- Inflation rates drop again in June (Speed Round)

- Timeline to turn Egypt into an energy hub moved forward to 2018 (Speed Round)

- NTA to sign new contract for Cairo Metro Line 6 today with Canada’s Bombardier (Speed Round)

- Toyota is planning to increase its investment in Egypt over the next five years (Speed Round)

- Hilton expanding in Egypt with seven hotels in four years (Speed Round)

- Private universities hike tuition fees by 10% (Speed Round)

- Carillion to exit Egypt, Qatar and Saudi (Speed Round)

- Is Egypt on the verge of a housing bubble collapse? (Worth Watching)

- By the Numbers —

Tuesday, 11 July 2017

Inflation rates drop again in June

TL;DR

What We’re Tracking Today

Inflation figures for June are out and they are quite encouraging. Monthly core inflation rates dropped to 0.8% in June from 1.99% in May, with inflation settling in at 30.57%. Don’t get too attached to seeing rates like these, considering the impact of the wave of price hikes we have seen recently (we have more coverage on that in the Speed Round).

Day 2 post interest rate hikes saw Egyptian stocks witnessing a bump of 1.1% and no major announcement that companies were suspending CAPEX. This comes as foreigners snapped up USD 30.5 mn worth of high-yielding debt in Monday’s auction. Average yields on Egypt’s three-year and seven-year bonds rose to 19.48% and 19.21%, respectively, from 18.38% and 18.35%, central bank data showed.

On a related note, Finance Minister Amr El Garhy denied statements attributed to ministry sources that the recent interest rate hikes by 200 bps would increase the budget deficit by EGP 30 bn. He added that monetary and fiscal policies were in sync. We had noted on Sunday that Vice Minister of Finance Mohamed Maait said that neither Thursday’s interest rate hike nor May’s interest rate hike had been factored into the budget.

Glory, hallelujah. Some progress on getting the laptop ban on flights to the US from Egypt removed? A delegation from the US is set to arrive this week to inspect Egypt’s airports to decide whether to lift the ban on laptops and other devices onboard flights to the US, Civil Aviation Minister Sherif Fathy tells Al Mal. As we noted yesterday, all other countries who have been slapped with the laptop ban have been given at least a tentative exemption. Royal Jordanian and Kuwait Airways announced exemptions on Sunday, joining Etihad Airways, Qatar Airways and Turkish Airline. Royal Air Maroc, Saudi Airlines and Emirates Airlines have announced an exemption is forthcoming. As we have been spending plenty on developing security at our airports, especially since the Metrojet crash of 2015, we expect (hope) that these inspections by the US delegation would go swimmingly.

…The UK is also sending a delegation to inspect airports this week, according to some infuriating comments by Ambassador John Casson on Saturday, who said that we still have some ways to go before UK resumes flights to Sharm.

The same could not be said for the resumption of flights from the Russians: Fathy had nothing to offer by way of progress on the resumption of flights with Russia. Talks are ongoing, he said at the opening of a new duty free store in Cairo Airport, but there was nothing new to report there, according to Al Mal.

We are hearing some very interesting news from the global oil and gas market that are worth a look this morning:

- Qatari LNG exports remain stable amid ongoing tension, a top official at Shell tells Reuters.

- After signing agreements with Iran, France’s Total appears to be the most ideal candidate to bid on Qatari gasfields (shared with Iran), sources in Doha said.

- Indian energy company ONGC Videsh will bid in an upcoming auction to explore and develop gas fields off the coast of Lebanon, in the pool of gas in the Mediterranean shared with Egypt, Cyprus and Israel, Reuters reports.

- Aramco plans to invest USD 300 bn over the next 10 years, CEO Amin Nasser said according to Bloomberg.

We hope your ACs are working, as Cairo will see temperatures today reaching a high of 39 degrees Celsius, according to Ahram Online. It will be more tolerable in Alexandria, with a high of 31 degrees Celsius. Looks like another weekend in Sahel.

What We’re Tracking This Week

Egypt’s investment roadmap will be available for viewing this week, according to Minister Sahar Nasr. She had previously said that the plan will be regularly updated but currently contains 600 investment opportunities concentrated mostly in New Valley, Fayoum, and Qena.

