- The central bank has cleared its import, trade-finance FX backlog. (Speed Round)

- We are one step closer to finally making it back to the World Cup. (Speed Round)

- Tourism revenues up 170% y-o-y in first seven months of the year. (Speed Round)

- We make progress on Daba’a, and suddenly the Russians have no need to further inspect our airport security. (Speed Round)

- Egypt inks major agreements with China at the BRICS Summit, including a USD 1.2 bn funding package for an electric rail line. (Speed Round)

- Bright Star military exercises with US kick off this coming Sunday. (Speed Round)

- The road to Economic Nirvana runs through Parliament? (On Deadline)

- On behalf of Enterprise and the People of Egypt, The Hound offers fraternal greetings to the good people of the UK’s Northampton Borough Council. (Image of the Day)

- The Market Yesterday

Wednesday, 6 September 2017

Tourism receipts up, FX backlog down and we’re one step closer to the World Cup.

Plus: A special message to the Northampton Borough Council from Sandor Clegane

TL;DR

What We’re Tracking Today

If we seem a bit giddy this morning, it’s because we’re high on the run of excellentnews in the past 24 hours or so. From reports that the CBE has cleared its trade finance backlog, to the Russians signalling the tourists may come back (after confirmations on Daba’a, of course — ah, conditionality), to Mohamed Salah’s winning goal, and finally, the fruits of President Abdel Fattah El Sisi’s trip to the 2017 BRICS Summit in China — we have more for you on all of this in Speed Round, below.

On that last note, El Sisi should be in the Vietnamese capital Hanoi today and tomorrow to meet with President Tran Dai Quang and other officials. Expect a number of agreements to be signed, according to statements from Investment and International Cooperation Minister Sahar Nasr, who added that the two sides are looking to collaborate on fish farming and shipbuilding. The visit is the first by an Egyptian head of state since diplomatic ties were first established in 1963 and is “expected to boost the traditional partnership between the two countries in all fields,” says Vietnam Plus.

All this positivity has wanting to be optimistic about the Emirates NBD PMI reading forAugust, which comes out this morning not long after we hit “send” and which can be accessed here. Here’s to breaking the bad streak that has plagued the index since Morgan Freeman first learned to shave. (Note we said “wanting” to be optimistic.)

Cabinet is scheduled to discuss today the executive regulations for the law on repossession of illegally occupied land, Prime Minister Sherif Ismail told reporters yesterday, Ahram Gate reports.

Emerging markets got more private equity love this year than in any other since records were first kept in 2008, with flows of USD 22 bn, a 50% jump according to the FT, which marshals data from the Emerging Markets Private Equity Association. More than USD 15 bn of that sum was invested in “emerging Asia” (China, India and South Korea) — and just USD 896 mn of it in Southeast Asia. MENA (USD 242 mn) and Africa (USD 580 mn) were on track for their worst year since 2010 “with investment targets shifting from big-ticket oil and infrastructure [transactions] to smaller, often technology-related” investments.

Hey, investment bankers / sales traders / other friends: This is how you recognize burnout before you’re burned out. It’s a nice primer from the NYT’s Smarter Living page, and we heartily endorse its final recommendation: Laugh, particularly at work. Want something a bit chattier and personal? Go read Nerd Fitness’ “What happens when you get burned out.”

Pink chocolate is a thing. But if it ain’t brown and doesn’t taste of classic cocoa, we’re not interested. The pink stuff, called “ruby chocolate” by Swiss chocolate maker Barry Callebut, is apparently fruity and has a “ruby” hue (sure looks pink to us). The Wall Street Journal and Bloomberg have coverage. We’re not going to dignify it with a photo. It is no more “chocolate” than that white stuff is, whatever type of “cocoa” may be used in its manufacture.

Our On Your Way Out section today introduces a new feature we’re calling “On This Day.” We hope you enjoy reading it as much as we plan to enjoy researching it. Send your own submissions at least a day ahead of time to editorial@enterprise.press.

Oh, and we offer very warm greetings this morning to the hypocrites at the UK’s Northampton Borough Council in this morning’s Image of the Day.

On The Horizon

The 2017 Alliance for Financial Inclusion (AFI) Global Policy Forum is set for 13-15 September in Sharm El Sheikh, according to Al Shorouk. The Central Bank of Egypt will be welcoming central bankers and senior government officials from 94 countries and 119 international institutions, which could make the event AFI’s “ largest and most comprehensive” to date. You can check the agenda here.

The Council of State is set to start reviewing the Investment Act’s executiveregulations next week and conclude before the end of the month, sources tell Al Borsa. Implementation will then be pending Cabinet approval.

