- Rising natural gas production will help bump Egypt’s GDP growth to 5.2% this year, 5.5% next year –IMF (Speed Round)

- Automotive sales rebound in 1Q2018. (Speed Round)

- Sarwa Capital closes EGP 2 bn securitized bond issuance, the largest yet in the market. (Speed Round)

- Compass subsidiary to acquire Designopolis mall from Qalaa Holdings. (Speed Round)

- Job platforms Wuzzuf and Forasna raise USD 6 mn in Series B funding. (Speed Round)

- After the success of FiT for solar, is the gov’t abandoning FiT for wind? (Speed Round)

- Under fire from the chattering class, Education minister defends curriculum revamp for K-12 schools. (Last Night’s Talk Shows)

- Simon Kucher & Partners opens office in Cairo. (What We’re Tracking Today)

- The Market Yesterday

Thursday, 3 May 2018

Job platforms Wuzzuf and Forsana raise USD 6 mn Series B round

TL;DR

What We’re Tracking Today

It’s PMI Day: The Emirates NBD Egypt PMI reading for April comes out this morning. You’ll find it here once it lands. March’s reading dipped unexpectedly, coming in at 49.2.

The Central Bank of Egypt should release foreign reserves figures some time between today and early next week.

Inflation numbers should come out on or about 10 May. This month is all the more significant as the central bank’s Monetary Policy Committee will meet on 17 May to set interest rates.

Did you plough cash into high-yielding CDs after the devaluation? It’s payment time: Banks that have issued high-yielding, 20%+ interest certificates of deposit following the November 2016 devaluation began paying on Wednesday, Al Masry Al Youm reports. Officials from the National Bank of Egypt and Banque Misr — which together hold 45% of the EGP 550 bn in CDs out there — tell the newspaper that they are ready to meet payments. Banks stopped issuing the 20% CDs back in February.

Is Egypt seriously considering Trump’s “Arab force” in Syria? Setting up an an Arab military force that would cover America’s withdrawal after defeat of the Daeshbags in Syria is under consideration among the nations invited to partake in the initiative, Foreign Minister Sameh Shoukry reportedly said at a workshop on Wednesday, Al Shorouk reports. He made sure to note that the initiative — proposed by US President Donald Trump last month — would need significant preparation and consideration before any decision is made. Trump’s new national security advisor called acting intelligence chief Abbas Kamel last month “to see if Cairo would contribute to the effort.”

Further afield this morning:

The US Federal Reserve left interest rates unchanged yesterday and seems on track to raise rates next in June as it said that “a recent rise in inflation to near the U.S. central bank’s target” looks sustainable, Reuters reports.

Required reading for anyone planning a merger or acquisition: A megadeal joined Sharpie markers and Crock-Pots. What could go wrong? A lot. The Wall Street Journal presents a cautionary tale of how a USD 15 bn acquisition that brought together Elmer’s glue, Sharpies, Graco strollers, Rawlings baseball gloves and Bicycle playing cards became a “case study of the ways a megadeal can go bad.”

Required reading for anyone tempted to diss sell-side analysts: Elon Musk dismissed an analyst’s questions as “so dry, they’re killing me,” then promptly cut off another who was asking about a capital requirement. Investors were unimpressed, Reuters writes, “giving a rare rebuke” to the “iconoclastic” Tesla CEO by “sending shared down 5% despite promises that production of the troubled Model 3 electric car was on track,” Reuters reports.

Required reading for all Egyptians: How Cape Town beat the drought in the Financial Times. The pitch: “The city was on the verge of becoming the first major urban centre to run out of water but has averted the crisis. But for how long, and at what cost, in a divided country?”

Goldman Sachs promises it’s going to be very, very careful with its foray into consumer lending as CEO Lloyd Blankfein tried to “ease concerns among shareholders” that the firm “may be ploughin into consumer credit at the wrong point in the cycle,” the FT reports.

Bloomberg wants you to pay to read its redesigned website. Its editor-in-chief, former Economist boss John Micklethwait, explains why. We don’t like the redesign, but we suppose we’ll be shelling out for the subscription.

Simon Kucher & Partners opens office in Cairo: Our friends Martin Janzen and Sara Shenouda formally opened yesterday the Cairo office of Simon Kucher & Partners, the global consultancy that focuses on what it calls “TopLine Power” — helping clients profitably grow their revenues. We’ve intersected with Sara and Martin primary on the banking and finance beat at our parent company, Inktank Communications, and have found them impressive. We recently enjoyed meeting their CEO, Georg Tacke, in Dubai, and we’ll be introducing you folks to him in an interview soon. In the meantime, Simon Kucher’s blog is worth checking out. It’s a too-rare example of a company doing well at sharing knowledge as a teaser to prompt you to engage with them. Joining Martin and Sara at the Cairo office are Aly Khattab, Youssef Yakout and Sherine Soliman.

