Tabby puts Egypt business on ice on economy woes + Big Bosta news

Tabby suspends Egypt operations: Emirati buy now, pay later firm Tabby is putting its operations in Egypt on hiatus only six months after entering the country, company representatives confirmed to Enterprise. The news was first reported by the National, which picked up a leaked email the startup sent to Egyptian merchants.

No staff cutbacks: “There are no layoffs in our Egypt office. Our Egypt team will continue to support operations in other core markets. We'll continue to expand hiring in the Egypt market,” company co-founder and CEO Hosam Arab told Enterprise.

The rationale? A tough economy: “Recent macroeconomic developments have made our operating model challenging while maintaining our principles of interest-free payments,” the leaked email read. The fallout from the war in Ukraine and rising interest rates has tipped the Egyptian economy into crisis over the past year, causing the EGP to lose almost half its value against the greenback and sending inflation to its highest rate in five years. “We must prioritize projects that align with our long-term goals in core markets, and as a result, we have decided to pause our commercial operations in the Egyptian market,” Tabby said in an emailed statement.

This may not be goodbye forever: “We remain optimistic about the future of the Egyptian market and will continue to assess opportunities to re-engage in the future,” Tabby said.

Tabby customers have one month to find alternatives: Local customers will no longer be able to make new payments through Tabby as of 23 March, according to the email. The company has requested that its partner sellers remove any Tabby branding from their shops, apps, and websites by that date. “We understand if you prefer to switch Tabby off before 23 March,” the company told merchants.

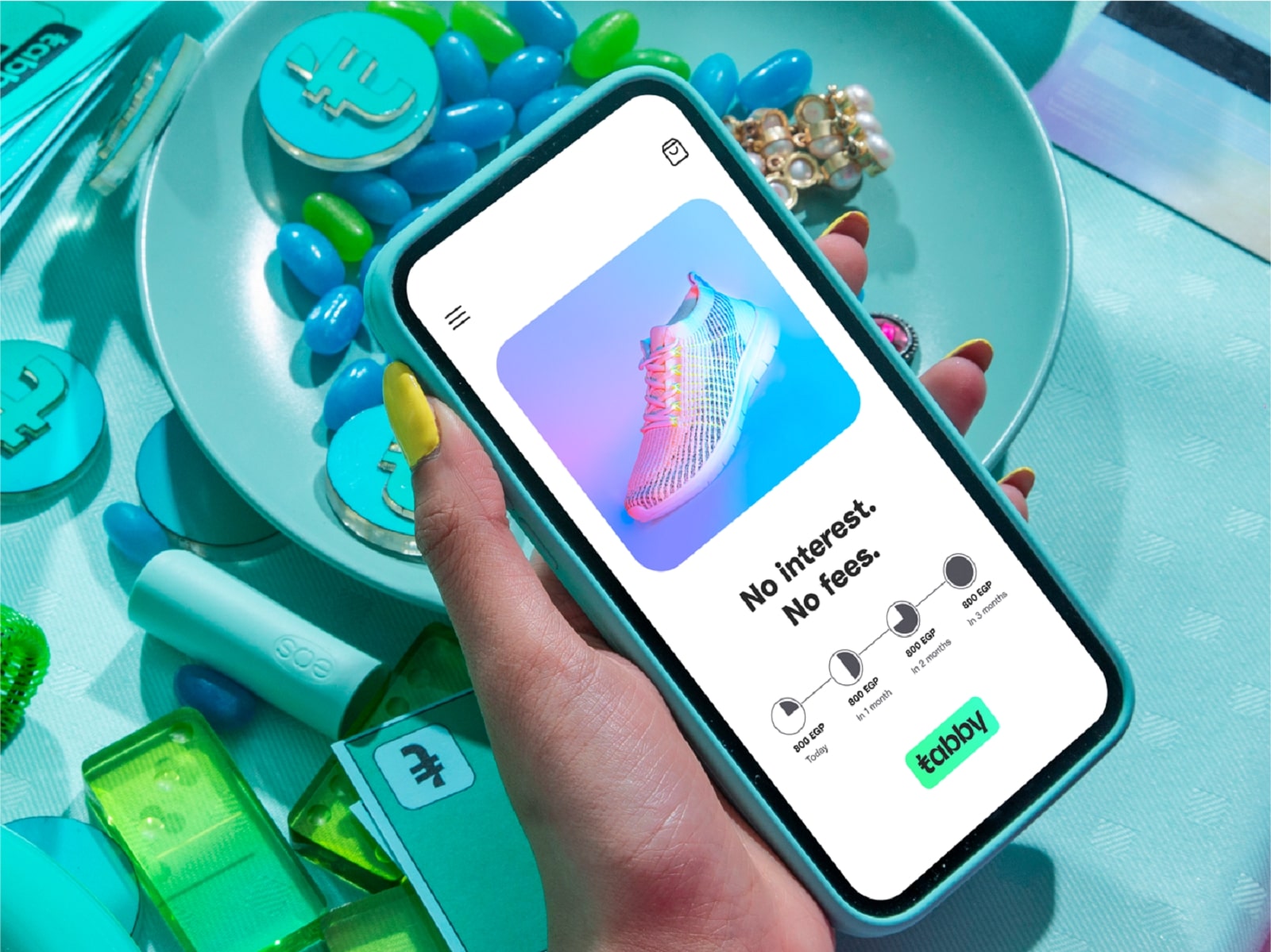

REFRESHER- Tabby, which offers zero-interest, zero-fee BNPL services, entered our market in September after securing USD 275 mn from global and regional investors. Egypt was the company’s fourth market after the UAE, Saudi Arabia, Bahrain, and Kuwait.

IN CONTEXT- The economic turmoil of the past 12 months has been a boon for others in the BNPL industry: Surging inflation is forcing more Egyptians than ever to rely on installment services to meet their needs, according to Reuters. Homegrown BNPL platform Sympl saw a 50% m-o-m increase in new clients in January and existing customers are turning to the company more regularly to fund purchases, co-founder Yasmine Henna told the newswire.

ALSO IN STARTUP WATCH-

Big news for Bosta: Logistics industry leader and ex-DHL Express Global CEO Ken Allen (LinkedIn) has joined Egyptian courier startup Bosta as an investor and board member, the firm said in a statement (pdf) yesterday. Allen spent 37 years at the German logistics giant, serving as its global CEO for a decade and heading up its e-commerce arm for three years. “Allen’s leadership and experience in the logistics industry will be invaluable as we continue to expand Bosta's footprint beyond Egypt and into new international markets,” said Bosta CEO and co-founder Mohamed Ezzat. The company did not disclose the size of Allen’s investment.