- Suez Canal Authority inks MoUs for projects worth a combined USD 40 bn at Sharm forum. (Speed Round)

- Egypt growth will hit 4.5% in FY2017-18 –EBRD. (Speed Round)

- Oil at two-year high, Arab markets down as world remains preoccupied with MbS’ crackdown on corruption in Saudi Arabia. (What We’re Tracking Today)

- FRA approves Cairo 3A’s bid for NCMP, rejects rival offer from ADM; NCMP valued at EGP 1.33 bn. (Speed Round)

- Dice domestic offering 5.96x oversubscribed. (Speed Round)

- LEGISLATION WATCH- House gives preliminary nod to basket of legislation. (Speed Round)

- Meet the man who will help shape how the US Senate sees Egypt. (Speed Round)

- EL SISI INTERVIEW- “Up to the people” whether he runs for a second term in office. (Speed Round)

- The Market Yesterday

Wednesday, 8 November 2017

El Sisi says in interview it’s “up to the people” whether he seeks a second term

TL;DR

What We’re Tracking Today

As it was yesterday, we’re looking at another day in which the global business and political elite are squarely focused on developments in Saudi Arabia in the wake of Crown Prince Mohamed bin Salman’s crackdown on corruption:

Oil prices rose yesterday to their highest level in two years on tensions in KSA, with Brent crude breaking the USD 64 barrier yesterday. Oil was already on the upswing before the Saudi corruption crackdown, but analysts are drawing a fairly direct link between it and yesterday’s surge. A CNBC piece predicting that “oil prices are more likely to rise toward USD 70 a barrel than sink back to USD 50” is getting wide traction.

Arab stock markets were among the world’s worst performers yesterday in the wake of the corruption crackdown, Bloomberg reports. “Investors have been hammered with bad news on the geopolitical front … It’s not easy to see what is coming next. Some individuals and institutions are trying to dump assets that are tied to the investigations, there is selling pressure,” Nabil Al Rantisi, Managing Director of Mena Corp. Financial Services, says.

Market players think government funds are supporting the Saudi market, preventing bigger drops. “I think the government funds, led by the Public Investment Fund, are supporting the market … Look at other markets, all are down by more than a couple of percentage points in the last three days, while Saudi is the only market which is still holding up … The government needs to show that financial markets are taking the move positively and business is as usual in Saudi, while the reality is something else,” Joice Mathew, head of equity research at United Securities says.

Asset freezes expanding? The corruption crackdown, led by Crown Prince Mohammed bin Salman, is also reportedly expanding beyond those already detained, as sources say the central bank “ordered lenders in the kingdom to freeze the accounts of dozens of individuals who aren’t under arrest.” Saudi Arabia’s attorney general said that the arrests were only “phase one” of a drive against corruption.

The arrests appear to have the backing of US President Donald Trump, who tweeted on Monday, “I have great confidence in King Salman and the Crown Prince of Saudi Arabia, they know exactly what they are doing…Some of those they are harshly treating have been “milking” their country for years [exclamation mark].”

Other developments from the kingdom yesterday and overnight: MbS accused Iran of having committed “an act of war” when it supplied Houthi rebels with missiles used to launch an attack on Riyadh. Former Lebanese Prime Minister Saad Hariri left Riyadh yesterday, dispelling rumors he was being held against his will in KSA. And the last khawaga journalist to have interviewed Alwaleed bin Talal has filed the lengthy “I Dined With Alwaleed in the Desert Days Before His Arrest” for Bloomberg, in which he recounts how the two discussed politics and watched football together 10 days before Alwaleed’s arrest.

Many of our friends and readers are still in London this morning for day three of the EFG Hermes London Conference. The firm says 290 fund managers and institutional investors are on London for meetings with 130 presenting companies representing 10 industries and 20 countries. “The inclusion of companies from Pakistan, Bangladesh, Sri Lanka, Georgia, Turkey, Uganda and Vietnam is driven by the Firm’s strategy to provide investors access to new markets outside of MENA,” said Group CEO Karim Awad. Speakers at the gathering include EGX boss Mohamed Farid as well as stock market bosses from Nigeria, Kenya and Pakistan. The gathering is taking place at Emirates Arsenal Stadium and wraps up tomorrow. Tap here for the conference press release.

A 40-company delegation from the British Egyptian Business Association is in the UK for four days as of today to take part in Friday’s MENA Britain Trade Expo, where infrastructure, financial services, renewable energy, and oil will be in the limelight.

The House of Representatives’ Industry Committee is also expected to resume talks on the Automotive Directive today. The bill was amended for the third time after a German consultancy firm assisted the Trade and Industry Ministry in refining it. The law gives assemblers incentives to go further up the value chain into manufacturing.

