- Egyptian American Enterprise Fund looks at acquisition of maker of ophthalmic products –report. (Speed Round)

- Archer Daniels Midland reportedly has another acquisition play in the pipeline once the NCMP bidding war is resolved. (Speed Round)

- SEIC is looking to acquire an unnamed, privately-held food manufacturer.

- US VC outfit invests USD 200k in Egyptian online food delivery platform Mumm. (Speed Round)

- From Russia with … indifference? Don’t expect flights soon after we again ‘flunk’ airport security review. (Speed Round)

- Potential central bank oversight of non-banking financial sector in proposed legislative changes stirs new controversy. (Speed Round)

- Next year’s presidential elections are on opinion writers’ minds. (On Deadline)

- Is bike sharing coming to Cairo? (On Your Way Out)

- The Markets Yesterday

Wednesday, 26 July 2017

Digging up lots and lots of M&A

TL;DR

What We’re Tracking Today

That VIX play we noted yesterday looks momentarily less likely to pay off amid good news out of the US of A: Results from McDonald’s and Caterpillar point to a continued strong economic recovery. “McDonald’s has reported its best showing for global comparable sales in five years … [saying] it drew more Americans into its restaurants in the three months to the end of June, the first time in years,” the Financial Times notes. McD’s (or Magdy’s, as we prefer) also reported good non-US sales. Caterpillar, the world’s largest heavy machinery maker, meanwhile boosted its outlook for the year based on a good global sales and “despite sluggish infrastructure spending in the U.S. and weakness in Brazil and the Middle East,” the Wall Street Journal reports.

Fintech is the flavour of the day, and we’re left thinking that Egypt and the rest of the Arab world still haven’t caught on to how fundamentally it will transform our lives — as consumers, savers, investors and business leaders. Notes Reuters: “Venture capital investment in financial technology companies grew 38 percent globally in second quarter of 2017 from the same period last year, according to new data released by CB Insights. Fintech firms raised USD 5.19 bn from 251 [transactions] in the three months ending in June.”

Speaking of tech in Egypt: Omm El Donia has the lowest internet speed with the highest comparative cost, according to a global survey by RS-Tech. The survey shows that South Korea leads the world in terms of both internet speed and cost. Overall, Venezuela has the lowest cost of internet with lowest speeds up to 2MBPS.

The way we work today, part I: Allowing employees to work from home is starting to chafe on some managers, the Wall Street Journal suggests. The practice has been beloved by corporate bean counters for its cost savings — and promoted with messianic glee by devotees whose Qur’an / Bible / Torah is cult software maker Basecamp (formerly 37 Signals) and its book Rework. The Journal notes that IBM, health insurer Aetna, Bank of America, big-box electronics shop Best Buy (no relation to the Egyptian Apple monger), Honeywell and Reddit are among those who have recently “ended or reduced remote-work arrangements as managers demand more collaboration, closer contact with customers—and more control over the workday.”

The way we work today, part II: If you think the worshippers of work-from-home are a tad zealous, you haven’t read about “a Wisconsin vending machine company … offering its employees a chance to have a microchip implanted in their hands that they could use to buy snacks, log in to computers or use the copy machine.” Folks there have been gleefully signing up — [redact] the privacy implications, to say nothing of the “ick” factor. Reuters has the story, do the Verge and the New York Times.

Global sperm counts have fallen more than 50% in the past 40 years — with the drop-off most precipitous in the western world, where the figure for men in North America, Europe, Australia and New Zealand apparently stands at 59.3%, according to the Financial Times (paywall). Local nutters will dismiss the story on its face for having come out of Hebrew University of Jerusalem, but even skeptical scientists say the most recent study on the phenomenon “dealt with many” of their criticisms. BBC and Reuters also have the story, with the former declaring that “Sperm count drop ‘may lead to human extinction’.”

Also this morning: Adobe Flash will finally go bye-bye by 2020 (and Microsoft Paint looks set to go the same way) • The UAE has joined Saudi Arabia in oil output cuts • China and Russia are freaking out the neighbors with their first-ever joint naval exercises in the Baltic Sea.

What We’re Tracking This Week

Resuming exports of produce to the Gulf? The trade and agriculture ministries are sending a joint mission to Saudi Arabia for talks on restarting exports of fruits and vegetables, Al Mal reports. Saudi Arabia banned the import of peppers from Egypt in December, and a ban on strawberry imports came into effect earlier this month.

