- valU snaps up 100% of PayNas. (The Big Story Today)

- Proprietary software is suppressing innovation and solidifying large companies’ market positions. (What’s Next)

- TikTok has in-app browser code capable of tracking your keystrokes. (For Your Commute)

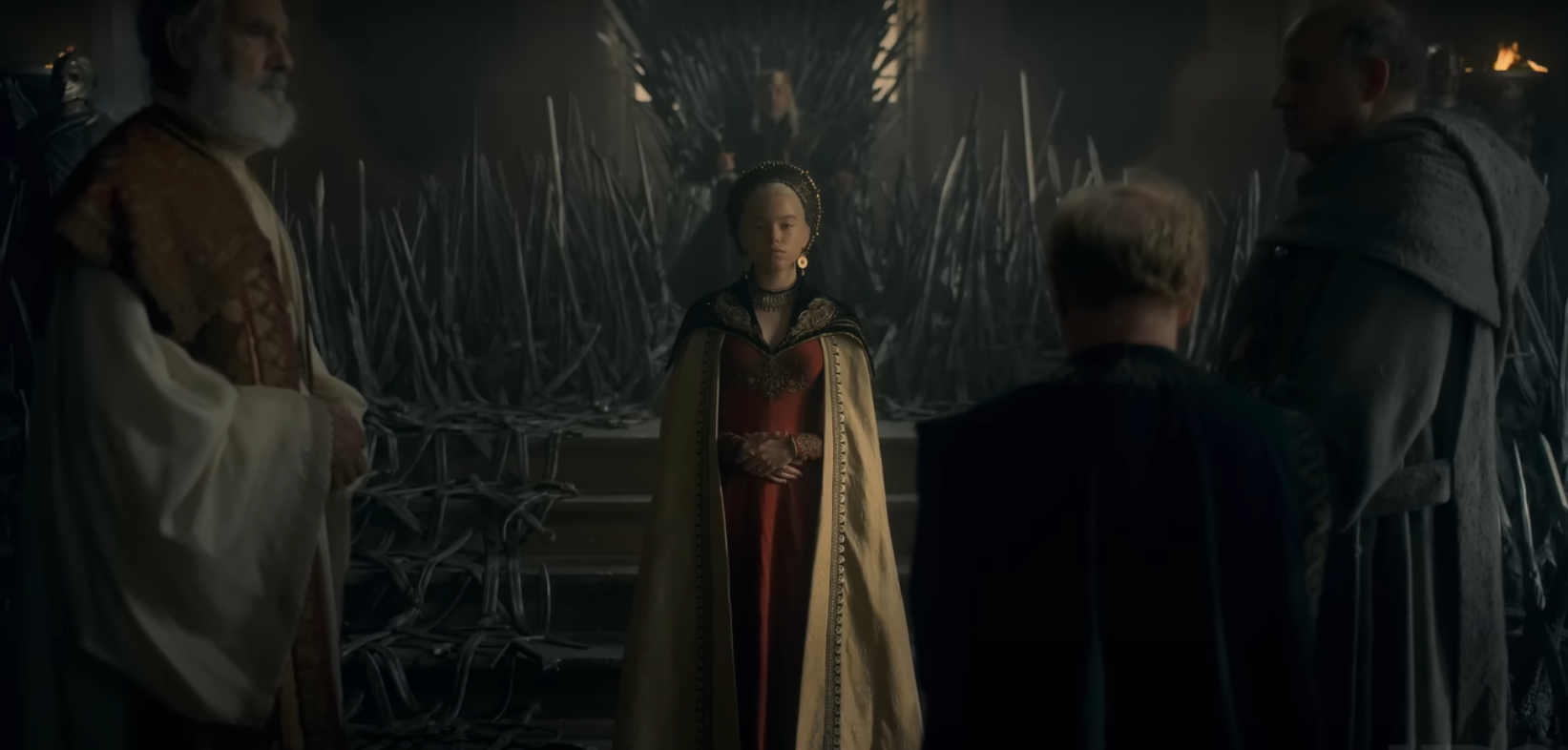

- We’re going back to obsessing over the world of Westeros. (On the Tube Tonight)

- Get your caps out and find some shade: It’s going to be hot tomorrow. (Tomorrow’s Weather)

- It’s chick flick night at CJC 610 and standup night at Tap West. (Out and About)

- A Woman of No Importance: The story of one of the Allied Forces’ biggest assets in espionage during WWII. (Under the Lamplight)

Monday, 22 August 2022

PM — Is software killing innovation?

