- Egypt’s economy grew 9% 1H2021-2022 + A new desalination plant coming? + Egypt signs USD 1.5 bn funding agreement for diesel production. (The Big Stories Today)

- Scientists are getting closer to finding a cure for HIV. (For Your Commute)

- A “dirty dozen” banks and investors have been propping up the global coal industry these past two years. (For Your Commute)

- The art scene is thriving this week with exhibitions at Ubuntu, TAM, and Lamasatt. (Out And About)

- How to identify your business’ purpose to set an effective management ethos: Deep Purpose. (Under The Lamplight)

- Global footballers have spoken: Fifa’s money grab won’t be accepted. (For Your Commute)

Wednesday, 16 February 2022

PM — A thriving art scene this week

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

The race to the weekend is in full swing, ladies and gentlemen. It’s a busy Wednesday afternoon, with a very healthy pipeline of news to keep you busy.

#1- THIS JUST IN- Egypt’s economy grew at a 9% clip in 1H2021-2022, with 8.3% growth during the second quarter of the current fiscal year, Prime Minister Moustafa Madbouly said at a presser, according to Youm7. The 2Q2021-2022 figure is higher than was previously expected, as Planning Minister Hala El Said had signaled in December that GDP growth was forecast at 6-7% during the quarter. The government now expects GDP growth to come in at or above 6% in the third and fourth quarters, Madbouly said. You can view the full press conference, which ended moments ago, here (watch, runtime: 1:09:38).

#2- USD 1.5 bn renewables-powered desalination plant coming? A consortium made up of UAE-based Metito Holdings, Scatec Solar, and Orascom Construction is in talks with Egyptian authorities to build a USD 1.5 bn water desalination plant that would be powered entirely using renewables, Metito Africa Managing Director Karim Madwar tells Bloomberg. The consortium is looking to get the Sovereign Wealth of Egypt onboard the project as a partner, according to Madwar.

#3- Egypt signed a USD 1.5 bn funding agreement with a syndicate of six international banks to finance a diesel production complex in Assiut at Egyps today, the Oil Ministry said in a statement. The complex will produce Euro V-grade diesel and gasoline, among other products, according to the ministry. The funding, provided by Crédit Agricole, UniCredit Italia, HSBC, BNP Paribas, and Société Generale France, will be backed by the Italian Export Credit Agency Sace.

^^ We’ll have these stories and more in tomorrow’s edition of EnterpriseAM.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- CBE holding the line on new import rules: The Central Bank of Egypt (CBE) is not going to reverse its decision requiring importers to get letters of credit (L/Cs) for their purchases, CBE Governor Tarek Amer said, urging businesses to comply with the new requirements.

- The Suez Canal Authority is considering selling 20% stakes in two or three of its companies on the EGX, authority boss Osama Rabie said. Rabie named Canal Rope alongside Canal Harbor and Great Projects as two of the companies the SCA is considering for the float, without disclosing an expected timeline.

- New green, Islamic microfinance products on the menu for 2022: The Financial Regulatory Authority (FRA) could soon issue licenses for green and Islamic microfinance products, FRA’s Deputy Chairman Islam Azzam said.

Former Supreme Constitutional Court (SCC) President Said Maree Gad has passed away at age 68, Akhbar Al Youm reported. His death comes a few days after President Abdel Fattah El Sisi appointed Judge Boulos Fahmy to head the SCC, succeeding Gad, who retired for health reasons as the president of the court.

THE BIG STORY ABROAD- We interrupt your regularly scheduled Ukraine Watch programming: Making the rounds in the global business press this afternoon is news that Sweden’s Ericsson may have inadvertently been making payments to Daesh in Iraq. The company announced earlier today that an internal probe found evidence of payments to use transport routes that circumvent customs authorities. The probe was inconclusive in determining the beneficiaries of these payments, but noted that they occurred when Daesh, among other militant groups, were controlling transport routes. Reuters and the Financial Times have the story.

|

FOR TOMORROW- The two-day EU-AU summit kicks off in Brussels tomorrow, where President Abdel Fattah El Sisi is set to meet with Prime Minister Alexander De Croo to talk diplomatic relations and regional issues. The president is also scheduled to meet Belgium’s King Phillipe and a group of Belgian business leaders.

Also on the agenda for the summit: Look for El Sisi to speak about the integration of African countries into the global economy, ramping up foreign investment across the continent, and supporting developing countries in their green transition — all of which are key action points for COP27 in Sharm El Sheikh this November.