On The Horizon

GERD talks on Saturday: The next round of talks over the Grand Ethiopian Renaissance Dam (GERD) will be held in Addis Ababa on Saturday, 5 May, said Sudanese Irrigation Minister Moataz Moussa, according to El Watan. Ethiopian Prime Minister Abiy Ahmed also arrived in Khartoum yesterday to meet with Sudanese President Omar Al Bashir and discuss the dam and other economic issues, Xinhua reports.

Our friends at AmCham will be holding their fifth annual HR Day on Monday, 7 May. The gathering will discuss new ways of attracting talent, developing culture, implementing leadership practices and diversity and inclusion, in addition to raising questions on the value of a company’s culture. You can register for the event here.

The Egyptian embassy in London will be hosting a “Made in Egypt” gala on Tuesday, 8 May. The event, which will exhibit the work of leading Egyptian designers, is sponsored by Mr & Mrs Samih Sawiris, CIB, Edita, EgyptAir, Palm Hills, Ramsco and SODIC.

Contracts for the Russian Industrial Zone (RIZ) should be signed at the end of May, Russia’s Deputy Industry and Trade Minister Georgy Kalmanov said last week. This could happen at the Egyptian-Russian Economic Committee summit, scheduled for the second half of May, during which both countries’ trade and industry ministers are expected to meet.

LEGISLATION WATCH- The Tenders and Auctions Act will go to a plenary session vote this month, according to House Planning Committee member Rep. Yasser Omar. The committee has concluded its review of the bill, which was originally scheduled to be issued last month, he said.

Enterprise+: Last Night’s Talk Shows

Plans to revamp the country’s education system continued to capture the talking heads’ attention last night on an otherwise humdrum evening.

Education Minister Tarek Shawky quelled Amr Adib’s concerns about plans to teach subjects in English across public middle schools, which Adib thinks would prove to be too challenging for students. Students will be taught in both English and Arabic throughout elementary school to give them a solid linguistic foundation by the time they reach middle school, Shawky said. The new system will allow public schools to be on par with their private counterparts, the minister ambitiously claimed (watch, runtime: 18:37).

Shawky’s appearance came as the nation’s columnists whined that he’s moving too fast with the implementation of the K-12 education system. Al Ahram’s Salah Montaser argues the rollout should start only with the first year of kindergarten pending further discussion. Al Shorouk’s Ashraf El Barbary also took a potshot at the minister, saying curriculum reform should come at the same time as investment in infrastructure, the hiring of new teachers — and a driver to explain to parents why the reforms matter in the first place.

As for higher education, several international universities are expected to set up branches in Egypt by the end of next year, including Carleton University and the University of Prince Edward Island, both from Canada, according to Higher Education Minister Khaled Abdel Ghaffar. If the House is quick enough to pass a draft law allowing foreign universities to set up shop in Egypt (which the Ismail Cabinet approved yesterday), the first phase of Toronto’s York University could open its doors as early as October 2018, Abdel Ghaffar told Masaa DMC’s Osama Kamal (watch, runtime: 8:35).

Meanwhile, the idea of integrating Al Azhar’s teachings with the public education system was the topic of discussion between MP Mohamed Abu Hamed and Al Azhar’s Islamic Research Academy member Mohamed Al Shahat on Al Hayah Al Youm (watch, runtime: 42:22).

Last night’s edition of the CIB-sponsored Hona Al Shabab was dedicated entirely to fintech startups, which doubled the prize money to EGP 200k for first-place winner 7aweshly. YallaPay and Vapulus came in second and third place, respectively (watch, runtime: 3:15).

Also last night: The Supply Ministry’s decision to raise the price of rice purchased from the private sector to EGP 6,300 per tonne from EGP 6,100 per tonne (watch, runtime: 5:19); an Agriculture Ministry spokesman vehemently denied rumors that pesticide-contaminated watermelons are currently in the market (watch, runtime: 3:28); and the Prosecutor General’s investigation into last week’s flooding of New Cairo (watch, runtime: 7:21) and (watch, runtime: 8:36).

