Why is FDI declining in Egypt and should we be worried?

EXCLUSIVE- Why is inbound foreign direct investment to Egypt declining — and should we be worried? Official figures released earlier this month showed that fresh foreign direct investment (FDI) had fallen to USD 2.84 bn in 1H2018-19 from USD 3.76 bn in the same period a year before, putting us on track for another year in which we fall short of the state’s target of a minimum of USD 10 bn in FDI per year. We spoke with Investment Minister Sahar Nasr as well as EFG Hermes’ Mohamed Abu Basha and Naeem Brokerage’s Allen Sandeep to look at what’s behind the dip and where FDI goes from here.

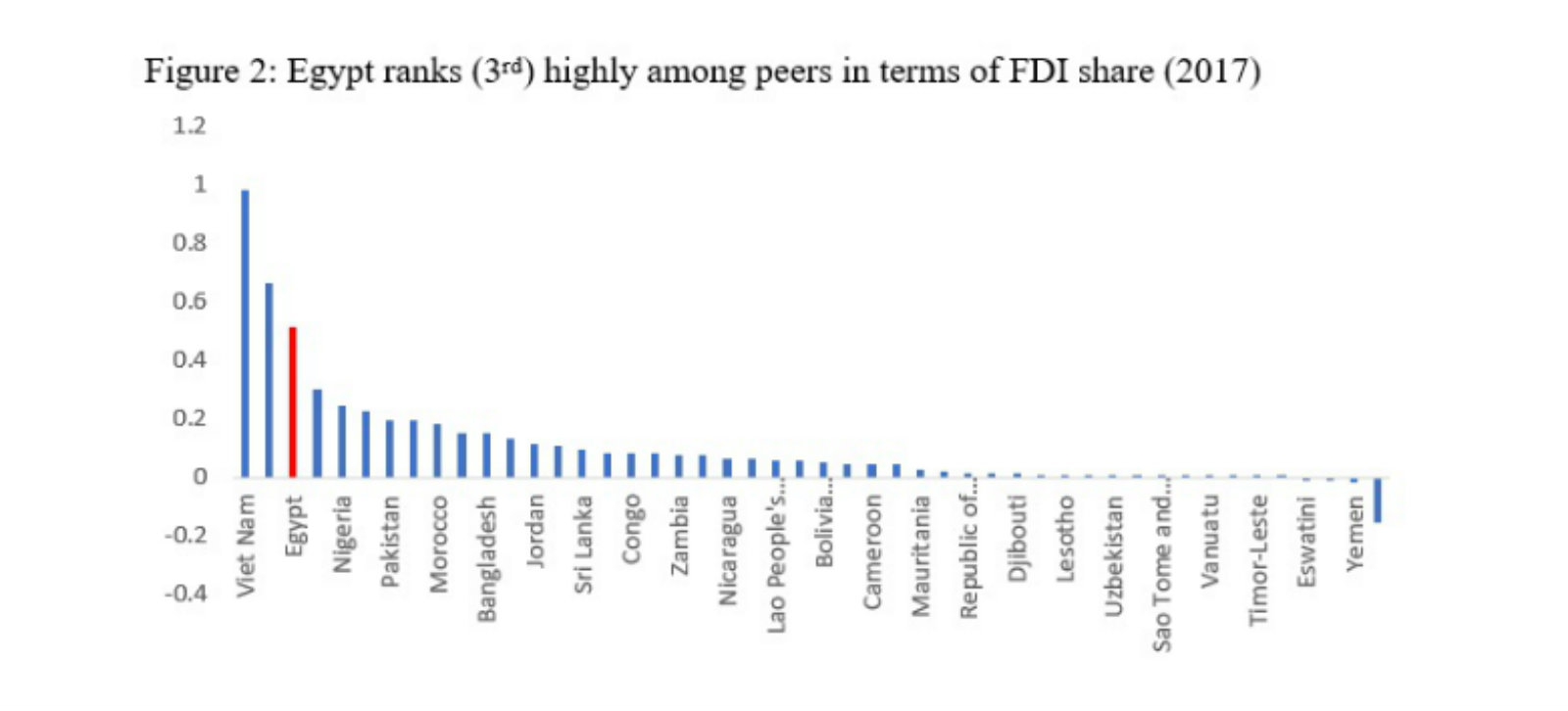

In a declining international market, it’s not about FDI in absolute terms, but Egypt’s share of global FDI, says Nasr: Egypt’s share of global FDI has continued to increase despite a global slowdown in foreign investment, Investment Minister Sahar Nasr told us. According to figures from the Investment Ministry, 2017 saw Egypt’s share of global FDI rise to 0.4% in 2017 from around 0.35% the year before. This came as net FDI inflows in FY2017-18 dipped to USD 7.7 bn, down from USD 7.9 bn the previous year. “Compared to peer countries with similar income levels, Egypt was ranked third worldwide in terms of share of FDI in 2017,” the minister said, adding that Egypt had the second-highest share of FDI in the MENA region in 2017, behind only the UAE.

More companies are setting up shop in Egypt: Nasr also pointed out that the number of new firms entering the market has increased alongside the expansion in Egypt’s share of global FDI. The results demonstrate confidence among international investors, she said — they’re setting up shop as a prelude to doing business here.

Expectations of a post-float spike in FDI were overly optimistic: The notion that FDI would spike immediately after the float of the EGP in 2016 were unfeasible, said Mohamed Abu Basha, EFG Hermes’ head of macroeconomic analysis. “It was somewhat unrealistic to expect FDI to recover immediately after the devaluation given the tough times the economy had to first go through and, equally importantly, given the nature of FDI that Egypt attracts, which mainly plays on domestic demand.” 2017 was a turbulent year which businesses spent evaluating the post-floatation economic environment. 2018 meanwhile brought more stability, but the private sector remained hesitant, preferring to assess demand before making new investments and looking for avenues for expansion, Abu Basha said.

