% for middle- and upper-income staff. That’s our take on the matter. One of the smartest guys we know has looked at inflation for his (very, very large) white-collar staff and estimated it’s running at something around 85%. That meshes just about perfectly with the peak increase in price of baskets of consumer goods (food and non-food) at two high-profile retailers whose data we’ve reviewed.

Just when you thought the ergot issue was resolved, it comes back like Glenn Close in Fatal Attraction: An Administrative Court ruled on Tuesday a decree from the prime minister’s office last year that effectively allowed wheat shipments of 0.05% ergot to enter Egypt was invalid, Reuters reports. The ruling raises the specter that the zero-tolerance policy which shook up international wheat markets and raised prices of wheat imports for Egypt may see a comeback after we thought the issue had been given an appropriate burial. The court said in its ruling on Tuesday that the prime minister was not legally authorised to issue last year’s decree because his office was not the competent authority governing import rules for agricultural products, said Tarek Al Awadi, a lawyer who raised the case.

The government responds: Egypt’s budget cannot sustain purchases of wheat shipments that are ergot-free, said Nagla Balabel, head of the Agriculture Ministry’s quarantine body. She tells Al Mal that the ministry will now look for ways to fight back against the decision, including appealing it. Meanwhile, the Agriculture and Supply ministries have agreed to form a joint committee to set clear guidelines on importing wheat, Deputy Agriculture Minister Safwat El Haddad said, according to Al Shorouk. This committee will have the deciding vote on what happens to shipments which contain ergot, he added. The Supply Ministry had already issued a streamlined guide for wheat imports, which have won praise from traders, after the whole poppy seed fiasco.

Al Awadi claims that the court’s ruling must be enforced even as the government looks to appeal the decision with a higher administrative court and that all shipments with ergot must be suspended. An Egyptian court earlier this year ordered the suspension of an inspection system launched to streamline trade in response to the ergot row, but the government did not implement the ruling. We’ve been noting claims by traders that recent disruptions in shipments and wheat markets due to traces of harmless poppy seeds was the result of Egyptian wheat inspectors fighting to maintain their travel perks. Hell hath no fury like a bureaucrat scorned.

But don’t worry, we have enough wheat on hand: Supply Minister Ali El Moselhy told the House of Representatives that strategic wheat reserves (both in storage and contracted) are currently enough to last until 5 April 2018.

LEGISLATION WATCH- The executive regulations of the Natural Gas Act are coming in days, Oil Minister Tarek El Molla said in an interview with Bloomberg on Tuesday. The long-awaited regs would effectively open the door for the private sector to import, produce, and distribute gas, turning the state into a regulator of the national gas grid. Among its responsibilities will be to issue licences to import natural gas. Four unnamed private firms have already submitted requests to EGAS for preliminary approval on their import licenses. EGAS had reportedly approved natural gas import licenses in August for Fleet Energy, BB Energy, and Qalaa Holding’s TAQA Arabia following the issuance of the Natural Gas Act, effectively opening the market to competition.

El Molla also elaborated on plans to cut state LNG imports by 2018, explaining that the move was a result of the giant Zohr gasfield. The government will issue another tender for LNG in early 2018 to cover needs for the second quarter, and it plans to stop importing the fuel by the end of next year, El-Molla said. EGAS had issued a tender for 12 LNG shipments for delivery in 1Q2018.

El Molla confirmed that initial negotiations have taken place with Saudi Aramco to refine oil in Egypt, according to Reuters. El Molla had told Hona El Asema’s Lamees Al Hadidi last night that the two sides are hoping to begin refining on a trial basis in Egypt in the beginning of 2018. This appears to contradict reports we noted over the past few months that agreements have already been signed. Al Borsa had reported that Aramco signed an agreement that will see it refine some of its crude through the Middle East Oil Refinery (MIDOR). This follows other reports that Aramco had agreed to a plan last month to ship crude through the SUMED pipeline and use Sidi Kerir as a center for exporting refined output to Europe.

LEGISLATION WATCH- New SMEs law to offer tax and non-tax incentives, could eliminate interest on loans for registered businesses: SMEs will receive a number of tax and nontax incentives, under new legislation being prepared by the government, to encourage them to join the formal economy, Vice Minister of Finance Amr El Monayer said yesterday, Ahram Gate reports. While tax exemptions have previously proved ineffective, the bill — which aims to lower the barriers of SMEs’ entry into the formal economy — will offer a simpler tax structure and relieve small businesses from administrative costs and processes, which are generally why they tend to shy away from going official, El Monayer explained.

