- EGAS set to launch new int’l tender for oil and gas exploration blocks next week. (The Big Story Today)

- Productivity really takes a nosedive around holiday season. (For Your Commute)

- Soaring global debt is about to get expensive. (Macro Picture)

- Nanny: An undocumented Senegalese immigrant tries to make a living in New York. (On the Tube Tonight)

- English Premier League’s round of 16 continues. (Sports)

- A whole lot of music around town. (Out and About)

- A story of women and cats — told partly from the cats’ perspectives. (Under the Lamplight)

Wednesday, 21 December 2022

PM — The most wonderful time of the year (to not work)

TL;DR

WHAT WE’RE TRACKING TONIGHT

Good afternoon, ladies and gents. It’s almost-THURSDAY — and it appears to also be almost time for the full holiday news lull.

THE BIG STORY TODAY

Energy companies can bid for 12 new oil and gas exploration blocks starting next week in an international tender set to be launched by state-owned Egyptian Natural Gas Holding Company (EGAS), Bloomberg Asharq reports, citing an unnamed Oil Ministry source. The door for bidding will close five months from the tender’s launch, the source added.

THE BIG STORY ABROAD

There’s no single big story driving the conversation in the international business press this afternoon. Among the stories getting play:

- Sovereign bond yields in Japan rose again today after the Bank of Japan announced yesterday a surprise loosening of its “yield curve control” policy (Financial Times)

- Twitter would have suffered a USD 3 bn shortfall if it weren’t for significant cost-cutting measures, CEO Elon Musk said (Bloomberg | CNBC)

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- The IMF is watching what happens to the EGP in January: The IMF will be keeping an eye on what happens to the exchange rate when the central bank ends import restrictions at the end of the month.

- Suez Canal fund not privatization via the back door, gov’t says amid controversy: The Madbouly government yesterday denied claims that a proposal to set up a fund for the Suez Canal Authority will enable it to privatize assets by the back door.

- A Chinese company and a Japanese company have submitted bids to the Electricity Ministry to invest over USD 4 bn in renewable energy projects in Egypt over the next eight years.

|

FOR TOMORROW-

It’s the Central Bank of Egypt’s final policy meeting of the year: Most analysts in a Reuters poll are expecting policymakers to close out 2022 with another king-size 200-bps rate hike to support the currency and tackle rising inflation — chiming with the majority of those we surveyed last week. Seven of the nine analysts and economists we spoke to are forecasting the central bank to raise rates when it meets tomorrow, with five of those surveyed expecting a 200-bps hike. This would take the policy rate to 15.25%, its highest level since early 2019.

???? CIRCLE YOUR CALENDAR-

The Senate will be back in session next Sunday, 25 December, while the House of Representatives is in recess until Monday, 2 January.

????️ TOMORROW’S WEATHER- There’s a chance of showers in Cairo tomorrow, with the temperature expected to rise to 20°C during the day before falling to 13°C at night, our favorite weather app tells us.

