- Fitch revises Egypt’s outlook to ‘positive,’ affirms rating at ‘B’; Moody’s sees accelerating GDP growth. (Speed Round)

- FRA boss expects amendments to Capital Markets Act to be issued in February, paving way for new financial instruments. (Speed Round)

- Will Ethiopian PM Desalegn arrive in Cairo today as planned? (What We’re Tracking Today)

- German consultants have yet to hand in report on Automotive Directive + It looks like Lexus is finally coming to Egypt. (Speed Round)

- Tourism Ministry abandons plan to stipulate minimum rates for hotels. (Speed Round)

- E-commerce platforms embrace regulation in Egypt? (Speed Round)

- Endowments Ministry says it is employing Professor X to weed out atheism. (Egypt Politics + Economics)

- BlackRock wants you to start paying attention to “societal impact” if you want it to invest. (What We’re Tracking Today)

- The Market Yesterday

Wednesday, 17 January 2018

Fitch, Moody’s growing positive on Egypt

TL;DR

What We’re Tracking Today

We’re on day two of EFG Hermes’ Egypt Day in Cairo. Yesterday saw President Abdel Fattah El Sisi meet with representatives (pdf) of 26 regional and international investment funds. Investors have already had sit-downs with Central Bank Governor Tarek Amer, Finance Minister Amr El Garhy and other members of cabinet. Fund and portfolio managers with aggregate AUM north of USD 10 tn will continue to meet with senior execs at major local companies today as the three-day conference wraps up.

CEOs of Egypt’s largest companies expect the economy to do well in 2018–and say they have seen an improvement in business conditions, according to EFG Hermes’ CEO Poll, which took place at the firm’s CEO dinner the night before last. “The majority (60.7%) of attendees also expect to hire more workers in 2018. Most attendees (54%) saw high interest rates as the biggest constraint facing investments in Egypt.” Most of the CEOs polled said they would invest in listed equities in 2018, followed by T-bills. Zohr is expected to have the biggest positive impact on the economy, followed by new FDI, and tourism. The government should prioritize education spending in the next 10 year, the respondents said overwhelmingly, eclipsing spending on infrastructure, healthcare, and security. Despite security spending being only seen a top priority by 7.7% of the respondents, the largest number of respondents see geopolitical risks and terrorism (50% combined) as the key risk facing the Egyptian economy in 2018. Tap here to read the full survey results.

Ethiopian Prime Minister Hailemariam Desalegn is expected to arrive in Egypt today for a three-day visit that has been postponed twice. The prime minister is scheduled to meet with President Abdel Fattah El Sisi, and the two leaders will participate tomorrow in the sixth session of the Higher Joint Egyptian-Ethiopian Committee, which began prep meetings yesterday, according to a Foreign Ministry statement. Pundits are watching to see whether the meeting will prove to be turning point in the stalled negotiations between Cairo and Addis Ababa over the Grand Ethiopian Renaissance Dam. Desalegn will also meet with House Speaker Ali Abdel Aal and members of the House African Affairs Committee, but will not address the House of Representatives as previously planned, parliamentary sources say, according to Ahram Gate.

The global (read: American) business community is talking about: The potential breakup of GE. The conglomerate suggested yesterday it is “looking aggressively” at spinoff for its power, healthcare and aviation units — the latter two of which are very active in our neck of the woods. The process, in fact, “could result in many, many different permutations, including separately traded assets really in any one of our units,” the company’s CEO said. The move comes after GE announced more than USD 11 bn in charges from its long-term care insurance portfolio and new US tax laws, the Financial Times reports. “Some Wall Street analysts saw Tuesday’s remarks as a sign that GE may already have figured out valuation, timing or disclosure requirements for a spin-off,” Reuters added.

So, this is a breakup? CNBC thinks say, and quotes sources that say it’s likely to come as early as this spring. But the New York Times’ DealBook column counters that while a spring announcement is probably in the cards, it is “unlikely that [CEO John] Flannery will be the one to break up the 125-year-old conglomerate. It’s more likely that Mr. Flannery and his team will consider unique ways of separating G.E.’s core business units without actually splitting them completely apart.” BloombergGadfly, meanwhile, sees that “reasons for keeping the industrial giant together look increasingly tenuous” and Reuters Breakingviews sees that “legacy losses reinforce the case for a breakup.” Are you paying attention, big media and tech companies? Look for the academic business literature to start mulling once more questions about whether there is a natural limit to the size of a corporation.

BlackRock wants you to start paying attention to “societal impact” if you want it to invest. “Lawrence Fink, the boss of the world’s largest money manager, told corporate chiefs to get ready for BlackRock to become a more assertive shareholder and called on them to better articulate how their organizations contribute to society,” the Wall Street Journal writes this morning.w

Also worth noting this morning:

- Saudi Arabia plans to announce up to USD 7 bn worth of renewable energy projects this year with a bias toward solar plants over wind.

- The Donald passed cognitive tests as part of his annual physical and is “fit for duty,” the presidential physician has announced, adding that the US president takes aspirin and meds to treat both cholesterol and hair loss. Oh, and he needs to lose 10-15 lbs.

- Keep a close eye in the weather forecast if you’re headed to the East coast of the US of A—another heavy winter storm is in the works.

