- MP leaks new details of next state budget on Twitter. (Speed Round)

- Does Mostafa Madbouly hitting the road to KSA suggest he’s a candidate to become the next prime minister? Amr Adib thinks so. (Last Night’s Talk Shows)

- A banking sector meltdown in Bangladesh could be good news for garment makers in Egypt. (What We’re Tracking Today)

- Central Bank could slash interest rates another 100 bps next month despite upcoming subsidy cuts -Badr. (Speed Round)

- M&A WATCH- OTMT backs out of Inertia acquisition after talks falter. (Speed Round)

- FRA to complete draft of Insurance Act by month’s end, expects to see it out in 2H2018

- Proposed food cart act gets preliminary approval from House. (Speed Round)

- Egyptian photographer wins World Press Photo award for ‘Banned Beauty’ project. (Image of the Day)

- The Market Yesterday

Monday, 16 April 2018

Budget details leak on Twitter

TL;DR

What We’re Tracking Today

Finance Minister Amr El Garhy will be in Washington, DC, today for the IMF and World Bank’s Spring Meetings, which will wrap on 22 April. Investment Minister Sahar Nasr and Central Bank Governor Tarek Amer are also attending. You can check out the landing page for the spring meetings here.

Does a US support for a World Bank capital mean more financing down the line for Egypt? The US administration is set to support an imminent USD 13 bn capital increase at the World Bank. Treasury Secretary Steven Mnuchin is expected to announce the news during the week’s spring meetings, sources told the FT. US government officials have been tight-lipped as the administration had “expressed reservations about World Bank lending to China and other middle-income countries at last October’s annual meetings,” which made it “wary of the plans for a capital increase.” World Bank Group Executive Director and Executive Board Dean Merza Hasan had said last month, during AmCham’s 2018 Doorknock mission to Washington, that Egypt could be looking at a financing package of over USD 1 bn this year if the Bank was able to up its capital.

Mideast markets were unaffected by airstrike carried out by the US, UK, and France against Syria on Saturday, analysts tell Bloomberg. EFG Hermes Research’s Mohamad Al Hajj says that geopolitical disputes are of little consequence to most Middle East investors. “Specifically in the MENA, political risk has always been there… But if we look at returns since the Arab spring, for example, banks like CIB in Egypt have delivered returns better than emerging markets. The leading companies in the GCC delivered returns better than emerging markets.” Regional equities rose yesterday, the business information service noted, with the Tadawul gaining 1.9% after a tough week last week and the DFM up 1.8%. The piece notes that in Egypt, SODIC shares rose by as much 4.3% and have “gained 11% in the past three sessions as it announced it was starting talks with MNHD” over a potential merger or acquisition.

A looming bank crisis in Bangladesh is an opportunity for Egyptian garment manufacturers. That’s our takeaway from a Financial Times piece this morning that suggests banks “in the south Asian nation face a credit crunch following mass deposit withdrawals in March and soaring levels of non-performing loans. Analysts and investors fear a full-blown crisis could spill over into Bangladesh’s strongest link to the global economy — the production of textiles and ready-made garments for fast fashion brands and retailers such as H&M, American Eagle Outfitters, Zara, Walmart and Target.” Bangladesh is the world’s second-largest RMG exporter after China. We get that exports are hard, but the opportunities, friends, is simply too large to ignore across multiple industries.

Making sense of the end of the world, Part I: With increasing volatility in equity markets, fears of a global trade war sparked by China and the US, and a rising tide of nationalism on just about every continent, it’s become vogue to speculate about how the coming global meltdown will play out. An emerging consensus suggests that it may not be as painful as the Chicken Littles would have had us believe. Wall Street economists are sticking to their forecasts of global growth at about 4% this year, Bloomberg reports, suggesting that “global growth is cresting, not collapsing.” (The story has money quotes from just about every major global sell-side house stacked one after the other — definitely worth reading.)

(The update to banks’ growth forecasts comes as the IMF prepares to release tomorrow its semi-annual update of its global economic outlook.)

Part II: The end of the nine-year-old bull market shouldn’t be agony, Morgan Stanley’s US equity strategists suggest. While it’s natural to “want to sell everything” when you remember the corrections of 2008-09 or 2000-02, the bank says, “we envision a 1-2-year consolidation with 10-20% price swings and concentrated pain in certain sectors that are either overbought, expensive or fundamentally challenged. This will not be the wipe-out scenario that some of the perma-bears out there have been warning about for the past eight years."

