- Unemployment falls for the second quarter in a row. (Speed Round)

- Gov’t (sort of) denies reports suggesting home electricity prices will rise 30-60%. (Speed Round)

- Gov’t denies 18% social media ad tax is already in place, but says it is working on a 15-20% levy. (Speed Round)

- Cabinet approves new NGOs Act. (Speed Round)

- Regional roundup: KSA residency visas, Majid Al Futtaim’s corporate green sukuk, Finablr goes public on LSE and Americans are pulling staff out of Baghdad embassy. (Speed Round)

- IMF’s senior resident representative to Egypt is now the governor of the central bank of Pakistan. (What We’re Tracking Today)

- What could be better than antibiotics? Viruses found in sewage. (Worth Reading)

- My Morning Routine: Hassan Massoud, principal equity lead, Egypt and Southern Mediterranean at the EBRD.

- The Market Yesterday

Thursday, 16 May 2019

Unemployment falls for the second quarter in a row

TL;DR

What We’re Tracking Today

Well folks, we have a new contender for the slowest news day of the month. You know it is slow when the biggest news is the last gasp of earnings season, with companies filing a decidedly mixed set of results yesterday.

The EGX30 was down 1.5% yesterday in light trading, but global markets took a breather as US shares reversed early losses in Wednesday’s trading session in the wake of the Trump administration’s decision to delay car tariffs, avoiding a clash with the European Union and Japan. It was a “crazy session” that hints at the market’s “new normal,” CNBC screamer Jim Cramer suggested.

Asian markets fell into the red this morning after a mixed open as the Trump administration issued an order that effectively bans US companies from using telecom equipment from Huawei and (likely) ZTE, as Reuters suggested earlier this week would happen. The news is front page in the global business press (Financial Times | Reuters | Bloomberg | New York Times | Wall Street Journal).

Leading indices were lower in China, Hong Kong, South Korea and India, with only Australia and New Zealand bucking the trend.

What are the chances of multiple rate-cuts by the Fed this year? Federal-funds futures would have us believe that the US Federal Reserve will take a hard U-turn and make multiple cuts to interest rates this year, despite positive US economic data. Expectations of a downturn in the coming years, combined with the intensifying US-China trade war, have increased investor confidence that the Fed will begin easing before long. Fed Chairman Jay Powell has poured cold water on predictions of any rate changes in the near term, and according to analysts, the probability of a cut is overpriced. The Wall Street Journal has more.

In miscellany worth knowing this morning:

Random note: We’re a few days late to this party, but think it worth noting that Reza Baqir, the IMF’s senior resident representative to Egypt, has left the country to become the new governor of Pakistan’s central bank. More on Bloomberg, the Financial Times or Nikkei Asian Review, as you prefer.

Less-random fact: “Around 1 mn cubic meters of concrete as well as 1,400 km of steel wire for 160 suspension cables” were used in the construction of the Rod El Farag suspension bridge, which President Abdel Fattah El Sisi officially opened yesterday. It is the widest suspension bridge in the world, according to the Guinness Book of World Records.

Egypt was one of only three countries in which Vodafone recorded revenue growth in the year to March, alongside Greece and Portugal. As we noted yesterday, total revenues in Egypt rose to EUR 1.1 bn with a healthy EBITDA of EUR 514 mn. Vodafone’s earnings release is here (pdf).

Egypt has blocked illegal movie upload site EgyBest as part of a wider clampdown on piracy after complaints from content providers and creators, according to Egypt Independent, which picked up the news from Al Masry Al Youm, its parent organization. The news comes as the Egyptian Media Company promotes its WatchIt app as the sole legal place to stream Ramadan mosalsalat. EMC also pulled leading soaps from YouTube.

Bitcoin is back. But why? Bitcoin has more than doubled in value since the start of 2019 to exceed the USD 8k mark on Tuesday. The sudden appreciation could come down to it being taken more seriously as an asset class by institutions, academics and finance professionals, Bloomberg suggests. Data provider Indexica discovered a higher quality discourse taking place around the cryptocurrency, with three factors driving positivity: more complex conversations about Bitcoin, fewer concerns about fraud, and a shift to talking about it in the future tense rather than the past (which tends to denote optimism).

