- Good news to start your week: Ismail gov’t reaches staff-level agreement on release of next tranche of USD 12 IMF extended fund facility. (Speed Round)

- Bad news to start your week: You need to protect yourself from the massive global WannaCry hack. (What We’re Tracking Today)

- We’ve started weaning ourselves off imported natural gas, Reuters says. (Speed Round)

- Fuel price hikes coming before September? The rumor-mill has kicked into overdrive. (Speed Round, Last Night’s Talk Shows)

- Is CIB eyeing expansion into Africa? (Speed Round)

- EFG Hermes’ Vortex renewable platform closes UK solar acquisition. (Speed Round)

- What Tarek El Molla told AmCham about gold exploration, de-regulation of the natural gas industry and the coming swing in priorities toward oil. (Speed Round)

- Standard & Poor’s affirmed Egypt’s long-term and short-term sovereign credit ratings at B- and B. (Speed Round)

- Two Chinese companies planning to establish industrial complexes with combined investment cost of USD 1.35 bn. (Manufacturing)

- The Markets Yesterday

Sunday, 14 May 2017

We have a staff-level agreement with the IMF on release of the next tranche of the USD 12 bn bailout package

TL;DR

What We’re Tracking Today

Businesses and government agencies across the world who rely on Windows PCs running older versions of the operating system were hit by a massive global cyberattack on Friday. The WannaCry / WannaCrypt attack encrypted the hard drives of some 200k infected users, offering them the ability to un-encrypt it in return for a ransom payment (transferred via bitcoin) that starts at USD 300 and goes up over time. Among those who fell prey to the attack — thought to have originated out of Russia — were major companies in Spain, Germany and Portugal, the UK’s national healthcare service, and the Russian Interior Ministry.

We’re going out on a limb here and dispensing tech advice. Namely: If you receive an email that sounds even a fraction off in tone, grammar or subject matter — even if it appears to be from someone you know — stop and think a moment before you open the attachment or click the link that it encloses. Not sure why? Go read this excellent primer on how to figure out if someone is setting you up for a phishing attack.Next, update your OS. The WannaCry attack takes advantage of an exploit developed by the US National Security Agency that got into the wrong hands. Microsoft released a patch in March — folks (including some in Egypt — check this animated map of the attack) who are infected didn’t patch their machines (or couldn’t, because their machines are running old, non-supported versions of Windows). And if you’re on a Windows box, you probably want to run Microsoft’s anti-virus software, which it provides without charge.

Microsoft has gone so far as to issue a patch for no-longer-supported operating systems (you can read more on the company’s recommendations for all systems and download the patches on Microsoft’s blog here), and Hacker News is warning that the attack isn’t over — the attackers have released a new version of the ransomware that is not stopped by a kill switch that a researcher inadvertently flipped on Friday.

The New York Times has an excellent, accessible rundown of what’s known about WannaCry as of about 4am this morning and warns that with new digital tools, even nonexperts can wage cyberattacks.

If you’re a CTO / head of IT / head of tech support, this morning might be a good time to reach out to your users and give them a pep talk / raise some awareness of best practices in security. This is a teachable moment.

Oh, and if you’re deploying HP laptops to your users, there’s a chance you have a security vulnerability — two dozen HP laptops and tablets on the market “covertly monitor every keystroke a user makes, security researchers warned Thursday. The devices then store the key presses in an unencrypted file on the hard drive.” John Gruber’s Daring Fireball links to the original piece in Ars Technica.

Sharm El Sheikh is Airbnb and Pinterest’s top trending destination, according to JOE.ie’s Conor Heneghan. The South Sinai city topped the list of “destinations that people are saving on Pinterest and checking out on Airbnb and we want to go to every single one of them as soon as possible.” This comes just days after Thomas Cook cancelled its Sharm El Sheikh holiday bookings for the winter of 2017-18 and summer of 2018 seasons. The cancellation came as the UK FCO did not remove its travel restrictions, to which the former head of the British Secret Intelligence Service says that the travel industry should challenge FCO advice. He adds that “Foreign Office travel advice does not always reflect the situation on the ground, and unnecessary blanket travel bans can harm local economies fuelling extremism.”

The EBRD is becoming rather active once again, announcing on Thursday a USD 25 mn facility for a subsidiary of Elsewedy Electric and a separate USD 11 mn facility for Basel El Baz’s Carbon Holdings. In each case, the funding will help the companies cut the environmental footprints.

The Ismail cabinet is expected to receive the executive regulations for the Civil Service Act today Youm7 reports.

A Trade and Industry Ministry delegation is in Riyadh to participate in the Egyptian-Saudi Trade Committee meeting taking place today and tomorrow, Al Mal reports.

PSA #1- Expect the mercury to spike to 40°C today and tomorrow before starting to cool on Tuesday. Temperatures will slide to 31°C by Friday.