Diverging opinions within the US Fed on interest rate hikes: US Fed governors have come out with statements urging caution about the notion of raising interest rates ahead of the Fed Policy meeting on 19-20 September. Fed governors Lael Brainard and Minneapolis Fed President Neel Kashkari have expressed reservations on a rate hike, with the central issue being continued low inflation. In a speech on Tuesday, Brainard said that the weakness of price growth over the past five years was “troubling” and suggested that the Fed should be cautious about tightening further until its officials were confident inflation was back on track, according to the Financial Times. Kashkari took it a step further, attacking the whole policy of money tightening over the past 18 months, saying it was doing “real harm” to the US economy and leading to slower job and wage growth, Bloomberg reports.

Our central bank’s Monetary Policy Committee will be meeting on 28 September to decide on Egypt’s interest rates. We don’t expect rates to be lowered until the end of the year, when the CBE can point to falling inflation thanks to the high base effect of late 2017.

Egypt to sign EUR 172 mn loan agreement with European Investment Bank: The Investment and International Cooperation Ministry will sign a EUR 172 mn loan agreement with the European Investment Bank this month to fund wastewater treatment projects, sources tell Al Mal. This will be on the sidelines of the EIB MED Conference in Cairo on 13 September. The bank will also provide Egypt with a EUR 400k grant for development projects in Alexandria, sources say. You can find the event’s agenda here.

Telecom Egypt will roll out mobile services nationwide this month, sources tell Youm7,dismissing local media reports suggesting the service will be limited to certain governorates. Commercial launch is now pending regulatory approvals and TE’s numbers will start with 0155.

A UK trade delegation headed by trade envoy Sir Jeffrey Donaldson will be visiting Egypt this month to discuss investments in infrastructure.

Enterprise+: Last Night’s Talk Shows

The majority of the talking heads were still off enjoying the last days of summer, leaving us with yet another evening of miscellany.

The resumption of the Bright Star military exercises after its eight-year suspension is an indicator that US-Egypt ties are warming up significantly and returning to pre-2011 levels, Gen. Nasr Salem, a professor of strategic sciences at Nasser Military Academy, told OnLive. The fact that the exercises will resume just a few short weeks after the US decided to withhold some of its aid to Egypt is further proof that the aid is not the only barometer of relations between the two sides (watch, runtime 6:05).

Defending Dabaa: Over on Sada El Balad, Hussein El Shafie, the head of the Egyptian-Russian Foundation for Culture and Science, defended the Dabaa nuclear power plant, saying the plant’s reactors will be operational and Egypt will be selling the power produced from the plant by 2023, while the first installment of the loan is not due until 2029. The four reactors are also expected to reel in USD 264 bn for state coffers over their 60-year lifespan. El Shafie says operating the plant will require no more than 5% of the fuel that would normally be required for gas-fired power plants (watch, runtime 9:03).

And, of course, folks commented on the national team’s World Cup qualifier victory last night, none of them holding a candle to football superfan and Chief of Bombast Amr Adib, who remains on vacation.

Speed Round

Egypt has cleared its import, trade-finance FX backlog: In another milestone of the nascent economic recovery, Egypt has managed to clear its multi-bn USD FX backlog for imports and trade financing, an unnamed CBE official tells Bloomberg. Some USD 49 bn of trade-financing transactions were cleared between the EGP float and August, including USD 2.1 bn in requests made by importers and other businesses seeking to settle temporary overdrafts, the official said. Some USD 552 mn has been made available to foreign companies seeking to repatriate profits, following the CBE’s announcement that USD 1.2 bn in pending requests by multinationals have been cleared. “The figures confirm the economy is recovering and is increasingly able to generate more of its FX needs,” said Arqaam Capital’s Reham El Desoki. Increased transparency from the CBE, in line with its commitments to the IMF, would help reassure investors, she said. Net FX reserves reached their highest point ever in July, jumping to USD 36 bn, with the government expecting this number to rise this month, according to statements by Prime Minister Sherif Ismail yesterday, AMAY reports.

Tourism revenues have increased by 170% y-o-y in the first seven months of 2017, a government official told Reuters. Tourism revenues came in at USD 3.5 bn as the number of tourists increased 54% y-o-y to 4.3 mn in the year to July. The number of arrivals has already almost surpassed last year’s total tally of 4.5 mn visitors. Three-quarters of the visitors were European and 20% were Arab. The official attributes the increase in arrivals to a rise in visitor numbers from Germany and Ukraine. While we have to note that the EGP devaluation plays an important in this increase — Egypt is now ridiculously affordable in hard-currency terms — the unnamed official says the government aims to increase the number of tourists to eight mn this year, despite the continued Russian flight ban. That target is still well below the 2010 peak of 14.7 mn visitors.