Also today, Electricity Minister Mohamed Shaker will inaugurate the first station at the Benban solar power complex in Aswan. Infinity Solar will become the first company to complete a solar power plant under the feed-in tariff program, connecting 50 MW of power to the national grid once trial operations conclude.

Election results from state and municipal races in the US are flowing in as we write this morning, and early indications show the Democrats posting gains. The Dems have taken the statehouse in Virginia and New Jersey and progressive mayor Bill de Blasio stomped to victory and a final term in New York. Political junkie like us? Head over to Politico for the blow-by-blow, and start with their 15 elections you should be watching.

Other miscellany worth checking out this morning, if you’re looking for something to read during your commute:

For basketball fans of a certain age: New York Knicks’ great Patrick Ewing is finally a head coach … but not in the NBA, ESPN tells us in a very nice feature.

From the Financial Times: Erratic Trump puzzles China’s Americanologists. “Elite US experts in China” are struggling to help Beijing “make sense of an unpredictable president.”

Snap(chat) foundering: Longtime readers won’t be surprised that we’re kind of delighted that Snap, which delivered “the most shareholder-unfriendly governance in an initial public offering, ever,” has seen its shares plunge again after posting disappointing revenue and growth figures. Party’s over, folks: The company’s shares nosedived as much as 20% “after the company said its quarterly loss more than tripled.”

One more thing: A number of our friends and readers got in touch yesterday to tell us that Cherine Chalaby is not the first Egyptian to run the Internet Corporation for Assigned Names and Numbers (ICANN). Fadi Chehadé, ICANN’s previous president, was born in Beirut to Egyptian parents and is active in the Egyptian-American community and Coptic church in Southern California. Chehadé was the President and CEO of ICANN from 14 September 2012 until 10 March 2016. H/t Patrick E, Amr El S, and others.

What We’re Tracking This Week

Get your running shoes ready: Our good friends at SODIC are hosting their annual Charity Run this coming Friday at 7:45 am in SODIC West. This year, SODIC is teaming up with Cairo Runners to support the Magdi Yacoub Heart Foundation. It’s the third time SODIC and Cairo Runners have supported a cause together. The foundation, a registered charity NGO in Egypt, was founded in 2008 by Sir Magdi Yacoub, the late Dr. Ahmed Zewail and Ambassador Mohamed Shaker and is funded entirely through donations. Tap here for the Facebook event page if you’re interested in the 6 km run, or click the photo above. Don’t feel like driving on a Friday morning? Shuttle buses will run to SODIC West from Heliopolis, Lebanon Square and Nasr City

A proposed law that seeks to make same-gender relations punishable by up to 15 years in prison is up for discussion by the House’s Legislative Committee.

Enterprise+: Last Night’s Talk Shows

The airwaves served up continued coverage of the World Youth Forum in Sharm El Sheikh and the investment agreements that were signed on the forum’s sidelines yesterday on an economics-heavy night.

Investment Minister Sahar Nasr told Al Hayah Al Youm’s Tamer Amin that the government has raised its foreign direct investment target for FY2017-18 to USD 12 bn from USD 10 bn after seeing significant inflows during the first quarter alone. The Suez Canal Economic Zone has signed some 30 agreements over the past three months; seven of those agreements could benefit from perks and incentives outlined in the newly-enacted Investment Act. Nasr also pointed to a basket of legislation the government has pushed out over the past several months to improve the investment climate, including the Bankruptcy Act, which is currently before committee in the House (watch, runtime 6:36).

Agreements signed yesterday on the sidelines of the World Youth Forum are ready for implementation and are not preliminary MoUs, SCZone Chairman Mohab Mamish told Amin (we have a full list of these agreements in Speed Round, below). The agreements are expected to create as many as 1 mn new jobs, Mamish said (watch, runtime 5:10).

Amin also hosted the Arab Investors Union’s secretary general Gamal Bayoumi, who urged the country to focus on attracting more investments from Egyptians expats, whom he says invest as much as USD 180 bn in other markets that would be better off in Egypt (watch, runtime 4:40).

Apparently, we’re not paying enough taxes: Amin also discussed Egypt’s tax systems with Cairo University economics professor Aliaa El Mahdy, who said the government is mismanaging its resources through an unbalanced tax system that allows businessmen to pay lower-than-average taxes (watch, runtime 3:27). Please, God, don’t get us started.

Over on Kol Youm, Amr Adib lambasted Banque Misr’s decision to launch savings certificates carrying an 18% interest rate as a deterrent to investment, saying that people will be more likely to leave their money in the bank than take the risk of investing (watch, runtime 2:54).

His better half on Hona Al Asema discussed the National Council for Human Rights’ latest report, which earned the ire of House MPs for its opinions on enforced disappearances and the contentious NGOs law. Council member Hafez Abu Seda maintained that the council adheres to international laws in its assessments (watch, runtime 5:02).