What We’re Tracking Today, the Ramadan edition:

A pre-iftar reading list to kill time between your post-workout shower and the breaking of the fast:

- For the hard-core finance geeks among us: Stephen Levy has been writing cogently about the development of tech since the 1980s. He recently republished a 1984 story about the rise of the then-new concept of a computerized spreadsheet. Read: A spreadsheet way of knowledge.

- For all of us age 30 and above: Here’s how to get stronger after 50, in Outside magazine.

- Everything that is wrong with internet culture in one story (and we’re only sorta being hyperbolic): “James Charles, From ‘CoverBoy’ to Canceled: The 19-year-old internet personality and makeup artist has provoked the ire of beauty YouTube.”

Bring this to Egypt and we will forgive any number of Uber sins: Uber launches Quiet Driver mode.

The 10 most-clicked links in Enterprise this past week:

- Egyptian bn’aire Sawiris backs bail for Abraaj’s Abdel-Wadood. (WSJ)

- Earth from space: Egyptian crop circles. (ESA video, YouTube)

- Sultana and croissant um ali — a dessert inspired by the legend of a protofeminist Egyptian slave girl. (Financial Times)

- “My house in Cairo,” by former New Yorker Cairo correspondent Peter Hesseler, timed to coincide with the release of his new book on his tenure in Egypt. (New Yorker)

- I raised two successful CEOs and a doctor — here’s one of the biggest mistakes I see parents making. (CNBC)

- “Small and medium enterprises landscape in Egypt: New facts from a new dataset,” by Hala El Said and colleagues, back when she was dean of FEPS at Cairo U. (pdf download)

- WhatsApp voice calls used to inject Israeli spyware on phones. (Financial Times)

- This Gen X Mess. (New York Times)

- I trained myself to be less busy — and it dramatically improved my life. (Vox)

- How the rise of developing countries has disrupted global trade. (Bloomberg)

PSA- Remember that rumored Stranger Things Lego set? It is real and will be in stores on 1 June, just over a month before the debut of season three on 4 July. The set includes the Byers’ residence, Hopper’s Chevy Blazer and eight minifigures — the Demagorgon among them. Watch the Lego mini-video on Twitter or read more on the Lego website. The resident 11-year-old is not the only one who is excited…

RAMADAN PSA- Bank hours are at 9am-2pm for employees; doors are open from 9:30am until 1:30pm for customers. The trading day at the EGX runs 10:00am until 1:30pm.

WEATHER- It’s going to be hot in the capital city today, with a daytime high of 41°C. Look for a comparatively balmy 35°C tomorrow before the mercury rises again on Saturday, according to our favorite weather app. We’re looking at temperatures in the 40s again at the end of next week.

So, when do we eat? Maghrib is at 6:42pm CLT today in Cairo. You’ll have until 3:21am tomorrow morning to caffeinate / finish your sohour.

WANT TO HAVE IFTAR WITH US? Take our very short survey, in which we ask you which sector you would most like to see us explore in a dedicated weekly vertical. You can choose from the seven sectors we have included or name a sector yourself. We would also like to know what it is you enjoy and like about Enterprise and what it is you don’t. The survey will run all week.

We’ll be drawing the names of at least 10 survey takers and inviting them to join us for iftar on Wednesday, 29 May at the Four Seasons Cairo at the First Residence. Think of it as a chance to get to know some of you and discuss the survey questions, your views on Enterprise, the economy, life and the universe, so please mark the date. We’ll announce the winners on Tuesday, 21 May.

IF YOU WANT TO ENTER THE DRAW, you need to make sure to give us your name, company, phone number and email at the end of the survey. The poll closes on Sunday, so vote now.

Become a sponsor of an industry vertical: If you would like to be a sponsor of an Enterprise vertical, contact Fady Sherif on fsherif@inktankcommunications.com. We’ll talk about your interests and our editorial goals and see if we can’t do something amazing together.

Enterprise+: Last Night’s Talk Shows

Check back after Ramadan for our daily wrapup of last night’s talk shows. The talking heads are on hiatus for the duration.