And speaking of the Russians, they seem to have finally been satisfied with our airport security (took y’all long enough). Further security inspections of Cairo International Airport are not necessary, Russian Transport Minister Maksim Sokolov told TASS. But as Russian officials are not ones to leave a conversation on a high, he added that the resumption of flights between Russia and Egypt “depends on the government’s decision.” Sokolov had said earlier this week that Russian aviation security experts “positively assessed” security at the airport.

Coincidentally (pronunciation: sɑː(r)ˈkæstɪkli) the about face on our airport security came just as President El Sisi and Putin appeared to have sealed the final contracts on Dabaa (minus the actual signing) at the BRICS Summit. The Ismail cabinet confirmed yesterday that the contracts for the Dabaa nuclear power plant agreement have been finalized and approved, according to Ahram Gate. The contracts were revised by the Council of State (Maglis Al Dawla), Prime Minister Sherif Ismail said, confirming earlier reports. What remains is the contract for the nuclear power plant’s fuel, which Ismail says is in its final stages.

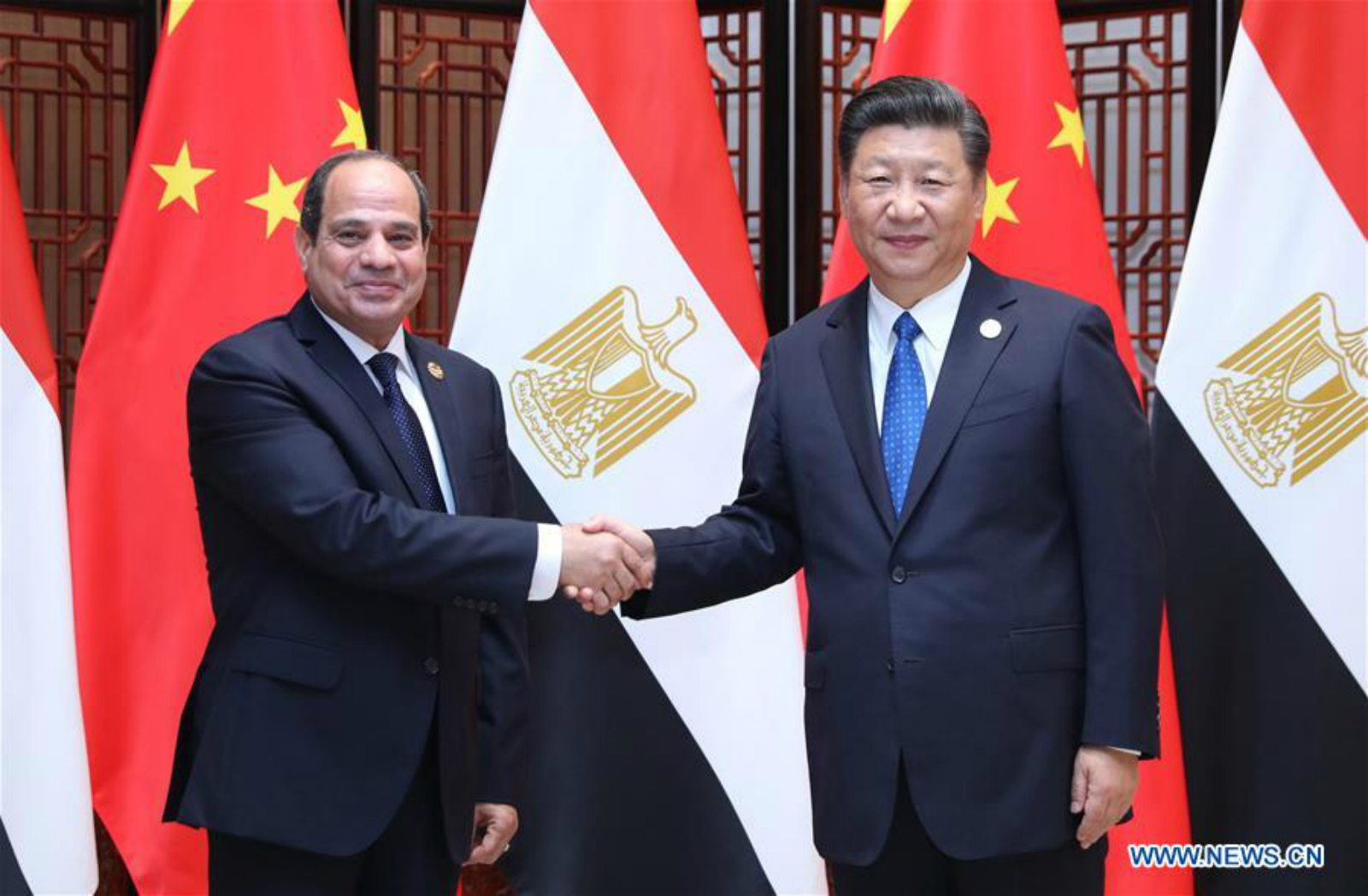

Egypt inks major agreements with China at the BRICS Summit: Egypt and China inked a number of agreements on key strategic projects on the sidelines of the 2017 BRICS Summit in Xiamen, the likes of which we haven’t seen since Chinese premier Xi Jinping’s visit to Cairo last year.