Speed Round

INVESTMENT WATCH- The Suez Canal Authority signed six MoUs for projects worth a combined USD 40 bn at the World Economic Youth Forum yesterday, Youm7 reports. DP World is expected develop USD 5.6 bn in infrastructure over a 96k sqm area in Ain Sokhna, sources tell Al Mal. The port operator had signed a preliminary agreement with Suez Canal Economic Zone (SCZone) chief Mohab Mamish last month to establish a joint venture to develop and manage an industrial zone in Ain Sokhna that could serve a range of industries including construction, textiles, and SMEs. DP World Group Chairman and CEO Sultan bin Sulayem said the company plans to attract 10 firms to the area, promising more announcements on new industrial zones over the coming three months.

China’s COSCO Shipping also inked a USD 30 mn agreement with the SCZone to build a 130k sqm logistics park in the TEDA Industrial Zone in Ain Sokhna, Xinhua reports. The project, which TEDA Executive General Manager of China-Africa Wei Janqing said will be the first bonded logistics park in any of Egypt’s special economic zones, will include storage yards and bonded and non-bonded warehouses. No details were provided on the expected timeline of the project, the initial phase of which is expected to create some 300 jobs.

Polaris Al Zamil, ARDIC and the Industrial Construction & Engineering Company (SIAC) will develop a 5.5 mn sqm business park in Ain Sokhna, Al Borsa reports. Polaris Parks had announced last month it was conducting the technical and feasibility studies for the project, which aims to attract USD 3.5 bn in investments to the area over 15 years. The land was allocated on a right-to-use basis for 50 years.

Egyptian Steel and an arm of Samcrete have also signed for land. The steel manufacturer will develop a coal storage facility on a 100k sqm plot in Ain Sokhna, while Samcrete was expected to receive a 4 mn sqm plot in East Port Said, Managing Director Sameh Attia had previously said.

The European Bank for Reconstruction and Development expects Egypt’s economy to grow by 4.5% in FY2017-18, up from 4.1% in FY2016-17, in its Regional Economic Prospects report. For the EBRD’s southern and eastern Mediterranean (SEMED) region, the report expects an overall growth of 3.8% in 2017 and 4% in 2018, “supported by reform implementation and continued recovery in the tourism sector, and export rebounds in Egypt and Jordan.”

M&A WATCH- The Financial Regulatory Authority (FRA, formerly EFSA) has approved Cairo 3A’s mandatory tender offer to acquire 100% of the shares of the National Company for Maize Products (NCMP) at EGP 45 per share, according to a bourse statement. FRA also rejected an EGP 35.56 per share bid presented by ADM International SARL, a unit of Archer Daniels Midland (ADM). The ADM unit was the only other bidder remaining for NCMP remaining. Pharos Holding is sellside advisor to Misr Capital Investment (owner of the NCMP stake on offer), while CI Capital is advising Cairo Three A Group and Matouk Bassiouny is its legal counsel. CI Capital says Cairo 3A’s offer values NCMP at EGP 1.33 bn and that its mandatory tender offer is valid for a period of ten working days effective from 8 November 2017 ending 21 November 2017.

IPO WATCH- Dice Sport and Casual Wear announced yesterday that its domestic offering was 5.96x oversubscribed, with demand reaching 29.542 mn shares, Youm7 reports. Subscription to the domestic offering, which had initially included 4.956 mn shares, closed yesterday. The company’s institutional offering was also 3.1x oversubscribed, as we noted earlier this week. EFG Hermes is sole global coordinator and bookrunner for the offering and Matouk Bassiouny is local counsel.

Saudi Prince Alwaleed bin Talal has no investments in Talaat Moustafa Group Holding (TMG) personally or indirectly through subsidiaries including Kingdom Holdings, the company told the EGX yesterday. The real estate developer also said the company has so far spent USD 213 mn to expand and develop the Four Seasons Sharm hotel using its own funds and it expects to self-finance the remaining USD 170 mn required for the project. The company did not include any comment on the proposed plans to build with Alwaleed a new hotel in Alamein and a Four Seasons in Madinaty. The USD 800 mn in investments were announced back in August.

The Egyptian Media Production Company also denied any affiliation with Alwaleed or Saudi investor Sheikh Saleh Kamel, Al Borsa reports. The company said that the extent of its relationship with both figures was restricted to them paying for studio time at the media production complex.

LEGISLATION WATCH- House gives preliminary nod to basket of legislation: The House of Representatives gave a preliminary nod to a basket of legislation yesterday, votes on which had been postponed due to lack of quorum. MPs signed off in principle on the Labor Unions Act, Al Shorouk reports, which comes ahead of an International Labor Organization (ILO) visit on 13 November to review legislative reform and the new law. Labor unions have said is too restrictive while members of the House Manpower Committee have said think it gives unions too much power. Having accepted the draft act in principle, the bill now moves to committee for study.

