- Food manufacturers condemn new regulation requiring prices be printed on product packaging. Healthcare providers are next. (Speed Round)

- Finance ministry seeks advisors for upcoming bond issuances. (Speed Round)

- El Sisi inaugurates first phase of the new administrative capital, China State Construction Engineering Company inks contract to build business district there. (Speed Round)

- Egypt growth stronger than expected, regional economic growth prospects improve for 2018 –PwC. (Speed Round)

- Gender-based discrimination in laws costs MENA countries USD 575 bn annually –OECD. (Speed Round)

- Investor attention back to US, bear market seen in 2018. (The Macro Picture)

- Will the rise of the USD threaten EM growth? (The Macro Picture)

- Military Production Ministry in the RDF game with EGP 700 mn investment in four plants. (Energy)

- House of Representatives will begin discussing Capital Markets Act “soon.” (Legislation + Policy)

- The Market Yesterday

Thursday, 12 October 2017

Food manufacturers condemn new regulation requiring prices be printed on product packaging. Healthcare providers are next.

TL;DR

What We’re Tracking Today

Investment Minister Sahar flew to Washington, DC, yesterday to attend the IMF and World Bank annual fall meetings, which run until 15 October. Finance Minister Amr El Garhy arrived there on Tuesday with a stacked agenda that includes meetings with IMF officials (among them IMF boss Christine Lagarde), sit-downs with ratings agencies and international banks, as well as meetings on the G20’s African initiative.

Also in DC is Egyptian Financial Supervisory Authority boss Mohamed Omran, who met yesterday with officials from international banks and funding institutions, Al Masry Al Youm reports. His agenda included talks with European Bank for Reconstruction and Development to discuss ways to develop short-term debt instruments in the Egyptian capital market; a meeting with the German Technical Cooperation Agency to discuss an SME funding agreement signed during President Abdel Fattah El Sisi’s visit to Germany earlier this year; a meeting with the IFC to discuss technical support for the launch of green bonds in Egypt; and a meeting with the African Development Bank to discuss economic legislative reforms and the third and last USD 500 mn tranche of its USD 1.5 bn loan to Egypt, which will be disbursed in January 2018.

Central Bank Governor Tarek Amer gave a speech about economic reforms at the Institute of International Finance, according to Youm7, and EGX boss Mohamed Farid is also in Washington for the get-together.

Moushira Khattab placed third again yesterday in the third round of balloting for UNESCO’s top job, earning a total of 13 votes, Al Masry Al Youm reports. France’s Audrey Azoulay caught up with former Qatari culture minister Hamad bin Abdulaziz Al Kawari, with each of them earning 18 votes. The secret ballot will continue for the rest of this week, and Khattab’s campaign manager Mohamed El Oraby said the Egyptian candidate is expected to reel in 17 votes during tomorrow’s round, Ahram Gate reports. According to Oraby, Qatar reached the “maximum” number of votes it will be able to earn, hinting that Egypt’s aggressive diplomatic efforts will bear some fruit. AMAY says that UNESCO announced Vietnam’s candidate has withdrawn, but that’s yet to be confirmed by any other outlet.

Back home, the House wants to do its part to help Khattab: House Human Rights Committee Chairman Alaa Abed issued a statement calling for the prosecution of NGOs and civil society members that opposed Khattab’s candidacy, AMAY reports. The MP suggested that naysayers should be charged with “being unpatriotic” and “adopting stances similar to … Human Rights Watch” — clear infractions of the criminal code, if ever there was one. The human rights set had spoken out against Khattab’s candidacy to draw attention to the nation’s rights record.

The source of Smiley Face’s superpowers is up for debate today: The House Economics Committee will continue today to debate amendments to the Consumer Protection Act, which the Ismail Cabinet had signed off on in June. Debate yesterday centered around protection of user data in industries including telecoms, as well as consumers’ right to compensation, which MP Medhat El Sherif said should be handled by the Consumer Protection Authority rather than the judiciary, according to Al Mal.

