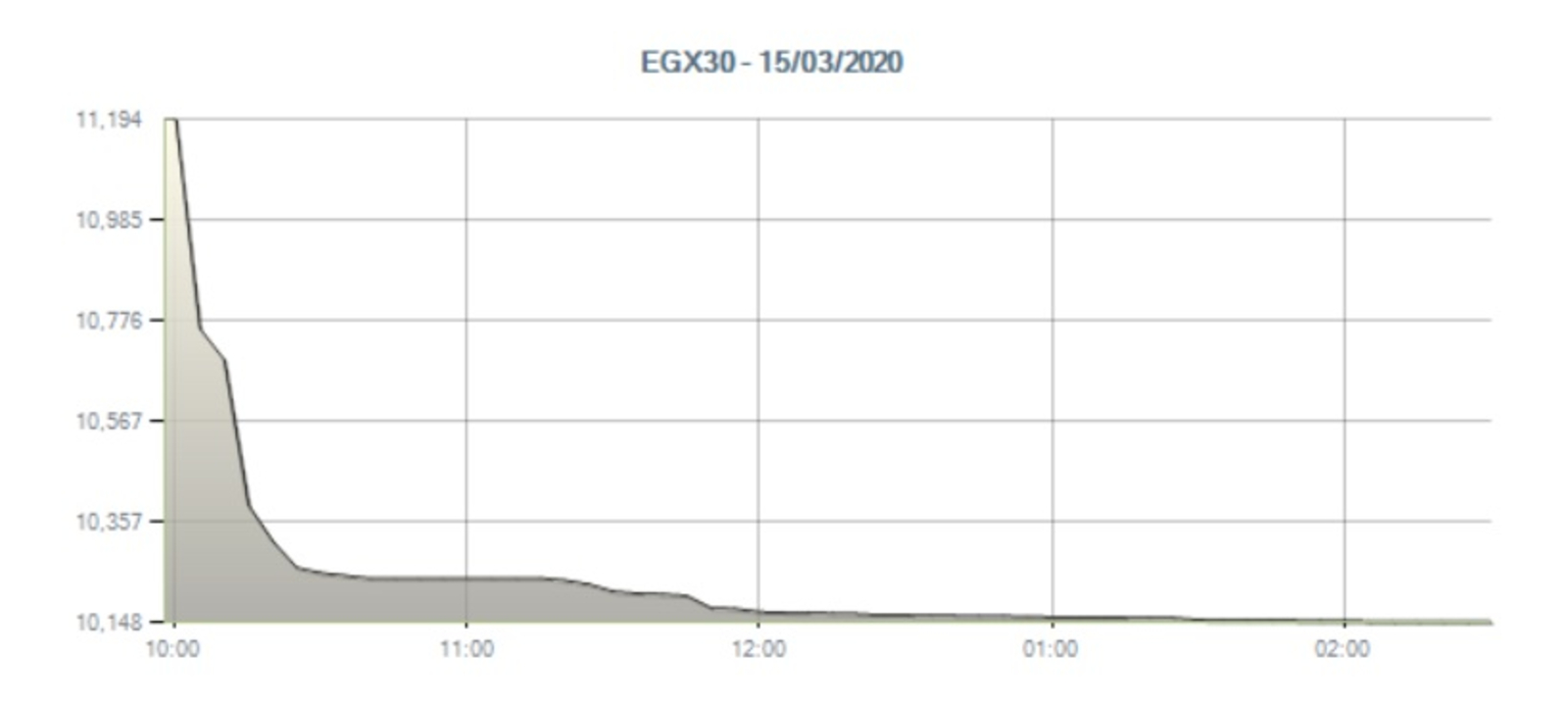

EGX30 tumbles 9.3% in worst showing since 2012

EGX30 tumbles 9.3% in worst showing since 2012: The EGX30 caught up yesterday with last week’s turbulence across global financial markets, closing down 9.3% in what was its sharpest one-day decline since November 2012. Index heavyweight CIB closed down 9.9%. The bourse suspended trading for half an hour after the wider EGX100 index fell more than 5%, triggering circuit breakers for the second time this month. The EGX30 is now down a bit more than 27% for 2020.

The heavy selloff came after the EGX was closed on Thursday, a day on which global markets plunged, with US and European markets recording their biggest single-day drops since 1987 after US President Donald Trump’s decision to suspend air travel between the US and Europe. It also followed the government’s rollout over the weekend several measures to contain the covid-19 outbreak. After banning large gatherings and urging citizens to practice social distancing last week, cabinet decided on Saturday to close schools and universities nationwide for two weeks.

Markets across the region took a beating yesterday. Boursa Kuwait (which was also closed on Thursday) closed down 6.5%, while Dubai’s main index fell 3.4%, the Abu Dhabi Exchange ended the day down 1.9%, while Bahrain’s bourse was 1.5% in the red and Saudi’s Tadawul fell 1.1%. Oman, Qatar, and Israel were the only regional markets to close in the green.

The regional sell-off came despite Egypt, the UAE and Saudi Arabia unveiling a combined USD 47 bn in stimulus packages over the past few days, including a EGP 100 bn response package from Egypt. The efficiency of these packages on easing pressure on businesses “largely depends on the depth and persistence of the coronavirus spread, as well as banks’ appetite to deploy this liquidity into credit growth,” a financial industry analyst told the business information service.

The CBE sold less than half of the EGP 24 bn in bonds put up for auction yesterday as investors continued to demand higher yields. Investors bought just EGP 11.81 bn of the total amount offered, which was spread between three auctions of six-month, one-year and seven-year bonds. Particularly notable was the six-month issuance, which saw the CBE sell just EGP 111 mn of the EGP 10 bn on offer after investors requested a 15.3% yield — a full 100 bps higher than the rate accepted by the central bank. It also failed to find buyers for its EGP 3.5 bn seven-year offering, selling EGP 1.2 bn at a yield of 14.6% rather than the 15.3% requested by investors. The CBE did manage to offload all of the EGP 10.5 bn one-year issuance at a yield of 14.7%, marginally below the 14.9% requested by investors.

EGP WATCH: The EGP dropped three piasters against the greenback yesterday from last week to 15.69. The currency has eased gradually from its peak of 15.49 on 23 February.