- Egypt risks facing tender boycotts for a second season –Bloomberg (Speed Round)

- 4G mobile internet broadband is coming this month, CIT minister says. (What We’re Tracking Today)

- Serious governance questions raised about Telecom Egypt. (Speed Round)

- Government looking to cap prices for private healthcare providers before rolling out the Universal Healthcare Act? (Speed Round)

- Saudi Aramco may have given a big boost to our ambitions as a regional energy hub

- OCI N.V. appoints Hassan Badrawi as chief financial officer as Butt steps down. (Speed Round)

- EGX cuts circuit-breaker time to 15 minutes from previous 30. (Speed Round)

- EIB makes its first investment in an Egyptian fund since 2011. (Speed Round)

- Egypt just took a major step yesterday toward breaking ties with North Korea. (Speed Round)

- The Market Yesterday

Tuesday, 12 September 2017

From early steps to breaking ties with North Korea to the threat of a wheat tender boycott and flags about governance at Telecom Egypt, it’s a big news day for business in Egypt

TL;DR

What We’re Tracking Today

Habemus 4G mobile internet broadband: Egyptian telecom operators will begin offering high-speed 4G mobile broadband services this month, CIT Minister Yasser El Kady announced yesterday. El Kady also noted that the Ministry “would offer more wireless frequencies for sale at an unspecified later date,” Reuters reports, raising the prospect that quality of service would ultimately be okay. Sources from within the National Telecommunications Regulatory Authority (NTRA) told Al Borsa that they have completed technical tests for 4G for all the operators and that they are all good to go.

Telecom Egypt is also expected to launch its mobile network this month. The NTRA has asked the nation’s three mobile operators to conclude their interconnection rate talks with TE ahead of the rollout, Al Mal says. Orange Egypt had accused TE of demanding below-average interconnection rates. That’s the fee TE pays when one of its subscribers calls a number on a different network. Oh, and it looks like TE’s rollout may be off to a rocky start (we have more in the Speed Round).

And before the industry can begin to celebrate 4G, MNOs need to take stock of theconsequences of raising international call rates, which has led to the flight of part of their customer base to internet-based calling services such as Skype and Facebook Messenger, sources told Youm7.

Are you willing to pay your investment bank for the privilege of consuming their research? The clash between investment banks for clients’ eyeballs under MiFID II is heating up, and it could have implications for houses out here in MENA. Among its many other provisions, the European Union’s MiFID II will demand that any research house based in or associated with the EU charge is clients fair value for research starting in 2018. The cost of research had previously been bundled with trading commissions (ie: given away for free as an inducement to trade with the house in question). It seems not everyone is betting their clients will cough up the dough: Some big US banks are planning to charge, the Financial Times says, while “several banks, including BBVA, NatWest, Credit Suisse, ING and Daiwa, are preparing to provide some or all of their fixed income research for free.” If you work in the industry, the FT’s look at the jockeying — and fears — MiFID II is sparking is a must-read this morning.

Apple will reveal its new iPhones today. Leaks suggest the company is releasing three new models: the iPhone 8 and 8 Plus, as well as the all-new iPhone X, which will reportedly include a new screen, camera, wireless charging, and facial recognition software in place of a physical home button. Don’t expect to pay less than USD 1,000 for your next phone, whether it’s an iPhone or Samsung’s upcoming Galaxy Note 8, which will go on sale in just a few days’ time, Bloomberg notes. The WSJ is also playing up the USD 1,000 angle.

The columnists are kicking into overdrive in anticipation of the 10th anniversary iPhonelaunch, with entries in the mainstream press from the New York Times (“It Distracted Us. It Gave Us Uber. It Made Selfies a Thing.”), the Wall Street Journal (“The 10th Anniversary iPhone: Is Apple Trying to Do Too Much?”) and Bloomberg notes that there is a “fine line between success or failure” for the tenth anniversary iPhone. As for us iSheep? We swore off reading the tech press a couple of days ago to preserve some “surprise” about tonight’s announcements. Pathetic, we know.

How do you watch the Apple reveal? Livestream it here on Apple’s site at 7pm CLT (10am Pacific) from the Steve Jobs Theater in California.

Sabet makes global fashion power list for the fourth time running: Longtime readers know we’re fans of the business model of vertical media outlet Business of Fashion, so we’re particularly happy to note this morning that Susan Sabet, publisher and editor in chief of Pashion, the pan-Arab fashion and luxury magazine and Pashion Vienna, the first and only Arabic fashion and luxury magazine in Austria, has for the fourth year in a row made BOF’s list of the 500 most influential members of the global fashion industry. Thabet is the only Egyptian and one of 10 Arab nationals on the list, with others from the region including Lebanese fashion designers Elie Saab and Rabih Kayrouz and the UAE’s Mohamed Alabbar. The list was released on 9 September at the annual BOF500 gala in New York. You can read Thabet’s profile on BOF here.

