- El Garhy confirms he wants cabinet approval for two eurobond issuances, sees inflation falling to 15% by June 2018. (Speed Round)

- Banks in Egypt “learned their lesson,” regain control over FX market –Reuters. (Speed Round)

- M&A WATCH- Beltone reconsiders microfinance acquisition, more focused on international growth now -El Torgoman. (Speed Round)

- For the “nth” time, analysts suggest TE could be forced to divest its stake in Vodafone Egypt as the state-owned giant enters the mobile market, rolls out 4G services. (Speed Round)

- Count on Parliament to ruin everything good — this time the proposed reform of the thanaweya amma high-school education system. (Speed Round)

- State “wage council” coming as gov’t sees unemployment falling to 9.5% over two years, will phase out paper cheques in November –Planning minister. (Speed Round)

- Egypt’s mediation effort on Palestine bears fruit as Hamas agrees to elections. (Speed Round)

- Take that, Axe: Hedge funds run by women have generated returns two times higher than their male counterparts this year. (Speed Round)

- The Market Yesterday

Monday, 18 September 2017

Woman-run hedge funds generate 2x the returns of their male-run competitors

TL;DR

What We’re Tracking Today

President Abdel Fattah El Sisi arrived in New York yesterday for the UN General Assembly’s 72nd regular Session, which began last week and runs until 25 September. El Sisi is scheduled to join a UN Security Council summit on peacekeeping and is making the crisis in Libya a signature issue. The president will address the General Assembly tomorrow, where his speech is expected to focus regional politics and the war on terror, according to Al Ahram. The Egyptian delegation accompanying El Sisi is scheduled to meet with the president of the World Bank, in addition to several US investors, Investment Minister Sahar Nasr told reporters in New York yesterday, according to Al Shorouk.

Also on El Sisi’s agenda is a meeting with US President Donald Trump on Wednesday.

All eyes on The Donald: Trump will address the UN for the first time since his election and “since his credo of ‘America First’ began to alarm allies that he would permanently upset the liberal international order that the US did so much to help create at the UN’s 1945 foundation,” writes the Financial Times. The New York Times shares the outlook, noting that the world leaders gathering in the Big Apple are still trying “to figure out this most unusual of American leaders.”

Shaker to discuss Dabaa in Vienna nuke speech: Electricity Minister Mohamed Shaker is expected to give a speech today at a general meeting of the International Atomic Energy Agency (IAEA) about Egypt’s plans to build the Dabaa nuclear power plant, according to Ahram Online.

And speaking of Dabaa, we’re hearing that the Council of State (Maglis El Dawla) is expected to complete its review of the contracts today. Sources close to the matter tell Youm7 that the Council will meet with officials from the Electricity Ministry today to discuss the final points of the contracts. This contradicts reports over the weekend that the contracts would not be approved until next month.

The Euromoney Egypt Conference kicks off today and ends tomorrow, with ministers Amr El Garhy, Sahar Nasr, and Tarek Kabil having been announced as scheduled to attend.

PSA- Traffic is about to get much, much worse: The new academic year officially began on Saturday for some 2.5 mn public university students around the country, Ahram Online reports. State-run K-12 schools will open their doors this coming Saturday, so expect your morning commute to be a bit tougher this weekend.

Some hibhob for the minister: To celebrate their first day back in school, some students at Cairo University put together a little dance routine for Higher Education Minister Khaled Abdel Ghaffar (who looked rather bemused throughout the whole show). We leave you the video with no further comment (runtime 1:03) because, really, there are no words.

The Emmys have been quite a distraction for us this morning. The big winner was The Handmaid’s Tale, which won best drama series, capping a night in which it also took home nods for best lead actress (the amazing Elisabeth Moss) and best supporting actress (Ann Dowd). The show boxed out Enterprise favourites Stranger Things and Westworld. The other big winner of the night: The HBO miniseries Big Little Lies. On the comedy side of things, SNL, and Last Week Tonight with John Oliver received some well-deserved the golden statues. The New York Times has the list of winners, as the Emmy website hadn’t been updated at dispatch time.

Want to know what’s going to be on stage at next year’s Emmys? Esquire has the full rundown on what seems to be an excellent fall calendar of television. While some shows caught our eye, the one we feel strongly about has to be HBO’s The Deuce, created by the brilliant mind behind The Wire, David Simon. That and the fact that Stranger Things is back on 27 October for its sophomore season.

Then again, you may not want to make plans, because the world is scheduled to end this weekend. That’s according to a Christian numerologist who claims D-Day is next Saturday, when a planet is set to collide with Earth, Fox News says. The nutjob says he pinpointed the 23 September end-of-the-world date using codes from the Bible, as well as a “date marker” in the Pyramids of Giza here in Egypt.