Speed Round

Speed Round is presented in association with

GOOD NEWS- Unemployment falls for the second quarter in a row: Egypt’s unemployment rate fell to 8.1% in 1Q2019, down from 8.9% in 4Q2018 and 10.6% in 1Q2018, the Central Agency for Public Mobilization and Statistics (CAPMAS) said yesterday. This is the second consecutive quarter the country’s unemployment rate has fallen, after it ticked up marginally to 10% in 3Q2018 from 9.9% in 2Q2018. There were 2.27 mn unemployed people at the end of the quarter, out of a 27.97 mn-strong labor force. Reuters also has the story in both their English and Arabic services.

Gov’t (sort of) denies reports suggesting home electricity prices will rise 30-60%: The Madbouly Cabinet denied yesterday domestic press reports that emerged earlier this week quoting Electricity Ministry officials as suggesting that residential electricity prices could increase by 30-60% after the next round of subsidy cuts. The government will enforce the next phase of subsidy cuts at the start of the 2019-2020 fiscal year in July. The denial hedged its bets, saying the officials spoke based on their personal expectations and were not announcing a policy decision. The local press had reported on Monday that the ministry is expected to officially announce the new rates by the end of the month.

Background: Egypt raised its average electricity prices for all tiers of industrial, residential, and commercial consumers by an average of 26% last July as part of the plan to gradually phase out electricity and fuel subsidies. The plan began in FY2015-2016 with the launch of the IMF-sanctioned economic reform program and is now approaching its fifth, and penultimate round. Electricity subsidies were originally due to be fully lifted this coming fiscal year, but the period was extended to FY2020-2021 to avoid placing too much pressure on household budgets.

Gov’t denies 18% social media ad tax is already in place, but says it is working on a 15-20% levy: The Cabinet Information and Decision Support Center has issued a statement denying a report earlier this week in Al Mal that the Finance Ministry has begun requiring that advertisers charge an 18% tax on social media advertising campaigns run for overseas clients. The ministry is working on draft legislation to have ads on social media platforms subject to a 15-20% stamp tax that is “on par with international standards,” the statement notes.

CABINET WATCH- Cabinet approves new NGOs Act: The Madbouly Cabinet approved at its weekly meeting a final draft of the proposed NGOs Act that will replace the controversial 2017 NGO law, according to a cabinet statement. The move came after President Abdel Fattah El Sisi directed the government to amend the contentious legislation during last year’s World Youth Forum. The 98-article bill is expected to scrap prison sentences for violations of the act and create a single body charged with supervising civil society groups, among other details announced last month following public consultations with several local and international NGOs.

What’s next? The bill will now make its way to the Council of State (Maglis El Dawla) for review before heading to the House of Representatives, where it will need to move through committee before going to the House General Assembly for a final vote.

Background: The NGO law passed in 2017 placed sharp restrictions on civil society and was roundly criticized by domestic and international NGOs as well as the global press. The government has been working on amendments to the law since the Supreme Constitutional Court judged one of its clauses unconstitutional in June 2018.

Other cabinet decisions taken at yesterday’s meeting:

- STEM incentives: Issuing the executive regulations of a recently-approved law to provide incentives to encourage science, technology and innovation;

- SEZ near Giza: Allocating a 124 feddan land plot to the General Authority for Investments (GAFI) to set up a customs-exempt special economic zone near Giza;

- Smart card contract: Renewing for a year starting July a government contract with fintech companies including Smart Cards Applications and First to provide access to subsidized bread via smart cards;

- Gilead MoU: Ratifying a MoU between the Health Ministry and pharma producer Gilead Sciences Ireland UC, which specializes in hepatitis C medicine.

IDA sets new deadline for unregistered factories to go legit: The Industrial Development Authority (IDA) has given unregistered factories in accredited industrial zones until 30 June to obtain licenses and sign up with the registry of industrial companies, according to an IDA statement. Companies that comply will be exempt from fines for having missed an earlier deadline of 30 December.

The incentive is part of the government’s drive to widen the tax base by encouraging the informal economy to leave the shadows. The Sisi administration is presently preparing tax incentives for SMEs to encourage them to join the formal sector.

EARNINGS WATCH- B Investments posted a net profit of EGP 35.48 mn in 1Q2019, up 5.5% y-o-y from EGP 33.53 mn in the comparable quarter last year, the company said (pdf). The rise in profits was fueled by an 18% increase in revenues to EGP 50.25 mn during the quarter from EGP 42.6 mn in 1Q2018. B Investments is an active growth capital investor managed by BPE Partners.

