- Surprising no one, the central bank’s Monetary Policy Committee left interest rates on Thursday. (Speed Round)

- The disappointment of the weekend: Moody’s left Egypt’s credit rating unchanged at B3. (Speed Round)

- Cabinet approves investment act executive regulations, natural gas act regs should be ready by October. (Speed Round)

- EBRD, GCF earmark USD 1 bn for renewable energy fund in Egypt. (Speed Round)

- New EGX boss Mohamed Farid speaks with AMAY on regulatory changes, attracting new listings, and international marketing of the bourse. (Speed Round)

- GB Auto CEO Raouf Ghabbour sees the car market coming back in 4Q2017. (Speed Round)

- Prosecutor General brings cases against 14 companies for alleged antitrust violations. Caught in dragnet are beIN Media Group, med distributors, poultry producers. (Speed Round)

- Ikhwan asset committee freezes accounts of publishing companies, puts them under new management. (Speed Round)

- Construction on the Grand Egyptian Museum has reached the 70% mark. (Speed Round)

- The Market Yesterday

Sunday, 20 August 2017

Interest rates were left unchanged on Thursday — and so was Moody’s rating on Egypt

TL;DR

What We’re Tracking Today

President Abdel Fattah El Sisi is scheduled to meet with his Somali counterpart, Mohamed Abdullahi Farmajo, in Cairo today, Youm7 reports. On the agenda are regional issues, led by cooperation on counter-terrorism.

CBE to receive FEB’s notes on Central Bank and Banking Act today? The Federation of Egyptian Banks should be sending its notes on the Central Bank and Banking Act to the central bank today, a source close to the matter tells Daily News Egypt. The memo will reportedly outline the thoughts of multiple bank leaders. We previously noted that there were unconfirmed reports of progress on controversial items in the bill, including term limits for managing directors, CBE representation on bank boards and a proposal that banks kick in 5% of their bottom line for an industry development fund. A draft of the proposed amendments first surfaced last month.

Eid Al Adha is but 11 mornings away (not including this morning), running Thursday, 31 August through Monday, 4 September. Count on being back at your desk on Tuesday, 5 September. We are (uncharacteristically) loving the heat with which our fair city has been blessed, probably because the humidity has been so low and the mercury has plunged each day after 3:30 or 4pm. And we still hold that Cairo is never better than during the Eid. But if you want to get away: Eight Spots for When You Need to Get Away for a Weekend from Bloomberg includes three places we’ve enjoyed very much over the years, so we credit it for having taste.

Oh, and it’s just a few short weeks until the expected unveiling of the next iPhone and the launch of iOS 11, with the latter promising to turn your iPad into a productivity machine by addressing the lingering restrictions about which business types have complained for years. Apple released this weekend six minute-long videos outlining how to use some of iOS 11’s cooler iPad features. MacStories has links to all six here.

What We’re Tracking This Week

Foreign Minister Sameh Shoukry and his Russian counterpart, Sergei Lavrov, are set to meet on Monday. We expect that the resumption of direct flights to Egypt that Russia’s industrial zone and the Dabaa nuclear power plant will be on the agenda. TASS reports that cooperation on counter-terrorism alongside the Syrian, Libyan, and Yemeni crises will also be on the agenda.

4G alert: The National Telecommunications Regulatory Authority is expected to announce the launch of commercial 4G service in the coming days, after completing service network quality checks, sources tell Al Borsa.

On The Horizon

The Italian government will brief that nation’s House and Senate foreign affairs committees on 4 September on the decision to send ambassador Giampaolo Cantini to Cairo “after cited progress in cooperation over the torture and murder of student Giulio Regeni,” ANSAmed reports. This comes as the Regeni family is reportedly planning to come to Egypt on 3 October to “continue the search for truth and justice,” according to Mada Masr which cites an interview on Italy’s Rai News last Wednesday.

Enterprise+: Last Night’s Talk Shows

The notion of extending presidential terms to six years from four was the topic of the night on Mehwar TV’s 90 Minutes — and the highlight of an otherwise exceptionally bland evening on the airwaves. Host Moataz El Demerdash had point-counterpoint with two members of the House of Representatives on the idea (watch, runtime 33:29). Their appearance came as others in the political arena are reportedly circulating a petition against the extension of presidential terms, Al Masry Al Youm reports.

The purge of welfare rolls is over: Supply Ministry spokesperson Mamdouh Ramadan told Hona El Asema substitute host Lama Gebril that the ministry has updated ration card data for 30 mn beneficiaries. He also explained that the new system will allow holders to easily replace lost cards and use their cards across governorates without restriction (watch, runtime 7:21). Ramadan’s appearance was part of a media blitz now that the welfare rolls have been purged of cheats. Al Masry Al Youm has additional covered here and here.)