The most notable of these was for USD 739 mn in funding for the first phase of the electric railway projectlinking Salam City with the new administrative capital, according to a statement from Ittihadiya (pdf). The signing came with the announcement that the Export-Import Bank of China has approved funding the project’s second phase to the tune of USD 461 mn, bringing the total funding of the project to around USD 1.2 bn, Transport Minister Hisham Arafat said, according to Al Borsa.

This comes as the Asian Infrastructure Investment Bank (AIIB) pledged up to USD 210 mn in debt financing to fund renewable energy projects, the bank said in a statement yesterday. The funding will be used to develop 11 solar power plants with a total capacity of 490 MW, under phase two of the feed-in tariff program. The International Finance Corporation is also helping fund the project “and attracting additional lenders from the private sector and bilateral financial institutions.” The plants will be developed by TAQA Arabia Solar Energy, SP Energy, Phoenix Power 1, Winnergy, Arinna Solar Power, ARC Renewable Energy, Delta Renewable Energy, Alcazar Energy Egypt Solar 1, TBEA Enara, Enara SunEdison, and Al Subh Solar Power. “We are supporting this project because it contributes to Egypt’s renewable energy capacity, and it will help position the country as a regional energy hub, which will have economic benefits for the entire region,” says D.J. Pandian, Vice President and Chief Investment Officer of the bank. CNBC has taken note of the story, as has the UN’s Climate Action Programme.

Other MoUs signed include a USD 45 mn technical grant for the launch of a new satellite and an agreement on security cooperation, said Ittihadiya.

More agreements with China on the horizon: We are expecting to hear soon of the signing of a USD 13.5 bn contract with China Fortune Land Development Company to develop sections of the New Administrative Capital. Talks to finalize the long-awaited contract are in their final phase, government sources tell Al Borsa. The state-run Egyptian Countryside Development Company (which runs the 1.5 mn feddan land reclamation project) said it expects to sign an MoU with a Chinese partner during the expo to collaborate on growing long-staple cotton in Egypt, the newspaper reports. Trade and Industry Minister Tarek Kabil, who is sticking around in China to continue bilateral trade talks today, held a high-level meeting with the China Development Bank to discuss funding for Chinese projects in Egypt, particularly in electricity generation and transport. He is also expected to kick-off the 2017 China-Arab States Expo today, where Egypt is the guest of honor.

President Abdel Fattah El Sisi also met with a number of senior Chinese company executives yesterday, inviting them to invest, particularly in the Suez Canal Axis, according to an official statement. El Sisi’s second speech at the Summit, which he delivered yesterday (pdf), also centered on the same topic. Ittihadiya said Chinese executives are particularly interested in infrastructure, transport, and renewable energy.

El Sisi also held cooperation talks with Indian Prime Minister Narendra Modi (pdf). The two sides agreed that a joint ministerial committee will begin preparations for Modi’s planned trip to Cairo. Modi said on his Twitter he was “delighted” to meet El Sisi and discuss “further strengthening our historical ties with Egypt.” Also on the agenda was a meeting with South African President Jacob Zuma (pdf), who Sisi invited to attend the Africa 2017 forum in Sharm El Sheikh in December. The two discussed counterterrorism and a Cairo-Cape Town highway project.

Will all this China stuff finally give us clarity on an EEDC zombie project? The multipurpose platform in the Port of Alexandria has been on autopilot for so long, we figured we had our best White Walker on the job. Now comes news that the Ismail cabinet is expected to issue a final ruling on the matter in the wake of another round of talks between state officials and China Harbour, sources tell Al Mal. The project has been scraped and resurrected at least twice since the agreement was inked at the Egyptian Economic Development Conference in 2015, with one of the biggest stumbling blocks being disagreements over funding. Egypt is eyeing other partners in case the Chinese side objects to the cabinet’s decision, according to port authority chief Medhat Attia.