Part III: Are we headed for USD 80 oil? “Brent oil could spike to $80 a barrel if the U.S. and European Union reimpose sanctions on Iran and as Western powers expand the scope of the Syrian civil war, JPMorgan strategists,” Bloomberg reports.

Also making headlines this morning in the global business and finance press:

Where were the lawyers? Martin Sorrell’s resignation as chief of WPP, the world’s largest ads group, may mean “the end of the Mad Men era,” but guess what? Dude apparently hasn’t got a non-compete and his partisans have left the WSJ reporting that “left because of exasperation with the handling of the prive, not because he was worried about its details becoming public.” Is it the start of a final act for the 73-year-old?

Longtime readers will know we’re a sucker for this story from the headline alone: Bringing blockchain to the coffee cup. (WSJ)

Readers of a certain age will doubtless share our feeling that an era is closing as Barbara Bush, the wife of former president George H.W. Bush (the “good” Bush president) is reportedly in “failing health” and has decided to no longer seek medical treatment.

The war of words between former FBI Director James Comey and US President Donald Trump has deepened as Come calls Trump “morally unfit to be president.”

What We’re Tracking This Week

Our friends at AmCham are hosting a breakfast meeting and visit to the National Museum of Egyptian Civilization in Fostat on Thursday. The visit will include an exclusive viewing of the newly inaugurated exhibition hall: “Egyptian Crafts through the Ages.” Speakers will include Antiquities Minister Khaled El Anany and Mostafa Waziry, the director-general of the Supreme Council of Antiquities. Members and their guests can register here.

On The Horizon

Egypt calls for fresh round of GERD talks next week: Egypt has invited Sudan and Ethiopia to another round of negotiations over the Grand Ethiopian Renaissance Dam (GERD) in Cairo on 20 April.

The Egyptian-Sudanese Business Council will hold its first meeting on Saturday 21 April. The Council hopes to use cross-border business ties to help smooth over a recovering but strained diplomatic relationship between the two countries. The inaugural meeting of will look at obstacles to trade (we imagine Sudan’s boycott of Egyptian goods being one of them) and projects that will help move trade relations forward.

The seventh edition of the El Gouna International Squash Open will take place on 20-27 April in the Red Sea resort town of El Gouna. “This year’s tournament features a women’s World Series tournament alongside the men’s event for the first time in history,” according to the event’s website. Winners of each tournament will take home up to USD 165k each. Qualifying rounds will take place on 18-19 April at the El Gouna Squash Complex.

A French business delegation is scheduled to visit Cairo on 22 April to look into investment options in the agriculture, infrastructure, oil and gas, and electronic waste recycling sectors, Al Masry Al Youm reports.

Pride Capital to host workshop on financing small merchants next week: Pharos-affiliated Pride Capital, Egypt’s first fintech-focused accelerator, is hosting a workshop titled “Financing Small Merchants” on Monday, 23 April at the Greek Campus. The workshop will feature a discussion with Tamweely Chairman Amr Abu Elazm, former Financial Regulatory Authority Chairman Sherif Samy, and Fawry CEO Ashraf Sabry. Tap or click here to register for a spot in the workshop. You can also check out the workshop’s Facebook page for more information on the event or Pride Capital’s LinkedIn page for more on the accelerator.

French President Emmanuel Macron will also reportedly visit Egypt in early May for talks with President Abdel Fattah El Sisi on bilateral relations and regional issues, according to Foreign Ministry sources.

Enterprise+: Last Night’s Talk Shows

The talking heads hovered last night between heavy econ and political stories, with the top concern being the FY2018-19 budget, the debate on which formally opened at the House of Representatives yesterday.

Skimming through the highlights of the budget, Hona Al Asema’s Lamees Al Hadidi wondered whether Egyptian debt will be globally attractive with the budget expecting yields to fall to around 14.7%. She joined a number of MPs in calling for further clarification of the issue and seemed particularly keen on the 43% increase in government investment in the new budget — and asked when expected fuel subsidy cuts will come (watch, runtime: 6:11).

She delved further into the subsidy cuts with businessman Hany Tawfik who found the 19% cut on fuel subsidy spending to EGP 89 bn to be reasonable. He objected, however, to nearly halving electricity subsidies to EGP 16 bn. He expects the CBE will cut interest rates 100 bps next month, but that these would either remain stable or possibly even rise again as a result of the resulting inflation. He also called for a more efficient tax system that he said would help offset the subsidy budget. Tawfik added that continued regional instability could spook the carry trade (watch, runtime: 8:34).