On The Horizon

World Hepatitis Day is coming on Friday, 28 July. To mark the occasion, our good friends at Al Borg Laboratories will be participating in the World Hepatitis Alliance’s global campaign, the company announced in a statement. The campaign — one of only four global disease-specific awareness days that are officially endorsed by the World Health Organization — rallies the support of organizations and individuals all over the world to stop the spreading of the disease through diagnosis of as many of those infected as possible. Al Borg is offering a 30% discount on all Hepatitis tests during the month of July for the nationwide campaign.

Enterprise+: Last Night’s Talk Shows

Finance Minister Amr El Garhy’s interview with Lamees Al Hadidi was the only thing to stand out in another tepid night in the airwaves.

The second USD 1.25 bn disbursement of the IMF’s USD 12 bn extended facility will be checked into state coffers within the week, Finance Minister Amr El Garhy told Lamees on last night’s Hona Al Asema. The minister also said month-on-month inflation levels are expected to decline gradually, but it will take time for consumers to feel the change.

Speaking on the murmurs of an upcoming EUR 1-1.5 bn eurobond issuance supposedly happening in September, El Garhy confirmed that there are discussions on these happening. He said, however, that the ministry has yet to conduct a study to determine whether this will take place.

The effect of fiscal reform measures, such as new fuel and electricity price hikes, will reflect on July inflation rates, but it will not be as hard on them as November’s EGP floatation, “because at that time, it was a combination of fuel price hikes and currency liberalization all at once.”

On the CBE’s recent decision to hike key interest rates by 200 bps, El Garhy said that the impact on the budget represents the main challenge, as the hike was not factored in. The impact might not be so substantial though, as the Finance Ministry calculates average rates and the hike is likely only temporary. Interest comprises around EGP 307 bn of Egypt’s EGP 1.2 tn budget, from EGP 292 bn previously. Interest on Suez Canal certificates will not rise in step, El Garhy also said (watch, runtime 10:29).

On Kol Youm, Amr Adib was still on the Qatar mosalsal, speaking to Kuwaiti newspaper Al-Seyassah’s Editor in Chief Ahmed Al Jarallah, who said that Qatar failed to play by the rules when it came to the Riyadh agreement (watch, runtime 7:26).

Adib then moved on to talk about the launch of the new Toyota Fortuner Egypt assembly line. Arab Organization for Industry (AOI) head Abdel El Aziz Seif El Din said in a report that the original agreement with Toyota was inked in 2010 and that the AOI will manufacture three models of the Toyota Fortuner under a new agreement. 14 factories will be involved in the process, he said (watch, runtime 3:53).

Also harping on Qatar was political analyst Abdel Moneim Said told Yahduth fi Misr’s Sherif Amer that the contents of the Riyadh Agreement that were just made public prove that Egypt, Saudi Arabia, UAE, and Bahrain banded up against the small Gulf country.

Over on Masaa’ DMC, Health Ministry spokesperson Khaled Mogahed denied news of shortages in baby formula supplies (watch, runtime 4:51).

Speed Round

Inflation rates drop again in June: Egypt’s core inflation rose to 31.95% year-on-year in June from 30.57% in May, according to a statement by the CBE on Monday. The good news is that the monthly core inflation rate dropped to 0.8% in June from 1.99% in May. Annual headline consumer price inflation rose slightly in June to 29.8% from 29.7% in May, CAPMAS said on Monday. However, the monthly inflation rate in Egyptian cities eased to 0.8% in June from 1.7% in May.

This is the second drop in inflation rates after May since the EGP was floated back in November, with consumer goods seeing the slowest rise in prices since early 2016, according to HSBC MENA economist Razan Nasser. The slowdown also beat expectations of a rise in consumer prices during Ramadan. Pharos Holding’s Radwa El Sweify said that inflation in food, which has made up a marginal 0.3% of the inflation growth, usually rises in the months preceding Ramadan. She noted that the uptick in prices was more prominent on clothes and other items that have more to do with Eid.

Do not expect such results next month: Following the fuel price hikes late last month and the electricity price hikes last week, analysts are unanimous in expecting that the slowdown in inflation rates will not continue next month. The government had expected these measures will raise inflation rates 3-4.5%. “Invariably, most goods and services are impacted by energy costs … be it in the form of energy input, transportation, feed stock,” Allen Sandeep, head of research at Naeem Brokerage tells Reuters. He expects headline inflation should rise above 35% starting in July. However, some of this could get offset if the EGP continues to strengthen.