And, finally, best piece to come out of the too-early passing of the Cranberries’ Dolores O’Riordan is this meditation on music, parenting and age by Shireen Ahmed for Canada’s Globe and Mail. O’Riordan passed away unexpectedly at the age of 46 on Monday, according to the BBC, while in London for a recording session with a heavy metal band. She was due to sing on the band’s cover of the Cranberries’ hit Zombie, spurred by an Irish Republican Army terror attack on the UK. Police have yet to release details of her death, but have said it was not suspicious. Watch the video for the original Zombie here (runtime: 5:15).

What We’re Tracking This Week

The Transport Ministry is days away from announcing new railway ticket prices, which are expected to rise by 20-25% over multiple stages.

On The Horizon

The IMF will issue a report on its second review of Egypt’s economic reform program within the coming few weeks, Egypt Mission Chief Subir Lall told Al Mal. The IMF’s executive board had agreed last month to disburse USD 2.03 bn of Egypt’s USD 12 bn extended fund facility after concluding its review, which found that reform measures are “yielding encouraging results.” The tranche, which could be issued as early as this month, would bring total disbursements up to around USD 6.08 bn.

Prime Minister Sherif Ismail is said to be returning to work within a week. It’s rumored that Ismail has been on the mend since his return from Germany last month and has already started working from home.

US Vice President Mike Pence will stop in Egypt on 20 January to meet with President Abdel Fattah El Sisi as part of a regional tour that will also take him to Jordan and Israel.

(Pence’s visit comes after the US has informed Palestinian aid agency UNRWA that it is freezing USD 65 mn in funding, pending “some reforms” of how the organization operates, Department of State spokesperson Heather Nauert said at a press briefing yesterday. Nauert admitted that the decision was partially fueled by the backlash to the US’ Jerusalem declaration.)

Arab League member states are scheduled to meet less than two weeks after Pence’s visit to discuss how best to counter US President Donald Trump’s Jerusalem declaration.

Enterprise+: Last Night’s Talk Shows

Fitch Ratings’ revision of Egypt’s outlook to positive and EFG Hermes’ Egypt Day Conference were the most business-relevant topics of discussion on the airwaves last night.

An upgrade in Egypt’s credit rating from any one of the ratings agencies is likely to happen sometime this year as economic reforms continue to bear fruit, Finance Minister Amr El Garhy told Hona Al Asema’s Lamees Al Hadidi. El Garhy noted that the state budget deficit has narrowed to 10.9% this fiscal year — and said that the significant drop in the primary deficit is also a positive indicator that signals the state’s expenditures are tenable. The ministry is anticipating that next year’s financing gap will stand at USD 12-14 bn.

On concerns over Egypt’s total debt level, El Garhy said the state is looking to push the figure to less than 90% of GDP in FY2018-19, down from 108% currently. He said that the discrepancy between the CBE and Fitch’s figures for Egypt’s debt is because of how the ratings agency accounts for investment in treasury bills, which the CBE does not include in its calculations since they are short-term instruments. External debt currently account for 41% of the country’s total debt, with the government aiming to bring it down to 25% by the end of FY2017-18 and 30-31% by the end of FY2018-19.

El Garhy also briefly touched on President Abdel Fattah El Sisi’s meeting yesterday with fund managers at EFG Hermes’ Egypt Day conference, where he said investors paid particular attention to improvements to the investment climate, the Trade and Industry Ministry’s map, regulations for investing in the Suez Canal Economic Zone, and the effect of regional politics on Egypt (watch, runtime: 17:49).

Lamees also spoke to Middle East Rating & Investors Service Chairman Amr Hassanein about Fitch’s outlook upgrade, which he said is usually a precursor to a full upgrade of the rating. Hassanein said he expects the credit upgrade to come within six months to a year provided the economy’s performance continues on the same upwards trajectory. Hassanein stressed the importance of boosting the country’s GDP — which would automatically reduce the debt-to-GDP ratio — and suggested further policies on integrating the informal economy were needed achieve this growth. He also pointed out the credit rating report mentioned political concerns, including a tightening grip on political opposition, as weighing down Egypt’s credit rating (watch, runtime: 8:08).

EFG Hermes CEO Karim Awad phoned in to tell Masaa DMC’s Osama Kamal about the Egypt Day Conference. Attending fund and portfolio managers have a generally positive view on what 2018 holds, Awad said, and believe economic reforms will continue to bear fruit throughout the year (watch, runtime: 3:49).

Kamal then spoke to MP and tourism expert Amr Sedky, who said that newly appointed Tourism Minister Rania Al Mashat’s economic background is just what the doctor ordered for the tourism industry. The majority of tourism investors are facing business-related burdens, including outdated bus fleets that would be costly to replace. Solutions require someone of Mashat’s background, Sedky said (watch, runtime: 6:02).

Over on Kol Youm, Amr Adib was fixated on Turkey having unveiling plans for a canal to reduce shipping traffic on the Bosphorus Strait. He said that the new canal is meant to replicate the Suez Canal and the Suez Canal Economic Zone and is an intentional attempt to take business away from Egypt (watch, runtime: 6:55). (Before we move on, we’d like to implore Adib to open a geography book every now and again.) SCZone deputy head Abdel Kader Darwish said that Turkey’s replication plans lends credence to Egypt’s vision for the SCZone, and told Adib that the zone has been working on infrastructure services such as water, gas, and communication networks to allow for the implementation of industrial projects (watch, runtime: 12:32).