The House also gave preliminary approval to a law that bans the use of unmanned aerial vehicles — a.k.a drones — without Defense Ministry approval, claiming that the equipment has been used for terrorist attacks. The bill, which prohibits the manufacturing, possession, and use of drones without Defense Ministry approval, sets punishments as severe as the death penalty and maximum prison sentence for those who use the aircraft to commit acts of terror, Al Borsa reports. It also sets prison sentences of up to seven years and fines ranging between EGP 5,000-50,000 for those found in possession of the aircraft.

Parliament also signed off on a EUR 100 mn loan from the French Development Agency for the EUR 360 mn Alexandria tram project, Al Mal reports. The loan agreement had reportedly been opposed by several MPs who objected to taking on more loans — and claimed that they had not been provided with details including the stipulated interest rates. The agreement was pushed through after the majority, pro-government Support Egypt Coalition threw its weight behind it.

Also from the House: Budgeting Committee debate of the Auctions and Tenders Act have been postponed, pending the planning and finance ministers’ return from the World Youth Forum, MP Mervat Alexan tells Al Mal.

More on the way: MPs are also set to receive a new election law in a month’s time, House speaker Ali Abdel Aal announced yesterday. The new law will contain a new electoral system, Abdel Aal said, without specifying whether the bill relates to presidential, parliamentary or local council elections, Al Masry Al Youm points out. A Local Administration Act is in the works and aims to decentralize local councils and organize their elections.

Other items on the House’s agenda include the Universal Healthcare Act, the Bankruptcy Act, the Social Welfare Act, and a law that would make it easier for foreign universities to open branch campuses in Egypt. Tap or click here for a refresher on pending legislation.

MOVES- Eric Trager has joined the US Senate Foreign Relations Committee’s majority staff as the professional staff member covering the Middle East and North Africa. That makes him a key voice in DC shaping the Senate’s view on all things Egypt. Trager, who has long studied Egypt and was no fan of our Islamist interregnum, was the Esther K. Wagner Fellow at The Washington Institute until 2017. Follow him on Tweeter or check out his Arab Fall: How the Muslim Brotherhood Won and Lost Egypt in 891 Days, which got a great review from the Wall Street Journal.

MOVES- The board of gold miner Stratex International voted to remove Marcus Engelbrecht as a director and to terminate his employment as CEO. The board also terminated the proposed bid to acquire Crusader Resources Limited. Stratex has a 30.5% interest in privately-owned Thani Stratex Resources Limited for its projects in Egypt and Djibouti.

EARNINGS WATCH- Cheese maker Obour Land reported its 9M2017 net profit increased to EGP 176.5 mn from EGP 110.1 mn a year earlier. Revenues also increased to EGP 1.46 bn from EGP 1.05 bn during the period.

EL SISI INTERVIEW- “Up to the people” whether he runs for a second term in office. Asked in a one-on-one with the regional Asharq Alawsat newspaper whether he would consider running for a second term in office, President Abdel Fattah El Sisi said the decision was not up to him, but to the people. He added that running the first time was the hardest decision he’s ever had to make, knowing the amount and extent of challenges facing Egypt.

On Egypt-US relations, El Sisi said that he sees ties returning to “what they used to be” under President Donald Trump, alluding to Egypt’s strained relations with the Barack Obama administration. He said he believes the US could be a major driving force for the Arab-Israeli peace process.

It’s important to maintain good relations with the regional and international community, especially now as the fight against terrorism intensifies, El Sisi suggested. A united front is key, he added, confirming Egypt’s support for national unity in Syria, Libya, and Iraq. He also commented on the situation in Lebanon, saying that balance is the only path to stability in a country with such a diverse and complex social structure, and criticizing Iran’s alleged infringement on Lebanese sovereignty. "Our stance on Syria and other conflicts in the region is ruled by our foreign policy approach. We support national unity and reject all attempts to divide based on race or sects,” El Sisi said.

Ball is in Qatar’s court: Dialogue and diplomacy are the only ways to diffuse existing tension and conflict in the region, the president said. But Qatar is a different story since “the ball is in their court” and “the demands are clear.”

Meanwhile, speaking in Sharm El Sheikh at the World Youth Conference yesterday, El Sisi identified Egypt’s illiteracy and unemployment rates as the biggest obstacles facing the country’s youth, according to an Ittihadiya statement. Speaking yesterday at a World Youth Forum session on challenges facing youth around the world struggle, El Sisi also pointed to Egypt’s ballooning population as a major culprit behind the lack of adequate opportunities for all citizens. He said that providing one mn job opportunities per year would cost state coffers around EGP 100 bn. The president also announced that the forum will become an annual event, according to Al Shorouk.