***HOW DO YOU FEEL ABOUT BUSINESS THIS MORNING? Tap or click here to tell us in our 3Q2017 reader sentiment survey, the largest survey of senior execs doing business here and of the folks who invest in them. We’re asking you throughout this week how you feel about doing business in Egypt this year, if you’ll invest more and the biggest challenges you face, among other questions. The survey will run until Thursday. It won’t take more than a couple of minutes to complete unless you’d like to leave us a note at the end (optional, but it would be cool if you did). We’ll have the results ready for you next week.

What We’re Tracking This Week

Look out, Fawry — you have (state-owned, analog) competition. You’ll be able to pay your electricity bill and re-charge pay-as-you-go meters at the Post Office in the next few days, reports Youm7. Post Office boss Essam Al-Saghir also suggests you’ll be able to pay your telephone and internet bills there, too.

We should be getting 4G signals on our phones any day now, according to statements by Communications Minister Yasser El Kady. The national telecoms regulator is also just a few weeks away from making a decision on MNOs’ request to hike local roaming charges.

We’re heading into a long Thursday-Saturday weekend in observance of the Islamic New Year — then come back to slide into 2018 planning and budgeting season.

On The Horizon

The Investment Ministry appears to have given itself until the end of the year to prepare and release its investment map of some 600 projects it plans to offer to investors, according to statements by General Authority for Investment and Free Zones Managing Director Mona Zobaa picked up by Youm7.

The Egyptian-American Business Council will meet with a delegation of US companies in November to pitch Egypt as an investment destination, council head Omar Mehanna tells Al Borsa. Mehanna called on the government to establish a freetrade zone with the US to capitalize on improved relations between the two countries.

Enterprise+: Last Night’s Talk Shows

The airwaves are finally starting to get the post-vacation grogginess out of their system and address topics that matter: the eurobond issuance, President Abdel Fattah El Sisi’s trip to New York, and the Hamas reconciliation move.

Another eurobond issuance is a means for the government to replace short-term bonds with longer duration ones, House Budget Committee member Rep. Yasser Omar told TEN TV on the government’s anticipated eurobond issuance.He added that the move was a sign of the confidence international markets have in Egypt’s economy. Speaking on reports that the trade deficit narrowed to 50% y-o-y in June, Omar said that the drop was a result of the restrictions put in place against low-quality imports (watch, runtime 5:01).

From his temporary outpost in New York, Kol Youm’s Amr Adib interviewed Naguib Sawiris, who said he expects the flow of FDI to improve significantly over the next three to four years. Naguib lauded the Investment Act for improving the business climate, while noting that “the devil is in the details.” He did point out, however, that the appetite for investment took a hit when the CBE raised interest rates again this past summer. Naguib took the time to level criticism at Tourism Minister Yehia Rashed, who he said is not working closely enough with tourism investors to revive the sector.

Naguib also expressed his confidence that President Abdel Fattah El Sisi is guaranteed to win reelection next year — and that a second term in office would see improved performance based on lessons learned during his first term (watch, runtime 43:12).

Hona Al Asema’s Lamees Al Hadidi discussed the Fatah-Hamas reconciliation initiative with Deputy Director of Al Ahram Center for Political and Strategic Studies Emad Gad, who said this pact is different from its 2011 iteration. The main difference, he feels, is that Hamas is approaching the issue without relying on support from Qatar (watch, runtime 10:18).

Speed Round

Moving forward with the eurobond issuance plan: The Finance Ministry has asked cabinet to approve its two planned eurobond issuances, sources told Reuters. “The first issuance would range between EUR 1-2 bn before the end of 2017. The second would range from USD 4-8 bn and would be in 2018.” Finance Minister Amr El Garhy told Bloomberg he expects the cabinet to approve the issuance in two to three weeks’ time. The minister spoke about “pockets of money” in Europe that are interested in Egyptian debt and said “we’re taking good advantage of the current market conditions as well as the progress in our current economic reform program.”

El Garhy also expressed some frustration at Moody’s not raising Egypt’s credit rating or even upgrading its outlook from stable. “It was a bit strange to say the least … In a year full of economic reform actions and very bold actions on all fronts, you don’t see anything, you don’t see any positive sign,” El Garhy said about Moody’s inaction.