Speed Round

Fitch revises Egypt’s outlook to positive, affirms rating at ‘B:’ Ratings agency Fitch has revised Egypt’s long-term foreign currency issuer default rating to ‘positive’ from ‘stable’ and affirmed the rating at ‘B.’ Fitch says macroeconomic stability in Egypt is starting to improve from a fragile state. Public finances will remain a key weakness of the country’s credit profile, but expect continued fiscal consolidation to start to reduce government debt to GDP in FY 2018-19, the ratings agency says. Tap or click here for the full report.

This comes as Moody’s predicts that Egypt’s growth will accelerate to 5.0% in FY2019 and then to 5.5% by 2021 — the strongest growth rate in the Levant and North Africa region. In its regional outlook (pdf), Moody’s credits structural reforms with driving the economy away from a consumer-based growth model and towards a more diversified activity, with the EGP float increasing Egypt’s competitiveness. The flotation, coupled with new large gas finds in Zohr, will help further drive a structural improvement in the current account deficit to around 3.0% of GDP by 2021 from 6.8% in 2017.

On the other hand, the report predicts that fiscal consolidation in Egypt will be harder in the coming period, largely as a result of high inflation and interest spending at levels above 40% of GDP, which has led to led to an estimated deficit of 11% of GDP in 2017. The ratings agency expects the budget deficit to fall to 10% in 2018 and 8.5% in 2019. Continued fiscal consolidation will lower the debt-to-GDP ratio, which Moody’s expects will peak at 100% in 2017 and fall to 83% of GDP.

And what’s the biggest risk we face to this growth acceleration? You guessed it: it’s the election. Moody’s is running the same worn-out line as plenty of analysts that a government, which for the past four years has remained steadfast in its commitment to reform, might reverse course to win political favor in the very short months of the election cycle. Moody’s domestic political risk assessment remains at “High (-)”.

Commenting on the outlook change from Fitch, Finance Minister Amr El Garhy stated the move was crucial in helping to reduce Egypt’s borrowing costs while also bolstering confidence in Egypt’s economy. This is made more crucial as Egypt heads to the international bond market at the end of the month to sell USD 3-4 bn USD-denominated eurobonds. El Garhy assured that Egypt has the political will to continue with the reform agenda, according to a Finance Ministry statement.

Our reminder: President Abdel Fattah El Sisi will run. Nasserist (or at least soft-socialist) murmurings will be made by politicians of all stripes. The president will win a second term. The international press will kick the daylights out of us throughout the entire process (sometimes rightfully, but do you really think Egypt could do what KSA is doing right now at the Ritz and not already be under an international sanctions regime?) And in the end: Policy stability will prevail and we’ll remain the best place in the region to invest if your horizon is medium-to-long term.

LEGISLATION WATCH- The Capital Markets Act is expected to come out sometime in February, Financial Regulatory Authority (FRA) head Mohamed Omran said yesterday, Al Mal reports. The House’s Economics Committee had said in December that it was close to finalizing its review of the act — which should clear the way for a basket of new financial instruments to be introduced, including futures trading, short-selling and a commodities exchange, in addition to introducing penalties for financial crimes and new rules governing taxes for the sector — and moving it along to a plenary session vote. An FRA committee is currently drafting the mechanisms through which short-selling will be implemented and these will be used when drafting the executive regulations for the Act, he added, according to Al Borsa.

Leasing and factoring, insurance acts coming soon: The House should also receive the Leasing and Factoring Act “soon,” once the State Council and Justice Ministry are done revising it, Omran also said. He also stated that the new Insurance Act will also be completed this year, though he gave no detail on when that will be or details on the act itself.

In other news from the House, the Planning and Budgeting Committee is looking to increase the quota of local components required in government contracts stipulated in the Auctions and Tenders Act, committee deputy head Yasser Omar tells Al Borsa. The committee will likely raise the quota to 40% from 10% currently, bringing it in line with the Public Procurement Act’s imposed quota for Egyptian products used in national projects, Omar says. The Federation of Egyptian Industries’ engineering industries division is also drafting a list of requested amendments to the legislation, which it will present to the House Industrial Committee next week.

The German consultancy firm hired to advise on the redrafting of the Automotive Directive should complete its work within a month, sources familiar with the matter tell Al Masry Al Youm. Industrial Development Authority head Ahmed Abdel Razek had said last month that the final draft of the law — which would grant local assemblers incentives to move further up the value chain to manufacturing — would be out in January, blaming the delay in redrafting the bill on the German firm. The Automotive Directive is being redrafted after disagreements over stipulations for local content requirements as well as the extent of incentives offered to manufacturers, which importers decried, claiming it would be detrimental for their business and a violation of freetrade agreements with the EU.

A business case for the Automotive Directive: Auto industry insiders are claiming that there is an ever-increasing backlog on orders for locally assembled cars. A source from GB Auto tells Al Mal that the company has an order backlog stretching for about a month on its locally assembled models. They also added that demand for locally assembled vehicles has outsripped supply, with the industry experiencing shortages in 4Q2017. Insiders also say that the main culprit had been difficulties in sourcing imported components. If the demand for more affordable locally-manufactured cars is as high as it is, how does it serve the market by not passing a law which would encourage and expand local manufacturing?