Abu Dhabi Islamic Bank net profits after tax rose by 78% y-o-y to EGP 279.4 mn in 1Q2019, up from EGP 156.8 mn in 1Q2018, according to a bourse filing (pdf). Revenues increased to EGP 1.59 bn during the first quarter, a 27% y-o-y rise from EGP 1.25 bn.

Arabian Cement profits plunge 96% y-o-y in 1Q19 to EGP 5.98 mn, according to the company’s quarterly financials (pdf). The drop came on the back of falling revenues and rising costs.

Heliopolis Housing and Development (HHD) profits plunged 67.5% in 9M2018-19 to EGP 39.6 mn from EGP 120.5 mn a year earlier, the real estate developer said in a bourse filing (pdf). Revenues retreated 13.7% in 9M2018-19 to EGP 468.6 mn.

Eastern Company reported net profits after tax of EGP 867.04 mn in 1Q2019, down about 22% y-o-y from EGP 1.12 bn in the first quarter of last year, according to the state-owned company’s earnings release (pdf). Topline sales for the quarter increased to EGP 3.37 bn, up 4.2% y-o-y from EGP 3.23 bn in 1Q2018.

Raya Holding turned in a loss in 1Q2019, reporting an EGP 26.2 mn losses compared to profits of EGP 15.8 mn a year earlier, the company said in a bourse filing (pdf). 1Q2019 revenues rose to about EGP 2 bn, compared to EGP 1.8 bn last year.

EIPICO reported 1Q2019 net profit of EGP 218.3 mn, 18.7% y-o-y, the company said in a bourse filing (pdf). Revenues came in at EGP 915.26 mn, up from EGP 732.08 mn during the same period last year.

Cheesemaker Obour Land recorded a net profit of EGP 53 mn in 1Q2019, up 5.5% y-o-y from EGP 50.2 mn during 1Q2018, according to its earnings release (pdf). Revenues for the quarter increased to EGP 575.8 mn, up 25.6% y-o-y from the same quarter the previous year.

Naeem Holding profits fell 41% in 1Q2019 to USD 1.3 mn compared to USD 2.2 mn last year, the company said in a regulatory filing (pdf). Revenues came in at USD 4.1 mn compared to USD 5.9 mn a year earlier.

A handful of regional stories worth knowing about as we all prepare to head into the weekend:

Saudi Arabia is launching two new residency categories to attract skilled foreign workers. One will offer a form of permanent residency, while the other will include annually renewable work permits in a move that could allow some foreigners to live and work in the country without local sponsorship. Details of the two categories are expected within 90 days. Bloomberg and the FT have the story.

UAE’s Finablr began trading on the London Stock Exchange yesterday, with shares in the payments platform changing hands at GBP 1.75 apiece, our friends at EFG Hermes announced. The share price gave Finablr “an implied market value at the opening bell of GBP 1.23 bn.” Finablr had cut earlier this week its IPO price amid weak investor demands, after having initially planned to list its share on the LSE at GBP 2.10-2.60 per share. EFG Hermes served as joint bookrunners on the GBP 337 mn transaction, which was led by JPMorgan, Barclays, and Goldman Sachs.

Majid Al Futtaim issues USD 600 mn corporate green sukuk in regional first: Majid Al Futtaim brought to market the region’s first USD 600 mn benchmark corporate green sukuk issuance yesterday, according to a company statement (pdf). The shariah-compliant bond issuance “will be used to finance and refinance Majid Al Futtaim’s existing and future green projects, including green buildings, renewable energy, sustainable water management, and energy efficiency.” Majid Al Futtaim CEO Alain Bejjani noted, “We are extremely proud to list the world’s first benchmark corporate green sukuk. The widespread interest from global investors in the bond indicates their confidence in our ESG rating, BBB credit rating, and prudent financial and risk management approach.”

The US has ordered the partial evacuation of its embassy in Baghdad “responding to what the Trump administration said was a threat linked to Iran, one that has led to an accelerated movement of American ships and bombers into the Gulf,” per the New York Times reports. British defense officials aren’t on the same page, saying there is no elevated threat from Iran, according to the Guardian.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Image of the Day

Space tourism: Is it finally a reality? Virgin Galactic could begin flying tourists into space as early as this year, following major engineering redesigns after the death of a test pilot in 2014, Bloomberg reports. Some 700 customers have already signed up for the ride, each paying USD 250k for a 90-minute flight where a carrier aircraft will take the Virgin Galactic spacecraft up 45k feet, before the spacecraft fires its rockets to blast off into suborbital space.