PSA #2- It is Mother’s Day in the United States and Canada. Mom may be 100% Masriyya, but if she’s spent any length of time in North America, she’ll expect a call on this version of Mother’s Day, too.

What We’re Tracking This Week

The House Budget Committee will begin its deliberations on the 2017-18 state budget tomorrow, MP Yasser Omar tells Al Borsa. The ministers of finance and planning should be present for the session.

The Finance Ministry is expected to send a report on the country’s “private funds” (which have been criticized for being graft magnets) to the House Economics Committee tomorrow, Al Borsa reports. The report is being issued after MP Mohamed Elsewedy suggested using a portion of them to ease the burden of the subsidy system.

The house is expected to vote on the new stamp duty on capital market transactions before Wednesday, 17 May. The levy will rise from 0.125% at implementation to 0.175% by year three.

The first expo highlighting Egyptian exports to Africa will be held in Nairobi, Kenya, also from 15-18 May.

Investment Minister Sahar Nasr is pitching Chinese investors tomorrow in Beijing, where she is attending the Belt and Road Forum.

On The Horizon

The Central Bank of Egypt’s Monetary Policy Committee will hold a rare Sunday meeting on 21 May to discuss interest rates. Will the MPC hike rates, as it appears the IMF is pushing it to do? Pharos Holding’s Ramy Oraby suggests it will leave them unchanged, noting that a cool-off in headline consumer price inflation and of the producer price index as well as tight monetary conditions across the economy. Tap or click here to read the full note (pdf).

The Finance Ministry hand out 10% hardship raise for bureaucrats not covered under the Civil Service Act in a single transaction before Ramadan starts, a statement from the ministry carried by Al Borsa said on Thursday. The raise will be applied retroactively from July 2016.

Enterprise+: Last Night’s Talk Shows

On Hona Al Asema, Finance Minister Amr El Garhy had a chat with Lamees Al Hadidi, telling her he expects receive the second tranche of the IMF loan in the second half of June. El Garhy also vehemently denied rumors suggesting that the government has plans to hike energy prices, telling Lamees that the authorities have not yet made any final plans on the FY2017-18 increases. Social welfare programs including Takaful and Karama are also getting larger slices of the budget next fiscal year, El Garhy said. And no, the EGP is not about to get a graphic facelift — that’s just another rumor, the finance minister said( watch, runtime 9:16).

Lamees also followed up on the latest in the squabble between the presidency and Council of State judges over controversial amendments to the Judicial Authorities Act (watch, runtime 13:39).

Over on Kol Youm, Amr Adib hosted Antiquities Minister Khaled El Anany to talk about the new archaeological finds in the catacombs of Minya (about 17 mummies and a whole lot of artefacts), where Cairo University archaeologists been working in 2015 using ground penetrating radar (watch, runtime 5:28). The Antiquities Ministry is also working on an exhibition that will showcase the contents of child-pharaoh Tutankhamun’s tomb (watch, runtime 4:48).

Meanwhile, Al Hayah Al Youm’s Lobna Asal spoke to Zohour Club head Mahmoud El Seringawy about the new Sports Act, which he praised for loosening the state’s grip on private sporting clubs (watch, runtime 1:24). Even though the law does give club leaders more authority, it still gives the Sports Ministry financial oversight on their affairs (watch, runtime 3:36).

Speed Round

Egypt is now just a few signatures away from receiving the second tranche of its USD 12 bn loan from the IMF,after the delegation assessing the country’s economic reform progress gave it a clean bill of health on Friday. The IMF’s executive board will now have to sign off on a staff-level agreement announced Thursday to disburse the USD 1.25 bn tranche, which Egypt Mission Chief Chris Jarvis signed with the government, according to a “This agreement is a vote of confidence by the IMF staff in the continued implementation of the Egyptian authorities’ program,” Jarvis said in the statement, praising decisions including the float of the EGP, the implementation of the value-added tax, and subsidy reforms. It remains unclear when Egypt is to receive its funds, but chatter says sometime in June.

Curbing inflation and continued progress on reform will be top priorities for the government and the central bank, Jarvis added. He also stressed that the importance of strengthening Egypt’s social safety net “to protect the most vulnerable people in Egypt while reform is underway.”

Jarvis gave props to the FY2017-18 budget, which he described as “very strong” and if approved, “will place public debt on a clearly declining path to sustainable levels.” Jarvis was particularly happy that the governmentdecided to raise the VAT in the next fiscal year and that it’s pushing forward with the energy subsidy phase-out scheme. He was also quite optimistic about the prospects offered by the recently-passed investment and industrial permits acts.

News of the staff-level agreement is being played prominently by Bloomberg and Reuters.

