- Annual urban inflation rises to 8.8% in Feb + Trade Ministry bans exports of key food commodities. (The Big Stories Today)

- Russian, Ukrainian foreign ministers fail to reach agreement in talks today. (The Big Story Abroad)

- Trading in NFTs soared 21k% y-o-y in 2021 with total sales reaching USD 17.6 bn. (For Your Commute)

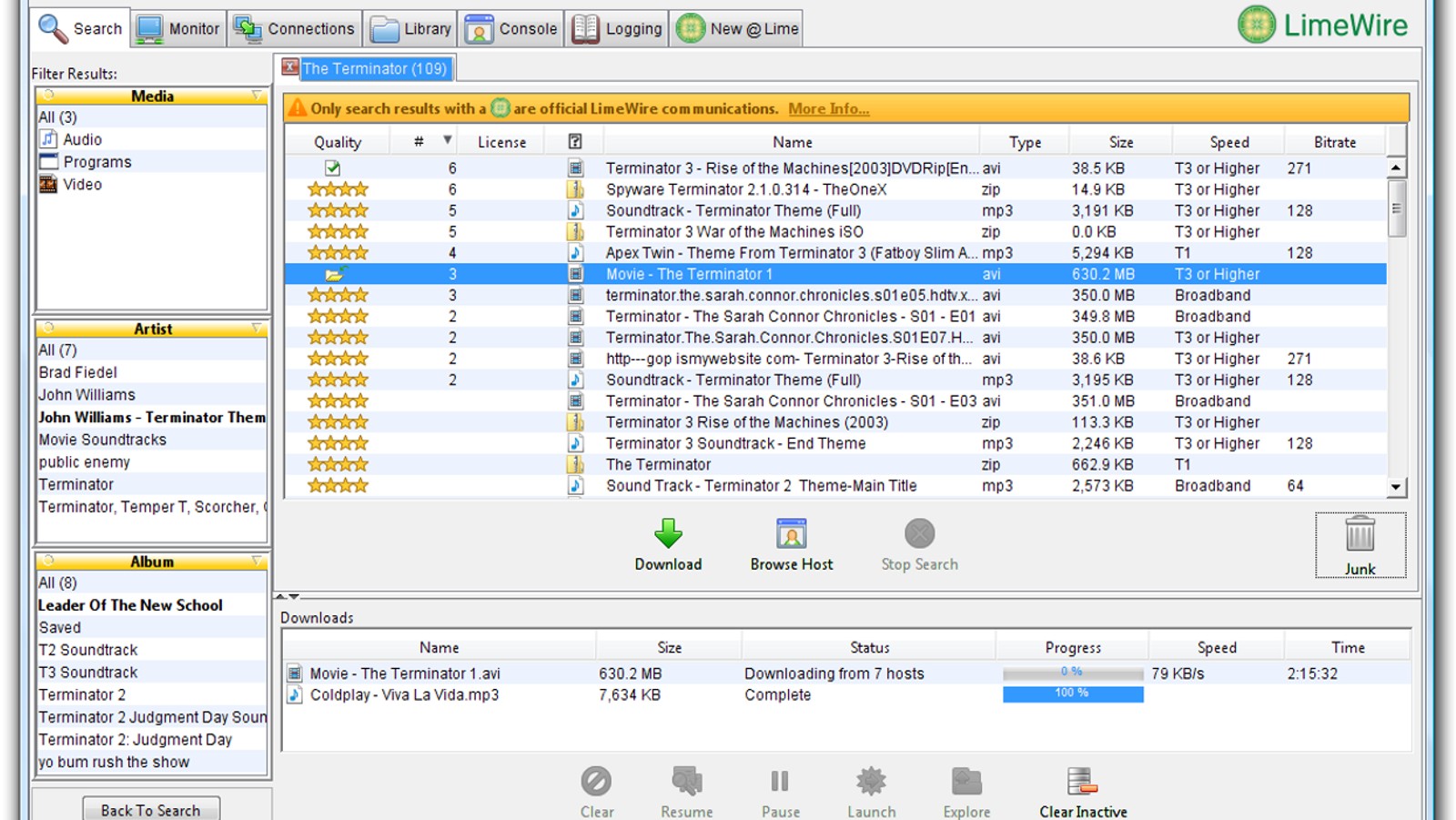

- LimeWire is back — and it’s also jumping on the NFT bandwagon. (For Your Commute)

- The Andy Warhol Diaries is a biopic created partly through the artist’s own writings. (On The Tube Tonight)

- Masters of Scale features guests who have been involved in the key inflection points of their businesses. (Ears To The Ground)

- Egyptian author Alya Mooro writes about her experience as a “Middle Eastern woman outside the stereotypes.” (Under The Lamplight)

Thursday, 10 March 2022

PM — LimeWire’s back, y’all

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Happy Thursday, wonderful people. We hope the howling winds and thoroughly brown view from our windows aren’t putting too much of a damper on this final day of the workweek.