The Macro Picture

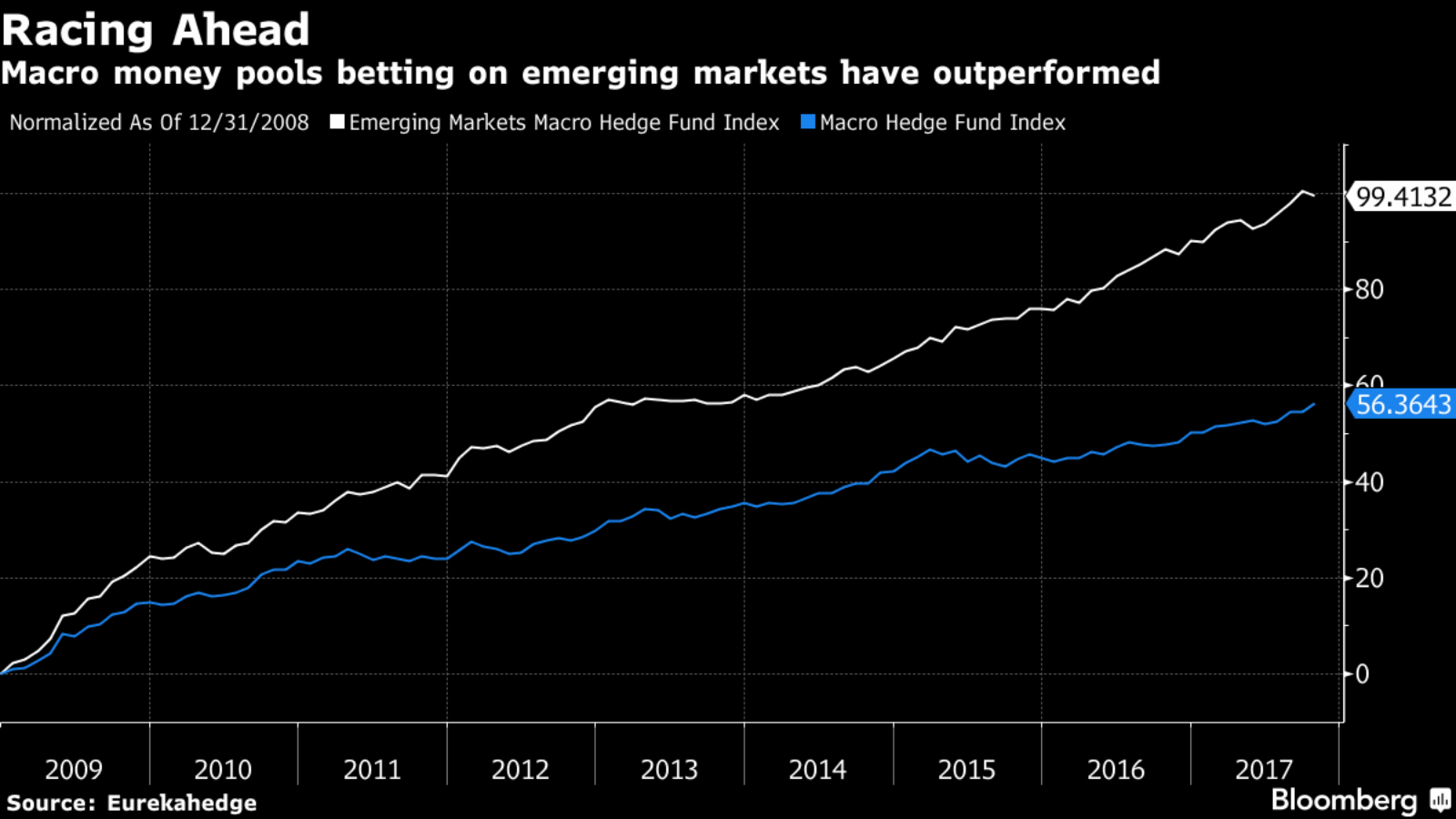

EM hedge funds continue to attract investors despite fears of interest rate hikes in developed markets: Emerging-market macro hedge funds have been riding the EM rally to the point of having to turn away clients, Suzy Wait and Nishant Kumar write for Bloomberg. EM macro hedge funds have widely outperformed those trading in the broader market. Emerging market funds returned 99% since the end of 2008, compared with 56% for the broader money pools. The interest these figures have stoked among investors does not seem to be abated by concerns that interest rate hikes and pulling back of quantitative easing might hurt EM growth.

Image of the Day

The USD 1 bn Louvre Abu Dhabi is set to open on 11 November with more than 600 pieces for its permanent collection and 300 on loan from Paris, reports Bloomberg. The museum has been ten years in the making and the results look like they will be breathtaking with 23 permanent galleries set to display. The collection will vary from historical pieces from across the ancient world such as the statue of Rameses II to expressionist and surrealist masterpieces from the likes of Vincent Van Gogh. The New York Times also has coverage, and you can check out the Louvre Abu Dhabi’s website here.