Under the new law, micro- and very-small enterprises will be categorized into three tax brackets. For microenterprises, the Finance Ministry is considering imposing a single annual tax of “EGP 1,000, for example,” instead of having these businesses pay individual duties, such as income tax and value-added tax, El Monayer said. A similar system would apply to another bracket that covers independent occupations — such as taxi and truck driving, and crafts such as carpentry — and would be re-evaluated every five years. Very small businesses could be subject to a nominal income tax possibly as low as 1%, El Monayer added.

The government is studying the possibility of enshrining facilitated funding for registered SMEs at zero interest under the new law, El Monayer also said. Other non-tax incentives would be awarded to employees who register for social insurance and innovative businesses in tech and other scientific fields. The bill would also ensure SMEs access to all basic services and utilities.

All of this is good policy: As we’ve explained before, we’re rabidly in favour of any combination of tax and non-tax incentives that bring more companies into the tax system. Why not give a complete, time-limited income tax holiday to SMEs that opt to go legit and become part of the formal economy? The state can then raise taxes for them to a reasonable and appropriate level when that holiday runs out.

As for their obligations under the law, registered SMEs would have to open bank accounts and use electronic receipts to keep track of their transactions, the Vice Minister said, adding that input from civil society on the tax structure is encouraged. The House of Representatives is expected to receive the bill during their current legislative term.

In other news from the Finance Ministry, legislation now being drafted could “unify tax procedures,” ministry tax adviser Ramadan Seddik tells Ahram Gate. The bill would resurrect the Supreme Tax Council and give it authority to participate in new tax-related legislation.

INVESTMENT WATCH- Rosneft is looking to invest USD 2 bn in the field over the next four years, Reuters reports. Rosneft also said it may increase its stake in gasfield to 35%. The Russian major had purchased a 30% stake from Eni for USD 1.125 bn. The company and its investments have made it an effective foreign policy tool for Russian President Vladimir Putin, often at the cost of its investors, Stephen Bierman and Elena Mazneva write for Bloomberg. The company has spent USD 100 bn during Putin’s tenure, accruing a substantial amount of debt, which increased for a fifth consecutive quarter to USD 48.4 bn.

IPO WATCH- EFG Hermes expects Banque du Caire to IPO in 1H2018, after the transaction was initially expected to take place last fall, Co-head of Investment Banking Mostafa Gad told AMAY. Gad attributed the delay to what he called the many changes which impacted the banking sector this year, including the interest rate hikes and the board shake ups that took place earlier this fall. The banking sector is looking more stable in 2018. Coupled with the drop in inflation and impact of the EGP float dissipating, 2018 would be a more opportune time for the listing of BdC and other companies as well, he added. Banque du Caire is expected to be the second transaction under the state’s IPO program, after energy company Enppi.

Speaking on the IPO of Dice Sport and Casual Wear IPO, whose shares began trading yesterday at EGP 22.6 per share according to Al Borsa, Gad said that the retail offering 5.96x oversubscribed and institutional offering 3.1x oversubscribed. Twelve funds from Egypt, the US, UK, and Europe collectively acquired 75% of the company, according to Chairman and MD Nagy Toma, who added that the company’s current plans involve increasing exports to 80% of output from a current 73% and expanding domestic presence with new branches to bring the total number up to 153 from 141. Dice shares popper 4.6% in their first day of trading.

M&A WATCH- FRA rejects ADM’s counter offer for NCMP: The Financial Regulatory Authority (FRA) rejected again yesterday Archer Daniel Midland’s (ADM) offer to acquire 100% of the National Company for Maize Products (NCMP), according to a regulatory bourse filing. The statement contains no detail on why the bid was refused, ADM submitted a counter offer of EGP 50 per share, the CEO of ADM subsidiary Medsofts, Salah Tawfik, tells Al Borsa. The FRA had rejected ADM’s initial offer of EGP 35.56 per share, favoring instead Cairo Three A’s mandatory tender offer for NCMP of EGP 45.00 per share. ADM executives had reportedly been surprised by the refusal, particularly since they had met several times with Investment Minister Sahar Nasr to discuss the transaction, which was meant to kick off their expansion plans in the country’s food sector.

