- Morocco’s Attijariwafa acquires Barclays Egypt. (Speed Round)

- Beltone completes acquisition of 60% stake in Auerbach Grayson. (Speed Round)

- IMF sees Egypt consumer prices rising more than 18% in 2017. (Speed Round)

- El Garhy in DC for annual IMF meetings (What We’re Tracking)

- Competition Authority probing automotive industry. (Speed Round)

- EFG Hermes said to lead as government narrows list of candidates for Banque du Caire IPO. (Speed Round)

- Not registered for the VAT by Sunday? You could be facing tax evasion charges. (Speed Round)

- Maglis El Dowla ratifies FiT phase one agreements. (Speed Round)

- House returns from recess, approves Civil Service Act, may sanction Agina (Speed Round)

- By the Numbers

Wednesday, 5 October 2016

IMF says inflation will run north of 18% next year

TL;DR

What We’re Tracking Today

Devaluation before the long weekend? The Central Bank of Egypt kept the exchange rate unchanged at yesterday’s FX auction, selling USD 117.9 mn to banks at EGP 8.78 per USD 1. This was “confounding expectations of a devaluation that had helped fuel a stock market surge,” Reuters says. The newswire noted the parallel market’s FX rate dropped to the “unprecedented level” of EGP 14.20-14.25 per USD 1. Al Borsa pegs the rate lower at EGP 13.85 per USD 1. An FX trader told Al Shorouk there’s no turnover in the market, saying most are sitting on the sidelines waiting to see where the official rate will hit. The parlour game now expects devaluation to hit today.

Finance Minister Amr El Garhy left for London yesterday en route to the annual meetings of the IMF and World Bank Group, which are due to take place on 7-9 October. El Garhy will be meeting with a number of investment banks and executives from the London Stock Exchange ostensibly to draw investments to Egypt’s infrastructure projects, according to a ministry statement which ran in Al Borsa, although it is more than likely that discussions there will include the USD 3 bn eurobond issuance. El Garhy, who has proven himself an exceptionally competent steward of his ministry (between the IMF talks and the enacting of the VAT), has previously said the eurobond would likely be placed sometime this month. Also on the road: Deputy Finance Minister Ahmed Kouchouk and a number of other senior ministry officials, all of whom are set to arrive in DC on Thursday. Central Bank Governor Tarek Amer and Planning Minister Ashraf El Araby are set to join them for the final push to secure the USD 12 bn IMF facility.

El Garhy is also expected to speak at the International Institute of Finance meeting (pdf) on Thursday along with Mohamed El Erian. El Garhy is then off for another round of meetings in New York with investment banks.

International Cooperation Minister Sahar Nasr is in Washington DC this weekend for talks on securing USD 8 bn in funding pledged by the World Bank Group, (including USD 2 bn from its member the International Finance Corporation) Al Ahram reports. The minister will be meeting with the Executive Directors of the World Bank in her capacity as the Governor of Egypt to the World Bank Group.

The Emirates NBD/ Markit purchasing managers’ indices for Egypt, Saudi Arabia and the UAE will appear here this morning about 15 minutes after we dispatch. The Egyptian gauge deteriorated for 11 straight months through August.

A ban on the sale in Egypt of tickets that do not begin or end in Egypt will go into effect today. Civil Aviation Minister Sherif Fathi issued the decree last weekend.

President Abdel Fattah El Sisi will discuss the Grand Ethiopian Renaissance Dam with Sudanese president Omar Al Bashir at Ittihadiya today. On the agenda: Trade and the Grand Ethiopian Renaissance Dam.

The first and only vice presidential debate of the US campaign season between Democratic nominee Tim Kaine and Republican Mike Pence was ongoing around time of dispatch. PBS, as they did for the first presidential debate, had a livestream and transcript interspersed with fact-checking that can be found here. The next presidential debate will take place on Monday, 10 October.

*** Tomorrow is a national holiday in observance of Armed Forces Day. Enterprise will be off tomorrow and Friday (so no Weekend Edition). We’ll be back at the usual time on Sunday morning.