Capital Economics takes a more optimistic note, arguing that the effects of the price hikes would not have as large an impact as expected, considering similar moves were taken last year to minimal impact. Capital Economics expects the resulting inflation to only climb 1.5%. BNP Paribas’ Pascal Devaux suggests that there are limited tools the government can take to stave off this inflation. He projects the fiscal year will end with an inflation reaching 25%.

Government much more optimistic on impact of fuel hikes: Egypt expects the monthly inflation rate to stabilize within four months at 1-1.25%, Finance Minister Amr El Garhy told Reuters on Monday. Vice Minister of Finance Mohamed Maait took it a step further and said that he expects the inflation rate to begin dropping again by August, according to Al Masry Al Youm. El Garhy tells Al Borsa that inflation is expected to drop to 16% by 4Q18. The CBE had said it was targeting lowering inflation to 13% by the end of next year.

Is the Oil Ministry reworking the timeline of its “Egypt as an energy hub” timeline? It appears that the Oil Ministry has set a ambitious target of turning Egypt into a regional energy hub by 2018, three years ahead of schedule. Oil Minister Tarek El Molla told EGPC workers it is necessary to complete the sector’s development before the end of 2018, in order to boost economic growth, Al Masry Al Youm reports. The statements come as we have seen a number of important developments come into fruition at this time. On the legislative front, Parliament passed Natural Gas act last week, with the executive regulations coming in September. Trial runs on SUMED’s LNG pier were announced on Sunday, while production on Eni’s Zohr field looks set to take off at the end of this year.

No metro price hikes until 2020: The prices of metro tickets will not be rising in 2018 despite the increases in fuel and energy prices, Transportation Minister Hisham Arafat tells Al Shorouk. He appears to refute statements he made last Saturday where he supposedly said that the pricing scheme will change in 4Q18. He added that prices will not change until 2020, when phase four of the Cairo Metro Line 3 is completed. He did repeat that the new pricing mechanism will be determined according to the distance traveled. This is standard protocol at this point for the Transportation Ministry to hint at price hikes, and then retract them when the populist masses cry out. We expect this show to happen over and over again before a sudden hike, as was the case with last March’s hikes.

In other metro news, the National Tunnels Authority (NTA) will sign a preliminary contract today for the Cairo Metro’s Line 6 with Canada’s Bombardier, according to Al Borsa. The line will be complete by 2022 and run parallel to Line 1, NTA spokesperson Hassan Tawfik said. Bombardier is expected to begin arranging project financing once the contracts are signed and the new line’s designs are set by the end of July. Around 65 train cars will be used to operate Line 6 but no details on the value of the contract have been given. The line is expected to service around 2 mn passengers per day.

The Ismail government has decided to continue banning rice exports during the coming period until local consumption is fulfilled, Supply Minister Ali El Moselhy announced yesterday, Al Shorouk reports. The government had reinstated the export ban last year, after flip-flopping on the policy a few times. Egypt had been banning rice exports on and off since 2008 — rightfully so, considering how we don’t need to export water.

El Moselhy also said the government “would allow market forces to determine rice prices” during the upcoming marketing season. The vague statement does signal that it may ease up on the ban next season. On a related note, the minister discussed ways to maintain market prices at EGP 6 per kg of rice with Federation of Egyptian Chambers of Commerce head Ahmed El Wakil, head of the Agricultural Export Council’s rice committee Mostafa El Naggary, and the Federation of Egyptian Industries’ cereals chamber’s rice division chairman Ragab Shehata. Shehata had previously said rice prices are not expected to rise, as there is sufficient domestic supply.

Toyota is planning to increase its investment in Egypt in the next five years, Toyota Egypt’s CEO Ahmed Monsef told Daily News Egypt at the launch ceremony of its new USD 8.5 mn Toyota Fortuner production line yesterday. “Egypt is a very important market to us. We plan to make it our regional hub in the coming five years,” he said, without specifying the scope or size of upcoming investments. We noted yesterday that the Arab American Vehicles Company (AAV) — a joint venture between Arab Organization for Industrialization (AOI) and Chrysler Group — will begin assembling Toyota Fortuner 2017 cars in Egypt. Local components make up 47.1% of total production input, AOI chief Abdel El Aziz Seif El Din, according to a statement (pdf). The facility is expected to have a production capacity of 2-3,000 cars per year, said AAV’s chairman Mohamed Anis. You better save up if you are interested as the model may retail at around EGP 1 mn, said Anis.