Separately, El Garhy believes that inflation should drop to c. 15% by the end of the current fiscal year. In an interview on the economy with Youm7 editor Ahmed Yakoub, El Garhy said that the central bank’s interest rate policy has raised the cost of Egypt’s debt service this year to EGP 400-410 bn, up from a projected EGP 380 bn before the interest rate hikes. As for tax revenues, El Garhy expects these to come in at around EGP 605 bn in FY2017-18.

The nation’s banks appear to have “learned their lesson” and are working hard to cement their control of the FX market, Reuters’ Ihab Farouk writes. Before the float of the EGP last November, the central bank had tightened the regulations governing privately-owned FX bureaux in a bid to control the flow of FX in the black market during the USD shortage.

Exchange bureau employees tell the newswire’s Arabic service that banks alone now hold sway over FX rates, as privately-run bureaux’ work is now mostly driven by importers of non-essential goods, who aren’t always able to receive their financing through banks due to regulatory restrictions. With the FX crisis now a thing of the past, a number of local banks are now expanding geographically to offer accessible exchange services through their own bureaux. The National Bank of Egypt recently inaugurated two exchange branches, with plans to establish another 13 over the next six months; the state-owned giant is targeting 30 such outlets by mid-2019. Banque Misr has also so far set up 21 bureaux, a number it intends to more-than-double over the coming two years. These banks have reportedly also been poaching exchange bureau employees for their own operations, drawing them in with higher salaries and better job security and benefits, sources add.

Pharos Holding held its Egypt Banking Day event last week, which highlighted industry to international and local fund managers. Pharos COO Angus Blair gave a welcome speech that was followed by a panel discussion led by Head of Research Radwa El-Swaify. Panelists included CIB Consumer Banking CEO Ahmed Issa, EG Bank Head of Corporate Banking Ahmed Nagui, and Banque Misr Deputy Head of Retail Banking Hendy Fahmy. The event included a discussion on the role of the banking sector in financing large projects, in addition to the importance of banks in financing SMEs. Seven Egyptian banks and more than 40 fund managers participated in the event, which El-Swaify called “an excellent [chance] to exchange experiences among fund managers and to hold multiple discussions about the latest developments in the Egyptian banking sector and the economy.”

M&A WATCH- Beltone Financial is reconsidering its planned acquisition of microfinance firm Reefy, Beltone chairman Sameh El Torgoman told Al Mal. He says the acquisition of Reefy would require new preparations in a time when Beltone is looking to expand internationally and to strengthen its brokerage and investment banking arms. Beltone had planned to acquire 70% of Reefy for EGP 105 mn and received EFSA’s greenlight for the transaction in November 2016. El Torgoman notes that Beltone has not ruled out moving forward with the transaction, but that it will reconsider it in 2018. Pharos Holding was the independent financial advisor on the transaction.

M&A WATCH- For the “nth” time, analysts suggest TE could be forced to divest its stake in Vodafone Egypt as the state-owned giant enters the mobile market, rolls out 4G services.Stop us if you’ve heard this one before: Telecom Egypt may be forced to divest its full 45% stake in Vodafone Egypt because it needs the capital to help roll out 4G — and to avoid a conflict of interest as it enters the mobile phone market, sector analysts tell Reuters’ Arabic service. TE could make losses in the next four to five years, as it pays some USD 400 mn to establish its network, build infrastructure, and obtain licenses, according to EFG Hermes telecom analyst Omar Maher. TE also borrowed EGP 13 bn from a consortium of banks under an agreement signed in July to help fund its EGP 7.08 bn 4G license for which it has paid EGP 5 bn so far.

IPO WATCH- The Transport Ministry has reportedly abandoned a plan to list the Alexandria and Damietta Container and Cargo Handling companies on the EGX under the state’s IPO program. Sources tell Al Mal that both companies have enough available liquidity to finance planned expansions and upgrades without resorting to an initial public offering.

INVESTMENT WATCH- Home services marketplace FilKhedma announced closing a second investment round led by Algebra Ventures and Glint Consulting. “The investment will help attract more talent to its operations, development and marketing teams and significantly grow its user base,” FilKhedma notes. The value of the investment was not disclosed. In addition to Algebra and Glint, FilKhedma’s current shareholders include founder Omar Ramadan and Khaled Ismail’s KiAngel.

INVESTMENT WATCH- German and Polish investors have signed five agreements to invest a combined EUR 150 mn to open manufacturing facilities in Port Said. The plants will manufacture tractors, buses, irrigation systems, armored doors, steel locks and boats. Representatives from the unnamed companies met Prime Minister Sherif Ismail on Sunday to follow up on the agreements, according to Cabinet’s website.