Speed Round

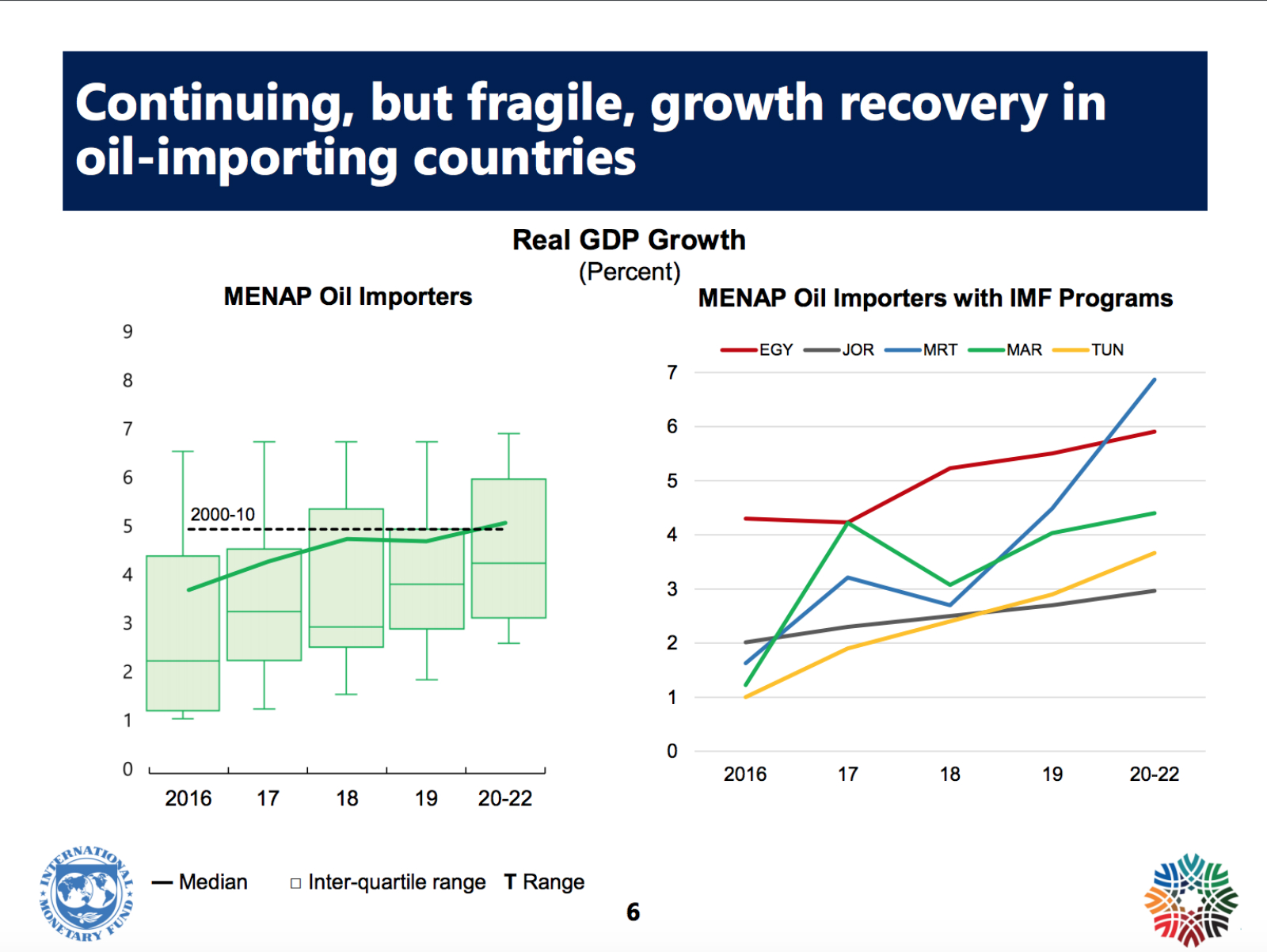

Rising natural gas production in Egypt will help bump GDP growth to 5.2% this year and 5.5% in 2019, the IMF said in its Regional Economic Outlook May 2018 report. “The outlook for Egypt has improved relative to the October 2017 forecast. In the context of its IMF-supported program, improving confidence is boosting private consumption and investment, adding to the increase in exports and tourism.” This forecast puts Egypt ahead of most other net oil importers in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region, which the report expects to record growth rates between 1.5% and 4.5% this year. Across MENAP, Pakistan alone outstrips Egypt with an estimated GDP growth rate of 5.6% this year.

Debt levels remain high in Egypt, the report notes, with significant debt-service burdens that “crowd out growth-enhancing expenditures.” Tightening monetary policies in high-deficit countries including Egypt are expected to drive up financing costs and further increase the debt burden, according to the report.

Growing economies aren’t creating jobs fast enough to make a dent in youth unemployment: Growth levels across the region “remain too low to effectively reduce unemployment, particularly for young people.” According to the report, oil-importing countries — including Egypt, Jordan, Lebanon, Morocco, and Syria — must reach growth levels of 6.2% just to keep unemployment at its current average of 10%.

For Egypt, this means creating 700k to 1 mn new jobs every year, which is only attainable with private sector involvement, the IMF’s Middle East & Central Asia Department Director Jihad Azour tells the Associated Press. “Allow the private sector to be in the leading role and for the state to move from being an operator to an enabler, and give more room for the private sector to invest,” he said.

Automotive sales rebound in 1Q2018: Total vehicle sales (including passenger cars and commercial vehicles) jumped 32.3% y-o-y in 1Q2018, with around 35,100 units sold, according to figures from the Automotive Information Council (AMIC). Passenger car sales grew 24% during the quarter. Sales of imported cars were up more than 21%, while, sales of locally assembled cars surged more than 40% y-o-y. Nissan continued to top passenger car sales with a 23% market share, followed by Hyundai (22%), Renault and Chevrolet (10% each), Toyota (7%), and Kia (6%). Truck sales soared 91% y-o-y during the quarter to 7,440 units, up from 3,900 during the same period last year.

