- The full draft of the FY2017-18 budget is out. (Speed Round)

- Mobius thinks Egypt should be reclassified as frontier. (Speed Round)

- EFG Hermes inaugurates Pakistan office. (Speed Round)

- Banque du Caire IPO will be in 2018. (Speed Round)

- Earnings watch: Cleopatra Hospitals Group, Integrated Diagnostics Holdings, Orascom Construction, Domty all report 1Q17 results. (Speed Round)

- El Sisi is adamant about reclaiming ‘occupied’ state land. (Speed Round)

- CBE Microfinance to push out EGP 30 bn in subsidized financing to as many as 10 mn borrowers within four years. (Spotlight)

- Mercedes-Benz’s new CLA Shooting Brake is now available in Egypt. (Automotive)

Wednesday, 24 May 2017

The full budget draft is out. Plus: Mobius wants us reclassified as frontier.

TL;DR

What We’re Tracking Today

The central bank’s decision to raise interest rates 200 bps was “historic” and any detractors simply don’t get it, CBE Governor Tarek Amer said yesterday in his first public statement on the move. He implied that those who disapprove of the move are looking for short-term gains. Amer declared that inflation was worse for companies than a marginal hike in interest rates, reports Al Masry Al Youm. Amer asserted controlling inflation was the primary mandate of an “independent central bank.” His comments came at a presser announcing a EGP 30 bn CBE microfinance initiative, which we attended. You can catch our coverage of the presser in Spotlight, below.

Are we joining OPEC’s output cuts or not? The oil cartel is expected to announce a nine-month extension of its output cuts when it meets tomorrow. Kuwait’s oil minister says his Saudi counterpart “has talked to several countries including Norway, including Turkmenistan, including Egypt, and they have made signs of their willingness to join the collaboration,” according to Reuters. We have more in Speed Round, below.

Austrian Chancellor Christian Kern is due to meet President Abdel Fattah El Sisi in Cairo today, after which the two will hold a joint press conference, Ahram Gate reports.

PSA for Giza residents: Water service will be interrupted in certain parts of Giza starting today at 8 AM and until Thursday morning due to construction on the Rod El Farag Axis project, according to the Holding Company for Water and Wastewater.

Al Jazeera learns how hard Karma can hit after the UAE blocked Aljazeera.net, the outlet said on Tuesday.

With Ramadan just days away (we’ll know Thursday evening whether the fast begins on Friday or Saturday), our thoughts have already turned to food. Cue the perfectly timed publication of the New York Times food section’s beautiful, clear and simple How to Make Burgers, with a particular emphasis on using cast iron or other heavy-bottomed frying pans in your kitchen.

It’s turning out to be another crappy year on the dead celebrities front. This past weekend, it was Soundgarden frontman and godfather of grunge Chris Cornell, dead in a suicide at age 52. (We don’t normally do the NYT for music coverage, but they owned coverage of his death with their rock-solid obituary, an early appraisal of his legacy and list of his top 10 songs, which is really missing only Birth Ritual and Heretic.) This morning, it’s Roger Moore, and once again we find ourselves agreeing entirely with A.O. Scott, who writes that “Roger Moore Was the Best Bond Because He Was the Gen X Bond.” Moore was 89 and passed of cancer in Switzerland, according to his obituary.

This morning’s edition of Enterprise is brought to you by the Soundgarden Essentials and Soundgarden Next Steps playlists on Apple Music, with a few of tracks from late ‘80s and early ‘90s concert bootlegs thrown in.

On The Horizon

EGX trading hours during Ramadan will be from 10:00 am to 1:30 pm, the bourse announced this week. The shortened trading day kicks into effect on Sunday.

The Petroleum Ministry is expected to announce the results of its global gold exploration tender before the end of next week, officials said.

The Contractors’ Compensation Act could be coming to a plenary session vote at the House by 29 May.

Enterprise+: Last Night’s Talk Shows

The Central Bank’s decision to hike interest rates by 200 bps still preoccupied the nation’s talking heads on the airwaves last night.

On Masaa DMC, Prime Holdings Head of Research Abu Bakr Imam told Osama Kamal that the interest rate hike’s cons far outweigh its benefits, explaining that Egypt’s elevated inflation levels are a result of higher production costs on the back of the float of the EGP and not higher demand (watch, runtime: 2:30). Kamal also spoke to veteran research analyst Hany Genena, who said he believes that the CBE’s decision was a move in the right direction (watch, runtime: 5:21).

Over on Hona Al Asema, MP and Federation of Egyptian Industries (FEI) chief Mohamed Elsewedy complained to Lamees Al Hadidi about how “these repeated interest rate hikes” will harm industry, explaining that manufacturers around the world — “our foreign competitors” — are given special interest rates as incentives (watch, runtime: 4:47).

Lamees also spoke to Egyptian Gulf Bank Executive Director Nidal Assar, who said that the bank has no plans to raise interest rates on CD but will be gradually increase rates on savings accounts. As for his view on the hike, Assar said people need to understand that it’s only a temporary measure that should dissipate once Egypt’s inflation levels begin to cool further (watch, runtime: 4:31).