Summer might be spiritually over (it doesn’t officially end until later this month) but weare in for another scorcher today with temperatures in Cairo peaking at an uncomfortable 37°C, according to Al Masry Al Youm.

What We’re Tracking This Week

Pharos Holding is hosting its “Egypt Banking Day” eventtomorrow (Wednesday, 13 September) to highlight developments in the banking sector domestically. The event aims to provide insight on the banking sector through one-on-one meetings, as well as to foster closer relationships and open communications between the banks and investors. Egypt Banking Day will focus on allowing more than 40 fund managers to meet and discuss the growth of and issues surrounding the local market with local bank management teams.

Away from Cairo, Sharm El Sheikh will be hosting international officials and central bank governors from 94 countries for the Alliance for Financial Inclusion’s (AFI) Global Policy Forum, which runs from 13-15 September.

Enterprise+: Last Night’s Talk Shows

A terror attack in North Sinai that left 18 security personnel dead topped the airwaves last night. We have more coverage on the story in this morning’s Speed Round.

But we before we dive into that, Hona Al Asema’s Lamees El Hadidi spoke to Palm Hills Development Chairman Yasseen Mansour about the EGP 150 bn October Oasis project the company is co-developing with the New Urban Communities Authority. Mansour said the partnership reflects the government’s acknowledgement of the role the private sector has to play in building the economy (watch, runtime 7:43).

As for the attack, Deutsche Welle correspondent Hatem El Bolok phoned in from North Sinai to tell the host that yesterday’s attack was in retaliation for the previous day’s raid on a terrorist cell in Giza. El Bolok also said the Sinai attack signals a resurgence of violence in the peninsula (watch, runtime 4:51).

Meanwhile on Kol Youm, employment was the highlight of the show for Amr Adib, who showcased a report about a Cairo governorate project geared towards supporting SMEs. The initiative brought street vendors into a gated lot in Heliopolis, where they could sell their merchandise (watch, runtime 9:57). Adib also aired pictures of laborers at the new administrative capital, which he said serve as a reminder that national projects are important because they create jobs, economic feasibility be damned (watch, runtime 7:50).

Adib also delved into the Warraq Island debacle with an old-fashioned sit-down between island residents and their elected representative. Adib said the Armed Forces Engineering Corps has formulated a development strategy for the island, as well as a plan to compensate the evicted residents (watch, runtime 59:16).

Over on Masaa DMC, Eman El Hosary discussed the latest Human Rights Watch report on Egypt with National Council for Human Rights head Hafez Abou Seada, who joined the chorus of domestic voices questioning the report’s credibility (watch, runtime 14:02).

Speed Round

“Egypt risks facing tender boycotts for a second season” after it stopped a French shipment earlier this week claiming it contains poppy seeds, Bloomberg says. The case is being referred to prosecution, even though the French embassy in Cairo confirmed the cargo met Egyptian specifications. “The new holdups are reviving concerns over which government body is responsible for inspecting cargoes in Egypt,” the news website says. Egypt had sent home two shipments of Romanian wheat last month for the same reason. We had said yesterday that some traders suggested that the agriculture quarantine body stopping shipments in order to pressure the government to allow their employees to travel for inspections at the port of origin again.

Serious governance questions raised wannabe 4G provider Telecom Egypt. Egypt’s Government Accountability Office (GAO) issued a largely negative qualified report after a limited scope audit of Telecom Egypt (TE) on both its standalone and consolidated financials. On the consolidated financials, the GAO’s qualified opinion came with a number of issues it said TE should fix before the full audit. The GAO said TE failed to provide it access and data it needed for its audits and didn’t make available its ratified AGM reports. It also said it had questions regarding how financials were consolidated as it did not receive the subsidiaries’ financials, and could thus not ascertain the numbers.

The state auditor also wants to see feasibility studies for projects TE flagged as the basis for a capital increase three years ago — and for which it appears to have used only a third of the capital it raised. GAO also flagged that it could not ascertain EGP 988 mn in revenues generated from business lines including TE’s cables and interconnection services. Also among the points raised in the consolidated financials limited scope audit was what the GAO sees as TE’s inadequate provisioning in a number of issues including major court disputes.

TE, the landline monopolist, is a publicly traded, taxpayer-owned company with international shareholders that has recently decided to increase its borrowing to enter into the cut-throat market of mobile telephony.

