- Inflation hits its highest level in four years. (The Big Story Today)

- Your beloved koshk is here to stay — especially as their owners embrace tech. (What’s Next)

- A bad work day can quickly spiral. (For Your Commute)

- The “Luckiest Girl Alive” — with a dark secret from the past. (On the Tube Tonight)

- Usain Bolt has (robot) competition. (For Your Commute)

- Just a few games left in the European leagues. (Sports)

- The “endangered species” of powerfully creative and passionate women. (Under the Lamplight

Monday, 10 October 2022

PM — The spiral of a bad workday

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, friends. We have a reasonably busy Monday on our hands here in Omm El Donia, while the international press’ attention is divided between the latest developments in Ukraine and the IMF / World Bank annual meetings.

THE BIG STORY TODAY

Inflation accelerated last month to its fastest pace since November 2018 as price shocks continue to linger, figures (pdf) from official statistics agency CAPMAS showed. Urban consumer price inflation rose to 15.0% y-o-y in September, up from 14.6% a month earlier, largely on the back of rising food and beverage prices, as well as housing and utilities costs.

THE BIG STORY ABROAD

Russia launched missile attacks in many major cities in Ukraine this morning, killing at least five civilians. The attacks were retaliation for what President Vladimir Putin claimed was a “terrorist attack” from Ukraine on the bridge to Crimea. The story is on the front pages of the Reuters, Financial Times, the Wall Street Journal, and the Washington Post, among others.

HAPPENING NOW-

The IMF and World Bank annual meetings kicked off today in Washington, DC, and wrap up on Sunday, 16 October. The theme of the in-person gathering is clear from the very first session: “addressing multiple crises in an era of volatility.” You can explore the meetings’ website here or dive deeper into the day-by-day agenda here.

Wrapping up just minutes before we hit “send” on this afternoon’s edition: The meetings’ first joint seminar, titled The Way Forward: Addressing Multiple Crises in an Era of Volatility, in which IMF Managing Director Kristalina Georgieva and World Bank Group President David Malpass discussed future global economic growth in light of “multiple overlapping crises.”

In Washington for the meetings: Central Bank of Egypt Governor Hassan Abdalla, several cabinet members, and figures from the Egyptian banking community. International Cooperation Minister Rania Al Mashat is among those attending the meetings and is expected to sit down with several development partners on the sidelines, according to a statement.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Supply Minister revives talk of bread subsidy reform in the House of Representatives: Supply Minister Ali El Moselhy called on MPs to form an ad hoc committee to look into possible changes to the country’s massive bread subsidy program.

- Orascom Investment Holding (OIH) has earmarked USD 200-300 mn to build four new hotels — two in the North Coast, one in Cairo and another in Giza near the pyramids, chairman Naguib Sawiris said.

- MNHD to tap securitization market before end of 1H 2023: EGX-listed Madinet Nasr Housing and Development (MNHD) is looking to take the second issuance of its three-year, EGP 3 bn securitization program to market before the end of 1H 2023.

***

Take our EV survey: Are you an ex-petrolhead shopping around for your first electric vehicle? EV-curious and wondering what all the fuss is about? Or are you not ready to say goodbye to that sweet smell of benzene as you wait at the gas station?

We want to hear from you: We’re taking the pulse on how the nation feels about Egypt’s nascent EV transition. Take a few minutes to fill out our short survey. We’ll be back with the results in a couple of weeks.

***

|

???? CIRCLE YOUR CALENDAR-

The EGX is looking to drum up interest in listed companies on a roadshow to Dubai and Abu Dhabi later this month, an EGX source told Enterprise. The bourse has tapped Al Ahly Pharos to help manage the roadshow, with EGX boss Rami El Dokany set to meet with as many as 100 regional and international financial institutions, the source said.

Fuel prices to rise this month? We’re expecting the government to hike fuel prices for the seventh consecutive quarter when the fuel pricing committee meets this month. Fuel prices have risen by as much as 28% over the past 18 months in response to heightened international oil prices, which surged earlier this year on the back of Russia’s invasion of Ukraine.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- Expect temperatures to rise to 31°C during the day tomorrow before falling to 20°C at night, our favorite weather app tells us.