FOR YOUR COMMUTE

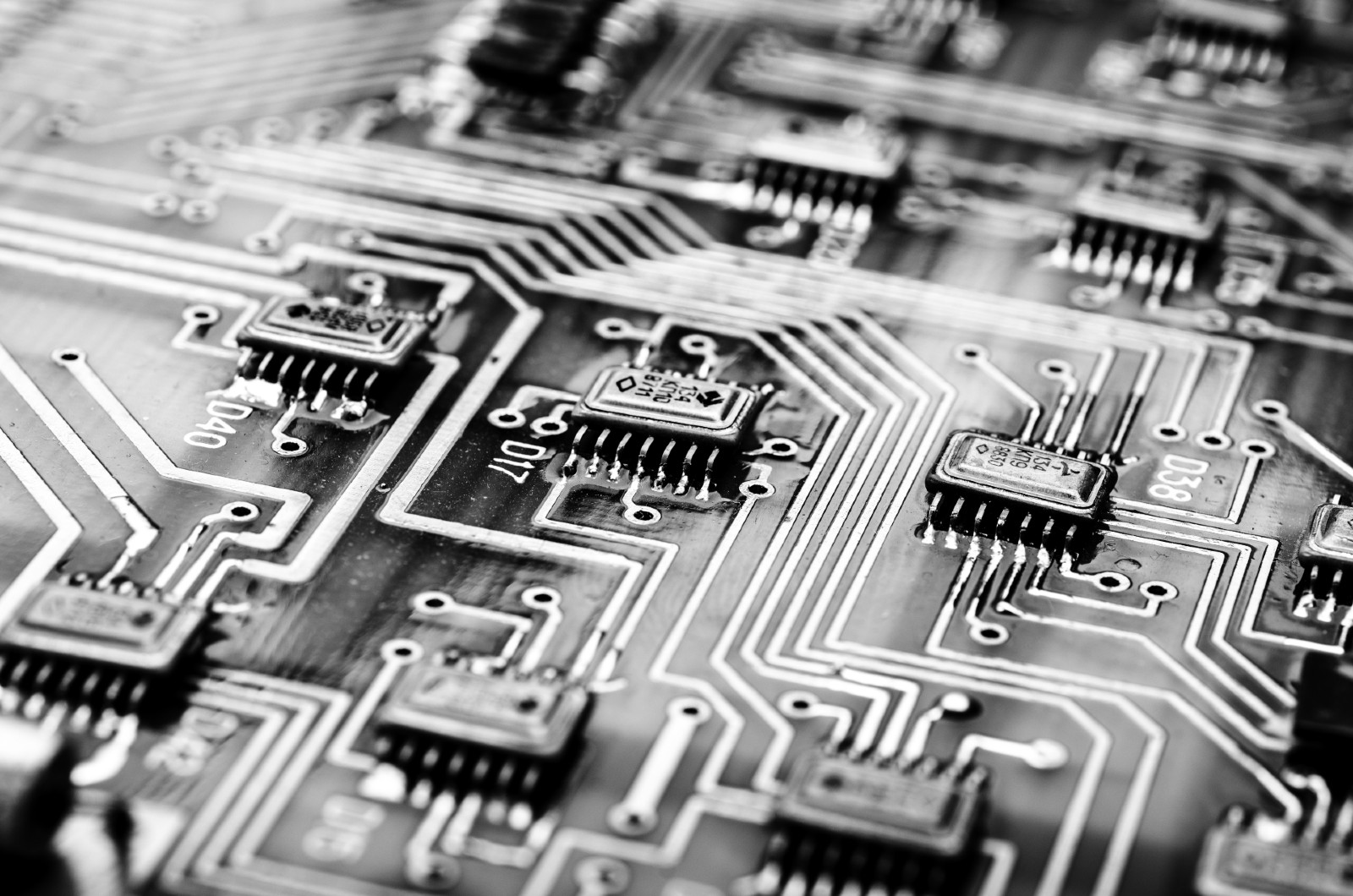

The global auto industry is preparing for semiconductor shortages to last until the end of 2023, driven by an increase in electric vehicle demand and “more connected functions” in regular fuel cars, the Financial Times reports. Advanced power chips known as silicon carbide chips (SiC) — which are specifically used for EVs — are expected to see a 14% compounded annual growth rate by 2030, the salmon-colored paper reports. Semiconductor manufacturers plan to expand plant capacity, but current production rates are struggling to keep up with the demand of long-term supply agreements. This shortage is piling onto the preexisting supply tightness caused by covid-19 lockdowns, which disrupted chip production and global supply chains, and is expected to take years to be resolved.

It’s the most wonderful time of the year — to not work: Across the globe as Christmas and New Year’s draw nearer, employees are likely to have checked out of work between 16-19 December, with their focus pulled to holiday planning, the Financial Times reports. And it’s not just the staff that have mentally clocked off — companies with lighter end-of-year workloads are using the slower pace to offer staff incentives, like bonus Christmas shopping days. Packed Christmas markets and bars are an indication that many are embracing the distraction of Christmas despite the cost-of-living crisis, the FT says.

ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Nanny: An unsettling immigrant psychological horror story streaming on Amazon Prime. Writer/director Nikyatu Jusu’s debut film, which received the 2022 Grand Jury Prize from the Sundance Film Festival, follows Aisha (played by Anna Diop), an undocumented Senegalese immigrant and single mother trying to make ends meet in New York. Aisha is trying to save up for a flight to bring her son, Lamine, over from Senegal to join her in the US. She takes on a new job caring for Rose, the daughter of a wealthy liberal white couple Amy (Michelle Monaghan) and Adam (Morgan Spector), who live in a sleek modern apartment. She begins experiencing terrifying vivid nightmares and hallucinations that begin occurring throughout the day. The film draws on elements of West African folklore as Aisha befriends the building’s doorman and meets his grandmother, a spiritual priestess (watch trailer, runtime 2:13).

⚽ We’ve got a few matches in store for you tonight. Here at home, Al Masry faces Al Mokawloon at 5pm in the Egyptian Premier League.

English Premier League: The round of 16 continues today with three matches. Blackburn play Nottingham Forest while Charlton face Brighton at 9:45pm and a few minutes later the Manchester United v Burnley kicks off at 10pm.

???? OUT AND ABOUT-

(all times CLT)

Noha Fekry is performing at the Jazz Bar at the Kempinski Nile Hotel tonight at 9:30pm.

Egyptian rock band Malaaz takes the stage at the River Hall at El Sawy Culturewheel tonight at 7:30pm.

Warm up your vocal chords, Karaoke Night at Room New Cairo starts at 8pm.

???? UNDER THE LAMPLIGHT-

Anime director Makoto Shinkai and Naruki Nagakawa’s She and Her Cat tells four short interrelated stories of women and the cats, switching between human and feline perspectives. Set in Tokyo, the bestselling novel follows Miyu, a college administrator who finds it difficult to express herself and is feeling lonely in a disappointing casual relationship until she stumbles upon Chobi, an abandoned cat. It also introduces readers to Reina, an art student at the college Miyu works at, who makes the error of assuming that her natural talent are all she needs to thrive and her cat Mimi a small fragile stray. Mimi’s kitten helps a woman named Aoi cope with the loss of a friend. Finally, Kuro, the neighborhood's alpha stray cat, brings comfort to Shino.

GO WITH THE FLOW

The EGX30 rose 0.1% at today’s close on turnover of EGP 1.74 bn (13.1% above the 90-day average). Foreign investors were net sellers. The index is up 21.7% YTD.

In the green: Juhayna (+7.8%), CIB (+2.0%) and Mopco (+1.9%).

In the red: Ibnsina Pharma (-3.3%), Ezz Steel (-3.1%) and Oriental Weavers (-3.1%).

MACRO PICTURE

After years of cheap borrowing, the global debt pile is growing increasingly unsustainable — especially for developing countries: A decade of cheap borrowing has led to a whopping global debt pile of USD 290 tn for households, businesses and governments, up by more than one-third from a decade ago, according to research from the Institute for International Finance. Global debt has actually decreased this year — after peaking on the back of a flurry of borrowing during the worst of the covid-19 pandemic — but the debt service burden is growing as a result of a steep global monetary tightening wave.

It’s a problem for everyone, but some have it worse than others: Higher debt loans will squeeze economies already struggling with a cost-of-living crisis, reports Bloomberg. But while developed countries will undoubtedly feel the strain, the danger is more acute for developing countries — especially those that borrow in USD — who face debt distress.

Level with governments, corporates were the biggest borrowers of cheap money, most recently through pandemic support packages. While emergency measures kept many companies afloat during a tough time, there is a risk of a rise in so-called “zombie” firms — which essentially earn only enough to service their debt, European Bank for Reconstruction and Development (EBRD) Chief Economist Beata Javorcik said, according to Reuters. The risk of contagion from these corporates would infect the progression of healthy firms in economies, by bringing down investment, revenue, and employment, Javorcik said. Zombie firms are more present in economies dominated by government-run companies and banks, according to the EBRD’s latest Transition Report (pdf).