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Happy hump day, wonderful people. We have a slightly slower news afternoon to bring you today — a welcome breather after the marathon sprint we’ve been keeping up with over the past couple of weeks.

THE BIG STORY TODAY

EFG Hermes’ consumer finance subsidiary valU has acquired 100% of digital financial services platform PayNas, according to an emailed statement (pdf). The acquisition “opens wide doors for valU’s BNPL solutions by tapping into Paynas’s roster of MSME clients and employees, integrating them into valU’s client base, while augmenting Paynas’s offering with a comprehensive range of financing products,” the statement says. The value of the transaction was not disclosed.

^^We’ll have more details on this story in tomorrow’s edition of EnterpriseAM.

THE BIG STORY ABROAD

It also appears to be a slower day abroad, as no single story dominates headlines in the international business press. Among the headlines worth noting: Citi expects inflation in the UK to breach 18% in January on the back of rising energy prices (CNBC | Financial Times); disruption to a pipeline carrying oil from Kazakhstan to Europe via Russia could spell further energy shortages for Europe (Reuters); and GCC countries are doubling down on tech stock investments by buying the dip amid market volatility (Bloomberg).

HAPPENING NOW(ish)-

The launch event for the global ClimaTech Run competition for tech entrepreneurs, hosted by USAID-backed Business Egypt, takes place today at Le Lac du Caire at 5pm CLT. The competition is also backed by the Environment Ministry and the International Cooperation Ministry.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Saudi Arabia’s sovereign wealth fund is making headlines in Cairo with at least three possible high-profile acquisitions now appearing to be in its pipeline, including Egypt Aluminum’s capital increase, Egyptian Media Production City, and United Bank.

- Moody’s speculates on the fate of the EGP: Egyptian policymakers will likely choose to maintain a close watch on the EGP and allow it to ease gradually against the greenback to avoid exacerbating inflationary pressures, Moody’s said in a report.

- Pachin’s biggest shareholder to hire advisors for fair value study: Chemical Industries Holding Company (CIHC) will appoint an independent financial advisor to value Paint and Chemical Industries’ (Pachin) amid a bidding war for the EGX-listed paint company.

|

FOR TOMORROW-

A delegation of Turkish businessmen and manufacturers is scheduled to visit Cairo tomorrow to talk investment and cooperation, Al Mal reports. The delegation includes investors in sectors including agricultural equipment, automotive components, textiles and garments, food and beverage, consumer goods, and building materials.

???? CIRCLE YOUR CALENDAR-

The Union of Arab Banks is organizing a forum on money laundering and terrorism financing in Sharm El Sheikh from 1-3 September. Participating institutions include the Central Bank of Egypt and the Federation of Egyptian Banks, among others.

☀️ TOMORROW’S WEATHER- We’re in for a hot day tomorrow, as temperatures in Cairo will hit 41°C during the day before falling to 27°C at night, our favorite weather app tells us.

???? FOR YOUR COMMUTE

Your in-app browser clicks, screenshots, and form inputs are being tracked by some of your favorite social media apps — and TikTok is arguably the biggest offender, according to tech researcher Felix Krause. When you open a link on apps like Facebook, Instagram, or TikTok, it defaults to an in-app browser that can rewrite parts of web pages, Krause told Forbes. On TikTok, code is inserted that can monitor page activity including keystrokes leading to security concerns around passwords or credit card information shared. In response, the Chinese-owned company confirmed that while those script features exist within their code, they are only used for debugging and performance monitoring. Instagram and Facebook also track every tap on a website and monitor when people highlight text, while Snapchat appears to be the least data-hungry, according to Krause’s researchy.

What’s your safest option to get around this? Head to the in-app menu after you’ve clicked and open pages in Safari or your phone’s default browser for more secure surfing.