MOVES- New MDs appointed at Credit Agricole, HDBK, ADIB: A number of Egyptian Banks announced new appointments yesterday. Those include:

- Credit Agricole Egypt naming Pierre Finas its new managing director and Assem Fahmy its non-executive Chairman after receiving central bank approval, according to a bourse disclosure. Finas’ appointment was announced in late July. Outgoing Managing Director François-Edouard Drion will stay on the bank’s board of directors as a non-executive member representing Credit Agricole France, the disclosure notes.

- The Housing and Development Bank (HDBK) appointed Hassan Ghanem as managing director, AMAY reports. Ghanem previously served on the board of Alexbank, a position from which he recently resigned.

- ADIB Egypt is also reportedly going to pick Mohamed Aly to be its new managing director, sources tell Al Mal. The bank told the EGX it has not yet made a decision on the appointment. Aly is currently the country head and CEO of Mashreq Bank Egypt and, if appointed, would succeed the late Nevine Loutfy. ADIB Egypt had appointed in November 2016 Fareed El Belbesy as acting non-executive chairman and Zohair Hamada Ahmed Edris as acting managing director. Sources added that ADIB Egypt is waiting for the central bank to approve Aly’s appointment.

Bright Star military exercises with US kick off this coming Sunday: The joint Egypt-US Bright Star military exercise will begin in Egypt next Sunday after an eight-year hiatus, according to an Armed Forces statement. The wargames will run until 20 September and focus on counterterrorism strategies and modern-day security threats, with about 200 US troops participating, according to a US Embassy statement (pdf). The Associated Press and Chinese wire Xinhua both note the story.

Also taking place later this month: Egyptian and Russian paratroopers will partake in the Protectors of Friendship 2017 counter-terrorism drills in Russia, Al Masry Al Youm reports citing statements from the Defense Ministry.

We are one step closer to finally making it back to the World Cup: The Pharaohs did us proud last night folks, with Mohamed Salah (who else, really) scoring the sole goal of the fourth round match of the World Cup qualifiers against Uganda. And we really needed that goal too, as a loss would have tacked on another four years to our streak of failing to make it to the World Cup — a streak that has been going strong for as long as the Soviet Union has been dead. Salah has been receiving much of the credit for the victory in the foreign press, which we believe is much deserved. With some breathing room, the surest path for Egypt to reach the World Cup is to beat Congo and Nigeria. You can view highlights from the match here (runtime 13:47) or just watch the winning goal (runtime 0:30).

The Macro Picture

China could have “an important role to play in Middle Eastern diplomacy,” especially if it wants to see the Belt and Road initiative run smoothly, Euan Austin writes for the Market Moghul. “Whilst China and the Middle East are in an economic matrimony, Middle Eastern states themselves are struggling following a bitter divorce,” Austin says, pointing to Saudi Arabia and Iran’s animosity and the diplomatic rift between Qatar and its neighbors as obstacles to China’s prospects in the region.

Even though Beijing’s foreign policy has always steered clear of meddling in others’ affairs, the Chinese could take a leaf out of Russia’s book for this one, using their influence as a major economic player to “force actors in the Middle East to cooperate.” Oil, for example, could hold a lot of sway. The author notes that China is vital to the Middle East’s oil economy, pointing out — in the Saudi Arabian case specifically — that “if Beijing was to accelerate its domestic oil output decline, or buy GCC oil to store in their Strategic Petroleum Reserve, then the situation in the Middle East could improve.”

By getting more Middle Eastern countries to sign on to the Shanghai Cooperation Organisation and the Asian Infrastructure Investment Bank as well, “China could stick by their principles and step into the power vacuum to become the Middle East’s economic leader.”

Image of the Day

First, you sell our cultural heritage. Now, you want to promote your own “rich and diverse heritage”? The UK’s Northampton Borough Council, which sold an ancient Egyptian statue of the scribe Sekhemka in 2014, says it wants to promote its global cultural reputation, according to BBC. The council says it wants to “come up with an ‘action plan’ to promote the town internationally,” noting that Northampton has a “rich and diverse heritage.” The council had come under fire after selling the statue for GBP 15.67 mn to an anonymous buyer to finance an extension to the town’s museum and art gallery. Egypt fiercely opposed the sale and had launched fundraising attempts to purchase the statue at the museum’s auction.

There’s a word for people like this — one we can’t use it in a family-friendly publication such as Enterprise. But The Hound can do it for us (language advisory is in effect here, folks, if the kiddies or your boss are in earshot).

Egypt in the News

Topping coverage of Egypt in the international press this morning is our toughwin against Uganda in the fourth leg of the African qualifiers for the World Cup 2018, with the likes of Reuters and the BBC noting Mohamed Salah’s goal.