THE BIG STORIES TODAY

Annual urban inflation rose in February to 8.8% — its highest since mid-2019 — from 7.3% in January, according to figures released today by statistics agency Capmas. The acceleration was driven primarily by surging food prices. On a monthly basis, inflation was up 1.6%. The inflation uptick came before the impact of the Russia-Ukraine war hit commodity prices.

As food inflation bites, the Trade Ministry is banning exports of key food commodities: The Trade Ministry introduced a three-month export ban on six key commodities, according to a copy of the decision carried by Ahram Gate, as the ongoing war in Ukraine continues to roil global commodity markets. The ban, which comes into effect today, covers exports of wheat, lentils, flour, pasta, and whole and crushed fava beans.

We’ll have more on these and other stories in Sunday’s EnterpriseAM.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- The government will try to absorb the shock of spiraling commodity prices “as much as possible,” Prime Minister Moustafa Madbouly said yesterday.

- Banks now have until 14 September to comply with the new capital requirements in the 2020 Banking Act after the central bank agreed to extend the deadline by a year.

- EFG Hermes Corp-Solutions has signed a EGP 600 mn sale and leaseback agreement with real estate developer LMD to finance its multi-purpose 3’Sixty project in New Cairo:

Remember those hopes everyone had this morning for an imminent Russia-Ukraine ceasefire? They’ve been all but dashed, after the two countries’ foreign ministers failed to make any progress during talks today. Russian Foreign Minister Sergei Lavrov did not commit to setting up a humanitarian corridor for civilians to flee Ukraine’s Mariupol, Ukrainian Foreign Minister Dmytro Kuleba said after the two officials met in Turkey, according to Reuters.

Lavrov rejected Ukraine’s proposal of enshrining its neutrality in its constitution in exchange for a ceasefire and to maintain its territory, the Financial Times reports.

What Russia might be willing to entertain: A direct sit-down between Russian President Vladimir Putin and Ukrainian President Volodymyr Zelensky, Lavrov told reporters following his meeting with Kuleba.

Meanwhile, UK sanctions have finally hit Russian b’naire and Chelsea FC owner Roman Abramovich, after the UK government introduced asset freezes, travel bans, and transport sanctions on Abramovich and six other Russian oligarchs, according to a statement.

ON THE HUMANITARIAN FRONT- The US is fast-tracking the disbursal of a USD 13.6 bn aid package to Ukraine, with the House of Representatives signing off on the bill last night and shipping it off to the Senate for approval before midnight tomorrow.

|

???? CIRCLE YOUR CALENDAR-

Contemporary art and culture center Darb1718 is hosting its 3031 Art Festival until this Saturday, 12 March on its premises in Fustat, Old Cairo.

Green energy forum: The German Arab Chamber of Industry and Commerce is hosting the Egyptian German Green Energy Forum on Tuesday, 22 March. Planning Minister Hala El Said, Vice Minister of Finance Ahmed Kouchouk and German Ambassador Frank Hartmann are among those slated to attend. The event runs 5:30-9pm CLT at the InterContinental Cairo Semiramis.

Interest rates: The Central Bank of Egypt will hold its next monetary policy meeting on Thursday, 24 March.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- You’ll want to keep your bataneya close: Temperatures over the weekend will reach 18°C during the day before falling to 7-8°C at night, our favorite weather app tells us.

???? FOR YOUR COMMUTE

SIGN OF THE TIMES- Trading in NFTs soared 21k% y-o-y in 2021 with total sales reaching USD 17.6 bn as the tokens entered the mainstream last year, co-founder of Nonfungible.com Gauthier Zuppinger told CNBC. These estimates — as large as they are — may be even smaller than reality, with blockchain analysis firm Chainalysis putting the figure north of USD 40 bn. The number of NFT buyers rose to 2.3 mn from 75k as people became more skilled at making a buck from the digital assets, Zuppinger added. The most popular category of NFTs was collectibles, with USD 8.4 bn spent on them during 2021, followed by Gaming NFTs (USD 5.2 bn). Later on in the year as the metaverse gained traction, sales of digital land and other projects in the space grew quickly to reach USD 514 mn.