Automotive sales are expected to rise as much as 10-15% over the course of 2018, deputy head of the car dealers association Ehab El Moslemy tells Al Mal. The expected rise will come as consumers absorb the shock of rising prices, he said. The year-long slump in the auto industry, which saw passenger car sales decline 30% in 2017 after the float of the EGP in late 2016, began slowing in November, which saw a 0.4% increase in sales. December saw a sharp jump of 21% in sales, but the recovery was short-lived — January recorded the lowest number of cars sold since May 2017 due to low sales of imported vehicles.

Sarwa Capital closes largest securitized bond issuance in the market to date: Our friends at Sarwa Capital closed yesterday the issuance of EGP 2.03 bn in securitized bonds backed by the portfolios of Contact Auto Credit and its affiliate companies. The three-tranche offering included one-, three- and five-year bonds with ratings of AA+, AA and A, respectively, from Middle East Ratings and Investors Service (Meris), the firm said in a statement on Wednesday (pdf). “We are proud to have completed this milestone issue, which is the largest ever in the market, amid strong demand and following the EGP 1.1 bn issue in December 2017,” said Ayman El Sawy, Managing Director of Sarwa Promoting & Underwriting, which acted as lead manager and financial advisor on the transaction. The issue was fully underwritten and arranged by CIB, Banque Misr, Arab African International Bank, and Ahli United.

M&A WATCH- Sky Realty to acquire Designopolis from Qalaa Holding subsidiary: Sky Realty Holding Ltd., a subsidiary of Compass Investment Holding Limited, entered into a sale and purchase agreement to acquire Designopolis from Qalaa Holding. In the transaction, Sky acquired 100% of Qalaa subsidiary MENA Home Furnishings Mall’s stake in Designopolis owner Bonyan for Development and Trade. Proceeds to Qalaa amounted to EGP 162 mn. You can read Compass’ statement (pdf) here and Qalaa’s disclosure here (pdf). Compass Capital was buy-side advisor.

INVESTMENT WATCH- The VC parade continues as Egypt’s Wuzzuf and Forasna raise USD 6 mn in Series B funding. Job recruitment platforms Wuzzuf and Forasna — both owned by BasharSoft — have raised USD 6 mn in Series B funding, Forbes Middle East reports. The round was led by the European Bank for Reconstruction and Development through its VC Investment Program, Vostok New Ventures (Sweden), Endure Capital (US) and Kingsway Capital (UK). Wuzzuf, which does white collar jobs, and blue-collar-focused Forasna had previously raised a USD 1.7 mn Series A round in 2015. The news is the latest in a wave of VC funding announcements over the past few weeks. Mass transit platform Swvl set a record for a Series A funding round in Egypt with USD 8 mn, while online gown rental platform La Reina raised USD 1 mn in Series A funding, in a round led by Egypt’s Algebra Ventures.

After the success of FiT for solar, is the gov’t abandoning FiT for wind? It appears that the government’s feed-in-tariff (FiT) program for wind power has not picked up in the same way as that of solar, allegedly leading the Electricity Ministry to consider scrapping the wind program entirely. Minister Mohamed Shaker is expected to present a proposal to have some of these wind projects taken out of the FiT program and have them tendered under a Build-Own-Operate framework, said ministry sources. While the Benban solar park has drawn in around USD 2 bn in funding from international finance institutions, lenders have shied away from funding FiT wind farm projects, leaving companies bidding on the program in the lurch. The companies, which have already begun spending money on the projects, are undeterred and wish to continue. Six of the nine companies that had bid on wind farms under the program reportedly support Shaker’s plan.

LEGISLATION WATCH- House subcommittee finalizes contentious clauses in proposed Ride-Hailing Act? A House of Representatives’ subcommittee charged with reviewing the Ride-Hailing Apps Act has reportedly finalized changes to the wording of the legislation’s contentious clauses, including one requiring companies such as Uber and Careem to protect data privacy and another compelling them to share their data with state agencies when requested, Al Mal reports. There’s no word on the exact nature of the amendments the committee has made.

Uber / Careem appeal this Saturday: The news comes just days before the Supreme Administrative Court is scheduled to hear on Saturday, 5 May an appeal by Uber and Careem of a lower court decision that ordered the two companies to suspend operations. The Administrative Court has scheduled a separate hearing for 15 May. The two companies continue to operate under a Court of Urgent Matters ruling that stayed the initial suspension.

Business leaders and analysts watching Egypt expect investment to “take off” as the government’s reform program begins to bear fruit, writes the Financial Times’ Heba Saleh as part of a special series of reports on investing in the Arab world. Investors, including US multinationals are “looking with interest” at the Egyptian market now that the government has adopted legislation such as the Bankruptcy Act and addressed power shortages. Many of them have been watching from the sidelines to ensure that the government will push ahead with the necessary reforms, says AmCham President Tarek Tawfik.

The lag between the implementation of reforms and the inflow of FDI is understandable, says EFG Hermes’ head of macroeconomic analysis Mohamed Abu Basha: “It takes time for demand to recover after macro adjustments like the one Egypt went through … starting next year, we will see a pick-up of FDI as demand rebounds.” Abu Basha expects demand to continue rising as interest rates drop, creating the “perfect storm” for investment. Business leaders are still complaining, however, about bureaucracy and competition from state institutions expanding their involvement in the economy, Saleh notes.