We’ve started weaning ourselves off imported natural gas, Reuters says: Egypt is holding talks with its LNG suppliers to defer contracted shipments this year and aims to cut back on purchases in 2018, traders and industry sources tell Reuters. Domestic gas production is squeezing out demand for foreign imports, Oleg Vukmanovic writes for the newswire. EGAS “is also scaling back LNG purchase plans for 2018 from 70 to as low as 30 cargoes, one Egyptian industry source added, signalling the withdrawal of one of the fastest-growing LNG importers from the global stage.”

The deferment is being driven by new gas discoveries. “Test flows from [BP’s] West Nile Delta have started ahead of schedule and Eni’s giant Zohr find is progressing quickly on track for first gas later this year, but it’s output from the Nooros field that has surprised everyone this year,” said Adam Pollard, senior North Africa oil and gas analyst at Wood Mackenzie. BP announced first gas from West Nile Delta, eight months ahead of schedule last Wednesday. “Already this year EGAS has deferred about ten shipments, with about 10-15 shipments left to go, trade sources said. The scale and speed of Egypt’s turnaround suggests the government may yet wean itself off foreign gas but how sustainable that turns to be will depend on domestic pent-up demand,” Reuters adds.

Fuel price hikes coming before September? The rumor mill has kicked into overdrive. The government is planning to hike fuel prices by 25-40% before the end of August, Al Shorouk reports, citing an unnamed source. According to the source, the government has yet to settle on a timeline for the hikes and is looking into implementing the new prices as early as July — in time for the start of the new fiscal year. The exact formula for the increase is still under discussion. Meanwhile, Al Borsa alleges the government is debating pushing the expected 20% hike in fuel prices to 2018.

The House wades in: Separately, House Budget and Planning Committee Yasser Omar said that a July price hike will hit only 92-octane gasoline, according to Al Mal. House Economics Committee chair Amr Ghallab tells Al Shorouk that the government has yet to consult parliament on the hikes. Ghallab also criticized the planned move as being ill-timed and “inconsiderate” of citizens’ financial struggles. The government has laid out a target in the FY2017-18 budget of EGP 110.148 for fuel subsidy spending.

Is CIB eyeing expansion into Africa? CIB’s board of directors discussed and approved a plan in principle to expand internationally to African markets, according to a regulatory filing. The board also tasked the bank’s management to assess the required procedures and implement an action plan. The disclosure did not specify which markets the bank is considering.

EFG renewable platform closes UK solar acquisition: EFG Hermes’ renewable energy platform Vortex announced completing its acquisition of 100% of a 365 MW portfolio of 24 operational solar assets in the United Kingdom from TerraForm Power. This increases Vortex’s total net operational capacity to 822 MW. The agreement, which sets an enterprise value of GBP 470 mn for the assets, was signed in January. “Vortex’s success to date underpins our transformation from being a manager of investments across MENA to being an investment manager that caters to our client’s specific needs in our region and beyond. Vortex will continue to target wind and solar acquisitions in Europe with a target of owning a total of more than 2 GW in generation capacity within three years,” EFG Hermes’ Head of Asset Management and Private Equity Karim Moussa says. EFG Hermes says, “Vortex plans to sell down 45% of the equity share capital of the transaction in the near future, retaining a 5% stake in line with its previous transaction structures. Vortex is also in the process of refinancing the portfolio’s existing debt facilities.” Read the full release here (pdf).

Tarek El Molla on gold exploration, de-regulation of the natural gas industry and the coming swing in priorities toward oil: Petroleum and Mineral Resources Minister Tarek El Molla spoke at an AmCham luncheon we attended on Thursday. We learned that the gold exploration tender results will be out within a week or so, that the amendments to the Mineral Resources Act are in the works, and the Natural Gas Act — which portends de-regulation of the market — is pending a plenary discussion at the House. Key takeaways:

- On whether fuel subsidy cuts will come before the end of the FY, El Molla told Enterprise, “We don’t know yet.”

- Results of the Egyptian Mineral Resources Authority’s controversial gold exploration tender will be announced within the coming week or so. “We received really good offers,” El Molla said, adding that a large number of investors are interested.

- On the Mineral Resources Act, El Molla said, “We are working on amendments to the law that will satisfy most of the stakeholders.” He gave no further details.

- Committee-level discussion of the proposed Natural Gas Act to deregulate the market has ended. The ministry is now waiting for a date on which to introduce the bill to the House as a whole. El Molla stressed that there will be an independent regulator for a deregulated market in which EGAS and EGPC will be players alongside others.

- Production from the second phase of BP’s North Alexandria concession will begin ahead of schedule in 2018 instead of the planned 2019. “By the end of 2018, we will have self-sufficiency in gas and we will exceed [domestic] demand,” El Molla said.

- A record number of 76 upstream agreements were signed in the last three years. 21 gas development projects with USD 7.4 bn investments were completed; nine are ongoing with USD 30.2 bn investments, and 11 are planned with USD 17.5 bn investments.

- Look for the emphasis going forward to swing toward oil from natural gas: “I am satisfied with what we have done with our partners [to accelerate natural gas production] … we need to do the same with oil. This is what we are focusing on,” said El Molla.