Egypt in the News

For some reason, Laura Plummer, the 33 year old Englishwoman who thought it was cool to travel to Egypt with 290 tablets of restricted opioids, is still topping coverage of Egypt in the foreign press. The only update we’re seeing is that the arrest has prompted the UK’s Foreign Office to issue new warnings to travellers about medicines, reports the Guardian.

The Wahat attack risks opening up another front for security forces far beyond northern Sinai, Patrick Markey and Ahmed Mohamed Hassan write for Reuters. “Analysts and security sources said the heavy weapons and tactics employed indicated ties to Islamic State or more likely an al Qaeda brigade led by Hesham al-Ashmawy, a former Egyptian special forces officer turned jihadist.” An intelligence analyst says, “there is a strong al Qaeda presence in Libya that can support such an endeavour in Egypt. Usually, a militant group in decline (IS) and an increase in competition between two groups translates into a more aggressive stance, and attempts at larger and more quality attacks.” A police officer says the nature of this front is different from Sinai’s as terrorists “are able to move in the Western Desert easier than they do in Sinai … It’s not like Sinai, which you can cordon off.”

Mona Seif and other human rights activists penned a letter to American actress Helen Hunt, condemn her participation in The World Youth Forum, the Associated Press reports. The activists say her participation whitewashes the government’s human rights and free speech issues. Hunt was a keynote speaker at the opening ceremony.

Human rights lawyer Khaled Ali’s bid for the presidency continued to make the rounds in the foreign press, with the New York Times’ Declan Walsh saying his candidacy “could offer a focus for criticism of Mr. Sisi at a time when he is grappling with a sharp economic downturn and a jolting surge in violent attacks by Islamists linked to the Islamic State and Al Qaeda.” Ali’s appeal of his September conviction of public indecency, which commences today, will determine whether his candidacy will be valid, noted Walsh.

Also worth a skim this morning:

- A team of scientists who last week announced the discovery of a large void inside the Great Pyramid of Giza have created a virtual-reality tour of the pyramid’s interior, Reuters report.

- Islamic Scholar Tariq Ramadan, and grandson of Ikhwan founder Hassan Al Banna, is taking a leave of absence from Oxford University after allegations of rape were levied against him, according to Reuters.

On Deadline: From Israel

With little of interest from domestic opinion writers this morning, we offer two pieces from the Israeli press on regional issues of interest to many of our readers:

Former US Ambassador to Israel Dan Shapiro believes Saad Hariri’s sudden resignation as prime minister of Lebanon is all about Iran, he writes in an op-ed for Haaretz. He says Saudi Arabia is potentially trying to maneuver Israel into a direct confrontation with Iran. “It is plausible that the Saudis are trying to create the context for a different means of contesting Iran in Lebanon: an Israeli-Hezbollah war… With Assad clearly having survived the challenge posed by Saudi-backed rebels, the Saudi leadership may hope to move its confrontation with Iran from Syria to Lebanon. By pulling Hariri out of his office, they may hope to ensure that Hezbollah gets stuck with the blame and responsibility for Lebanon’s challenges, from caring for Syrian refugees to mopping up Al Qaida and ISIS affiliates. That could, the Saudis may believe, lead Hezbollah to seek an accelerated confrontation with Israel as a means of unifying Lebanese support for their dominance… Israeli leaders will want to take care not to find themselves backed into a premature confrontation by the maneuvers of their allies who sit in Riyadh,” Shapiro posits.

Anshel Pfeffer writes in another Haaretz piece saying “practically everyone” in the Middle East wants a war, “but no one wants to fight it themselves.”

Separately, Mark Langfan, Chairman of Americans for a Safe Israel, argues in Arutz Sheva that Israel should be included as part of the US Middle East CENTCOM combatant command structure instead of EUCOM. “The time is ripe for change… Israel now stands as the pivot point hub of any effective defense against Iran. Therefore, the time has come for the US Combatant command structure to politically morph to meet this new reality… More importantly, it is vital for the United States to actively project to the Arabs of the Levant and Egypt that Israel is a vital component to the Arabs’ protection,” he writes.

Diplomacy + Foreign Trade

The Trade and Industry Ministry will begin negotiations with the Eurasian Economic Union on a freetrade agreement between Egypt and the federation early next year, Egypt’s ambassador to Russia Ihab Nasr said, Youm7 reports. We had noted reports back in August that the agreement’s final form was being drafted. The Russia-led trade bloc includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

Foreign Minister Sameh Shoukry met with his Finnish counterpart Timo Soini on the sidelines of the World Youth Forum in Sharm El Sheikh Tuesday, according to an official statement. The two discussed cooperation, regional security, illegal migration and EU support of Egypt’s economic reforms.

