- Inflation surges to 33% in July on subsidy reform, VAT bump — could continue to rise through September before impact is fully passed through. (Speed Round)

- Trains collide in Alexandria, killing 42. Transport Minister blames human error, signals more room for private-sector involvement in the sector. (Enterprise+: Last Night’s Talk Shows)

- As prelude to launch of short trading, the EGX, clearinghouse set to work on a systems upgrade. (Speed Round)

- Egypt has pulled in USD 40 bn worth of inbound investment and transfers from abroad since the EGP float in November. (Speed Round)

- Zulficar & Partners has been tapped as legal advisor on three M&As in the healthcare and retail sectors. (Speed Round)

- Egyptian cotton is making a comeback. (Speed Round)

- Sudan has been invited to join Bright-Star. (Speed Round)

- Careem launches services in Canal governorates. (Automotive + Transportation)

- The Market Yesterday

Sunday, 13 August 2017

Inflation surges to 33% on subsidy cuts, VAT — and could continue to rise through September on pass-through effect

TL;DR

What We’re Tracking Today

Please, God, let them lower interest rates. The central bank promised us that the 200 bps rate hike earlier this summer would be ‘temporary.’ Their first opportunity to prove this with a rate cut comes this Thursday, when its monetary policy committee is next scheduled to meet.

Where’s the market to short humankind? “It’s hard to price a potentially extinction event (at least for much of the Korean peninsula),” Timothy Ash, a senior strategist at Bluebay Asset Management, told Bloomberg in commentary on why financial markets haven’t really reacted much to the escalation in tensions between the US and North Korea. Templeton Emerging Markets Chairman Mark Mobius echoes a similar sentiment, saying “there’s nothing you can do about it — if something breaks out, we’re all finished anyway.” US President Donald Trump warned in a tweet over the weekend that, “Military solutions are now fully in place, locked and loaded, should North Korea act unwisely.” The Donald then RT’ed a tweet from US Pacific Command echoing US forces in Korea’s motto: “#USAF B-1B Lancer #bombers on Guam stand ready to fulfill USFK’s #FightTonight mission if called upon to do so.”

It seems likely to be a US-centric news week: Look for US movement this week on Chinese trade practices, where Trump will reportedly call on Monday for a probe — or not, if the ChiComs help out with North Korea. The Donald is also picking a fight with Venezuela and sending his son-in-law to launch a fresh round of Palestinian-Israeli talks.

Maybe it’s that summer is sliding to a close — or the prospect of nuclear apocalypse — but we’re feeling our age here at Enterprise. First, it was being told “Move over, millennials: Gen Z agencies are on the rise” by ad agency and media bible Digiday — with all of the precious exceptionalism with which headlines once told Gen X’ers they were ‘over’ because the millennials among us were here. Moving on up the age spectrum, we recently stumbled across this 2012 piece by author Marci Alboher (subtly pitching her book) on career changes in midlife to “make a difference.” Then there’s training for masters sports competitions in your 70s and beyond in “She Just Won 3 Gold Medals for Her Swimming. She’s Only 73.” And to cap it all off? The cutest love story we can remember reading in forever from the New York Times’ weddings column: “She’s 98. He’s 94. They Met at the Gym.”

It’s going to be a more than a few years, we suspect, before we hit the same saturation point and this becomes relevant to Egypt, but Business Insider nevertheless has a good read in, “The retail apocalypse is heading straight for Kroger, Whole Foods, and Aldi.”

Oh, and two pieces that were quite helpful to us this weekend: In a land of [redacted] internet, we got a bump from following some of the advice in Wired’s “Easy ways to make your janky wi-fi faster and better.” And Dave Zinczenko’s outfit at Best Life echoes Men’s Health during his iconic editorship with the very useful “60 Ways to Buy an Extra 60 Minutes Every Day,” which is nowhere near as clickbaity as it sounds.

What We’re Tracking This Week

President Abdel Fattah El Sisi kicks off an Africa tour starting Monday, according to Al Masry Al Youm. El Sisi will stop in Tanzania, Rwanda, Gabon, and Chad. Trade and Industry Minister Tarek Kabil put out a statement ahead of the trip saying exports to African countries in 2016 were worth USD 3.4 bn. Egypt also recently opened new trade representation in five African countries and a logistical center in Kenya, the statement adds.

Central bank governor Tarek Amer headed to the United States on Saturday as part of a foreign tour, says Ahram Gate.

