- e-Finance IPO is 61x oversubscribed. (What We’re Tracking Tonight)

- What incentives the FinMin has in store for the private sector, according to Ahmed Kouchouk. (What We’re Tracking Tonight)

- EBRD Vice President of Banking, Alain Pilloux + UK MENA Minister James Cleverley are in town. (What We’re Tracking Tonight)

- Beware the clueless tourist VC. (For Your Commute)

- Trading on Odin Investments’ real estate investment firm Emerald on the Nilex begins tomorrow. (Go With the Flow)

- We’re in the Big Quit era. Blame the economy. (Careers)

- Manga mania + Binge at Binge Cairo + VR takes center stage in Downtown art exhibits. (Enterprise Recommends)

- Short Arabic fiction, in English. (Enterprise Recommends)

Sunday, 17 October 2021

EnterprisePM — e-finance’s IPO was 61.4x oversubscribed after the subscription period for the retail portion of the IPO ended today.

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, ladies and gentlemen. A light news day is just what the doctor ordered for a short work week in observance of the Prophet Muhammed’s birthday.

On that front, the EGX announced (pdf) that the bourse will be closed on Thursday in a statement out today. The nation’s banks will also be off on Thursday, the central bank said over the weekend.

THE BIG STORIES TODAY-

#1- e-Finance IPO retail offering is 61x oversubscribed: The quiet news day was pierced by the announcement at the end of trading from the EGX that the retail offering of the anticipated EGX debut of state-owned e-Finance were 61.4x oversubscribed. The subscription period for the retail portion of the IPO had ended today.

CORRECTION- An earlier version of this story incorrectly said that the IPO’s retail and institutional offerings were 61x oversubscribed.

e-Finance launches digital healthcare platform: Earlier in the day, e-finance announced that it partnered with Universal Health Ins. Authority (UHIA) to launch eHealth, a platform specialized in developing and operating digital solutions for healthcare sector services, according to a company statement (pdf).

#2- What incentives does FinMin have in store for the private sector? Vice Minister of Finance Ahmed Kouchouk tells us in the second part of our exclusive interview. From export subsidies to performance-based incentives for specific industries (including automotive), you don’t want to miss this one.

#3- From Startup Land: Egyptian construction tech startup Elmawkaa raised an undisclosed six-figure sum (pdf) in a seed round led by Flat6labs, which the company plans to use to onboard new suppliers and increase its transactions. Meanwhile, mobile security startup MagicCube — co-founded by Egyptians Nancy Zayed and Sam Shawki — raised USD 15 mn in a round led by Mosaik Partners, with the participation of Bold Capital, Epic Ventures, card-reader/POS hardware maker ID Tech along with unnamed individual investors, TechCrunch reported.

^^ We’ll have these stories and more in tomorrow morning’s edition of EnterpriseAM.

HAPPENING NOW-

The final day of the IMF / World Bank Fall Meetings is getting underway in Washington, DC as we hit “send” on this afternoon’s edition. The weeklong gathering was marked by a slew of reports and economic forecasts, including the IMF’s World Economic Outlook and Fiscal Monitor Report, as well as the World Bank’s MENA economic update.

EBRD Vice President of Banking, Alain Pilloux, is in Egypt from today until this Wednesday for high-level meetings with government officials including Prime Minister Moustafa Madbouly and several cabinet ministers, according to an emailed statement (pdf). The visit comes ahead of the signing of the new country strategy between Egypt and the EBRD.

James Cleverly, the British MP responsible for MENA affairs, landed in Cairo yesterday for his first official visit to Egypt, Cleverly said on Twitter. He said his “packed agenda” would include talks on “climate change, [potential] UK investment and regional issues.” He’s set to meet Foreign Minister Sameh Shoukry at some point today, according to MENA.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Egypt’s balance of payments flipped to a surplus of USD 1.9 bn in FY2020-2021, while a “noticeable drop in tourism revenues” led to our current account deficit widening by USD 7.2 bn in the state fiscal year.

- Egypt signs MoUs with Greece, Cyprus to link electricity grids: The USD 4 bn EuroAfrica Interconnector project, which will connect the electrical grids of Egypt, Greece, and Cyprus, got a huge boost over the weekend after the three countries signed MoUs to build an undersea cable connecting their grids.