Drought and heat waves in a southeastern Chinese province is prompting an extension of coal usage to make up for electricity shortages, the Financial Times reports. The drought means that hydropower dams are (literally) running dry and starving industry from energy supplies, forcing a return to coal as an alternative source of energy. Coal consumption to fuel power plants in the country increased 15% y-o-y during the first two weeks of August, according to Vice Premier Han Zheng, forcing government officials to order the closing down of some factories to prioritize key industries and residents. These decisions have impacted automotive manufacturers’ supply chains, while energy shortages have also been felt in subway stations and shopping centers.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

House of the Dragon, the long-awaited Game of Thrones prequel, is finally here. The epic series chronicles different members of House Targaryen vying for the coveted seat on the Iron Throne in a war of succession, known as the Dance of the Dragons, rather than competing houses battling for dominance. After Game of Thrones’ infamously unsatisfying series finale, House of the Dragon has some compensating to do, the New York Times says in a review. The series’ first season is made up of 10 episodes, and is available on OSN+, with a new episode out every week. You can also catch the trailer here (runtime: 2:49).

The standalone sequel is set 172 years before the birth of Daenerys (and the events of GoT), in the golden age of Westeros when the then-100-year-old Targaryen Dynasty was at the height of its power. House of the Dragon is also markedly Targaryen-skewed so expect more long white-blonde wigs this time around, and way more dragons — 10 to be exact. Unlike with the last couple of seasons of GOT that were based on an unfinished book series, House of Dragons is based on George Martin’s finished volume of fictional history Fire & Blood, so Google at your own risk — there will be spoilers abound.

⚽ Manchester United’s clash with Liverpool at 9pm tonight concludes the English Premier League’s Matchday 3.

Speaking of which, don’t forget to sign up for the Enterprise Fantasy League via this link, or by using this code: 8o4sut.

Locally: Pyramids FC tries to hold tight to any chance to earn the league title with a game against Future FC at 8pm. Theoretically speaking, chances are still there in case of a victory, but a tie or a defeat would pave the way officially for Zamalek to grab the title for a second consecutive season. Assuming Pyramids wins tonight’s game, Zamalek can be officially crowned title holder if it defeats Alexandria’s Al Ittihad tomorrow. Rival Al Ahly has already missed the chance to compete for the league after tying 0-0 yesterday against Ismaily FC.

Also at home: Ghazl El Mahalla v Misr Lel Makassa and Ceramica Cleopatra v Talae’ El Geish at 5:30pm.

???? OUT AND ABOUT-

(all times CLT)

Chick-flick fans rejoice: Cairo Jazz Club 610 is screening 10 Things I Hate About You at 8pm on their terrace, followed by How To Lose A Guy In 10 Days at 10:40pm.

If rom-coms aren’t your thing, Wong Kar Wai’s 2046 is screening at Zawya tonight at 7pm. This is the final screening of Zawya’s Wong Kar Wai Retrospective that saw four restored films directed by Wong Kar Wai screened throughout August.

You’re in for a night of laughter at the Tap West, with a lineup of Egyptian comedians taking the stage at 9pm, including: Youssef El Gallad, Mohamed Kamatcho, Kerolos Azer and Amgad Elshawshy.

???? UNDER THE LAMPLIGHT-

A Woman of No Importance recounts the true story of Virginia Hall, an American spy who thrived in the espionage of World War II. Written by award winning author Sonia Purnell, the book details the overlooked story of a spy who was sent to occupied France and ultimately helped the Allied Forces to victory in the war. After being rejected from the foreign service for being a woman and having a prosthetic leg (she lost a leg in a hunting accident) she talked her way into the new British secret service, The Special Operations Executive, and became the first Allied woman deployed behind enemy lines. There, she created a wide network that helped her gain intel on German troop movements and stir up French Resistance. Hall went on to become one of the most sought-after Allied spies, prompting the Gestapo to send out an urgent transmission in 1942: “She is the most dangerous of all Allied spies. We must find and destroy her.”

???? GO WITH THE FLOW

The EGX30 fell 0.9% at today’s close on turnover of EGP 1.54 bn (47.6% above the 90-day average). Foreign investors were net sellers. The index is down 14.3% YTD.

In the green: Madinet Nasr Housing (+13.3%), Palm Hills Development (+3.7%) and Heliopolis Housing (+2.7%).

In the red: Credit Agricole Egypt (-3.3%), Rameda (-2.5%) and Ibnsina Pharma (-2.4%).

???? WHAT’S NEXT

Is the growing use of software at large companies fueling a slowdown in innovation? That’s the broad hypothesis Boston University School of Law’s Technology and Policy Research Initiative Executive Director James Bessen poses in his book, The New Goliaths: How Corporations Use Software to Dominate Industries, Kill Innovation, and Undermine Regulation. Tech-powered corporate giants (think Amazon, Google, and Facebook) have built and mastered software designed to their operational and business advantage, but these software systems have acted as “moats against competitors,” Bessen argues, according to the New York Times.