Hilton Hotels is also planning on expanding in Egypt with seven hotels in Cairo, Hurghada, and Ain Sokhna, in the next four years, Hilton MENA’s newly-appointed VP for Operations Mohab Ghali said, according to Al Shorouk. The company had decided to make Egypt the regional headquarters for the hotel chain, as it has been the centerpiece of its regional growth strategy, Ghali added.

MOVES- Memphis Pharma appointed Amal Abdelwahed as the company’s new managing director, effective yesterday, Al Borsa reports. Abdelwahed succeeds Osama Abdelsattar, who resigned from his positions as managing director and chairman of the company, Al Mal reports.

MOVES- Abdel Aziz Nosseir was appointed as the executive director of the CIB-affiliated Egyptian Banking Institute, and began his position at the beginning of June, Youm7 reports. The position was held in the past by current Planning Minister Hala El Said. Nosseir spent eight years at CIB, after which he taught business management at the American University in Cairo for 14 years.

Hear ye, all you proud parents of recent graduates, private universities’ tuition fees have been hiked by 10%, according to statements by Higher Education Minister Khaled Abdel Ghaffar yesterday. The fee increase applies to the 20 private universities in the country, including those established by foreign governments, Egypt Independent reports. Some universities, including the American University in Cairo (AUC) have already hiked their tuition fees. As of February, the university had more than doubled its fees in EGP terms after the November EGP float, leading its students to protest on campus.

Jumia is expecting e-commerce in Egypt to grow to USD 2.7 bn in 2020, according to Al Borsa. The number of Jumia customers who pay by cash decreased to 8% of total customers last year from 98% in 2012, CEO Hesham Safwat says. Market dynamics had played a crucial role in the emergence of e-commerce and its success in Egypt, as 65% of all online shoppers were below the age of 25. A report by PricewaterhouseCoopers, which we noted yesterday, had estimated that the number of online shoppers in the Middle East grew 6% between 2013-17, with around 29% of Middle East consumers now shopping online each month.

Seriously, Union of Egyptian Investors Associations. Slow your roll: The communists who bleed green at the Union of Egyptian Investors Associations are not happy with the foreign labor requirements in the executive regulations of new Investment Act, Youm7 reports. The organization’s head Mohamed Farid Khamis said that raising the limit on foreign labor employment for an investment project to 20% would open the door to corruption, adding that the requirement is unnecessary as Egypt’s labor is more than capable of meeting the demands of investment. Patriotic verver aside, what really got our blood up is their suggestion that passing the executive regulations requires their approval and that of other industry associations such as the Federation of Egyptian Industries. Instead, we propose that members of these associations, perhaps get into politics, join parliament and head up coalitions in…oh wait.

Carillion to exit Egypt, Qatar and Saudi: UK construction firm Carillion announced that it is exiting Egypt, Qatar, and Saudi Arabia in addition to exiting some UK partnerships, Reuters reports. Carillion said it would pull out of construction projects in these three countries after a decline in the oil price caused those countries to stall projects and stretch payments on key contracts. It added that it would only pursue jobs in that region in future “via lower-risk procurement routes,” according to the Financial Times. The firm, which also helps maintain British railways and roads, said payment problems on four construction contracts nearing or reaching completion had forced it take a provision of USD 1.1 bn. Carillion had also seen costs escalate on other projects, sometimes due to design changes, taking a particular hit on public partnership contracts with governments where prices are set ahead of time. The company’s CEO resigned on Monday, plummeting the value of the company’s stock.

Other EM exits worth noting this morning include Etisalat leaving Nigeria. The company, which is exiting its 45% stake in the company, terminated a management agreement with its Nigerian arm and gave the business time to phase out the Etisalat brand, Etisalat International’s CEO told Reuters on Monday. Nigerian regulators had tried last week to save Etisalat Nigeria from collapse after talks with its lenders to renegotiate a USD 1.2 bn loan failed.