Al Azhar Grand Imam Ahmed Al Tayeb met with Pope Francis I at his residence while attending a conference in the Vatican, according to an official statement. Details of the meeting are scarce but it marks the second meeting between the two since dialogue between both institutions resumed in 2016.

Energy

Gov’t picks LNG suppliers for 1Q2018

The Oil Ministry will has picked its LNG suppliers for 1Q2018, Oil Minister Tarek El Molla said, according to Reuters. Spain’s Gas Natural Fenosa to deliver five LNG cargoes, Switzerland-based trader Trafigura will deliver three, Vitol three, and Glencore one. The report confirms earlier speculation of the awards. Egypt imports 2.1 mn tonnes of fuel a month for about USD 800 mn, 32-25% of its needs, sources tell Youm7. Average local consumption of petrol, diesel, and natural gas rounds off to c. 6.8 tonnes a month, whereas production stands at around 4.7 mn tonnes, they add.

West Delta gas fields expected to produce 500-700 mcf/d

The Oil Ministry is expecting the West Delta gas fields to produce 500-700 mcf/d when they come online by the end of 2018,the ministry said in a statement.

Basic Materials + Commodities

Evergrow to complete studies on EGP 9.5 bn phosphate complex next month

Fertilizer producer Evergrow expects to complete the technical studies on its planned EGP 9.5 bn phosphate production complex and meet with the project’s foreign investors to determine their ownership stakes next month, the company’s Commercial Director Emad Nabil said, Al Borsa reports. Evergrow’s chairman had announced last month that the company was in talks with a consortium made up of Borealis and EcoPhos over their ownership stakes. Evergrow’s share in the plant is expected to be at least 30%, according to Nabil. Construction will begin early next year, and will take between two and three years to complete. The plant will produce an annual 600k tonnes of fertilizer, 500k tonnes of calcium diphosphate, and 700k tonnes of sulfuric acid per year.

Brazilian textile companies look to Egypt for raw materials

Three Brazilian textile firms are interested in importing raw material from Egypt,according to ANBA. Textiles maker Fiama, yarn maker Círculo and elastic band manufacturer Damenny will view examples of Egyptian raw materials at Destination Africa, a textile industry show slated for 11-12 November in Cairo.

GASC issues tender for wheat delivery in December

The General Authority for Supply Commodities (GASC) issued a tender on Tuesday to purchase an unspecified amount of wheat, to be delivered between 15 and 30 December, Reuters reports.

Tourism

Travco and Albatros to open two hotels in Marsa Alam in 2018

Travco Travel Company of Egypt and PickAlbatros Group are planning to open two hotels in Marsa Alam next year with total investments of USD 154 mn,company heads told Al Shorouk. Travco plans to open a USD 120 mn 300-room hotel, Albatros hopes to launch its 480-room hotel it invested USD 34 mn in. Travco also has a USD 57 mn hotel in the pipeline which it plans to open in Sheikh Zayed City in 2019.

Telecoms + ICT

CIB selects IBM to provide bank system security

CIB has selected IBM Security to protect and enhance identity and access governance management for the bank’s systems, applications and data, IBM announced. “CIB turned to IBM solutions to be able to quickly and drastically improve its banking processes through a complete identity and access management framework that provides centralized services to manage the entire cycle flowing through the bank’s platform of applications; including automation for user management, user provisioning, lifecycle and password management.”

Other Business News of Note

Trade Ministry to grant temporary licenses for importers who don’t yet comply with Import Registry Act

The General Authority for Export and Import Control will grant temporary licenses to importers who are currently unable to meet the December deadline to comply with amendments to the Importers Registry Act, the authority’s head Ismail Gaber said, according to Al Mal. The Trade and Industry Ministry had extended to December the deadline to comply with the new act, which increases the minimum capital for importers and imposes stricter penalties for violation of import regulations in a bid tighten import controls. Gaber implied that the move was part of a number of measures to improve Egypt’s cross border trade rankings in the World Bank’s Doing Business report. Egypt was ranked 170th globally on that metric in the 2018 report.

Law

ZH&P advise on HP’s acquisition of Samsung Electronics

Zaki Hashem & Partners advised on domestic aspects of a USD 1.05 bn transaction where HP acquired Samsung’s printer business, which closed last week. The law firm advised on the optimum transfer mechanism and documentation, the tax implications, and the applicable consent and approvals for the consummation of the transaction in Egypt. It also advised on the local applicability of the master conveyance agreement. The international counsel on the Transaction was Paul, Weiss, Rifkind, Wharton & Garrison LLP.