At the heart of the issue: Proprietary software, which Bessen defines “broadly as not only code but also the data that companies collect on their customers and operations, the skills of their workers, and the organizational changes they made to exploit the technology,” the Gray Lady writes. Proprietary software, he says, is not just the regular software that most businesses build and employ in their operations. It’s the software that is specifically built to “better manage complexity and thus differentiate themselves from rival firms,” making it more difficult for smaller market players or new entrants to unseat one of the heavy hitters in any given industry, Bessen wrote for the MIT Technology Review.

How big is the proprietary software push? In 2016, US firms spent around USD 250 bn on developing proprietary software, Bessen says, citing government statistics.

More investments in proprietary software = larger market shares: Over the past couple of decades, firms have ramped up their investments in proprietary software, which has been accompanied by a rise in market shares held by the biggest firms in individual industries, according to research from Bessen published in 2020. And that trend means that these businesses are more entrenched in their industries: “In a given industry, the chance that a high-ranking firm (as measured by sales) will drop out of one of the top four spots within four years has fallen from over 20% to around 10%,” Bessen said in MIT Technology Review.

With the suppression of innovation comes inevitable economic concentration: “Technology,” Mr. Bessen said, “is playing a different role than it has in the past — less to disrupt than entrench.” Sectors that are highly digitized and reliant on technology can be a double-edged sword as far as concentration goes, researchers Nicolas Crouzet and Janice Eberly argued in a 2019 paper (pdf). While on the one hand, they can lead to efficient concentration (by eliminating inefficient market players), they can also create barriers to entry for smaller companies that can’t keep up with the entry costs associated with high-tech industries.

Startups — which are broadly known for “disrupting” industries with innovative offerings — can’t keep up with the heavy hitters: “Across a wide range of industries, dominant firms are employing large-scale information systems to outflank their competitors, including innovative startups,” Bessen wrote.

That’s not to say that technology is the enemy: Bessen caveats that proprietary software isn’t necessarily an all-bad thing and can — besides improving companies’ bottom lines — serve important benefits. For one, successful software-enabled companies “are more productive than their smaller rivals” and have an average 17% premium on salaries for the same jobs compared to their competitors. Companies that have been able to invest in building proprietary software have also reported significant improvements in their operational efficiency.

But the answer could simply be to make these proprietary softwares more accessible to the wider industry, Bessen argues. Policymakers could enact reforms or policy changes that “nudge or force” dominant companies to open up their softwares to other players, he suggests. “Banning non-competes would help employees spread their knowledge by moving jobs. Reforming patents, which aren’t always necessary to protect software innovation and are abused by patent trolls to the detriment of nearly everyone, would help, too,” he wrote for the Harvard Business Review.

???? CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

AUGUST

August: Sharm El Sheikh will host the African Sumo Championship.

17-21 August (Wednesday-Sunday): Delegation from the European Investment Bank visits Egypt to discuss the NWFE program with the Ministry of International Cooperation.

22 August (Monday): The Climate Finance Accelerator hosts a webinar on climate finance in Egypt.

22 August (Monday): ClimaTech Run 2022, Le Lac du Caire, Cairo.

23 August (Tuesday): The government hosts public consultations on its state ownership policy document with firms in the construction sector.

23 August (Tuesday): Window to apply for government non-profit universities via the online tansik (enrollment) website opens.

25 August (Thursday): Second Egypt and UN-led regional climate roundtable ahead of COP27, Bangkok, Thailand.

25 August (Thursday): The government hosts public consultations on its state ownership policy document with firms in the water sector.

25-27 August (Thursday-Saturday): Jackson Hole Economic Symposium.

27 August (Saturday): The National Dialogue board of trustees holds its fifth meeting, which will set the agenda for the dialogue and choose rapporteurs for the involved committees.

28 August (Sunday): Retail portion of Ghazl El Mahalla IPO ends.

28 August (Sunday): The government hosts public consultations on its state ownership policy document with mining and petroleum refining players.

30 August (Tuesday): Deadline for companies to file 2Q financial statements.

30 August (Tuesday): Deadline to apply for government non-profit universities via the tansik (enrollment) website.

30 August (Tuesday): The government hosts public consultations on its state ownership policy document with timber merchants.