On The Horizon

Sunday is the deadline to register for the value added tax. The domestic press is quite convinced that late registrants could face tax evasion charges. We have more in Speed Round, below.

The deadline for phase one feed-in tariff investors to decide whether to remain under phase one conditions or move to phase two terms is on Friday (07 October).

The NTRA board is set to decide the fate of the 4G spectrum rejected by the three incumbent mobile network operators on Wednesday (12 October).

Speed Round

BARCLAYS BANK HAS AGREED TO SELL its Egyptian unit to Morocco’s Attijariwafa Bank. Barclays says the sale of 100% of its Egyptian subsidiary is expected to reduce its risk-weighted assets by GBP 2 bn, boosting its core capital ratio by nearly 0.1%. “Barclays Bank Egypt has approximately 1,500 employees and 56 branches. Completion is subject to regulatory approvals, and is currently expected to occur by the end of 2016.”

Neither Barclays nor the Casablanca-listed lender’s statement yesterday (pdf) disclosed the value of the transaction. The bid has previously been rumored to be in the USD 500 mn neighborhood. The Financial Times (paywall) puts the sale value at USD 500, while Reuters says unnamed sources have previously valued Barclays Egypt at about USD 400 mn.

Attijariwafa Chairman and CEO Mohamed El Kettani said: “The Egyptian economy and banking sector offer significant growth prospects in the medium and long term. Barclays Bank Egypt, thanks to its positioning, highly talented management and motivated workforce, strong capitalization and clean balance sheet is the ideal platform to roll out Attijariwafa bank’s universal banking model in Egypt.”

The new kid on the block: Based in Casablanca and traded on the Casablanca Stock Exchange. Attijariwafa Bank has a 20-country footprint with brands including Attijari Bank in Tunisia, CBAO in Senegal, SIB in Ivory Coast, CBAO in Burkina Faso, BIM in Mali, among others. Attijariwafa employs some 17,367 people. It had a market cap of USD 7.4 bn last week and reported “net banking income of USD 1.9 bn and net income of USD 535 mn” in 2015. Attijariwafa bills itself as a universal bank offering “retail banking, private banking, corporate & investment banking, specialized financial services, asset management, insurance and international retail banking.”

Attijariwafa bank was advised by UBS Investment Bank, Attijari Finances Corp., Naciri & Associés Allen & Overy, Sharkawy & Sarhan Law Firm and Mazars. Barclays, which first opened in Egypt in 1864, did not disclose its advisors.

BELTONE CLOSES AUERBACH ACQUISITION: In other M&A news, Beltone Financial Holding announced late yesterday afternoon (pdf) that it had completed its acquisition of a 60% stake in New York-based brokerage Auerbach Grayson & Company. The financial details of the transaction were not disclosed. Naguib Sawiris, CEO of Beltone parent company OTMT, said “the Auerbach Grayson acquisition is a natural extension for our businesses and is the first step in our strategy to create a major Middle East-based global investment bank.” Beltone Chairman Sameh El Torgoman says the acquisition enables Beltone to “increase its exposure and broaden its customer base in emerging and frontier markets” and “aligns with Beltone broader corporate strategy to expand its brokerage, asset management and investment banking operations beyond the Middle East.” Auerbach Grayson specialises in global trade execution and exclusive in-depth research on developed, frontier and emerging markets for US institutional investors. Reuters has the story, which first broke in FastFT.

