End of special FX repatriation mechanism is boon for Egypt banking sector

End of CBE’s special repatriation mechanism is a boon for banks, says industry: The CBE’s decision to terminate its parallel foreign exchange repatriation mechanism for new portfolio investments starting 4 December is receiving so much positive attention from the banking sector, it would have received a “certified fresh” from Rotten Tomatoes had it been a film.

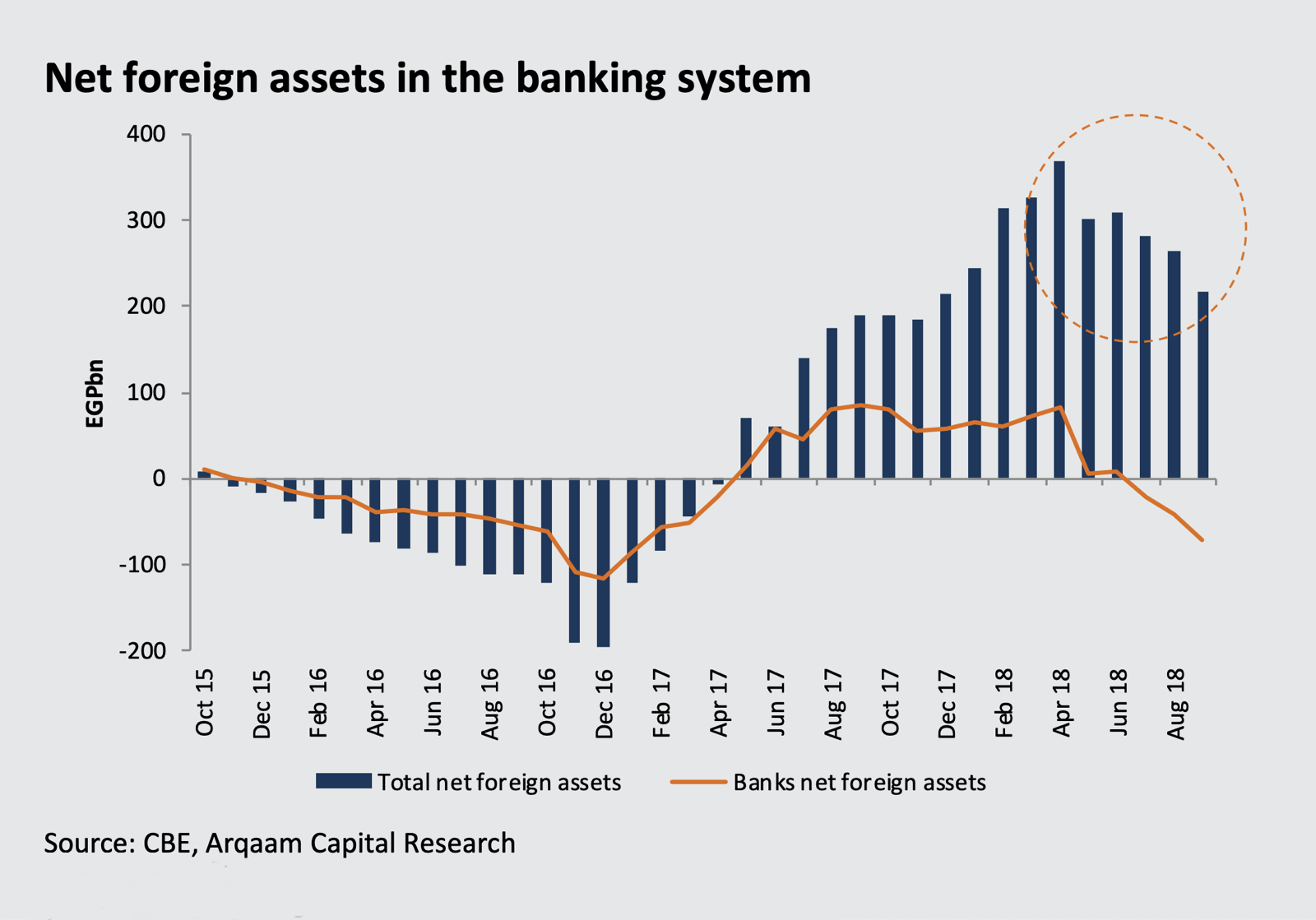

The bottom line: The move will drive much-needed USD liquidity into the banking sector, allowing banks rebuild their positions, Beltone Financial writes, noting that “the banking sector[‘s net foreign assets] continue to weaken, registering a deficit of USD 3.95 bn in September, up from a deficit of USD 2.3 bn in August.” Shuaa Capital concurs, but with a caveat, saying in a report out on Thursday, “We believe this will revive banks’ net foreign assets in the near term but highly subject to international investors’ appetite for Egyptian assets and net trading position as net buyers / sellers.” Sell-side analysts universally saw the decision as expected.

Background: A growing number of analysts have been suggesting that the central bank has been pushing banks to prop up the EGP amid outflows of hot money. Arqaam Capital had warned last month that banks are now “less shock absorbent for a future devaluation” of the EGP (however unlikely at this stage) and need fresh inflows of FX to continue acting as shock absorbers. Providing a single mechanism through the interbank system by which investors can bring USD into and out of the country will drive more FX liquidity to banks.

The timing of Thursday’s announcement was interesting, coming as it did after a rough period for banking stocks. Shares in publicly traded banks plunged after the government moved to amend the tax treatment of income from state bonds. Thursday’s trading saw select private sector bank stocks gain moderately or remain flat, following a number of days last week of across-the-board declines in stock values. CIB’s shares rose 0.6% and ADIB shares were up 0.4%, while Faisal Islamic Bank rose 1.7%. Other major private sector banks, including QNB and Credit Agricole, were flat.

Those proposed changes to the tax treatment of bank holdings of treasuries? They’re likely to spur private lending, Reuters reports. Banks will be prompted to “boost credit to the private sector” at the same time as the move forces up yields on treasury debt, the newswire says, noting that “Egyptian banks have for years been top-heavy on government lending at the expense of the private sector.” They’re not wrong, but the issue here is not bank appetite to lend to the private sector: It’s private-sector demand. Businesses faced with credit-card interest rates on capex are simply opting not to borrow. Banks, for their part, would have happily allocated funds to both state paper and private borrowers had the market for the latter been there.