Just how bad is construction material pollution in Egypt?

Just how bad is construction material pollution in Egypt? And which materials should we be worried about? Construction is a major contributor to air pollution, and as we know, Egypt’s pollution levels are dangerously high. The World Bank’s recently-greenlit USD 200 mn loan shows substantial (and expensive) steps are needed to improve air quality. Reducing the harmful impacts of construction material production is urgent. But to do this, we need to understand the scale of the problem, and which materials are most harmful.

Globally, construction accounts for some 40% of greenhouse gas (GHG) emissions, estimates Deloitte, citing (pdf) data from 2018 by the World Business Council for Sustainable Development.

Construction materials produce two kinds of emissions — fuel combustion emissions and industrial process emissions — which are measured separately. Global GHG emissions are measured within four specific categories: energy, industrial process and product use (IPPU), waste and agriculture, forestry and other land use (AFOLU), following UN guidelines. Fuel combustion emissions from construction materials fall under energy, and industrial process emissions fall under IPPU, this EMEP/EEA guidebook (pdf) notes.

Egypt’s most recent available stats show construction accounts for at least 23% of our GHG emissions: Egypt’s 2015 GHG emissions totaled 325 mn metric tons carbon dioxide equivalent (Mt CO2e), according to a 2018 Environment Ministry report (pdf). Energy emissions accounted for 64.5% (roughly 210 mn Mt CO2e) and IPPU emissions for 12.5% (about 40 mn Mt CO2e) of total emissions. Construction and manufacturing emissions made up 23% of these energy emissions (47 mn MT CO2e). And construction material production contributed at least 75% (30 mn Mt CO2e) to Egypt’s 2015 IPPU emissions. So in total, at least 23% of Egypt’s total 2015 GHG emissions (77 mn Mt CO2e) came from construction.

Egypt probably falls just outside the world’s top 20 biggest emitters of GHG: Egypt produced 329 mn Mt CO2e GHG emissions in 2018, according to the World Resources Institute CAIT database. Italy — number 20 in the Union of Concerned Scientists’ list of the world’s heaviest CO2 emitters — produced some 386 mn Mt CO2e in the same year, the CAIT database tells us.

And CO2 makes up some 73% of our GHG emissions: CO2 is the biggest contributor to GHG emissions globally, and known as the “most dangerous” greenhouse gas. In 2015, Egypt’s estimated CO2 emissions stood at 237 mn Mt CO2e, meaning CO2 accounted for some 73% of our total GHG emissions.

Where’s it coming from? Globally, concrete is the worst offender. But steel, glass, red brick, paint, and solvents also play a big role. Concrete — of which cement makes up 10-15% of the mix — is responsible for some 4-8% of the world’s CO2 emissions. Only coal, oil and gas are greater sources of GHG emissions. An estimated 1.83 tons of CO2 is emitted for every ton of steel produced. Glass production is a major source of emissions, a Berkeley study (pdf) shows. Fired-clay (red) bricks are also very energy-intensive, according to a joint study (pdf) by BUE and several Scandinavian universities. Paint and solvents are major sources of volatile organic compounds (VOCs), which react with the air’s oxygen to produce ozone, the most toxic component of smog.