Also last night, El Demerdash looked into allegations that the former heads of the Tax and Customs authorities misused up to EGP 32mn in public funds. Administrative Prosecution Authority spokesperson Mohamed Samir said the two former officials had given themselves perks and allowances between 2008-13 without Finance Ministry approval (watch, runtime 4:35). Opposition outlet Al Wafd has more on the charges against former customs chief Ahmed Farag Saudi and ex-Tax Authority chief Ahmed Refaat Abdel Ghaffar.

Speed Round

The central bank’s Monetary Policy Committee left interest rates on Thursday. The overnight deposit rate was held steady at 18.75% while the overnight lending rate was kept the same at 19.75%. Annual urban headline inflation rate increased to 33% in July on account of numerous subsidy cuts and a slight uptick in the value-added tax to 14%, something the CBE had anticipated, the central bank said in a statement (pdf) on Thursday. GDP grew to 4.9% in 4Q2016-17, demonstrating that the economy is on a more sustained growth path, the bank said.

The CBE believes that inflation is on track to meet its target of 13% by 4Q2018, but said more fiscal reforms could have an impact on inflation that would require the CBE to take an ‘adaptive approach’ to monetary policy. Economists had predicted that the CBE would leave interest rates on hold.

The disappointment of the weekend: Moody’s left Egypt’s credit rating unchanged at B3 even as the research houses (including Pharos Holding and Goldman Sachs) suggested there was room for an upgrade to B2. “Very weak government finances will continue to constrain the rating pending further clarity on the sustainability and impact of the reform programme,” the agency said on Friday. While it did acknowledge that Egypt’s external liquidity position has significantly improved over the past 12 months, “the increase in international reserves has been mainly driven by debt-creating inflows, thus also raising the level of external debt and FX denominated debt.” Fears of political instability in the run up to the May 2018 presidential elections was an apparent factor in the decision.

Prime Minister Sherif Ismail approved the executive regulations of the Investment Act at a Thursday meeting of cabinet. “Investment Minister Sahar Nasr said the law will now be passed to Egypt’s administrative court, the state council, which is expected to give a final legal review before the law enters into force,” Reuters reports. The newswire notes that “new incentives under the investment law include a 50% tax discount on investments made in underdeveloped areas, and government support for the cost of connecting utilities to new projects. Under the law, investors can recoup half of what they pay to acquire land for industrial projects if production begins within two years. It also restores private-sector free zones.” Nasr reiterated that the government is bound by 90-day period to implement the law and have the executive regulations issued, according to Al Masry Al Youm.

…Apart from signing off on the investment act’s executive regulations, the Ismail cabinet also approved a draft law to extend the mandate of the Arab Petroleum Pipelines Company (SUMED) for 27 years.

Meanwhile: Top regional executives from Pfizer, Sanofi, MSD Pharma and others met with Nasr, according to a ministry statement.

Oh, and the number of new businesses formed in July 2017 was more than 50% above the same figure in July of last year, according to an Investment Ministry statement. Of more than 1,350 new businesses incorporated last month, c. 37% were in services and 32% in manufacturing.

The executive regulations of the Natural Gas Act should be ready by early October, an EGAS official tells Al Shorouk. The source expects the new natural gas industry regulator would be set up before the end of the year — and that the first license to import gas privately should be issued in 1H2018. As we noted last week, EGAS had reportedly approved natural gas import licenses on Wednesday for the three private companies: Fleet, BB Energy, and Qalaa Holding’s TAQA Arabia.

EBRD, GCF earmark USD 1 bn for renewable energy fund in Egypt: The European Bank for Reconstruction and Development (EBRD) and the Green Climate Fund (GCF) are earmarking USD 1 bn to invest in renewable energy projects in Egypt, EBRD said in a statement. The EBRD is providing USD 352.3 mn while GCF is making a contribution of USD 154.7 mn and other sponsors co-financiers will bring the total investment to up to USD 1 bn. The EBRD says “the financing will allow independent power producers to invest in the first wave of private renewable energy production in Egypt.”

…In related commentary, Andrew Roscoe writes in MEED that Egypt “gets it right” with the second round of the feed-in-tariff agreement and has ironed out the issues from the first round. In the first round, after 40 bidders were prequalified, only nine signed power purchase agreements, with just three of them reaching financial close. “The impressive progress under second round is testament to Cairo having learned from the first round, and allaying fears of potential investors. The fact that more projects are likely to proceed in the latest round despite tariffs being reduced by more than 40 per cent from round one, shows increased confidence in Egypt to deliver on promises,” Roscoe adds.

Newly-appointed EGX boss Mohamed Farid plans to introduce short-selling, moveforward with new listings, and launch int’l roadshows: Farid outlines what he calls a three-point development strategy that aims to improve the EGX’s overall performance and boost liquidity levels in the medium-term. The EGX boss told Al Masry Al Youm in an interview yesterday that his strategy aims to first deepen the market by introducing new trading tools that would attract new investors, such as sukuk, as well as short-selling and an options market, with the latter two possible coming into effect by the end of this year.