EgyptAir, Bombardier sign letter of intent for USD 1.1 bn aircraft purchase: EgyptAir Holding Company signed yesterday a letter of intent with Canada’s Bombardier to purchase up to 24 C-Series planes for USD 1.1 bn, the Canadian company said in a statement. The agreement will see Egypt’s national flagship carrier purchase at least 12 CS300 airliners, with an option to purchase another 12 planes, which would bring the total value of the agreement to USD 2.2 bn. “We undertook a thorough evaluation process of our fleet and realized that the CS300 would fit perfectly into our business plans and growth strategy,” EgyptAir Holding Company Chairman and CEO Safwat Musallam said at the signing ceremony. As we anticipated yesterday, the two companies signed the agreement at the Dubai Air Show.

The agreement is “a significant win for Bombardier” that comes less than one month after Europe’s Airbus took control of the C Series “in exchange for the European planemaker’s marketing heft, manufacturing expertise and financial muscle,” Bloomberg says. Bombardier’s decision to sell a majority stake in the business came after the US Commerce Department “imposed harsh duties on Bombardier, charging the Canadian company of selling the C Series planes in America below cost and receiving government subsidies,” the Associated Press notes. However, Musallam maintained that Airbus’ acquisition of the line “had not been the incentive for his airline to buy the aircraft,” according to the Financial Times.

USD 3.1 bn extended financial repo transactions carries same collateral: The USD 3.1 bn expanded financial agreement with global banks secured as part of a repurchase (repo) transaction in 2016 carried the same collateral and came with favorable terms, CBE Sub-Governor Rami Aboul Naga said in a phone interview with Bloomberg. “The funding is based on the same collateral of last year’s agreement and was concluded at favorable terms reflecting confidence in Egypt’s economic reforms,” he said. The expansion of the November 2016 agreement was made with the same consortium of banks, which included Deutsche Bank, HSBC, and J.P. Morgan Securities, the CBE said in a statement. Aboul Naga did not specify the terms of the agreement, but Finance Minister Amr El Garhy had previously stated that the discount rate was set at 30%, adding that he anticipated any extension of the agreement would see the rate drop to 25%. The expanded financial agreement follows a repayment of the original USD 2 bn loan which the CBE made on 9 November.

Elsewedy Electric replaced Orascom Telecom Media and Technology Holding on the MSCI Global Small Cap Index. The move is part of the MSCI Global Standard Indexes’ semi-annual revision, which will start as of 30 November.

EARNINGS WATCH- Telecom Egypt reported net profit growth of 16% y-o-y to EGP 1 bn in 3Q2017, up from EGP 866 mn last year. Revenue for the quarter grew 34% y-o-y to EGP 4.43 bn, the company said in a statement (pdf).

MOVES- Sarah Shabayek has left Arqaam Capital to join Telecom Egypt as head of investor relations, according to Bloomberg. Ziad Itani replaces her as head of telecom research at Arqaam.

The Suez Cement Company gave a preliminary nod yesterday to merging the Helwan Cement Company’s operations into its own, according to an EGX filing (pdf). The company will be working on determining the legal and financial framework and setting a timeline for the transaction before bringing the matter to the general assembly for a vote. The company also plans to sell up to 5% of Tourah Cement. Details on the size of either transaction have not yet emerged.

Cruise lines now see the Middle East as an attractive place to move their Europe fleets in the winter season, Fran Golden writes for Bloomberg. Travelers also see the itineraries provided by cruise lines around the Middle East as an easy way to check off several bucket list attractions they may not previously have visited. “The Egyptian pyramids, the rose-hued ancient city of Petra in Jordan, the Wailing Wall in Jerusalem—the Middle East has many tourism calling cards, and cruising is an easy way to see several of them in one fell swoop … Combining these places on a land trip requires expert-level planning. Dicey relationships between neighboring governments mean you may get turned away from a border for having old stamps from a rival country in your passport … By ship, it’s foolproof: Visas are arranged by the cruise line and issued as you pull into port.”