EARNINGS WATCH- Edita reported a 23.5% y-o-y increase in net profit to EGP 40.4 mn in 1Q2017, with revenues increasing by 24.0% y-o-y to EGP 642.4 mn, according to the company’s earnings release. “Strong revenue growth in the first quarter of the year came thanks to Edita’s repricing and portfolio optimization strategy, which the company rolled out starting September 2015 and accelerated in 4Q2016 to address a rapidly changing macroeconomic environment… Management notes that production capacity freed by lower volumes on existing SKUs allowed the company to rapidly introduce new innovative propositions, with 1Q2017 witnessing the launch of several new products across all segments, in line with the company’s long-term growth strategy, ” the company says.

Also reporting results this past Thursday:

- Global Telecom Holding reported a 99% y-o-y decrease in profit in 1Q2017 to USD 1 mn. Total revenue dropped to USD 752 mn in 1Q2017 from the pro-forma figure of USD 785 mn of 1Q2016.

- Talaat Mostafa Group Holdings’ consolidated net profit after tax for 1Q2017 grew by 38.85% to EGP 288.5 mn from EGP 207.8 mn in the same period last year, according to the company’s regulatory filing.

Standard & Poor’s affirmed Egypt’s long-term and short-term sovereign credit ratings at B- and B, respectively, with a stable outlook, the ratings agency announced on Friday (paywall). Egypt’s ratings “remain constrained by wide fiscal deficits, high public debt, low income levels, and institutional and social fragility.” (This from the people who helped bring you the Global Financial Crisis…) S&P anticipates that the USD 12 bn IMF facility will support the country’s FX requirements over the coming years “and restore macroeconomic stability via gradual reform implementation over 2017-2020.” The ratings agency also predicts that macroeconomic obstacles such as persistent unemployment and poverty will challenge the implementation of reform measures.

S&P’s lowered its estimate of Egypt’s real GDP growth to 3.8% from 4.3% in 2015/2016, reflecting “the authorities’ tight fiscal and monetary stance and sluggish domestic demand.” Real GDP will maintain an average growth rate “just under 4%” until 2020, while economic growth over the next three years will be spurred by factors such as security improvements, stronger capital flows, improved eternal competitiveness on the back of the EGP float, and improved power supply from natural gas developments.

S&P’s says it could upgrade Egypt’s rating “if GDP growth picks up beyond our expectations, and if Egypt improves its fiscal and external positions substantially.” On the flipside, factors such as increased political risk, reduced funding from GCC countries, and a weaker institutional environment would cause Egypt’s ratings to be lowered. S&P’s unchanged ratings on Egypt comes days after Bloomberg’s Ahmed Namatalla and Ahmed Feteha said Egypt’s performance on the bond market warrants a credit upgrade.

The executive regulations for the new Investment Act are 90% complete and are expected within a month of the bill becoming law, top Investment Ministry officials tell Youm7. The Investment Ministry has already sent copies of the draft regulations to different ministries for their input before preparing a final draft. Prime Minister Sherif Ismail has to sign off on the regulations before they are reviewed and issued by the House of Representatives. The Ismail government is reportedly preparing to hold meetings with foreign diplomatic offices to brief them on the act, South Korea’s ambassador to Cairo tells Al Mal. The act is still pending the signature of President Abdel Fattah El Sisi.

State Council defiant of Judicial Authority Act? Maglis Al Dawla (Council of State) presented one nominee to be the judicial body’s head, violating the controversial amendments to the Judicial Authority Act, which require it to present the names of three nominees to the president, Al Mal reports. The council’s deputy chief maintains that the move is not in defiance of President Abdel Fattah El Sisi and is based on the council’s belief in selecting its head on the basis of seniority, as the law originally stipulates, Al Shorouk reports.

Claims for refugee protection from Canada filed in Egypt are now eligible for expedited processing, effective 1 June, according to an Immigration and Refugee Board of Canada statement. “The designation was initiated based on high 2016 national acceptance rates, a sufficiently high volume of cases, and review of common claim types and issues relating to claims from these countries,” the statement reads. The policy also applies to Syria, Iraq, Burundi, Afghanistan, and Yemen.

Egypt in the News

It’s a mixed bag of coverage for Egypt in the international press this morning, with coverage being led by the discovery of a cache of 17 mummies and, separately, of the 3,700 year-old tomb of a pharaoh’s daughter. Reuters reports that the finds are the latest in a string of discoveries that represent “a helping hand from the crypt for [our] struggling tourism sector.” Elsewhere, an Associated Press piece on the “ballet bubble” in Cairo is also getting increasingly wide pickup.

Archaeology and ballet are drowning out pickup of stories from Reuters and Bloomberg on Egypt reaching a staff-level agreement with the IMF to disburse the next tranche of the USD 12 bn extended fund facility. Also flying below the radar: AP’s story noting that President Abdelfattah El Sisi is “calling on the international community to lift an arms embargo on Libya so that weapons can be delivered legally to a powerful general he backs in the fractured country’s east.”

