Egypt sees new success in second round of eurobond issuance

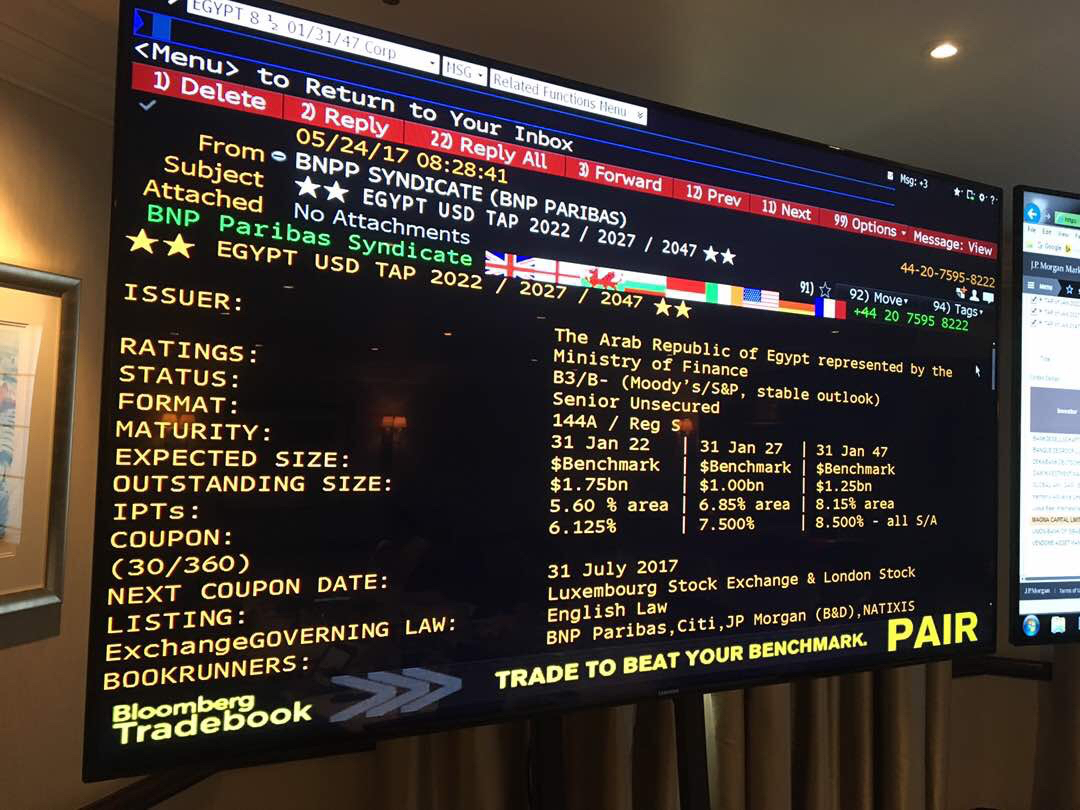

Even more success with eurobond issuance round 2: Egypt raised USD 3 bn in a triple tranche eurobond sale on Wednesday, about twice as much as targeted and at lower cost than when the same bonds were first sold in January, Reuters reports. The government sold USD 750 mn worth of five-year bonds at yields of 5.45%, down from 6.125% in January’s eurobond sale. USD 1 bn of 10-year bonds were sold at yields of 6.65%, down from 7.50% in the last sale, while 30-year bonds raked in USD 1.25 bn at yields of 7.95%, down from 8.50%. 80% of the money raised from the bond sale came from North America and Europe, and that the proceeds would reach the central bank by May 31, said Finance Minister Amr El Garhy.

“This is a great success and shows confidence in the economy," a Cairo-based banker told Reuters. “This shows that there is very good sentiment on Egypt and expectations that yields could fall further in the future.”

Heavily oversubscribed: Order books closed at USD 11 bn or 4x oversubscribed, a document issued by one of the banks leading the deal showed. BNP Paribas, Citi, JP Morgan, and NATIXIS were joint bookrunners. The issuance is listed in Luxembourg and London and governed by English law. We hope to have more color in Sunday’s edition.