Federal court allows partial implementation of Trump’s ‘Muslim ban’; Egypt is on the list: A federal appeals court yesterday allowed for a partial implementation of President Donald Trump’s travel ban, which places restrictions on the processing of refugee cases from 11 MEA countries, including Egypt, Sudan, Libya, Iraq, Iran, Syria, and Yemen. “Lawyers on both sides of the issue are preparing for yet another round of appeals court arguments next month,” according to the AP, which notes that Trump’s third so-called Muslim ban had been blocked by a federal judge last month before it was due to take effect.

Egypt in the News

Egypt is the top export destination for German arms in 3Q2017, having purchased around EUR 300 mn worth of weapons during the quarter. Germany approved arms exports to Egypt and Saudi Arabia worth a combined EUR 450 mn in 3Q2017 alone, “more than five times the EUR 86 mn it sold in the same quarter of last year,” according to Deutsche Welle. While it remains unclear what Egypt has purchased, German Chancellor Angela Merkel has been under fire for allowing weapons’ sales to both countries to grow this year, given the red flags surrounding their use in human rights violations domestically and overseas in neighboring Yemen.

In related news, Egypt has also placed an order for new MiG-35s from Russia, Bloomberg says. The new aircraft’s “range, greater weapons load, and reduced radar signature make it ideal for Middle Eastern countries,” the Director General of Russian Aircraft Corp. MiG, Ilya Tarasenko, said yesterday.

The upcoming presidential elections campaign “offers an opening to mobilise opposition and breathe life into a political scene choked by the civil liberties crackdown,” despite an expected victory for President Abdel Fattah El Sisi, writes Heba Saleh for The Financial Times. “The [campaign provides] an opportunity to debate important issues because people feel there is a lot of injustice,” former MP Mohamed El Sadat says. Presidential hopeful Khaled Ali also said he wants to “force the authorities to ensure the contest will be a real race rather than a charade.” An MP backing El Sisi tells Saleh “the mere fact that Khaled Ali is running is a point in our favour. It is the biggest proof that there is no repression of freedoms in Egypt.”

An American evangelical delegation that visited Egypt last month was encouraged and reassured by Egypt’s commitment to religious freedom and combating terrorism, Jayson Casper writes for Christianity Today. The statement comes as Egypt has been getting flak for its treatment of religious minorities from both NGOs and the US State Department. US Vice President Mike Pence is expected in Cairo in December to address the issue of the oppression of Christians in the Middle East.

An Indian man called Suyash Dixit has planted a flag in Bir Tawil, the terra nullius between Egypt and Sudan, and declared himself “king.” Dixity is not the first person to attempt such a stunt. Author Jack Shenker attempted a similar feat in 2011 and in June 2014 a 38-year-old farmer from Virginia named Jeremiah Heaton followed suit. Bir Tawil is claimed by neither Egypt nor Sudan, as claiming it could impact the rights to the Halayeb triangle.

A Russian archaeological team discovered a mummy from the Greco Roman period in the village of Qalamshah, according to Pakistan Today. Mummification is generally associated with ancient Egypt but the practice did carry over into the Greco Roman era. While the wooden casket carrying the mummy was in need of restoration the mummy itself was in good condition.

Also making headlines on a slow morning for Omm El Donia in the international press:

- Egypt has placed “tremendous pressure” on the Palestinian Islamic Jihad organization (PIJ) lately to prevent tensions with Israel from escalating, sources tell Ynet News. The group appears to be responding to Egypt, proving that, at least for now, Egypt holds greater sway in the region than Iran, PIJ’s main patrons.

- Factions loyal to the late Libyan leader Moammar Gaddafi are planning a return to Libyan politics from Cairo, the Washington Post reports. Led by Gaddafi’s cousin Ahmed Gaddaf Al Dam, they hold regular meetings in a Zamalek apartment and believe there is an opportunity for their involvement in the Libyan political process.

Diplomacy + Foreign Trade

Foreign Minister Sameh Shoukry ended his Gulf tour yesterday with meetings with Saudi Crown Prince Mohamed Bin Salman and his counterpart Adel Al Jubeir, according to a Foreign Ministry statement. Egypt completely rejects attempts by Iran to shake the stability of Arab states, Shoukry told MbS. He stressed Egypt’s strong condemnation of attacks against Riyadh by the Iran-allied Houthi rebels in Yemen rebels, as well as an attack that recently targeted a Bahraini oil pipeline. Shoukry also met with his Omani counterpart Youssef Bin Alawi in a brief stop in Oman, according to a Facebook statement.