???? FOR YOUR COMMUTE

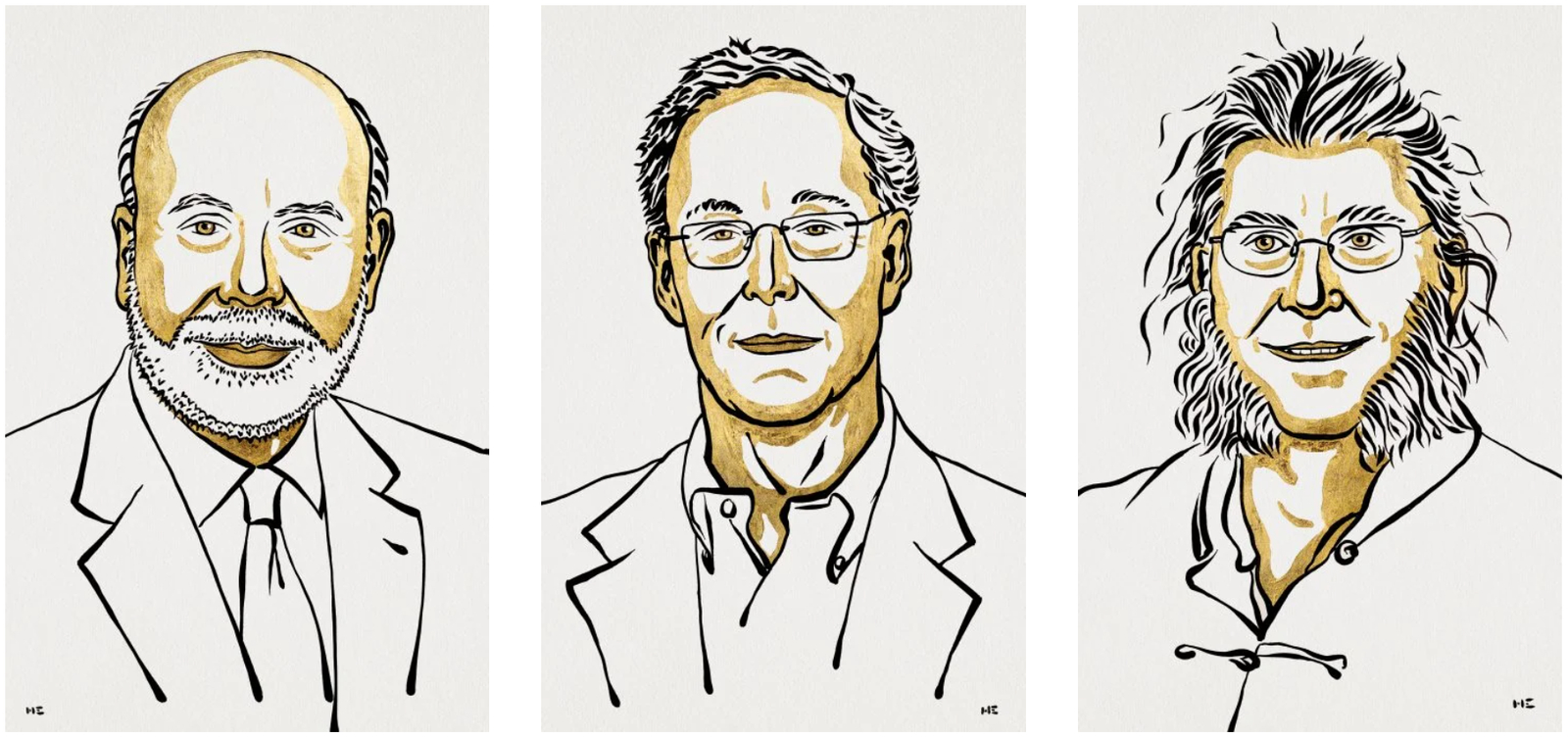

Last Nobel Prize of 2022: Ben Bernanke, Douglas Diamond and Philip Dybvig won the 2022 Nobel Economics Prize “for research on banks and financial crises,” the Royal Swedish Academy of Sciences announced in a press release. In the 1980s, they laid the foundation for modern banking research that explains why banks exist, how to make them more resilient to crises, and how bank failures exacerbate financial crises. “The laureates’ insights have improved our ability to avoid both serious crises and expensive bailouts,” the prize’s committee chair said. The three laureates will share the SEK 10 mn (USD 883,954) prize sum. The prize, known formally as the Sveriges Riksbank Prize in Economic Sciences in memory of Alfred Nobel, is the last of this year's Nobel Prizes to be awarded.

Your bad work day can become three: New research has identified five types of days that occur in the workplace, including “bad” ones that can spiral into three days of low productivity and morale, according to a study out of Virginia Commonwealth University. The researchers based their findings after analyzing 11.2k workday surveys taken within two to nine months by 221 employees. They found employees go through a cycle of days ranging between typical, ideal, crisis, disengaged or toxic.

The cycle of days: An ideal day — which typically accounts for 29% of employees’ work week — sees employees being quite productive with no obstacles hampering their way of doing business. A crisis day, representing 19% of days, would see some problems emerging yet things are still kept under control. The bad days, you ask? These are characterized by disengagement and toxicity, which leads to a lack of energy that offsets motivation and kills any chances of productivity.

