Noble, Delek, East Gas sign agreements paving the way for gas exports to your favorite new regional gas export hub

We just became the East Med’s premier energy hub: The operators of Israel’s Leviathan and Tamar gas fields, Noble Energy and Delek, along with their Egyptian partner East Gas, have signed agreements to acquire a 39% stake in pipeline operator East Mediterranean Gas (EMG). This paves the way for the gas field operators to export natural gas to Egypt under a USD 15 bn agreement signed in February with Alaa Arafa’s Dolphinus Holdings. “[The agreements] represent another major milestone toward Egypt’s goal to become a regional energy hub, providing access to both growing domestic markets and existing LNG export facilities,” Noble Energy said in a press release on Thursday morning. “With these agreements, we are securing the capacity to deliver on our firm gas sales agreement with Dolphinus for Leviathan while also allowing for interruptible sales from Tamar into Egypt,” the statement read.

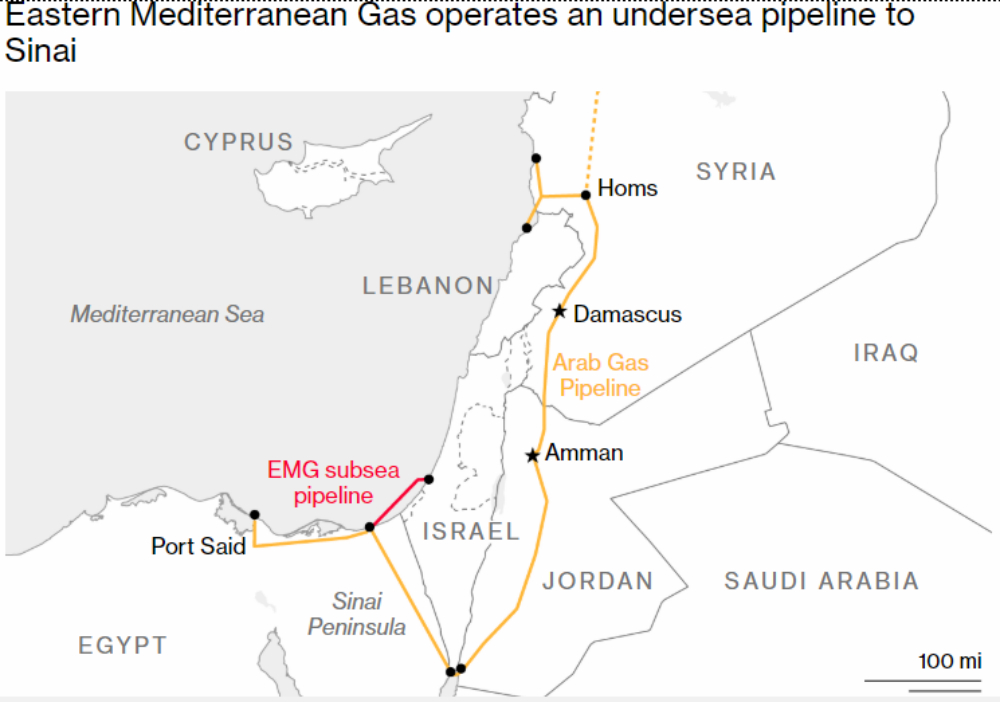

The mechanics of the agreement: The agreement grants the three companies access to EMG’s 90 km pipeline connecting Israel’s grid to Egypt’s at El Arish, according to the statement. The partnership will pay USD 518 mn for the stake, with Noble and Delek each paying USD 185 mn, while East Gas will pay USD 148 mn, Reuters reports. Noble Energy will own an indirect and effective 10% stake in the pipeline.

Agreement opens up private sector natural gas import licenses… The Oil Ministry is ready to consider permit requests from the private sector to help Egypt become a regional hub for gas trading, Oil Ministry spokesperson Hamdi Abdel Aziz said in a statement (pdf). “The ministry welcomes this new step by the private companies responsible for the commercial project’s implementation,” he said of the agreement. The Natural Gas Regulatory Authority postponed earlier this month the issuance of natural gas import licenses to private sector companies, ostensibly because the private sector was “unprepared.” EGAS has renewed preliminary approvals giving Qalaa’s TAQA Arabia, BB Energy and Fleet Energy the import licenses.

…and clears arbitration cases: “The [agreement] will also entail the settlement and waiver by the sellers, their shareholders and affiliates of any claims, actions or awards related to arbitrations against the Government of Egypt and state owned companies,” according to an emailed statement by Alliance Law Firm (pdf), which was buy-side legal counsel on the transaction. Sources had told Bloomberg last month that the Egyptian government has reached an agreement to reduce the USD 1.76 bn international arbitration ruling against EGAS, EGPC and East Mediterranean Gas (EMG) to around USD 470 mn and would be amortized over a period of around 15 years. Negotiations are with banks for financing to cover it.

Gas exports to begin in early 2019: “The partnership intends to act to close the transaction and begin piping natural gas from Israel to Egypt as early as the beginning of 2019,” Delek said in a statement. By the end of 2019, 350 mcf/d is expected to be pumped to Egypt from the gas fields, supplying around 64 bn cbm of gas over a 10-year period. Delek and its partners will begin working on reversing the flow of the EMG pipeline, which used to carry Egyptian gas to Israel. The companies still need to test the state of the pipeline, according to Bloomberg.

Delek has a short investor presentation (pdf)and a long statement (pdf) breaking down the transaction.

It’s all coming together nicely: Inking the 10-year agreement with Dolphinus is only the most recent step in Egypt’s march to become the premier export hub of East Mediterranean gas to Europe and other markets. Egypt signed an agreement with Cyprus last week that would see the two sides build a USD 1 bn pipeline connecting gas from Cyprus’ Aphrodite field to Egypt’s liquefaction plants. Production at the supergiant Zohr field is ramping up, breaking the 2 bcf/d mark earlier this month, bringing the country’s total production up to 6.6 bcf/d.

More yet to come: Eni and Tharwa Petroleum were also said to have kicked off drilling at the Noor gas field in North Sinai last week. Market expectations are high: Eni, which holds an 85% stake in the field, denied in recent months reports claiming that it had discovered 90 tcf of reserves there, or 3x as much as Zohr. The Oil Ministry had also signed in the past month new exploration agreements that are together worth more than USD 1 bn with Shell and Malaysia’s Petronas, as well as Rockhopper, Kuwait Energy and Canada’s Dover Corporation.

The story topped coverage of Egypt in the foreign press on Thursday, with all stating how historic it was. Bloomberg noted that Israeli energy stocks soared on Thursday, while some, including Haaretz, are playing up how the agreement has brought the former enemies together.

Additional reading: Last month, Bloomberg uncovered the web of offshore companies that established the partnership, with a company based in Cyprus and another in the Netherlands. It also revealed that a 37% stake in EMG was bought by Sam Zell and Yosef Maiman, who won arbitration cases against Egypt.