Lamees then moved on talk about the new furniture city in Damietta, where work officially started yesterday. Trade Minister Tarek Kabil told the host that the city will be equipped with state-of-the-art equipment to help the city — home to two-thirds of Egypt’s furniture industry — improve its production capabilities (watch, runtime: 7:21).

Meanwhile on Kol Youm, Amr Adib spoke to MP Mostafa El Gendy about the struggle to reclaim state-owned land from trespassers, which El Gendy said has been a long time coming (watch, runtime: 4:58). Adib said that President Abdel Fattah El Sisi’s speech today about the issue made it sound as though “some people in high places” believe themselves to be above the land reclamation campaign (watch, runtime: 10:51).

Speed Round

The Finance Ministry made its budget proposal public yesterday (pdf, Arabic, 146 pp): The government is targeting a primary surplus of 0.3% of GDP in FY 2017-18 according to the Finance Ministry’s budget proposal (and financial statement) presented to the House of Representatives. The primary surplus is expected to increase to 1.7-2% of GDP in FY 2018-19. Overall the budget deficit is expected to come at 9% of GDP in FY 2017-18, down from the 10.5-10.8% projected for FY 2016-17. For the current fiscal year, the budget deficit for the first nine months dipped to 8% of GDP from 9.4% during the same period last year, the Ministry said. The budget proposal assumes GDP growth will be no less than 4.6% in FY 2017-18, which would create jobs, lowering the unemployment rate to 11-12% in the same year and to below 10% in the medium term.

The government plans to cut the budget deficit by growing its revenue base 29.6% y-o-y from FY 2016-17’s levels, predominantly through increased tax revenues, compared to a 21.3% y-o-y increase in expenditures. On the revenue side, the base value-added tax rate will rise to 14% from 13% currently, which is expected to increase tax revenues by 0.2-0.3% y-o-y in FY 2017-18. The government will also work on implementing the civil service act, reform the subsidies regime, and expand cash transfers to qualified welfare beneficiaries in lieu of subsidising commodities. The government will also target reducing the ratio of gross debt to GDP to 95% from the projected rate of 102% in FY 2016-17.

One thing that caught our eye is the government’s plan to completely reshape the subsidy regime by relying proportionally more on cash subsidies. The Finance Ministry plans to cut petroleum product subsidies to 33% of total subsidy spending in FY2017-18 compared. By comparison, petroleum subsidies accounted for 64% of all subsidy spending in FY2011-12. With spending on subsidies already projected to grow by 19.5% y-o-y in FY 2017-18, the additional funds will be allocated towards subsidising electricity and to have the state’s contribution to retirement funds increase to 19% of the total subsidy spending.

Funds earmarked for the Takaful, Karama and other cash-handout programs are set to increase to EGP 15.4 bn in FY 2017-18 from EGP 10 bn a year earlier. This comes despite spending on petroleum products being expected to increase by 214.3% y-o-y in FY 2017-18 because of the increase in average oil prices globally and the drop in the value of the EGP.

The Finance Ministry also says it is committed to maintaining the constitutional spending requirement on health and education, while avoiding accounting tricks that would include reclassifying other items as part of the spending. In total, the Ministry says spending on education, higher education, research, and health will be 10.3% of GDP, slightly higher than the total of 10% of GDP required constitutionally.

Mobius thinks Egypt should be reclassified as frontier: Emerging markets icon Mark Mobius said he believes the Philippines and Egypt should be demoted to frontier market status, according to Fund Strategy. Mobius also believes Pakistan should not “graduate” into the emerging market index (it’s set for an upgrade at the end of this month) and that Templeton will continue investing in the country through its Frontier Market fund. Mobius takes issue with using “free float” as the driver of the classification. He says “if the market capitalisation rises and if the trading turnover increases and the number of shares increases through IPOs and other measures, then the free float increases and they want to graduate. That doesn’t really mean the companies increase their governance or improve their behaviour.”

…Mobius’ statements appear to come from a place of love, as he tells the Financial Times that he sees frontier markets as an incredible investment opportunity. “Demographics are very impressive. Urbanisation has a long way to go. Financial penetration is low, therefore there is big potential for growth,” he said. This view goes against what appears to be a recent conventional wisdom, as investors pull their funds out of frontier markets since February. These outflows stand in stark contrast to the rally behind emerging markets as a whole, according to the salmon-colored paper. As we noted earlier this week, Mobius is putting his AUM where his mouth is, resurrecting Templeton’s frontier fund.

Taking an alternative view to placing Egypt and Pakistan in the same category is Mattias Martinsson, CIO of Swedish frontier markets asset manager Tundra Fonder. He tells Frontera that Egypt, which is currently in the recovery phase and lags 4-5 years behind Pakistan, which is in its expansion phase. Egypt remains one its promising new investments. Tundra had been drawn to Egypt following the float and has invested in the likes of Suez Cement, El Sewedy, GB Auto, and Juhayna.