Egypt in the News

The international press is blessing us with another quiet morning, with no single story on Egypt getting widespread attention.

Headlines worth a brief skim:

- Bad times for NGOs: Egypt is a country in which “anti-NGO measures are pending or possible,” according to a recently-released report by Freedom House.

- Good times for potato farmers: Potato farmers in Egypt are enjoying a bumper harvest this year after imported Chinese seeds brought a 50% higher yield, Xinhua reports.

- Iftars for the poor: A volunteer group delivers “dignified iftars” to Egypt’s poor, Gulf News reports.

- Still more Ikhwan: Bloomberg is the latest outlet to chime in on the topic that the international media can’t seem to get enough of these days.

On The Front Pages

President Abdel Fattah El Sisi’s inauguration of two major bridges tops the front pages of the country’s three state-run dailies this morning (Al Ahram | Al Gomhuria | Al Akhbar). The bridges — Tahya Misr and the record-breaking Rod Al Farag — are being hailed for meeting international quality standards.

Worth Reading

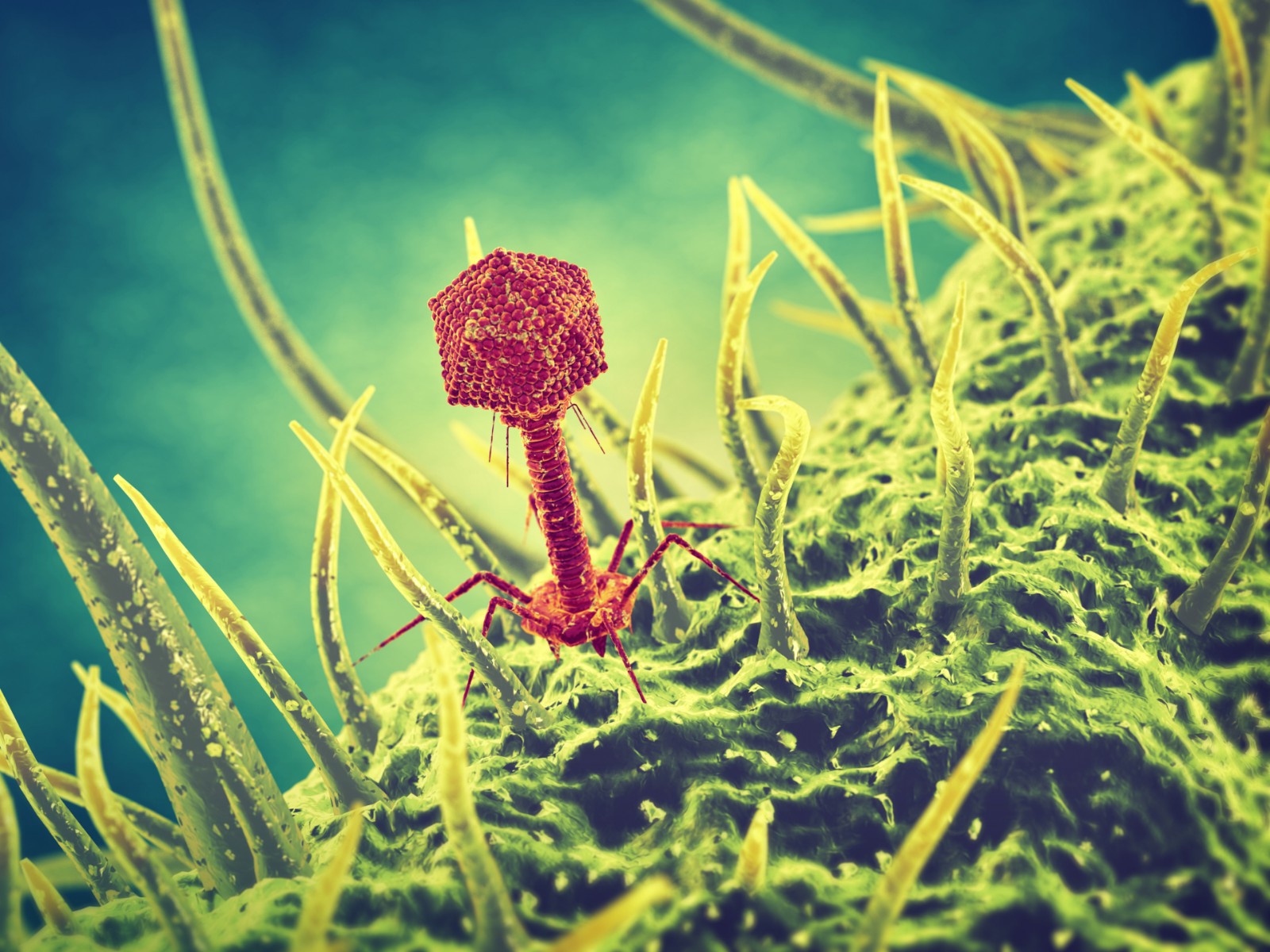

What could be better than antibiotics? Viruses found in sewage. Antibiotic resistance is one of the looming global health crises of our time, and now phages (viruses that target and kill specific bacteria) are being put forward as a way to treat illnesses that antibiotics can no longer be used on, Vox reports. The catch? Phages are often found in really dirty places, like sewage or pond scum.

How exactly does phage therapy work? When a phage comes into contact with bacteria, it attaches itself to it, injects its own DNA into it, and then starts to reproduce, essentially overpowering the host bacteria with multiple phage copies. Phages can be deployed to target particular bacteria (unlike antibiotics, which often kill the good bacteria along with the bad). They can even cause bacteria to evolve, in some cases changing from being antibiotic-resistant to being sensitive to your-antibiotics.com, ultimately giving a patient more treatment options. Commonly used in the early 20th century, phage treatment is now experiencing a revival, with viruses being assembled by scientists. The treatment is experimental but phages themselves are abundant (with an estimated 10 mn tn on Earth at any given time) and very easy to clone and culture.