The Economist takes positive note of the passing of the new investment act, correctly adding that the devil is in the details of its implementation at the sub-ministerial level. The story also mixes in the moribund one-stop shop and the industrial permits act for good measure — and springboards off our “dismal” 122nd-place ranking on the World Bank’s ease-of-doing-business index. H/t Youssef B.

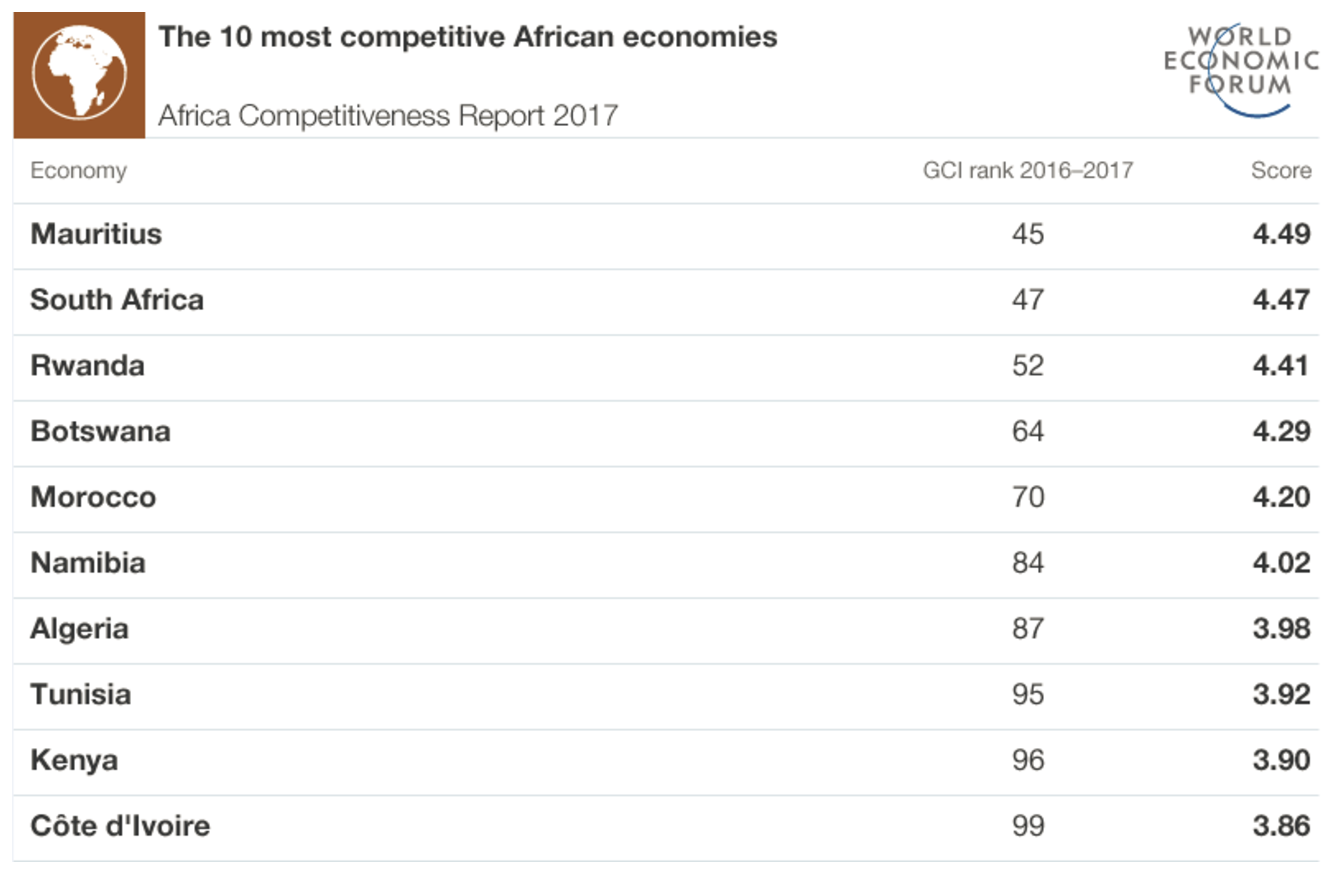

The World Bank and World Economic Forum also spring-boarded off the Ease of Doing Business index in partnership with the African Development Bank for the 2017 edition of the Africa Competitiveness Index (pdf), wherein the disaster zone that is Algeria (for anyone who has ever tried to be a non-oil foreign investor there) is said to be among the 10 most competitive African economies. The five most competitive African economies, per the report, are Mauritius, South Africa, Rwanda, Botswana and Morocco. Check out the table below, which accompanies this story on the WEF blog.