The Egyptian Commission for Rights and Freedoms says the government has started blocking its website since yesterday, according to the Associated Press. The rights group says it will “continue publishing its reports on human rights abuses on other platforms, including its Facebook page” and calls the move a “new attack” on free speech.

A group of 20 Egyptians are working to preserve what is left of the country’s Jewish heritage in hopes of “reopening a page of history that was deleted from [Egypt’s] textbooks,” The Economist says. Founded by 65-year-old Magda Haroun, Drop of Milk has plans to turn Egypt’s 12 surviving synagogues into cultural centers and historical exhibitions, in addition to protecting other Jewish sites such as a cemetery in Cairo. While Haroun is the only Jewish member of the group, many others were born to Jewish fathers who converted to Islam under Gamal Abdel Nasser’s rule.

Also worth a skim today:

- An Armenian tourist stabbed during a July knife attack on a Hurghada beach has returned home, the Armenian Foreign Ministry said, Yerevan-based Arka reports.

- The government’s efforts to integrate Syrian students in Egyptian schools are diverse and comprehensive, Ahmed Aleem writes for Al-Monitor. These include the “Education in a Safe Environment” project — an initiative put forward by the Plan International organization, in coordination with the Canadian Embassy.

- Egyptian filmmaker Amr Salama is planning a rebuttal to Clint Eastwood’s racist take on the Iraq War in “American Sniper” with a film from the Iraqi side of things, Washington Post reports.

On Deadline

A (thorough) reminder of parliament’s shortcomings: As the House of Representatives gears up for its next legislative session next month, it’s worth remembering all of its rather significant shortcomings during its last session, Tarek Abdel Aal writes in a scathing column penned for Al Shorouk. Although MPs boasted about the volume of legislation that passed over the past year, it’s important to note that many of these laws were hardly discussed despite their significance, and many were also rubber-stamped despite their being detrimental to the country. This is to say nothing of our elected representatives’ failure to actually represent their constituents, and instead invariably act in accordance with the executive branch of government. As a result, Abdel Aal says, parliament’s main role as a watchdog has been entirely eroded, allowing the government to take important decisions such as signing the IMF loan agreement and lifting fuel subsidies (twice) without waiting for MPs’ approval.

Yes, ladies and gentlemen, that’s the path to Economic Nirvana: Leave the decisionmaking up to our brave elected representatives, who will surely get around to fixing all our woes when not volunteering themselves for hazardous assignments in Amreeka.

Worth Watching

“Meet George Jetson”: Lilium, a German startup formed two years ago, is planning on bringing the Jetsons’ fully electrical flying taxi to life. The company launched a successful test flight back in April (watch, runtime: 1:53), with its two-seater plane reaching a speed of 300 km/h at traveling at a range of 300 km. The company is at the forefront of an investment bonanza in urban air travel. Lilium has raised USD 100 mn in total to develop a five-seater from the likes of Chinese social media giant Tencent, Skype founder Niklas Zennström’s Atomico, and Twitter co-founder Ev Williams’ Obvious Ventures, the FT reports. The company faces stiff competition, as German carmaker Daimler joined a consortium to invest EUR 25 mn in Volocopter, while Uber and Airbus also pouring into their own rival products.

Diplomacy + Foreign Trade

Egypt’s freetrade agreement with Mercosur countries will come into effect before year’s end, unnamed Trade and Industry Ministry officials tell Al Masry Al Youm. The agreement, which was meant to take effect in August, is expected to lower prices within various sectors, including auto manufacturing and food production, the sources added. The agreement also covers industrial supplies and auto parts, reducing some tariffs by up to 60% for a 10-year period, which worries some local manufacturers of the goods about future competitiveness.

France is sending its former ambassador to Saudi Arabia, Bertrand Besancenot, as special envoy to the region to mediate on the Qatar Smackdown. “France, which has close ties with Egypt and the United Arab Emirates while also being a major arms supplier to Qatar and a key ally of Saudi Arabia, has been relatively discreet on the crisis, largely sticking to calls for calm,” Reuters notes. Kuwait’s Emir Sheikh Sabah Al Ahmad Al Jaber has been leading the regional mediation efforts.

Even as the mediation efforts take place Qatar inaugurated the USD 7.4 bn Hamad Port, in an attempt to skirt the blockade imposed by GCC neighbors and Egypt, according to Reuters.

Well this should complicate things with Sudan: Egyptian forces reportedly shot four Sudanese nationals in the disputed area of Halayeb, according to All Africa. The forces are also said to have confiscated two vehicles in the area.