Regional investment bank EFG Hermes announced it has opened its office in Pakistan, “making it the first foreign investment bank to directly enter the market and the first foreign broker to have a local footprint in the country since 2008.” The opening follows EFG Hermes’ acquisition of Pakistani brokerage Invest and Finance Securities, which will now operate as EFG Hermes Pakistan Limited. “In moving into Pakistan and other markets, our goal is to replicate [in frontier markets] our growth out of Egypt into the Gulf Cooperation Council in the early 2000s … Pakistan was our first choice for geographic expansion outside what was previously our core MENA footprint, sharing as it does many of the same characteristics as Egypt, our original market,” CEO Karim Awad says. “We will be particularly focused on securities brokerage, research and on investment banking advisory … We will also be pushing ahead with new voice and mobile trading for high-net-worth individuals as we upscale our existing retail brokerage business this year,” added CEO of EFG Hermes Frontier Ali Khalpey.

IPO WATCH- Egypt expects to raise as much as EGP 7.2 bn from the IPO of Banque du Caire by 2018, Reuters reports. Banque du Caire had planned to list its shares on the EGX in 1H2017 as part of the government’s plan to list state-owned companies. Finance Vice Minister Ahmed Kouchouk, however, told Reuters, the state expects to raise a lower amount of EGP 5-7 bn through the IPO of state-owned companies in FY 2017-18.