Advanced economies saw the biggest drop in debt, with public and private debt dropping 5% of GDP last year, but for low-income countries, total debt rose to reach 88% of GDP, driven by higher private debt, reports Reuters. With debt levels the way they are, there are concerns of low- and middle-income countries to repay their debts, with 25% of emerging market countries and 60% of low-income countries are on the border of debt distress, the IMF said in a blog post accompanying its first Global Debt Monitor. Total public and private debt dropped 10 percentage points to 247% from its peak level of 257% a year earlier, the IMF said.

For the poorest countries, debt defaults means having less to spend on essential sectors and policies such as health, education, or adapting to climate change. Many have looked to alternative forms of debt relief — borrowing from private banks or non-governmental sources, with the Guardian reporting that by close of 2021, 61% of long-term public and publicly guaranteed debt worth USD 3.6 tn was owed to private creditors rather than Paris Club (officials from major creditor countries) or other official creditors, compared to 46% in 2010.

But alternative creditors present serious drawbacks — half the payback time scale, high interest rates and difficulty in negotiating or rescheduling payments. If a country defaults on a private bank loan, the debt restructuring process does not give priority to economic and developmental concerns or the sustainability of the repayments. The lack of debt transparency is a key constraint to a country’s return to economic stability, the World Bank said earlier this month.

A strain on sustainable development: The damage of large debt will depend on how high central banks push interest rates, and while these look set to continue (see the Federal Reserve’s most recent hike) the global effects are yet to come.The prospect of debt distress, which the World Bank put at 60% of low-income countries and more than 25% of middle-income countries, will endanger nations abilities to invest in the Sustainable Development Goals, according to the UN Conference on Trade and Development’s Trade and Development Report (pdf).

Less liquidity for households: Consumers are already feeling the effect of higher central bank rates on their monthly budgets, as housing debt will dominate, leaving less disposable income for goods and luxuries but also other necessities, like bills, education or future planning. Canadian, Australian and South Korean households are the most exposed as their countries dodged a housing or banking crash in the Great Recession and have a large share of floating-rate mortgages.

It’s not just mortgage debt that households need to account for: For the UK, debt payments will exceed 10% of all household incomes, while Scandis in Sweden and Norway should account 15% of their salaries to repayments, Bloomberg says.

Mounting debt, high inflation and low growth create an unsustainable burden that may lead to a global economic crash, says economist Nouriel Roubini, according to Business Insider. While raising interest rates may combat soaring prices (see: the Central Bank of Egypt and the US Federal Reserve, among others) Roubini warns that households and companies may no longer have the ability to meet their loan repayment commitments.

CALENDAR

DECEMBER

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

25 December (Sunday): Senate back in session.

31 December (Saturday): E-invoicing registration deadline.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

January: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

1 January (Sunday): Use of Nafeza becomes compulsory for air freight.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

2 January (Monday): House back in session.

7 January (Saturday): Coptic Christmas.

24 January-6 February: Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): President El Sisi will visit India as “chief guest” at celebrations to mark the 74th anniversary of Indian independence.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

30 January-1 February (Monday-Wednesday): CI Capital’s Annual MENA Investor Conference 2023, Cairo, Egypt.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): Annual Business Women of Egypt’s Women for Success conference.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

1 April (Saturday): Deadline for banks to establish sustainability unit.

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

30 April (Sunday): Deadline for self-employed to register for e-invoicing.

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday): National holiday in observance of Labor Day (TBC).

4 May (Thursday): IEF-IGU Ministerial Gas Forum, Cairo.

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

10 June (Saturday): Thanaweya Amma examinations begin.

19-21 June (Monday-Wednesday): Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

End of December/early January: SFE’s pre-IPO fund to kick off roadshow.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q 2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

End of 2022: Decent Life first phase scheduled for completion.

2023: The inauguration of the Grand Egyptian Museum.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

1Q 2023: Internal trade database to launch.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.