US financial industry on edge over EU’s MiFID II rules on unbundling of research and commissions: The US financial industry is waking up to the regulatory quagmire it will face when the European Union implements the new MiFID II financial regulations in 2018, a number of which conflict with US regulations. Chief among them: MiFID’s provisions that demand the unbundling of payment for research and trading. “While many asset managers reluctantly agree with the aim, it runs counter to US regulations that require any institution that sells research for ‘hard’ USDs — as opposed to ‘soft,’ indirect payment through trading commissions — to register as an investment adviser,” Robin Wigglesworth writes for the Financial Times. Financial services lobbyists complain that the Securities and Exchange Commission has been slow to clarify how US firms should integrate with MiFID come January.

And for your viewing pleasure this morning as we slide into the weekend: The Donald says “Bns and bns” — over and over and over and over again. Watch (runtime: 2:03).

On the Horizon

Our friend Andre Valavanis, IRO at GB Auto, will be defending his WBF Intercontinental Welterweight title on 21 October against challenger Vladimer Janezashvili. The bout will take place on at the Ace Club in Maadi. Valavanis is sponsored GB Auto in his pursuit to become the first Egyptian World Champion, a shot he is hoping to take next year. “Having previously held Egyptian International, WBF All Africa and WBF International titles, Valavanis added the WBF Intercontinental crown to his list of achievements last July when he stopped Tanzanian Omari Ramadan in three rounds. And he is still only 9-0,” the WBF says. Look for more details on the event’s Facebook page.

Enterprise+: Last Night’s Talk Shows

The inauguration of the first phase of the new administrative capital was front and center on the airwaves last night.

On Masaa DMC, Osama Kamal shared his enthusiasm about the project with viewers, saying he expects the new capital to attract significant investment as well as more expats (watch, runtime 7:38). He said there was a “long waiting list of investors wanting to participate in new capital projects”(watch, runtime 5:34).

While on Kol Youm, Amr Adib attempted to clarify that the new capital will not be home only to the wealthy (watch, runtime 7:01).

Adib also hosted the CEO of online employment website Shaghalni, Omar Khalifa, who said his platform now hosts around 80k job seekers, up from 500 when it was first launched. He said that some 5,000 companies use his website to find staff (watch, runtime 2:19).

Hona Al Asema’s Lamees Al Hadidi was off last night

Speed Round

Food manufacturers condemn new regulation requiring prices be printed on product packaging: Food manufacturers were livid yesterday about a snap Supply Ministry decree forcing them to print prices on their packaging or face fines and jail time, arguing it “risks increasing pressure on an industry already squeezed by austerity measures,” Reuters reports.

Hani Berzi and Ashraf El Gazayerli flew the flag for industry, while lawyer Ziad Bahaa-Eldin spoke for the wider business community when he noted, “You cannot place compulsory pricing anyway and think you can implement it. What kind of message are you sending to investors?” Manufacturers say the move will have no impact on inflation and is really just “stripping the market of needed competitiveness and flexibility.” Aside from the additional costs entailed, the directive will also be disruptive to the production process, Edita Chairman Hani Berzi explained, especially for exporters who have to consider the difference in prices for different locations.

The Supply Ministry insists printing prices on stickers is a tool in the war on inflation and will protect consumers from “unjustified” price increases, according to Supply Ministry spokesperson Mamdouh Ramadan.

Lobbying campaign to start next week? Members of the Chamber of Food Industry (CFI), the Chamber of Commerce, and the Federation of Egyptian Chambers of Commerce are drafting a proposal they intend to submit to the Supply Ministry in a meeting next week that will include measures that “‘ensure the decision doesn’t have a negative impact on the investment environment, exports and production, and that it doesn’t violate pre-set regulations by mother companies,” CFI Chairman El Gazayerli told Reuters.

The local press, a bastion of socialist fellow-travelers whose incomes are being eroded by record-high inflation, will ultimately come out in favour of the regulations, but are asleep at the switch right now. The story is getting no traction one way or the other with the domestic press this morning.

Our bottom line: This is one of those threats that may never be implemented, but that government will use as a bargaining chip — and cudgel — against both manufacturers and retailers who don’t outwardly promise to get in line and hold the line on price increases. Either way, it’s not a message investors should welcome and bodes poorly for the healthcare sector, where the government has also signalled it will move forward with price controls despite the dismissive eye-rolling of some industry executives.