Speaking of regional instability, the Arab League Summit got substantial coverage across the airwaves. The general consensus was that these were just another set of pointless meetings that achieved nothing. Both Lamees and Al Hayah Al Youm’s Khaled Abu Bakr extolled President Abdel Fattah El Sisi’s speech saying it was the “boldest” of all (watch, runtime: 56:57). Kol Youm’s Amr Adib rambled on about an “Arab Eurozone.”

Adib also zeroed in on the presence of Housing Minister Mostafa Madbouly at the summit, which he suggested either means that Madbouly was there to discuss potential development projects or that he in the running for a big political promotion (watch, runtime: 39:52). Madbouly has been touted as a potential prime minister amid expectations President Abdel Fattah El Sisi will soon announce a cabinet shuffle. On Masaa DMC, Eman Al Hossary spoke to Arab League Assistant Secretary General Hossam Zaki on how the summit addressed the developments in Syria (through the usual condemnations) (watch, runtime: 5:47).

For some reason, the issue of merging political parties is still being discussed, and of all people by Lamees (we expected this from Amr, frankly). House spokesman Salah Hassaballah through cold water on the talks, saying that there were no draft laws on this and that these are just ideas under discussion (watch, runtime: 3:46).

Local farmers are griping with the EGP 600 per ardib price for wheat set out this harvest season and have taken to the airwaves to voice their complaints. Farmer’s Syndicate head Hussein Abu Saddam called in to say the Supply Ministry’s price is “acceptable.” Supply Ministry spokesman Mamdouh Ramadan defended the decision, saying that the farmers bottom line under this price is fair and in line with the current economic and global market conditions (watch, runtime: 8:10).

Speed Round

BUDGET WATCH- House budget debate leaks to Twitter overnight: Previously unreleased figures for the FY2018-19 budget, including details on subsidy cuts and health and education spending, were posted to Twitter overnight courtesy of House of Representative Budget Committee member MP Heytham El Hariri. The numbers El Hariri tweeted vary widely in places from those noted prior in earlier media reports and official statements. The figures appear to be from a summary copy of the budget that the Ismail Cabinet sent to the House. Overall spending on subsidies and welfare will reach EGP 332.29 bn, with total subsidy spending alone falling 3.8% y-o-y to EGP 213.76 bn. Other key figures highlighted in the release include:

- Fuel subsidies: The government is cutting fuel subsidies 19.1% to EGP 89.08 bn. Reuters had said last week in a report on subsidy cuts that fuel subsidy costs would be cut 26%.

- Electricity subsidies: These would be cut by 46.6% to EGP 16 bn next fiscal year.

- Commodity subsidies: Spending on commodity subsidies is expected to grow a whopping 36.6% in FY2018-19 to EGP 86.18 bn, far greater than the 5% reported by Reuters.

- Export subsidies: Spending on export subsidies will grow a substantial 53.8% to EGP 4 bn.

- Welfare spending: Overall spending on social welfare will fall 0.5% to EGP 298.94 bn, with public sector wages growing marginally to EGP 2.06 bn.

- Health and Education spending: The budget for healthcare will grow 12.5% y-o-y to EGP 61.81 bn, while spending on education will grow 8% to EGP 115.66 bn in FY2018-19.

- Debt service will jump 42% y-o-y next fiscal year to EGP 541.31 bn.

Meanwhile: The government sees revenues from tax collections rising 23.4% y-o-y in FY2018-19 to the equivalent of14.7% of GDP,Finance Minister Amr El Garhy told the House of Representatives on Sunday, according to Al Mal. A pre-budget report released late last week had suggested that tax receipts are projected to contribute EGP 770.3 bn to total state revenues of EGP 989.2 bn in FY2018-19, as the government seeks to expand its tax base, mainly through financial inclusion initiatives that aim to encourage SMEs to join the formal economy. We noted yesterday that the new budget sees inflation dropping to lows of 10%, GDP growing at 5.8%, and the budget deficit narrowing to 8.4%.

The fear in the business community, naturally, is that it is easier for lower-level bureaucrats with significant tax-collection targets to put the squeeze on current taxpayers than it is to broaden the tax base by giving the informal economy incentives to go legit.

The government is also focused on rationalizing spending and reducing its debt levels, according to El Garhy, who said that the new fiscal year will see unutilized state assets and resources put to work, which should help the government achieve its target primary budget surplus of 2%. El Garhy was joined by Planning Minister Hala El Said in briefing MPs as the House budget debates officially kicked off yesterday.Parliament Speaker Ali Abdel Aal referred the FY2018-19 state budget to the House Budget Committee.