The series also looks at how fiscal strains and economic realities have been weighing down Saudi Arabia’s reforms. Saudi’s economy has been slowing since the oil price crash of 2014, slipping into a recession last year and compounding very weak growth in the non-oil sector in 2016. Foreign direct investment in Saudi Arabia fell to USD 7.5 bn in 2016 from USD 8.1 bn in 2015, writes the FT’s Simeon Kerr. “Lost in the optimistic noise are the considerable fiscal difficulties that remain across the Gulf, along with bureaucratic challenges, deteriorating credit standings and rising interest rates,” says Nomura Asset Management Middle East CEO Tarek Fadlallah. Optimism still pervades the Saudi story, with Kerr noting the importance of the FTSE emerging market classification and the upcoming MSCI upgrade.

Cyprus, Israel look to settle territorial dispute over Aphrodite gas field, possibly clearing last barrier to pipeline connecting Aphrodite to Egypt: Cyprus and Israel are looking to settle their ongoing dispute over their respective maritime borders and how much of the Aphrodite gas field in the eastern Mediterranean falls in Israeli territory, the Associated Press reports. Companies with a stake in the field are expected to sit down with Israeli energy firms to reach a solution, and an expert “will be called in to arbitrate” if all else fails, according to Cypriot Energy Minister Yiorgos Lakkotrypis. The dispute appears to be the final hurdle to overcome before Cairo and Nicosia can sign the agreement to establish a pipeline connecting the Aphrodite field to Egypt’s LNG facilities, which requires Israel’s approval.

Meanwhile, Egypt, Greece, and Cyprus are set to hold a trilateral summit in Athens this fall to discuss energy cooperation, Ittihadiya spokesperson Bassam Rady said yesterday. Egypt and the EU had signed an MoU on energy cooperation last week that will see the two sides work together to help Egypt realize its goal of becoming a regional hub for LNG exports. Egypt could also receive as much as EUR 3.8 bn in funding for energy funding, EU Energy Commissioner Miguel Arias Cañete said at the time.

This comes as direct flights between Cairo and Cyprus’ Larnaca are expected to resume in October after an eight-year hiatus, former Egypt Tourism Federation Chairman Elhamy El Zayat said, Al Shorouk reports. The four weekly flights will be operated by Cyprus Airways. Cyprus is also planning to operate four weekly flights between Alexandria and Paphos within nine months, Al Masry Al Youm reports.

LEGISLATION WATCH- The Ismail Cabinet approved a law establishing a new transportation regulator to monitor land and air transportation, Cabinet said in a statement on Wednesday. The new authority will be charged with managing transportation and road networks in Egypt, in addition to running public transportation. The authority will also be charged with monitoring and supervising safety for road and air transportation.

The law would also sets new procedures for how licenses are issued and by which government department, though details on this remain scant. The new law also sets new punishments for violators of rad safety regulations, but the statement does not delve into these either.

The Ismail Cabinet also approved a law that would set guidelines for foreign universities opening up shop in Egypt. The law also contains articles that govern Egyptian universities. The cabinet statement does not little to inform us on either aspect of the law. Other decisions taken by the cabinet in its weekly meeting include:

- Approving a EUR 4 mn cooperation agreement between the environment ministries of Egypt and Italy.

- Granting Misr Phosphate the rights to explore and develop the 220 km Abou Tartour phosphate concession in Wadi El Gedid.

LEGISLATION WATCH- The House Economic Committee is planning to discuss amendments to the law governing special economic zones such as the Suez Canal Economic Zone (SCZone) after it wraps up its talks on the FY2018-19 draft state budget, committee head Amr Ghallab tells Al Mal. The amendments would grant projects established in these zones several non-tax incentives currently granted to investments in high-priority sectors, according to Ghallab.

Seven companies chosen as part of phase one development of 200 PPP schools: Seven Egyptian and Saudi Arabian companies have been tapped to take part in phase one of the government’s program to develop 200 schools under a public-private partnership framework. El Gazeera and the Middle East Education Services Group were among the winning bidders selected by an inter-ministerial committee tasked with reviewing bids. Three of the seven winning companies had initially been rejected by the committee only to be selected following an appeal, sources from the committee said. These firms included CIRA — owned by the family of Hassan El Kalla and recently exited by Dubai-based PE firm Abraaj. The company is considering an IPO sometime in 4Q2018. The government plans to hold a tender for phase two of the program in mid-May, sources added.

EARNINGS WATCH- Heliopolis Housing & Development reported an 11.32% y-o-y decline in net profit after tax to EGP 120.5 mn in 9M2017-18, down from EGP 135.8 mn during the same period last year, according to a bourse filing (pdf). The company explained that the dip in net profit came as a result of a EGP 80 mn installment payment on a EGP 500 mn leasing contract.