Count on Parliament to ruin everything good — this time the proposed reform of the thanaweya amma high-school education system: House Education Committee chairman Gamal El Sheeha has all but signalled his opposition to the government’s plan to reform the outdated thanaweya amma secondary school education system. He struck all the familiar antagonistic tones in an interview with Al Ahram, where he said “he was unconvinced of the plan.” He even went to declare that the buck on education reform stops with the committee, adding that he plans to hold hearings the proposed system, which would do away with traditional exams and scoring systems in favour of a new GPA-based framework based on coursework and electronically-graded multiple choice exams. The proposed curriculum is intended to reduce the importance of rote memorization.

Planning Minister Hala El Said had a number of things to say at a national competitiveness council event yesterday about which you folks need to know this morning. Among the highlights:

A government “wage council” is coming: The establishment of the National Wages Council is awaiting ratification by the Ismail Cabinet, Youm7 reports. The council, which is expected to set new guidelines for pensions and minimum wages, among other things, is part of the Labor Act that will continue to make the rounds of the House next month. Remember the government’s muttering earlier this summer about a new private-sector minimum wage? Watch this space, folks.

The Ismail government sees unemployment falling to 9.5% over the next two years, Al Shorouk reports Planning Minister Hala El Said as having said in a speech yesterday in which she also repeated her ministry’s forecast of 5.3-5.4% GDP growth in the current fiscal year.

Gov’t to ditch paper cheques in November: El Said also noted that the National Payments Council’s decision to stop using bank cheques and cash payments for anything over EGP 20k by government entities will be implemented in November.

Egypt’s mediation effort on Palestine bears fruit as Hamas agrees to elections:Hamas agreed yesterday to dissolve its government in Gaza and hold general elections after mediation efforts by Egypt, the group said in a statement (you can read the full text here on AMAY). Hamas invited the 2014 Palestinian Unity Government to begin working from Gaza effective immediately and responded to Egyptians calls for dialogue with rival faction Fatah on the implementation of a 2011 agreement to form a new national unity government. Senior Fatah official Mahmoud Aloul tells Reuters the move “is a positive sign,” adding that “we in Fatah movement are ready to implement reconciliation.” Egyptian officials have been in talks with representatives from both factions over the past week. “There is apparently a wave of optimism this time because it seems that the Egyptians are more serious than before, and also because Hamas and Egypt’s ties are getting better, so Hamas is keen to keep these ties good with Egypt,” Gaza-based political analyst Talal Oukal tells Bloomberg.

Kuwait downgrades diplomatic ties with North Korea. Will regional US allies follow suit? Kuwait has given North Korea’s ambassador a month to leave the country and will downgrade its diplomatic representation with Pyongyang, a senior Kuwaiti diplomat told AFP. The source also said North Korea’s diplomatic representation in Kuwait will also be reduced to a charge d’affaires and three diplomats. Besides stopping new visas for North Koreans and suspending all trade relations and flight links with Pyongyang, “Kuwait will also not renew the permits given to North Korean workers to re-enter the country after projects they are currently working on are completed ’within one or two years.’” AFP adds that Asian diplomatic sources told it that “South Korea and Japan have been putting pressure on Gulf states to stop employing North Korean workers because money they sent home was benefiting the regime.”

British authorities have reduced the country’s terror threat to “severe” from “critical,” after police yesterday apprehended a second suspect in the Friday bombing, BBC reports. Detectives have started questioning the two men, aged 21 and 18, who were detained in connection with the weekend attack on Parsons Green tube station in London, which left 30 injuries in its wake.

Maybe Wags can help you process this, Axe: Woman-run hedge funds outperform those run by men. Returns from hedge funds run by women were twice as high as those run by their female counterparts in 2017, according to the Financial Times. The HFRX Women index, which aggregates the performance of female hedge fund managers, has returned 9.95% in the first seven months of the year, while the HFRI Fund Weighted Composite index, a gauge of hedge funds across all strategies and genders, pulled 4.81%. These numbers make the best case we’ve ever read against the underrepresentation of women in the sector. “We definitely need more women in fund management, because we bring slightly different approaches to analysis and risk. Our diversity is complementary,” said Helena Morrissey, head of personal investing at the USD 1.1 tn Legal & General Investment Management.

***

COME WORK WITH US: We’re looking for bright, talented analysts and writers to join our team to work on the current Enterprise Morning Edition and new products we have in the pipeline. You’re likely an equities / macro / research analyst, IR professional or journalist, but we’re less interested in your formal education than we are in amazing writing and storytelling skills, intellectual curiosity, fluency with numbers and passion for business / finance / economics / politics. Bilingual candidates preferred (English-Arabic). A sense of humor is a must, as is healthy skepticism. We prefer Egyptian nationals, but can sponsor work permits for particularly talented foreign applicants. Want to get the conversation started? Send a great cover letter and an updated CV to editorial@enterprise.press. Emails and cover letters opening with “Dears” will be summarily deleted.