Early reactions to the budget in House appear mixed. El Hariri had been the most vocal critic on the Budget Committee — not surprising, since he is a member of the House Club of Trolls otherwise known as the 25-30 Coalition. He criticized heavy spending on debt service, which came at the expense of outlays on health and education, according to Al Mal. El Hariri appears to not like inflows of USD, as he also criticized increases in export subsidies spending. How he made on that committee, we don’t know. House Economic Committee member Amr El Gohary called on ministers to explain how the government plans to reduce public debt, and how it plans to reduce unemployment beyond its stated sub-11% target.

Renaissance Capital MENA CEO Ahmed Badr believes Egypt’s central bank could slash interest rates by another 100 bps at its 17 May meeting despite expectations of inflation rising temporarily in July as the government further reduces energy subsidies.

Real estate stocks in favour? Interest rate cuts are shifting investor focus to real estate stocks, which Badr told Bloomberg TV is only natural. He warned, though, that Egypt’s real estate market is “overheated” and “fragmented … there’s too many developers now. That’s why I think consolidation in the market is something very important. We started seeing signs of it when Madinet Nasr Housing and Development might be considering a merger with SODIC.” Egypt stocks climbed the most in the Middle East last week on the back of cooling inflation levels cool, he noted .

On the regional equities fronts, strategic foreign investors have been moving to Egypt and Saudi Arabia and away from markets such as the UAE and Qatar on the back of their respective reform stories, says Badr. Saudi’s expected emerging market classification by the MSCI, which he calls a huge liquidity event, will continue to drive inflows there, especially as foreign ownership ratios there are small and have room to grow.

In terms of the regional bank space, Saudi is where you want to be, despite Qatar National Bank announcing that it can ride out the impacts of the blockade, Badr said. This primarily comes on the back of an expected emerging market classification by the MSCI and US interest rates moving up, he added. You can catch the full interview here (watch here, runtime: 5:45).

Badr’s remarks come as Renaissance Capital prepares to hold its third annual Egypt Investor Conference in Cape Town on 24-25 April. The event will see senior management from leading Egyptian companies meet one-on-one with South Africa-based investors.

M&A WATCH- OTMT and Inertia suspend acquisition talks: Orascom Telecom Media and Technology (OTMT) announced yesterday that it has decided to suspend negotiations for the acquisition of a 51% stake in real estate outfit Inertia for Engineering and Trading, after it failed to reach an agreement with the company. OTMT said it intends to continue pursuing other investment opportunities in the real estate sector. The company had said last month that it was two weeks away from finalizing the acquisition and was in the process of hammering out final details on the value of the transaction with Inertia. Matouk Bassiouny had been tapped as legal counsel for the sellside, while White & Case acted as OTMT’s legal counsel.

IPO WATCH- MG Developments is planning to list shares on the EGX by the end of 2019, marketing manager Aya El Shenawy tells Reuters’ Arabic service. El Shenawy did not disclose any further details on the expected size or value of the share sale.

LEGISLATION WATCH- FRA to complete draft of Insurance Act by month’s end, expects to see it out in 2H2018: The Financial Regulatory Authority’s (FRA) newly-formed board of directors is expected to sign off on the amended Insurance Act by the end of April, FRA deputy head Reda Abdel Moty said yesterday, Al Mal reports. The committee drafting the bill is set to meet this week to finalize its work before passing the bill over to the board and then putting it up for “national dialogue.” The Investment Ministry and Ismail Cabinet would then revise the bill before handing it over to the House of Representatives to be issued some time in the second half of 2018, Abdel Moty said. In addition to providing incentives for insurance companies to cover SMEs, the Insurance Act is expected to give the FRA regulatory control over the sector, once it comes in effect, allowing it to govern everything from the establishing and licensing of companies, to setting industry standards and practices.

On a related note, the FRA says it has completed a draft of the regulations that will set up and govern a policyholder protection fund, according to Al Mal. The fund’s primary goal will be to protect beneficiaries against any potential insolvencies that insurance companies may face. The fund, which will be under FRA oversight, will have an independent budget and will require licensed insurance companies to pay a periodic subscription fee. The board of directors will also have authority to accept or reject any grants or contributions to the fund, as well as invest proceeds according to an annual plan.