The House of Reps will pass key changes to regulations governing private placements and the issuance of sukuks. MPs will also be asked to give the EGX flexibility to set lower listing fees to attract smaller companies. Farid had also promised a commodities exchange and a secondary bond market during his tenure. Look for much of this to be enshrined in proposed amendments to the Capital Markets Act, which as we’ve noted in the past the House should receive in October.

The EGX is currently reviewing IPO filings from six other companies not including state companies Enppi and Banque du Caire, Farid said. Negotiations are ongoing with the Investment Ministry to add more state companies to the IPO pipeline. These efforts, he added, are also accompanied by a drive to implement structural reforms and upgrade the EGX’s technical infrastructure. New directives have already been put in place to reinforce data protection mechanisms and improve overall market transparency.

The final cornerstone of the EGX’s strategy is marketing. In collaboration with the Investment Ministry, the coming year will see roadshows to the Gulf, Europe, and the US to promote investment in Egypt and speak with foreign investors about regulatory changes. Further promotional efforts will see the Egyptian Exchange joining the 57th World Federation of Exchanges general assembly and annual meeting from 6-9 September in Bangkok, Thailand. Cairo will also host the annual assembly for African exchanges on 19-21 November, Farid added.

IPO WATCH- Ibn Sina Pharma plans to list its shares on the EGX in October, company chairman Mohsen Mahgoob tells Al Borsa. Mahgoob added that the company has yet to settle on the size of the transaction. Ibn Sina CEO Omar Abdel Gawad had previously said the funds raised will be used to finance expansion domestically and internationally. The company had tapped Beltone Financial back in July to manage the listing.

GB Auto CEO Raouf Ghabbour sees the car market coming back in 4Q2017 as dealers run down their inventory. "I am very confident that during 4Q, we’ll be completely off the hook — off the hook in terms of stock liquidation will be completed, our inventory level will be back to historical low levels," Ghabbour told Reuters in an interview on Thursday. GB Auto had held back on sales to licensed distributors in 1Q2017 to allow them to clear out their inventory and adjust the price of their vehicles to reflect the new market conditions. The market is already signally this rise, as demand for passenger cars has already edged up to 70% of what it was before the EGP float, while two- and three-wheel vehicles has rebounded in June and July to pre-float levels.

Commenting on the impact of the CBE’s recent interest rate hikes, Ghabbour said: “I’m not saying I have suspended [expansion plans] but I’m working at a slower pace.” He added that the company was working on manufacturing tyres and alloy wheels. Ghabbour also sees strong growth in Iraq and Algeria.

M&A WATCH- Ukraine’s Naftogaz taps France’s Lazard to advise on potential sale of Egypt assets: The Ukraine’s Naftogaz has contracted France’s Lazard Freres to advise on the potential sale of its Egyptian assets, Naftogaz announced on Saturday, according to Ukrainian news agency Interfax. Lazard had been the only bidder for the tender, which was issued twice in March and May this year. The contract will run until the end of 2018. Youm7 incorrectly states that Naftogaz tapped Lazard to advise on new oil and gas exploration activities in Egypt.

EARNINGS WATCH- Our friends at SODIC reported a 130% y-o-y increase in consolidated net profit to EGP 340 mn in 1H2017. Revenues increased by 88% y-o-y to EGP 1.173 bn. The surge in revenues was driven by a 103% y-o-y rise in deliveries in 1H2017. “Net contracted sales for the six months stood at EGP 2 [bn], up 7% [y-o-y] and on track to achieving our target for the year of EGP 5.6 [bn],” the statement read. Managing Director Magued Sherif said, “SODIC today is reaping the benefits of our land bank expansion strategy that began in 2014, delivering solid year on year growth and record levels of revenues and earnings.” Sherif said strong sales momentum continued in the second quarter with the high-end apartment offering Sky Condos in Villette. “The launch was met with strong demand for this differentiated product,” he said. SODIC East will be launched in 2H2017 and the company will begin its revenue share development in New Heliopolis. Sherif also confirmed the company’s guidance for the year.

Prosecutor General brings cases against 14 companies for alleged antitrust violations: The Prosecutor General’s office has filed charges with the Economic Court against 14 companies including beIN Media Group for alleged anti-competitive practices. The move follows investigations by the Egyptian Competition Authority, the authority said in a statement on Thursday. BeIN is accused of monopolizing the distribution of world sports leagues, forcing consumers to pay for both Spain’s La Liga and the World Cup. Four med distributing companies — Ramco Pharm, Ibn Sina Pharma, Multipharma, and United Company for Distribution and Trade — are being accused of coordinating on reducing discounts offered to small pharmacies. Nine poultry companies accused of price-fixing have also been charged.

Egypt’s first bitcoin exchange is set to begin trading this month, Eric Knecht writes for Reuters. “We’re still waiting on the Egyptian government to set some kind of regulations … Without any laws, bitcoin is not legal money in Egypt,” said Bitcoin Egypt founder Rami Khalil. The CBE issued a disclaimer on Thursday saying that bitcoin was not a currency recognized by the Egyptian banking sector, warning that transactions will be undertaken at the user’s own peril.

