What we’re tracking on 20 June 2018

Expect the FY2019-2020 budget debate to dominate the headlines next week. The House of Representatives general assembly will reconvene on Saturday to conclude debate of the FY2019-2020 budget before a vote.

Pharos Holding’s annual investor conference (pdf) wraps up today in El Gouna. The two-day event brought together investors, IPO prospects and more than 40 listed companies for meetings with institutional investors in one-on-one meetings during the conference’s first day.

The African Cup of Nations kicks off tomorrow at Cairo Stadium at 10 PM CLT. The Pharaohs are set to play Zimbabwe in the first match of Group A, which also includes DR Congo and Uganda. CAF has warned participating teams of high temperatures that will average 35-38ºC over the coming month, Reuters noted. Summer in Cairo. Shocking, we know.

The tournament featured heavily in coverage of Egypt in the international press. We have a look in this morning’s Egypt in the News, below.

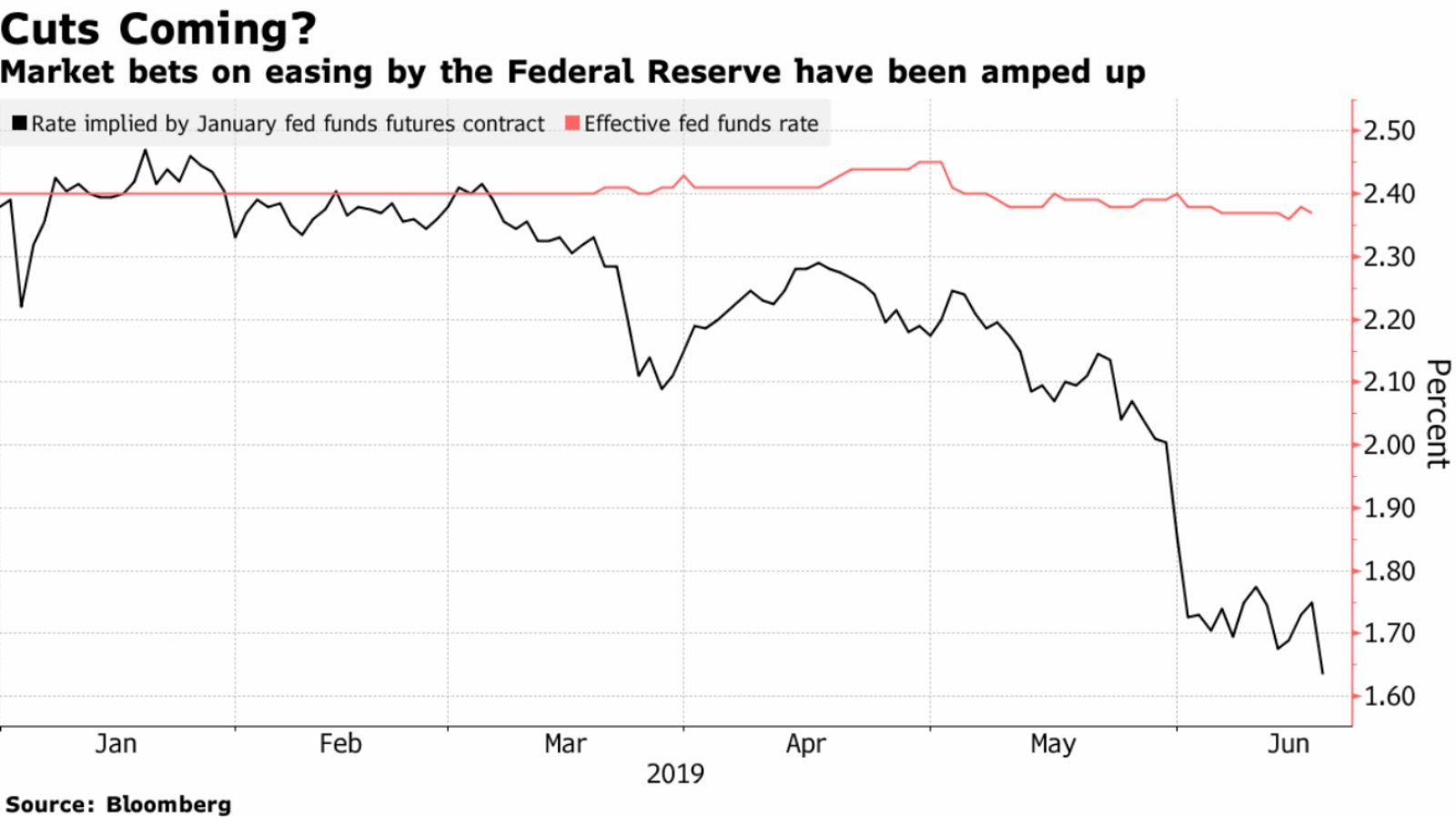

The US Federal Reserve left key interest rates on hold but indicated that it could cut them in the coming months if the economic outlook in the US deteriorates, the Wall Street Journal reports. “The case for a somewhat more accommodative policy has strengthened,” Fed Chairman Jay Powell said at a news conference following the conclusion of the two-day FOMC meeting. The benchmark rate is currently in a target range of 2.25% to 2.50%. The reaction on Wall Street was muted: The S&P was up 0.3%, while the Dow rose 0.15%.

When could we see a rate cut? The “divided” Fed may be guiding for a cut or two in 2020, but bond traders aren’t on the same page, CNBC and Bloomberg say. Federal funds futures now give a 100% chance of the central bank cutting rates and a 67% chance of a cut to 2% when officials next meet on 30-31 July. Market expectations of a rate cut before the end of the year have continued to rise in recent weeks as trade tensions and slowing global growth weigh on the minds of investors.

Advanced economies are behaving like emerging markets, El Erian says: ECB chief Mario Draghi’s suggestion yesterday that the central bank could soon resort to more stimulus measures is another example of how advanced economies are starting to act like emerging markets, Mohamed El Erian writes for Bloomberg.