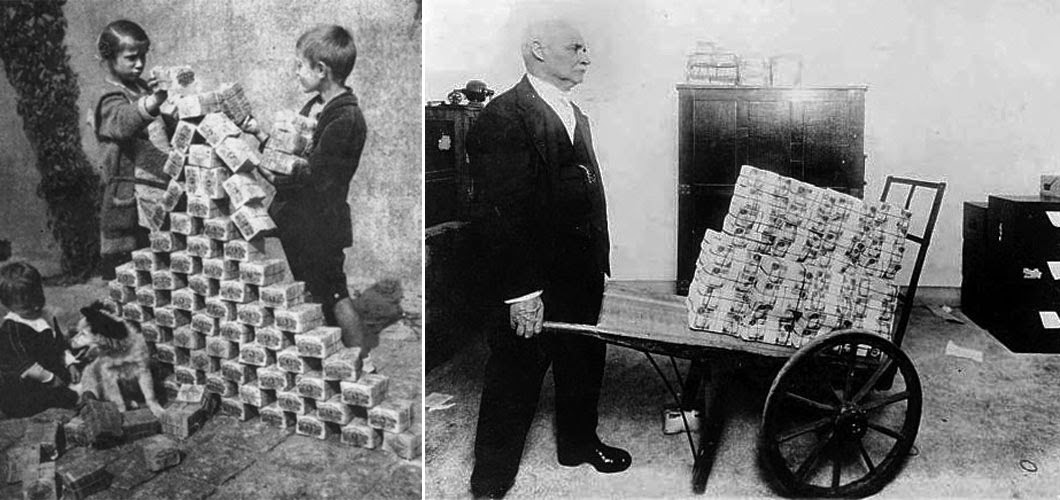

PRICES COULD RISE >18% NEXT YEAR, according to the IMF. The International Monetary Fund sees consumer prices in Egypt rising 18.2% in 2017 compared with a 10.2% hike this year — that’s the highest projected rate in the entire Middle East, North Africa, Afghanistan and Pakistan region. The IMF dropped the bombshell in its October 2016 World Economic Outlook (pdf), the standard revision of its annual forecast issued in April. The IMF document revised its 2016 forecast for rise in Egyptian consumer prices to 10.2% from April’s estimate of 9.6% — and more than doubled its outlook on 2017 to 18.2% from the April estimate of 9.5%.

There is a hint of good news: The IMF has revised Egypt’s projected growth in real GDP for 2016 to 3.8% (from 3.3% in the April 2016 WEO). However, projections for growth in 2017 were cut from 4.3% in April to 4.0% in the October report. Its projections for Egypt’s unemployment rate improved to 12.7% for this year (from 13.0% in the April estimate) and 12.3% for 2017 (from a projected 12.4% in April). The current account balance as a percentage of GDP was revised downwards to -5.8% in 2016 (from an estimated -5.3% in April), but shows a slight improvement in 2017 projections to -5.2% (as opposed to April estimates of -5.3%). On the very long run, the IMF projects (pdf) Egypt’s real GDP to continue to grow, hitting annual growth rate of 6.0% in 2021.

Meanwhile, the IMF held steady its projections for global growth, lowering them for the US in 2016 and 2017 and the UK for 2017 on the back of growing populist sentiment against trade and economic integration. Revisions to its outlook for Egypt cannot be described as simply “positive” or “negative.”

What to make of the IMF’s global forecasts? Capital Economics released a note yesterday by their Global Economist Michael Pearce, who says that while the IMF pessimistically admits that the world economy is “moving sideways,” he feels that the IMF has actually “consistently been over-optimistic in recent years” and “the IMF’s latest forecasts will be downgraded further. For a start, the Fund seems to be too upbeat on the prospects for the euro-zone… Second, the IMF is anticipating stronger growth in many emerging markets than we think is likely.” Read the full note here (pdf).

GOV’T ZEROES IN ON ADVISERS FOR BANQUE DU CAIRE IPO: The Ismail government is actively seeking financial advisers for a possible IPO of Banque du Caire, El Watan reports. BdC subsidiary Misr Financial Investments Company (MFIC) is charged with managing the selection and has narrowed it down to four candidates:

- Pharos + Deutsche Bank

- EFG Hermes + HSBC

- CI Capital

- Morgan Stanley

The newspaper cites unnamed industry sources as saying EFG Hermes (whether in a in partnership with a global institution or alone) is favoured by a committee charged with managing the IPO with representatives from the central bank, the Finance Ministry, BdC and MFIC. It is yet unclear how big the stake in the bank will be on offer, but as we noted earlier, the state will be looking to retain a minimum 51% ownership stake. Banque du Caire is expected to be part of the first wave of state-owned companies up for IPO as early as 1H2017.