Will 2022 see just as much growth? Probably not, Zuppinger believes. While the NFT platform does expect some level of growth, the eye-watering figures of 2021 might have been the peak due to “ speculation and a loss of interest in collectibles,” he said. The NFT market will instead see more large companies and financial institutions enter, while more speculative assets start to disappear, Zuppinger predicts.

The millennial / Gen Z crossover we didn’t know we needed: LimeWire is back — and it’s also jumping on the NFT bandwagon. For the uninitiated, LimeWire was the 90s and early 2000s’ version of Spotify, wherein users downloaded music (and typically a host of viruses that slowly killed your family desktop computer). After years of being a must-have for millennials, LimeWire faded from existence after the emergence and adoption of streaming services. However, the platform is now making a return with an emphasis on music-based NFTs as it attempts to enter the crypto market. The new Austria-based owners, brothers Paul and Julian Zehetmayr, are looking to bank on LimeWire’s name recognition. In comments to Bloomberg, Julian explains that the name still inspires nostalgia in the hearts of music lovers. “Everybody connects it with music and we’re launching initially a very music-focused marketplace, so the brand was really the perfect fit for that with its legacy,” he said.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

The Andy Warhol Diaries is a biopic created partly through the artist’s own writings: Andrew Warhola, the son of Austro-Hungarian immigrants, reinvented himself as Andy Warhol as he grew up in Pittsburgh. Tagged an outsider, but always wishing to be part of the mainstream, Warhol documented his thoughts and feelings of his art, religion, and self-image. The new Netflix biopic uses these writings as well as interviews with friends and acquaintances to paint a picture of the artist who rose to fame for his depictions of others. Several celebrities and big names emerge throughout the story and the curtain behind which Warhol hid his life is somewhat raised in celebration of the late artist. The Guardian and CNN are out with reviews.

⚽ We’ve got two big games we’re excited about in the UEFA Europa League’s Round of 16 tonight: Sevilla v West Ham at 7:45pm and Barcelona v Galatasaray at 10pm.

Over in the Premier League, Week 28 wraps today, with three games at 9:30pm: Norwich City v Chelsea, Southampton v Newcastle, and Wolves v Watford. Leeds United will also play against Aston Villa at 9:45pm.

La Liga has one game tomorrow: Atletico Madrid v Cádiz at 10pm.

Moving to the CAF Champions League, Zamalek will clash with Wydad at 6pm in the CAF Champions League’s group stages. Rival Al Ahly will meet with Mamelodi Sundowns on Saturday at 3pm.

European leagues will begin new rounds on Saturday, with the EPL seeing Brighton v Liverpool at 2:30pm, Brentford v Burnley at 5pm, and Manchester United v Tottenham at 7:30pm.

Happening in La Liga on Saturday: Levante v Espanyol at 3pm, Granada v Elche at 5:15pm, Villarreal v Celta Vigo at 7:30pm and Getafe v Valencia at 10pm.

In Serie A, we’ll be watching Sampdoria v Juventus at 7pm and Milan v Empoli at 9:45pm on Saturday.

???? EAT THIS TONIGHT-

Zamalek’s Sapori di Carlo takes Italian food to a new level: The restaurant is perfect for an outing with friends or a date night, with its fancy interiors and dim lighting. The menu has a selection of antipasti, pizza, and pasta that are made in the open kitchen in front of you (there’s nothing better than seeing your pizza rise in the oven). We loved their carbonara and seafood pastas as well as their pasta burrata — even though it’s a bit on the too-cheesy side (if such a thing exists). For pizzas, we suggest opting for their pepperoni, salamino, or their fresh mussels covered pizza, testa rossa. Finish off your meal with a lemon tart or tiramisu.

???? OUT AND ABOUT-

SceneNoise and Cairo Jazz Club 610 are back again, this time giving a platform to the underground Sudanese rap scene, with a debut by Sudanese star Soulja on Saturday, along with Sudanese rapper Walgz and Egyptian rappers Uzu and Swani with K-Laff DJ-ing.