LEGISLATION WATCH- The House of Representatives has given preliminary approval of a Food Cart Act that would regulate the sale of street food nationwide. Lawmakers are positioning the bill as part of a pro-SME drive, a report from Al Mal suggests. The legislation, proposed by Rep. Mohamed Ali Youssef, includes 17 clauses regulating permits, equipment, location, fees, and food safety standards. Food cart owners will pay an annual fee of no more than EGP 5,000 for a three-year, renewable permit. Vendors would also be exempt from paying taxes in the first three-year period. Governors or and local district bosses would still have the right to zone areas for food carts and restrict their operation in front of licensed restaurants that sell the same type of food or drink.

Also yesterday:

- Tax code changes: MPs voted to give individual taxpayers a 60-day window after submitting their initial tax forms to file any remaining necessary documents, Al Shorouk reports. The move is meant to reduce the rate of incomplete tax declarations filed by taxpayers with sources of income outside their primary employment.

- Ikhwan assets bill: A new committee of judges will regulate the freezing and seizure of Ikwan-related assets if a bill moving through committee is approved.

- State of emergency: The House General Assembly approved extending the state of emergency for an additional three months. Prime Minister Sherif Ismail said the extension is necessary to establish stability in Egypt, Youm7 reports. President Abdel Fattah El Sisi had signed off on the extension on Saturday.

Gov’t pledges EGP 275 bn for Sinai development over four years: Yesterday also saw Prime Minister Sherif Ismail deliver a speech to the House on the government’s spending plans to develop Sinai, which he says will cost EGP 275 bn over the coming four years. These would be financed by both the state and through loans from international and regional finance institutions. Investment Minister Sahar Nasr had signed a USD 100 mn loan from the Kuwait Fund for Arab Economic Development (KFAED) to complete the financing of five water desalination plants in South Sinai, while the Ismail Cabinet signed off on USD 258.5 mn in funding from KFAED for North Sinai last week. The Arab Fund for Economic and Social Development had pledged three grants of USD 2.8 in total to support development projects in Sinai.

This comes as Ismail issued a directive to establish a freezone in Nuweiba, Al Masry Al Youm reports. The General Authority for Freezones and Investors (GAFI) will finance the infrastructure development and construction of the 1 mn sqm zone. The freezone is part of the government’s Sinai development strategy, which relies significantly on attracting local and Arab investors to the peninsula to spur growth, Investment Minister Sahar Nasr told reporters last month after the Cabinet approved the project.

The race to develop Saudi cinemas is on, with MAF looking to take a chunk of the market: Mall developer Majid Al Futtaim (MAF) is hoping to land a license to build and operate cinemas soon, and plans 600 Vox Cinemas screens over the coming decade. “It could be a big opportunity, subject to content regulations and real estate partners who are able to provide us locations,” CEO of MAF Ventures Ahmed Ismail tells the National. If granted, MAF will be competing with US-based AMC, which plans to open the first theatre in the kingdom, which will start with a screening of Black Panther on 18 April. AMC plans to build another 40 cinemas in the country over the next five years. Saudi Crown Prince Mohamed Bin Salman had made Hollywood a stop on his US tour. KSA expects its nascent cinema industry will grow to over USD 1 bn by 2030.

As for Egypt, MAF sees the country as its fastest-growing market this year, where it has seen performance “improve significantly” and expects to grow ahead of the inflation rate, Ismail said.

Image of the Day

Egyptian photographer Heba Khamis has won first prize in the contemporary issues section of the 2018 World Press Photo competition for her “Banned Beauty” project, becoming the third Egyptian photographer to win the award. Khamis’ project captures images of Cameroon’s young girls who are subjected to “breast ironing,” a traditional practice that involves “massaging or pressing the breasts of pubescent girls in order to suppress or reverse breast development.” The practice is carried out in hopes to delay maturity and prevent rape.

Egypt in the News

On an exceptionally quiet news day for Egypt in the international press, we wonder: Does anyone other than WaPo remember Smurf Islands? The Washington Post is really scraping to the bottom of the barrel to portray Egypt as unstable by marking the second anniversary of the “massive” protests over Tiran and Sanafir. Writing for the Monkey Cage blog, Janis Grimm appears to be crossing her fingers in hope that it may happen again.

On Deadline

The nation’s columnists don’t expect much from the ongoing Arab League Summit in Saudi Arabia. Al Masry Al Youm’s Mohamed Amin says the “pre-packaged” gathering was doomed to fail before it even began, while Ahram Gate’s Mohamed El Shazly isn’t holding his breath for results, saying that the Arab Summit has not made a real decision in 20 years.