At least least 14 people were killed yesterday in a terror attack on Libya’s election commission headquarters in Tripoli, Bloomberg reports. Egypt’s Foreign Ministry condemned the attack, which was carried out by suicide bombers allegedly linked to Daesh. The attack comes just days after President Abdel Fattah El Sisi and French Foreign Minister Jean-Yves Le Drian agreed in a Cairo meeting that Libya should hold elections by year’s end.

***

SMART PEOPLE WANTED. We’re hiring at both Enterprise and at our parent company, Inktank. We’re looking for critical thinkers who have outstanding English-language writing skills. Don’t apply if you are not (at an absolute minimum) unafraid of numbers. We offer a great, casual work environment, the opportunity to work with smart people who care about what they do, and plenty of intellectual challenge. You’ll do your best work here, whatever your profession is. Check out the open positions, from creative director to reporter, from Enterprise editor to senior investor relations advisor at Inktank.

***

Image of the Day

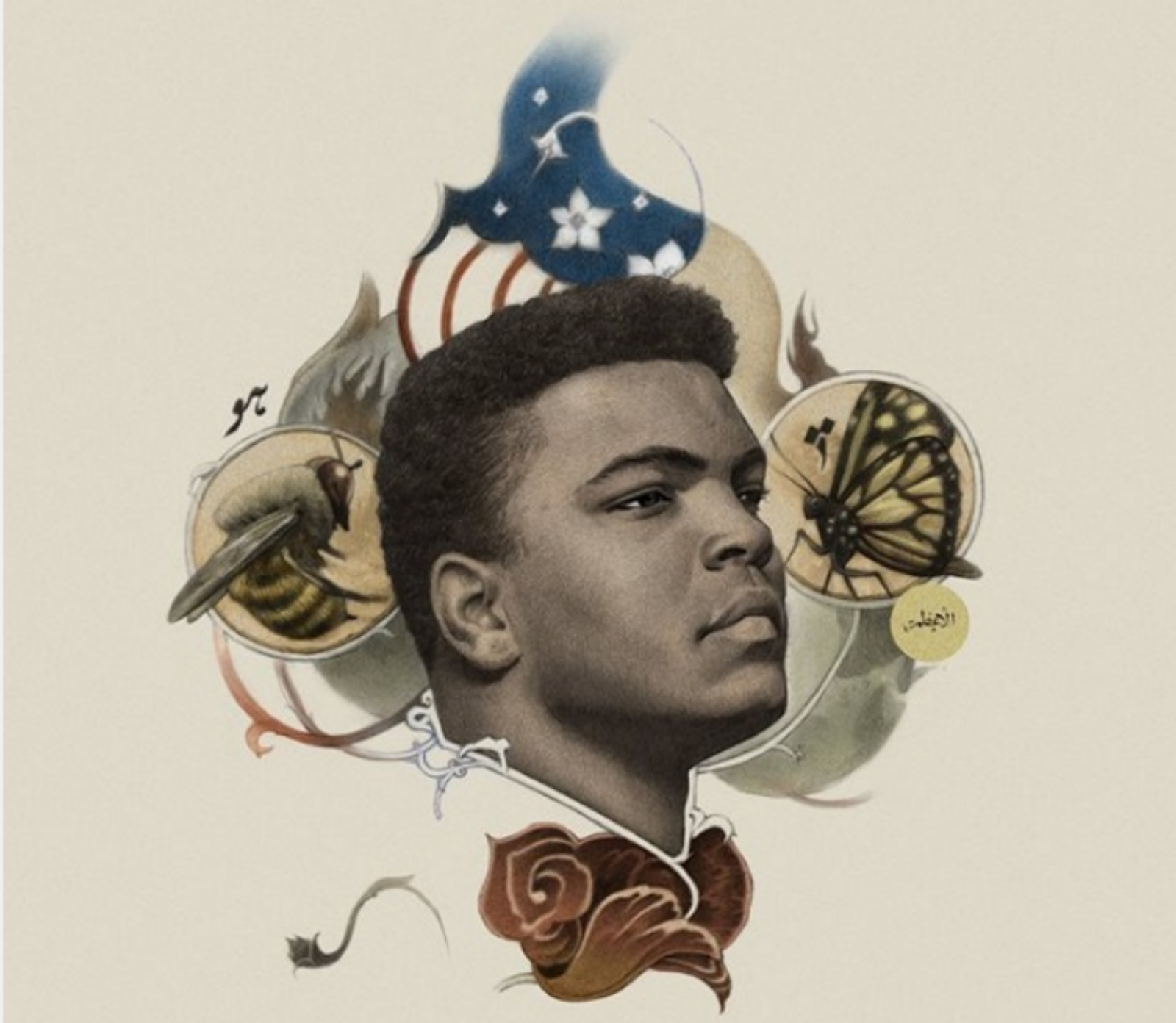

Egyptian visual artist Muhammad Mustafa was named as one of 2018’s 200 best illustrators worldwide by Lürzer’s Archive magazine,Nile FM reports. Also known as Oracle Ostraca, Mustafa was selected for four of his illustrations, including “American Muslim,” which features professional boxer and activist Mohamed Ali. His other illustration, made for a novel by Essam Mansour titled “The Journey of the Samovar,” was also selected by Spectrum 25: The Best in Contemporary Fantastic Art as one of the year’s best artworks.