Is the government looking to cap prices for private healthcare providers before rolling out the Universal Healthcare Act? The Ismail government is still looking to bring in the Universal Healthcare Act next year, with Health Minister Ahmed Rady saying the bill will go before the House of Representatives when it reconvenes in October. In statements to the press yesterday, Rady drew a connection between enacting universal healthcare with a piece of legislation being shopped around by the ministry that would reportedly allow the government to set prices for the private sector. He said that the bill, which would impose caps on private hospitals and clinics based on a still undefined tier system, would also be introduced in the House this session and would pass before the Universal Healthcare Act would be rolled out. He added that the move would control “the chaotic pricing” in the private sector.

Good news for our energy hub ambitions: Saudi Aramco is considering using excess capacity at Egyptian refineries to refine Saudi crude and use Egypt as a marketing hub for refined Saudi oil products, according to Ahram Gate. The suggested plan is to ship the crude through the SUMED pipeline and use Sidi Kreir as a center for exporting refined output to Europe. Also being considered is using the storage capacity in Egypt. Both Kuwait and Iraq supply around 2 mn bbl of crude each month to be refined in Egypt. A source at EGPC said Egypt is set to receive the fifth shipment of Iraqi crude in the agreement on Wednesday.

MOVES- OCI N.V. has appointed Hassan Badrawi as Group CFO, effective 1 October, the company said in a statement. A prominent member of the business community and longtime Orascom exec, Badrawi has served as executive vice president of OCI N.V. since 2016. He succeeds Salman Butt, who served as CFO for 12 years and will “remain as an advisor to OCI to ensure a smooth transition.”

EGX cuts circuit-breaker time to 15 minutes from previous 30: The Egyptian Financial Supervisory Authority (EFSA) has approved the EGX’s decision to reduce trading halt times to 15 minutes, down from 30 minutes, as of today. Reuters’ translation of the bourse statement notes that the decision will lead to a “shortening of the time for which trading can be temporarily halted on a security during a session due to a price change … and will provide the bourse management the flexibility to increase or decrease halt times within a 15-30 minute range.” The move aims to increase market activity and attract foreign investors, the bourse says. The EGX has been suspending trading on stocks that go up or down by over 5% for 30 minutes.

IPO WATCH- DBK Pharma’s drawn out relisting will take place in 4Q2017, the company’s chairman Hamdy El Debeky tells Al Borsa on Monday. The company’s relisting on the EGX had been marred by delays after it was initially expected to take place earlier this year. The Egyptian Financial Supervisory Authority had signed off on the company’s fair value assessment of EGP 3.1 per share back in July. We have yet to hear whether the company has settled on advisers for the listing.

EIB makes its first investment in an Egyptian fund since 2011: The European Investment Bank will invest USD 15 mn in Egypt Mid-Cap, a private equity fund targeting investments in small and medium-sized companies on Sunday. “This is the first EIB operation signed in Egypt under the Risk Capital Facility for the Southern Neighbourhood Countries and the first investment in an Egyptian fund since 2011,” the EIB said. Egypt Mid-Cap, which is targeting at close at the USD 100 mn mark, has already raised USD 85 mn, including USD 70 mn from other international and local investors including the European Bank for Reconstruction and Development, the UK’s CDC group, and the Netherlands Development Finance Company.

Elsewhere, the Egypt is expected to sign three loan agreements with EIB today worth EUR 172 mn to fund wastewater treatment projects in Fayoum, Alexandria, and Kafr El Sheikh, according to a European Commission statement picked up by AMAY.

IFC committed USD 1.7 bn in funding to MENA private-sector projects in FY2016-17: The World Bank Group’s International Finance Corporation (IFC) announced yesterday (pdf) that it committed USD 1.7 bn to private-sector projects in the MENA region in the fiscal year ended on 30 June. The amount — which exceeds the previous year’s USD 1.3 bn by 30% — included an USD 11 mn contribution to Egyptian startup accelerators Flat6Labs and Algebra Ventures. “IFC’s focus was on creating new markets, supporting power and renewable energy projects, and fostering entrepreneurs, including those who run high-potential technology start-ups,” the statement reads. Those funding priorities remain unchanged for 2017-18, it added. Are you crafting an investment pitch? Make sure to hit on IFC MENA Director Mouayed Makhlouf’s priorities, which include addressing “power shortages, youth unemployment, and restricted access to finance, [which] continue to hold back economic growth.” The IFC recently pledged USD 100 mn to oil and gas projects in Egypt.

CIB partners with Orange Business Services to develop fintech ecosystem: Our friends at CIB are teaming up with Orange Business Services’ Digital Lab to develop a new fintech ecosystem geared towards increasing Egyptian entrepreneurs’ access to banking and financial services, CIB announced in a statement yesterday.