Worth Watching

A coffee shop in Alexandria has become a popular with deaf and mute customers, Al Jazeera English reports. “The waiters and customers communicate through their own version of sign language.” They can be seen using a set of different hand gestures to order tea, coffee, hot chocolate, or yoghurt drinks. It takes a while for customers to be comfortable and trust the other goers or the waiters, the staff say, but once they do, “they keep coming back.”

Diplomacy + Foreign Trade

El Sisi reaffirms the need for political resolution to regional crises: President Abdel Fattah El Sisi stressed the need to resolve the conflicts in Palestine, Syria, Yemen, and Libya through political channels to restore stability to the Middle East, according to an Ittihadiya statement. El Sisi said that Arab countries are facing the "most serious crisis since their independence," accusing regional states of working hard to establish spheres of influence within other states and foreign armies occupying Arab countries (an obvious allusion to Turkey and Iran). He reaffirmed Egypt’s rejection of the US recognizing Jerusalem as Israel’s capital and urged quick action to resolve the Palestinian-Israeli conflict. He also renewed calls for the establishment of a pan-Arab security force or mechanism to create a united front against terrorism and external aggression.

Arab leaders called yesterday for an international investigation into the “criminal use “of chemical weapons in Syria, Reuters reports.

A delegation from the Visegrad Group visited the Suez Canal Economic Zone (SCZone) yesterday to discuss investment opportunities, according to a Trade Ministry statement. President Abdel Fattah El Sisi visited Hungary last year for the Visegrád Group-Egypt Summit, where he discussed cooperation on combating terrorism and illegal immigration and energy security with the four countries of the Group: Hungary, Poland, Slovakia, and the Czech Republic.

Energy

EEHC to reach final agreement on Al Nowais’ Oyoun Mousa coal plant by June

The Egyptian Electricity Holding Company (EEHC) is expected to reach a final agreement with the UAE’s Al Nowais for its USD 4 bn “clean coal” power station in Oyoun Mousa by June, an EEHC source said, Al Mal reports. The two sides are still negotiating the feed-in tariff rate for the project, which will likely be set at USD 0.045 per kWh. The company’s proposed tariff ranges from USD 0.058-0.067 per kWh, officials had previously said. According to the EEHC source, Al Nowais is expected to accept the lower tariff in exchange for certain “benefits,” the nature of which he didn’t specify.

Basic Materials + Commodities

Gov’t makes final preparations before wheat harvest season

The government is making final preparations for the start of this wheat harvest season, which begins this week and runs until July, Al Mal reports. The Supply Ministry is readying logistics and silo networks across the country. This government set this year’s prices for purchasing local wheat at EGP 600 per ardib to the dismay of local farmers. The ministry is expecting to purchase over 4 mn tonnes of local wheat this year.

Tourism

British, German summer bookings to Egypt through Thomas Cook up 40% y-o-y

Thomas Cook’s summer bookings for Egypt from the UK and Germany are up 40% y-o-y, the company’s agent, Blue Sky Chairman Moudy El Shaer tells Al Mal. Tourism portal FVW had previously announced that Egypt is one of a few top Eastern Mediterranean destinations for the upcoming summer season among German tour operators. Germans topped the list of tourist arrivals in 2017 with 1.23 mn tourists.

Telecoms + ICT

Appeals court overturns 2016 ruling awarding Orange Egypt EGP 500 mn from Etisalat Misr

An appellate court has overturned a 2016 ruling compelling Etisalat Misr to pay Orange Egypt EGP 500 mn in arbitration relating to a dispute over interconnection fees. The initial ruling, which had awarded Orange EGP 285.19 mn, in addition to fines and arbitration costs, did not take into consideration that the National Telecommunications Regulatory Authority had set the interconnection fees and that Etisalat had implemented the authority’s decision.

Other Business News of Note

L’Oréal targets producing 80 mn packs of makeup in 2018

L’Oréal Egypt is targeting producing 80 mn packs of makeup and other cosmetics for local distribution and exports to North Africa and the Middle East this year, up from 75 mn last year, country managing director Benoit Julia said.

Egypt Politics + Economics

Court clears Ahmed Ezz of final corruption case following reconciliation

A Cairo Criminal Court has cleared steel tycoon Ahmed Ezz of the final corruption case — the alleged squandering public funds from the Dekheila Steel company case, which saw Ezz and three others reach a EGP 1.7 bn settlement agreement with the government, Egypt Independent reports.