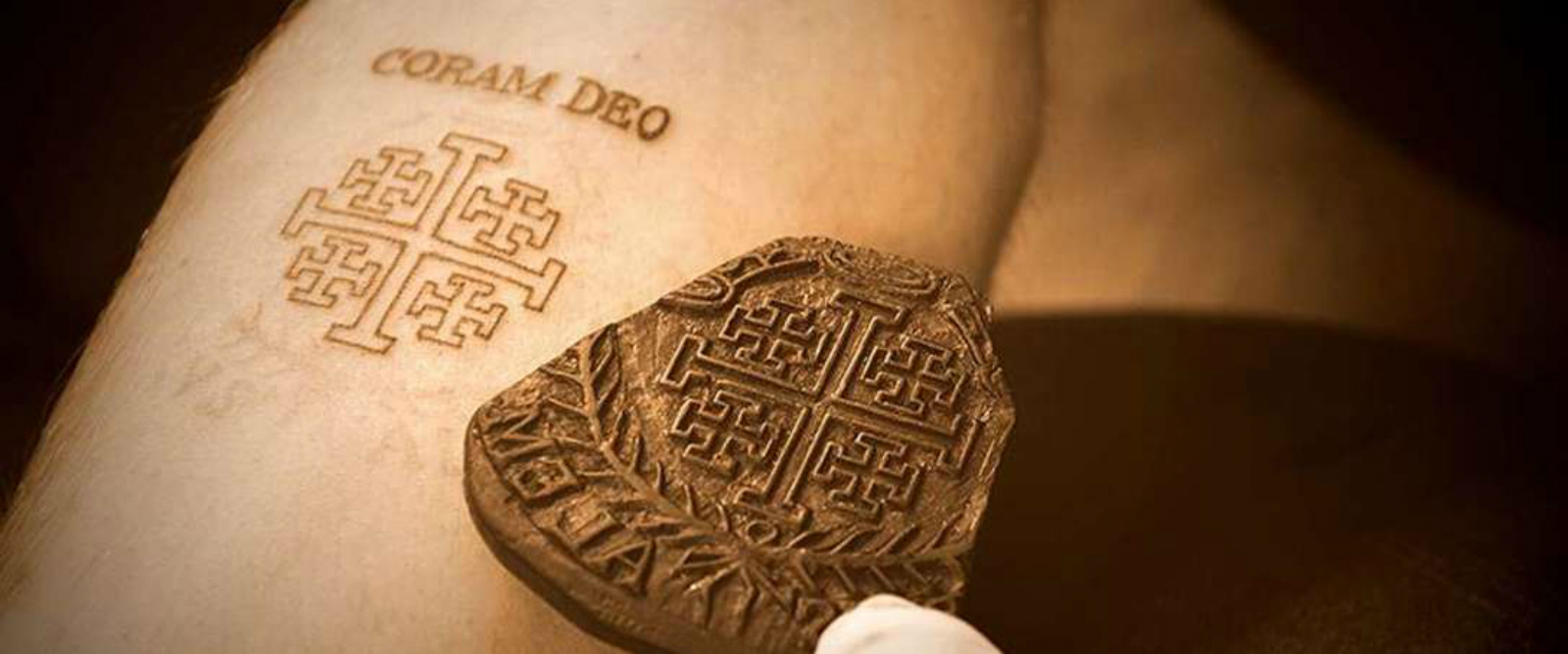

Image of the Day

From wooden stamps to sterile machines: The evolution of the Christian tattoo: An Egyptian Coptic Christian family is carrying on the 700-year tradition of Christian tattoos at a tattoo parlor in Jerusalem, according to Catholic News Agency. “For the past 500 years, we’ve been tattooing pilgrims in the Holy Land, and it’s been passed down from father to son,” says 43-year-old Wassim Razzouk of his family, which boasts a long line of Christian tattoo artists. The tattoo parlor — Razzouk Ink — now uses sterile tattoo machines that differ greatly from the historic practice of using wooden stamps with homemade ink, like the one pictured above.

Egypt in the News

Topping coverage of Egypt in the foreign press this morning is wire coverage of security forces killing six suspected militants during a security raid and shootout in Assiut. The Interior Ministry said security forces raided an apartment being used as “an organizational base” for terror operations, but did not clarify when the shootout took place, Reuters reports. The raid comes days after Daesh claimed twin bombings at two military checkpoints in Rafah that killed at least 23 soldiers, in what was one of the worst attacks against the country’s security forces.

Egyptian authorities’ alleged arrest and deportation of dozens of Uyghur students is drawing the ire of rights groups, Radio Free Asia reports. Authorities “forced [the students] to sign a form stating that they had joined extremist organizations,” the Uyghur Human Rights Project claims, saying that Egypt’s roundup of Uyghur students comes at the behest of the Chinese government. Human Rights Watch also condemned the “outrageous” arrests, saying the Uyghurs risk torture upon their return to China. One student tells RFA that as many as 200 Uyghur students, most of whom are religious students, have been rounded up by Egyptian authorities since 4 July. Human Rights Watch has put the number of detained at 62.