???? CIRCLE YOUR CALENDAR-

A call for tech startups: The Information Technology Industry Development Agency (ITIDA) and US-based VC firm Plug and Play have launched an incubator and accelerator program for digital transformation-focused startups in partnership with our friends at USAID. The newly launched “Smart Cities” innovation hub will select 20-30 Egypt-based companies for its inaugural three-month program, which starts in March. Startups can apply here before applications close on 28 February.

PSA- Your commute is going to get worse this weekend. Public universities begin the second term of their 2021-2022 academic year this Saturday, 19 February.

The Nebu Expo for Gold and Jewelry 2022 kicks off this Saturday, 19 February and wraps on Monday, 21 February.

⛅ TOMORROW’S WEATHER- It’s going to be cloudy: Don’t expect too much sun tomorrow, our favorite weather app forecasts. As for the temperature, we’re in for a daytime high of 21°C and a nighttime low of 10°C.

???? FOR YOUR COMMUTE

Scientists are getting closer to finding a cure for HIV: A team of American researchers have cured a woman of HIV through a stem cell transplant, making her the first woman and the third person to be successfully treated, Reuters reports. Prior to the woman — who was diagnosed with HIV in 2013 and leukemia four years later — two male HIV patients were successfully cured by receiving adult stem cells, which are usually used in bone marrow transplants. “Taken together, these three cases of a cure post stem cell transplant all help in teasing out the various components of the transplant that were absolutely key to a cure,” said the head of the International AIDS Society.

A “dirty dozen” banks and investors are propping up the global coal industry, channeling USD 1.5 tn into the fossil fuel over the past two years through lending and underwriting mandates, finds a study by Urgewald and Reclaim Finance. Institutional investors were found to have upward of USD 1.2 tn in global coal industry stocks and bonds. The research, which is based on the Global Coal Exit List (GCEL), found that 1,032 companies account for 90% of the world’s thermal coal production and coal-fired capacity, with 12 banks accounting for 48% of lending on the GCEL. Ten of those 12 lenders are members of the UN’s Net Zero Banking Alliance, an initiative to align the industry’s portfolios with net-zero emissions by 2050. BlackRock was found to be the strongest supporter of the global coal industry among investors.

A benchmark for phasing out coal use: One of the goals of last year’s COP26 summit in Glasgow was to phase out coal usage, which, although not met, did secure pledges to “phase down” coal usage from coal-dependent countries. Campaigners have said Urgewald’s study should be a benchmark to assess the promises made at COP26. Egypt and at least 22 other countries signed on to several landmark agreements to phase out the use of coal power and end financing for new coal plants at the COP26 summit, including pledges from banks and financial institutions to end financing for new plants.

Players strike down Fifa’s proposal for a World Cup every two years instead of the current four: A survey of more than 1k male players of 70 nationalities showed opposition against the idea of a more frequent championship, reports The Independent. The survey found that 77% of players in both Europe and Asia favored the four-year system, while the majority of respondents from the Americas (63%) also said they don’t want to change the current system. Players in Africa were leaning more towards the new proposed tournament, with 49% of athletes saying they want to continue with four-yearly World Cups.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