National Security

Cassation Court upholds death sentence against 4 Ikhwanis for planning attacks

The Court of Cassation, Egypt’s highest appeals court, upheld yesterday the death sentence against four Ikhwan members for plotting attacks against security forces, the Associated Press reports. The court upheld 15-year imprisonment sentences for 14 other defendants on the same charges. The verdict is final.

Sports

Goalkeeper Ahmed El Shenawy bows out of World Cup due to ACL injury

Zamalek football club goalkeeper Ahmed El Shenawy has sustained an anterior cruciate ligament injury and will not be able to play in the World Cup this year, the national team’s doctor Mohamed Abu El Ela tells the BBC. “El Shenawy, 26, was a key part of Egypt head coach Hector Cuper’s World Cup plans, and the news comes as a big blow to both the country and the player.” El Shenawy’s injury now clears the way for 46-year-old Essam El Hadary to be the national team’s main goalkeeper at the championship.

On Your Way Out

More than 200 art pieces produced under multiple Islamic empires, including 14th-century Egypt, are being auctioned by New York firm Sotheby’s, according to Forbes Middle East. Among the pieces being sold is a Mamluk silver-inlaid cast brass bowl priced at USD 85,500-114,000. The exhibition kicks off on Friday as part of Orientalist and Middle Eastern week.