Banking + Finance

Pharos Holdings bid for NDC’s upcoming EGX listing

Pharos Holdings is reportedly bidding to manage the National Drilling Company’s (NDC) upcoming share offering on the EGX, which is necessary for the company to meet new listing regulations handed down by the Egyptian Financial Supervisory Authority (EFSA) in July, sources tell Al Mal. The new regulations — former EFSA Chairman Sherif Samy’s parting gift — stipulate that listed companies have at least 5% of their share in freefloat or face delisting. The NDC is wholly-owned by Chairman Ahmed Rashad and his family, the newspaper notes. EFSA had named 30 companies that need to comply with the amendments, including the NDC, Orange Egypt, QNB, Bank ABC, and the National Cement Company.

MNHD extends deadline to convert shares to GDRs

Madinet Nasr Housing & Development (MNHD) has extended the deadline for those wishing to convert shares of the company to global depository receipts (GDRs) to tomorrow from last Monday, the company said in a bourse filing (pdf).

Energy

Eni asks to drill its eighth well away from Zohr gas field’s first phase

Eni has requested permission from the Egyptian Natural Gas Holding Company (EGAS) to drill its eighth well in Zohr away from the first phase development area of the gas field to confirm the size of the field’s reserves, Al Shorouk reports. EGAS has yet to reach a decision, a source from the regulator said. The Oil Ministry had announced last month that seven of the eight wells were drilled and producing, and that overall work on the field was 83.5% complete as of August. Zohr is expected to be fully developed by the end of 2018.

Infrastructure

Elsewedy Electric unit signs EGP 620 mn agreement with El Mostakbal Urban Development

Elsewedy Electric’s Trading & Distribution unit signed a EGP 620 mn agreement with El Mostakbal Urban Development that will see it establish electricity and communications infrastructure for sections of the Mostakbal City project, according to an EGX filing (pdf). Work should be complete within 18 months. The Mostakbal City project is being developed near the new administrative capital. Reuters took note of the agreement.

Developers complete 6.8 km of two 13 km tunnels connecting Suez Canal banks

Developers have completed 6.8 km of the two 13 km tunnels that will run under the Suez Canal to connect its eastern and western banks, sources tell Al Mal. The tunnels, which are being constructed by Petrojet and Concorde, will be inaugurated by 30 June next year, sources add. Dutch firm Arcadis was tapped as a consultant for the designs, with German firm CDM Smith reviewing the plans and supervising the construction work, the newspaper notes. Italian firm Cmc and French firm Razel-Bec were both tapped for technical assistance.

Basic Materials + Commodities

Gov’t stepping up wheat purchases to account for drop in private sector’s

Egypt’s grain purchases have “surged” this year, “partly driven by government efforts to fill a gap left by a shrinking private sector hit by a crackdown on fraud and smuggling,” Reuters reports. Government wheat purchases increased 80% y-o-y for the first seven months and GASC says it aims to buy 7 mn tonnes of wheat in FY2017-18, up from 6 mn tonnes the last fiscal year. “The [7 mn] tonnes is the normal now as they have to fill the old fake numbers,” said Hesham Soliman, president of Medstar for Trading. Reuters notes that “wheat buying has moved away from the private sector in the aftermath of reforms brought in this year barring private dealers smuggling foreign wheat into the local harvest to collect on subsidies.”

Health + Education

Orthomed E to open new factory in Sixth of October

Medical supplier Orthomed E is expecting to open a new EGP 60 mn medical equipment factory in Sixth of October next year, according to Al Borsa. The facility will rely on locally sourced goods and will save the company nearly USD 3 mn in imported raw materials. The company exports 30% of its goods regionally and to the EU.

Education Ministry looking to use revenues from selling state land to raise teachers’ salaries

The Education Ministry is drafting a bill to increase teachers’ salaries and finance the development of public schools using funds from selling reclaimed state lands, Minister Tarek Shawki told reporters yesterday. The details of the legislation will be released “soon,” Shawki said.

On Your Way Out

The European Bank for Reconstruction and Development (EBRD), in partnership with the British Council, is launching a literature prize that will be granted to this year’s best work of literary fiction from the Bank’s countries of operations translated into English. The prize aims to “recognise and promote the extraordinary richness, depth and variety of culture and history in the countries where the Bank invests. The award aims to underscore the importance of writers in reflecting the aspirations and challenges facing people across these regions.” The first prize is worth EUR 20,000, to be split between the winning author and translator. Two runners-up and their translators will receive EUR 1,000 each. EBRD says “submission may only be made by UK-based publishers for books translated for the first time in the period between 1 October 2016 and 30 September 2017.”