- Egytrans walks away from HAUH takeover bid: A potential reverse merger between Egytrans and Hassan Allam Utilities Holdings subsidiary Hassan Allam Utilities BV appears to have fallen through after the two sides failed to agree on a fair value.

THE BIG STORY ABROAD-

The global supply chain crunch is not looking good: Buyers waiting on goods from Chinese exporters may have to wait a little bit longer than usual as the country’s energy shortfall forces factories to cut down their operations, when demand for Chinese exports is at an all-time high, the Financial Times reports. Electricity prices in the country rose by 20% after the government decreed sweeping market reforms, forcing coal-fired power generators to sell into the wholesale market. This hike in energy prices is expected to quickly force some manufacturers to cut production, with one factory owner saying the power cuts have already pushed down production by 20-30%.

Compounding the pre-Christmas supply chain gridlock: A typhoon in Asia over the weekend worsened a container ship pileup in Hong Kong and Shenzhen, where the number of ships is now higher than records reached in May during a fresh covid-19 outbreak, Bloomberg reports. The ripple effect of global trade means that even when the Asia bottleneck is resolved, the congestion will likely just move to destination ports, particularly in the US and Europe, which are already overwhelmed and unable to offload shipments to trucks fast enough. The shipping crunch coincides with resurging consumer demand, especially ahead of the Christmas shopping season — which could mean a serious blow to retail sales.

Earnings season rolls on in the US — and it’s mostly looking good. Tesla, Netflix, P&G, and J&J are among the big players set to publish earnings reports in the week ahead, with reports also coming from railroads, airlines, health care, tech, financial firms, and energy and consumer product companies. The financial sector has already performed remarkably well, with Citigroup, Goldman Sachs, Bank of America, and Morgan Stanley posting good Q3 results last week and the energy sector is expected to boast the biggest gains. But a patchy earnings season that only sees some groups doing well “could be a risk for the market,” Jonathan Golub, chief U.S. equity strategist at Credit Suisse tells CNBC.

|

FOR TOMORROW-

i-Sheep PSA: A Mac revamp and new AirPods are among new tech expected to be unveiled at Apple’s launch event tomorrow. You can catch a livestream here; it kicks off tomorrow at 10 am PDT, or 7 pm CLT for the folks tuning in from home.

???? CIRCLE YOUR CALENDAR-

Four days to go until the Cairo International Furniture Show, Le Marche. The four-day event runs from this Thursday, 21 October until next Sunday, 24 October. It is the first and largest furniture, material and home accessories exhibition in the region.

Fall conference season is still going strong. Among the exhibitions and business events here and throughout the region:

- The GITEX Global at the Dubai World Trade Center kicks off today and runs through this Thursday. The event brings together players in Big Tech to discuss what’s next in areas such as AI, cloud, 5G, cybersecurity, blockchain, and more.

- Cairo Water Week begins next Sunday, 24 October. The annual event will wrap next Thursday, 28 October.

- The two-day Intelligent Cities Exhibition & Conference takes place next Wednesday and Thursday, 27 and 28 October.

- Later this month: The Middle East Angel Investment Network is hosting its Angel Oasis in El Gouna on 27-29 October, with separate pricing for in-person and virtual attendance.

MENA’s largest innovation and entrepreneurship summit, RiseUp, will take place from 25-27 November. This year’s event will be held at the Giza Pyramids. Applications will be opening soon, but you can go ahead and RSVP through the event’s LinkedIn page.

Calling all entrepreneurs in Egypt: You have one month to apply for the acceleration exchange program Meet Silicon Valley, which will take a group of entrepreneurs to California for a 10-day program to meet with tech executives and investors. The program is being implemented by Injaz Egypt and TechWadi with the support of the US Embassy in Egypt. Startup founders must be between the ages of 23 and 35 to be eligible for the program. The deadline for applications is 15 November, and you can check out the full criteria and program details here.

(Much) further down the road: A conference and exhibition on MENA healthcare is coming to Egypt in June 2022, head of the Egyptian Authority for Unified Procurement Bahaa El Din Zidan said last week, according to Ahram Online.

☀️ TOMORROW’S WEATHER- It should start to feel slightly more like fall as the week progresses, with highs of 29°C tomorrow and on Tuesday, following a hot weekend. Nights will be chillier too, with lows of 18-19°C, our favorite weather app tells us.