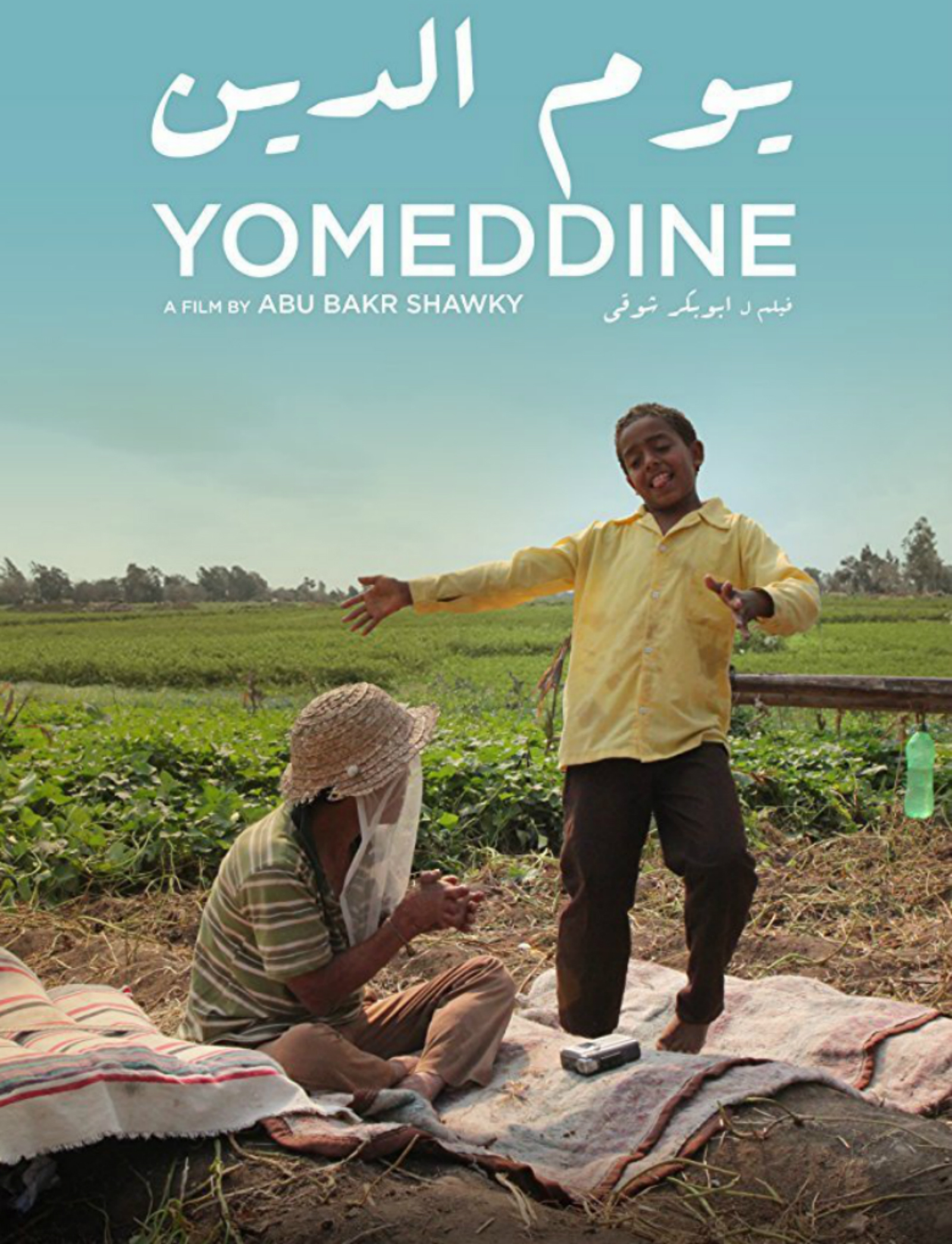

Egyptian independent film “Yomeddine” has been selected to participate in the official competition of the 71st Cannes Film Festival, which runs from 8 to 19 May, Egypt Today reports. Directed by first-time Egyptian-Austrian filmmaker Abu Bakr Shawky, the film tells the story of a leper who escaped from a leper colony with a friend to begin a road trip in search for his family. The story is based on real characters Shawky met at the Abu Zaabal Leper Colony while filming his award-winning documentary “The Colony,” according to the description he wrote for the Kickstarter campaign.

The Market Yesterday

EGP / USD CBE market average: Buy 17.63 | Sell 17.73

EGP / USD at CIB: Buy 17.63 | Sell 17.73

EGP / USD at NBE: Buy 17.57 | Sell 17.67

EGX30 (Sunday): 17,589 (-0.2%)

Turnover: EGP 991 mn (13% BELOW the 90-day average)

EGX 30 year-to-date: +17.1%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 0.2%. CIB, the index heaviest constituent ended up 0.1%. EGX30’s top performing constituents were Telecom Egypt up 4.1%, Amer Group up 2.7%, and Orascom Telecom Media & Technology up 2.6%. Yesterday’s worst performing stocks were ACC down 2.8%, Egyptian Iron & Steel down 2.6%, and Pioneers Holding down 2.0%. The market turnover was EGP 991 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -484.6 mn

Regional: Net Long | EGP +237.8 mn

Domestic: Net Long | EGP +246.8 mn

Retail: 52.4% of total trades | 60.6% of buyers | 44.2% of sellers

Institutions: 47.6% of total trades | 39.4% of buyers | 55.8% of sellers

Foreign: 30.9% of total | 15.8% of buyers | 46.1% of sellers

Regional: 18.1% of total | 25.5% of buyers | 10.6% of sellers

Domestic: 51.0% of total | 58.7% of buyers | 43.3% of sellers

WTI: USD 66.90 (-0.73%)

Brent: USD 71.99 (-0.81%)

Natural Gas (Nymex, futures prices) USD 2.74 MMBtu, (+0.33%, May 2018 contract)

Gold: USD 1,346.20 / troy ounce (-0.13%)

TASI: 7,972.51 (+1.90%) (YTD: +10.33%)

ADX: 4,699.43 (+1.00%) (YTD: +6.84%)

DFM: 3,150.93 (+1.83%) (YTD: -6.50%)

KSE Weighted Index: 415.78 (+1.52%) (YTD: +3.58%)

QE: 8,891.89 (-0.30%) (YTD: +4.32%)

MSM: 4,776.55 (-0.27%) (YTD: -6.33%)

BB: 1,292.47 (+0.08%) (YTD: -2.95%)

Calendar

17-18 April (Tuesday-Wednesday): Creative Industry Summit, Four Seasons Nile Plaza Hotel, Cairo.

21 April (Saturday): The Egyptian-Sudanese Business Council will hold its first meeting here in Egypt.

24-25 April (Tuesday-Wednesday): Renaissance Capital’s 3rd Annual Egypt Investor Conference, Cape Town, South Africa.

25 April (Wednesday): Sinai Liberation Day, national holiday.

01 May (Tuesday): Labor Day, national holiday.

02-03 May (Wednesday-Thursday): Cisco Connect Egypt 2018, Nile Ritz-Carlton Hotel, Cairo.

03 May (Thursday): Egypt’s Emirates NBD PMI reading for April released.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

07 May (Monday): International Data Corporation’s CIO Summit, The Nile Ritz-Carlton Hotel, Cairo.

07-08 May (Monday-Tuesday): Fourth annual Egypt CSR Forum, InterContinental Semiramis Hotel, Cairo.

15 May (Tuesday): Expected date for the start of Ramadan (TBC).

17 May (Thursday): CBE’s Monetary Policy Committee meeting.

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

28 June (Thursday): CBE’s Monetary Policy Committee meeting.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

24-25 November (Monday-Tuesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.