Phage therapy has an Egypt tie-in: An American who contracted an antibiotic-resistant illness in Egypt in 2015 was successfully treated with phage therapy, with doctors saying the treatment saved his life. Egypt has a high rate of antibiotic abuse, including overuse of antibiotics and using them when they are not actually needed (to treat a cold, for instance). We have been ranked among the top three low- and lower-middle-income countries in terms of antibiotic consumption.

Diplomacy + Foreign Trade

US Representative Edward Case visited the Egyptian House of Representatives yesterday, making him the first member of Congress to visit the legislature in three years, according to Al Masry Al Youm. Case met with the heads of the National Defense and Security and House Foreign Affairs committees.

El Sisi, Abu Dhabi’s bin Zayed talk regional tensions: President Abdel Fattah El Sisi met yesterday with Abu Dhabi Crown Prince Mohamed bin Zayed to discuss recent regional developments, including the striking of two Saudi oil pumping stations by Iran-backed Houthi rebels earlier this week, according to an Ittihadiya statement. The two leaders talked about increasing cooperation and resisting attempts at “foreign intervention” in internal affairs.

Energy

Egypt offers 13 LNG cargoes in auction

The Egyptian Natural Gas Holding Company (EGAS) is offering 13 LNG cargoes in a number of auctions for shipment in June and July, Reuters reports. Egypt is expected to export 12 mn tonnes of natural gas worth USD 2 bn in FY2019-2020.

Banking + Finance

Central Bank of Egypt, EBRD look to set up new entity to settle gov’t bonds

The Central Bank of Egypt and the European Bank for Reconstruction and Development (EBRD) are looking into setting up a new specialized body to settle government bonds and set up a comprehensive electronic system for their trading, sources close to the matter tell Al Mal. The new entity will take over tasks that are currently under Misr for Central Clearing’s mandate, including settling taxes due on bond sales, the sources said.

Other Business News of Note

Nine companies submit offers for development of Delta Steel Mill Company

Nine companies have submitted proposals for the USD 45 mn development of the Delta Steel Company, Chemical Industries Holding Company Chairman Medhat Nafi tells Youm7. The company aims to increase its annual production tenfold to 500k tonnes of steel billets, from a current 50k tonnes.