Prime Minister Sherif Ismail is heading to Amman tomorrow for talks and a meeting with his counterpart, Hani Al-Mulki, Al Ahram reports. Look for economic cooperation in fields including pharma, agriculture, energy, transportation, and irrigation to be on the agenda. Cairo and Amman are also apparently interested in increasing the frequency of flights between the two countries,

A law that sets a framework for reclaiming land seized under the government’s campaign to clear unlicensed developments and squatters from state property is expected to come into effect this week

On The Horizon

The House Economics Committee looks set to discuss the executive regulations of the new Investment Act this coming Sunday. Again, we remind readers that the House’s input on the regulations is simply not required.

The Eid Al Adha vacation is set to run Thursday, 31 August through Monday, 4 September, according to the state’s Astronomical and Geophysics Institute. Final dates are subject to confirmation by the Council of Ministers.

Enterprise+: Last Night’s Talk Shows

Our talk show roundup continues to bask in the blissful nothingness that is our summer hiatus and will be back this coming Sunday.

Speed Round

M&A WATCH- Our friends at the Egyptian American Enterprise Fund (EAEF) are reportedly planning to invest in Orchidia Pharma, sources close to the matter tell Al Borsa. While EAEF is hoping to acquire up to 100% of the company, it would settle on a majority stake of 55%, the sources told the newspaper, adding that due diligence is already underway ahead of presenting the company with a formal offer. Orchidia, which holds a 30% market share of the domestic eye drops market, is majority owned by its chairman Osama Abbas, who holds a 62% stake in the company. Investment firm Swicorp owns 38% of the company through its Intaj Capital II fund and had reportedly been looking to sell its stake. The newspaper also reports that Orchidia had been an acquisition target for Jordan’s Hikma last year. Acquisition talks failed on a buyer-seller price disconnect, as Hikma was offering c. EGP 400 mn against a demand of EGP 450 mn from shareholders.

M&A WATCH- Swiss firm Archer Daniels Midland (ADM) will bid for another food company in Egypt after the winner of the bidding war for National Company for Maize Products is made clear,according to Al Borsa. We had previously covered the ongoing contest for NCMP, and now it looks like the firm is looking to expand even further into Egypt. ADM intends on announcing the investment in the second half of this year, the newspaper suggests. The company is being aggressive with its Egypt strategy with the unannounced acquisition being the third such investment after NCMP and their 50% stake in Medsofts. Pharos Holding is sell-side advisor to NCMP owner Misr Capital Investment, while Al Tamimi & Co. is legal advisor.

M&A WATCH- The Saudi Egyptian Industrial Investment Company (SEIC) is looking to acquire an unnamed, privately-held food manufacturer, CEO Ahmed Ata tells Al Mal. Ata expects the transaction to be completed by the end of 2017. SEIC has tapped Cairo Financial Holdings as advisor on transaction, he added. SEIC — an investment company set by the governments of Saudi Arabia and Egypt — has invested around EGP 1 bn in Egypt, and its investments includes stakes in medical disposables producer Farco Make and in Alexandria Carbon Black.

Count this more as “consolidation of state assets” than “M&A”- The Egyptian Financial Supervisory Authority exempted the government’s National Investment Bank from presenting a mandatory tender offer after it submitted an offer to acquire a 40.06% stake in the Egyptian Satellite Company (Nilesat), according to a filing with the EGX. NIB already own 10% of the company; other shareholders include Egyptian Investment Projects at 8.8%, National Bank of Egypt at 7.5% and Banque Misr at 7.5%. EGX rules state that any tender for over 33% of shares outstanding demand that the buyer bid for 100% of shares, but exceptions can be made with shareholder approval.

INVESTMENT WATCH- Silicon Valley-based VC fund 500 Startups invested USD 200k in Egyptian online food delivery platform Mumm, Al Mal said on Tuesday. Mumm is an online portal that sells home-cooked meals prepared by local housewives and refugees. Mumm aside, 500 Startups picked eight other MENA-based startups to invest in through its 500 Falcons early-stage fund. The VC firm had said in 2015 that it would invest USD 30 mn in MENA through 500 Falcons.