***

The Macro Picture

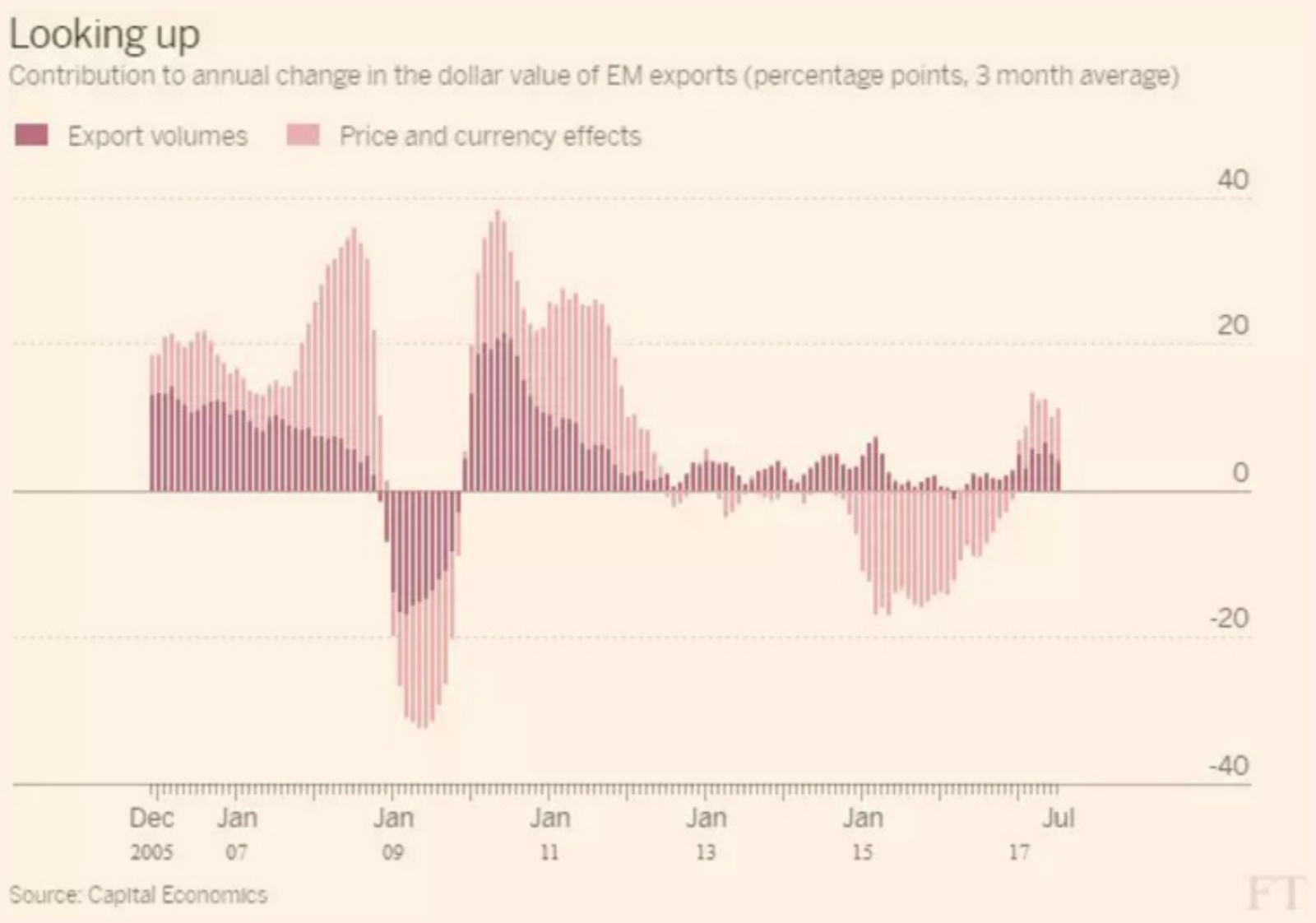

2017 looks to be the best year for emerging markets exporters since 2011: Emerging markets export volumes appear to be growing at their fastest pace this year since 2011, writes Steve Johnson for the Financial Times. Emerging market exports rose 5.2% y-o-y in volume terms in the 1H2017, according to data from Capital Economics. USD value of EM exports has also risen about 11% y-o-y, largely thanks to commodities trading at levels comfortably above those witnessed in the 1H2016. “Emerging market economies are on average growing faster than advanced economies and their rate of trade growth is also typically greater,” says Jon Harrison, emerging market macro strategist at research firm TS Lombard. “The rise in exports is part of the synchronised global expansion led by the US and the eurozone,” Harrison added.