Legislation + Policy

Egypt’s draft Social Security and Pensions Act to reach parliament by June

The Social Solidarity Ministry will send the Social Security and Pensions Act to the House of Representatives for review and approval at the beginning of June, an unidentified source tells Al Mal. The bill aims to amend the overall framework governing social welfare and pensions programs by guaranteeing the right to unemployment benefits and establish a new pension fund. Ministry spokesman Mohamed El Okabi had previously said the legislation is expected to come into effect by July.

My Morning Routine

My Morning Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Hassan Massoud, principal equity lead for Egypt and the Southern Mediterranean at the European Bank for Reconstruction and Development (EBRD).

I’m Hassan Massoud. As the principal equity lead, I originate, assess, and execute potential equity investment opportunities for the EBRD in Egypt and across the Southern Mediterranean region, which includes Egypt, Lebanon, Jordan, Morocco, and Tunisia. Our wide investment mandate covers everything from initial public offerings (IPOs) to private equity co-investments to quasi-equity and mezzanine structures. We work flexibly across the capital structure, but what sets EBRD apart is its breadth of industrial expertise. I have the luxury of calling on industrial expertise on everything from building naphtha crackers to non-performing loan buyouts. Once, I was searching the internal website for a colleague whose name starts with “Nu…” and discovered that EBRD has a number of nuclear safety experts — just in case.

The EBRD was established in 1991 after the fall of the Berlin wall to foster “market-oriented economies and the promotion of private and entrepreneurial initiative.” This remains our guiding principle and we’ve since expanded from east and central Europe to central Asia and the southern and eastern Mediterranean region, investing almost EUR 135 bn across 38 economies.

In the region, we’ve invested growth equity in Ibn Sina, an Egyptian pharma distributor, helping bring the company to its current leading market position and taking it to IPO with the founders — and taken an equity stake to expand Jordan’s Queen Alia airport. We have also done a number of co-investments with private equity firms, taken a stake in Bank Audi, and are actively looking to do more.

It’s difficult to tell you what kinds of investments we’re looking at today without breaching 17 different non-disclosure agreements, but here’s a brief idea: A consolidation in midstream food and agriculture with a regional private equity player; a number of large-scale project finance greenfields; providing minority growth capital to a tech-driven business; and a large-cap buyout in the consumer space. We’re also seriously studying the companies in the Egyptian government’s privatization program.

There is only one real cornerstone to my morning routine: As soon as I wake up, I try to drink more than a liter of freshly squeezed (but unsweetened) lemon water. There’s lots of scientific and quasi-scientific stuff online about why this unorthodox activity is a great way to start your day, but empirically, I assure you that it has the alerting effects of a strong cup of coffee, but via a much gentler and organic push. In the chunk of time it takes me to drink a liter of water, I read Enterprise and scroll through my Twitter feed (the American day is just ending then, so American Twitter is particularly lively).

I don’t know how to meditate or do yoga, so I don’t do that.

The car ride to the office is for audiobooks, podcasts, or random interviews on YouTube. It feels good to warm up by thinking about something completely unrelated to the rest of my day. Breakfast doesn’t really feature because anything that I can cook for myself pales in comparison to a hearty early lunch. Sometimes, I will stop at my parents’ on the way to the office for a proper breakfast of eggs, Alexandrian sogok, and impassioned arguments about politics.

I’ve started taking a more conscious approach to my digital diet. I don’t own a TV and try to keep my phone facedown to avoid notifications as much as possible. Twitter consistently feels like the best use of time on my phone. My feed is a collection of topics I’ve accrued from previous professional associations – private equity in Africa, startups and tech products – or pet causes I’ve picked up over the years like Kenyan and South African politics, Trump White House drama, or the increasingly strange cult around Bitcoin #HODL’ers.

What have I read and loved recently? I can’t resist giving you a quick list:Parting The Desert is a great book about the making of Suez Canal, the OG of 19th century project finance investments. The canal was conceived and executed by a French entrepreneur, majority owned by the Egyptian government, publicly listed in France, and fiercely opposed by the British government — one of the most fascinating stories of 19th century politics and finance.

Robert Sapolsky’s A Primate’s Memoir is a highly entertaining account of his time studying baboons in Kenya in the 1970s. The book is part travelogue, part observations of the social life of baboons, part intro to the intersection of the study of hormones and sociology.