Ikhwan asset committee freezes accounts of publishing companies, puts them under new management: The government committee seizing assets of accused Ikhwan members have frozen the accounts of a number of media and publishing companies owned by suspected Ikhwan members and family members of exiled cleric Youssef Al Qaradawi on Thursday, said state-owned Ahram Gate. The companies include Business News, which publishes Al Borsa and Daily News Egypt, which were brought in after the assets of Chairman Moustafa Sakr were frozen. The committee also froze the accounts of Alef Bookstore after sanctioning its parent company and owner Omar El Shineity. Akhbar Al Youm’s investment arm was appointed by the committee to manage the companies and their assets. The committee made sure to point out that the companies are all still operational.

A criminal court fined former Central Auditing Organization boss Hesham Genena EGP 60k after finding he had libeled former Justice Minister Ahmed El Zend, according to Ahram Online. The charges date back to statements Genena made in an interview in 2015 in which he spoke about corruption in the judiciary. Genena was fired from his post in March of last year.

MOVES- The Electricity Ministry appointed Amgad El Wakeel as the new head of the Nuclear Power Plants Authority, ministry spokesperson Ayman Hamza announced yesterday, Al Shorouk reports. El Wakeel was previously the executive director of the Daba’a nuclear power plant project, and is a member of the committee that negotiated the terms of the project between Egypt and Russia.

Construction on the Grand Egyptian Museum has reached the 70% mark, bringing it on track to meet its soft opening deadline next year, the museum’s general director and head supervisor Tarek Tawfik tells Daily News Egypt. Some 4,000 of more than 5,000 artifacts associated with the Tutankhamun collection have been moved there. The c. USD 1 bn project is mostly funded through the Japan International Cooperation Agency, which provided USD 760 mn, while the Egyptian government is putting up USD 300 mn.

REGIONAL- Jordanian med manufacturer Hikma signed an agreement with Takeda to expand licensing and distribution. The agreement allows Hikma to have the right to register, manufacture, market, distribute, and sell four of Takeda’s leading primary care products in 17 markets in the MENA region. “The agreement, however, does not include the Egyptian market for Alogloptin. Hikma also has exclusive rights to manufacture and commercialise Takeda’s Dexlansoprozole in its MENA markets, with the exception of Saudi Arabia, the UAE and Egypt.” Hikma had acquired Egypt’s EIMC United in early 2016 and had announced plans to open an EGP 500 mn cancer drug manufacturing plant later during the year. Separately, The FT’s Matthew Vincent says Hikma’s below forecast 1H2017 result shows the challenges for generic medication makers. CEO Said Darwazah blamed part of the drop in earnings on the EGP devaluation.

Among the handful of international stories worth a look this morning:

- Spanish authorities are on high alert while they search for the man responsible for the attack that left 13 people dead in Barcelona over the weekend, Reuters reports. Bloomberg provides round-the-clock updates here, while the Financial Times and Wall Street Journal both look at how the attacks will impact Spain’s tourism industry.

- US President Donald Trump fired chief strategist Steve Bannon over the weekend, Reuters reports. The Financial Times says Bannon has promised to open fire (metaphorically speaking) on the White House, calling the firing the “first shot in the battle for the soul of the presidency.”

- The Trump administration also lost investor Carl Icahn, who quit his advisory post, the New York Times reports.