???? FOR YOUR COMMUTE

Beware the clueless tourist VC: The soaring interest in Egyptian startups from foreign VCs may seem opportune. But without the local knowhow needed, these type of investors may end up hurting the startups they invest in, Mohamed Aboulnaga, co-founder and CEO of Egypt-based fintech Klivvr and co-founder of Halan (now MNT-Halan) writes in an oped for Wamda. Global VCs who wish to tap into the local market will opt for one of two routes. The smart approach: which he says entails appointing local partners or local boards and have them scout for companies to invest in — similar to how a tourist would bring a local along to ensure they don’t get lost or fall victim to tourist traps. Then there are those VCs that invest somewhat blindly, without taking the advice of locals who know the market more intimately, which then results in them paying premiums — just like a clueless tourist would.

The clueless tourist approach bears “dangerous” consequences to both the VC and the startup, Aboulnaga warns. “It inflates the valuation of certain startups and puts a lot of pressure on the founder and the management team,” he says, explaining that they will now feel like they have to perform more to keep up with the stamped valuation. As for the VC, it will have the wrong impression of the local market and its prices, and if their investment does not perform they will not come back.

His oped comes as Egyptian startups have been raising larger sums in funding rounds from foreign VCs. Most recently, digital ins. startup Amenli raised USD 2.3 mn in a seed round co-led by P1 Ventures, Global Founders Capital, and Anim Fund, and also included Costanoa Ventures, Liquid2 Ventures, Cliff Angels and other angel investors. It followed Odiggo securing USD 2.2 mn in seed finance as part of the Y Combinator 2021 summer batch. 500 Startups, Plug and Play Ventures, and a number of regional VCs including Seedra Ventures and LoftyInc Capital joined Y Combinator in the round. And Aboulnaga’s very own MNT-Halan closed what we believe is the largest fintech round ever to take place in MENA, raising c. USD 120 mn from a group of investors that includes financial services-focused PE house Apis, the UK’s Development Partners International (DPI) and Lorax Capital Partners.

SOME COVID STORIES- After spending a collective 262 days stuck at home due to covid lockdowns, Melbourne citizens will officially be allowed to roam starting Friday, 22 October, after Premier Daniel Andrews announced that the Australian state of Victoria will start opening up. This comes after 90% of the state’s citizens got their first jab and 70% are expected to have received both jabs by the end of the week. And although the state is reopening and the high vaccination rate, precautionary measures will still be enforced with citizens having to wear their masks at all times and a strict capacity limit set on all public venues. These restrictions are expected to ease once 80% of the state’s citizens are fully vaccinated. Students will also be allowed to go back to classrooms.

FDA panel recommends J&J booster shots: A US FDA advisory committee recommended the use of Johnson & Johnson boosters on Friday, paving the way for 15 mn Americans to receive a second dose of the shot as early as this week, pending FDA approval.

It was hardly a glowing endorsement for the company’s jab: Panel members said that having recently approved third jabs of Moderna and Pfizer-BioNTech shots, they were obliged to authorize Johnson & Johnson boosters — especially given the one-shot vaccine’s lower efficacy. They added that recipients of a first Johnson & Johnson shot might be better off getting Pfizer-BioNTech or Moderna booster instead, something an FDA official said was being considered.

???? ENTERPRISE RECOMMENDS

Manga mania + Binge at Binge Cairo + VR takes center stage in Downtown art exhibits

???? ON THE TUBE TONIGHT-

(all times CLT)