Egypt’s balance of payments report for fiscal year 2016-17 is out. Here’s what you need to know: The carry trade boomed post-float as foreign investors looked to take advantage of high interest rates here. Oil and gas investment led a surge in FDI. Exports started to pick up. Tourism did reasonably well, all things considered, particularly in the back half of state’s fiscal year. Remittances picked up nicely after the float of the EGP, the Suez Canal is underperforming, and foreign companies here managed to repatriate a tiny slice of the profits they made. Here are the details:

Egypt’s balance of payments recorded a surplus of USD 13.71 bn in FY 2016-17, of which USD 12.2 bn was registered after the EGP was floated in November, central bank data showed on Monday. Egypt’s BoP had registered a deficit of USD 2.8 bn in the previous fiscal year. The increase was driven by inflows of USD 29.0 bn into the capital and financial account, as well as the current account deficit narrowing by 21.5% y-o-y to EGP 15.6 bn for the period, compared to USD 19.8 bn a year before.

Net FDI inflow grew to USD 7.9 bn in FY2016-17 from USD 6.9 bn a year before, mostly as the result of a USD 2.3 bn increase in net inflows into the oil sector. Portfolio investments netted USD 16.0 bn, thanks mainly to increased foreign holdings in Egyptian treasuries, which stood at USD 10 bn at the end of the period.

Merchandise exports increased by 15.9% y-o-y to USD 21.7 bn in the last fiscal year, driving trade deficit down by 8.4% y-o-y to USD 35.4 bn. This improvement in export figures came on the back of the heightened competitive advantage of Egyptian exports in light of their prices following the November float.

Tourism receipts captured USD 4.4 bn in FY2016-17, an increase of 16.2% y-o-y that’s mostly owed to improved receipts from January through June 2017 after a rough season July-December 2016.

Still underperforming was the Suez Canal, which saw its earnings decline during the fiscal year to record USD 4.9 bn, compared to USD 5.1 bn a year before, due to a decline in net transiting tonnage. Remittances remained strong, registering USD 17.5 bn for the period, compared to USD 17.1 bn a year before. While foreign companies operating in Egypt managed to repatriate c. USD 3.2 bn in profits during FY2016-17.

Another Daesh attack on North Sinai leaves 18 policemen dead, seven injured: At least 18 policemen were reported killed and seven others injured when Daesh terrorists attacked a convoy in North Sinai yesterday, the Associated Press reports. “Among those killed were two police lieutenants. The wounded included a police brigadier general,” according to unnamed security officials. The US Embassy in Cairo condemned the attack, saying in a statement issued yesterday that it “stands firmly with Egypt.” Yesterday’s was the deadliest attack against police forces since July, when terrorists attacked an outpost in Sinai, leaving 23 dead. The news comes one day after police forces announced killing 10 suspected Hasm terrorists in a gun battle in Cairo.

A Cairo criminal court decision has strengthened the power of the committee tasked with seizing Ikhwani assets, Ahram Online reports. The order, which was published on the Official Gazette on Monday, grants the committee’s decisions immunity from appeals. It also brings the committee under the jurisdiction of the head of Cairo Court of Appeals. Last month, the committee froze the accounts of several media companies, including Business News — which publishes Al Borsa and Daily News Egypt — and Alef Bookstore. The committee’s latest tally also showed that it has frozen bank accounts of some 1,400 individuals.

Are you keeping an eye on this, Mr. Tillerson? Egypt took a major step yesterday toward breaking ties with North Korea when the Egyptian and South Korean defense ministers signed an agreement yesterday to “deepen the partnership between their countries on North Korea and arms development,” according to Yonhap News Agency. “Egyptian Defense Minister Sedki Sobhi stressed that his country has already severed all military ties with North Korea,” according to South Korea’s Defense Ministry. Sobhy also reportedly said that “Egypt will actively cooperate with South Korea against North Korean acts that threaten peace and stability in the international community.” Egypt also plans to open a defense attaché office in Seoul next month, Yonhap adds. Egypt’s ties to North Korea are believed to be one of the main factors behind a series of aid cuts by the US over the past month.

Egypt’s North Korea snub comes as the United Nations Security Council approved the sternest wave sanctions yet against North Korea on Monday, the Washington Post reports, after the US toned down its demands to get the Russians and Chinese onside. Some 90% of North Korean exports are sanctioned, the nation’s key textile exports are banned, and its access to oil has been curbed.

In other US-related news: Centcom chief meets El Sisi: US Central Command boss Gen. Joseph Votel, who is here for the resurrected Bright Star war games, met yesterday with President Abdel Fattah El Sisi and separately with Chief of Staff of the Armed Forces Mahmoud Hegazy, according to an Ittihadiya statement. Apart from discussing the drills, talks covered regional security and areas of coordination when it comes to combating terrorism and shared security.