The Ismail cabinet is expected to sign off on the executive regulations to the Investment Act when it meets on Wednesday. On a thematically related note: Also look for the Trade ministry’s thoughts on some 4,000 opportunities for investment nationwide, due to be released sometime in September, Al Masry Al Youm, citing unnamed ministry officials.

The Supreme Judicial Council should be nominating its picks for the National Elections Commission sometime this week.

On The Horizon

The Federation of Egyptian Banks is set to send the CBE its comments on the Central Bank and banking act in the coming few weeks.

President Abdel Fatah El Sisi is due to visit China next month. He will be meeting his Chinese counterpart Xi Jinping on the sidelines of a BRICs conference on emerging markets.

The Ismail cabinet will review theUniversal Healthcare Act by the end of the month, with an eye to moving it to the House for debate by September.

We’re all off on a five-day long weekend in observance of Eid Al-Adha. Look for the country to shut down on Thursday, 31 August and go back to work on the morning of Tuesday, 5 September (TBC).

Enterprise+: Last Night’s Talk Shows

As we expected, the Friday train collision near Alexandria that claimed the lives of at least 42 people was front and center on the airwaves last night. On Masaa DMC, Health Ministry spokesperson Khaled Mogahed updated host Eman El Hosary on the human cost of the incident, which also injured 133 (watch, runtime 4:32).

It seems likely that human error was behind the accident, Transport Minister Hisham Arafat told El Hosary. He dismissed the possibility of a technical failure, saying preliminary results point to speeding and potential negligence as being involved. The train’s equivalent of a ‘black box’ has been found, he said, so investigators should know more soon.

Work is being carried out to decrease the margin for human error by developing the railway network, Arafat also said. International firms including Thales have been working since the end of 2014 to set up an automated railway signaling system. The Cairo-Alexandria line should be complete by the end of 2018, he said (watch, runtime 15:29).

The World Bank is providing the c. EGP 2.5 bn needed for the development of the railway system, Arafat also told Ten TV’s Amr Abdel Hamid. He said as well that the sector needs private investors, whether local or foreign, to help with the upgrades. Arafat promised that safety and maintenance would be main priorities, with the aid of foreign partners (watch, runtime 15:38).

Meanwhile on Hona Al Asema, host Dina Zahra (who’s sitting in for Lamees Al Hadidi) was on about the disposition of state-owned land repossessed from squatters. The proposal currently being floated suggests that people wishing to reclaim land they had been using pay 25% of its value upfront and the balance over four installments, according to the spokesperson of the committee tasked with managing the issue, Ahmed Ayoub. The Justice Ministry found no legal obstacles, but the central bank has concerns on assurance. Another meeting will be held soon to finalize the issue (watch, runtime 7:30).

Speed Round

Inflation surges in July: The annual urban headline inflation rate increased to 33% in July from 29.8% in June with the m-o-m rate also rising to 3.2% from 0.8%, according to CAPMAS. The annual rate is the highest since the EGP float last November. Core inflation also shot up to 35.26% on an annualised basis from 31.95% in June, Reuters notes.

Blame subsidy reform, VAT: The government had implemented new fuel and electricity price increases as well as increasing the value-added tax rate to 14% from 13% Pharos Holding head of research Radwa El Swaify tells Bloomberg.

It could get worse before it gets better: El Swaify believes inflation could rise to 36% in August and September “because it takes about three months for the full pass-through of the subsidy cuts into the economy,” but that the rates should see a significant drop in the annual rates starting November because of base effects. Tap here to read Pharos’ Thursday research note on the topic (pdf), including breakdowns on contribution to inflation by category and of non-food items specifically.

Short selling coming to the EGX? The EGX and Misr for Central Clearing, Depository, and Registry (MCDR) plan on introducing upgrades to the bourse’s trading systems that herald the coming of short-selling and an options market, newly-appointed EGX boss Mohamed Farid said on Saturday, Al Borsa reports. The announcement comes more than a decade after regulations were put into place to regulate shorts, the newspaper notes. Farid agreed with MCDR Chairman Mohamed Abdel Salam yesterday that they would begin developing the new system next week, but gave no indication as to when it could be implemented. The EGX has been the belle of the ball in the region since the November float. If implemented, the measures would spark new interest in our market, so we can expect some added volumes from foreign traders. This would also propel the EGX out to the front of the regional pack in terms of trading capability.