Former Trade and Industry Minister Mounir Fakhry Abdelnour threw his weight behind the Automotive Directive, denouncing claims made by importers that the act was made to grant an advantage to a few large assemblers such as GB Auto. Abdelnour, now a member of the board at GB Auto as well as other major Egyptian listed corporations, said the legislation aims to encourage all auto industry players to move into domestic production and allow smaller assemblers a chance to grow, according to Al Mal.

Lexus is coming to Egypt: In other auto industry news, Toyota Egypt has reportedly signed an agreement with Lexus — the luxury brand of parent company Toyota — to begin distributing Lexus vehicles in Egypt, Daily News Egypt reports.

INVESTMENT WATCH- The Egyptian Propylene & Polypropylene Company (EPPC) is reportedly planning to spend USD 890 mn over the next two years on expansion plans, Al Mal reports. The company has received the Irrigation Ministry’s’ approval to acquire a 20-feddan land plot in Port Said for the project, which is expected to increase production to 600k tonnes a year. Karim Saada, the regional director at Amwal Al Khaleej (which owns 16.4% of EPPC), had said last year that the company plans to invest USD 1 bn in expansion during 1Q2018. Amwal Al Khaleej is planning on funding the expansion through an IPO of EPPC which was slated for 1Q2018. There has been no update as of yet on the listing, which is being managed by EFG Hermes.

Aeroflot won’t be operating flights from Russia to Egypt until “late February,” when the two countries sign another security protocol, CEO Vitaly Savelyev told reporters yesterday, according to TASS. Savelyev didn’t get into details of the protocol, but said that its signing is a prerequisite for Aeroflot to begin selling plane tickets to Cairo. Egypt apparently didn’t get the memo and was only informed earlier this week that flights are scheduled to resume on 3 February, Egyptian Holding Company for Airports and Air Navigation Chairman Mohamed Said Mahrous tells Ahram Gate. Russia had sent Egyptian authorities an official letter saying that Russian airlines would begin operated twice-weekly flights as of that date and until 24 March, Mahrous says. Russian President Vladimir Putin had authorized the resumption of air travel between Moscow and Cairo earlier this month, after the two countries signed a civil aviation security protocol. The status of charter flights, the resumption of which is contingent on additional security measures, will be discussed at an April 2018 meeting.

The Tourism Ministry appears to have abandoned plans to set a minimum charge of per night for hotel rooms in Egypt after it was rejected by the Ismail Cabinet. Ministers refused the proposal after studies suggested no other nation has a similar policy, Deputy Tourism Minister Adela Ragab tells Al Mal. The committee mandated with the task had recommended imposing a minimum charge of USD 110 per night on five-star hotels in Cairo, while five-star hotels in Sharm El Sheikh, Hurghada, Alexandria, and Luxor charge guests USD 35 per person for an all-inclusive stay. The committee had also recommended a minimum charge of USD 25 a night for four-star hotels and USD 20 for three-star hotels across the country.

Nonetheless the Egyptian Competition Authority (ECA) wants the industry to be mindful of larger players undercutting smaller operators. Outgoing ECA boss Mona El Garf said that while setting a minimum charge for hotels is antithetical to a market economy, she warned against undercutting prices, which could help foster monopolies by favouring deep-pocketed players. The ECA will meet with Tourism Ministry officials to discuss antitrust strategies and policies which will implemented sector-wide on Wednesday, El Garf tells Al Borsa.

Damietta Ports lasts USD 74 mn international arbitration case: The International Court of Arbitration has ordered the Damietta International Ports Company and Kuwait and Gulf Link Transport (KGL) to pay USD 74 mn in addition to interest and legal expenses to Doosan Heavy Industries. KGL is part of an international consortium that owns a 25% stake in Damietta Ports.The case relates to a 2006 dispute relating to building and operating container terminals in which the Damietta Ports Company claimed USD 1.2 bn in compensation. KGL says it will appeal the decision.

E-commerce platforms embrace regulation in Egypt: Some of the largest e-commerce platforms operating in Egypt, among them Jumia and Amazon subsidiary Souq.com, have (at least publicly) expressed support for the government’s drive to regulate their industry. Only 2% of Egypt’s e-commerce market is regulated, with the rest being unregistered and un-taxed, Hisham Safwat, CEO of Jumia Egypt, tells Al Monitor. “Egypt has a thriving e-commerce market but it lacks rules,” said Souq.com Egypt CEO Omar El Sahy. Both appeared to look favorably on House Industry Committee member Ali El Kayal’s draft law to regulate the e-commerce industry by implementing a tax framework for it. “The draft law submitted by Kayal targets entities that do not have headquarters on Egyptian territory or are not registered with the [authority],” said Safwat, adding that the law will create a way to tax foreign companies’ sales in Egypt.

Freeing up liquidity? The Religious Endowments Authority sold a stake worth EGP 404.9 mn in the Housing and Development Bank, according to a bourse disclosure. The Authority’s head, Ahmed Abdelhafez, had said earlier in the month that it was looking to invest in the upcoming round of state-owned company IPOs. Abdelhafez had also said the authority had already earmarked EGP 1 bn to be invested in EGX-listed companies.