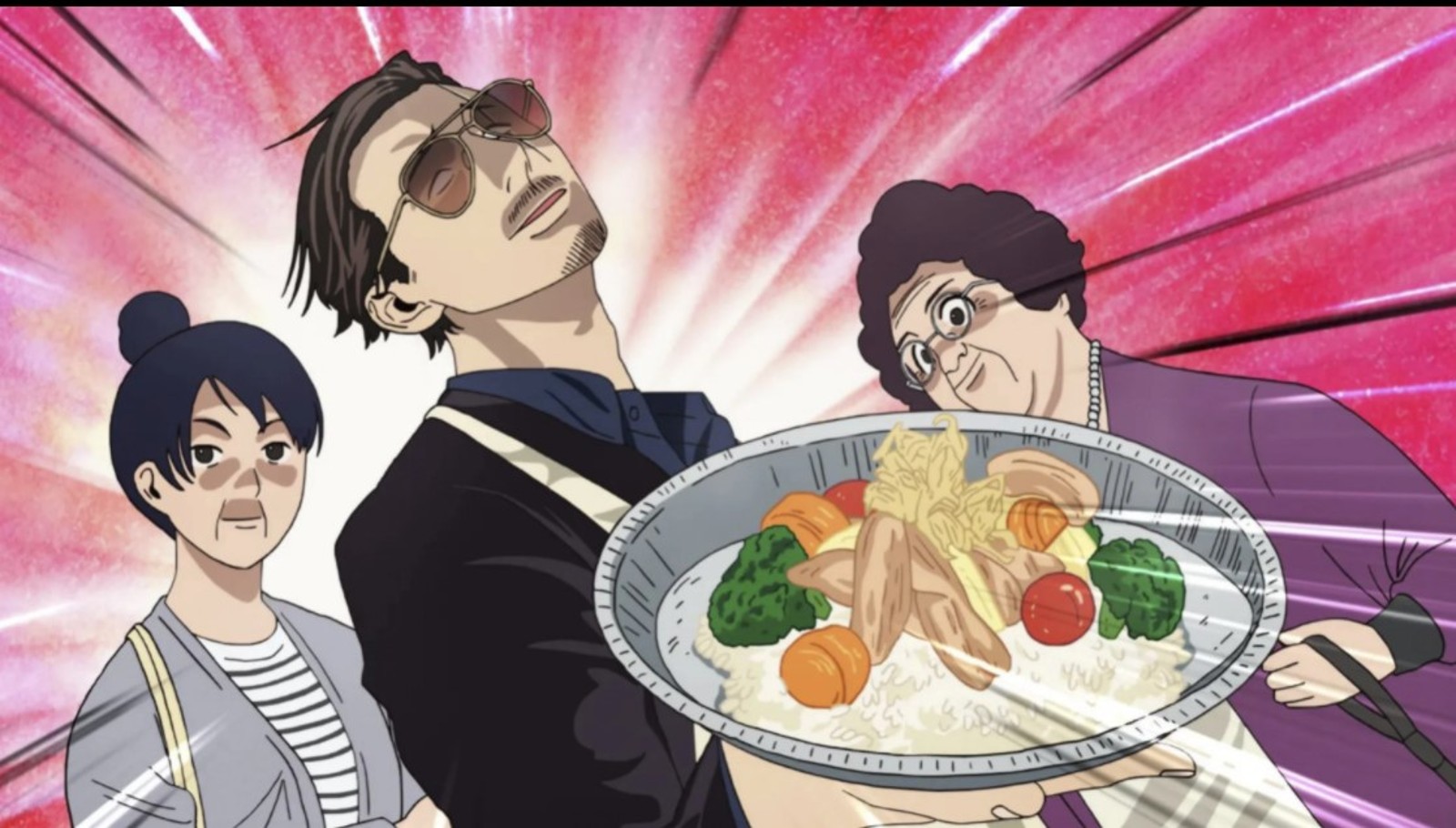

You finished Squid Game. Then you finished Alice in Borderland. Now what? If our recent recommendations have gotten you hooked on manga-inspired series, try long-running Japanese hit show Midnight Diner. There are five seasons on Netflix, but it’s an anthology, so you can jump in anywhere. Each 24-minute episode introduces you to a different customer at the Tokyo all-night bar and restaurant run by the mysterious Master, who listens as well as he cooks. Weirdly and brilliantly, the characters' lives are always marked by a particular dish that the Master makes for them — and at the end of every episode, you get a two-minute lesson from them on how to cook it yourself.

For a more recent — and slightly more out there — manga adaptation that also offers cooking and general household tips, there’s anime series The Way of the Househusband, which follows former yakuza boss the Immortal Dragon Tatzu as he brings all his underworld intensity to the task of being the perfect stay-at-home husband. It’s silly and cute, and you might even learn something. There’s a live-action version too.

⚽ Continuing on from Super Saturday in the English Premier League yesterday, we’re following two matches today: Everton v West Ham, which kicked off at 3pm today and is still ongoing at publication time, and Newcastle v Tottenham, which starts at 5:30pm.

In the Spanish league: Barcelona will face Valencia at 9pm, and Villarreal plays Osasuna at 6:30pm.

Juventus v Roma kicks off at 8:45pm in the Italian league, while the Napoli-Torino match will take place earlier at 6pm.