And while we’re on IPOs, Obour Land has selected Grant Thornton to conduct the fair value report ahead of its planned IPO, which according to Matouk Bassiouny’s head of capital markets Mohamed Abdel Fattah will take place before the year is out, Al Borsa reports.

TAX EVASION CHARGES COULD AWAIT YOU if you are not registered for the value-added tax (VAT) by Sunday 9 October, which Al Mal says is the revised deadline for registration given the statutory deadline of 8 October falls on a Saturday. Businesses with annual sales of more than EGP 500k in the 12 months prior to the passing of the tax are required to register within 30 days of the legislation becoming law (8 September). Failure to register could ultimately result in a prison sentence of three to five years and a EGP 5,000-50,000 fine under article 67. By last month’s count, 260K businesses have been registered, with the Tax Authority expecting with 200K more to be registered by the deadline.

Lawyers are in big trouble… A survey by Al Mal found that “professional service providers” (doctors, accountants) have not been registering, with 1 out of 11 offices having registered for the VAT. Lawyers have avoided registering in protest, while accountants, naturally, have been doing a better job. It is unclear as of yet whether private medical practices will be exempt. Despite their protests and a lawsuit challenging the VAT, lawyers are obliged by law to register, said Ashraf Abdel Ghany, head of the Egyptian Tax Experts Group. The Lawyer’s Syndicate alleges its members are exempt from paying taxes under Article 198 of the constitution, which defines the profession as “Free” or “independent.” The Egyptian Council of State has set a date of 23 October to look into the case.

Deadline for the executive regs slipping? The executive regulations for the VAT will be released before the end of October, Deputy Finance Minister Amr El Monayer told Al Mal, in a vague hint at that it may not be ready with the regs on time. Tax Authority chief Abdel Moneim Mattar had hinted at a closer deadline, saying that the regulations would be released this week, as we had noted yesterday.

MAGLIS EL DOWLA RATIFIES FIT PHASE ONE CONTRACTS: The Egyptian Council of State (Maglis El Dowla) has ratified the agreements for phase one of the feed-in tariff program, government sources tell Al Borsa. The agreement would be for companies that have chosen to remain under the phase one conditions of the FiT program, which enforces domestic arbitration, requires 85% of funding for the project to be sourced abroad but has a FiT rate of USD 0.14 per kWh for solar projects as opposed to USD 0.084 in phase two. Phase one companies are expected to sign the contracts in about 20 days’ time, said Gamal Abdel Rahim, head of the Egyptian Electricity Transmission Company. Infinity Solar, Summit Egypt, and Saudi’s Al Fanar are reportedly set to meet the 26 October deadline to close on their phase one solar projects.

The state is now arranging reimbursements for those exiting FiT altogether, sources tell the newspaper. Three companies have formally written to the government of their intention to exit: Abdul Latif Jameel, Enel Green, and Cairo Solar. Other companies who have not signed on to phase one, have until 7 October to decide whether to accept phase one conditions, move to phase two terms, or exit the program altogether.

THE NTRA COULD CHARGE bidders for the 4G licence entirely in USD, should the authority issue an international tender, Al Mal reported. The NTRA board will decide on the fate of the licence, which was rejected by local MNOs, on 12 October. Options on the table include tendering the license for bids from international operators with new conditions or selling some of the remaining 25 MHz spectrum bandwidth to Telecom Egypt (TE). Kuwait’s Zain formally renewed its interest in acquiring a 4G license in USD, while China Telecom and Saudi’s STC have also said they’re interested, but have not formally filed a request with the CIT Ministry. As we had previously reported, Vodafone Egypt, Orange Egypt, and Etisalat Misr have all refused the 4G license citing the spectrum on offer would neither allow for operating 4G services effectively nor for faster internet speeds, as well as difficulty arranging 50% of the cost in USD.

But an international tender is probably the worst option, unnamed telecom sector sources tell Al Borsa. A fifth operator entering the market means they would have to sign a framework agreement with the existing MNOs to piggyback off their infrastructure for 2G and 3G services, which would increase the load on the networks, impacting service levels negatively. Additionally, the CIT Ministry, according to the sources, should ensure TE gets a 10% market share before allowing another operator into the market. The best option, they say, is to restart talks on 4G spectrum with the existing operators.