Other international coverage of Egypt worth a skim this morning:

- Saudi Arabia has agreed to extradite four Libyans it arrested for their suspected kidnapping Egyptian diplomats three years ago, the Libya Herald reports.

- Four Coptic Christians in Egypt were murdered in the past few weeks in separate killings blamed on Daesh in Menoufiya, Minya, and Cairo, according to The Christian Times.

- Business tycoon Bill Gates’ daughter Jennifer Gates has been seen with Egyptian professional equestrian Nayel Nassar, 26, on several occasions including at the 12th edition of the International Jumping Monte Carlo, France’s Le Parisien daily reported, according to Al Alrabiya.

Worth Watching

Is Egypt on the verge of a housing bubble collapse? Egypt currently isn’t experiencing a housing bubble at all, since bubbles are created when debt levels are high in the real estate financing system, SODIC Managing Director Magued Sherif tells CBC’s Lamees Al Hadidi during a televised debate over the country’s real estate sector. Sherif points out that mortgage finance is not a particularly popular concept in Egypt, meaning there is limited space for a bubble to emerge. The head of the Federation of Egyptian Industries’ real estate developers division Tarek Shoukry concurred that mortgage finance is underdeveloped here in Egypt, and said he hopes to see the Central Bank of Egypt’s mortgage finance initiative expanding to accommodate middle-income earners. These middle-class citizens will likely be forced to downsize their real estate purchases and settle on smaller units than prior thanks to the EGP float in November, Al Ahly for Real Estate Development CEO Hussein Sabbour maintains. He added that the sector’s skyrocketing prices has led some to perceive it as a precursor to a housing bubble. You can watch the debate in full here (runtime 31:08).

Diplomacy + Foreign Trade

Egypt and the US Agency for International Development (USAID) are in talks for USD 104 mn in funding, according to an Investment and International Cooperation Ministry statement. The funding would be directed towards investments, science and technology, higher education, agriculture, basic education, health, and water and sanitation. Minister Sahar Nasr met with USAID Mission Director to Egypt Sherry Carlin yesterday to discuss cooperation in anti-corruption measures and in technical education, according to the statement. Carlin said the US administration is keen to expand its funding programs in Egypt.

The Egyptian-Lebanese Company For Trade and Investment in Africa signed agreements for Egyptian exports to West African countries worth USD 25 mn in 1H17, managing director Ahmed El-Gohary tells Al Borsa. The company signed USD 5 mn worth of agreements with the Ivory Coast last month, including a USD 500,000 contract to export 1,000 tonnes of potatoes per month, as well as other agreements to export drugs, cosmetics, agricultural crops, and furniture. The company is planning a visit by a delegation of 10 companies to the Ivory Coast’s capital, Abidjan, in the coming weeks to follow up on the signed agreements. The company is also eyeing expansion in Senegal and Ghana as part of its bid to increase exports to African markets to USD 55 mn by year-end.

Energy

Transport Ministry, Eni begin establishing logistics station at Damietta Port

The Transport Ministry and Eni began working on establishing a logistics center and storage areas at the Damietta Port, port chairman Ayman Saleh says, according to Al Masry Al Youm. The new facilities will serve the ground pipeline set to connect the Zohr gas fields to the port’s processing plant, from which gas will be exported. The project is part of a EGP 10 bn investment plan to develop the Damietta Port. There was no word on when the project will be completed.

GANOPE to award two international companies E&P projects Gulf of Suez, Western Desert

The Ganoub El Wadi Petroleum Holding Company (GANOPE) will award two international companies oil and gas E&P projects in 10 areas in the Gulf of Suez and the Western Desert, head of GANOPE’s exploration division Mostafa Abdel Ghaffar tells Al Borsa. GANOPE will announce the winners of the tender in two weeks’ time, according to Abdel Ghaffar.

LaFarge subsidiary to invest EGP 350 mn in alternative fuel source development

Lafarge Group subsidiary GeoCycle is planning to raise its investments in alternative fuel source development to EGP 350 mn during 2017, Al Borsa reports. The company is also looking to boost its production capacity to reach 1 mn tonnes of alternative fuel during the coming years, and is set to launch an alternative fuel factory with a production capacity of 450k tonnes per annum before the end of August. It is also currently in talks with officials from two governorates to establish a refuse-derived fuel factory, which will begin production in 2018.