Egypt has pulled in USD 40 bn worth of inbound investment and transfers from abroad since the EGP float in November, said CBE Deputy Governor Rami Aboul Naga on Thursday. The influx comes from receipts from exports, the carry trade, and de-USDization (either on the local market or through remittances) he added according to Bloomberg.

The country managed to attract USD 15 bn to government debt since the float, said Finance Minister Amr El Garhy on Thursday in remarks to a team from ratings agency Moody’s, which was in town for one of its periodic check-ins, according to a ministry statement. The Moody’s team also met with other senior government officials; the ratings agency affirmed Egypt’s B3 rating with a stable outlook last month.

Meanwhile, average yields on six-month and one-year T-bills fell further on Thursday, following a downward trend since the CBE announced a surge in international net reserves to USD 36.036 bn, Reuters reports. Yields on one-year bill have fallen 2.25% since reserves were announced, while six-month T-bill yields fell by 2.34%.

CBE breathing life back into FX bureaus? The central bank plans to allow up to 24 FX bureaus it had shuttered last year at the height of the FX crunch to come back to life, according to statements by CBE Sub-Governor Tarek Fayed on Saturday. The move comes as FX reserves have been shored up, reaching USD 36 bn in July. By Al Masry Al Youm’s count, up to 27 bureaus were given temporary suspensions or saw their licenses revoked for engaging in black market FX transactions.

On a related note, the National Bank of Egypt plans to open a foreign exchange company sometime this week, said the head of the new company, who explained it will operate outside banking hours and could open 50 branches nationwide.

Zulficar & Partners has been tapped as legal advisor on three M&As in the healthcare and retail sectors, senior associate Hegui Taha tells Al Mal. Zulficar & Partners will be advising on an acquisition of an unnamed Egyptian retail chain by a foreign bidder in a transaction worth EGP 700-800 mn. Taha added that the firm will also advise on acquisition of a hospital by a multinational but did not elaborate. The firm is also advising on the acquisition of a hospital with a ticket size of EGP 40-50 mn, Taha said.

MOVES- Prime Minister Sherif Ismail appointed Investment and International Cooperation Minister Sahar Nasr as chairperson of the General Authority for Investment and Free Zones (GAFI). Nasr, meanwhile, announced that Mona Zobaa was appointed as the full-time Managing Director of GAFI. Zobaa has been the acting head of GAFI since May. Ismail’s decision also included appointing Mohamed Abdel Wahab as Zobaa’s deputy. Incoming GAFI board members include Banque Misr head Mohamed El Etreby and Tarek Tawfik, who will represent the Federation of Egyptian Industries. The newly appointed board will hold office for three years.

MOVES- Orange Egypt has appointed Ashraf Halim as deputy to CEO Jean-Marc Harion, according to the company’s website. The changeup in management also includes hiring Etisalat’s head of corporate sales, Abdelfattah Faizy, as Orange’s new VP of sales. Vodafone Egypt veteran Maha Nagy joins to head communications, according to Al Mal. The moves come about a month after board-level changes that saw Bruno Mettling become chairman after the sudden resignation of Atef Helmy.

EARNINGS WATCH- Palm Hills Developments reported a 114% y-o-y increase in net profit after tax and minority interest to EGP 137 mn in 2Q2017. New sales grew by 156% y-o-y to EGP 2.5 bn in 2Q2017. The company also reported a 51% y-o-y increase in revenues to EGP 1.6 bn.

Egyptian cotton is making a comeback: Exports of Egypt’s long-staple cotton are expected to rise 19% y-o-y to 38,000 tonnes in the 2016-17 export season which ends this month, according to Reuters. This follows a six-year slump marked by lax enforcement of quality measures on cotton. After strict measures on cultivating long-staple cotton were enforced last year, production has been scaled up to about 220,000 acres this year and is expected to hit up to 500,000 acres in the next two to three years, according to cotton traders. That, coupled with a weaker EGP since the float, has led to growth in exports. Modern Nile Cotton, Egypt’s largest cotton trading company, expects to more than double its exports to about 16,000 tonnes this year from about 7,000 in the season that ends this month, chairman Ahmed El Bosaty tells Reuters.