31 August (Wednesday): Late tax payment deadline.

31 August (Wednesday): Deadline for qualifying companies to submit offers to manage and operate a soon-to-be-established state company for EV charging stations.

31 August (Wednesday): Submission deadline for fall 2022 cycle of EGBank’s Mint Incubator.

31 August (Wednesday): Beltone convenes its general assembly to restructure the board following the change of ownership.

SEPTEMBER

September: Naval Power, Egypt’s first naval defense expo

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

September: Egyptian-German Joint Economic Committee.

September: A delegation from Germany’s Aldi will visit Egypt to look at potential investments.

September: Government to launch an international promotional campaign for Egyptian tourism.

September: Egypt will host the second edition of the Egypt-International Cooperation Forum (ICF).

1 September (Thursday): Credit hikes for ration card holders will come into effect.

1 September: Madbouly government set to introduce new social protection measures.

1 September (Thursday): The government hosts public consultations on its state ownership policy document with experts and think tanks.

1-2 September (Thursday-Friday): Third Egypt and UN-led regional climate roundtable ahead of COP27, Santiago, Chile.

1-3 September (Thursday-Saturday): The Union of Arab Banks is organizing a forum on money laundering and terrorism financing in Sharm El Sheikh.

4 September (Sunday): The government hosts public consultations on its state ownership policy document with electricity players.

4 September (Sunday): Industrial Development Authority’s deadline for companies interested in providing various services in the industrial zones in Qena and Sohag to submit a written expression of interest.

5-8 September (Monday-Thursday): Gastech 2022, Milan, Italy.

6 September (Tuesday): The government hosts public consultations on its state ownership policy document with building and construction players.

6-9 September (Tuesday-Friday): Gate Travel Expo 2022, El Qubba Palace, Cairo.

7-9 September (Wednesday-Friday): African Finance Ministers to meet in Cairo to coordinate an African-led position during COP27.

8 September (Thursday): European Central Bank monetary policy meeting.

8 September (Thursday): The government hosts public consultations on its state ownership policy document with experts and think tanks.

11 September (Sunday): The government hosts public consultations on its state ownership policy document with accommodation and food services players.

13 September (Tuesday): The government hosts public consultations on its state ownership policy document with sports industry players.

11-13 September (Sunday-Tuesday): Environment and Development Forum (EDF), InterContinental City Stars, Cairo.

14 September (Wednesday): Expedition Investments’ MTO for Domty expires.

15 September (Thursday): The government hosts public consultations on its state ownership policy document with water and sewage utilities players.

15 September (Thursday): Fourth Egypt and UN-led regional climate roundtable ahead of COP27, Beirut, Lebanon.

18 September (Sunday): Deadline for brokerage firms, asset managers and financial advisors to register with the Egyptian Securities Federation.

19-22 September (Monday-Thursday): EFG Hermes One on One Conference, Dubai.

20 September (Tuesday): Fifth Egypt and UN-led regional climate roundtable ahead of COP27, Geneva, Switzerland.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

22 September (Thursday): Deadline to submit prequalification applications for companies interested in submitting a proposal for sea water desalination projects

25-27 September (Sunday-Tuesday) A delegation of executives at Egyptian real estate companies visit Saudi Arabia to present developers with investment opportunities in Egypt’s real estate sector.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

27-29 September (Tuesday-Thursday): Africa Renewables Investment Summit (ARIS), Cape Town, South Africa.

OCTOBER

October: House of Representatives reconvenes after summer recess

October: Air Sphinx, EgyptAir’s low-cost subsidiary to commence operations.

October: Fuel pricing committee meets to decide quarterly fuel prices.

1 October (Saturday): Use of Nafeza becomes compulsory for air freight.

1 October (Saturday): Start of 2022-2023 school year.

1 October (Saturday): 2022- 2023 academic year begins for public universities.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10-16 October (Monday-Sunday): World Bank and IMF annual meetings, Washington, DC.

16-19 October (Sunday-Wednesday): Cairo Water Week 2022, Nile Ritz Carlton, Cairo.

18-20 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October-14 November: 3Q2022 earnings season.

NOVEMBER

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7 November (Monday): The inauguration of the first line of the high-speed rail.

7-13 November (Mon-Sun): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

DECEMBER

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday) — First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

4Q2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.