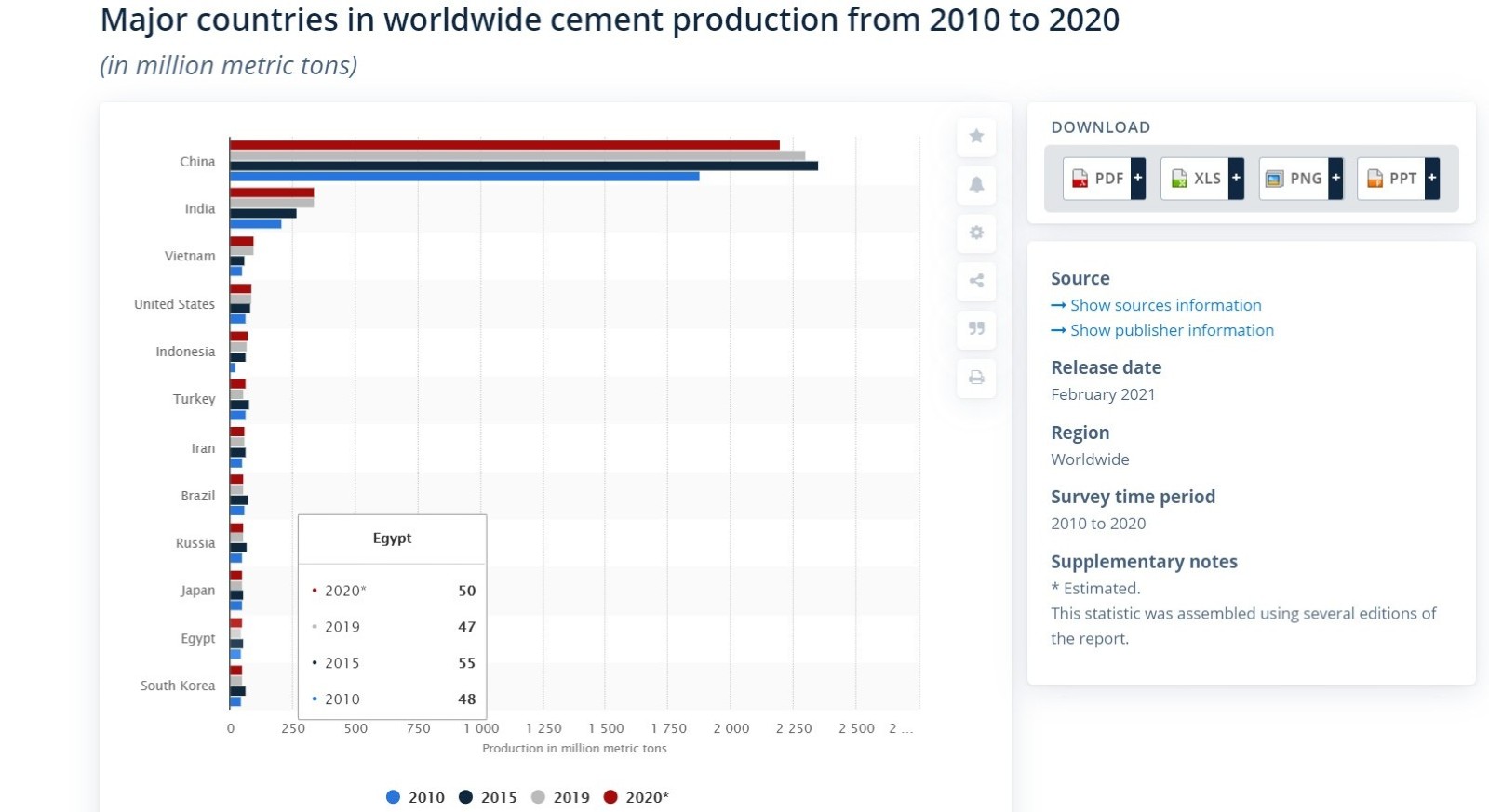

Egypt’s a top producer and consumer of some of these materials: Egypt was among the top 12 producers of cement from 2010-2020, producing an estimated 50 mn metric tons of cement in 2020, according to Statista. Egypt is the largest steel consumer in the MENA region, according to a 2020 OECD report (pdf). We produced 7.3 mn metric tons of steel in 2019, ranking 23 in a list of the world’s 50 top steel-producing countries in a 2020 report (pdf) by the World Steel Association.

Egypt’s CO2 emissions from cement were already bad in 2014-15: Egypt’s CO2 emissions from cement production alone saw an average annual growth rate of 6.85% between 1965 and 2014, according to tech company Knoema Corporation. Cement production was responsible for roughly 8% of Egypt’s total CO2 emissions in 2015, the Environment Ministry report shows.

Iron and steel made up 1% of Egypt’s CO2 emissions in 2015: Out of a total of 3.5 mn Mt CO2e emitted by the metal industry in 2015, 3.1 mn Mt CO2e came from the iron and steel sector — some 1% of Egypt’s overall CO2 emissions.

We’re doing a poor job just keeping track of polluting construction materials: There’s no current official estimate for which construction materials are the most polluting in Egypt, sustainability consultant and Egypt Green Building Council board member Hoda Anwar tells Enterprise. “But we know from experience that cement and steel are the biggest contributors,” she says. A 2016 Egypt-Japan University of Science and Technology (E-JUST) study (pdf) notes a “remarkable shortage” of specialized studies of the Egyptian cement industry using Life Cycle Assessment (LCA) — a technique that assesses the environmental impacts of all stages of a product's life.

And construction is growing rapidly: Construction was termed one of Egypt’s “more stable sectors” by EFG Hermes in its 2021 Year Ahead report. Building construction was estimated to grow at 6.6% y-o-y from 2005-2030, according to 2018 Capmas figures. Our cement industry alone grew from four factories producing 4 mn tons of cement clinker a year in 1975 to 14 factories producing some 38 mn tons in 2016, the E-JUST study tells us.

In Egypt, it’s still early days when it comes to making construction materials more environmentally-friendly — but players are getting on board: Some traditional construction companies are starting to integrate environmentally-friendly approaches into their operations. We look at what they’re doing in part 2.

Your top climate stories for the week:

- Fossil fuel funding on the decline: For the first time ever, bank finance for renewable energy projects could this year outpace funding lenders have made available for fossil fuels.

- SWFs pour into climate sectors: Sovereign wealth funds nearly doubled their total investments last year, with a particular focus on climate change-related sectors like agritech, forestry and renewable energy.

- ESG investors ♥ EM: Investors with environmental, social, and governance (ESG) mandates are turning to emerging markets, which have traditionally been slow on the uptake of green investments.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.