Finance ministry seeks advisors for upcoming bond issuances: The Finance Ministry issued the terms for investment banks interested in managing its next eurobond issuance and will accept applications between the end of the month and early next month, ministry sources told Al Shorouk. BNP Paribas, Citi, JP Morgan, and NATIXIS were joint bookrunners last time around. The ministry will take 3-4 weeks to review the banks’ bids. The ministry is looking for counsel on where to list the bonds (the UK, Ireland and Luxembourg are in the running), the timing of the issuance, and whether to go to market with an offering in USD or EUR. Last week Finance Minister Amr El Garhy said the government is planning on floating EUR 3-4 bn in USD bonds and EUR 1-1.5 bn in EUR bonds between January and February of next year.

President Abdel Fattah El Sisi inaugurated the first phase of the newadministrative capital yesterday. In his speech, El Sisi addressed naysayers, telling the audience that the project would prove that sustainable urban development in the form of new cities would be key to Egypt’s bid to cope with its growing population. Housing Minister Moustafa Madbouly, Planning Minister Hala El Saeed and other cabinet ministers also attended.

Chinese company to develop business district in the new capital: Following the speech, China State Construction Engineering Company (CSCEC) signed a contract with the Housing Ministry to develop the district of the new capital. CSCEC joins compatriots China Fortune Land Development Company and the Metallurgical Corporation of China, which were among the top developer of phase one of the new capital. The contract size with CSCEC was not disclosed.

Housing Minister Moustafa Madbouly also spoke on the development of the new capital and its first phase. Key highlights from the project included:

- The first phase development will cost EGP 17 bn;

- The city is expected to become home to some 6.5 mn residents;.

- The first phase will include 17,000 homes.

You can catch the full inauguration ceremony here (watch, runtime: 2:31:52).

Egypt delivered a much stronger than expected 2Q2017 growth of 4.9% and “burgeoning central bank reserves could be a lead indicator of higher foreign investment,” according to the PwC Middle East Economy Watch. The story was not similar across the region as a whole, as oil prices remained below expectations. Richard Boxshall, Senior Economist at PwC Middle East, said: “While the economic and fiscal outturns for the first half of the year are less than anticipated, momentum is building in key parts of the region. These signs suggest that stronger economic growth could return in 2018, so long as oil prices maintain or exceed current price levels.” He added that “a change in the currency regime is only likely to make good economic sense if and when commodities play a much smaller role in the Gulf economies as a result of successful diversification efforts. For most countries, this remains a fairly distant goal.”

It appears as though talks are back on between the Port of Alexandria and China Harbour over a multi-purpose platform — the Egypt Economic Development Conference project that has been killed and resurrected more times than we can count. The agreement for the project will reportedly be signed before the end of the year, an unnamed official tells Al Mal, without clarifying whether the two sides had resolved the dispute over the project’s total cost. Last we heard, the Transport Ministry was considering launching a new tender for the multi-purpose facility after negotiations with China Harbour reached an impasse.

The General Authority for Freezones and Investments (GAFI) approved the establishment of three new investment zones yesterday, according to an Investment Ministry statement. Those include an SME-focused zone in Qalyubia and two commercial zones for the Majid Al Futtaim Group at the Six October City Mall of Egypt and the City Center Mall in Almaza.

Gender-based discrimination in laws costs MENA countries USD 575 bn annually, the Organisation for Economic Co-operation and Development (OECD) report estimates. “Gender equality is not only good for women, it’s good for businesses, it’s good for sound economies and it’s good for happier societies,” Gabriela Ramos, OECD chief of staff, says, according to Reuters. The OECD report “urged MENA countries to update their labour and family laws, improve women’s access to finance and develop policies to help them fulfill their potential.” You can read the full report online here.

The Macro Picture

Growing talks on US tax reform has shifted global investor attention back to the US and away from the economic recovery in the European Union, Goldman Sachs’ October marquee QuickPoll suggests. Market sentiment feels even more bullish than after the US election, offering a reminder that “the end of a bull market is still a bull market,” Oscar Ostlund, head of New York Market Strats in the Securities Division, says. The results, taken together, fit a “classic end-of-cycle pattern, but timing the turn is a notoriously difficult task,” Ostlund says. Most of the survey respondents expect reversal to a bear market in 2018.