Electricity Minister meets with local company to discuss expanding production on prepaid electricity meters

Electricity Minister Mohamed Shaker discussed increasing local production of prepaid electricity meters with representatives from Global Electronics yesterday, Al Masry Al Youm reports. The ministry wants to increase the rate at which prepaid meters are installed, the minister said, but provided no further details.

Basic Materials + Commodities

Egypt imports 5.580 mn tonnes of wheat during 2016-2017

Egypt imported 5.580 mn tonnes of wheat during 2016-2017, up from 4.440 mn tonnes the previous year, Supply Ministry spokesman Mamdouh Ramadan said, according to Reuters. The ministry is planning to import 6.2 mn tonnes in 2017-2018, in addition to the 3.4 mn tonnes it purchased from local farmers during the domestic wheat purchase season. Egypt uses around 9.5 mn tonnes of wheat each year for subsidized bread production, the newswire notes.

Centamin’s production from Sukari gold mine drops 11% in 2Q2017

Preliminary gold production from the Sukari gold mine dropped 11% year-on-year in 2Q2017 to 124.6k ounces, Centamin announced yesterday. Meanwhile, quarter-on-quarter production saw a 14% jump, while quarterly throughput increased 5% from the previous quarter. The company is “on course” to reach its target of producing 540k ounces this year, Centamin CEO Andrew Pardey said.

Automotive + Transportation

Passenger car imports drop 53.4% y-o-y during 1Q17

In case you needed any more evidence the auto market is in a rut, passenger car imports declined 53.4% year-on-year in spending terms to USD 329.2 mn in 1Q2017, down from USD 707.8 mn during the same period last year, according to CAPMAS statistics picked up by Al Mal. Imports of car components also declined 26% y-o-y to USD 219.7K, while car part exports earned around USD 104 mn for the period. Passenger car exports during the quarter reeled in a measly USD 30 mn.

Banking + Finance

ICON management makes mandatory offer to acquire company

Industrial Engineering Company for Construction and Development’s (ICON) management, headed by chairman Arafat Mohamed Maged appears to have made a mandatory tender offer to acquire the remaining 46.7% shares of the company and has sent the Egyptian Financial Supervisory Authority (EFSA) the offer for approval, the company said in a bourse filing.

Other Business News of Note

Kuwait’s Wataniya Airways set to resume operations today, will offer flights to Egypt soon

Kuwait’s Wataniya Airways is set to resume operations today after a one-year hiatus, with its first flight heading to the Georgian capital city of Tbilisi, Kuwait News Agency reports. The airline, one of Kuwait’s three national carriers, will offer flights to 16 countries, including Egypt, during its first phase of operation.

Legislation + Policy

Agriculture Ministry working on new penalties for violators of pesticides regulations

The Agriculture Ministry is drafting legislation that would regulate pesticide usage in agriculture and set stricter punishments for the use of unsanctioned pesticides, Agriculture Minister Abdel Moneim El Banna said on Monday, according to Al Mal. The move is meant to address health concerns, El Banna added. The overuse of pesticides in Egypt’s agriculture produce has been an issue of growing concern, especially after a number of Arab countries banned Egyptian agricultural exports. Saudi Arabia had banned Egyptian strawberries last month, saying they contained alarming levels of pesticides, to which Egypt had responded by saying it would impose international quality standards on future agricultural exports to avoid similar incidents.

Government committee begins reviewing Cyber Crimes Act

A committee from the justice and communication ministries has started reviewing the Cyber Crimes Act, MP Kamal Amer said on Monday, according to Al Mal. The legislation will attempt to regulate crimes related to the internet and social media and will be sent to cabinet once the review concludes.

National Security

Egyptian, French navies conducting military exercise

Egyptian and French navy forces are conducting a joint military training under the name “Cleopatra 2017” in Egypt’s Mediterranean and Red Sea waters, according to a statement from the Armed Forces. France and Egypt’s Mistral helicopter carriers, as well as a number of frigates, rocket launchers, and Egyptian F-16 helicopters, will be used in the exercises.