Egypt Politics + Economics

State Commissioners’ Committee orders investigation on conditions of Aqrab prison

The State Commissioners’ Committee ordered Cairo University to organize an investigation by a team of medical and human rights specialists to assess whether the infamous "Aqrab" wing of Tora prison is suitable to house inmates, according to a document obtained by the Associated Press on Tuesday. The order follows requests by prisoner families and NGOs who have alleged prisoners were kept in inhumane conditions. The Committee’s recommendation following the investigation is non-binding.

Sports

Egyptian weightlifter awarded Olympic silver medal for 2012 London Games after top three are suspended

Egyptian weightlifter Abeer Abdel Rahman received an Olympic silver medal yesterday for the 2012 London Games after the competition’s top three finalists were suspended, KingFut reports. The three athletes from Kazakhstan, Russia, and Belarus failed doping tests, clearing the way for Spain, Egypt, and Cameroon to rise to the top. Abdel Rahman had originally finished in fifth place.

On Your Way Out

Canadian-Egyptian Doreen Assaad became mayor of the town of Brossard, Quebec, and naturally, the local press, including Egyptian Streets, wants to lay claim. Check out coverage from Canada’s Global News or her biography on her campaign website.

ON THIS DAY- German physicist Wilhelm Conrad Rontgen became the first person to observe X-rays on this day in 1895. Donald Trump was elected US President on this day last year and voters in Ireland elected Mary Robinson as its first woman president. In 1656, English astronomer and mathematician Edmond Halley, the first to calculate the orbit of Halley’s Comet, was born. Oil and gas producers in Egypt were rushing to finalize agreements signed with the government this time two years ago. This time last year, Saudi Aramco cut us off, saying it is halting fuel shipments to Egypt until further notice.

The Market Yesterday

EGP / USD CBE market average: Buy 17.5991 | Sell 17.6991

EGP / USD at CIB: Buy 17.58 | Sell 17.68

EGP / USD at NBE: Buy 17.60 | Sell 17.70

EGX30 (Tuesday): 14,058 (-0.1%)

Turnover: EGP 1.1 bn (4% above the 90-day average)

EGX 30 year-to-date: +13.9%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.1%. CIB, the index heaviest constituent closed up 0.2%. EGX30’s top performing constituents were: Domty up 2.7%; Global Telecom up 2.2%; and Eastern Co up 0.9%. Yesterday’s worst performing stocks were: Egyptian Financial and Industrial down 4.3%, Abu Dhabi Islamic Bank down 3.0%; and SODIC down 2.7%. The market turnover was EGP 1.1 bn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -20.3 mn

Regional: Net Short | EGP -17.6 mn

Domestic: Net Long | EGP +37.9 mn

Retail: 67.5% of total trades | 67.4% of buyers | 67.7% of sellers

Institutions: 32.5% of total trades | 32.6% of buyers | 32.3% of sellers

Foreign: 15.1% of total | 14.1% of buyers | 16.0% of sellers

Regional: 12.1% of total | 11.3% of buyers | 12.9% of sellers

Domestic: 72.8% of total | 74.6% of buyers | 71.1% of sellers

WTI: USD 57.24 (-0.19%)

Brent: USD 63.68 (-0.92%)

Natural Gas (Nymex, futures prices) USD 3.15 MMBtu, (+0.48%, December 2017 contract)

Gold: USD 1,277.3 / troy ounce (-0.34%)

TASI: 6,933.46 (-0.74%) (YTD: -3.84%)

ADX: 4,419.62 (-0.35%) (YTD: -2.79%)

DFM: 3,480.7 (-1.79%) (YTD: -1.42%)

KSE Weighted Index: 387.0 (-3.8%) (YTD: +1.82%)

QE: 7,930.78 (-1.05%) (YTD: -24.01%)

MSM: 5,078.55 (-0.01%) (YTD: -12.18%)

BB: 1,253.07 (-0.99%) (YTD: +2.67%)

Calendar

06-09 November (Monday-Thursday): EFG Hermes’ 7th Annual London Conference on 6-9 November, Arsenal’s Emirates Stadium.

10 November (Friday): The SODIC annual Charity Run, SODIC West, Cairo.

14 November (Tuesday): SEMED Business Forum: Investing for Sustainable Growth, Conrad Hotel, Cairo.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

19-21 November (Sunday-Tuesday): 11th Annual INJAZ Young Entrepreneurs Competition, Four Seasons Nile Plaza, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

01-03 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Center.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Center.

05 December (Tuesday): Egypt’s Emirates NBD PMI reading for November to be announced.

03-06 December (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

19 December (Tuesday): Village Capital’s Financial Health Competition: Middle East and Egypt (applications close 3 November)

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

12-14 February 2018 (Monday-Wednesday): Egypt Petroleum Show 2018 (EGYPS), New Cairo Exhibition Center.

17-21 February 2018 (Saturday-Wednesday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.