Elsewhere on the international front this morning:

- “A gulf Arab political figure visited Israel last week… reinforcing Prime Minister Benjamin Netanyahu’s recent claim that relations with Arab states have never been better,” Bloomberg reports.

- BP has filed with the US Securities and Exchange Commission to raise up to USD 100 mn in an IPO of its US pipeline assets on the New York Stock Exchange, the Wall Street Journal reports.

- Oh, and Ferrari will unveil today a new model it’s dubbing Portofino, which will start at about USD 225k to attract more “average” (as in “garden-variety rich” consumers, the Wall Street Journal reports. The teaser image, below, has us drooling. See more on the Ferrari site (here and here, both pre-show) and on Car and Driver.

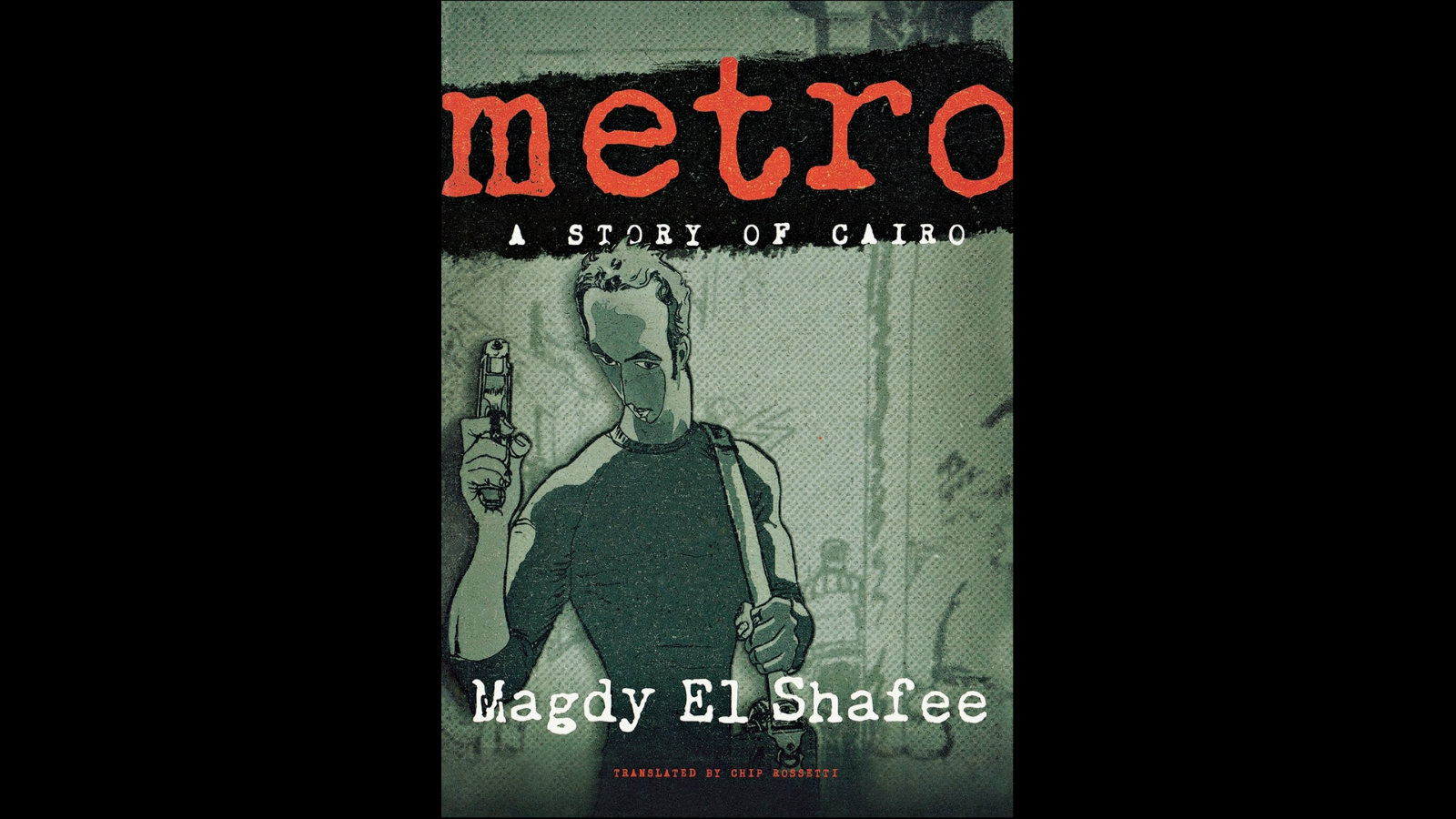

Image of the Day

Egyptian Author Magdy El Shafie’s graphic novel Metro was written, published, and banned in 2008 for telling “the story of a bank robbery and two friends in Mubarak’s corrupt, oppressive Egypt.” Graphic novels are growing in popularity in Africa, according to The Herald, which claims to have a roundup here of the best and most celebrated. You can grab an English copy of Metro here on Amazon.