Fi Al She’r Al Gaheli, is Taha Hussein at his peak intellectual combativeness. This pretends to be a book about poetry but is actually a hard-hitting critical take on how early Islamic politics abused both language and poetry.

And in Sanay’eyet Masr, Omar Taher takes a quick tour of the untold stories of the industrialists and craftsmen and women who built the industries and trades that shaped Egypt’s 20th century, like Anis Ebeid and El Deif Ahmed.

Almost all of my work activities are related directly to one transaction or another, so to stay organized, I start with a simple list of transactions. I then filter that into two lists: Things I Owe Others (be it decisions, feedback, documents, analyses, introductions, models, etc) and Things Others Owe Me. While this systems fits almost everything and keeps things moving, its primary and ongoing failure is grocery shopping, which never seems to fall on either list. I use Elmenus at least as much as most people use WhatsApp.

What’s the best piece of business advice I’ve ever been given and by whom? Most business advice is only meaningful in the context of its giver’s biases, but here’s a cute excerpt from Stephen Colbert’s speech to my graduating class at Knox College that really stuck with me: “When I was starting out in Chicago, doing improvisational theatre, there was only one rule I was taught about improv. That was, ‘yes-and.’ And yes-anding means that when you go onstage to improvise a scene with no script, you have to accept what the other improviser initiates on stage. They say you're doctors—you're doctors. And then, you add to that: We're doctors and we're trapped in an ice cave. And then hopefully they ‘yes-and’ you back. You have to be aware of what the other performer is offering you, so that you can agree and add to it. And through these agreements, you can improvise a scene or a one-act play. Neither of you are really in control. It's more of a mutual discovery. So say ‘yes.’ And if you're lucky, you'll find people who will say ‘yes’ back.”

The Market Yesterday

EGP / USD CBE market average: Buy 17.02 | Sell 17.12

EGP / USD at CIB: Buy 16.99 | Sell 17.09

EGP / USD at NBE: Buy 17.01 | Sell 17.11

EGX30 (Wednesday): 13,809 (-1.5%)

Turnover: EGP 380 mn (53% below the 90-day average)

EGX 30 year-to-date: +5.9%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 1.5%. CIB, the index heaviest constituent ended down 1.0%. EGX30’s top performing constituent was Heliopolis Housing up 0.8%. Yesterday’s worst performing stocks were Cairo Investment & Real Estate Development down 5.7%, Ezz Steel down 5.0% and Egyptian Resorts down 4.7%. The market turnover was EGP 380 mn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +5.3 mn

Regional: Net Short | EGP -10.6 mn

Domestic: Net Long | EGP +5.3 mn

Retail: 43.7% of total trades | 44.5% of buyers | 42.9% of sellers

Institutions: 56.3% of total trades | 55.5% of buyers | 57.1% of sellers

WTI: USD 62.14 (+0.19%)

Brent: USD 71.77 (+0.74%)

Natural Gas (Nymex, futures prices) USD 2.61 MMBtu, (+0.31%, Jun 2019)

Gold: USD 1,297.30 / troy ounce (-0.04%)

TASI: 8,480.70 (+1.27%) (YTD: +8.36%)

ADX: 4,777.57 (-0.52%) (YTD: -2.80%)

DFM: 2,583.74 (-1.12%) (YTD: +2.13%)

KSE Premier Market: 6,011.41 (+0.21%)

QE: 9,864.26 (+0.67%) (YTD: -4.22%)

MSM: 3,828.21 (+0.16%) (YTD: -11.46%)

BB: 1,408.66 (+0.22%) (YTD: +5.34%)

Calendar

May: 50 Egyptian companies are set to visit Libya to discuss trade, investment and reconstruction.

May: An IMF delegation will be in town to conduct its final review of the reform program ahead of the disbursement of the sixth and final tranche of Egypt’s USD 12 bn IMF loan.

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

28 May (Tuesday): 30 Saudi stocks join the MSCI Emerging Markets Index at the end of the day’s trading session.

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Mediterranean (UfM) countries to promote trade and investment in the 43 member states.

June: President Abdel Fattah El Sisi to attend US-Africa Business summit in Mozambique.

4-5 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

5-6 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development.

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International

Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.