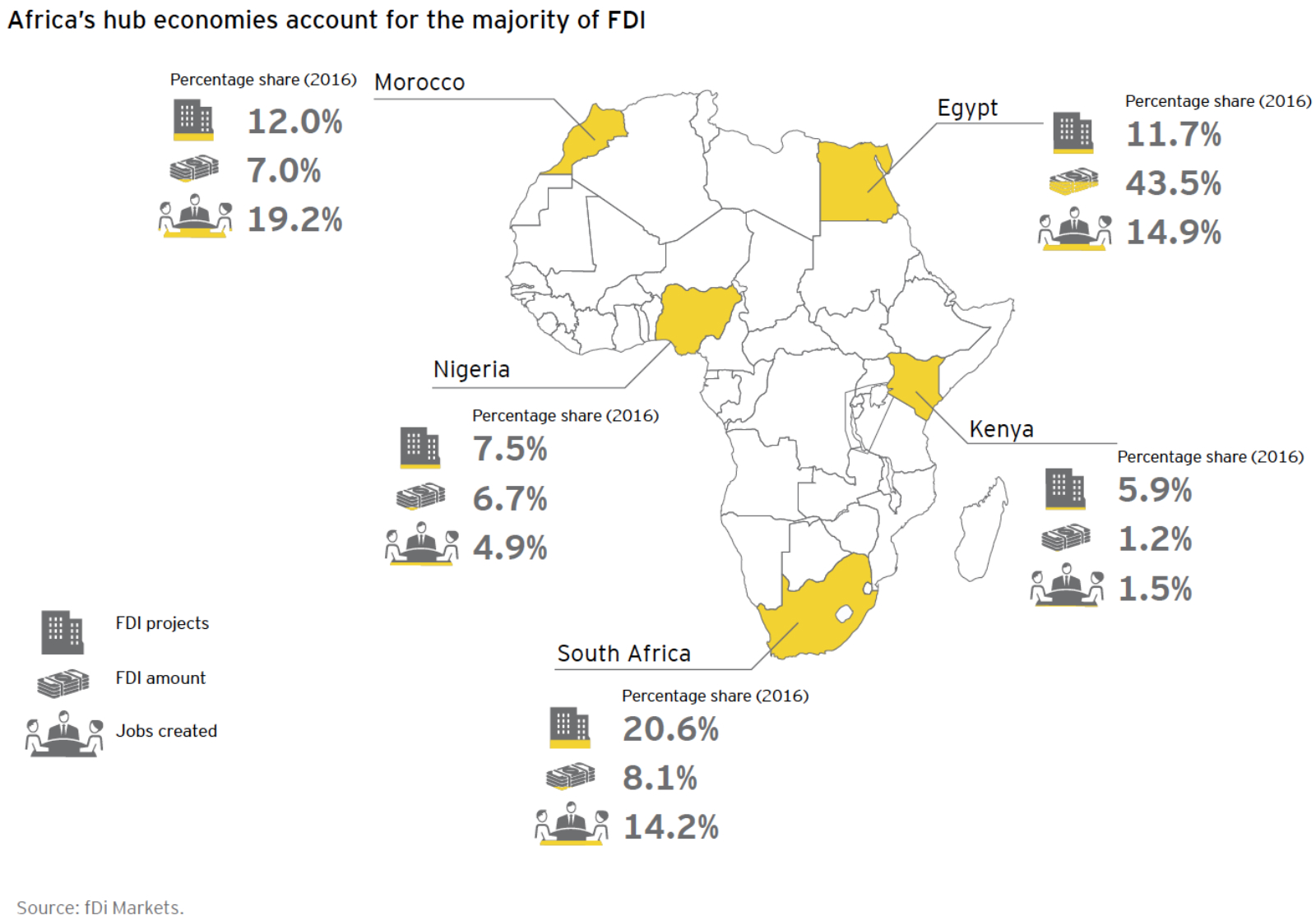

Egypt saw the highest percentage increase in foreign direct investment in Africa in 2016, growing 43.5%, according to EY’s Africa Attractiveness Program 2017 report (pdf). Egypt was the third most popular destination for investments from outside the continent last year, following Morocco and South Africa which remained the top FDI destination in Africa. Out of the top three, Egypt saw the highest number of new FDI-funded projects in 2016, growing 19.7% year-on-year. Egypt, however, dropped eight places in EY’s Africa Attractiveness rankings in 2017 to 11th place. The rankings factor in macroeconomic resilience, market size, business enablement, investment in infrastructure, economic diversification, and governance.

Continent-wide, the report had glowing things to say, predicting that Africa’s economy will reach USD 3 tn by 2030, on the back of 19 countries growing at an average rate of 5%. “Overall growth is likely to remain robust relative to most other regions over the next decade. Structural evolution will continue, and as economic conditions improve globally, much of Africa will be well positioned to accelerate the growth momentum once again,” the report said.

Cairo Angels is investing in EdTech startup Orcas, formerly known as Cairo Sitters, Cairo Angels announced yesterday. Orcas is a “digital [marketplace] for education, tutoring and caregiving services.” The investment is Cairo Angels’ twentieth in a MENA startup. Read the full press release here (pdf).

EARNINGS WATCH- Cleopatra Hospitals Group reported a 29% rise in net income to EGP 29 mn in 1Q17 as revenues advanced 24% y-o-y to EGP 262 mn, according to the company’s earnings filing (pdf). Revenue growth for the quarter was largely driving by better pricing, the company said. While pushing ahead with a number of quality, revenue retention and other initiatives, the Abraaj-backed company also signalled it is moving forward with an acquisition and the rollout of its polyclinic model. Cleopatra CEO Ahmed Ezzeldin noted “progress on expanding our hospital network, including one Cairo-based operating hospital acquisition in the documentation stage; a brownfield, 200-bed hospital in Upper Egypt and Al Shorouk hospital extension in the feasibility study stage; and the signing of a lease for our flagship polyclinic project in East Cairo expected to open in 3Q17.”

London Stock Exchange-listed Integrated Diagnostics Holdings reported a 6% rise in unaudited net profit to EGP 89 mn in 1Q17 in a trading statement released yesterday. Revenues advanced 26% to EGP 346 mn in the same period. “I am very pleased to report the Group is off to a strong operational and financial start in 2017. Our revenue growth accelerated 26% year-on-year in 1Q2017, up significantly from a fully-year rate of 15% in 2016, spurred by higher patient and test volumes and better pricing, as well as some favourable currency translation impact,” said IDH CEO Hend El Sherbini.

Orascom Construction (OC) reported (pdf) a 21.7% y-o-y increase in net income to shareholders to USD 28.0 mn in 1Q2017. OC says its revenues grew by 9.5% y-o-y to USD 1.07 bn in 1Q2017. The company also says it added USD 387.4 mn to its backlog in MENA and the US successfully. CEO Osama Bishai noted, “In the U.S., we are focused on improving our cost structure and market positioning to enhance profitability. Furthermore, we are working on converting existing sizeable committed work into our backlog while pursuing new construction opportunities.” OC’s AGM also approved the appointment of Mustafa Abdel Wadood as a non-executive director of the Company.

Cheese manufacturer Domty recorded a net loss of EGP 6 mn in 1Q2017, down from a net profit of EGP 24.1 mn in the same period last year. The drop came despite revenues growing 27% y-o-y to EGP 471.4 mn, according to the company’s earnings filing (pdf).

Ezz Steel reported a net profit of EGP 560.2 mn for the full year 2016, compared to a net loss of EGP 603.3 mn in 2015, according to a regulatory filing.

Pioneers Holding reported a net profit after tax of 318.9 mn for 1Q2017, down from EGP 354.5 mn in the comparable period last year, according to a regulatory bourse filing.

French dairy producer Danone is partnering with Abraaj Group in a USD 25 mn investment in west Africa-based Fan Milk, Maggie Fick writes for the Financial Times. “The investment in Fan Milk’s Ghana business will help the company meet growing demand for yoghurt and other dairy products in west Africa’s second-biggest economy.” Danone remains bullish about its own growth prospects in Africa, with Pierre-André Térisse, executive vice-president for Africa, saying everything the company experienced in the continent “has been a confirmation of our strategy, even though we are facing volatility in some markets” including Nigeria and Egypt.

Turkmenistan, Norway, and Egypt have all signaled willingness to join OPEC members in cutting their production of oil, Kuwait’s Oil Minister Essam Al Marzouq said, according to Reuters. Norway’s oil ministry was quick to deny any plans to cut output. Al Marzouq said OPEC are discussing “whether to extend output cuts for six months or nine months, because not all [members] were on board for nine.” However, he said that deeper cuts were not being considered. The meeting comes as US President Donald Trump made remarks suggesting the US is considering selling half of the country’s strategic reserve to help balance the books, according to the Financial Times.