The Egypt section (pp. 106-107) notes “Egypt remains stable at 115th position this year. To create growth and employment, Egypt could build on its large market size (25th); its business sector, which by some accounts appears more sophisticated than those of neighboring countries (85th); and its geographical proximity to the large European market.” We get particularly low marks for “government instability / coups” and “foreign currency regulations,” which makes us wonder when the bloody thing was written. H/t Haitham A.

From there, hop over to the Wall Street Journal (paywall), where Maria Abi-Habib has a long take this morning headlined “Christians, in an Epochal Shift, Are Leaving the Middle East.” Sadly, Egypt features heavily in the story, which notes that, “By 2025, Christians are expected to represent just over 3% of the Mideast’s population, down from 4.2% in 2010, according to Todd Johnson, director of the Center for the Study of Global Christianity at Gordon-Conwell Theological Seminary in Hamilton, Mass. A century before, in 1910, the figure was 13.6%.”

Finally, Hassan Khan, the Cairo-born artist, has won the Silver Lion at the Venice Biennale as “the most promising young artist in the central exhibition,” the New York Times notes in passing. More on Khan here.

Other coverage worth a skim:

- David Schenker says it is unclear that Egypt is “actually an asset” in the fight against Daesh in a piece for Foreign Affairs (paywall).

- Egypt could mediate a political settlement in Iraq, Joelle El-Khoury writes in Al-Monitor. This follows a meeting between President Abdel Fattah El Sisi and Ammar Al Hakim, the head of the ruling Shiite Iraqi National Alliance.

- Alexandria is one of the cities that could disappear off the map by 2070, according to The Science Times.

Worth Watching

Ramsey wows Masterchef students with lobster-handling techniques: There’s a reason why people like Gordon Ramsey are so hard to impress. He spent years honing his craft, so much so that the mastery and skill with which he handles everything in the kitchen makes cooking elaborate gourmet dishes look like no job at all. In fact, in this one clip from Masterchef, Ramsey dismembers and de-shells a lobster with the ease that most of us handle a banana, squeezing (literally) every bit of meat out — intact — then puts it back together again in a most jaw-dropping, mouthwatering display (watch here, 3:00).

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi met with Libyan Armed Forces chief General Khalifa Haftar in Cairo yesterday to discuss developments in the Libyan crisis, according to an emailed Ittihadiya statement (pdf). The president generated international headlines by stressing “the need to lift the arms embargo imposed on the Libyan army, given it is a fundamental pillar for eradicating terrorism in Libya.”

Prime Minister Sherif Ismail discussed Egypt’s economic reform drive with British Prime Minister Theresa May in London on Thursday, Al Mal reported. Ismail also met with UK Defense Minister Michael Fallon during his trip to London to discuss ways to further strategic cooperation, particularly on fighting terrorism. The Prime Minister, who was in the UK for the 2017 London Somalia conference, also talked cooperation with Somali President Mohamed Abdullahi Mohamed, the newspaper added.

Uganda has postponed the Nile Basin Initiative’s presidential summit to mid-June to give Egypt a grace period to decide whether or not it will resume its membership in the initiative, Al Shorouk reports.

The Trade Ministry is sponsoring a delegation of 15 Egyptian business women on a roadshow to the UAE and Germany in June to promote their crafts and products, Trade Minister Tarek Kabil said, according to Al Shorouk.

Egypt’s armed forces sent Somalia a shipment of food and medical aid to help with drought relief. “The drought has left 6.2 mn people — more than half of the population of Somalia — in need of immediate lifesaving assistance,” according to Ahram Online.

Energy

Dana Gas net income nearly doubles, output increases by 16% in 1Q2017

Dana Gas’ output increased by 16% y-o-y to 69,900 boepd in 1Q2017 driven by increased production from Egypt, according to Bloomberg. The company’s net income in 1Q2017 rose to AED 40 mn, from AED 22 mn a year earlier. Dana Gas says it is owed USD 1 bn from Egypt and Kurdistan, up from USD 982 mn at the end of 2016, because payments from Egypt slowed, CEO Patrick Allman-Ward said. He added that new investment in Egypt will depend on the country’s ability to pay for current deliveries. The also said it has started refinancing discussions with the holders of its USD 700 mn sukuk maturing in October. “The lack of collections had raised concerns over the company’s ability to repay the dollar sukuk over the past few months, which put downward pressure on the price of the company’s outstanding Islamic debt,” Reuters says.

Shell to supply South Helwan plant with industrial oils

Shell signed an agreement to provide the South Helwan Supercritical Power Plant with industrial oils need for electricity generation, Al Borsa reports. The plant is operated by Mitsubishi Heavy Industries and Toyota Tsusho Corporation.