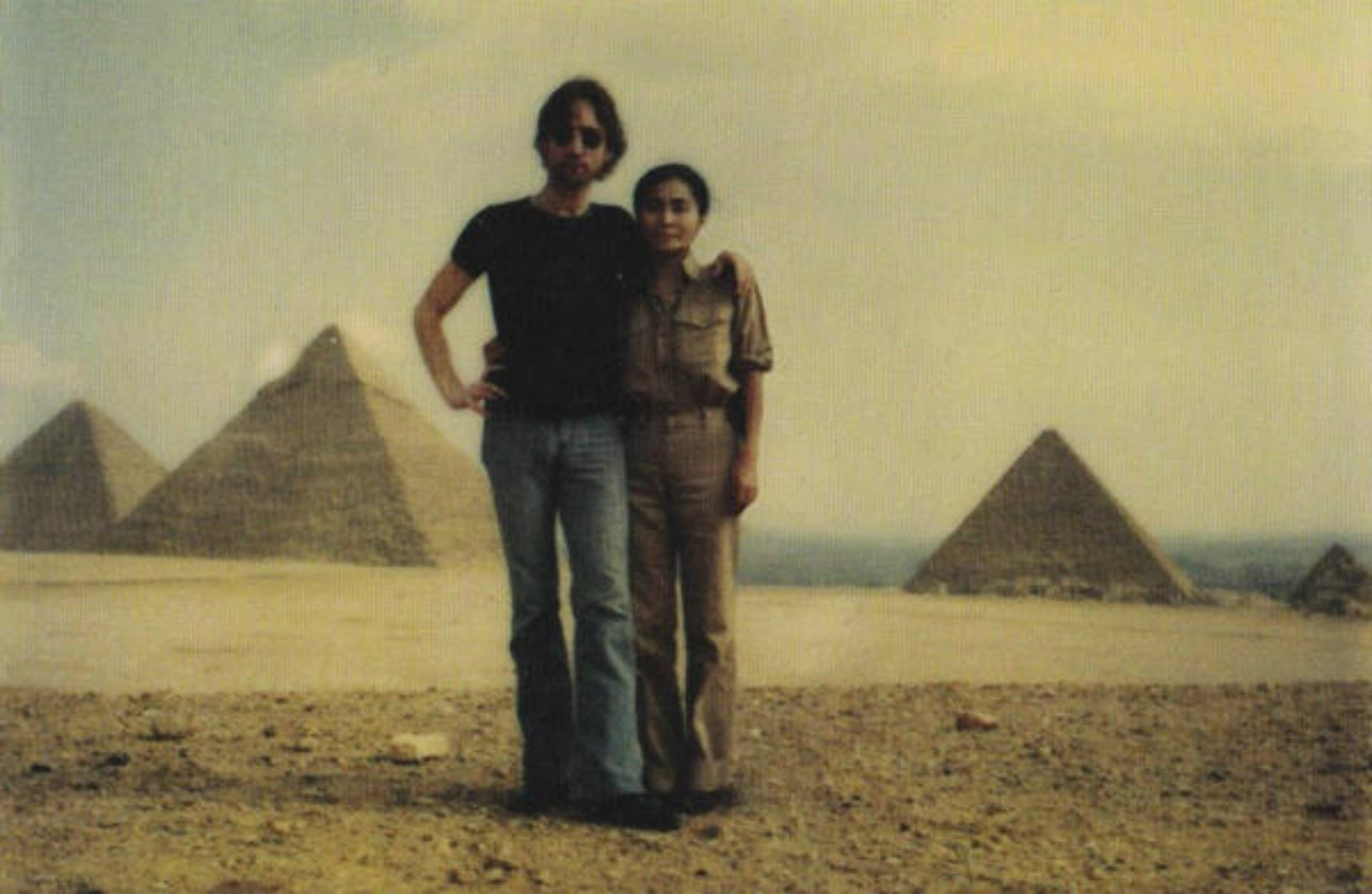

Image of the Day

Once upon a day in 1977, Beatles’ frontman John Lennon and wife Yoko Ono came to Cairo to dig for buried treasure. Wanting to break the monotony of their lives, Yoko encouraged Lennon to join an archaeological dig. “An enraptured John spent his first night exploring one of the seven wonders of the ancient world, the great Cheops Pyramid, built by Pharaoh Khufu,” claims one blog post. “He took in the nightly Giza light-show extravaganza, a gaudy commercial tourist attraction he enjoyed thoroughly.”

Egypt in the News

A suicide pact that saw a 60-year old Irish woman and her 43 year-old Egyptian husband drown this weekend was the top story on Egypt in the foreign press this morning. The two were found dead in a villa in Hurghada alongside a video recording with their final message and a playback of the incident, according to Ireland’s The Independent. The IB Times and UK’s Mirror also have the story.

Egypt could help Israel get rid of its excess gas and help it with its “gas conundrum,” according to The Economist. A better solution to avoid having gas pipelines cross either Lebanon or Syria, or having to go underwater through Cyprus to either Turkey or Italy is to send the gas through Egypt, the newspaper suggests. “Imports from Israel could help fill any gaps—and turn Egypt into a regional energy hub. Unlike Israel, it has two liquefaction terminals, which allow natural gas to be loaded onto tankers and shipped round the world.” The Economist also suggests that the newly adopted natural gas act, by allowing the gas to be pumped through private companies, could help avoid complications that arose from the Israeli arbitration case against EGAS.

UK MPs and Lords have lent their voices to calls for transparency over the UK Government’s GBP 2 mn funding of security projects in Egypt, according to the Guardian. The funding through the “conflict, stability and security fund (CSSF)” allegedly includes support for policing, the criminal justice system and the treatment of juvenile detainees. The issue is apparently raising concerns of how ministries other than Department for International Development disburse aid — which makes up 36% of the GBP 13 bn budgeted for international aid. Human rights groups have been sounding the alarm bells over how these funds might be used to fund “abuses as serious as torture.”

Also worth noting in brief today:

- Websites blocked: Egypt has reportedly blocked access to the website of media advocacy group Reporters Without Borders, with users unable to access the website since 14 August, the Associated Press reports. Qantara, an Arabic-language news and culture website operated by Germany’s Deutsche Welle, has also recently been blocked in Egypt, the website’s spokesperson tells the AP.