COMPETITION AUTHORITY PROBING AUTO INDUSTRY? Automotive distributors are reportedly the subject of a probe into price-fixing allegations by the Egyptian Competition Authority (ECA), according to Al Mal. The newspaper quotes ECA chief Mona El Garf as saying the ECA is looking into practices that it alleges contributed to unreasonable price hikes in all categories of vehicles. El Garf provides no further information, saying the results of the probe would be released only after it is reviewed by the ECA’s board.

The news comes as automotive sales fell 26% year-on-year in 8M2016 to 137.6K vehicles sold, down from 185.9K during the same period in 2015 as the industry grappled with the impact of the FX crunch. Passenger car sales declined by 25% to c.97,400 vehicles sold, down from 130k in the same period last year, Al Mal reports. Hyundai held the top spot and saw its market share rise to 28.9% y-o-y from 24%, followed by Nissan with a 13.9% market share, Chevrolet (10.1%), and Kia (7.7%). Meanwhile, bus sales plummeted by 31.7% y-o-y for the period, with 15,246 vehicles sold, down from 22,336, according to the newspaper which cited a report by the automobile industry’s information council (AMIC). Truck sales have fallen 25.8% for the period.

HOUSE FINALLY GETS AROUND TO APPROVING CIVIL SERVICE ACT: The House of Representatives passed the Civil Service Act on Tuesday — its first day back from recess — with 401 MPs voting in favor, Al Masry Al Youm reports. While the House initially approved the law back in July, amendments to certain clauses and delays in reaching a quorum resulted in a three-month delay for final approval.

MPs also approved “in principle” a bill clamping down on illegal migration, agreeing to consider the proposed law in full at a later date. The bill defines the crime of human trafficking and imposes new fines and prison sentences on traffickers and those who aid and abet them. The law would also guarantees protections to migrants from prosecution, mandate that the state provide for their needs and set up a fund to defray the cost of assistance to migrants in Egypt.

The Thing Called Agina has been referred to a disciplinary committee hearing, Al Mal reports. Members of the House said Rep. Elhamy Agina most recent comments were offensive and do not represent parliament. The National Council of Women and Cairo University President Gaber Nasser have also filed a complaint with the Prosecutor General’s Office after the MP called for women to undergo [redacted] tests as a condition for admission to university.

The Nobel Prize in Chemistry will be announced today. The announcement press conference will be available online at 11:45 am CET. Yesterday, The 2016 Nobel Prize in Physics was awarded to David Thouless, as well as F. Duncan Haldane and J. Michael Kosterlitz “for theoretical discoveries of topological phase transitions and topological phases of matter.” The awarding committee says this year’s laureates “opened the door on an unknown world where matter can assume strange states. They have used advanced mathematical methods to study unusual phases, or states, of matter, such as superconductors, superfluids or thin magnetic films. Thanks to their pioneering work, the hunt is now on for new and exotic phases of matter. Many people are hopeful of future applications in both materials science and electronics.” You can read more about the scientific background behind their work. The Nobel Peace Prize will be announced on Friday. The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel will be announced on Monday, 10 October.

Yahoo is spying on you. If you have an email account with the digital also-ran, you’re going to need to ask yourself whether you’re comfortable using a service that built an app to actively scan mns of accounts — including incoming and stored messages — for the US intelligence community. Read the exclusive from Reuters here. If the hacking of 500 mn or more accounts wasn’t enough…

The Macro Picture

Yuan joins SDR basket of currencies: Last Friday, the Chinese yuan joined the basket of currencies that form the International Monetary Fund’s unit of account, the Special Drawing Right (SDR). The inclusion in the SDR is a “big milestone in the in the internalisation of China’s currency. While the yuan is still far from being a major global reserve currency, inclusion in the SDR basket will help nudge it in that direction,” the Economist notes.