El Sisi is adamant about reclaiming ‘occupied’ state land: The government is pressing ahead with its campaign to reclaim state-owned land from trespassers and will evaluate the progress on these efforts at the end of the month with input from governors “and the youth,” President Abdel Fattah El Sisi said at the inauguration of development projects in Damietta yesterday, Al Borsa reports. The president also discussed the effects of the EGP flotation on the country, saying that while it was tough for citizens, it gave the country a chance to increase industrial and agricultural exports, according to Al Shorouk. El Sisi instructed Trade and Industry Minister Tarek Kabil to facilitate low-interest loans for workshop owners in the Damietta furniture city, the construction of which kicked off yesterday.

Human rights lawyer and former presidential candidate Khaled Ali was picked up for questioning by the Prosecutor General for questioning on public morals charges, reports Al Masry Al Youm. Al Shorouk had initially reported that Ali was being questioned on accusations of promoting a political party that is yet to be founded — the Bread and Freedom Party. Ali had been a vocal opponent of agreement to hand Tiran and Sanafir islands to Saudi Arabia and has been suggested as a likely contender for the presidency in 2018. Wire coverage of his arrest (see Reuters and the AP) is getting wide pickup.

In other news from the campaign trail: Ahmed Shafik, the former presidential candidate and Hosni Mubarak’s last prime minister, is “leaning towards” running for president again, the vice president of Shafik’s Egyptian Patriotic Movement tells Al Shorouk. According to Raouf El Sayed, Shafik has yet to make a formal announcement of his 2018 intentions because election proceedings have not begun. Shafik had denied last year in a series of tweets (here and here) that he was considering running for office.

Egyptian investigators are insisting that EgyptAir flight MS804 from Paris crashed after an explosion and not as a result of any malfunction, according to a statement from the Egyptian Civil Aviation Ministry. Egypt’s forensic examinations from December reportedly found traces of explosives on some of the victims’ bodies. French investigators countered earlier this month that they had found none. France’s Le Figaro had said Egypt was trying to conceal “the poor maintenance of the national company’s aircrafts” by pegging the incident on a terror attack. Egypt, by contrast, maintains that France does not want to own up to a failure of airport security.

British police identify Manchester concert suicide bomber, Daesh claims responsibility: British police forces said on Tuesday that they’ve identified 22 year-old Salman Abedi as the suicide bomber behind the attack on a concert in Manchester arena on Monday, which left 22 people dead and dozens other injured, Reuters says. The UK-born Abedi is of Libyan origins, according British intelligence officials. Daesh claimed responsibility for the attack, calling it a “retaliation for Western involvement in the conflicts in Syria and Iraq,” according to the newswire. Egypt’s Foreign Ministry condemned the attack in a statement on Tuesday.

Spotlight

The Central Bank of Egypt launched a new microfinance initiative yesterday that aims to funnel EGP 30 bn to around 10 mn beneficiaries over the next four years. The initiative, which was first hinted at back in December and was formed in collaboration with the Egyptian Microfinance Federation (EMF) and the Egyptian Financial Supervisory Authority (EFSA), was announced by CBE Governor Tarek Amer at a presser we attended yesterday. Key features of the initiative include:

- Eight banks will offer subsidized funding to three microfinance companies and around 752 EFSA-accredited institutions and NGOs working under the umbrella of the EMF. The funding will then be on-lended to individuals or and micro-enterprises seeking specific forms of financing. Recipients may also be able to access direct funding from the Microfinance Projects Development Authority (former Social Fund for Development) and banks.

- The initiative will be rolled into the CBE’s SME-funding initiative, which requires banks grow their SME businesses to 20% of their portfolios by 2020. Microfinance under the initiative will be counted towards that SME quota funding, according to a CBE press release.

Other highlights from the conference, which was attended by other senior CBE, government, and banking sector officials include:

- The move appears to be part of a wider financial inclusion strategy which include a new emphasis on mobile payments. The CBE will hold a meeting with President Abdel Fattah El Sisi to discuss a wide-reaching mobile payments policy, said Governor Tarek Amer. There are now 7 mn mobile payments customers in Egypt, he added.

- The immediate aim is to see micro enterprises grow into small, and then to medium enterprises, said Deputy Governor Gamal Negm.

- Technology is expected to play a leading role in the initiative, said Hisham Ezz El Arab, chairman of CIB and the Federation of Egyptian Banks. He stressed the necessity for the banking sector to make microfinance a crucial part of the banking sector’s strategy going forward.

- It aims to reach places that are most in need, namely Upper Egypt. The main sector in need being the agricultural sector in rural areas, said EMF chairman Mona Zulficar. Total microfinance loans in the market reached EGP 6.7 bn as of the end of 2016, benefiting 2 mn customers, said Zulficar. Repayment rates on these loans has been 99.5%. Women made up 70% of microfinance beneficiaries, according to EFSA numbers.