But hey, it’s not really your fault, according to the research, which found evidence that the factors constituting what is a bad day are typically beyond individuals’ control. “Leaders play a really important role in engineering the work environment and how people perceive it day to day,” the research’s lead author said. And it’s not all bad — if your employer provides enough support and encouragement and you have some awareness on how days unfold. “There’s nothing to suggest that you’re going to have weeks of toxic days — there’s a light at the end of the tunnel,” one of the co-authors said. “Or, if you’re riding a wave, at some point that wave is going to come crashing down.”

Move over, Usain Bolt: Cassie, a bipedal robot, broke the Guinness world record for the fastest 100-meter dash in 24.73 seconds, The Washington Post reports. Designed at the Oregon State University, Cassie has been taught to walk correctly since 2017 and trained to improve its speed and agility. The robot is trained using algorithms that reward her when it behaves, which is inspired by Pavlovian psychology. “This is the first big step to humanoid robots doing real work in the real world,” AI professor and Cassie’s trainer Alan Fern says. The development in Cassie’s running abilities is significant because robot designers have previously struggled to create robots that can move around while maintaining balance.

However, challenges lie ahead in guiding robots across difficult terrains and understanding the functionality of objects. The most difficult procedure, according to an Arizona State University professor of human systems engineering, is designing a robot that interacts with humans in a natural way, and can accomplish things humans cannot.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Netflix’s suspenseful film Luckiest Girl Alive, starring Mila Kunis, is a dramatic thriller based on a 2015 best-selling book about a woman’s life unraveling as she faces trauma from her past. Ani Fanelli is a vitriolic New Yorker with an ideal life: She has a great job, stylish wardrobe, and a fairytale wedding on the horizon. Life begins to unravel after an interview with a crime-documentary director triggers a dark truth dating back to her adolescence. Although the book on which the film is based is fictional, some of the events are inspired by the author's personal experiences (watch trailer, runtime 2:12).

⚽ On the eve of tomorrow’s big Champions League lineup, catch the handful of games still remaining in the European leagues: Nottingham Forest v Aston Villa in the English Premier League at 9pm, at the same time as Elche v Real Mallorca match in the Spanish league.

Over in the Italian league: Fiorentina will play against Lazio tonight at 9:30pm.

???? OUT AND ABOUT-

(all times CLT)

Catch The Nights by Anurupa Roy tonight at 7:30pm at the Cairo Opera House. This incredible puppet show is in town all the way from India, showcasing the country’s beauty and talent through a captivating story of adventure and love.

Kickstart spooky season with a screening of The Shining tonight at 9pm at Room Art Space and Cafe. Scary movies will be screened at Room throughout the month.

The Charisma troupe will be presenting A Hero From Denshway tonight at 7pm at El Sawy CultureWheel, directed by Amr Darwish.

For the creative minds out there, AUC Public and Community Events will host Documentary Filmmaking in the Middle East and North Africa: A Virtual Book Talk via Zoom at 7pm, discussing the socio-political, ethnic, linguistic, and cultural evolution of documentary filmmaking.

???? UNDER THE LAMPLIGHT-

Tap into your “Wild Woman”: Women Who Run With The Wolves is a deeply spiritual book by Clarissa Pinkola Estés that argues inside of every woman is a powerful voice of good and ageless instinctual nature, creativity, and passion known as the “Wild Woman.” According to Estes, the wild woman is an endangered species, almost extinct due to societal pressures for women to fit into “civilized” roles. Readers, especially females, can regain an understanding of the deep feminine psyches and the truest sense of knowing the soul. The book’s unique format also piqued our interest, as it unveils rich multicultural myths, fairy tales, folk tales, and stories — many from Estes own traditions — that support women in rediscovering the powerful, healthy, and imaginative aspects of their innate nature.

???? GO WITH THE FLOW

MARKET NEWS-

EGX-listed education outfit CIRA will pay out dividends of EGP 0.21 a share for FY 2020-2021, redeemable on 26 October. (Regulatory filing, pdf)

MARKET ROUNDUP-

The EGX30 rose 0.1% at today’s close on turnover of EGP 1.15 bn (15.9% above the 90-day average). Foreign investors were net sellers. The index is down 16.7% YTD.

In the green: Sidi Kerir Petrochemicals (+3.0%), Housing and Development Bank (+2.6%) and Alexandria Containers and Cargo Handling (+1.9%).

In the red: Qalaa Holdings (-2.1%), Orascom Construction (-1.6%) and Ibnsina Pharma (-1.4%).

???? WHAT’S NEXT

Hypermarkets and e-commerce haven’t yet replaced the koshk: Despite the rise of big box retailers, supermarkets, and online grocery stores in the past few years, 90% of all grocery sales in Egypt still take place at koshks or corner stores, according to a new report by global venture firm Flourish in partnership with research firm 60 Decibels and B2B e-commerce platform MaxAB. The 214 surveyed shoppers rated corner stores highly for their convenience — while favorable customer service, product quality and prices also factored in.