Egypt in the News

US Democratic vice-president nominee Tim Kaine had a blueprint for rebuilding the relationship between the US and Egypt, Al-Monitor reminds us. In 2014, he presented his plan to President Abdel Fattah El Sisi, asking for “bold and courageous policy initiatives.” Kaine had said El Sisi “should narrow the definition of terrorism and announce ambitious security sector modernization” adding that he should “release political prisoners … pardon nongovernmental organization workers convicted under Morsi and invite all Egyptians who renounce violence back into the political process.” On the economy, Kaine said El Sisi should “pursue difficult but practical reforms, and engage the international financial institutions” and “needs to create a business-friendly environment to invite investment and tourism to return.” He also said that, ideally, Egyptians would “not be stuck with the same old choice between the statist establishment and the Muslim Brotherhood.”

Gulf News’ Linda S. Heard argues that “a strong Egypt would serve western interests,” claiming that the US and Europe have not praised Egypt enough on their efforts to establish security and stability in the region. While western media continues to attack Egypt over its human rights record and ignores that of Turkey, Heard claims that President Abdel Fattah El Sisi has done or is in the process of doing everything he pledged to do. A weaker Egypt may lead to an influx of immigrants into Europe, as well as an unstable region “amounting to a calling card for terrorist groups […] to flood in from Libya,” she warned, before claiming that Donald Trump seems to be the only politician standing with Egypt.

The Guardian’s Alexander Stille wrote for the long read section about the murder of Giulio Regeni. Stille does not bring to light any new information, but notes that, “in a digital age, it’s harder than ever to get away with murder.”

Image of the Day

Rice straw fires in the Nile Delta: Journalist Peter Schwartzstein tweeted this image from a plane over the Nile Delta, where visible plumes of smoke rise from burning rice straw fires set by farmers — smoke that drifts to Cairo and aids to its air pollution. The air quality has been better than usual this fall, leading us to wonder whether the cement industry’s appetite for refuse-derived fuel may be a factor. But it’s still early: We typically find mid-to-late October “high season” for the choking smoke.

Worth Watching

Google keynote Silicon Valley intro: While fans of HBO’s Silicon Valley will have to wait until April 2017 for new episodes, they can watch a scene with Ginesh (Kumail Nanjiani) and Gilfoyle (Martin Starr) which launched yesterday’s Google event. (Watch, running time: 1:48)

Diplomacy + Foreign Trade

The Trade and Industry Ministry has signed an MoU with its South African counterpart to boost bilateral investment, iafrica reported. “The MoU is designed to conduct an effective and efficient programme geared towards the promotion and facilitation of cooperation of investment activity within high valued added sectors,” the South African Department of Trade and Industry said.

President Abdel Fattah El Sisi met with a delegation of Anglican Church bishops and primates, along with MPs from the UK, attending the week-long meeting of the Global South group of Anglicans, according to Al Mal. The president asserted that Egyptians do not experience discrimination on the basis of their religious beliefs and his government’s commitment to shaping religious discourse away from fundamentalism.

Energy

KarmSolar launches Egypt’s first off-grid solar plant

KarmSolar has inaugurated Egypt’s first off-grid solar power plant, Al Borsa reported. Last year, the renewable energy firm became the first company licensed to sell electricity produced off-grid from solar energy to private consumers. The small plant, which has a capacity of 1 MW, was built on a dairy farm owned by a subsidiary of Juhayna. The plant will spare the farm having to consume 600k litres of diesel per year and will reduce emissions by 1.62k tons of carbon dioxide per year.

Beni Suef, Burullus power plants to be connected to the grid this month

The Beni Suef and Burullus power plants will be connected to the national power grid this month, said Electricity Minister Mohamed Shaker. The Beni Suef plant should be linked by 11 October while the Burullus plant will be connected by 30 October, Al Mal reports. He added that all three Siemens combined-cycle plants will be generating 4.8 GW from their total capacity of 14.4 GW by December, Shaker added following a meeting with Siemens. This comes as the ministry recently paid Siemens EUR 2.1 bn in arrears for their work on the power plants, a ministry source tells Al Borsa. The ministry has a three-year grace period to pay Siemens, under the agreement.