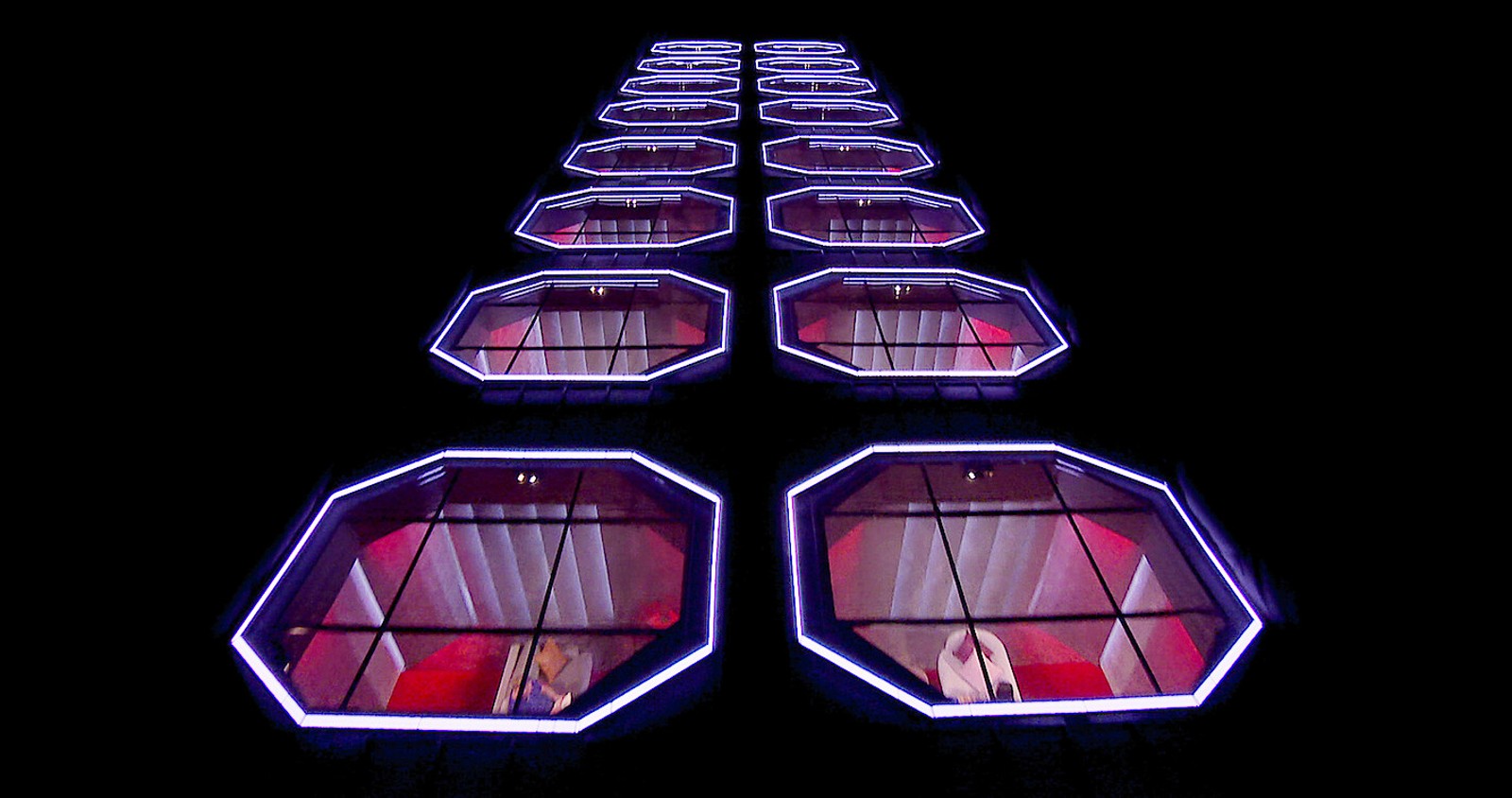

If you can stand to lose a few brain cells after a long day of work, we have season two of reality show Love Is Blind. The show brings together 20 singles in a social experiment that allows them to talk to each other in “pods” but not see each other until someone proposes. Once that happens, they finally get to see their now-fiancé(e) face-to-face for the first time. The series follows them as they go through meeting the parents, moving in together — all on an expedited timeline. And in another low, even for reality television, there’s a wedding with a possibility of a jilting at the altar. It’s really one of those dime a dozen dating reality shows that are derivatives of the Bachelor but in this situation or that. But guilty pleasures are a thing, and we won’t shame you for it. Afterall, we did write this.

⚽ Blue versus red: Inter Milan hosts Liverpool in the first leg of the 16th round of the Champions League at 10pm. At the same time, Austria’s Red Bull Salzburg will meet Bayern Munich. The victors of the two matches will meet in the quarter-finals.

Yesterday's Champions League results: Manchester City beat Sporting Lisbon 5-0, ensuring a spot in the quarter finals. Meanwhile, Paris Saint-Germain needed to wait until the 94th minute for Kylian Mbappe to snatch a deadly goal against rivals Real Madrid.

La Liga: Atletico Madrid will host Levante in the Spanish League at 8pm.

In the Egyptian Premier League: Pyramids will face El Ismaily in a match that starts at 5:30pm, while Future plays with the National Bank at 8pm.

???? OUT AND ABOUT-

(all times CLT)

The art scene is thriving this week:

Ubuntu Art Gallery has opened two new exhibitions: Banana Universe by Mohamed Khaled Omran features works by the visual artist who produces various styles of pieces such as paintings, stained glass, mosaic, sculptures, and installation art. Meanwhile, The Girls Windows III features art by Rana Samir, Fatma Mostafa, Mariam Soliman who explore what it means to be a woman.

TAM Gallery is hosting the exhibition Trifecta dedicated to the work of three artists: Amir Abdel Ghani, Mostafa Khedr, and Pancé Ahmed. Through their collections, the artists discuss important and impactful societal, existential and environmental topics.

The International Surrealist Photography Exhibition is on display at Lamasatt Gallery with artists from around the world showcasing their photographs.