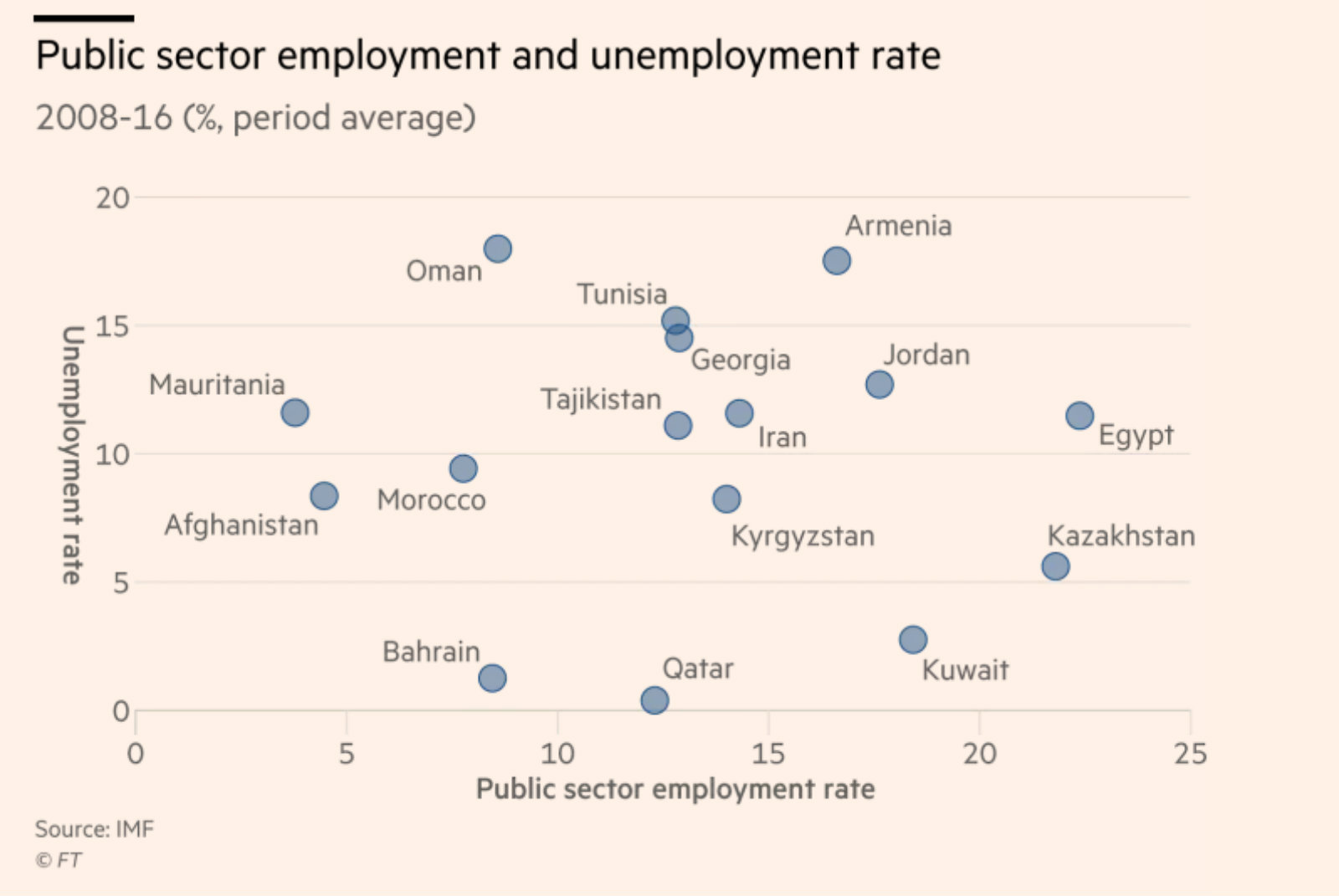

The IMF is advising Middle Eastern countries to work on cutting their public wage bills as “attempts to contain unemployment by creating bloated public sector workforces have completely failed,” says the Financial Times (paywall). In its latest report, Public Wage Bills in the Middle East and Central Asia, the IMF finds that countries across the MENA region, as well as Pakistan and Afghanistan, spend an average 6% of their respective GDP on public sector wages, despite there being no evidence to suggest that public sector employment can help boost overall employment levels. In fact, rather than create jobs, the existence of a large public sector workforce only translates to a smaller number of private sector jobs, the report also finds. “Countries such as Egypt, Armenia, Jordan and Tunisia all have high jobless rates despite having large public sector workforces, while Bahrain and Afghanistan each have low unemployment and small public sectors.”

The IMF says that by slashing their wage bills, governments in emerging economies would be able to spend more on development and social welfare, which “are crucial for inclusive growth and poverty reduction.” The report notes that “reforming public wage management is already on the policy agenda of several countries in the region,” including Egypt, Iraq, the GCC, and Tunisia, seeing it as “an important component of fiscal consolidation.”