Electricity Ministry reaches agreement with ACWA Power for 2.25 GW power plant

The Electricity Ministry has reached an agreement with ACWA Power to establish a USD 2.2 bn, 2.25 GW power plant in Luxor, unnamed ministry sources tell Al Borsa. The plant was originally planned for Dairut, Beheira, but was moved to Luxor to increase energy production in Upper Egypt. Cabinet had granted the Saudi company a government guarantee last week for the construction of the plant on a right-to-use basis for 25 years.

EETC signs PPA with India’s Shapoorji under FiT phase 2

The Egyptian Electricity Transmission Company signed a power purchase agreement with India’s Shapoorji Pallonji Group for a USD 75 mn, 50 MW solar power plant under phase two of the feed-in tariff program, Al Borsa reports.

Infrastructure

Titan Cement reduces losses, increases sales in Egypt

Titan Cement reported a net loss of EUR 3.9 mn in 1Q2017, a decrease from the EUR 18.6 mn loss recorded a year earlier, according to Global Cement. “In Egypt, the group’s plants have been in full operation utilising locally-ground solid fuels, which allowed for an increase in production and sales volumes in the first quarter of 2017. The group said that the economy has not yet adjusted to the large devaluation of the [EGP] in 2016 and a climate of uncertainty and volatility is affecting building activity and market prices.”

Tunneling completed for the Cairo Metro Line 3’s Phase 4A

Tunneling operations of Cairo Metro Line 3’s phase 4A was completed at a total cost of EUR 257 mn as well as local currency portion of EGP 1.8 bn, Transport Minister Hisham Arafat said, according to Ahram Gate. Phase 4A, which is 5.15 km long and includes five stations will be for an earlier delivery than end of 2018 as had been originally expected.

Arab Contractors, Hassan Allam awarded infrastructure development project in New Cairo

The New Cairo City Authority awarded the Arab Contractors, Hassan Allam, and the Arab Contractors’ Association a EGP 350 mn infrastructure development project for mid-income housing in the area, Al Borsa reported on Thursday.

Basic Materials + Commodities

Domty bakery production line completed, to be operational in 4Q2017

Domty’s baked products line will begin production in 4Q2017, according a regulatory filing.

Sugar prices reduced for regular, commercial, industrial use

Sugar traders and manufacturers reached an agreement to reduce the price of sugar sold to regular consumers to EGP 10 per kg from EGP 10.50 per kg, effective immediately, Supply Minister Ali El Moselhy announced yesterday, Al Borsa reports. The decision also reduces the price of sugar sold to traders at EGP 9,000 per tonne from EGP 9,250 per tonne, while sugar sold for industrial use is now priced at EGP 9,250 per tonne, down from EGP 10,500 per tonne.

Manufacturing

Two Chinese companies planning to establish industrial complexes with combined investment cost of USD 1.35 bn

Two Chinese companies are looking into establishing industrial complexes in Egypt with combined investments of USD 1.35 bn, Trade and Industry Minister Tarek Kabil said, according to Al Borsa reports. The minister says Shondong Ruyi Technology is looking to invest USD 800 mn into setting up a complex to manufacture textiles and ready-made clothing, while Shenyang Yuanda Enterprise Group (CNYD) is eyeing a USD 550 mn industrial complex spanning 4 km to manufacture construction materials.

IDA to tender 2 mn sqm to industrial developers this month

The Industrial Development Authority plans to tender 2 mn sqm in Sadat City to industrial developers this month, Al Borsa reports.

Health + Education

Health expenditures in FY2017-18 budget meet constitutional requirement -Maait

The Health Ministry’s annual public jockeying to increase its budget allocation has begun, with Assistant Health Minister Sayed El Shahed telling Al Mal the ministry asked for EGP 61 bn against the EGP 53.7 bn the Finance Ministry says it will provide. Deputy Finance Minister Mohamed Maait maintains that expenditure on healthcare in next fiscal year’s budget meet the constitutionally required 3% of GDP.

Tourism

Antiquities Ministry to begin final EGP 130 mn phase of Pyramids plateau development

The Antiquities Ministry is planning to begin the final phase of the Giza Pyramids plateau development project, which is expected to cost EGP 130 mn, this month, the plateau’s director-general Ashraf Mohy tells Al Borsa.

Automotive + Transportation

The Alliance adds Damietta Port to shipping route

The alliance of shipping lines that withdrew from East Port Said in March due to the hike in fees has agreed to add the Damietta Port to its weekly trade routes, Damietta Port Chief Ayman Saleh said on Thursday, Al Mal reports. Suez Canal Economic Zone Chief Mohab Mamish and Transport Minister Hisham Arafat will be traveling to London soon to attempt to reconcile and bring alliance shipping lines back to East Port Said, according to AMAY.

Other Business News of Note

FEP Capital to set up USD 150 mn direct investment fund this year

FEP Capital plans to begin raising this year a USD 150 mn private equity fund, CEO Mahmoud Khalifa tells Al Borsa. The company is eyeing opportunities in the local market after having recently acquired four companies, Khalifa says.