- Social Solidarity Minister Ghada Wali highlighted how the move sends a message of support from the banking sector to civil society organizations, stressing in publicly accessible terms the importance of building a credit history.

- The Alliance for Financial Inclusion, of which CBE is a member, will hold its meeting in Egypt this year in September in Sharm El Sheikh, Deputy Governor Lobna Helal said.

Egypt in the News

Topping coverage of Egypt in the foreign press this morning are pickups from the wires on the arrest of human rights lawyer Khalid Ali. The stories (see Associated Press and Reuters) have been framing the story as an attempt by the government to arrest opposition opponents ahead of the 2018 presidential elections.

Still high up on foreign coverage is again some beating up on Trump for minding his own business about the domestic affairs of Middle East allies. Abby Phillip and David Nakamura pen yet another piece for the Washington Post on how he has rejected pushing allies on human rights, while The Hill is now leaning purely leaning toward crass insults, calling regional leaders close to Trump “thugs.” Bloomberg is attempting to gauge the mood on the streets of Arab countries, including Egypt, on Trump’s speech in Riyadh.

The debate over the CBE raising interest rates 200 bps has carried into China’s official Xinhua news agency, which has a roundup of views from Egyptian experts and business folks including Mohamed Attwah (economics professor, Mansoura University), Hani Berzi (CEO, Edita), and Ihab Al Desouqi (chair of Sadat Academy’s economics department).

Daesh is spreading out of North Sinai and targeting minorities, writes Jenna Le Bras for Newsweek Middle East in a piece that attempts to cover just about everything about Daesh in Egypt. Le Bras speaks to displaced Christians from North Sinai on how their family members were killed by Daesh, and to Muslims about Daesh killing residents for cooperating with the army. In a sidebar, Lebras claims that political arrests have led to the radicalization of generations of people who become terrorists.

Other coverage worth noting in brief this morning:

- Tourists visiting Egypt should see the Egyptian Museum, the Giza Pyramids, ride a hot air balloon in Luxor, take a felucca down the Nile, and visit the White Desert, Karen Gardiner writes for television channel Bravo’s Jet Set blog.

- One asylum seeker who illegally crossed over into Israel from Egypt in November was the sole person to do so over the past year, marking a drastic drop from the “tens of thousands” who snuck into Israel before the border fence was built in 2012, Haaretz reports.

- What’s up with Moscow? Russia’s Patriarch Kirill has asked Pope Tawadros II to arrange for the transfer of artefacts “connected to the Egyptian forefathers of the Coptic Orthodox church” from Egypt to Moscow, TASS says in a very unusual introduction to a story that otherwise looks at warming ties between the two churches.

Worth Reading

Leading Chinese corporations are not as enthusiastic about the Belt and Road initiative as is Chinese President Xi Jinping, writes Ting Shin from Bloomberg. Under the initiative, China is expected to direct USD 122 bn on infrastructure projects across 65 participant nations, almost two-thirds of which have sovereign debt ratings below investment grade. This has top Chinese firms sweating at the level of risk they might have to take on meet these investments targets. State-owned companies had already insured more than USD 400 bn in projects in the four years before the recent Belt and Road summit, while more than USD 250 bn in China’s overseas investments failed between 2005 and 2015, according to the American Enterprise Institute and the Heritage Foundation’s China Global Investment Tracker. This comes at a time where they are struggling to cut costs and debt.

Some 71% of Chinese companies said political risk topped their concerns about investing abroad, according to a survey of 300 firms. Many executives even question whether top foreign investment insurer China Export & Credit Insurance Corporation, can keep with the pace of unstable governments in the region. Egypt, and some of the other countries vying for the Belt and Road investments, may be looking at less investments than previously hoped.

Worth Watching

Mozzarella sticks are so passé and Halloumi fries look like they’re here to stay. Food cart Oli Baba in London’s KERB Camden market has been driving people nuts with these delicious looking fried halloumi cheese fries. “Forget mozzarella sticks,” says Culture Trip (runtime 0:53). “Covered in yoghurt and a sweet glaze, and topped with mint leaves, pomegranate seeds and chili flakes” these halloumi fries with their “Middle Eastern twist” will leave you craving more and nothing else. You don’t need to go all the way to London to try them —they look easy enough to make at home. So maybe cut down on those ‘atayef this Ramadan and get your hands on some good halloumi. Check out the recipe here on BBC Good Food.

Diplomacy + Foreign Trade

Sudan-Egypt spat escalates again: Egypt is supplying Sudanese rebels with arms, Sudan’s President Omar Al Bashir said, according to Xinhua. Al Bashir said Sudan confiscated “Egyptian armored vehicles in a recent attack by Darfur rebel movements against areas in east and north of the region.” Al Bashir said “the attacking forces set out from South Sudan and Libya, with Egyptian armored vehicles taking part. We have seized these armored vehicles and great number of military vehicles and machinery … We say with high voice that they are Egyptian armored vehicles … Egypt has never provided us with any support in 20 years of war in South Sudan.”