Egypt in the News

With no single story dominating coverage of Egypt in the foreign press, the Cold War on the Nile, Russia’s growing ties with Egypt and human rights issues continue to guide the narrative on Egypt in the global press.

Egypt, Sudan, and Ethiopia are “close to armed conflict over a Nile dam project” and so far the US is ignoring the issue, Steven A Cook writes for Salon. “It is also a potential conflict that involves a number of important American allies against each other. Turkey, a NATO ally, and Qatar, which hosts the largest American military base outside the United States, have aligned themselves with Sudan and by extension with Ethiopia, another American ally. On the other side we have Egypt, a longtime partner of the United States in the Middle East, and Eritrea. The United Arab Emirates, a critical player in the Persian Gulf and beyond, would also likely be involved given its ties to Egypt and Eritrea… This is a situation that calls out for American mediation … Perhaps sensing another opportunity to reinforce the idea that Russia, not the United States, is a broker of security and stability, Vladimir Putin might step in and stave off the conflict over water that finally seems to have ripened.”

Russia, meanwhile, is “cozying up to Egypt” in bid to grow its influence in the Middle East, Lamont Colucci writes for US News. Colucci lists the recent agreement allowing both countries to use each others’ airspace and air bases, arms transactions, and the Dabaa nuclear power plant as examples of just how warm ties have become.

Amid a continuing regional realignment, there are reports of closer ties between Saudi Arabia and Israel, Herbert London writes for The Washington Times. “If the Saudi-Israeli alliance yields some form of regional stability,” London writes, many of the regional issues, including the war against Daesh in Sinai, could be resolved. “That is why the alliance is the harbinger of hope and the insurance policy for the moment,” he writes.

Closer to home: The acquittal of Egyptian activist Mahienour El Massry is a “rare moment of justice” that may pave the way for the release of more political prisoners, Amnesty International’s Deputy Director of Campaigns for North Africa, Najia Bounaim, said yesterday.

Another foodie piece about Egyptian cuisine: Egyptian eats have captured the attention of the international press. After yesterday’s story from the Independent on Cairo turning into a premier foodie destination, Tim Carman writes a glowing review of Egyptian restaurant Fava Pot in Falls Church, Virginia, for the Washington Post. Owned by Egyptian immigrant Dina Daniel, the restaurant offers all of our cuisine’s classics with the expected modern take — and a hand-picked list of ingredients which Daniel publishes on her website.

Also worth a quick skim this morning:

- Haaretz likes comedian Mohamed Andeel’s online satirical show mocking the political climate in Egypt.

- Nine people have been arrested for debauchery after accusations of homosexuality were leveled against them by neighbours, according to Pink News.

- A DNA test solves a century-old mystery about a pair of ancient Egyptian mummies, Science News reports.

- Egypt and Belarus are looking to bolster ties between their respective parliaments, Belarus News reports.

- Sight Magazine takes a look at how one Egyptian doctor promotes religious dialogue between Muslims and Christians through health work.

- Sabe’ Gar is a progressive series that “gives new view of Egyptian women,” writes Maha El Nabawi for The National.

On Deadline

Egypt, Ethiopia, and Sudan agreeing to launch a joint development project would be a show of good faith that could help ease tensions over the Grand Ethiopian Renaissance Dam, Mohamed Hegazy says in leading state-owned daily Al Ahram. Part of this project could be setting up a transnational highway and an electricity interconnection project between the three countries. The project could also include a framework to coordinate between the Nile Basin countries to fill up the reservoirs of each country’s water dams under certain specifications to ensure nobody’s share of Nile water is negatively impacted.

Worth Watching

The Detroit Auto Show is evolving into more of a tech and startup exhibition as car manufacturers race to keep up with developments in ride-sharing, electric and self-driving vehicles,a Reuters video suggests. From automated moving platforms made to transport anything to electric self driving shuttles that move in fleets, this year’s show even features a flying car concept that is working with Uber to provide on-demand aircraft services (watch, runtime 1:39).

Diplomacy + Foreign Trade

Organization of Islamic Cooperation (OIC) Secretary General Yousef bin Ahmed Al Othaimeen met with President Abdel Fattah El Sisi yesterday to discuss regional challenges, such as the stalled Middle East Peace Process and counterterrorism, according to an Ittihadiyah statement (pdf). Al Othaimeen, who’s in Cairo to attend an Azhar conference on Jerusalem today, also met with Foreign Minister Sameh Shoukry yesterday.

Also yesterday, Shoukry held talks with former Lebanese President Amin Al Jameel, who’s in town for the conference, which will also see Palestinian President Mahmoud Abbasin attendance.

Atta Investment Group signed an MoU with the South Sudanese state of Jubek for the establishment of a 116 sqkm industrial investment zone, according to AMAY. The agreements would also see both parties cooperate on increasing imports to the zone from Egypt.

Energy

Zhejiang Chint awarded USD 147.2 mn in projects in Benban, NEXTracker to supply single-axis trackers

China’s Zhejiang Chint Electrics announced that one of its subsidiaries was awarded photovoltaic solar power plant projects worth USD 147.2 mn in Egypt in Benban. The awards are for three projects with ACWA Power, Alcom Energy, and TK for Solar Energy. Separately, NEXTracker said it is going to supply its single-axis trackers to a project in Benban that will have 5 blocks of 65 MW each through a partnership with EPC firm Sterling and Wilson.