The Tourism Development Authority has revised the bank of land it will allocate forinvestment opportunities in the industry, according to Al Borsa. The total number of land plots allocated has dropped to 115 from 135, taking about 30 mn sqm out of potential circulation. The new allocations have been sent to the Ministry of Investment for review as the latter prepares its Egyptian investment map. The TDA will reportedly price land plots in EGP “to make them more attractive for investment,” the newspaper says.

So we guess Svetlana’s BFFs still aren’t coming for a beach holiday: Russia has again deemed our airport security unsatisfactory, says Svetlana Sergeeva, an adviser to the head of Russia’s Federal Agency for Tourism (Rostourism), according to Sputnik. The results of Russia’s most recent airport security inspection revealed that “the Egyptian side has not yet resolved all issues related to aviation security,” she said, without further clarification. Sergeeva added that “the recent attack on tourists on the beach in Hurghada” is a cause of great concern.

So we’re somehow able to get off the US in-flight laptop-ban list, but Russia’s security demands elude us?

New controversy around clauses on central bank oversight of non-bank financial sector in proposed amendments to the CBE and banking acts: The financial sector is in a modest uproar over proposed amendments to the Central Bank and Banking acts that would give the central bank oversight on non-bank financial institutions and brokerages. (That uproar would be more intense were half the community not on Sahel or in Europe / the US / Canada at the moment.) Article 21, which as we noted on Monday would give the CBE more sway over non-bank financial services by granting it the authority to issue licenses, would also give the central bank a say in regulating the sector, a role currently reserved to the Egyptian Financial Supervisory Authority (EFSA).

The Federation of Egyptian Banks (FEB) has reportedly called into question the constitutionality of the article, arguing that it infringes on the authority of EFSA, according to Al Mal. Egyptian Capital Markets Association board member Ayman Sabry took to the pages of the newspaper to also denounce the proposed changes, calling them an “unnecessary imposition of the CBE’s authority” on capital markets. The FEB has previously said it won’t accept changes that would give the CBE the power to impose term limits on bank managing directors.

EFSA is playing it cool: Unnamed officials from EFSA dismissed the current draft of the amendments as merely “preliminary,” saying they can only be taken as “suggestions.”

Egypt and the EU agreed on a new cooperation framework that outlines the two sides’ priorities for 2017-2020 on Tuesday, according to the EU’s External Action Service. The framework states that the EU and Egypt will cooperate “in all fields including Egypt’s sustainable economic and social development, good governance, the rule of law, human rights, migration, security and counterterrorism.” The pact was signed during a meeting in Brussels after a meeting between Foreign Minister Sameh Shoukry and EU High Representative of Foreign Affairs and Security Policy Federica Mogherini, where discussions centered on strategic issues, including the economy, migration, and security.

Migration paid lip-service? The EU downplayed talk on migration, with Mogherini simply stating, “We talked and we will talk about migration.” There had been some hope that previous talks between Egypt and EU members Germany and Austria could have seen Cairo sign a Turkey-style agreement under which Egypt would receive development aid for ensuring the safe residency of third-country migrants that had been bound for Europe. This comes as the EU’s top official for relations with neighboring states said the Turkey agreement appears to be working well.

NGOs, human rights, terrorism remain a sticking point: Shoukry called on the EU to “seriously reconsider its passive approach” to terrorism and countries that support it, according to a Foreign Ministry statement. Meanwhile, Mogherini voiced “the EU’s concerns about the consequences of the new NGO law” on civil society, stressing that “sustainable security and stability can only be achieved when human rights are fully available, implemented and upheld.” Amnesty International had called on the EU to consider Egypt’s human rights record as it looks at the state of relations between the two sides, and Mogherini had met earlier on Tuesday with Amnesty International Secretary-General Salil Shetty.

The Qatari smackdown was also on the agenda, with Shoukry stating that there will be no compromise — Doha must accept demands issued by Egypt, Saudi Arabia the United Arab Emirates and Bahrain to end the dispute. .

On a related note, the government will be signing an MoU with the EU on energy cooperation this fall, EU sources tell Al Mal. The MoU does not cover direct funding for energy projects or extend to the private sector, the sources add.