???? UNDER THE LAMPLIGHT-

How to identify your business’ purpose to set an effective management ethos: Deep Purpose by Harvard Business School Professor Ranjay Gulati explores the notion of corporate purpose, which is often conflated with strategy and other concepts like mission, vision, and values. However, Gulati argues that companies should interact with purpose on more than just a superficial, marketing level. Instead, he shows how companies can embed purpose to deliver impressive performance benefits that reward customers, suppliers, employees, shareholders, and communities. Using 200 interviews with selected companies such as PepsiCo and Microsoft, Gulati lays out the challenges of embedding purpose. They include how to create a purpose-led culture that allows for staff members’ individuality and diversity, and how to cope with “the personification paradox” — when the leader who embodies a company’s purpose moves on. The book stands out as a new way to set a direction for your business and identify the factors that will help it grow sustainably.

???? GO WITH THE FLOW

EARNINGS WATCH- Speed Medical’s net income rose 71.4% y-o-y in 2021, to record EGP 136.10 mn, according to the company's financial statement (pdf). The company’s revenues rose 110% y-o-y to EGP 365.2 mn.

MARKET NEWS- Egytrans is planning on spinning off several of its key business units as part of its restructuring plan following an approval of the plan by the company’s board, according to a bourse filing (pdf) today. The move would allow these units, who will remain subsidiaries of Egytrans, more flexibility when it comes to things like expanding abroad, acquisition and potentially listing these subsidiaries, the filing reads.

MARKET ROUNDUP-

The EGX30 rose less than 0.1% at today’s close on turnover of EGP 705 mn (32% below the 90-day average). Foreign investors were net sellers. The index is down 3.2% YTD.

In the green: Credit Agricole Egypt (+4.0%), Oriental Weavers (+1.7%) and Heliopolis Housing (+1.5%).

In the red: Rameda (-3.6%), Ibnsina Pharma (-1.9%) and Elsewedy Electric (-1.9%).

???? CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of a 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

1H2022: The Transport Ministry to sign a memorandum of understanding with Abu Dhabi Ports to set up a transport route across the Nile to transport products from Al Canal’s Minya sugar factory.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

February: Hassan Allam Construction’s new construction firm established with Russia’s Titan-2 to handle construction work on the Dabaa nuclear power plant begins its operations.

February: Ghazl El Mahalla shares will begin trading on the EGX.

Mid-February: End of grace period to comply with new minimum wage for firms who sent in exemption requests.

Mid-February: A Hungarian delegation will arrive in Egypt for talks over a potential investment in an industrial area in the SCZone.

4-20 February (Friday-Sunday): 2022 Winter Olympics, Beijing.

14-16 February (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

14-19 February (Monday- Saturday): An art exhibition created by marginalized children will be held at Townhouse Gallery. The event is organized by the Sawiris Foundation for Social Development, AlexBank, Townhouse Gallery, Al Ismaelia for Real Estate Investment, and Ubuntu Art Gallery.

17-18 February (Thursday-Friday): G20 Meeting of Finance Ministers and Central Bank Governors, Jakarta.

19 February (Saturday): Public universities begin the second term of the 2021-2022 academic year.

19-21 February (Saturday-Monday): Nebu Expo for Gold and Jewelry 2022.

21 February (Monday): Hearing at Cairo Economic Court (pdf) on FRA lawsuits filed against Speed Medical.

22 February (Tuesday): The Egyptian National Railway is holding a forum to gauge public interest in its plans to delegate the management and operations of freight transport to the private sector.

22-24 February (Tuesday-Thursday): Investment Forum, General Authority For Investments (GAFI) Main Office, Nasr City.

26 February (Saturday): Speed Medical will elect a new board during ordinary general assembly (pdf).

27 February (Sunday): British-Egyptian Business Association (BEBA) green finance event with Finance Minister Mohamed Maait, Semiramis Intercontinental, Cairo

28 February (Monday): Applications close for the incubator and accelerator program run by Information Technology Industry Development Agency (ITIDA), US-based VC firm Plug and Play, and USAID.

28 February- 1 March (Monday-Tuesday): The Future of Data Centers Summit.

End of February: Lebanon to receive gas from Egypt via a pipeline crossing Jordan and Syria.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

3 March (Thursday): Fawry’s extraordinary general assembly (pdf) to vote on EGP 800 mn capital increase.

9-18 March (Wednesday-Friday): The 55th edition of the Cairo International Fair.

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

25 March (Friday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers’ playoff (TBC).

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

28 March (Monday): The second leg of the 2022 FIFA World Cup qualifiers’ playoff between Egypt and Senegal (TBC).

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

Mid-April: Trading on the Egyptian Commodity Exchange to start.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.