Egypt in the News

A terror attack on security forces in North Sinai that killed at least 18 members of the police service and injured around a dozen others yesterday made top headlines on Egypt in the foreign press this morning. Wire services including Reuters, Xinhua, and Anadolu Agency picked up the story. Russia’s Sputnik and the Financial Times also have coverage..

EC’s misgivings on the Automotive Directive gets the attention of foreign trade journals: The Trade Ministry’s hiring of a German consultant to study the Automotive Directive is but a means to appease the European Commission (EC), Tires and Parts says. The European Commission had been heavily critical of the legislation, saying that its ultimate goal is “forced localization.” The EC had basically named it as an obstacle to trade in its Trade and Investment Barriers report (pdf). EC sources tell WardsAuto the EU exported nearly 49,000 cars worth EUR 846 mn to Egypt in 2016. “The draft law, if adopted, has the potential to significantly affect these trade flows,” an official warns.

Egypt’s latest outrages (yes, that was an actual headline on Egypt in the foreign press a few years back):

- We shouldn’t be allowed to buy arms from France and the UK under a United Nations arms treaty because we violate human rights (Amnesty International);

- Our pals in the UK (who still maintain that [redacted] flight ban) shouldn’t cooperate with us on counterterrorism, because we’re bad people (Human Rights Watch);

- We traffic in human organs (Reuters).

Other international news worth noting in brief this morning include:

- Egypt is angling at the UN to cover for the South Sudanese government in its civil war and funneling arms to the country fueling that conflict, according to the Daily Beast, citing UN reports.

- The foreign press is harping on Marisa Papen,the anatomical expressionist and culturally insensitive buffoon, and her journey from a photo shoot in her birthday suit around our heritage sites to (ever so briefly) a jail cell.

On Deadline

Could Amr Moussa’s memoirs in Al Shorouk be his swan song? Former Egyptian foreign minister and Arab League secretary general Amr Moussa’s announcement yesterday that he would not be running in the 2018 presidential race coincided with the publication of the first piece in a memoir series, which will be appearing in the pages of Al Shorouk. From his public stances against Israel in the 90s and early 2000s and his attempts to snag the presidency in 2012, Moussa’s illustrious career has earned him global recognition as (arguably) Egypt’s most celebrated foreign minister. But as he turns 81 this October, the renowned politician may just be ready to sing his swan song.

In the first episode of the series, he tells the story of his upbringing and early exposure to politics through the Wafd Party and his grandfather; his love for music and cigars from a young age; his university life; the switch from law to foreign affairs; and the quest to find his French half-brother after years of separation.

Diplomacy + Foreign Trade

Foreign Minister Sameh Shoukry met yesterday with his Japanese counterpart, Taro Kono, to discuss economic and political cooperation between the two countries, according to a ministry statement. He invited Kono to attend the opening of the Grand Egyptian Museum, the construction of which was funded largely through Japanese loans. Shoukry and Kono’s meeting came ahead of their participation in the Arab-Japanese dialogue session at the Arab League, Ahram Gate reports.

Sudan, Egypt to cooperate on mineral resources exploration: Sudan’s Minerals Ministry and Egypt’s National Research Institute of Astronomy and Geophysics (NRIAG) signed an MoU on cooperation on geophysical exploration of minerals and oil, according to Xinhua. The agreement designed a geotechnical map and could monitor the movement of the Nile River’s water, particularly during the flood season. The MoU “stipulates exchange of information between Sudan and Egypt at the regional and international level,” the head of Sudan’s Geological Research Authority said.

Hamas leader Ismail Haniyeh said that his faction is ready for conciliatory talks with the opposing Fatah following meetings with Egyptian officials, according to Haaretz.

Energy

Electricity Ministry looks JP Morgan to help finance upgrade to national grid

Electricity Minister Mohamed Shaker met with a delegation from JP Morgan Chase to discuss potential financing upgrades to the national grid, according to Al Shorouk. Shaker hinted that JP Morgan Chase was interested in the endeavor.

Basic Materials + Commodities

Pyramids looks to expand exports to the UK, Germany and Eastern Europe

Pyramids for Agro Industries is looking to increase its exports by 50% to USD 15 mn in part by tapping into the UK, Germany and Eastern Europe, according to Al Borsa. Chairman Hamdy Soliman said the firm exports to China, India, the UAE, Kuwait, Russia, Greece, and Italy.