President Abdel Fattah El Sisi handed down policy decisions designed to spur investment in the Western Desert and West Delta regions and away from the over-populated Nile basin, Al Ahram reports. El Sisi directed that the cabinet complete plans to redraw the borders of governorates and have the new map ready for the upcoming session of the House of Representatives, which will begin in September. He also ordered that the government complete a roadmap to develop Egypt’s western regions which will include new urban communities, investment zones, and logistics centers. Other key decisions, which came yesterday at the closing ceremony of the Alexandria youth conference, included:

- Establishing an agricultural commodities exchange in Beheira Governorate in one year;

- Setting a deadline of two years to complete the industrial zones of Beheira;

- Ordering the formation of a ministerial committee to complete a strategy to develop the desert regions of Gharbiya Governorate;

- Tendering projects in the 10,000 feddans investment zone in Kafr El Sheikh before the end of the year;

- Ordering a number of development projects for Alexandria, including increasing the city’s built up area by 18,000 feddans and upgrading road and tram networks.

El Sisi also called yesterday on the media to launch a week-long public education campaign focusing on the government’s economic reform program, Al Masry Al Youm reports.

Chambers of Commerce appears to discourage med price hike: There’s no need to raise med prices for the second time this year, says Tamer Qarmany, a member of the Federation of Egyptian Chambers of Commerce’s pharma division. He tells Al Masry Al Youm that since the EGP float, the FX exchange rate has stabilized at around EGP 18 to the USD 1, a rate that had helped determine the previous med price hike back in January. The Health Committee of the House of Representatives is planning to hold a meeting in August with the government, pharma companies, and industry associations to determine whether to recommend another price hike in meds.

On a related note, the rising cost of both domestic production inputs and finished medsproducts is hurting export sales, according to Youm7. Medical Industries Export Council head Maged George suggests that this has led export revenues to drop to USD 220 mn in 1H17, down from USD 260 mn in 1H16. He tells the newspaper that the council is renegotiate the pricing scheme of Egyptian med exports with GCC importers.

EgyptAir is expected to lower ticket prices that it had already set for Hajj season, according to Al Shorouk. This comes as EgyptAir Chairman Safwat Musallam came under pressure to reduce costs for pilgrims this year. EgyptAir had previously angered tour companies by pricing their Hajj season tickets too high and driving them to look to other airlines when offering packages. Saudi Airlines have yet to price their Hajj season tickets but they are expected to come in much lower than the initial prices EgyptAir put out.

Libyan factions agree to ceasefire, could hold spring elections: Rival Libyan leaders Prime Minister Fayez Al-Serraj and General Khalifa Haftar agreed yesterday to a conditional ceasefire and to hold elections in the spring under UN supervision, Reuters reports. The agreement came after peace talks in Paris brokered by French President Emmanuel Macron. Macron’s mediation has drawn the ire of critics and allies alike, including Italy, which “sees Libya, its former colony, as part of its sphere of influence,” Bloomberg says. Analysts also “warned the French intervention could only make the situation in Libya worse by giving legitimacy to General Haftar,” who commands eastern Libya, according to the Financial Times. Haftar is a staunch Cairo ally.

Israel will remove the metal detectors it had in Jerusalem’s Al Aqsa Mosque, which had led to violent clashes that culminated in the death of eight Palestinians, the BBC reports. Israeli authorities said they will opt for “less obtrusive surveillance” measures to prevent weapons from being smuggled into the holy site.

In regional investment news, Saudi Arabia has reportedly hired Goldman Sachs to manage the sale of a stake in Riyadh airport, sources told Reuters. “The Saudi Civil Aviation Holding Co plans to sell a minority stake in the Riyadh’s King Khalid International Airport, the sources said, adding the stake size could be significant” and the move could be the first major privatization of an airport in Saudi Arabia. “The estimated size or value of the stake was not immediately known,” Reuters says.

Is Abu Dhabi Ports also looking at an IPO? Bloomberg reported yesterday the firm could be poised to raise over USD 1bn from equity markets and would join an ever-growing list of sovereign companies out of the UAE doing the same including Emirates Global Aluminum and the Abu Dhabi National Oil Company. ADP said this morning is has no “immediate plans” to list.

Egypt in the News

On a slow morning for Egypt in the foreign press, coverage of life sentences handed down to43 protesters in their retrial for clashing with authorities in December 2011, led the conversation on Egypt. The defendants had been charged with rioting, vandalism and attacking security forces. They also received a collective fine of EGP 17 mn for damage to public property. 92 people tried for the incident were acquitted. Wire pickups of the story are focusing on the prevalence of mass trials on crimes of protest since 2013.