Egypt, Russia to hold joint paratrooper drills

An Egyptian military delegation visiting Russia reached an agreement for the two countries to hold joint paratrooper drills during the third quarter of the year, Russian news agency TASS reports. The drills will be held in Russia, but the exact date and procedures of the exercises have yet to be determined, according to the Russian Defense Ministry. The Egyptian delegation, which is in Russia until Thursday, will visit the site where the drills are set to be held.

On Your Way Out

The Environment Ministry has released 40 sea turtles, which prey on jellyfish, into the Mediterranean Sea to counteract the recent rise in the number of jellyfish, head of the ministry’s North District Protectorates division Mohamed El Essawi said, Al Shorouk reports. Some experts have said that the increase in jellyfish is due to the overfishing of sea turtles, which disturbed the marine ecosystem. El Essawi said the ministry has recorded 7,000 jellyfish washing up on the shores of the North Coast, Alexandria, and Baltim since 28 June, with the North Coast accounting for the lion’s share, according to Al Masry Al Youm.

Reports that Uighur Chinese students studying in Egypt have been arrested and deported en masse are false, Daily News Egypt reports a security source told the MENA news agency.

The markets yesterday

EGP / USD CBE market average: Buy 17.8362 | Sell 17.9368

EGP / USD at CIB: Buy 17.85 | Sell 17.95

EGP / USD at NBE: Buy 17.82 | Sell 17.92

EGX30 (Monday): 13,483 (+1.1%)

Turnover: EGP 1.1 bn (32% below the 90-day average)

EGX 30 year-to-date: +9.2%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 1.1%. CIB, the index heaviest constituent ended up 1.7%. EGX30’s top performing constituents were: Qalaa Holdings up 7.8%, Orascom Telecom Media & Technology up 3.0%, and Sidi Kerir Petrochemicals up 2.5%. Yesterday’s worst performing stocks were: Cairo Oils & Soap down 6.6%, Porto Group down 2.9%, and Arabian Cement down 0.8%. The market turnover was EGP 1.1 bn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -46.4 mn

Regional: Net Long | EGP +42.1 mn

Domestic: Net Long | EGP +4.3 mn

Retail: 62.9% of total trades | 63.9% of buyers | 61.9% of sellers

Institutions: 37.1% of total trades | 36.1% of buyers | 38.1% of sellers

Foreign: 15.2% of total | 13.0% of buyers | 17.3% of sellers

Regional: 14.7% of total | 16.7% of buyers | 12.8% of sellers

Domestic: 70.1% of total | 70.3% of buyers | 69.9% of sellers

WTI: USD 44.51 (+0.25%)

Brent: USD 46.97 (+0.56%)

Natural Gas (Nymex, futures prices) USD 2.92 MMBtu, (-0.17%, August 2017 contract)

Gold: USD 1,213.60 / troy ounce (+0.03%)

TASI: 7,236.94 (+0.98%) (YTD: +0.37%)

ADX: 4,397.96 (-0.28%) (YTD: -3.26%)

DFM: 3,417.94 (+0.45%) (YTD: -3.20%)

KSE Weighted Index: 400.81 (+0.41%) (YTD: +5.45%)

QE: 8,995.12 (+1.02%) (YTD: -13.81%)

MSM: 5,158.83 (+0.47%) (YTD: -10.79%)

BB: 1,308.25 (-0.14%) (YTD: +7.19%)

Calendar

13-15 July (Thursday-Saturday): AGRENA’s 19th Annual Poultry, Livestock, and Fish show, Cairo International Convention Center, Cairo.

15-19 July (Saturday-Wednesday): SSIGE’s GeoMEast 2017 International Congress and Exhibition, Sharm El Sheikh.

23 July (Sunday): Revolution Day, national holiday.

03-05 August (Thursday-Saturday): Watrex Expo Middle East, Cairo International Exhibition & Convention Center.

17 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

26 August (Saturday): 27th Egyptian-Jordanian Joint Higher Committee meeting, Amman Jordan. (TBC).

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

13 September (Wednesday): EIB MED Conference: Boosting investments in the Mediterranean Region, Cairo.

13-16 September (Wednesday-Saturday): Cairo Fashion & Tex exhibition, Cairo International Conference Center

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

23-25 September (Saturday-Monday): Invest In Africa Conference and Exhibitors Summit, Gala Theater Complex, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

06 October (Friday): Armed Forces Day, national holiday.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Smart Cities,” The French University, Cairo. Register here.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.