Cable seal manufacturer Roxtec secures role on BP West Nile Delta project

Cable seal manufacturer Roxtec has secured a role on the BP West Nile Delta gas production project in Egypt, Oilfield Technology reports. “Roxtec is supplying a range of products for this major development … This includes galvanised bolted Ex frames along with multi-cable and pipe transits,” Roxtec UK Managing Director Clive Sharp says.

Basic Materials + Commodities

GASC purchases 295k tonnes of Russian wheat in global tender

The General Authority for Supply Commodities (GASC) purchased 295k tonnes of Russian wheat in an international tender yesterday, Reuters’ Arabic service reports.

Tourism

166 King Tut artefacts cleared to go to California

Prime Minister Sherif Ismail issued a decree clearing 166 artefacts from the Tutankhamun exhibition to go on display in California, according to Youm7. The ‘King Tut: Treasures of The Golden Pharaoh’ exhibition will run in The California Science Center from 22 March 2018 until 6 January 2019. The artefacts will remain under the supervision of the Ministry of Antiquities throughout the period, though we doubt they’ll come into contact with industrial super glue over there.

Telecoms + ICT

Linatel in talks with TE to build its mobile network

Linatel Telecommunications is days away from resuming talks with Telecom Egypt (TE) over the establishment of the operator’s mobile network infrastructure, CEO Hamdy El Leithy tells Daily News Egypt. The company began negotiations with TE last year. TE has been using infrastructure belonging to private-sector mobile network operators, under domestic roaming agreements, since it launched its mobile phone services last year.

Banking + Finance

NBE to divest assets worth a total EGP 250 mn in 2018

The National Bank of Egypt is looking to divest its stake in assets worth a total EGP 250 mn during 2018, Vice Chairperson Yehia Aboul Fotouh said yesterday, according to Al Mal. Proceeds will be reallocated to more profitable investments, he added, noting that the NBE is also in talks to launch a leasing arm this year. We had said earlier this week that some state-owned and smaller, mid-cap banks — including the NBE and Banque Misr — were planning to offload various investments to provide liquidity needed to comply with Basel III regulations.

Other Business News of Note

G+D wins EUR 260 mn CBE contract to build a new mint in the new capital

German firm Giesecke+Devrient was awarded a EUR 260 mn contract by the CBE to build a production and processing plant for bank notes in the new administrative capital, according to Telecom Paper. The project, which includes IT and security systems, is set for completion in 2020 and will shoulder the majority of the country’s banknote production. G+D has a long history of sensitive government work, having worked on the current banknote printing systems, the national ID system as well as the production of SIM and payment cards.

MM Group signs agreement to sell Bosch appliances in Egypt

MM Group for Industry and Intrenational Trade (MTI) announced signing a distribution agreement with household appliance producer BSH Group, according to a bourse disclosure. The agreement will allow MTI to offer Bosch-branded, with sales planned to start in February 2018 and expected to add in-excess of EGP 200 mn in sales during the year.

Legislation + Policy

FEB, FEI, Thebes Consultancy draft legislation to transition to a cashless economy

The Federation of Egyptian Banks (FEB) and the Federation of Egyptian Industries (FEI) are drafting legislation to help Egypt’s transition away from cash dependency, Thebes Consultancy Managing Director Ziad Bahaa El Din announced yesterday, Al Mal reports. Speaking at the FEB’s second annual conference on moving towards a cashless economy, Bahaa El Din said the bill would offer incentives for the switch and set the framework for the transition to take place gradually. The legislation would also outlaw using cash for specific transactions, including government payments and receiving or repaying loans. The House Planning and Budget Committee is also prepared to cooperate with the FEI, FEB, and Thebes to reach a “feasible” draft of the bill, committee head Hussein Eissa said at the conference, according to the newspaper.

Egypt Politics + Economics

Ahmed Shafik resigns as head of the Egyptian Patriotic Movement Party

Ahmed Shafik resigned as leader of Egyptian Patriotic Movement Party, handing over the chairman role to deputy head Rauf Al Sayed, according to Ahram Gate. The step seems to be the latest move in a complete withdrawal from political life after he withdrew his rollercoaster bid for the presidency. We expect his name to come up again in the lead in to the 2022 elections as the lack of imagination of Egyptian pundits leads them to blurt out names of long-retired and once successful politicians. We’re honestly surprised that this is first election where Ahmed Nazif’s name has not come up.

NEC forms committees to monitor elections

The National Elections Commission (NEC) issued yesterday a decision establishing a special committee to receive and look into all elections-related complaints, Al Masry Al Youm reports. The NEC also announced the establishment of committees in each governorate to monitor the election process, with each committee comprised of a judge from the Administrative Prosecution Authority and representatives from the Accountability State Authority and the Justice Ministry, according to AMAY.