Those Kazakh students who were reported missing in Egypt have been found, a source at the Ministry of Foreign Affairs of Kazakhstan confirmed. Kazinform reports that the students were detained by local authorities. Kazakhstan is requesting to know why they were detained.

Also making headlines this morning:

- Prosecutors closed the case for the trial of Irish-Egyptian Ibrahim Halawa and 492 others after 27 adjournments, according to the Irish Times. Defense lawyers will begin responding to the case on 1 August.

- 26 UK tourists are suing top travel firm First Choice, claiming they got food poisoning from the Jaz Aquaviva resort in Hurghada, according to British tabloid the Sun.

On Deadline

Next year’s presidential elections seem to be on the minds of the country’s opinion writers this week, including Al Shorouk’s Mohamed Esmat, who points out that we should now be in the middle of a heated run-up to the election season but instead have no idea who will actually be throwing their hats in the ring. Even President Abdel Fattah El Sisi has yet to officially confirm whether or not he will seek re-election, which Esmat says just goes to show that Egypt is struggling with a severe case of political poverty alongside its economic woes. Meanwhile, Emad El Din Hussein brings a more confident tone to the pages of the same newspaper, saying that El Sisi will run for and win a second presidential term, but will need to focus his efforts on ensuring a high enough turnout rate in the elections to make his win legitimate. Hussein suggests that the president will formally announce his nomination early next year, when he is scheduled to present a report on his progress and achievements over the past three years. He notes that many of the president’s major projects are scheduled for completion around the same time, which will give his credibility as a competent ruler a considerable boost.

