What we’re tracking on 02 June 2019

It’s shaping up to be a five-day holiday weekend after cabinet announced over the weekend that Tuesday through Thursday will be off for the civil service in observance of Eid El Fitr. There have been no announcements yet from the Central Bank of Egypt or the EGX, but government holiday = CBE holiday = banks closed and, as a result, capital markets are on holiday.

Enterprise will be off Tuesday through Thursday. We wish all of you a blessed and relaxing Eid with family, friends and … coffee. Lots and lots of coffee.

The EGP gained 0.3% on the greenback last week, closing on Thursday at a sell price of 16.83, according to the CBE, against 16.88 at the end of the previous week.

Data points due out this week and next:

- Foreign reserves: The CBE should announce this week Egypt’s net foreign reserves as at the end of May.

- Inflation: Monthly inflation figures are due out next week. Annual headline inflation cooled unexpectedly in April to 13% from 14.2% in March.

- PMI: The purchasing managers’ index for Egypt, Saudi Arabia, and the UAE is due out on Monday, 10 June at 6:15am CLT.

Tariff Man’s latest: Fresh from upping the stakes in his trade war with China, US President Donald Trump threatened on Friday to slap a 5% tariff on all Mexican goods on 10 June unless the Mexican government put a stop to illegal migration.

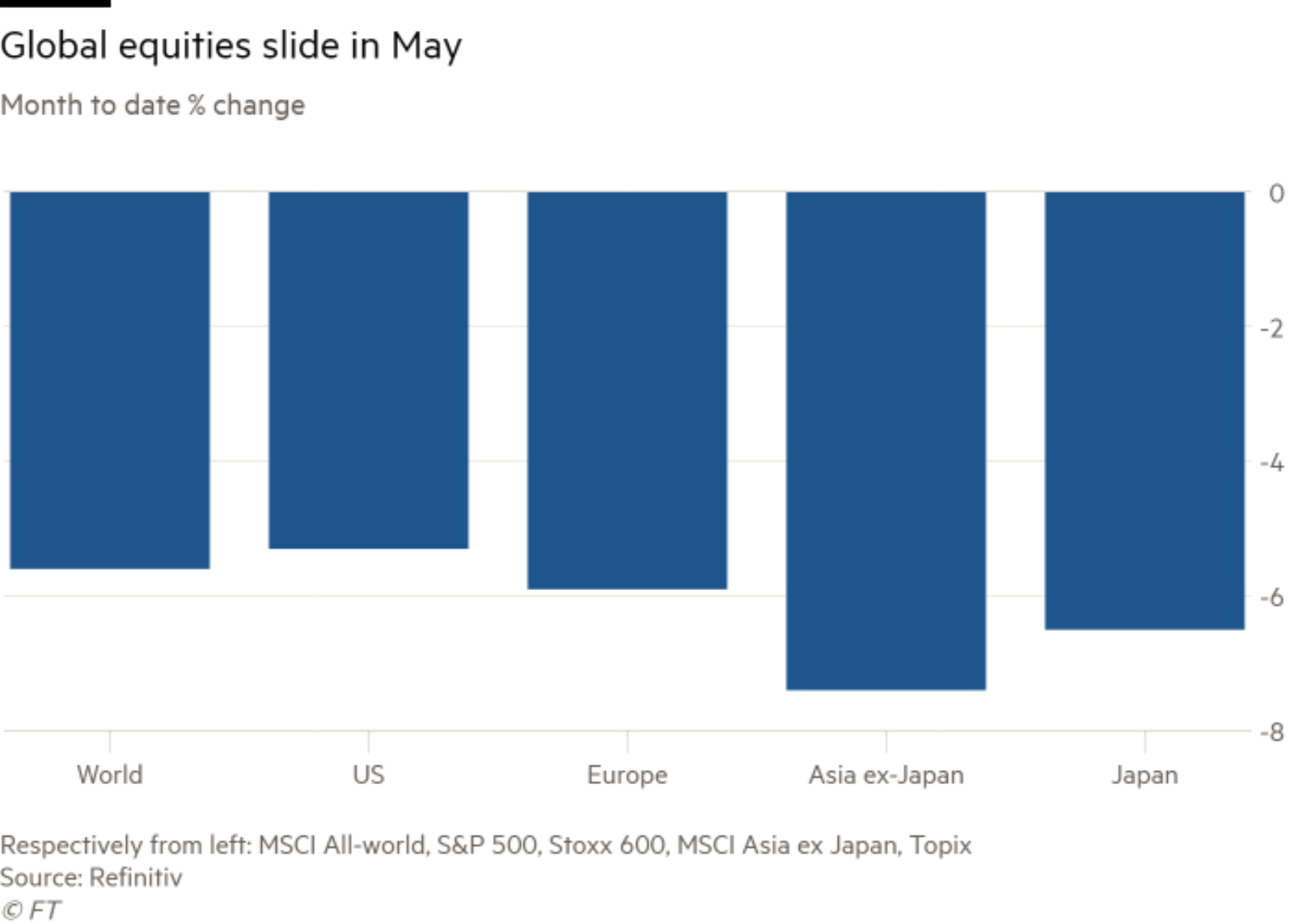

Global markets aren’t taking it very well… US markets closed last week in the red (with the S&P down 6% for May), as did European and Asian shares. Oil plunged, too, with Brent down nearly 4% on Friday. Investors continued piling into the relative safety of bonds, and the inverted yield curve is widening: The spread between 3-month and 10-year US bonds — traditionally an early predictor of a recession — widened to 21 basis points for the first time since 2007. See wall-to-wall coverage in the global business press: Bloomberg | FT | WSJ Reuters.