As for that other tiny Pariah state: Saudi Arabia, the UAE, Bahrain, and Egypt do not want to reach a solution to end the dispute with Qatar, Sheikh Tamim bin Hamad Al Thani said, according to Bloomberg. He said the “boycotting countries want to keep Qatar busy with the fronts they keep opening against it everywhere to hinder our policies inside and outside … But that won’t happen.’’ Al Thani also said that Qatar was “a thousand times better off” without the boycott countries, AFP says.

Maersk Group to invest in transport, energy infrastructure projects: Prime Minister Sherif Ismail met with the CEO of the Danish A.P. Moller–Maersk Group, Kim Fejfer in Cairo yesterday to discuss the company’s investment plans in Egypt, according to a Cabinet statement. Fejfer said Egypt was among 10 countries his company intends to focus on in the coming period, with plans to invest in a number of projects, particularly transport and energy infrastructure. Ismail said that negotiations with the Group over the specifics of the projects would be ongoing, especially as the government looks towards the development of the Suez Canal Economic zone and Golden Triangle area.

Egypt will be developing a trading zone along the border with Sudan in the Port Qustal area under an agreement between the Egyptian Company for Land, Dry Ports and Logistical Areas and the Trans Export Company, Al Masry Al Youm reports. The 57,000 sqm zone, which will focus on enhancing trade relations between Egypt and Sudan, will house a logistics area, land for agricultural development, and a slaughterhouse and veterinary quarry. Other facilities including a power station and integrated service station for trucks.

Egypt signed three cooperation agreements on tourism, healthcare, and youth and sports during Zambian President Edgar Lungu’s state visit in Cairo yesterday , an Ittihadiya statement says. Lungu met with President Abdel Fattah El Sisi to discuss bilateral ties in trade, economy, and investment. Chief of Staff of the Armed Forces Mohamed Hegazy also met with Zambian Army Commander Paul Mihova, according to an Armed Forces statement.

Energy

Contracts for Egypt-Saudi interconnection project to be signed in February 2018

The Electricity Ministry is in the final stages of drafting the contracts for the Egypt-Saudi electricity interconnection project and expects to ink the agreement in February 2018, Minister Mohamed Shaker said yesterday, Al Shorouk reports. The project will see Egypt and Saudi Arabia exchange up to 3 GW of electricity. Trial operations are slated for 2019.

Basic Materials + Commodities

Supply Ministry denies reducing flour allocations for subsidized bread bakeries

The Supply Ministry is not imposing an across-the-board reduction to the flour it supplies to subsidized bread bakeries, Ministry Spokesperson Mamdouh Ramadan tells Al Masry Al Youm. A ministry source had claimed on Monday that the ministry would cut down flour allocations to bakeries in urban areas and the countryside to 70% and 50% of their current levels, respectively.

Real Estate + Housing

Hisham Talaat Mostafa proposes imposition of 2% real estate industry development fee

Talaat Moustafa Group Chairman Hisham Talaat Moustafa proposed yesterday that real estate companies set aside 2% of their annual income as an industry development fee, Al Borsa reports. He added that proceeds could be as high as EGP 35 bn a year.

Automotive + Transportation

Metro ticket prices to increase by 2018’s end

Metro ticket prices will be increased and subjected to a tier system based on distance traveled by the end of next year, ministry sources tell Al Shorouk. The new pricing scheme will come into effect once the fourth phase of Cairo Metro Line 3 is launched in November 2018, according to the sources. The price changes are also contingent on the installation of new electronic turnstiles at the stations for lines 1 and 2. Transport Minister Hisham Arafat has given a number of dates by which tickets are expected to increase. He had initially said that an increase of EGP 2-4 would be implemented in 4Q2018, but then said the hikes would not happen until Cairo Metro Line 3 is fully operational in 2020. Last month, he said the government would only raise prices once the overhaul of the mass transport system is complete “within a year or two.”

Legislation + Policy

Contractors compensation rates published in Official Gazette

The rates at which contractors will be compensated for losses incurred as a result of the EGP float was published in the Official Gazette this week, Al Borsa reports. Previous estimates had put it at a range of 15-60% of the contract size, depending on the type of project, the equipment used, and whether materials had been imported. Compensations apply to contracts signed between March and December 2016 for the supply of steel, cement, generators and engines, as well as road works and development projects. Payments are due within a maximum 90 days from when the official request is made. We had previously reported that social housing project deliveries were facing delays as a result of the holdup in disbursing payments under the Contractors Compensation Act.