Worth Watching

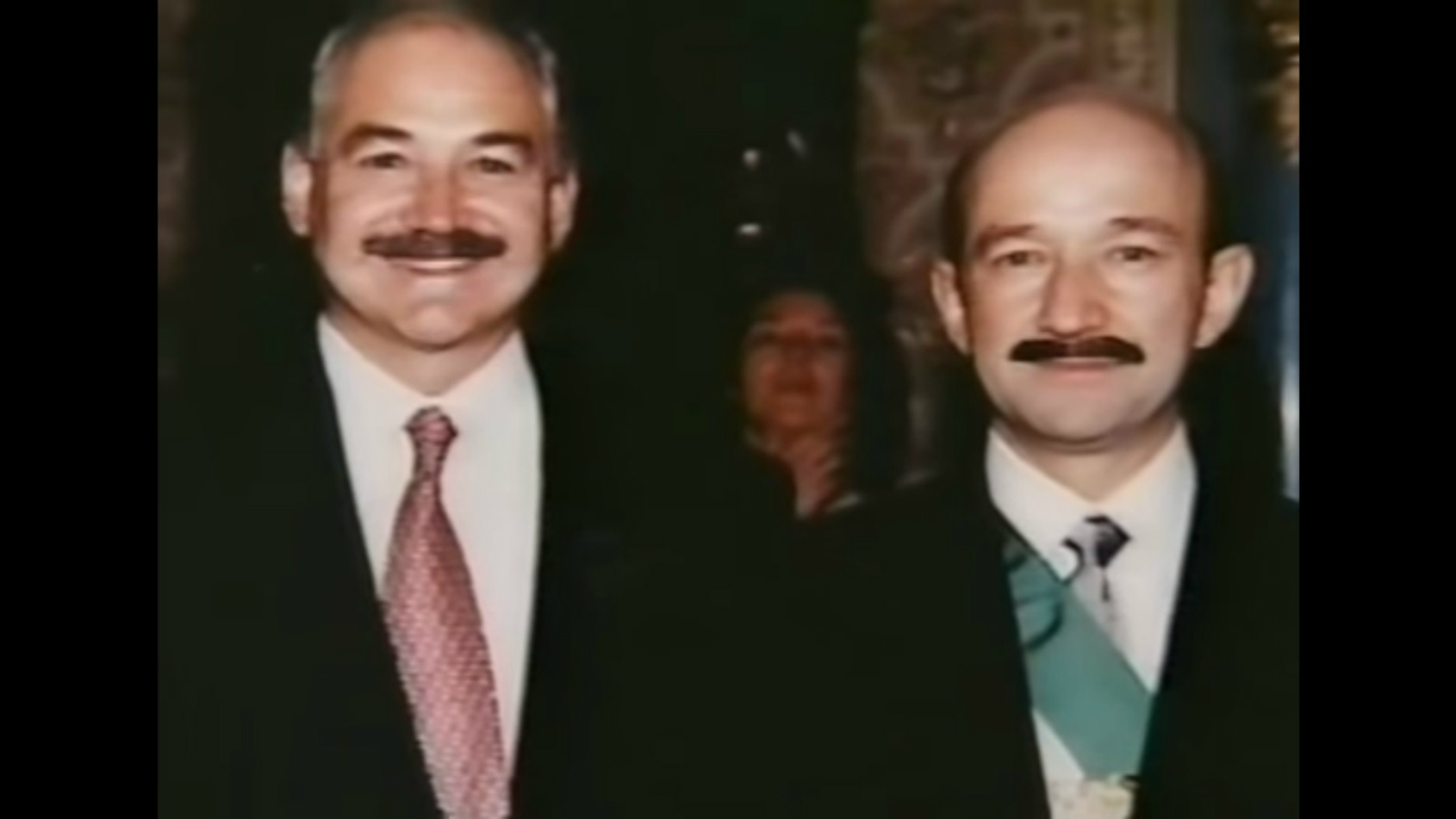

FRONTLINE – Murder, Money, And Mexico: We return with another excellent documentary from the good people at Frontline on the rise and fall of economic reformer and the former Mexican president Carlos Salinas and the kleptocracy he presided over with his brother Raul Salinas. Carlos Salinas had ruled Mexico from 1988-1994 on a platform to institute much-needed economic reforms and liberalization. He opened the country up for business and sold major companies long-held by the state, creating a generation of bn’aires, including telecom tycoon Carlos Slim, that still top the Forbes’ list of richest men in the world.

Salinas had been considered for most of his tenure as one of the most popular of Mexico’s presidents. Yet this legacy has been largely overshadowed by the corruption scandals involving his brother Raul, who used his influence to siphon hundreds of mns of USD into Swiss bank accounts, largely from bribes from businessmen and narco-traffickers.

The scandals came to a head when he was arrested and charged with the murder of his brother-in-law, forcing Carlos Salinas into self-exile in Ireland. It is a riveting cautionary tale of how even the most successful and well-intentioned economic reforms can come undone by institutional corruption. You can catch the full documentary here (runtime: 56:43).

Diplomacy + Foreign Trade

Suez Canal Economic Zone (SCZone) head Mohab Mamish met yesterday with Afreximbank President Benedict Oramah to discuss establishing an African investment zone in the SCZone, Al Shorouk reports. The new area would import raw materials from Africa and re-export them to Europe and Asia. Oramah said the bank is prepared to offer Egypt funding to support its exports to Africa and finance its projects in the petrochemicals and contracting industries.

Energy

Four companies bidding on 250 MW wind farm in Gulf of Suez

Four companies remain in the running for developing the 250 MW wind farm in the Gulf of Suez. Vestas, Siemens, Enercon, and Ray Power were the remaining bidders after a consortium made up of Power China and Goldenwind was eliminated from the race, Al Borsa reports. The bidding companies are scheduled to submit their technical and financial offers mid-August, and work on the project is expected to kick off next year.

Basic Materials + Commodities

Drop in demand, purchasing power drives food companies to spend more on marketing

The drop in consumer demand and purchasing power due to rising prices is causing food and beverage producers to increase spending on marketing and advertising in order to preserve their market shares, according to a report in Al Borsa. Overall demand for food and beverage is down 20-40% y-o-y in 1Q2017, sector analyst Omneya El Hamamy says. El Hamamy explains that the additional marketing costs have been a burden since most manufacturers sales and distribution costs have also risen as a result of the fuel price hikes.

Chemicals and fertilizers exports up 36% y-o-y in 1H2017

Exports of chemicals and fertilizers increased 36% y-o-y to USD 2.07 bn in 1H2017, the Chemicals and Fertilizers Export Council announced, according to Al Shorouk. Exports of plastic and rubber products led the way with USD 662.9 mn, up 18% y-o-y in 1H2017. Fertilizers were the second best performer, with their exports increasing 71% y-o-y to USD 501.99 mn. This comes as the Farmers Syndicate is calling for banning fertilizers exports, saying there is a sharp shortage in subsidized fertilizers. Only 50% of the mandated ration has been disbursed to farmers, they claim.