Egypt’s Foreign Ministry issued an official statement Tuesday denying any involvement with the Darfur rebels and stressing that Egypt “did not and will not ever interfere in any action that might destabilize neighboring Sudan or harm its people” because it respects its sovereignty.

The Argentinian parliament ratified the free trade agreement between Egypt and the Mercosur region that was originally signed in 2010, Deputy Trade and Industry Minister Ahmed Antar said, Al Borsa reports. Brazil, Uruguay, and Paraguay had already ratified the agreement.

A five-member EU delegation is set to visit Egypt next week for talks about the economy with CBE Governor Tarek Amer and Finance Minister Amr El Garhy, Al Mal reports. The Finance Ministry may hold a joint presser with the delegation after the discussions, according to an official from the EU Delegation to Egypt.

Energy

Singapore’s Vallianz signs OSV contracts in Egypt

Singapore’s offshore support vessel (OSV) provider Vallianz holdings says it signed its first contract agreements in Egypt and Turkmenistan. Vallianz says it “clinched its first contract with an Egyptian company for a three-year charter of one OSV which has commenced operations in the Red Sea.” Ling Yong Wah, CEO of Vallianz, says “Vallianz is one of the largest OSV providers in the Middle East and has now expanded our footprint to include Egypt.” Vallianz says it signed a total of USD 115 mn worth of contracts for four vessels between Egypt and Turkmenistan, but did not disclose the portion of the contract that was secured in Egypt.

Sinopec downplays concerns about its investment in Egypt

Sinopec downplayed concerns about risks to the value of its investments in Egypt, China Daily’s Zheng Xin reports. Sinopec bought a 33% stake in Apache’s assets in Egypt for USD 3.1 bn in 2013. “The Egyptian project is more of a long-term investment and four years is too short to draw a conclusion. The prices of oil and gas are fluctuating. Now that they have hit the bottom, we’re confident our investment will recover its cost within the expected 10 years,” Zhang Hong, head of the HSE Department of Apache’s JV, Qarun.

Health + Education

Shalakany signs education agreement with BUE

Shalakany Law Office signed an agreement with the British University in Egypt to provide law students with practical experience and education through workshops and an internship and mentorship program, according to a statement (pdf). “We are confident that this program will help talented young law students to bridge the gap between theory and practice. This initiative underlines the firm’s longstanding commitment to actively contributing to the development of the legal community,” Senior Partner Moataz El Mahdy said. The partnership program, which is the first of its kind in Egypt and the region, will be up for renewal in four years.

Real Estate + Housing

Heliopolis Housing to sign EGP 500 mn agreement with El Taamir on Thursday

Heliopolis Housing will sign a EGP 500 mn agreement with El Taamir (Al Oula) on Thursday to finance infrastructure projects at the up and coming New Heliopolis development, Chairman Hany El Deeb tells Al Borsa. The funds will be used in part for the construction of two electrical power stations and the development’s main water pipeline.

Tourism

Nile Air becomes first Egyptian airline to order A321neo aircrafts

Private carrier Nile Air became the first Egyptian airline to order the Airbus A321neo single-aisle aircraft, Aviation Tribune reports. “In April 2017, the airline successfully converted its existing order with the European manufacturer from the current generation A321ceo to the latest technology A321neo offering the best-in-class passenger comfort of any single aisle aircraft.”

Air Cairo to offer flights between Sharm El Sheikh and Copenhagen

Private charter carrier Air Cairo will operate a weekly flight between Sharm El Sheikh and Copenhagen as of 27 June, Travel Trade Weekly reports.

Telecoms + ICT

GTH subsidiary awarded additional 4G spectrum in Pakistan

VEON and subsidiary Global Telecom Holding announced the acquisition of additional 4G/LTE spectrum in Pakistan, through their local 85% owned subsidiary, Jazz. The company says Jazz won the auction, awarding it 10 MHz paired spectrum in the 1800 MHz band for a total consideration of USD 295 mn plus withholding tax of 10%.

Automotive + Transportation

Mercedes-Benz’s new CLA Shooting Brake is now available in Egypt

Mercedes-Benz Egypt released its new generation of compact cars with the new model GLA, CLA Coupé, and for the first time in Egypt, its CLA Shooting Brake, the company announced in a statement on Tuesday. The compact cars boasts newer sleek designs, bumpers, and new light-alloy wheels, said Mercedes-Benz.

Banking + Finance

Gov’t mulls increasing rates on Suez Canal investment certificates

The Finance Ministry is mulling raising interest rates on Suez Canal investment certificates to 17.5%, up from 15.5%, following the central bank’s decision to increase rates, sources tell Al Mal. The sources say the Ministry will deliberate the decision with the central bank. However, Vice Minister Mohamed Maait says the ministry has not yet issued a decision on the matter.

EGX approves CIB capital increase

The EGX approved CIB’s issued and paid-up capital increase to EGP 11.62 bn from EGP 11.54 bn. The capital increase is issued as part of the bank’s stock option compensation plan.