ON THIS DAY- On this day in 1915, the first tank ever produced rolled off the assembly line in England, according to the History Channel. The prototype nicknamed “Little Willie,” developed in response to trench warfare of WWI, “weighed 14 tons, got stuck in trenches and crawled over rough terrain at only two miles per hour.” … Also on this day, Nobel Peace Prize winner and social activist Jane Addams was born in 1860. … Pink Floyd fans will also want to wish Roger Waters a happy birthday today. … On Enterprise, you were reading last year about yet another dismal PMI report, the ergot content in wheat problem, and Moody’s praising the prospect of implementing VAT. … In 2015, Enterprise readers were reading about the prospect of the EGP losing 20% of its value within 12 months — that was back when the USD was changing hands for EGP 7.80.

The Market Yesterday

EGP / USD CBE market average: Buy 17.61 | Sell 17.71

EGP / USD at CIB: Buy 17.6 | Sell 17.7

EGP / USD at NBE: Buy 17.63 | Sell 17.73

EGX30 (Tuesday): 13,415 (-0.0%)

Turnover: EGP 624 mn (29% below the 90-day average)

EGX 30 year-to-date: +8.7%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session almost flat. CIB, the index heaviest constituent closed down 0.4%. EGX30’s top performing constituents were: Porto Group up 5.1%; Egyptian Resorts up 3.9%, and Qalaa Holdings up 3.2%. Yesterday’s worst performing stocks were: Global Telecom down 3.0%; Sidi Kerir Petrochemicals down 0.6%; and Cairo Oils and Soap down 0.4%. The market turnover was EGP 624 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long| EGP +91.4 mn

Regional: Net Short | EGP -76.6 mn

Domestic: Net Short | EGP -14.8 mn

Retail: 60.6% of total trades | 58.3% of buyers | 62.9% of sellers

Institutions: 39.4% of total trades | 41.7% of buyers | 37.1% of sellers

Foreign: 24.8% of total | 32.2% of buyers | 17.5% of sellers

Regional: 10.0% of total | 3.8% of buyers | 16.1% of sellers

Domestic: 65.2% of total | 64.0% of buyers | 66.4% of sellers

WTI: USD 48.55 (+2.66%)

Brent: USD 53.14 (+1.53%)

Natural Gas (Nymex, futures prices) USD 2.98 MMBtu, (-3.06%, October 2017 contract)

Gold: USD 1,346.3 / troy ounce (+1.2%)

ADX: 4,478.73 (-0.06%) (YTD: -1.49%)

DFM: 3,624.15 (-0.3%) (YTD: +2.64%)

KSE Weighted Index: 432.21 (+0.38%) (YTD: +13.71%)

QE: 8,800.56 (-0.66%) (YTD: -15.68%)

MSM: 5,063.11 (+0.21%) (YTD: -12.44%)

BB: 1,302.46 (+0.28%) (YTD: +6.72%)

Calendar

September — The House of Representatives is due to begin discussion of the proposed bankruptcy bill.

06 September (Wednesday): The Emirates NBD Egypt PMI report for August released.

06-09 September (Wednesday-Saturday): 2017 China-Arab States Expo (Egypt is the Guest of Honor), Ningxia, China.

08-09 September (Friday-Saturday): Educate Me’s Conference for Egyptian Education (Mo’allem), AUC, Cairo

11 September (Monday): Japanese Foreign Minister Taro Kono is scheduled to visit Cairo to participate in the Arab-Japanese dialogue session at the Arab League, according to a Foreign Ministry statement.

13 September (Wednesday): EIB MED Conference: Boosting investments in the Mediterranean Region, Cairo.

13-15 September (Wednesday-Friday): 2017 Alliance for Financial Inclusion Global Policy Forum, International Congress Center, Sharm El Sheikh.

15-18 September (Friday-Monday): Sharm Travel Market, venue TBD, Sharm El Sheikh.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD, Cairo.

19 September (Tuesday): Deadline for applications for funding under the Newton Institutional Links programme.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

22-24 September (Friday-Sunday): CairoComix Festival, AUC Tahrir Campus, Cairo.

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

23-25 September (Saturday-Monday): Invest In Africa Conference and Exhibitors Summit, Gala Theater Complex, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

06 October (Friday): Armed Forces Day, national holiday.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

15-16 October (Sunday-Monday): The Marketing Kingdom Cairo 3 conference, Dusit Thani Lakeview Hotel, Cairo.

17 October (Tuesday): The Narrative PR Summit, Four Seasons Nile Plaza, Cairo.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Smart Cities,” The French University, Cairo. Register here.

23-27 October (Monday-Friday): 29th Business and Professional Women International Congress themed “Making a Difference through Leadership and Action,” Mena House Hotel, Cairo. Register here.

06-07 November (Monday-Tuesday): Crisis Communications Conference, Four Seasons Nile Plaza Hotel, Cairo.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.