MM Group to invest EGP 20 mn in raising Masary’s capital

MM Group plans on increasing e-payments subsidiary Masary’s capital by EGP 20 mn during 2017 in two EGP 10 mn transactions, MM Group Chairman Khaled Mahmoud tells Al Borsa.

Legislation + Policy

House Speaker refers penal code amendments to Legislative Committee

House of Representatives Speaker Ali Abdelaal referred proposed amendments to the Penal Code and Criminal Procedures Act to the House’s Legislative Committee for review on Saturday, Al Ahram reports. The amendments were suggested by MP Mortada Mansour and 65 other representatives.

On Your Way Out

The Center for International Private Enterprise (CIPE), with support from the World Bank (WB), has launched an Arabic-language mobile app called Tamweely. Tamweely aims to “connect financiers to small businesses and entrepreneurs in Egypt seeking start-up funding, as well as to provide business education tools and information about the institutional and legal environment for entrepreneurs and startups.” CIPE and WB “hope the app will improve access to finance for Egyptian entrepreneurs.” Tamweely, available on the App Store and Android Play Store, “is designed to provide a platform to match entrepreneurs seeking finance with banks, non-banking financial institutions, and individual investors seeking partnerships.”

Finally, word on the street is that former Interior Minister Habib El Adly has been in the wind for some 10 days now, having allegedly headed for the hills after a court handed him a seven-year sentence on corruption charges. Al Mogaz has the story.

The markets yesterday

EGP / USD CBE market average: Buy 18.0368 | Sell 18.1376

EGP / USD at CIB: Buy 18.05 | Sell 18.15

EGP / USD at NBE: Buy 17.95 | Sell 18.05

EGX30 (Thursday): 12,907 (-0.7%)

Turnover: EGP 853.2 mn (40% below the 90-day average)

EGX 30 year-to-date: +4.6%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session down 0.7%. CIB, the index heaviest constituent ended down 0.3%. EGX30’s top performing constituents were: Domty up 1.1%, Credit Agricole up 0.5%, and Eastern Co. up 0.4%. Thursday’s worst performing stocks were: Orascom Telecom Media & Technology down 2.7%, Heliopolis Housing down 2.5%, and Cairo Oils & Soap down 2.4%. The market turnover was EGP 853 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +60.7 mn

Regional: Net Short | EGP -36.1 mn

Domestic: Net Short | EGP -24.6 mn

Retail: 67.9% of total trades | 66.8% of buyers | 69.1% of sellers

Institutions: 32.1% of total trades | 33.2% of buyers | 30.9% of sellers

Foreign: 20.8% of total | 24.3% of buyers | 17.3% of sellers

Regional: 11.8% of total | 9.7% of buyers | 13.9% of sellers

Domestic: 67.4% of total | 66.0% of buyers | 68.8% of sellers

WTI: USD 47.84 (+0.2%)

Brent: USD 50.84 (+0.14%)

Natural Gas (Nymex, futures prices) USD 3.42 MMBtu, (+1.42%, June 2017 contract)

Gold: USD 1,227.70 / troy ounce (+0.29%)

TASI: 6,882.51 (-0.69%) (YTD: -4.55%)

DFM: 3,420.19 (+0.74%) (YTD: -3.13%)

KSE Weighted Index: 400.71 (+0.38%) (YTD: +5.43%)

QE: 10,110.84 (+1.19%) (YTD: -3.12%)

MSM: 5,432.14 (+0.04%) (YTD: -6.06%)

BB: 1,307.09 (-0.07%) (YTD: +7.10%)

Calendar

11-14 May (Thursday-Sunday): Le Marché furniture expo at the state fairgrounds.

14 May (Sunday): The French Chamber of Commerce and Industry in Egypt’s discussion: “The EBRD approach to development financing and finance reform: the case of Egypt,” The Marriott Hotel, Cairo.

14-16 May (Sunday-Tuesday): CI Capital’s fifth annual Egypt Investor Conference, Gouna.

15-17 May (Monday-Wednesday): Morgan Stanley’s 3rd Annual GEMS Conference (EEMEA), London.

16 May (Tuesday): Official expiry date for the decision to suspend capital gains taxes on stock market transactions.

21 May (Sunday): Central Bank of Egypt’s Monetary Policy Committee Meeting.

22-23 May (Monday-Tuesday): North Africa Mobile Network Optimisation Conference, Cairo.

27 May (Saturday): First day of Ramadan (TBC).

07-09 June (Wednesday-Friday): 19th Annual Africa Energy Forum, Copenhagen, Denmark.

26-28 June (Monday-Wednesday): Eid Al-Fitr (TBC).

30 June (Friday): 30 June, national holiday.

23 July (Sunday): Revolution Day, national holiday.

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

06 October (Friday): Armed Forces Day, national holiday.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Smart Cities,” The French University, Cairo. Register here.

01 December (Friday): Prophet’s Birthday, national holiday.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.