And there’s no way the domestic private sector was going to borrow to back expansion when they’re paying credit-card levels of interest, we would add.

Comparing current FDI figures to reference points from before the float will naturally seem smaller in USD terms because the value of the EGP was slashed by half, Abu Basha pointed out.

Depressed local demand and consumption on the back of high inflation over the past two years have also been key in slowing down FDI, said Abu Basha. The devaluation was also not the only component weighing on demand, Abu Basha said, explaining that subsidy cuts and interest rates were also at play. “The nature of industries in Egypt is mostly domestic-based. Outside of oil and gas, foreign companies entering Egypt are mainly catering to domestic demand — if companies’ capacity utilization is at 40-50%, why would they be considering investing more?”

When will we see year-on-year growth in FDI? Probably in 2020 as market conditions normalize, interest rates fall and inflation continues to decline, Abu Basha said. Naeem Brokerage’s Allen Sandeep, however, predicted that non-oil FDI would not recover until the economic reform program is 5-10 years old. “I wouldn’t use the word ‘disappointed’ because if you look at other countries, you’ll see it took them 5-10 years to see FDI recover. The figures are below expectations, but I wouldn’t use the word ‘disappointed’.” Sandeep expects 2H2019 to see a pick up in non-oil FDI, especially in the agriculture and services sectors, due to seasonal factors. He also sees FDI in the upstream petroleum and minerals sectors to begin increasing by around 2021.

Egypt is expecting FDI to reach around USD 8-8.5 bn in 2019-2020, Nasr said. “[This] is because of risks facing the global economy, namely the potential slowdown and trade tensions, and allowing time for internal factors as inflation to be more conducive,” the minister added.

What are the government’s priority sectors for FDI? The government is committed to policies that cater to value-added and technology-oriented sectors that contribute to both economic growth and job creation, Nasr told us. “Also, the Investment Act and other related policies are designed to promote investments in lagging regions to raise the living standards in them,” Nasr added.

Have politics been a barrier to FDI growth? Not at all, Nasr said yesterday in a separate interview with Bloomberg TV (watch, runtime: 06:28). “The politics in the country has helped a lot to improve the business environment and has opened ground for more business to come to Egypt.”