Huh? Problems created by economic crises in EMs often cause considerable political and social instability. This is unlike advanced economies, which until the 2008 financial crisis were relatively adept at ensuring that economic turbulence didn’t affect the political status quo. Since 2008, though, developed countries have followed a path that more closely resembles emerging markets. Many countries have seen a fundamental change in political direction, while the efficacy of institutions has slowly eroded amid falling public trust.

Draghi’s short-term policy prescriptions are another step in this direction: The ECB’s willingness to fall back on increasingly ineffective short-term stimulus measures will only exacerbate problems that lie further down the road. “Such measures are developing deeper socio-political roots that render incremental reforms harder to enact, taking economies ever closer to cliff-like conditions involving the threat of accelerating economic and financial weakness in the absence of ‘big bang’ reforms,” El Erian says.

Exhibit A: Draghi’s dovish tone sent the value of the negative-yielding bond market to record highs of USD 12.5 tn yesterday, the FT reports.

Investors are making it rain for private equity: European private equity groups are looking to cash in on record investor demand and raise bns in funds before market conditions weaken, the FT says. CVC Capital Partners is targeting a record EUR 18 bn fund, while Swedish EQT expects to raise a record flagship fund of around EUR 14 bn next year.

Demand for private equity is going through the roof as investors search for returns amid a low interest rate environment. “There is a wall of cash desperate to be assigned to a private equity fund,” Ludovic Phalippou, professor of finance at Oxford Said Business School.

Just don’t expect prospective limited partners to have much appetite for MENA after the implosion of Abraaj…

You’re going to want to show this one to your employer: We should only be working eight hours per week (yes, per week — not per day) for good mental health, researchers from the University of Cambridge and the University of Salford have said after examining more than 71k employees in the UK. CNBC has the story.