Rice export ban drives down prices

Rice prices dropped EGP 600 to EGP 3,900 per tonne due to the ban on rice exports currently in place, a Supply Ministry source tells Al Shorouk. The ban, in combination with efforts to curb smuggling, has increased rice supply in the market, driving down prices, according to the source. The government had decided earlier this month to keep the ban in place during the upcoming period, after having re-imposed it last year.

Eastern Company sees sales up by EGP 300 mn in FY2017-18

The Eastern Tobacco Company expects to see its revenues climb by additional EGP 300 mn to EGP 12.2 bn in FY2017-18 following the recent hike in some of its product prices, the company said in an EGX filing. Earlier this month, Eastern Company had increased the prices for three of its Cleopatra cigarettes by 4.2-17.6% due to increasing production costs.

GASC submits tender for wheat

The General Authority for Supply Commodities (GASC) bought 420K tonnes of wheat on Tuesday, according Al Masry Al Youm. 300k tonnes of Russian wheat were bought, with the rest coming from the Ukraine and Romania.

Automotive + Transportation

MTI to increase investments for luxury cars centers

MM Group for Industry and International Trade (MTI) is set to invest up to EGP 240 mn — or some EGP 40 mn more than originally planned — to build a new Jaguar Land Rover service center in New Cairo as well as a Bentley center, Chairman Khaled Mahmoud tells Al Mal. The Bentley center planned will include a showroom, a maintenance center, and a spare parts shop. The company has postponed opening a similar 3S center for Ferrari as demand for the product has slowed down. He notes that sales of MTI brands were down 25% y-o-y between January and July, but expects a recovery in 2018.

Other Business News of Note

Court rejects Bassem Youssef’s appeal against EGP 100 mn fine to CBC

A Cairo court rejected talk show host Bassem Youssef’s appeal to reverse a 2013 verdict ordering him to pay a EGP 100 mn fine to satellite network CBC, Ahram Gate reports. The Cairo Regional Center For International Commercial Arbitration had ruled in CBC’s favor back in 2013, ordering Youssef to compensate the company for contract violations.

NileSat resumes broadcasting Al Hayat TV channels following debt settlement

NileSat resumed broadcasting Al Hayat TV channels yesterday after the network clear its debt to the satellite company, Al Mal reports, citing an unnamed source from Al Hayat. Al Hayat had also owed EGP 20 mn to the Egyptian Media Production City (EMPC), pushing the EMPC to cut off services provided to the network, including electricity, earlier this month. Al Hayat repaid its debts to the EMPC last week.

Egypt Politics + Economics

Sahar Nasr talks upcoming investments during youth conference address

The new administrative capital should have attracted a cumulative USD 6.7 bn in foreign direct investment by its fifth year of development, Investment Minister Sahar Nasr said on Tuesday, according to Ahram Gate. Speaking on the second day of the national youth conference in Alexandria, Nasr said that the Housing Ministry is currently in talks with China’s CFLD over the planning and development of the city and its infrastructure. Nasr will be visiting Singapore next month, accompanied by Suez Canal Economic Zone (SCZone) chief Mohab Mamish, to promote Egyptian investments in the area and is looking to reel in c. USD 30 bn in investments for the zone’s infrastructure development. The ministers of finance, supply, and public enterprises also spoke at the conference.

Government to pay cash subsidies to the disabled for first time -Ghada Wali

The Egyptian government will begin paying cash subsidies out to disabled citizens for the first time under the Takaful and Karama subsidy programs, Social Solidarity Minister Ghada Wali announced on Tuesday, according to AMAY.

National Security

Terrorists in Egypt are qualitatively shifting tactics after attacking elite battalion

Terrorists in Egypt appear to be “shifting their tactics” by taking on higher-risk attacks, Amr Mostafa writes for Al-Monitor, saying “militants might be adopting a new pattern of qualitative operations.” Mostafa says the escalation came in early July as the terrorists targeted an elite Egyptian commando force outpost in southern Rafah, suggesting “that terrorist operations in Sinai will no longer be limited to ambushing police patrols.” A high-ranking security force member says such operations “‘aren’t a sign of victory or advance,’ but rather indicate a setback as the attackers are driven out of one venue and forced to adapt to another.”