Two trains collided on Friday in Alexandria killing 42 and injuring 133, according to the latest tally by the Health Ministry. “Human error” was likely behind the crash, Transportation Minister Hisham Arafat said on talk show appearances last night. “To avoid it, we have to develop the infrastructure,” he said. President Abdel Fattah El Sisi ordered an investigation into the accident, according to Reuters, and Chief Prosecutor Nabil Sadek has appointed a committee to take up the task. Egypt sees more than 1,000 train accidents on average each year, according to CAPMAS statistics picked up by Egyptian Streets.

Word from the House of Representative rumor mill is that Arafat might sack the head of the Egyptian National Railways, Medhat Shousha, who was called into an “urgent” meeting with the minister yesterday after a fire broke out in another train on the Cairo-Aswan road when the engine overheated, sources tell Al Mal. There were no reports of casualties from the fire. The House’s Transportation Committee has asked both Arafat and Shousha to testify on the incident.

Sudan has been invited to join Bright-Star, the premier US-Egyptian military exercises, Reuters reports. The news is doubly significant: The US has eased sanctions against Khartoum, and the invite comes at a time when Egypt and Sudan seem to be looking for footing to move forward.

The uneasy calm that prevailed through the Kenyan elections has broken with the results that President Uhuru Kenyatta was victorious, The FT reports. Opposition leader Raila Odinga has rejected the results and accuses Kenyatta of tampering even though no evidence has been presented. Most of the unrest has been in Odinga strongholds and the death toll now stands at 24, unfortunate that the last two rounds of elections have seen much higher numbers than that. More from the Guardian, CNN and the BBC.

Egypt in the News

Topping coverage of Egypt in the international press this morning are wire pickups of the Alexandria train accident that killed 42. Start with coverage from the New York Times’ Declan Walsh. The incident has brought the spotlight back to Egypt’s sordid history with train deadly accidents. Publications have also been running social media reactions and images of the train crash.

A gold appears to be behind the most recent flare up between Sudan and Egypt over the Halayeb triangle, writes Keiichi Honma for Japan News. He points to the announcement by the Sisi administration of the existence of 18 high quality gold mines as causing a sense of consternation in Khartoum over Egyptian moves to develop the area. It is unlikely that Sudan could hope to gain something from the dispute as it lacks the political capital or will to press Egypt hard enough on its claim, which it has maintained since independence in 1956, says Honma.

Also worth noting in brief this morning:

- The Guardian’s Ruth Michaelson writes about population control and [redacted] education in Egypt

- Support for former Bibliotheca Alexandrina head Ismail Serageldin from the scientific community is being noted in Science Magazine.

- Colombian battalion attached to MFO in Sinai attacked by Daesh The troops are part of the Multinational Force and Observers and has apparently had frequent run-ins with militants, according to Colombian Army Maj. Alberto José Mejía Ferrero, Colombia Focus reports.

- Wilyat Sinai is looking to recruit from Gaza and other places. Alt-right outfit Breitbart says it has a Jihadi source with the scoop.

- You don’t have the luxury of being apolitical if you’re a writer hailing from one of this region’s “wounded” democracies, “such as Turkey, Egypt or Pakistan,” novelist Eli Shafak tells the FT in an in-depth interview (paywall).

Image of the Day

A Chinese artist is working with Egyptians on a number of ceramic art projects at a joint workshop promoting Chinese art among Egyptians as a powerful means of cultural exchange, Xinhua reports. Al-Monitor also covered the workshop.

On Deadline

The most important element of the new Investment Act is also one of the least-discussed, and that’s a series of provisions that outline how bureaucrats must cut red tape that stands in the way of investment, Medhat Nafei writes for Al Borsa. Nafei calls for strict enforcement of rules that provide a system of checks and balance for regulators.