Egypt in the News

Egypt’s role in brokering Hamas’ potentially landmark step toward elections and reconciliation with Fatah topped coverage of Egypt on an otherwise slow news day. Other headlines worth noting in brief include:

- Forbes Middle East published a list of what it says were the top 10 selling cars in Egypt in 1H2017. The top selling car during the period was the Nissan Sunny, followed by Mitsubishi Lancer.

- There’s a movement afoot in diplomatic circles to have Cairo boost its military presence in the Sinai to better battle terrorism, despite the restrictions placed on the country by its 1979 peace treaty with Israel, Ibrahim Ouf writes for Middle East Online.

- Government officials and religious scholars are up in arms against a fatwa issued by a former official from Dar Al-Ifta allowing citizens to illegally excavate treasures and artifacts, Al Monitor reports.

- Amr Salama’s “Sheikh Jackson” is a “well-crafted but middling drama whose attention-catching gimmick only gets in the way,” Variety’s Dennis Harvey says in a critique of the film.

- American citizen Ahmed Etwiy has been in prison for four years on charges of being involved in a protest and may get a shot at freedom today in a mass trial, according to the Huffington Post.

On Deadline

Egypt’s decisionmakers must begin looking forward instead of reverting to outdated ideas and technologies, with the most prominent example being our renewed interest in coal and nuclear energy, Ehab El Zalaky writes for Al Masry Al Youm. Experts see the coal business as dying out, and adopting a nuclear energy program when the cleaner and cheaper option of solar power is available is simply short-sighted, he says.

Worth Watching

An Egyptian-American bodega owner from Queens is now a favorite political commentator for Egyptian news channels: 48-year-old Hatem El Gamasy was just a regular guy who made a living off the bodega he owns in NYC and wrote opinion pieces on current affairs for fun. It was only last year that his “improbable broadcast career began” and he started appearing regularly “on popular Egyptian television news programs, holding forth on subjects from immigration policy to North Korea.” The New York Times shines the spotlight on El Gamasy’s life, telling the story of how the English teacher-turned-bodega owner, who moved to the US in 1999 to study, came to be “part translator of the American people to his homeland, and part good-will ambassador for a country where he feels more at home than where he was born.” (Tap here for the story and video, runtime 3:00)

Diplomacy + Foreign Trade

GAFI, Singapore’s SECC Group to cooperate on developing investment zones: The General Authority for Freezones and Investment signed an agreement with Singapore’s SECC Group yesterday that will see both sides cooperate on the development, management, and promotion of new investment zones, according to an Investment Ministry statement. The Singaporean firm will prepare preliminary studies for the development of investment zones in Qena, Kafr El Sheikh, and Qalyubia, which will include plans for potential economic and commercial activities in the zones. This comes as part of the Investment Ministry’s plan to attract new investments for public-private partnership projects and was discussed during Minister Sahar Nasr’s recent visit to Singapore.

Energy

Samanoud and Abo El Matameer transformer stations get EUR 100 mn

BNP Paribas has signed a EUR 100 mn agreement to facilitate financing the construction of two 220/500 kV transformer stations in Samanoud and Abo El Matameer, according to Al Mal. The funding will be extended to the Finance Ministry on a long-term basis and is guaranteed by Euler Hermes with BNP Paribas the lead arranger. Siemens and Elsewedy Electric are building the stations on an EPC+finance basis after the initial agreement for them was signed at the EEDC in March 2015. The transformer stations will be used to deliver electricity produced at the Burullus power station.

Basic Materials + Commodities

Agriculture Ministry to enforce spot checks for pesticide residues

The Agricultural Ministry will be conducting spot checks for pesticides residues on fruits and vegetables in local markets, according to AMAY. Agricultural Minister Abdul Moneim El Banna witnessed the signing of a protocol Sunday with the Agricultural Research Center to make the testing routine and part of a program to monitor pesticide levels.

Manufacturing

Trade Ministry signs MoU with Siemens on industrial development

The Trade and Industry Ministry signed yesterday an MoU with Siemens Egypt to train the industrial labor force and implement a technological development strategy for industrial zones, Ahram Gate reports. The first phase of the partnership will be implemented in the Rubiki Industrial Zone and Damietta Furniture City, Minister Tarek Kabil said at the ceremony.