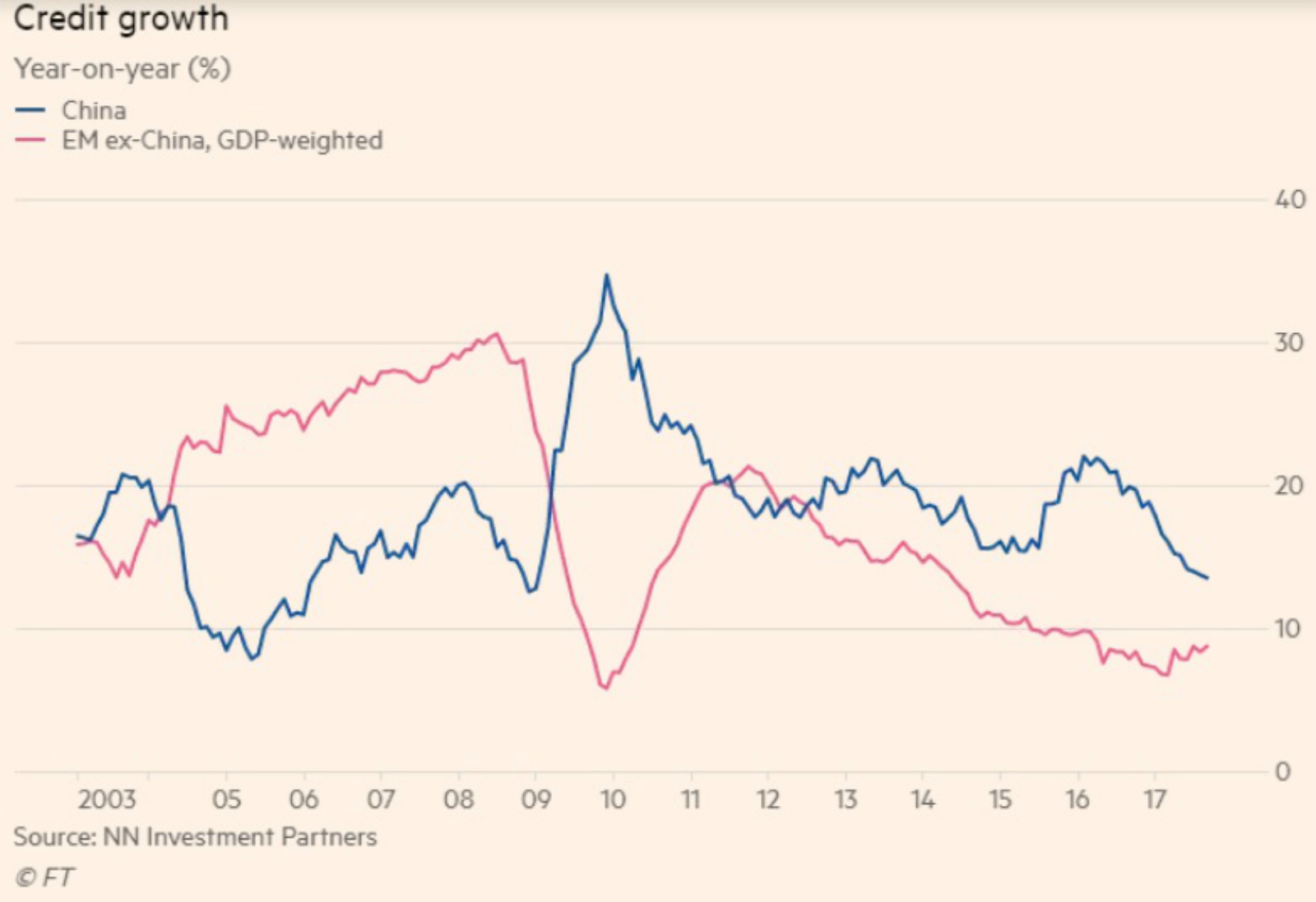

“Credit growth in non-Chinese emerging markets is accelerating for the first timesince 2011, buoying expectations of stronger economic growth,” writes Steve Johnson for the Financial Times. Credit growth hit an annual rate of 8.7%, according to data compiled by Dutch asset manager NN Investment Partners, which tabulates the GDP-weighted average of 19 EMs. This comes after a slump which saw the y-o-y credit growth rate stuck at 6.7% between 2011 and February 2017. “[Cross-border] capital flows are not as negative as before, currencies have recovered and central banks have been able to cut rates and, after a long period of lost confidence in these countries, that has bottomed out so people and companies are more confident about borrowing money,” said Maarten-Jan Bakkum, senior emerging markets strategist at NNIP. These improved economic metrics jive with the IMF’s forecast that GDP growth in emerging and developing countries will hit 4.6% 2017, up from 4.3% in 2016, and will even reach 4.9% in 2018.