- Advocacy group Coptic Solidarity refutes suggestions that the government has made the situation for Copts better, according to Business Insider.

- Omar Robert Hamilton talks to The Scotsman about his new novel The City Always Wins. He says his book “just happened. I knew that it came from a place of responsibility. I knew a lot of about what had happened, I had a very detailed experience … If it can stand as a record of what happened then I will be satisfied.”

- North Africa is re-emerging as a major travel and tourism force in Africa, after a dip in the last few years, Yomi Kazeem writes in Quartz.

- The Irish government is “determined” to see the release of Ibrahim Halawa, Foreign Affairs Minister Simon Coveney says, according to Irish Times. Halawa, an Irish citizen, has marked four years of incarceration on Thursday and his trial has been adjourned “at least 30 times.”

On Deadline

Income caps on eligibility for subsidy cards are good in theory but should be revised to account for inflation and the accumulating expenses citizens need to cover, Khaled Mubarak writes for Al Ahram. By his calculations — which include basic necessities such as food, transportation, utilities, and education expenses, in addition to accounting for medical expenses — the government should raise the income cap to EGP 5,000.

Worth Watching

The new space race is being dictated by business and not government: Today’s space race has been characterized as that between entrepreneurs, such as Elon Musk and Jeff Bezos — “more by commercial gain and personal vanity,” the Financial Times’ John Thornhill says in this mini-documentary on private sector space exploration. Thornhill attempts to address some of the underlying issues with the space economy: should the role of government be totally stripped away? Can the lofty goals of the bn’aires of making it too Mars actually make economic sense? And will VCs see beyond the short-term and more achievable returns launching satellites? And of course, all of that hinges on how affordable we can make space travel (watch, runtime: 16:57).

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi discussed strengthening ties with Chadian President Idriss Deby on Thursday, according to an Ittihadiya statement (pdf). The pair discussed cooperation on both the civilian and military levels, with counter terrorism featuring strongly.

Foreign Minister Sameh Shoukry met with the foreign ministers of Jordan and Palestine this weekend to further talks on the Arab-Israeli peace process. The three ministers agreed that there’s no alternative to Israel accepting the 1967 border agreement, which would allow for the creation of a Palestinian state with East Jerusalem as its capital, a joint statement picked up by Al Shorouk says. The statement also called on the international community to bolster efforts to restart the peace talks. The international press is taking note of the story, with pickups on Russia’s Sputnik, the AFP, Kuwait News Agency, and Jordan’s Petra News Agency.

Energy

Summit Egypt set to work on solar plant in Aswan

Summit Egypt is in talks with three potential foreign partners on its USD 80 mn solar power project in Aswan, Al Borsa reports. Summit is looking to finalize plans for the 50 MW feed-in tariff project with either one or two of the yet unnamed firms by the end of the month in order to reach final close and sign its power purchase agreement before the Electricity Ministry’s October deadline expires. 30% of project financing will be sourced locally through the National Bank of Egypt and CIB, while 70% will be acquired via international lenders.

Infrastructure

Emak awarded EGP 300 mn project

Emak Contracting Company, a subsidiary of the Kuwaiti Kharafi Group, signed contracts worth EGP 300 mn for roadworks at the new administrative capital, Executive Director Samir Fathy tells Al Masry Al Youm. Emak has been working on roads at the new capital since January and is completing work worth c. EGP 70 mn.

Basic Materials + Commodities

Arab Polvara looking to export to Brazil, boost export volume to Turkey

Arab Polvara Spinning and Weaving is looking to begin exporting its products to Brazil by year’s end, Managing Director Mohamed Assal said, Al Borsa reports. The company is also hoping to bump up its export volume to Turkey.

Manufacturing

Orientals Group to launch EGP 900 mn petrochemical project in Port Said

Orientals Group is planning to launch a EGP 900 mn petrochemical manufacturing project in Port Said in cooperation with local oil companies and unnamed Arab and Western investors, Al Masry Al Youm reports. Orientals Group will command a 25% stake in the project, while the remainder will be distributed among other investors, according to Orientals Group Chairman Mohamed Farid Khamis. Feasibility and financial studies are currently in their final stages, with the group hoping to break ground on the project within four months’ time, Khamis said.

Health + Education

USAID, Education Ministry provide training for 2,300 technical school teachers

USAID and the Education Ministry provided training for technical school teachers to help link students with the workforce and private sector jobs, according to a US Embassy statement. The project, aimed at enhancing career guidance at technical schools, is called Workforce Improvement and Skills Enhancement (WISE).

Real Estate + Housing

State turns into competitor of private sector in new capital

The state has turned into a strong competitor of private companies planning to invest in the new administrative capital, offering affordably-priced housing units that the private sector can’t compete with, Al Ahly For Real Estate Development Chairman Hussein Sabbour says, according to AMAY.