Worth Watching

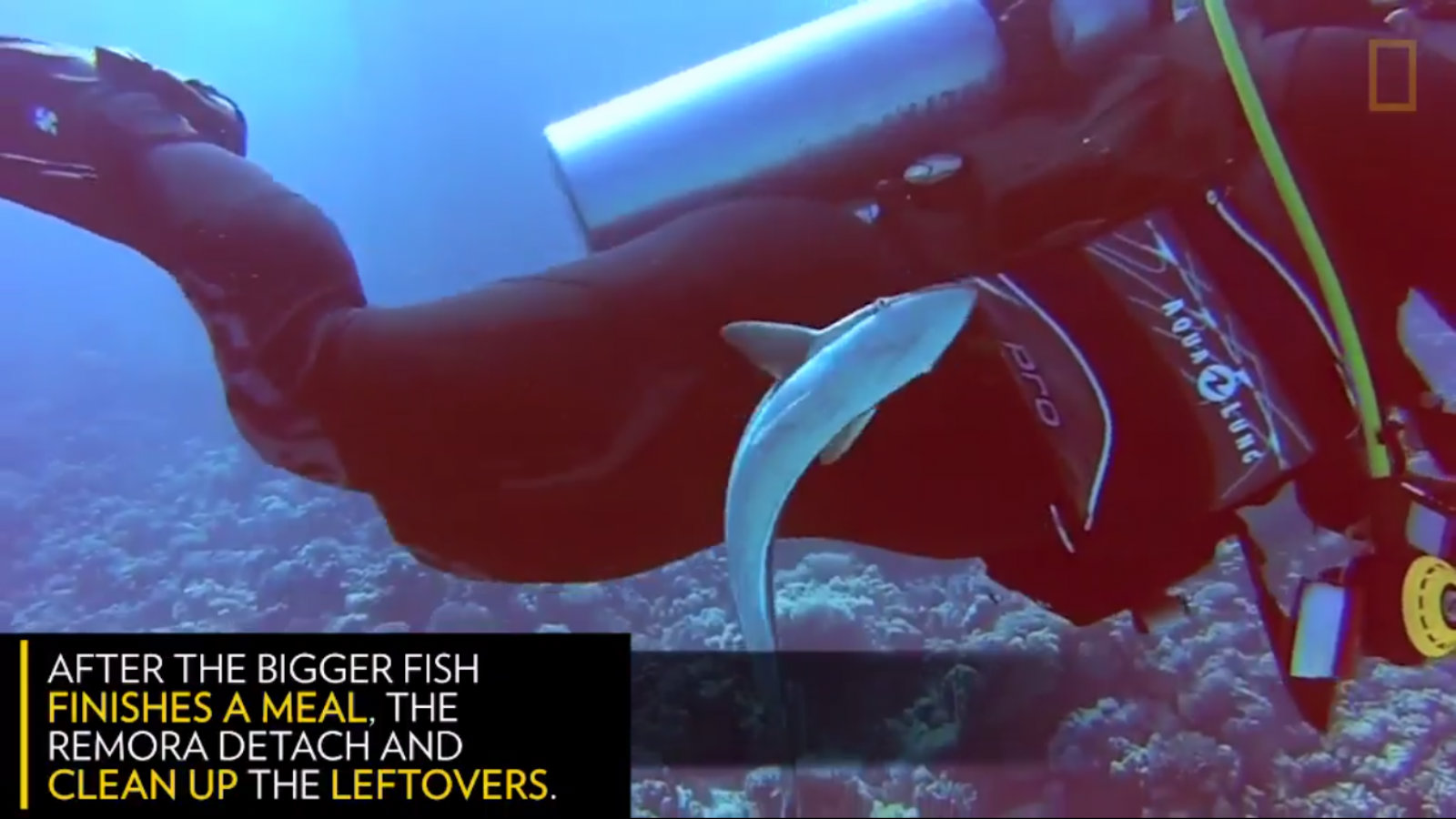

A confused suckerfish mistook this diver for a host: This scuba diver was gliding through the coral rich floors of the Red Sea just off the coast of Hurghada when a little remora fish — aka the suckerfish — mistook him for a shark and tried to hitch a ride, says National Geographic (runtime 0:36) . You can see the suckerfish, which typically uses its suction cup-equipped flat head to lock onto a body of bigger fish to travel easier and feed on its scraps, trying so persistently and failing every time to lock itself onto the diver’s wet suit. Not the sharpest tool in the shed, it’s apparently not uncommon of the suckerfish to make that mistake. But, don’t worry, they don’t bite.

Diplomacy + Foreign Trade

Trade delegation looking to smooth things out with Arab countries after produce bans: Trade and Industry Minister Tarek Kabil said Saturday that a delegation from his ministry will be visiting several Arab nations mid-September to promote exports and Egyptian products, reports Al Borsa.

It’s looking to be another busy week for Foreign Minister Sameh Shoukry, who continues to spend time on the Qatar file and who this week will make a push on Libya during a visit to Cairo by UN envoy to Libya Ghassan Salama, according to Ahram Gate. The newly appointed diplomat follows Martin Kobler in the role and is the sixth envoy for Libya since things went south there in 2011.