Egypt in the News

When not discussing Mohamed Salah’s performance last night in the Champions League, the foreign press honed in on Cyprus returning 14 ancient artifacts smuggled out of Egypt in the late 1980s, the Antiquities Ministry said in a statement. The Director of the Cypriot Department of Antiquities, Marina Solomidou, handed over over the smuggled pieces to the Egyptian authorities after they were seized in Nicosia. Interpol had informed Egypt of the objects’ seizure in 2017, the ministry said, adding that it ultimately succeeded "through diplomatic and legal efforts" to prove its ownership of these artefacts. AFP and Xinhua also have coverage.

Palestinian President Mahmoud Abbas has said he rejected an offer by deposed president Mohamed Morsi to settle Palestinians in part of Sinai, Al Arabiya English reports. The offer, discussed by Hamas and Israel years ago, was “an Israeli project dubbed Giora Eiland and aims to completely put an end to the Palestinian cause,” he said while addressing the Palestinian National Council in Ramallah. The Israeli plan would have taken 1,000 km from Sinai, making Gaza three times larger than its current area of 365 sqkm, says military expert Major-General Hussam Soueilam. In return, Egypt would be compensated with an equal area from Israeli lands southwest of Negev.

Anti-poverty NGO Global Citizen has cut ties with communications consultancy APCO Worldwide because of the latter’s work with the Egyptian government, PR Week reports. The news propmpted an APCO spokesperson to note that the company no longer represents Egypt: “Our work in supporting the US-Egypt partnership was contracted through the recent Egyptian election and we have concluded our work.”

Other stories on Egypt in the foreign press worth noting:

- The US sees greater benefit in embracing Egypt’s leadership rather than berating it over human rights concerns, Doug Bandow writes for National Interest.

- Formerly jailed Al Jazeera English journalists Peter Greste, Mohamed Fahmy, and Baher Mohamed stand in solidarity with journalists imprisoned in Turkey, they tell Amnesty International.

- NDTV takes a look at Egypt’s women’s flag football league, which has grown to include eight clubs since its establishment in 2016.

Diplomacy + Foreign Trade

Foreign Minister Sameh Shoukry is heading to Juba today to attend a meeting of the South Sudan Liberation Movement’s (SPLM) National Liberation Council, according to a ministry statement. The invitation was extended to African leaders who are guarantors of the Arusha accord for the movement’s reunification, and ending the civil war in South Sudan, the statement read.

Iraq is considering opening a permanent Egyptian trade office in Baghdad following a request by Egypt, Iraqi Ambassador to Cairo Habib Al Sadr announced, according to Al Ahram.

Energy

Expect delays in the in management, maintenance tender for Siemens plants

The Egyptian Electricity Holding Company (EEHC) wants to amend the tender to or the day-to-day management and maintenance of the three Siemens combined-cycle power plants. The EEHC is reportedly looking to ensure that smaller companies bidding on the tender have financial backing from a bank. The EEHC also wants the offers presented to be the opening position for further negotiations in order to obtain better terms, sources said. The EEHC has shortlisted four out of seven companies and consortia, including Siemens, an Orascom-ADERA Energy consortium, an Elsewedy-EDF consortium, a STEAG GmbH-PGESCo consortium, a Triangle-GD France consortium, Korea’s Doosan, and Japan’s Mitsubishi. The ministry was supposed to select the winning companies this month. The three fully-commissioned plants are also expected to be inaugurated next month with a combined production output of 14.4 GW.

Basic Materials + Commodities

Gov’t increases rice cultivation area by 100k feddans but only using treated wastewater

The Irrigation and Agriculture Ministries have agreed to increase the area allocated for growing rice by 100k feddans this season, but only if the expanse is irrigated with treated wastewater, senior Irrigation Ministry officials tell Al Shorouk. The decision brings the total area of rice cultivation to 824k feddans, he adds. This comes as the government clamps down on the cultivation of water-intensive crops through the recently-passed amendments to the Agriculture Act.

Manufacturing

Damietta Furniture City to issue phase two tenders in June

The Damietta Furniture City will issue land and factory tenders for phase two of the project in June, according to Governor Ismail Taha. The tenders for 620k sqm of land and over 1,400 workshops were scheduled to be issued in April, but had to be postponed due to delays in infrastructure work, which should be completed this month, he adds. The furniture manufacturing complex will include hotels, shopping malls, hospitals, and other services.

Tourism

Thomas Cook resumes Bristol flight to Hurghada

The first Thomas Cook flight from Hurghada to Bristol took off on Monday with over 200 passengers on board, according to the UK embassy in Cairo. “We have increased the number of seats on sale to Egypt by 14 per cent across the UK this year, flying to both Hurghada and Marsa Alam,” said the company’s Chief Airlines Officer Christoph Debus. Thomas Cook had announced last week that it had sold 89% more holidays packages to Egypt so far this year compared to 2017.

