Could we see 8% inflation this year? Renaissance Capital thinks so

Could we see 8% inflation this year? Renaissance Capital thinks so. Following the “stunning” December inflation figures posted last week, where annual headline inflation dropped to 12.0%, some analysts see the trend continuing. Among them is star analyst Charlie Robertson at Renaissance Capital, who predicts that headline inflation will continue to fall over the coming 10 months to 8% in October 2019 — a low not seen since August 2015. Among the primary drivers: base effects of food prices, he added in a research note. Inflation will then move back into double-digits (11-13%) until June 2020 before falling back again after the effects of subsidy removal dissipate.

Good news for consumers and FI investors alike: December’s inflation figure is “great news for Egypt,” Robertson writes, adding that it will provide additional incentive for fixed income investors to invest in the country.

And he’s not the only one — Beltone’s Alia Mamdouh expects inflation to remain subdued in 1H2019 despite fuel prices increases. She doesn’t see triggers for inflationary shocks, at least over 1Q2019, she said in a note. She expects a 20.6% increase in the average price of petroleum products as Egypt starts indexing prices at the pump to global fuel prices toward the end of 2Q2019, pushing headline inflation by an extra 2.5 to 3.5 percentage points. In 2H2019, she says, inflationary pressure should be lower than expected, remaining in the range of 14%-15% thanks to low figures reported in December.

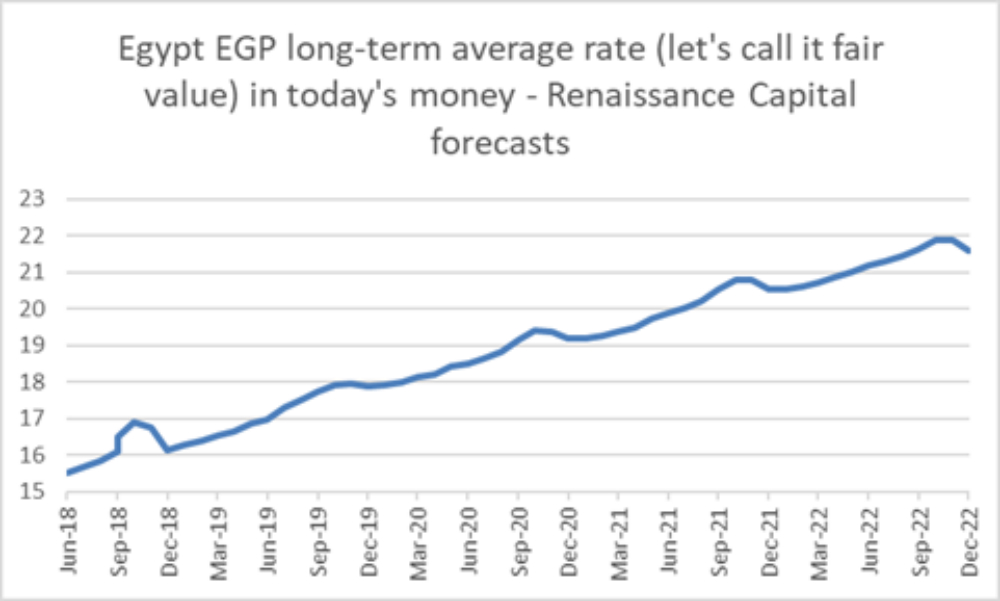

Slowing inflation is great if you’re hoping the EGP doesn’t slide against the greenback: Robertson reckons that cooling inflation will significantly slow devaluation of the EGP. Current estimates show the EGP hitting 18 to the USD in February 2020 and EGP 20 to the USD in July 2021, “giving a very attractive return to investors in local debt.” This is a slowdown from the bank’s previous estimate, which forecast EGP 17.90 for the USD as early as 2Q2019.

What this means for interest rates is unclear: Food and oil price volatility following the final round of subsidy cuts later this year lead Renaissance Capital to predict no moves on interest rates in the near term. They note, however, that others believe the CBE could push ahead with a rate cut as early as February 2019.

Beltone also reiterated their view that interest rates will be stable for the rest of the fiscal year, with a possible cut at the end of 2019, according to the note. However, a cut might take place earlier if inflation to ease, if foreign outflows from fixed income slow down, and if pressure subsides on the foreign assets held by the nation’s banks.