Real Estate + Housing

Housing Ministry completes amendments to Unified Building Codes

The Housing Ministry has completed amending the Unified Building Codes and has sent them to the Ismail cabinet for review, said Housing Minister Moustafa Madbouly. The amendments appear to extensive, and focus on facilitating licensing, tightening safety codes, and enforcement, according to Al Borsa. Under the amended law, building licenses will be granted for a duration of three years, instead of a current one, with licensing permits being approved within two weeks of submitting an application. The law would also designate the Housing Ministry’s building inspection authority the status of an independent authority to better enforce the codes. It would also grant governors and municipal authorities greater leeway in enforcing the codes. All building plans must include designs for wheelchair and handicap accessibility.

Sephora invests EGP 2.5 bn in New Cairo and Nasr City

Sephora Heights for Real Estate and Development is currently working on two projects in New Cairo and Nasser City worth EGP 2.5 bn, according to Al Mal. The company is investing EGP 1 bn into the Sephora Heights development in New Cairo, and EGP 1.5 bn into developing 24 residential towers in Nasser City.

Tourism

Egypt is banking on China to boost tourism, says Luxor governor

Egypt is banking on China to significantly boost its tourism industry, particularly as Chinese tourists have begun visiting Egypt in larger numbers since President Xi Jinping’s visit last year, Luxor Governor Mohamed Badr tells Xinhua. Badr says that Chinese visitors tend to flock to Luxor as an important historical and cultural destination, and the governorate is working to cater to these tourists by adding street signs in Chinese, among other measures. Tourism Minister Yehia Rashed had said earlier this month that negotiations are underway to increase air traffic between China and Egypt. The central tourism authority in the Ningxia Hui Autonomous Region had also signed an MoU with the Egyptian Tourism Authority to work together to boost tourism.

Egypt resumes participation in tourism expo in Moscow

Egypt will participate for the first time since 2015 in this year’s iteration of the OTDYKH LEISURE2017 tourism expo , which runs from Tuesday to Thursday in Moscow, Egyptian Tourism Federation acting head Karim Mohsen tells Reuters. The Tourism Ministry’s Tourism Promotion Authority and the Federation (standing in for the private sector), will represent Egypt at the exhibition. This comes as Egypt is preparing for the expected resumption of Russian flights, which have been suspended since the Metrojet flight crash in 2015.

Banking + Finance

China Development Bank signs loan agreements with SAIBANK, Banque Misr

The China Development Bank (CDB) signed an agreement with SAIBANK to provide it with a USD 40 mn loan for SME funding, and a separate CNY 260 mn (USD 40 mn) loan for infrastructure projects, Xinhua reports. CDB also signed an MoU with Banque Misr to provide it with a CNY-denominated loan, with the value of the loan yet to be determined. Banque Misr Vice Chairman Akef El Maghraby told the wire that receiving the loan in the Chinese currency will encourage Chinese investment in Egypt by facilitating loans for investors who want to enter the Egyptian market using their local currency.

HC Securities managing transactions worth USD 600 mn

HC Securities is currently managing M&A transactions worth USD 600 mn, some of which involve foreign investors, the firm’s managing director Mahmoud Salim tells Al Borsa. These transactions were in the petroleum, financial services, healthcare, engineering and food and beverage, and packaging industries, he added. The firm has recently set its sights on Kuwait and Saudi Arabia..

Egypt Politics + Economics

FEI’s bakeries division wants to cut moochers a break

The Federation of Egyptian Industries’ bakeries division is working on a proposal mimicking the golden card system that would allow citizens without a subsidy card to receive subsidized bread, division head Abdallah Ghorab said, Al Shorouk reports. For the uninitiated: golden cards were used by bakeries to tally distribution of subsidized bread to Egyptians who are eligible for bread subsidies but do not have permanent subsidy cards. Supply Minister Ali El Moselhy had argued that these cards left the entire system vulnerable to fraud.

Cairo Governorate to legalize street vendors

Cairo Governor Atef Abdel Hamid wants to expand a plan that grants legal status to street vendors in some of Cairo’s neighborhoods to the whole city, reports Ahram Online. The fundamental idea is that land would be provided to vendors to ply their wares, while also providing them with facilities and security services in exchange for a monthly fee. The idea is already being implemented in parts of Nozha, Ain Shams and East Nasr City. The move is part of a wider effort to curb the informal economy.

On Your Way Out

The Bill and Melinda Gates Foundation is providing USD 2 mn to support programs which focus on financial inclusion, particularly those that specialize in women empowerment, Investment Minister Sahar Nasr said, according to a ministry statement.