???? EAT THIS TONIGHT-

Binge Cairo arrived on the gastropub scene earlier this year promising “comfort food uplifted” — and that’s what we got when we popped by. Located in New Cairo’s Garden 8 Mall, Binge is open every day from 2pm until 1am, though it’s only family-friendly until 7pm. The decor is sharp with a breezy garden seating area, and true to its comfort-food brand, carbs abound: The menu stars thick burgers and crisp flatbreads with an upscale twist. Is it your cheat day? Go for a crazy shake, topped with all manner of froth, fruits, syrup and sprinkles. It seems there’s no delivery, so you can burn off some of the kcals getting there and back. We recommend you reserve a table on weekend nights.

???? OUT AND ABOUT-

(all times CLT)

The Downtown Contemporary Arts Festival (D-CAF) continues with a “virtual reality experience” at the Victoria Rooftop Building from 4pm-10pm every day this week until Thursday. Visitors to the exhibit don Oculus headsets to “plunge into the otherworld.” VR films by French artists will also be screened, in cooperation with the French Institute.

Also from D-CAF, audio walk exhibit How to Disappear Completely by Hungarian MeetLab studio launches at a 7pm reception tonight at the Liszt Institute in Downtown. Bring headphones and a smartphone to tap into the show, which uses geo-location to tell audiences a story as they walk through the city in an experience that falls somewhere between a game, audiobook and walking tour.

???? UNDER THE LAMPLIGHT-

Short Arabic fiction, in English: The quarterly journal and blog for all things Arabic literature in translation, ArabLit, this month announced the recipient of its 2021 Short Story Prize. Maisaa Tanjour and Alice Holttum are the translators of How Kind They Are, written by Syrian playwright and author Mustafa Taj Alden Almosa. The judges’ panel described the story as a “compelling and haunting tale” that makes for “one of the most memorable short stories about madness vs. sanity.” This is the first year the prize has been awarded to co-translators. Read the translated story in full at no charge here, or subscribe to ArabLit Quarterly for more Arabic fiction in English.

???? GO WITH THE FLOW

Eastern Co reports higher net income in FY2020-2021

EARNINGS WATCH- Eastern Company reported a 13% rise in its bottom line in FY2020-2021, reporting earnings of EGP 4.3 bn, up from EGP 3.8 bn, according to the company’s earnings filing (pdf). The company recorded EGP 16 bn in revenues during FY2020-2021 from 14.5bn during FY2019-2020, up 11% compared to FY2019-2020.

MARKET NEWS- Emerald mini-IPO tomorrow: Trading on Odin Investments’ real estate investment firm Emerald on the Nilex will begin tomorrow, the EGX said in a statement (pdf).

MARKET WATCH-

The EGX30 rose 1.5% at today’s close on turnover of EGP 1.3 bn (13.1% below the 90-day average). Local investors were net buyers. The index is up 2.9% YTD.

In the green: Ezz Steel (+10.3%), Qalaa Holding (+6.4%) and Raya (+4.0%).

In the red: CIRA (-2.1%), Aspire Capital (-1.8%) and Eastern Company (-1.8%).

???? CAREERS

We’re in the age of the Big Quit — and everyone is embracing it. A record number of people are quitting their jobs. In the US, this number reached the highest since the turn of the millennium. Why? The obvious reasons — the ones everyone (including us) have been whining about over and over again — stress, burnout, early retirement, etc. A reluctance to give up working from home has also been cited time and again as a major reason driving people out their company doors. But apparently, there’s more to the Big Quit than meets the eye. The number of people quitting their jobs could also be a barometer for the health of the labor market, writes The Washington Post.

Here at home, unemployment was largely flat in 2Q2021 at 7.3%, improving just 0.1 percentage points from the preceding quarter. But that’s still a huge improvement from 2Q2020, during which the jobless count rose to a two-year high due to the covid-19 pandemic. The unemployment rate hit 9.6% between April and June last year as the partial lockdown of the economy took its toll on the job market.

Is it an economic indicator, or a social phenomenon? The prevailing wisdom says that the fact that employees are willing to risk the security of their current job indicates their confidence in the economy, and that they believe that there are better suited jobs for them out there in the market. The phenomenon is also driven by employees becoming less tolerant to bad work environments with long working hours and poor compensation after the pandemic.

Or are people just lazy? “All this talk about the ‘great resignation’ and the epic labor shortage of 2021 is not hyperbole. People are sorting themselves into conditions that suit them best. And that’s why we’re seeing this huge reshuffling. People are voting with their feet,” labor economist at ZipRecruiter Julia Pollak told the Washington Post.