On Your Way Out

Is bike sharing coming to Cairo? The UN Human Settlement Programme signed an agreement with the Cairo governorate to introduce a bike-sharing scheme in the nation’s capital, Egypt Independent reports. The Drosos Foundation is providing USD 1.5 mn in financing for the project. The project, named Bicicletta, will introduce 300 bicycles and create several “bike-sharing stations” across the downtown Cairo. Drosos says UN Habitat is also building “bike lanes in the catchment area of Cairo University. Additionally, the partner will select and enable a local social enterprise to manage and operate the bike-sharing model, ensuring high quality services.”

Seventeen Chinese Uyghur students attending Al Azhar have been released, according to Daily News Egypt. There had been questions about the validity of their visas. Previous reports had said as many as 500 Muslim Uyghur students had been arrested in Egypt at the behest of Chinese authorities.

The markets yesterday

EGP / USD CBE market average: Buy 17.8440 | Sell 17.9438

EGP / USD at CIB: Buy 17.85 | Sell 17.95

EGP / USD at NBE: Buy 17.80 | Sell 17.90

EGX30 (Tuesday): 13,740 (-0.1%)

Turnover: EGP 683 mn (32% below the 90-day average)

EGX 30 year-to-date: +11.3%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.1%. CIB, the index heaviest constituent ended down 0.1%. EGX30’s top performing constituents were: Qalaa Holdings up 3.0%, Domty up 1.5%, and Telecom Egypt up 1.5%. Yesterday’s worst performing stocks were: Amer Group down 2.9%, Ezz Steel down 2.5%, and Egyptian Iron & Steel down 2.2%. The market turnover was EGP 683 mn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +37.8 mn

Regional: Net Long | EGP +0.0 mn

Domestic: Net Short | EGP -37.8 mn

Retail: 69.8% of total trades | 66.3% of buyers | 73.3% of sellers

Institutions: 30.2% of total trades | 33.7% of buyers | 26.7% of sellers

Foreign: 21.5% of total | 24.3% of buyers | 18.8% of sellers

Regional: 7.9% of total | 7.9% of buyers | 7.9% of sellers

Domestic: 70.6% of total | 67.8% of buyers | 73.3% of sellers

WTI: USD 48.40 (+1.06%)

Brent: USD 50.60 (+0.80%)

Natural Gas (Nymex, futures prices) USD 2.94 MMBtu, (0.00%, August 2017 contract)

Gold: USD 1,253.00 / troy ounce (-0.44%)

ADX: 4,541.94 (+0.04%) (YTD: -0.10%)

DFM: 3,594.62 (-0.13%) (YTD: +1.81%)

KSE Weighted Index: 417.03 (+0.78%) (YTD: +9.72%)

QE: 9,594.51 (+0.16%) (YTD: -8.07%)

MSM: 4,997.77 (+0.05%) (YTD: -13.57%)

BB: 1,334.67 (+0.54%) (YTD: +9.36%)

Calendar

26 July (Wednesday): “The implementation of the New Urban Agenda in Egypt” United Nations Information Center and UN Habitat seminar, Grand Nile Tower Hotel, Garden City, Cairo.

03-05 August (Thursday-Saturday): Watrex Expo Middle East, Cairo International Exhibition & Convention Center.

17 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

26 August (Saturday): 27th Egyptian-Jordanian Joint Higher Committee meeting, Amman Jordan. (TBC).

31 August-04 September (Thursday-Monday): Eid Al-Adha, national holiday (TBC) as specified by the Astronomical and Geophysics Institute. The Thursday is the waqfat Arafat, with the first day of the eid on Friday, 1 September.

September — The House of Representatives is due to begin discussion of the proposed bankruptcy bill.

13 September (Wednesday): EIB MED Conference: Boosting investments in the Mediterranean Region, Cairo.

13-16 September (Wednesday-Saturday): Cairo Fashion & Tex exhibition, Cairo International Conference Center

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

23-25 September (Saturday-Monday): Invest In Africa Conference and Exhibitors Summit, Gala Theater Complex, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

06 October (Friday): Armed Forces Day, national holiday.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Smart Cities,” The French University, Cairo. Register here.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.