Real estate developers reveal construction plans

Redcon Construction signed agreements worth a combined EGP 270 mn with SODIC and Abraj Misr to work on new developments in the Fifth Settlement area of New Cairo, Al Masry Al Youm reports. A number of other real estate developers also announced their upcoming construction plans. Those include:

- Dorra Real Estate Development Group’s EGP 2 bn project in New Cairo, which it plans to break ground on in October and complete within four years’ time;

- Emtelak Real Estate and Development’s EGP 1.7 bn hotel project in Ain Sokhna, where construction will begin early next year under a PPP agreement;

- Memaar Al Morshedy will begin constructing EGP 1 bn worth of projects at Katameya Gate and Lake Front in Six of October;

- Al Akareya began working on the first phase of its EGP 900 mn Korba Heights development and expects to complete the project by 2022.

Tourism

Ukrainian, Polish tourists up 120% in 1H2017 -Tourism Promotion Authority

The number of Ukrainian and Polish tourists visiting Egypt jumped 120% y-o-y in 1H2017, Tourism Promotion Authority head Hisham El Demery said, citing data from the Ukrainian and Polish governments. Although Ukrainian tourism to Egypt saw a significant jump in comparison to last year, arrivals from the country are currently less than half of 2010-15 levels, Al Shorouk reports. El Demery is currently on a trip to Warsaw and Kiev to discuss with tour operators how to further boost Polish and Ukrainian tourism to Egypt for the rest of summer and during the upcoming winter season.

Bulgarian government approves tourism agreement with Egypt

The Bulgarian government approved a tourism cooperation agreement with Egypt, according to Bulgaria’s Sofia News Agency. Egypt and Bulgaria will exchange information on potential tourism investments and participate in international exhibitions to promote joint tourism projects.

Automotive + Transportation

No consensus on the automotive directive risks delaying passing the act till after November

The lack of consensus within the auto industry on the automotive directive appears to be showing no signs of improvement. This is the primary reason cited by auto industry insiders who spoke to Al Shorouk as to why they doubt statements by House Industry Committee Chair Ahmed Samir that the law will pass by November. The divisions are too great, with some 10 key points of legislation still being contested, said Hassan Moustafa, head of the automotive division of the Federation of Egyptian Chambers of Commerce. Clauses on taxation and benefits down the value chain remain in heavy dispute, said the spokesperson for the Egyptian Automotive Manufacturing Association, Khaled Saad. The Trade and Industry Ministry had formed a committee back in June to break the deadlock. Alaa Elsaba, head of Elsaba Automotive, also believes that the bill likely awaits the completion of a report by a German consultancy hired by the ministry as an adviser.

Banking + Finance

Al Ahly Capital to convert 39.5% of its shares in AMOC to GDRs on LSE

Al Ahly Capital is converting 39.5% of its shares in state-owned Alexandria Mineral Oils Company (AMOC) — the equivalent of 10% of the company — to global depository receipts (GDR) on the London Stock Exchange in early 2018, Managing Director Khaled Badawi says, according to Al Mal. Al Ahly Capital is currently AMOC’s largest shareholder, owning 25.31% of the company. Other shareholders are expected to convert their shares in AMOC to GDRs, Badawi said. The roadshow for the issuance is set to begin sometime after summer. AMOC had tapped Bank of New York to run its GDR program, and chose Baker McKenzie as legal advisor.

Fawry to upgrade systems for EGP 300 mn

Fawry is looking to spend EGP 300 mn in the second half of the fiscal year to upgrade its systems, CEO Ashraf Sabry said in a story by Al Masry Al Youm. The firm is also planning on expanding its number of outlets to 100k by the end of the year from 65k currently. Fawry processes a daily 1.5 mn transactions daily, good for EGP 2.5 bn per month, of which 35% are prepaid phone cards.

Other Business News of Note

Elsewedy inks EGP 6 mn HR management program agreement with United Ofoq

Elsewedy Electric signed a EGP 6 mn agreement with United Ofoq on Saturday that will see the latter equip the company’s 30 subsidiaries with the Oracle HR management software, Al Masry Al Youm reports. Ofoq, which recently also signed agreements with Saudi’s Rajhi Group and Credit Agricole Egypt, expects to conclude its work by January 2018.

Egypt Politics + Economics

Oil and gas, commercial real estate expected to see FDI inflows

Oil and gas is likely to dominate future inflows of FDI to Egypt, “especially as these companies’ large arrears are now being cleared following the easing of [USD] liquidity,” says a Renaissance Capital report cited by CPI Financial. Besides oil and gas, “it is likely commercial real estate could see a greater impact from continued foreign interest, given Egypt’s limited mall space and low penetration of modern retail.” The report also sees potential opportunities in banking, but not in other regulated sectors as utilities and tobacco.

Operators from Alexandria’s train collision did not respond to traffic control, investigation shows

Audio recordings of the railway traffic control’s communications from the fatal train collision earlier this month indicated that train station technicians had attempted to contact the operators of the two trains several times prior to the collision, Al Masry Al Youm reports. According to the prosecution’s investigation, neither of the two operators responded over the course of 38 minutes. The crash killed 42 and injured 133 individuals.