Basic Materials + Commodities

Tecnova completes high-productivity greenhouse in Egypt in 2017

Spanish agriculture technology center Tecnova signed an agreement with the agriculture ministry to build high-tech greenhouse structures for temperate climates in the north of the country, Fresh Plaza reported. The government signed a similar agreement with the Netherlands to compare both technologies on the basis of productivity and profitability. Both pilot projects are set to be completed in 1H2017.

Russia reports 47 safety health violations in Egyptian exports in 10M2017

Russia reported 47 cases of suspected health violations in Egypt’s agricultural exports during 10M2017, Russian Trade Representative to Egypt Fedor Lukashin said, Al Mal reported. Russia is also set to send a delegation in the coming weeks to assess sanitary standards for Egyptian agricultural products, he added. Separately, Lukashin said that no date has been set yet for the resumption of Russian flights to Cairo.

Egypt to get more Lebanese apples

Egypt and Lebanon are finalizing an agreement to increase Lebanese apple exports to Egypt from 38k tons to 50k tons, Lebanon’s Agriculture Minister Akram Chehayeb said, the Daily Star reported.

GASC purchases 240k tonnes of wheat from Russia

The General Authority for Supply Commodities (GASC) has purchased 240k tonnes from Russia for delivery during the first ten days of November following Monday’s tender, Al Mal reports. PM Sherif Ismail ordered increasing sugar imports to 400k tonnes and rice imports to 500k tonnes, the newspaper adds.

Real Estate + Housing

ARDIC begins construction on EGP 2 bn Zizinia El Mostakbal project in New Cairo

Real estate developer ARDIC has begun construction on the EGP 2 bn Zizinia El Mostakbal project in New Cairo, Managing Director Ashraf Dowidar told Al Borsa. The development is part of the larger planned project El Mostakbal City, he added. The company has brought on three subcontractors, including Alpha Industries & Construction, Al Tabarak for Engineering & Contracting, and Al Huda for Contracting on board, Dowidar added. ARDIC is investing EGP 400 mn into the first phase, which is set to be completed in four years.

Zayed Edge completes design of EGP 1 bn mall in Sheikh Zayed

Elgabaly Architects have completed design work for a mall in Sheikh Zayed that has an investment cost of EGP 1 bn and will be built by the Zayed Edge company, Al Borsa reported.

Tourism

Gov’t to form a company to manage Antiquities sites

Egypt is mulling whether to set up a company to manage antiquities and historical sites with the assistance of French consultants and support from Ayadi Company for Development and Investment, Planning Minister Ashraf El Araby was quoted as saying by Al Mal. This would presumably exclude the Giza Pyramids, whose management will be outsourced private companies.

Tourism Ministry set to repay charter airline arrears

The Tourism Ministry is set to repay next week EGP 120 mn in arrears owed to charter airline operators since April 2015, the ministry’s economic advisor Adla Ragab told Al Mal. The arrears were restructured after they were delayed for a year, with the first instalment amounting to EGP 40 mn, she added. The return of charter flights to Sharm El Sheikh was expectedly well received, but tourism sector employees are stressing the importance of Russian tourism which accounts for 75% of hotel occupancy, Al Shorouk reported.

Telecoms + ICT

Global Telecom Holding brings 4G to Algeria

Algeria is getting 4G before us and it is provided by Djezzy, a subsidiary of Global Telecom Holding. Djezzy said it launched 4G/LTE services in Algeria yesterday, with parent company Vimpelcom saying it already launched 4G services in nine out of its 14 markets. “The launch of 4G/LTE is expected to boost Algeria’s economy, advance innovation, productivity and better optimize costs, reflecting the high quality network experience that countries such as the UK … [and] South Africa have enjoyed,” Djezzy says.

Automotive + Transportation

Ousta running a 20% discount on all rides for the upcoming three months

Ride-hailing app Ousta is offering a 20% discount on all rides for the next three months, Al Borsa reports citing a company statement. The company is framing the move as a response to an initiative called for by talk show host Amr Adib to reduce prices 20%. However, the company has solidified its place as third in a mostly two-horse race in part by undercutting giants Uber and Careem and not charging surging prices, a strategy that has worked well for Ousta so far.