Real Estate

PHD, NUCA sign EGP 150 bn agreement to co-develop project in 6 October

Palm Hills Developments (PHD) signed yesterday a EGP 150 bn agreement with the New Urban Communities Authority (NUCA) to co-develop the 3,000 feddan October Oasis residential and commercial project in Sixth of October, Al Mal reports. PHD expects to complete its general plan for the project and receive the necessary licensing within 18 months, according to Chairman Yasseen Mansour. Under the agreement, NUCA will take 26% of the revenues from the project.

Automotive + Transportation

NAT awards contracts for Alexandria tram project to six consortiums

The National Authority for Tunnels (NAT) awarded six consortiums contracts to design and supervise the EUR 360 mn El Raml tram renovation project in Alexandria, according to a list published by Al Borsa. The list is dominated by French and Spanish consortia. Qualified companies will now be required to present their technical and financial offers to participate in the tender for the project, which is scheduled to be issued in six months, a source from NAT tells the newspaper. The project is expected to be complete in three years.

Transport Minister looks to the private sector to help it fund electric rail project

Transport Minister Hisham Arafat urged the Tenth of Ramadan Investors Association to participate in funding the electric railway project linking Salam City with the new administrative capital during a meeting with the association yesterday, Al Borsa reports. Reports had emerged last month that the Transport Ministry is struggling to arrange its USD 500 mn share of the project’s funding. The project has received around US 1.2 bn in funding thus far, after Egypt and China signed last week a USD 739 mn funding agreement for the first phase of the project.

Nissan tops passenger car sales for 7M2017

Nissan was the top selling passenger car brand in the country for the first seven months of the year posting a market share of 24%, according to an AMIC report picked up by Al Mal. Hyundai came in second with an 18.2% market share, followed by Toyota (8.7%).

Banking + Finance

Al Ahly converting 10% of its shares in AMOC shares to GDRs

Al Ahly Capital is actually intending on converting 10% of its shares in Alexandria Mineral Oils Company (AMOC) to Global Depository Receipts (GDR) by the end of 2017, a senior official from the company tells Al Shorouk. It had previously been reported that Al Ahly will convert 39.5% of their stake in AMOC (or 10% of the company) to GDRs in early 2018.

Other Business News of Note

CAPMAS looking to use census results to release its own investment map

The Central Agency for Public Mobilization and Statistics (CAPMAS) is looking into using the results of its latest national census to create its own investment map that would be published on its website, CAPMAS head Abu Bakr El Gendy tells Al Borsa. El Gendy says that business figures have been increasingly reliant on CAPMAS to provide information and figures about various sectors, particularly as the state census bureau is in constant communication with all ministries and state bodies to keep its data up to date. Meanwhile, we have yet to hear anything on the official release of the Investment Ministry’s map of 600 projects, which was supposed to be out last month after the ministry sent a draft to the House Economics Committee.

On Your Way Out

Amr Salama’s film, “Sheikh Jackson,” has been selected as Egypt’s nominee for the Oscars’ best foreign-language film, Hollywood Reporter says. The film, which stars the like of Ahmed El Feshawy and Maged El Kedwany, is centered around a “hardline Islamic cleric” with a secret passion for the King of Pop.