ON THIS DAY- On this day in 1970 Jimi Hendrix, one of the greatest rock musicians of all time, died after collapsing at a party in London. Nine years earlier, UN Secretary General Dag Hammarskjold died in an air crash outside the Zambian (formerly Northern Rhodesian) town of Ndola. In the US, George Washington laid the cornerstone to the US Capitol building in 1793. This time last year, we here in Egypt were struggling to catch up with the avalanche of news that happened over the Eid break and came back to the government securing preliminary agreements for the supplementary funding it needs to unlock the IMF funding and receiving USD 1 bn from the World Bank. The ergot flap was, at the same time, cutting us off the international wheat market and the value-added tax was ratified.

The Market Yesterday

EGP / USD CBE market average: Buy 17.62 | Sell 17.72

EGP / USD at CIB: Buy 17.63 | Sell 17.73

EGP / USD at NBE: Buy 17.63 | Sell 17.73

EGX30 (Sunday): 13,613 (+0.0%)

Turnover: EGP 1.1 bn (33% above the 90-day average)

EGX 30 year-to-date: +10.3%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session almost flat. CIB, the index heaviest constituent closed down 0.2%. EGX30’s top performing constituents were: Elsewedy Electric up 5.6%; Arab Cotton Ginning up 5.3%; and Qalaa Holdings up 4.2%. Yesterday’s worst performing stocks included: Sidi Kerir Petrochemicals down 2.6%; Cairo Oils & Soap down 2.5%; and Egyptian Iron & Steel down 2.3%. The market turnover was EGP 1.1 bn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +46.8 mn

Regional: Net Short | EGP -26.4 mn

Domestic: Net Short | EGP -20.4 mn

Retail: 75.4% of total trades | 74.6% of buyers | 76.2% of sellers

Institutions: 24.6% of total trades | 25.4% of buyers | 23.8% of sellers

Foreign: 12.7% of total | 14.8% of buyers | 10.5% of sellers

Regional: 11.0% of total | 9.8% of buyers | 12.2% of sellers

Domestic: 76.3% of total | 75.4% of buyers | 77.3% of sellers

WTI: USD 49.89 (0.00%)

Brent: USD 55.62 (+0.27%)

Natural Gas (Nymex, futures prices) USD 3.02 MMBtu, (-1.5%, October 2017 contract)

Gold: USD 1,325.2 / troy ounce (-0.31%)

TASI: 7,403.02 (+0.4%) (YTD: +2.67%)

ADX: 4,446.57 (-0.77%) (YTD: -2.2%)

DFM: 3,631.76 (-0.70%) (YTD: +2.86%)

KSE Weighted Index: 444.98 (+0.83%) (YTD: +17.07%)

QE: 8,375.18 (-0.41%) (YTD: -19.75%)

MSM: 4,997.65 (-0.10%) (YTD: -13.58%)

BB: 1,300.02 (-0.29%) (YTD: +6.52%)

Calendar

15-18 September (Friday-Monday): Sharm Travel Market, venue TBD, Sharm El Sheikh.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD, Cairo.

19 September (Tuesday): Deadline for applications for funding under the Newton Institutional Links programme.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

21 September (Thursday): Islamic New Year, national holiday.

22-24 September (Friday-Sunday): CairoComix Festival, AUC Tahrir Campus, Cairo.

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

23-25 September (Saturday-Monday): Invest In Africa Conference and Exhibitors Summit, Gala Theater Complex, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

September — The House of Representatives is due to begin discussion of the proposed bankruptcy bill.

30 September-01 October (Saturday-Sunday): Techne Summit, Bibliotheca Alexandrina, Alexandria.

03 October (Tuesday): Egypt’s Emirates NBD PMI reading released.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

06 October (Friday): Armed Forces Day, national holiday.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

15-16 October (Sunday-Monday): The Marketing Kingdom Cairo 3 conference, Dusit Thani Lakeview Hotel, Cairo.

17 October (Tuesday): The Narrative PR Summit, Four Seasons Nile Plaza, Cairo.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Future of Cities: Innovation, Spaces and Collaboration,” The French University, Cairo. Register here.

23-27 October (Monday-Friday): 29th Business and Professional Women International Congress themed “Making a Difference through Leadership and Action,” Mena House Hotel, Cairo. Register here.

06-07 November (Monday-Tuesday): Crisis Communications Conference, Four Seasons Nile Plaza Hotel, Cairo.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

19-21 November (Sunday-Tuesday): 11th Annual INJAZ Young Entrepreneurs Competition, Four Seasons Nile Plaza, Cairo.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s “World of Possibilities” Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.