Other Business News of Note

WB’s Upper Egypt program to focus on cluster development

World Bank (WB) MENA Senior Infrastructure Economist Axel Baeumler sheds light on the research behind the WB’s USD 500 mn Upper Egypt development program on the World Bank’s Arab Voices blog. Baeumler describes finding solutions to support local private sector growth as “an intractable challenge.” With the informal sector dominating the local economy, he says that “cluster development,” where a group of enterprises produce similar products within the same region, is key to help these micro businesses grow, through support of product development, exposure to new markets and regulatory problem-solving, among others. A performance-based grant mechanism for infrastructure development will also be implemented, as infrastructure had always faced disinvestment and mismanagement in the Upper Egypt.

Tahya Misr Fund to launch a EGP 2.5 bn holding company

The Tahya Misr Fund plans to form a holding company with a capital of EGP 2.5 bn, said the fund’s CEO Mohamed Ashmawy. The company will look to develop seven pharma factories, he added, according to Al Mal.

On Your Way Out

Remembering the two regions that tried to secede from Egypt: The Al Masry Al Youm Lite edition recounts the stories of how two regions, Zefta and Minya, tried to secede from British-ruled Egypt following the exile of national leader Saad Zaghloul in 1919. In protest of the British occupation, Azhar scholar Sheikh Ahmed Hatata recruited former regime personnel by promising to raise their wages and declared Minya an independent empire. Similarly, in the city of Zefta, in the Nile Delta governorate of Al Gharbiyya, law student Youssef El Guindi rallied his classmates and townsmen and marched on the police station, post office, and train station, declaring Zefta an independent republic. Both rebellious acts were quashed pretty quickly.

Wamda’s Eman Mostafa reports that while a new wave of startups turning agricultural waste into furniture has arisen in Egypt, most lack access to funding and equipment.

The markets yesterday

USD CBE auction (Tuesday, 04 Oct): 8.78 (unchanged since 16 March 2016)

USD parallel market (Tuesday, 04 Oct): 13.85-14.25 (from 13.80-13.85 on Monday, 03 Oct, Al Borsa, Reuters)

EGX30 (Tuesday): 8,198.5 (+0.8%)

Turnover: EGP 671.8 mn (54% above the 90-day average)

EGX 30 year-to-date: +17.0%

THE MARKET ON TUESDAY: The benchmark EGX30 rose 0.9% an hour into the session, and ended the day up 0.8%. Index heavyweights EFG Hermes and CIB were both up, with top gainers including Eastern Company and Elsewedy Electric. The day’s worst performers were Domty, Porto Group and Amer Group. Market turnover was EGP 671.8 mn with foreign investors the sole net buyers of the day.

Foreigners: Net Long | EGP +122.2 mn

Regional: Net Short | EGP -23.1 mn

Domestic: Net Short | EGP -99.1 mn

Retail: 59.1% of total trades | 54.7% of buyers | 63.4% of sellers

Institutions: 40.9% of total trades | 45.3% of buyers | 36.6% of sellers

Foreign: 21.2% of total | 30.3% of buyers | 12.1% of sellers

Regional: 11.7% of total | 10.0% of buyers | 13.4% of sellers

Domestic: 67.1% of total | 59.7% of buyers | 74.5% of sellers

WTI: USD 49.28 (+1.21%)

Brent: USD 51.40 (+1.04%)

Natural Gas (Nymex, futures prices) USD 2.98 MMBtu, (+0.02%, Nov 2016 contract)

Gold: USD 1,274.00 / troy ounce (+0.34%)

TASI: 5,525.7 (+2.0%) (YTD: +8.1%)

ADX: 4,409.1 (+0.3%) (YTD: +2.4%)

DFM: 3,405.6 (-0.1%) (YTD: +8.1%)

KSE Weighted Index: 347.9 (-0.2%) (YTD: -8.9%)

QE: 10,388.2 (+0.8%) (YTD: -0.4%)

MSM: 5,613.3 (-1.1%) (YTD: +3.8%)

BB: 1,143.8 (-0.1%) (YTD: -5.9%)

Calendar

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.