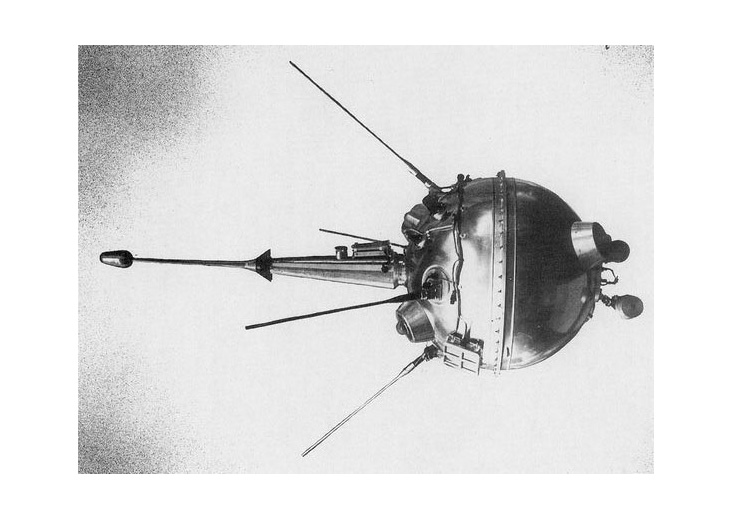

ON THIS DAY- On this day in 1959, the Soviet Union launched Luna 2, the first man-made object to land on another celestial body, after it landed on the moon the next day. Luna 2 was the second spacecraft launched as part of the Luna program and carried “equipment to measure, among other things, the magnetic fields of the Earth and the Moon and the belts of radiation surrounding the earth.” In France, a collection of prehistoric cave paintings, known as the Lascaux cave paintings, were discovered in 1940. The 15,000-17,000 year-old paintings depict “numerous types of animals, including horses, red deer, stags, bovines, felines, and what appear to be mythical creatures.” Also on this day, music icon Johnny Cash died in 2003 and the US declared war on terror in 2001. Enterprise was off on a long Eid holiday break this time last year.

The Market Yesterday

EGP / USD CBE market average: Buy 17.63 | Sell 17.73

EGP / USD at CIB: Buy 17.6 | Sell 17.7

EGP / USD at NBE: Buy 17.63 | Sell 17.73

EGX30 (Monday): 13,533 (+0.6%)

Turnover: EGP 1.1 bn (23% above the 90-day average)

EGX 30 year-to-date: +9.6%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 0.6%. CIB, the index heaviest constituent ended up 0.3%. EGX30’s top performing constituents were: Amer Group up 5.9%; Porto Group up 4.4%; and Cairo Oils & Soap up 3.4%. Yesterday’s worst performing stocks included: Egyptian Financial & Industrial Company down 1.4%; Domty down 1.0%; and Telecom Egypt down 0.5%. The market turnover was EGP 1.1 bn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +104.5 mn

Regional: Net Short | EGP -15.5 mn

Domestic: Net Short | EGP -89 mn

Retail: 70.1% of total trades | 66.6% of buyers | 73.7% of sellers

Institutions: 29.9% of total trades | 33.4% of buyers | 26.3% of sellers

Foreign: 17% of total | 21.9% of buyers | 12% of sellers

Regional: 11.4% of total | 10.7% of buyers | 12.2% of sellers

Domestic: 71.6% of total | 67.4% of buyers | 75.8% of sellers

WTI: USD 48.1 (+0.06%)

Brent: USD 53.84 (+0.11%)

Natural Gas (Nymex, futures prices) USD 2.95 MMBtu, (+0.03%, October 2017 contract)

Gold: USD 1,332.9 / troy ounce (-0.21%)

ADX: 4,438.46 (-0.16%) (YTD: -2.37%)

DFM: 3,654.04 (+0.18%) (YTD: +3.49%)

KSE Weighted Index: 442.38 (+0.41%) (YTD: +16.39%)

QE: 8,532.4 (-1.55%) (YTD: -18.25%)

MSM: 5,038.69 (-0.35%) (YTD: -12.87%)

BB: 1,310.63 (-0.46%) (YTD: +7.39%)

Calendar

13 September (Wednesday): Pharos Holding’s Egypt Banking Day event.

13 September (Wednesday): EIB MED Conference: Boosting investments in the Mediterranean Region, Cairo.

13-15 September (Wednesday-Friday): 2017 Alliance for Financial Inclusion Global Policy Forum, International Congress Center, Sharm El Sheikh.

15-18 September (Friday-Monday): Sharm Travel Market, venue TBD, Sharm El Sheikh.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD, Cairo.

19 September (Tuesday): Deadline for applications for funding under the Newton Institutional Links programme.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

21 September (Thursday): Islamic New Year, national holiday.

22-24 September (Friday-Sunday): CairoComix Festival, AUC Tahrir Campus, Cairo.

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

23-25 September (Saturday-Monday): Invest In Africa Conference and Exhibitors Summit, Gala Theater Complex, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

September — The House of Representatives is due to begin discussion of the proposed bankruptcy bill.

03 October (Tuesday): Egypt’s Emirates NBD PMI reading released.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

06 October (Friday): Armed Forces Day, national holiday.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

15-16 October (Sunday-Monday): The Marketing Kingdom Cairo 3 conference, Dusit Thani Lakeview Hotel, Cairo.

17 October (Tuesday): The Narrative PR Summit, Four Seasons Nile Plaza, Cairo.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Future of Cities: Innovation, Spaces and Collaboration,” The French University, Cairo. Register here.

23-27 October (Monday-Friday): 29th Business and Professional Women International Congress themed “Making a Difference through Leadership and Action,” Mena House Hotel, Cairo. Register here.

06-07 November (Monday-Tuesday): Crisis Communications Conference, Four Seasons Nile Plaza Hotel, Cairo.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

19-21 November (Sunday-Tuesday): 11th Annual INJAZ Young Entrepreneurs Competition, Four Seasons Nile Plaza, Cairo.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.