How has the market been affected? New data released from the Labor Department showed that some 4.3 mn US citizens quit their jobs in August, which is about 2.9% of the US workforce. Those numbers have been on the rise, even as the pandemic’s fourth wave begins to (sort of) cool down. Workers in the food service, accommodation, and retail industries led the quitters, accounting for some 1.4 mn resignations, CNBC reports. The data did not include information on the reasons people quit, or whether they pursued future employment.

But lest we forget why Egyptians quit their jobs: In 2019, bosses were the biggest reason why people quit. No growth potential was the second biggest reason, with entry level employees and employees of family-owned businesses saying this is the primary factor for why they quit. An organization not having systems in place was named as the third highest reason for quitting. Could these reasons be at play today as well?

Employees are more likely to leave their jobs when unemployment is low: When the employment rate is high, it is generally seen as a good time to reevaluate what you really want to do, according to CNBC. A high employment rate means that there are higher chances that people who just quit their jobs will land other jobs faster, as they will face less competition for the openings that do exist.

But this new trend also signals an element of unpredictability: Workers who quit their jobs in the hopes of finding a better suited one could find themselves in need of new skills or training, and could find more difficulty than they anticipated landing their dream job, the WaPo says.

And businesses are struggling, too… Many businesses are struggling with high turnover rates as they try to find ways to fill their vacancies and retain qualified staff, the newspaper says. Some anecdotal evidence, however, suggests that employers are asking for higher qualifications and more experience for entry-level roles, due to the high availability of qualified job-seekers.

???? CALENDAR

October: Romanian President Klaus Iohannis could visit Egypt mid this month to discuss ways to boost tourism cooperation between the two countries.

14-22 October (Thursday- Friday): El Gouna Film Festival.

11-17 October (Monday-Sunday): IMF + World Bank Annual Meetings.

Mid-October: The Egyptian Banking Institute, the Financial Services Institute, and I-Score will begin airing in mid-October the Digital Credit Scoring Webinar Series, a line-up of webinars on the banking sector and banking regulations.

Week of 17 October: E-Finance begins trading on EGX.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

24-28 October (Sunday-Thursday): Cairo Water Week, Cairo, Egypt.

27-28 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Royal Maxim Palace Kempinski, Cairo, Egypt.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28 October (Thursday): Second tranche of overdue subsidy payouts will be handed to eligible exporters.

30 October – 4 November (Saturday-Thursday): The first edition of Race The Legends, Egypt.

30-31 October (Saturday-Sunday): G20 Leaders’ Summit, Rome, Italy.

31 October (Saturday): World Cities Day, Luxor, Egypt.

November: The French-Egyptian Business Forum is set to take place in the Suez Canal Economic Zone.

November: Egypt will host another round of talks to reach a potential Egyptian-Eurasian trade agreement, which can significantly contribute to increasing the volume of Egyptian exports to the Russia-led bloc that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

2-3 November (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

7-10 November (Sunday-Wednesday): Cairo ICT 2021, Egypt International Exhibition Center, New Cairo.

15-21 November (Monday-Sunday): Intra-African Trade Fair 2021, Durban, KwaZulu-Natal, South Africa.

16-17 November (Tuesday-Wednesday): Africa fintech summit, Cairo.

25-27 November (Thursday-Saturday): RiseUp Summit, Cairo, Egypt.

26 November-5 December (Friday-Sunday): The 43rd Cairo International Film Festival.

29 November-2 December (Monday-Thursday): Egypt Defense Expo, Egypt International Exhibition Centre.

7-8 December (Tuesday-Wednesday): North Africa Trade Finance Summit.

8-10 December (Wednesday-Thursday): Global Forum for Higher Education and Scientific Research (GFHS), Cairo, Egypt.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

15 December (Wednesday): Deadline for joint stock companies and investment companies in Cairo to join e-invoicing platform.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1Q2022: Launch of the Egyptian Commodities Exchange.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

19 February 2022 (Saturday): Public universities begin the second term of the 2021-2022 academic year.

1H2022: The World Economic Forum annual meeting, location TBD.

22-24 April 2022: World Bank-IMF spring meeting, Washington D.C.

May 2022: Investment in Logistics Conference, Cairo, Egypt

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

18-20 October 2022 (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.