Sports

Egypt fails to qualify for 2018 African Nations Championship finals

Egypt failed to qualify for the 2018 African Nations Championship football finals in Kenya after suffering aggregate defeats to both Morocco and Libya, BBC Sports reports.

On Your Way Out

Arab performers at the Edinburgh Fringe festival faced with visa refusals: The exciting and promising Arab performances that were expected to feature at the Edinburgh Fringe festival are being hampered by visa issues. “The first showcase of Arab arts at the Edinburgh Fringe has been forced to cancel and completely rework several productions after nearly a quarter of the visas for their performers and organisers were refused more than once,” The Guardian reports. Egyptian playwright Sara Shaarawi, who lives in Glasgow, and is the Arab Arts Focus coordinator, says “the term Arab is very loaded in the media now, so we wanted to bring something that dismantles that and celebrates our region, breaks down stereotypes and creates space for people from the region to tell their own stories, because you don’t see that very often.”

The Market Yesterday

EGP / USD CBE market average: Buy 17.71 | Sell 17.81

EGP / USD at CIB: Buy 17.72 | Sell 17.82

EGP / USD at NBE: Buy 17.72 | Sell 17.82

EGX30 (Thursday): 13,119 (-0.2%)

Turnover: EGP 668 mn (27% below the 90-day average)

EGX 30 year-to-date: +6.3%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session down 0.2%. CIB, the index heaviest constituent ended down 0.4%. EGX30’s top performing constituents were: Elsewedy Electric, up 3.3%; Telecom Egypt, up 1.4%, and Eastern, up 1.3%. Today’s worst performing stocks were: Egyptian Financial and Industrial, down 3.0%; Pioneers Holding, down 2.5%; and Arabian Cement, down 2.2%. The market turnover was EGP 668 mn, and regional investors were the sole net buyers.

Foreigners: Net Short | EGP -78.1 mn

Regional: Net Long | EGP +85.4 mn

Domestic: Net Short | EGP -7.3 mn

Retail: 52.8% of total trades | 52.9% of buyers | 52.7% of sellers

Institutions: 47.2% of total trades | 47.1% of buyers | 47.3% of sellers

Foreign: 25.7% of total | 19.9% of buyers | 31.5% of sellers

Regional: 12.7% of total | 19.1% of buyers | 6.3% of sellers

Domestic: 61.6% of total | 61.0% of buyers | 62.2% of sellers

WTI: USD 48.51 (+3.02%)

Brent: USD 52.72 (+3.31%)

Natural Gas (Nymex, futures prices) USD 2.89 MMBtu, (-1.23%, September 2017 contract)

Gold: USD 1,291.6 / troy ounce (-0.06%)

ADX: 4,492.66 (-0.10%) (YTD: -1.18%)

DFM: 3,601.2 (+0.33%) (YTD: +1.99%)

KSE Weighted Index: 424.83 (+0.15%) (YTD: +11.77%)

QE: 9,106.19 (+0.93%) (YTD: -12.75%)

MSM: 4,889.28 (-0.47%) (YTD: -15.45%)

BB: 1,298.94 (-0.92%) (YTD: +6.43%)

Calendar

31 August-04 September (Thursday-Monday): Eid Al-Adha, national holiday (TBC) as specified by the Astronomical and Geophysics Institute. The Thursday is the waqfat Arafat, with the first day of the Eid on Friday, 1 September.

September — The House of Representatives is due to begin discussion of the proposed bankruptcy bill.

06 September (Wednesday): The Emirates NBD Egypt PMI report for August released.

06-09 September (Wednesday-Saturday): 2017 China-Arab States Expo (Egypt is the Guest of Honor), Ningxia, China.

08-09 September (Friday-Saturday): Educate Me’s Conference for Egyptian Education (Mo’allem), AUC, Cairo

13 September (Wednesday): EIB MED Conference: Boosting investments in the Mediterranean Region, Cairo.

13-15 September (Wednesday-Friday) Financial Inclusion Conference in Sharm El Sheikh.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD, Cairo.

19 September (Tuesday): Deadline for applications for funding under the Newton Institutional Links programme.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

22-24 September (Friday-Sunday): CairoComix Festival, AUC Tahrir Campus, Cairo.

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

23-25 September (Saturday-Monday): Invest In Africa Conference and Exhibitors Summit, Gala Theater Complex, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

06 October (Friday): Armed Forces Day, national holiday.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Smart Cities,” The French University, Cairo. Register here.

23-27 October (Monday-Friday): 29th Business and Professional Women International Congress themed “Making a Difference through Leadership and Action,” Mena House Hotel, Cairo. Register here.

06-07 November (Monday-Tuesday): Crisis Communications Conference, Four Seasons Nile Plaza Hotel, Cairo.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.