Italian tourist Ivan Moro is in police custody for the murder of a supervisor at a hotel construction site in Marsa Alam, reports Reuters. Moro admitted to the crime, which took place after the pair had quarrelled when the supervisor tried to stop Moro from entering a restricted area, the Tourism Ministry said.

Energy

AMOC waiting for EGPC’s approval to begin condensate imports from Dana Gas

The Alexandria Mineral Oils Company (AMOC) is waiting to receive for the EGPC’s green light to begin import a monthly 1,300-1,500 barrels of condensates from the UAE’s Dana Gas, AMOC CEO Amr Mostafa tells AMAY. AMOC expects to sign the final contracts with Dana this month.

Infrastructure

USD 400 mn container terminal in Safaga port

The Red Sea Governorate plans to establish a USD 400 mn container terminal in Safaga port, governor Ahmed Abdullah said, according to Al Mal. The 500k sqm terminal, which the Red Sea Port Authority will help build, will be used to supply projects in the Golden Triangle area. It is unclear whether this is will be part of or related to the USD 250 mn multi-purpose station, the tender for which was meant to be reissued, the Red Sea Port Authority had said in May.

Tianjin looks to establish waste recycling plant in Menoufia

A delegation from China’s Tianjin Waste Recycling Company discussed opening a waste recycling plant in Menoufia with Investment Minister Sahar Nasr on Saturday, according to a ministry statement. Company GM Hoover Kay told Nasr that the company had already studied the project and was keen on investing.

Basic Materials + Commodities

Saudi Arabia imposes five conditions on Egyptian vegetables and fruits exports

Saudi Arabia set five conditions for imports of Egyptian strawberries to resume, including health certificates for every shipment declaring it free of hepatitis C and an analysis of pesticides residues, Al Mal reports. Egypt will also have to list companies subject to government control and send periodical reports about exporting companies’ farming practices, including its irrigation techniques and use of fertilizers. Saudi Arabia also wants tighter control over pesticide usage. The conditions will apply to all fruits and vegetables shipments starting September, including currently-banned strawberries and peppers. The Agriculture Ministry had issued a new set of regulations to control agricultural exports.

Western Australia see Egypt as a potential market for seed potato, earmark AUD 100k to set up trade relations

Western Australian potato producers are viewing seed potato exports to Egypt as a new opportunity, ABC News reports. The Potato Growers Association of Western Australia (PGAWA) was set to receive AUD 60k in state government funding and AUD 40k provided from the Association to “build up trade relations” with Egypt. PGAWA’s CEO says Western Australian is well-equipped to supply Egypt “because of the alternate seasons, and lack of supply during the off-season,” but that it would not be feasible for eating potatoes because of competition from Europe. The project is scheduled to end in September next year.”

Beheira governor orders establishment of agriculture commodities exchange

Beheira Governor Nadia Abdu ordered the establishing an agricultural commodities exchange on Thursday, Al Borsa reports. The exchange will help stabilize prices for key crops by breaking suppliers’ hold on them, Abdu said. President Abdel Fattah El Sisi had ordered the establishment of the exchange as part of his strategy to spur development in the Western regions of Egypt.

Bangladesh looking to replace Indian onions for Egypt’s

Bangladesh may be looking to replace Indian onion imports with those from Egypt as a result of flash floods doubling prices, bdnews24.com reports. Bangladesh used to buy an annual 400k tonnes of onions from India, but flash floods have hit India as well, said Bangladesh’s Commerce Minister Tofail Ahmed. Egypt’s onion exports to Bangladesh are also 30% cheaper than India’s, he added.

Health + Education

Al Marasem inks JV MoU with consortium of doctors to establish medical complex in New Cairo

Saudi Binladin Group subsidiary Al Marasem International for Development signed an MoU on Saturday with a consortium of doctors to establish a joint venture to oversee the completion of a new medical complex in New Cairo, Al Borsa reports. Al Marasem will hold a controlling stake of 50% in the new company, with the other 50% distributed evenly between the five other partners, who are expected to invest around EGP 540-580 mn in the venture, sources said. Liquidity shortages had reportedly stalled the project.

Automotive + Transportation

Careem launches services in Canal governorates

Ride-hailing app Careem launched services in Suez, Port Said, and Ismailia, under a campaign dubbed “Careem in Canal,” the company said in a press release. This expands Careem’s coverage network to 14 cities and c. 50,000 drivers.