…And economists think the Mexico sanctions are a horrible idea: “The massive supply chain disruptions, significantly tighter financial conditions and depressed private sector confidence would amplify the direct tariff shock and increase the odds of a US downturn,” Gregory Daco, chief US economist at Oxford Economics, told the FT.

All of this could prompt the US Federal Reserve to cut interest rates if, as some expect, the trade wars cause the US economy to sputter — JPMorgan’s chief US economist is now calling rate cuts in September and December, though the FT’s Michael Mackenzie counters that the Fed is unlikely to cut “unless inflation falls below its 2% target rate or consumption and investment take a serious hit.”

Canary in the coal mine? Watch what happens with FedEx. China announced on Friday that it will draw up a list of “unreliable” foreign companies that could be banned from the country for harming domestic businesses and consumers. FedEx looks to be first on the chopping block, with Chinese officials announcing an investigation into the company’s “wrongful delivery of packages,” Bloomberg reports.

Is Turkey beginning to emerge from its recession? Yes, but it isn’t enough to undo last year’s damage and the recovery may not be permanent, according to the Financial Times. Propelled by government spending, Turkey’s GDP grew 1.3% during 1Q2019, but the economy remains 2.6% smaller than it was a year ago due to the effects of the recession. “Although the economy has grown at a high rate, we think that this was largely driven by the increase in fiscal spending and a loosening in credit conditions,” Goldman Sachs analysts said in a note to clients. The analysts expect another downturn and see the Turkish economy contracting again in 2Q and 3Q2019.

What We’re Tracking Today, the Ramadan edition:

The Boston Celtics’ Jaylen Brown joined a pickup game Cairo American College and the US sports press went a little bit bananas, saying the 2016 NBA draft’s third pick used the game as a “convenient excuse to show off his moves” as he “flashed an absolutely filthy crossover” on the CAC kid tapped to guard him before draining a jumper. Yahoo Sports and Boston CBS affiliate WBZ have the story. Watch what appears to be the original video here (runtime: 0:24).

Goodbye, iTunes? Kinda. Apple is expected to launch three new apps that individually provide what iTunes currently provides on one platform: Music, TV, and podcasts, according to Bloomberg in a t-up piece for WWDC — effectively the start of Apple’s product year. The shift away from iTunes comes in tandem with the company’s move to make its products more independent — it will introduce new iPad software that will help sell the product as a feasible alternative to laptops, as well as Apple Watch software that reduces its dependence on the iPhone.

True iSheep will want to tune in here tomorrow at around 7pm CLT to livestream WWDC. 9to5 Mac has more, as does the Financial Times with its Five things to watch at WWDC.

True nerds can follow WWDC by Sundell for daily coverage of the gathering including “articles, videos, podcasts, and interviews, covering all things WWDC — from recommendations on what session videos to watch, to in-depth looks at new APIs, to interviews with people from all over the Apple developer community.” Hometown bonus: The site is co-sponsored by Egypt’s very own Instabug.

A pre-iftar reading list to kill time between your post-workout shower and the breaking of the fast:

- Laptops are getting weird and wonderful again — it’s all about dual-screens and foldable devices, the Verge writes.

- ESG hypocrisy: How is it okay for a fund that claims to be driven by ESG principles to invest in a company that provides systems to dentention camps and enables “mass surveillance of a Muslim ethnic minority group” in China? (Financial Times)

- It can be hard to follow a legendary act. Here are thoughts on how you can pull it off. Tim Cook managed it — we don’t need to name his company for you to identify him, do we? But John Flannery? That’s another story. Check out Strategy + Business and read Succeeding the long-serving legend in the corner office and How new leaders can step out of the shadow of a legendary CEO.

BBM shut down on Friday. That is all.

Consumerism we love, part 1: Ikea UAE’s ad campaign titled Real life series, wherein Publicis Spain recreates iconic rooms from Stranger Things, Friends and The Simpsons using Ikea furniture. PetaPixel has the summary, while AdAge drills deep for the ad geeks out there.

Consumerism we love, part 2: Nike and Stranger Things seem set to launch a sneaker and clothing collaboration.

RAMADAN PSA- Bank hours are at 9am-2pm for employees; doors are open from 9:30am until 1:30pm for customers. The trading day at the EGX runs 10:00am until 1:30pm.

So, when do we eat? Maghrib is at 6:52pm CLT today in Cairo. You’ll have until 3:10am tomorrow morning to caffeinate / finish your sohour.