Egypt’s corner store market is estimated to be worth some USD 54 bn and globally that market is about USD 900 bn. In Egypt we’re looking at a total of some 400k corner stores generating these sales. The report also covers three other developing countries — Brazil, India and Indonesia — where corner stores are just as coveted, and most are still holding their ground.

Love for local corner stores runs deep: Some 93% of the 214 customers polled for Flourish’s survey said that they would use their local corner store at the same level or more in the future, including 35% who anticipate increasing their visits. Some 74% agree that corner stores are vital to their community.

A good chunk of people supplement their grocery shopping with other kinds of retailers: Some 38% of those surveyed by Flourish said that they visit supermarkets in addition to their local corner store, while 10% also rely on online retailers, and 7% also shop at the local market.

So what do we love about corner shops? Some 71% of customers surveyed said that they valued the location of their local corner shop, Around 36% said they like the product quality and variety, and 31% praised the quality of service. Around one-fifth of respondents go to the corner shop for better prices and because of longstanding relationships with store owners.

And what do we buy? The majority of respondents go to the corner shop for dairy products, water, and other beverages. Packaged goods and cleaning products are also popular choices.

Banknotes are still king at the corner store: Only some 2% of 205 corner store merchants surveyed offer digital payment services, while some 4% accept bank cards. A third of stores let customers run up weekly or monthly cashbased credit tabs. Otherwise, it’s all hard money.

But store owners are starting to embrace tech outside of payments: About 42% of corner store owners adopted some form of digital tools to enhance their business during the pandemic. Messaging apps are the most widely used tool, with some 26% of owners using them to communicate with suppliers and customers. Some 9% of shop owners already use digital cash registers, and a third of respondents expect to start using a digitized cash register in the next year or two. One in ten anticipate they will introduce digital payments in the next couple years.

There are still some barriers to incorporating tech: Some 29% of the merchant respondents said they have difficulties learning how to use digital tools. Cost is a concern for one in four store owners.

Digital tools could help solve some challenges shop owners face: Managing inventory and product placement is by and large the most challenging part of maintaining a corner store, with 88% of store owners reporting it as their single biggest operational concern. Dealing with wholesalers, and ordering, checking and reviewing products are also cited as so-called “pain points” almost 70% of store managers have to grapple with everyday. The report suggests new digital tools of the kind offered by MaxAB, which helped produce the report, could help streamline some of those challenges.

???? CALENDAR

OCTOBER

October: Air Sphinx, EgyptAir’s low-cost subsidiary to commence operations.

October: Fuel pricing committee meets to decide quarterly fuel prices.

10-14 October (Monday-Friday): Gitex Global, Dubai International Convention and Exhibition Center, Dubai, UAE.

10-16 October (Monday-Sunday): World Bank and IMF annual meetings, Washington, DC.

15 October (Saturday): Cairo Metro will launch a global tender for maintenance work on the power stations and overhead catenary system of Line 1.

16-19 October (Sunday-Wednesday): Cairo Water Week 2022, Nile Ritz Carlton, Cairo.

17 October (Monday): Fifth Egypt and UN-led regional climate roundtable ahead of COP27, Geneva, Switzerland.

18 October (Tuesday): The Egyptian-Swedish business forum, Stockholm, Sweden.

23-25 October (Sunday-Tuesday): Egypt economic conference, Cairo, Egypt.

24 October (Monday): Empowering Sustainable Trade Flows with Factoring conference, St. Regis Cairo.

27 October (Thursday): European Central Bank monetary policy meeting.

27-30 October (Thursday-Sunday): Cairo ICT, Egypt International Exhibition Center, New Cairo.

30 October-1 November (Sunday-Tuesday): Egypt Energy, Egypt International Exhibition Center (EIEC), New Cairo.

Late October-14 November: 3Q2022 earnings season.

Late October: First Abu Dhabi Bank to complete full integration with Bank Audi’s Egyptian operations after merger.

NOVEMBER

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

1-2 November (Tuesday-Wednesday): Arab League annual summit, Algiers, Algeria.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7 November (Monday): The inauguration of the first line of the high-speed rail.

9 November (Wednesday): Finance Ministry to host “Finance Day” at COP27.

7-13 November (Mon-Sun): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

DECEMBER

3 December (Saturday): Dior Men’s pre-fall collection show in Giza.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egyptian Automotive Summit.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Use of Nafeza becomes compulsory for air freight.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

24 January-6 February: The 54th Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

30 January-1 February (Monday-Wednesday): CI Capital’s Annual MENA Investor Conference 2023, Cairo, Egypt.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): The eighth annual Business Women of Egypt’s Women for Success conference.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

19-21 June (Monday-Wednesday) Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

4Q 2022: Saudi Jamjoom Pharma to inaugurate its EGP 1 bn pharma factory in El Obour.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.