The growth is in more than just credit, but in EM liquidity as a whole, which encompasses credit, savings and net foreign capital flows.

Will the rise of the USD threaten EM growth? But some analysts are suggesting that the USD’s strong run in September might point to a potential emerging markets currency sell-off, says Roger Blitz in the newspaper. “The chief cause of EM’s difficult September has been a recovery in the USD, which has drawn strength from signs that the Federal Reserve is intent on raising rates further, even as inflation remains subdued,” he writes. Not everyone is projecting doom and gloom. Piotr Chwiejczak, EM foreign-exchange strategist at BNP Paribas, believes that smaller current account deficits and accelerating economic growth have helped make EM less vulnerable. He adds that EMs are also less susceptible to fluctuations in the Chinese economy.

This comes as BlackRock has put out a strategy note it says can balance the risk of lengthening durations of emerging markets bonds as a result a stronger USD. “BlackRock recommends switching from index-tracking funds to active managers who can quickly shuffle the portfolios and shore up positions on developing-nation USD debt threatened by inflation and higher rates,” writes Srinivasan Sivabalan for Bloomberg.

Egypt in the News

Topping coverage of Egypt in the foreign press this morning were the UNESCO leadership elections. Egypt’s candidate for the job, Moushira Khattab, is within the top three, just under the French and Qatari candidates, who were head-to-head after yesterday’s ballot.

“We all have the right to vie in election as long as we fit the conditions,” potential presidential candidate Mohamed Anwar Sadat told Turkey’s Anadolu Agency. Sadat was kicked out of parliament after being accused of leaking the draft NGO law to foreign embassies, a charge he denies. “The atmosphere of this competition will make us decide whether to run or not,” Sadat says.

The arrest of members of the LGBTQ community in Egypt is “not necessarily any broader effort at diversion … This is the way that the government responds. It’s much more elemental than that,” Century Foundation senior Fellow Michael Hanna tells ABC News. He says it was unclear if the arrests were pre-planned to “draw attention away from Egypt’s weak economy or unrelated political developments,” but they “do follow a clear pattern.”

Also making the rounds this morning:

- Egypt win of a berth at the 2018 World Cup after a nearly three-decade absence is still finding its way to international headlines, with the latest piece coming from the New York Times.

- Egyptian authorities released an Israeli tourist from custody yesterday who had been arrested for having bullets in his bag crossing into Egypt, say the Times of Israel. The bonehead apparently left the bullets there from his army days.

- A recovery diver relives the horror of pulling up bodies from a refugee boat that sank off Rosetta last year and prompted Egypt to pass an a law criminalizing human smuggling, according to an article on the UNHCR website.

On Deadline

Opinion writers take a look at the prospect of local government: We shouldn’t be afraid to decentralize government and grant greater powers to local government, writes Newton for Al Masry Al Youm. However, since the concept of decentralization is a bit alien to Egypt, he advocates for taking a more gradual approach by granting complete local administrative powers to a select few governorates (maybe even one). His piece is part of a growing trend among opinion this week looking into local elections, with some, including Amr Rabei, saying the Local Administration Act should be among the House of Representatives’ top priorities.

Worth Watching

For all you space nerds out there, NASA has released hours upon hours of archival footage on Flight Research Center’s YouTube channel. There’s this footage of the wingless M2-F1 “flying bathtub” being pulled into launch by 1963 Pontiac Catalina (watch, runtime: 0:33). Or how about Neil Armstrong before his lunar fame test-piloting a Lunar Landing Research Vehicle (watch, runtime: 0:38). Or what happens to a hypersonic jet when it hits Mack 6.7. speed (watch, runtime: 0:47)?

Wired Magazine has a wonderful explainer for some the stuff on the channel.