Banking + Finance

Foreign investors seeking exposure to Egypt could use ETFs or ADRs

Foreign investors seeking exposure to the Egyptian market could invest in “ETFs that offer diversification through investment in a single US security,” Ridhi Khaitan writes for Frontera. While those looking for direct exposure can “consider ADRs of Egyptian companies.” The most popular ETF for US investors is the Market Vectors Egypt Index ETF with AUM of USD 57 mn, but Khaitan also mentions the WisdomTree Middle East Dividend Fund and the VanEck Vectors Africa Index ETF. ADRs available for investors include CIB, GB Auto, and Lecico.

Electricity Ministry receives EGP 1.3 bn tranche of EGP 37.4 bn loan

The Egyptian Electricity Transmission Company received a EGP 1.3 bn tranche of the EGP 37.4 bn facility it signed with a banking consortium last month to upgrade the national grid, Al Mal reports. More tranches will be disbursed in the coming days. The National Bank of Egypt and Banque Misr are set to provide EGP 12.2 bn each, while Qatar National Bank will chip in EGP 8 bn. The Arab African International Bank will contribute EGP 3 bn, while CIB will provide EGP 2 bn.

EFSA approves MTO by Arafat Sakr to acquire ICON

The Egyptian Financial Supervisory Authority (EFSA) has approved a mandatory tender offer by Arafat Sakr to acquire the remaining 46.5% shares of Industrial Engineering Company for Construction and Development (ICON), according to a bourse filing. As we noted last month, Sakr serves as ICON’s chairman.

Raya’s Aman to expand with 50 branches

Raya Holding subsidiary Aman is set to expand into the Delta and Canal governorates by opening 50 new branches, according to Al Masry Al Youm. The financial services arm is looking to invest EGP 20 mn in its new branches, through which it will offer bill payment services.

Other Business News of Note

Egyptian startup helps photographers manage content and increase exposure

Egyptian startup Mosawer launched what is claims to be the region’s first platform for photographers and videographers to manage workflow and increase their exposure, Tom Jackson reviews for Disrupt Africa. Mosawer allows photographers to “showcase their work, add rates and packages, manage their schedules, accept bookings and receive payments.” CEO Mohab El Mandouh says “our platform is open for photographers and clients from all over the MENA region, having said that we’re currently focusing our marketing efforts on Egypt until we secure an investment that will allow us to further grow regionally.”

Moukhtar Ibrahim snag Omani project

The Societe Egyptienne D’entreprises (Moukhtar Ibrahim), won a EGP 10 bn contract for the development of a water station in Oman, Al Masry Al Youm reports. Petrojet and Hassan Allam Construction are partners on the project, which should take around three and a half years to complete, with a 30% stake each. Work is expected to begin in the coming three months.

Egypt Politics + Economics

Council of State judge Yehia El Dakroury appeals presidential decision to bypass him

Egyptian Council of State (Maglis El Dawla) judge Yehia El Dakroury has filed a formal appeal against the presidential decree that bypassed him as head of the Maglis, Al Mal reports. President Abdel Fattah El Sisi had appointed Ahmed Aboul Azm as head of the judicial body, despite El Dakroury being the only nominee for the post. The judges had presented one instead of three nominees for the job to protest the controversial Judicial Authorities Act.

Another MP looks to extend the presidential term

Parliament member Ismail Nasr El Din plans to make a formal proposal to the House of Representatives to extend the presidential term to six years from four currently, Al Shorouk reports. The MP said he would be proposing several other constitutional amendments as well. The idea is already being met with resistance. Ex-foreign minister Amr Moussa, who sat on the committee that drafted the 2014 constitution rejected the proposal, saying that “renewed talk about amending the constitution in a presidential election year raises questions about the maturity of the political thought behind it,” according to the AP.

Two economic zones in Luxor

Investment Minister Sahar Nasr is looking to set up two investment zones in Luxor, according to a Saturday statement. The first would cater to large-scale investments, while the second would be geared towards small and medium businesses.

On Your Way Out

Forbes Middle East compiled its first ever list of the Top 100 Arab Celebrities, “looking at the popularity and influence of actors, singers and TV personalities from across the region.” Amr Diab tops the list, followed by Nancy Ajram. 46 Egyptians in total made the list.