Securities firms to move to fully electronic tax filing and payment system by year’s end

Securities firms will be filing their tax paperwork and making their payments electronically by the end of 2017, Vice Finance Minister Amr El Monayer said on Tuesday, Al Shorouk reports. The move to a digital tax platform is expected to help curb tax fraud and manipulation.

National Security

Egypt will join the NATO-like regional pact, but won’t fight in Syria

Egypt "is going to join" the Middle East military alliance pact advocated by US President Donald Trump and informally known as Arab NATO, if it is created, said MP Ahmed Ismail, member of the House of Representatives’ National Security Committee. However, missing the point entirely of the nickname, Ismail tells Sputnik that Egypt would not engage in active conflicts in Syria if it was called to do by the alliance as President Abdel Fattah El Sisi had declared that Syria could only be resolved peacefully. The alliance is expected to adopt a collective response clause, mimicking NATO’s Article 5.

On Your Way Out

Egypt’s Omar Hegazy became the first amputee to swim across the Red Sea’s 20 kilometer Aqaba Gulf from Egypt to Jordan, Reuters said on Tuesday. Hegazy, a 26 year-old banker who lost his left leg in a motorcycle accident two years ago, trained hard and long to regain his strength and return to his adventurous lifestyle, taking up rock-climbing, snorkeling, and even diving.

Egyptians are going to grow into a population of 119 mn citizens by 2030, the latest findings from a report by the UN Population Fund and Egyptian Center for Public Opinion Research (Baseera) show, according to AMAY. President Abdel Fattah El Sisi had said last week that the government is working on strategies to help curb Egypt’s soaring population growth rate.

The Endowments Ministry announced its intention to “regulate” the use of loudspeakers outside mosques during Ramadan’s Taraweeh prayers to prevent excessive noise, Egypt Independent reports. According to Minister Mokhtar Gomaa, the ministry will allow mosques to use amplifiers outside only if worshipers cannot fit inside the mosque.

The markets yesterday

EGP / USD CBE market average: Buy 18.0197 | Sell 18.1235

EGP / USD at CIB: Buy 18.00 | Sell 18.10

EGP / USD at NBE: Buy 17.95 | Sell 18.05

EGX30 (Tuesday): 12,792 (+1.1%)

Turnover: EGP 1.2 bn (40% below the 90-day average)

EGX 30 year-to-date: +3.6%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 1.1%. CIB, the index heaviest constituent ended up 0.5%. EGX30’s top performing constituents were: Amer Group up 6.7%, Porto Group up 6.3%, and EFG Hermes up 4.8%. Yesterday’s worst performing stocks were: Qalaa Holdings down 4.7%, Juhayna down 1.9%, and GB Auto down 1.4%. The market turnover was EGP 1.2 bn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +31.7 mn

Regional: Net Long | EGP +128.4 mn

Domestic: Net Short | EGP -160.1 mn

Retail: 58.2% of total trades | 48.5% of buyers | 67.8% of sellers

Institutions: 41.8% of total trades | 51.5% of buyers | 32.2% of sellers

Foreign: 24.3% of total | 25.6% of buyers | 23.0% of sellers

Regional: 13.3% of total | 18.6% of buyers | 7.9% of sellers

Domestic: 62.4% of total | 55.8% of buyers | 69.1% of sellers

WTI: USD 51.43 (-0.08%)

Brent: USD 54.18 (+0.58%)

Natural Gas (Nymex, futures prices) USD 3.24 MMBtu, (+0.53%, June 2017 contract)

Gold: USD 1,250.80 / troy ounce (-0.37%)

TASI: 6,936.37 (-0.73%) (YTD: -3.80%)

ADX: 4,546.30 (-0.13%) (YTD: -0.01%)

DFM: 3,363.60 (-0.78%) (YTD: -4.74%)

KSE Weighted Index: 404.25 (+0.44%) (YTD: +6.36%)

QE: 10,123.00 (-0.12%) (YTD: -3.01%)

MSM: 5,401.59 (-0.22%) (YTD: -6.59%)

BB: 1,309.86 (+0.07%) (YTD: +7.33%)

Calendar

27 May (Saturday): First day of Ramadan (TBC).

07-09 June (Wednesday-Friday): 19th Annual Africa Energy Forum, Copenhagen, Denmark.

11 June (Sunday): Egyptian Private Equity Association’s annual Sohour, Four Seasons Hotel Nile Plaza, Cairo.

26-28 June (Monday-Wednesday): Eid Al-Fitr (TBC).

30 June (Friday): 30 June, national holiday.

15-19 July (Saturday-Wednesday): SSIGE’s GeoMEast 2017 International Congress and Exhibition, Sharm El Sheikh.

23 July (Sunday): Revolution Day, national holiday.

03-05 August (Thursday-Saturday): Watrex Expo Middle East, Cairo International Exhibition & Convention Center.

26 August (Saturday): 27th Egyptian-Jordanian Joint Higher Committee meeting, Amman Jordan. (TBC).

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

06 October (Friday): Armed Forces Day, national holiday.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Smart Cities,” The French University, Cairo. Register here.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.