Diplomacy + Foreign Trade

Egypt clears Russian security experts to continue airport inspections after flight ban is lifted: Egypt has reportedly agreed to allow Russian security experts to continue inspecting the Sharm El Sheikh and Hurghada airports even after air travel between Cairo and Moscow resumes, a top Egyptian official told Russia’s Interfax yesterday, Al Shorouk reports (We were unable to track down the original article). The Russian government is said to be waiting on Egypt to review and sign an airport security protocol before it lifts the ban on air travel to Cairo. Flights should resume one month after the ban is lifted.

Egypt is ready to join the Syrian peace talks in Astana, Egyptian Ambassador to Russia Mohamed Elbadri told Sputnik. “We definitely exert all our efforts in trying to address the Syrian crisis. In the event of an invitation, we will participate, especially since Egyptian efforts have already resulted in gathering several opposition groups that came out with a unified document and a roadmap more than a year ago,” El Badri says. Elbadri also added that Cairo is expected to host Russian President Vladimir Putin “in the near future” but that no specific date has been set for the visit yet.

The Head of the Egyptian Interest Section in Tehran Yasser Omar met with the Iranian Parliament’s special aide, speaker Hossein Amir-Abdollahian, to discuss “regional developments” and bilateral ties, Iran Front Page reports. Iran and Egypt have had no diplomatic ties since 1980.

Khartoum’s dispute with Cairo over Egypt’s Halayeb and Shalatin must be settled “either by dialogue or through international arbitration,” Sudanese Foreign Minister Ibrahim El Ghandour said yesterday, according to the Sudan News Agency. The statement came during a meeting with members of Egypt’s Foreign Affairs Council, who are in Khartoum for a three-day visit to discuss bilateral ties.

Suez Canal Authority head Mohab Mamish discussed increased investments with Germany’s Economic Cooperation Minister Gerd Müller in Cairo yesterday, according to Al Shorouk. Müller met earlier in the week with President Abdel Fattah El Sisi and Investment Minister Sahar Nasr.

Water Ministers from Nile Basin countries are gathering in Uganda today to discuss their 10-year development strategy for the area, according to The Independent.

Energy

Military Production Ministry looking to expand use of RDF in industry

The Military Production Ministry is planning on opening four refuse-derived fuel (RDF) plants worth EGP 700 mn in Ismailia, El Sharqiya, Minya, and Beni Suef, government sources tell Al Borsa. The plants will also be able to produce organic fertilizers. Military Production Minister Mohamed El Assar met with Environment Minister Khaled Fahmy and Local Development Minister Hisham Sherif to discuss expanding the use of RDF in energy-intensive industries such as the cement, steel and ceramic industries. They also discussed using the organic fertilizers for the 1.5 mn feddans project, sources added.

Oil minister discusses further investments with APICORP CEO

Oil Minister Tarek El Molla met yesterday with the CEO of the Arab Petroleum Investments Corporation (APICORP) Ahmed Attiga to discuss the company’s ongoing petrochemical and natural gas projects in Egypt and chances for further investments, Al Shorouk reports.

Manufacturing

Sidel looks to sell factory to meet debt obligations

Packaging manufacturer Sidel Egypt is moving to sell its Six October factory in order to meet its debt obligations, which have risen sharply over the past year as a result of the EGP float, CEO Riad Sabra tells Al Mal. The company has been having trouble paying suppliers for imported production inputs and has sustained heavy losses due to rising costs, which has in turn hampered expansion plans. Sidel, however, is not planning to exit the Egyptian market, Sabra confirmed. The company is in talks with a cooking oil producer and alkaline water manufacturer Flo to install new production lines worth EUR 3 mn each, and targets sales of EUR 20 mn next year.

Tourism

German holiday bookings in Marsa Alam jump 121% in September, Europeans account for lion’s share of August’s tourist arrivals

German tourists continued to increase their holiday bookings in Hurghada and Marsa Alam in September, according to figures released by tourism portal FVW. Hurghada saw an 86% increase in bookings, while Marsa Alam saw a leap of as much as 121% “as Germans booked more winter sun holidays on the Red Sea coast. Meanwhile, European tourists accounted for the largest demographic in August’s arrivals at 446,773 out of a total 819,619, Youm7 reports, citing CAPMAS statistics. Arab tourists comprised the second-highest number of arrivals during the month, followed by visitors from North and Latin America. This comes as a report from global travel patterns firm ForwardKeys issued on Wednesday indicated that Egypt and Tunisia are “leading the recovery” of African international flight arrivals as concern over security and health issues from 2014-2016 are beginning to wane.