National Security

Egypt, Jordan Aqaba 3 military drill kicks off in Egypt

Egypt and Jordan began their joint military drill Aqaba 3 yesterday, which is expected to run for a number of days in Egypt, Ahram Online reports. The exercise involves sharing of expertise in coordination, planning, and conducting joint missions.

On Your Way Out

Engy El Shazly made history when she became the first ballerina in Egypt to perform with the Hijab. The 30 year old performed in the Russian Cultural Center in Cairo and has aspirations to perform in venues around the world. The ballerina has only been dancing for three years and plans to eventually open her own school (watch, runtime 1:16).

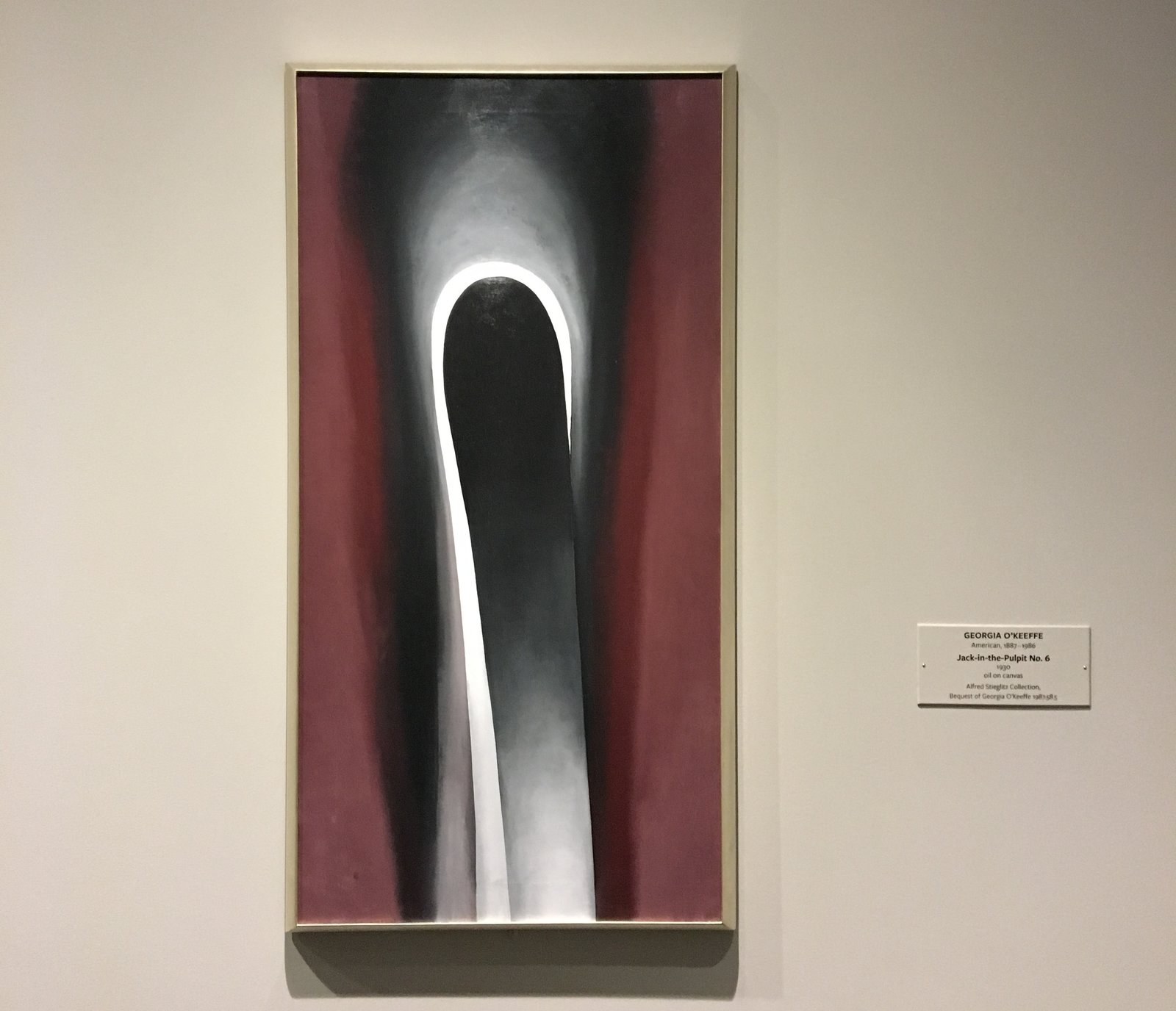

ON THIS DAY- The Palestine National Council, at the urging of PLO chairman Yasser Arafat, issued a declaration of independence for a state of Palestine in the West Bank and Gaza Strip on this day in 1988. American painter Georgia O’Keeffe was born on this day in 1887. O’Keeffe was known for her “large-format paintings of natural forms, especially flowers and bones, and for her depictions of New York City skyscrapers and architectural and landscape forms unique to northern New Mexico.” In 1867, the first stock ticker is unveiled in New York City. On this day in 1891, German field marshal Erwin Rommel, who led the Afrika Korps to spectacular victories during World War II, was born. Johannes Kepler, the German astronomer who discovered three major laws of planetary motion, died in Regensburg on this day in 1630. Also on this day, in 2001, Microsoft released the Xbox video game console. This time last year we were covering Central Bank Governor Tarek Amer’s meeting with the bank chiefs, in which he told them “in practice, I’m not a market maker anymore, I’m a regulator — and the market is being made by the banks.” A year earlier, we were noting the S&P cut Egypt’s credit outlook to stable.

The Market Yesterday

EGP / USD CBE market average: Buy 17.5909 | Sell 17.6909

EGP / USD at CIB: Buy 17.56 | Sell 17.66

EGP / USD at NBE: Buy 17.58 | Sell 17.68

EGX30 (Tuesday): 14,133 (+0.1%)

Turnover: EGP 1.0 bn (2% above the 90-day average)