An Egyptian show set to feature at the Edinburgh Fringe Festival is “theatrically sophisticated and potent” with “sensitive and clever crafting,” The Guardian’s Lyn Gardner reviews. The show is about the story of Kashmiry, “a young Egyptian man who not only had to journey across the border controls erected around gender but also the borders of countries. This is a journey from female to male, and from Egypt to Glasgow. It is performed on stage not just by Kashmiry but also by Neshla Caplan as the female element of Adam.” Gardner writes: “This duality works brilliantly, showing up the absurdity of the gender binary model and making manifest the male in the female and the female in the male. The two become constantly shifting overlaying images of each other as Adam is caught in a system where he cannot access help from a gender clinic until he is given asylum and cannot get asylum until he can prove that he really is transgender. His desperation is depicted in violent detail, but essentially this is a happy-ever-after fairytale.” The show is also highlighted in The Telegraph and The Scotsman.

The Market Yesterday

EGP / USD CBE market average: Buy 17.74 | Sell 17.84

EGP / USD at CIB: Buy 17.75 | Sell 17.85

EGP / USD at NBE: Buy 17.75 | Sell 17.85

EGX30 (Thursday): 13,462 (-0.9%)

Turnover: EGP 695 mn (25% below the 90-day average)

EGX 30 year-to-date: +9.1%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session down 0.9%. CIB, the index heaviest constituent closed down 1.4%. EGX30’s top performing constituents were: Abu Dhabi Islamic Bank up 4.7%; Telecom Egypt up 1.5%; and Sidi Kerir Petrochemicals up 0.4%. Today’s worst performing stocks were: Egyptian Financial and Industrial down 2.6%; Madinet Nasr Housing down 1.7%; and Cairo Oils and Soap down 1.5%. The market turnover was EGP 695 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP – 17 mn

Regional: Net Short | EGP – 2 mn

Domestic: Net Long | EGP + 19 mn

Retail: 72.3% of total trades | 76.7% of buyers | 67.8% of sellers

Institutions: 27.7% of total trades | 23.3% of buyers | 32.2% of sellers

Foreign: 12.2% of total | 10.9% of buyers | 13.4% of sellers

Regional: 8.1% of total | 8.0% of buyers | 8.2% of sellers

Domestic: 79.7% of total | 81.1% of buyers | 78.4% of sellers

WTI: USD 48.82 (+0.47%)

Brent: USD 52.1 (0.39%)

Natural Gas (Nymex, futures prices) USD 2.98 MMBtu, (-0.07%, September 2017 contract)

Gold: USD 1,294 / troy ounce (+0.3%)

TASI: 7,164.64 (+0.16%) (YTD: -0.64%)

ADX: 4,550.93 (-0.12%) (YTD: +0.1%)

DFM: 3,647.33 (+0.12%) (YTD: +3.3%)

KSE Weighted Index: 419.95 (+0.48%) (YTD: +10.49%)

QE: 9,242.82 (-0.69%) (YTD: -11.44%)

MSM: 4,991.51 (-0.06%) (YTD: -13.68%)

BB: 1,324.28 (+0.06%) (YTD: +8.51%)

Calendar

17 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

31 August-04 September (Thursday-Monday): Eid Al-Adha, national holiday (TBC) as specified by the Astronomical and Geophysics Institute. The Thursday is the waqfat Arafat, with the first day of the Eid on Friday, 1 September.

September — The House of Representatives is due to begin discussion of the proposed bankruptcy bill.

06 September (Wednesday): The Emirates NBD Egypt PMI report for August released.

06-09 September (Wednesday-Saturday): 2017 China-Arab States Expo (Egypt is the Guest of Honor), Ningxia, China.

13 September (Wednesday): EIB MED Conference: Boosting investments in the Mediterranean Region, Cairo.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD, Cairo.

19 September (Tuesday): Deadline for applications for funding under the Newton Institutional Links programme.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

22-24 September (Friday-Sunday): CairoComix Festival, AUC Tahrir Campus, Cairo.

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

23-25 September (Saturday-Monday): Invest In Africa Conference and Exhibitors Summit, Gala Theater Complex, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

06 October (Friday): Armed Forces Day, national holiday.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Smart Cities,” The French University, Cairo. Register here.

23-27 October (Monday-Friday): 29th Business and Professional Women International Congress themed “Making a Difference through Leadership and Action,” Mena House Hotel, Cairo. Register here.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.