You can still get that Mother’s Day gift, with Bazarna holding their Mother’s day POP-UP Market tomorrow at New Cairo’s Downtown from 12pm to 10pm. The pop-up market will be home to various collaborations of brands to pamper your mom.

???? EARS TO THE GROUND-

Masters of Scale features guests who have been involved in the key inflection points of their businesses: Host Reid Hoffman — the co-founder and executive chairman of LinkedIn — is a pro at bringing on an interesting flow of CEOs and entrepreneurs who have achieved massive growth for their company, sometimes from basically nothing. Through his off-the-cuff questioning style, Hoffman coaxes the guests to delve into the not-so-shiny story of scaling, looking at the challenges and obstacles these businesses faced along the way. Most episodes feature a main guest alongside one or two cameo appearances, and the show has a 50-50 gender balance commitment in place which helps showcase successful entrepreneurs from both genders and tell different perspectives. Recent episodes brought on General Motors CEO Gerald Johnson, Unilever CEO Paul Polman, Huffington Post Co-founder Arianna Huffington, and Tjada D’Oyen McKenna, the CEO of Mercy Corps, an NGO on the front lines of the Ukrainian crisis.

The podcast is a favorite of some of our My Morning Routine interviewees, such as Falak Startups CEO Ahmed Hazem and Tagaddod CEO and co-founder Nour El Assal.

???? UNDER THE LAMPLIGHT-

Egyptian writer Alya Mooro writes about her experience as a “Middle Eastern woman outside the stereotypes”: The Greater Freedom explores what it means to be from two cultures but feel like you don’t belong to either (popularly known as being “third culture”). Mooro is Egyptian-born and London-raised and the book acts as both a memoir and social commentary to her experience growing up and the “myth” of needing to define her identity as either Arab or Western. She also brings in research and other voices of Middle Eastern women who don’t fit the mold. Together they detail how it feels to be pushed to conform to a culture and lifestyle while every move they make feels like picking a side. Through all the difficulties, these women eventually realized that “the greater freedom is to be who you actually are; to be able to live your life in the way you deem best.”

???? GO WITH THE FLOW

The EGX30 rose 0.4% at today’s close on turnover of EGP 996 mn (6.3% above the 90-day average). Foreign investors were net sellers. The index is up/down 12.5% YTD.

In the green: Heliopolis Housing (+4.2%), Fawry (+2.8%) and Ezz Steel (+2.6%).

In the red: Cleopatra Hospital (-3.0%), CIRA (-2.9%) and Sidi Kerir Petrochem (-2.4%).

???? CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of a 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

1H2022: The Transport Ministry to sign a memorandum of understanding with Abu Dhabi Ports to set up a transport route across the Nile to transport products from Al Canal’s Minya sugar factory.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: Contracts for last two phases of Egypt’s USD 4.5 bn high-speed rail line to be signed.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

March: The new multi-purpose station at Dekheila Port and the revamped Ain Sokhna Port will start operating.

March: General Authority for Land and Dry Ports to issue the condition booklets for the operations of the Tenth of Ramadan dry port.

9-18 March (Wednesday-Friday): The annual Cairo International Fair.

Mid-March: Bidding for the construction of Anchorage Investments’ petrochemical complex in the Suez Canal Economic Zone starts.

15 March: The first edition of Export Smart at Royal Maxim Palace Kempinski

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

20 March (Sunday): Applications close for Visa’s global startup competition, the Visa Everywhere Initiative.

22 March (Tuesday): Egyptian German Green Energy Forum, 5:30-9:30pm CLT at the InterContinental Cairo Semiramis.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

24 March (Thursday): GB Auto Extraordinary General Assembly (pdf).

24 March-1 April: Ahlan Ramadan Supermarket Expo, Cairo International Convention Center.

25 March (Friday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers' playoff (TBC).

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

28 March (Monday): The second leg of the 2022 FIFA World Cup qualifiers' playoff between Egypt and Senegal (TBC).

28 March (Monday): The court hearing for a case brought by Arabia Investments Holding (AIH) against Peugeot has been postponed until 28 March.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

April: Ghazl El Mahalla shares will begin trading on the EGX.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

Mid-April: Trading on the Egyptian Commodity Exchange to start.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, New Administrative Capital.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

3Q2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release first financing product.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

August: Work to extend the capacity of the Egypt-Sudan electricity interconnection to 300 MW to be completed.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.