Tourism Minister Yehia Rashed heads to Italy for exhibition

Tourism Minister Yehia Rashed is heading to Rimini Fiera in Italy on Wednesday to attend the TTG Incontri exhibition, which will run from 12-14 October, according to Al Mal. The minister will hold meetings with tour companies and news agencies.

Telecoms + ICT

Phone scratch card shortage following NTRA decision to raise prices 36%

If you’ve been feeling like you cannot get a scratch card anymore from your local kushk, it’s because there’s been a shortage on the cards since the National Telecommunications Regulatory Authority (NTRA) announced it would raise their prices by 36%. Mobile network operators have apparently been withholding new shipments of phone cards in order to clear out current inventory of scratch cards, a number of distributors tell Al Borsa. Etisalat Misr had reportedly recently started distributing newly priced cards as of yesterday, one distributor said.

Automotive + Transportation

Nissan looks to sell 20k units by the end of April

Nissan is aiming to sell 20k cars by the end of April, head of sales and marketing Ahmed El Ghani told Al Mal. His statements come on the back of increasing demand for the Sunny and Sentra models as well as the introduction of a new model of the Qashqai. Auto sales have seen a slump lately due to decreasing consumer purchasing power and increasing prices in the market, of which Nissan had captured 17% share in August.

Banking + Finance

FEB looks to settle around 800 tax disputes filed by 25 member banks

The Federation of Egyptian Banks (FEB) is apparently looking to settle around 800 tax disputes filed by 25 of its member banks, including CIB, the National Bank of Egypt, and Banque Misr. An agreement is expected to be signed with the Tax Authority sometime this week to settle the cases after negotiations led to a preliminary agreement, government sources tell Al Borsa.

26 foreign exchange companies resume operations

26 foreign exchange companies have resumed operations after seeing through the suspension imposed on them during the currency crisis,Foreign Exchange Bureaux Division former headAli Al Hariri tells Al Mal. Al Hariri added that all 90 suspended exchange houses are now back in business, with the last of them coming online last week.

Other Business News of Note

Social Solidarity Ministry signs on 180k new families to the Takaful, Karama programs

The Social Solidarity Ministry included 180k new families to the roster of Takaful and Karama beneficiaries, Minister Ghada Waly tells Al Borsa. The programs currently supports 1.9 mn families, a number which will rise to 2 mn after applications to join the program are revised by the end of the November, Waly added.

Legislation + Policy

House of Representatives will begin discussing Capital Markets Act “soon”

The House of Representatives will begin discussing amendments to the Capital Markets Act “soon,” said EGX head Mohamed Farid at a meeting with the securities division of the Federation of Egyptian Chambers of Commerce on Wednesday. He urged members of the Federation to present their proposals for setting up a futures market, as the amendments contain a framework for establishing it. The amendments are also expected to modify the regulations governing private placement, cover the issuance of sukuks, and give the EGX flexibility to set lower listing fees to attract smaller companies.

Egypt Politics + Economics

Military court sentences 13 to death

A military court sentenced 13 people to death on Wednesday for a deadly attack on a military checkpoint in the Farfara Oasis in 2014, according to Ahram Online. 12 of the defendants were sentenced in absentia and one offense against a minor was dismissed. The story is getting international pickups on Anadolu Agency and the APA.

Sports

Cuper right man to lead Egypt -Abo Rida

Hector Cuper is the right man to lead Egypt at the World Cup finals, Egyptian Football Association President Hany Abo Rida tells BBC Sport. “Cuper’s style of football has not been popular in Egypt, leading to calls for him to be replaced.” Abo Rida noted “I can’t axe him after he took us to World Cup, after the draw the head coach will start prepare for the finals.”

On Your Way Out

Four Egyptian startups were named finalists in Visa’s Everywhere Initiative, Disrupt Africa reports. On-demand valet parking app Rakna, ridesharing service Swvl, virtual reality startup VRteek, and bot-building platform WideBot are competing for a USD 25k prize that will be awarded to the top competitor in each of the categories. One of the companies will also get a chance to earn a further USD 50k as Visa’s overall champion. Visa expanded its Everywhere Initiative to MENA in June, with the program designed to encourage the development of fintech startups in the region.