Endowments Ministry says it is employing Professor X to weed out atheism

The Endowments Ministry is taking “precautionary measures” against atheism by stopping “extremist ideas” from spreading, Minister Mokhtar Gomaa told the House Religious Affairs Committee yesterday, Ahram Online reports. “Gomaa said his ministry’s strategy is based on fighting the spread of atheist and heretical ideas in media outlets and via online social-media networks like Facebook and Twitter.” Gomaa acquiesced that there are some atheists in Egypt, but denied that atheism “has become a phenomenon” in the country, saying that “Egyptians … are religious by nature.” The minister’s statements come after committee head Amr Hamroush submitted a formal inquiry into the government’s strategy to combat atheism, which he said is equally dangerous as terrorism, Al Shorouk reports. Someone please find something useful for this ministry to do, or replacing this ministry with a wheelchair bound mutant with telepathic abilities. It would be state funds well-saved.

On Your Way Out

Substance abuse rates in Egypt have hit 10%, or double the global average, Social Solidarity Minister Ghada Wali said in an interview with Lamees Al Hadidi getting coverage in AMAY. She added that while rates of addiction amongst school bus drivers have dropped, this is attributable to more stringent testing during the hiring process rather than a drop in addiction rates. Tramadol is the most abused substance, followed by cannabis and heroin. The ministry has tried to clamp down on addiction in the public sphere by increased testing in government offices and of metro operators.

The Market Yesterday

EGP / USD CBE market average: Buy 17.67 | Sell 17.77

EGP / USD at CIB: Buy 17.67 | Sell 17.77

EGP / USD at NBE: Buy 17.65 | Sell 17.75

EGX30 (Tuesday): 15,089 (-0.3%)

Turnover: EGP 956 mn

EGX 30 year-to-date: +0.5%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.3%. CIB, the index heaviest constituent closed down 0.5%. EGX30’s top performing constituents were Sidi Kerir Petrochemical up 3.2%; Domty up 1.1%; and Emaar Misr up 1.1%. Today’s worst performing stocks were EFG Hermes down 2.7%; Global Telecom down 1.5%; and Ezz Steel down 1.2%. The market turnover was EGP 956 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +124.4 mn

Regional: Net Short | EGP -66.2 mn

Domestic: Net Short | EGP -58.2 mn

Retail: 61.6% of total trades | 60.6% of buyers | 62.6% of sellers

Institutions: 38.4% of total trades | 39.4% of buyers | 37.4% of sellers

Foreign: 16.4% of total | 22.9% of buyers | 9.8% of sellers

Regional: 12.2% of total | 8.7% of buyers | 15.7% of sellers

Domestic: 71.4% of total | 68.4% of buyers | 74.5% of sellers

WTI: USD 63.78 (-0.81%)

Brent: USD 69.23 (-1.47%)

Natural Gas (Nymex, futures prices) USD 3.12 MMBtu, (-2.56%, FEB 2018 contract)

Gold: USD 1,339.3 / troy ounce (+0.33%)

TASI: 7,531.56 (+0.65%) (YTD: +4.22%)

ADX: 4,615.41 (+0.29%) (YTD: +4.93%)

DFM: 3,525.59 (+0.85%) (YTD: +4.61%)

KSE Weighted Index: 419.53 (-0.19%) (YTD: +4.51%)

QE: 9,178.18 (+2.58%) (YTD: +7.68%)

MSM: 5,039.86 (-0.58%) (YTD: -1.17%)

BB: 1,321.4 (-0.2%) (YTD: -0.77%)

Calendar

15-17 January (Monday – Wednesday): EFG Hermes Annual Egypt Day Conference, Four Seasons Nile Plaza, Cairo

22-23 January (Monday-Tuesday): Arqaam Capital Egypt Investors Conference 2018, The Vineyard Hotel, Cape Town, South Africa.

25 January (Thursday): 25 January revolution / Police Day, national holiday.

29-30 January (Monday-Tuesday): Seamless North Africa, The Nile Ritz-Carlton, Cairo.

30 January-01 February (Tuesday-Thursday): CI Capital’s MENA Investor Conference, Four Seasons Nile Plaza, Cairo.

05 February (Monday): Egypt’s Emirates NBI PMI reading for January announced.

12-14 February 2018 (Monday-Wednesday): Egypt Petroleum Show 2018 (EGYPS), New Cairo Exhibition Center.

19-20 February 2018 (Monday-Tuesday): The Banking Tech North Africa, The Nile Ritz-Carlton, Cairo

17-21 February 2018 (Saturday-Wednesday): Women For Success – Women SME’s “World of Possibilities” Conference, Cairo/Luxor.

05-07 March (Monday-Wednesday): EFG Hermes’ One on One Conference 2018, Atlantis, The Palm, Dubai, UAE.

28-31 March 2018 (Thursday-Sunday): Cityscape Egypt, Cairo International Convention Centre, Cairo

08 April (Sunday): Easter Sunday, national holiday.

09 April (Monday): Sham El Nessim, national holiday.

24-25 April (Tuesday-Wednesday): Renaissance Capital’s 3rd Annual Egypt Investor Conference, Cape Town, South Africa.

25 April (Wednesday): Sinai Liberation Day, national holiday.

01 May (Tuesday): Labour Day, national holiday.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

15 May (Tuesday): Expected date for the start of Ramadan begins (TBC).

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday. (Look for possible Monday off given the first day falls on a Friday.)

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday

11 September (Tuesday): Islamic New Year (TBC), national holiday.

06 October (Saturday): Armed Forces Day, national holiday.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25 December (Tuesday): Western Christmas.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC)

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC)

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.