Other Business News of Note

Sameem Capital sues to reshape Prime Holding’s board and take control

Sameem Capital has filed a lawsuit to disband Prime Holding’s current board of directors and be represented on the newly formed board, said Sameem CEO Khaled Rashed. Sameem, which raised its stake in Prime Holdings to 27%, claims that Prime is not being managed effectively and could have achieved greater profits had its board done a better job. Rashed points to specific policies such as Prime only investing EGP 70 mn out of its total capital of EGP 600 mn, as well as backing away from various M&A opportunities.

Egypt Politics + Economics

Al Wafd’s Abu Shoka looks to create its own parliamentary coalition

Al Wafd Party head Bahaa El Din Abu Shoka is moving towards creating a parliamentary coalition by bringing together independent MPs and those in smaller parties, he tells Al Masry Al Youm. Abu Shoka has reportedly also approached MPs who are part of Parliament’s majority bloc, the Support Egypt coalition. Members of Al Wafd are opposing Abu Shoka’s plan, saying they see greater value in focusing on improving the internal politics of the party and increase its political activity, according to the newspaper.

On Your Way Out

Innoventures and ASRT launch Startup Reactor in Suez: Egyptian venture capital firm Innoventures has partnered with Suez University and the Academy of Scientific Research and Technology (ASRT) to launch Startup Reactor in Suez, Innoventures announced in a press release (pdf). The six-month entrepreneurship program, which is part of ASRT’s nationwide startup incubation program INTILAC, aims to “foster and accelerate innovative startups with high growth potential in emerging tech industries.” The first round of Startup Reactor in Suez will launch in July 2018. Information on how to join is available here.

The Market Yesterday

EGP / USD CBE market average: Buy 17.61 | Sell 17.71

EGP / USD at CIB: Buy 17.58 | Sell 17.68

EGP / USD at NBE: Buy 17.57 | Sell 17.67

EGX30 (Wednesday): 18,173 (-0.7%)

Turnover: EGP 1.4 bn (22% ABOVE the 90-day average)

EGX 30 year-to-date: +21.0%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.7%. CIB, the index heaviest constituent ended up 0.9%. EGX30’s top performing constituents were Orascom Construction up 5.2%, Egypt Aluminum up 4.7%, and Abu Dhabi Islamic Bank up 1.7%. Yesterday’s worst performing stocks were Heliopolis Housing down 4.0%, TMG Holding down 3.2%, and Global Telecom down 3.1%. The market turnover was EGP 1.4 bn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +31.6 mn

Regional: Net Long | EGP +34.3 mn

Domestic: Net Short | EGP -65.9 mn

Retail: 59.8% of total trades | 58.3% of buyers | 61.4% of sellers

Institutions: 40.2% of total trades | 41.7% of buyers | 38.6% of sellers

Foreign: 28.2% of total | 29.4% of buyers | 27.1% of sellers

Regional: 10.3% of total | 11.5% of buyers | 9.0% of sellers

Domestic: 61.5% of total | 59.1% of buyers | 63.8% of sellers

WTI: USD 67.92 (-0.01%)

Brent: USD 73.30 (-0.08%)

Natural Gas (Nymex, futures prices) USD 2.76 MMBtu, (+0.15%, June 2018 contract)

Gold: USD 1,310.40 / troy ounce (+0.37%)

TASI: 8,098.75 (-0.73%) (YTD: +12.7%)

ADX: 4,634.97 (-0.82%) (YTD: +5.38%)

DFM: 3,002.96 (-0.92%) (YTD: -10.89%)

KSE Premier Market: 4,778.38 (-0.06%)

QE: 8,953.40 (-0.68%) (YTD: +5.05%)

MSM: 4,730.83 (-0.01%) (YTD: -7.23%)

BB: 1,261.12 (+0.26%) (YTD: -5.30%)

Calendar

02-03 May (Wednesday-Thursday): Cisco Connect Egypt 2018, Nile Ritz-Carlton Hotel, Cairo.

03 May (Thursday): Egypt’s Emirates NBD PMI reading for April released.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

05-06 May (Saturday-Sunday): Inclusive Growth and Job Creation Conference, venue TBD, Cairo.

07 May (Monday): American Chambers of Commerce (AmCham) will be holding its fifth annual HR Day at the Four Seasons Nile Plaza, Plaza Ballroom.

08 May (Tuesday): The Egyptian embassy in London will be hosting a “Made in Egypt” gala exhibit event.

07 May (Monday): International Data Corporation’s CIO Summit, The Nile Ritz-Carlton Hotel, Cairo.

07-08 May (Monday-Tuesday): Fourth annual Egypt CSR Forum, InterContinental Semiramis Hotel, Cairo.

17 May (Thursday): Expected date for the start of Ramadan.

17 May (Thursday): CBE’s Monetary Policy Committee meeting.

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

28 June (Thursday): CBE’s Monetary Policy Committee meeting.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.