EGX 30 year-to-date: +14.5%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.1%. CIB, the index heaviest constituent ended down 0.4%. EGX30’s top performing constituents were: Abu Dhabi Islamic Bank up 5.1%, Elsewedy Electric up 4.4%, and TMG Holding up 1.9%. Yesterday’s worst performing stocks were: Orascom Telecom Media & Technology down 3.8%, and both Eastern Co and Emaar Misr ended down 0.8%. The market turnover was EGP 1.0 bn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +860.3 mn

Regional: Net Short | EGP -16.5 mn

Domestic: Net Short | EGP -843.8 mn

Retail: 58.3% of total trades | 34.2% of buyers | 82.4% of sellers

Institutions: 41.7% of total trades | 65.8% of buyers | 17.6% of sellers

Foreign: 32.6% of total | 54.8% of buyers | 10.5% of sellers

Regional: 7.4% of total | 6.9% of buyers | 7.7% of sellers

Domestic: 60.0% of total | 38.3% of buyers | 81.8% of sellers

WTI: USD 55.06 (-3.00%)

Brent: USD 61.43 (-2.74%)

Natural Gas (Nymex, futures prices) USD 3.08 MMBtu, (-2.78%, December 2017 contract)

Gold: USD 1,280.80 / troy ounce (+0.15%)

ADX: 4,366.41 (-0.07%) (YTD: -3.96%)

DFM: 3,488.99 (+0.32%) (YTD: -1.19%)

KSE Weighted Index: 399.88 (+1.14%) (YTD: +5.21%)

QE: 7,873.84 (+0.21%) (YTD: -24.56%)

MSM: 5,114.67 (+0.60%) (YTD: -11.55%)

BB: 1,259.87 (-0.24%) (YTD: +3.23%)

Calendar

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

19-21 November (Sunday-Tuesday): 11th Annual INJAZ Young Entrepreneurs Competition, Four Seasons Nile Plaza, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

01-03 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Center.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Center.

05 December (Tuesday): Egypt’s Emirates NBD PMI reading for November to be announced.

03-06 December (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

19 December (Tuesday): Village Capital’s Financial Health Competition: Middle East and Egypt (applications close 3 November)

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

12-14 February 2018 (Monday-Wednesday): Egypt Petroleum Show 2018 (EGYPS), New Cairo Exhibition Center.

17-21 February 2018 (Saturday-Wednesday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.