ON THIS DAY- On this day in 1810, the first Oktoberfest was celebrated in Munich, Germany The festival was celebrated first in the form of a horse race held in honour of the marriage of the crown prince of Bavaria, who later became King Louis I, to Princess Therese von Sachsen-Hildburghausen. In 1492, Christopher Columbus “discovered” the New World, believing he has reached East Asia. In 1999, the population of the world hit 6 bn, according to the UN. (We’re at about 7.6 bn this morning._ A year later on 12 October, US Navy destroyer USS Cole was attacked in the Yemeni port of Aden. On this day in 2015, our readers were introduced to Prime Minister Sherif Ismail’s economic plan. Last year, we were still hearing talk of a reported rift with Saudi Arabia.

The Market Yesterday

EGP / USD CBE market average: Buy 17.5915 | Sell 17.6915

EGP / USD at CIB: Buy 17.58 | Sell 17.68

EGP / USD at NBE: Buy 17.60 | Sell 17.70

EGX30 (Wednesday): 13,816 (-0.1%)

Turnover: EGP 1.4 bn (51% above the 90-day average)

EGX 30 year-to-date: +12.0%

THE MARKET ON WEDNESDAY: The EGX30 closed Wednesday’s session down 0.1%. CIB, the index heaviest constituent closed almost flat. EGX30’s top performing constituents were: Porto Group up 6.3%; EFG Hermes up 2.8% and Abu Dhabi Islamic Bank up 2.7%. Yesterday’s worst performing stocks were: Ezz Steel down 3.4%; Arab Cotton Ginning down 2.2% and Egyptian Financial & Industrial Company down 2.1% down. The market turnover was EGP 1.4 bn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -63 mn

Regional: Net Long | EGP +25.8 mn

Domestic: Net Long | EGP +37.2 mn

Retail: 67.2% of total trades | 70.1% of buyers | 64.3% of sellers

Institutions: 32.8% of total trades | 29.9% of buyers | 35.7% of sellers

Foreign: 18% of total | 15.8% of buyers | 20.2% of sellers

Regional: 8.3% of total | 9.2% of buyers | 7.4% of sellers

Domestic: 73.7% of total | 75% of buyers | 72.4% of sellers

WTI: USD 51.04 (-0.51%)

Brent: USD 56.61 (-0.58%)

Natural Gas (Nymex, futures prices) USD 2.91 MMBtu, (+0.76%, November 2017 contract)

Gold: USD 1,294.90 / troy ounce (+0.47%)

TASI: 6,889.98 (-2.15%) (YTD: -4.44%)

ADX: 4,514.99 (+0.96%) (YTD: -0.69%)

DFM: 3,637.55 (+0.8%) (YTD: +3.02%)

KSE Weighted Index: 431.14 (-0.34%) (YTD: +13.43%)

QE: 8,333.84 (+0.98%) (YTD: -20.15%)

MSM: 5,121.71 (-0.17%) (YTD: -11.43%)

BB: 1,274.9 (+0.25%) (YTD: +4.46%)

Calendar

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

15-16 October (Sunday-Monday): The Marketing Kingdom Cairo 3 conference, Dusit Thani Lakeview Hotel, Cairo.

17 October (Tuesday): The Narrative PR Summit, Four Seasons Nile Plaza, Cairo.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Future of Cities: Innovation, Spaces and Collaboration,” The French University, Cairo. Register here.

21 October (Saturday): The African Leadership Academy will hold its “Beyond Education” seminar on on university readiness and the future of leadership in Africa, at the Dusit Thani, Lakeview, New Cairo and the Hilton Pyramids Golf, 6 October City.

23-27 October (Monday-Friday): 29th Business and Professional Women International Congress themed “Making a Difference through Leadership and Action,” Mena House Hotel, Cairo. Register here.

06-07 November (Monday-Tuesday): Crisis Communications Conference, Four Seasons Nile Plaza Hotel, Cairo.

06-09 November (Monday-Thursday): EFG Hermes’ 7th Annual London Conference on 6-9 November, Arsenal’s Emirates Stadium.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

19-21 November (Sunday-Tuesday): 11th Annual INJAZ Young Entrepreneurs Competition, Four Seasons Nile Plaza, Cairo.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

01-03 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.