- Hussein Abaza named CEO, board member at CIB. (What We’re Tracking Today)s

- Some MPs are demanding an inquiry into the signing of the IMF facility. (Enterprise+: Last Night’s Talk Shows)

- Egypt was the top Middle East destination for inbound M&A in 2016 + other facts on Mideast ECM, DCM and M&A from Reuters’ league tables. (Speed Round)

- Egypt country risk improving, remains high. –BNP Paribas. (Speed Round)

- UK tour operators selling holidays to Sharm despite gov’t travel warning. (Speed Round)

- Did Disneyland cut off 28 Egyptian textiles exporters? (Speed Round)

- Gov’t to meet constitutional requirements on health, education spending next fiscal year. (Speed Round)

- Tear-jerker video for lovers of kids and dogs: Meet Abdelrahman, the street child who “Dances with Dogs.” (Worth Watching)

- The Markets Yesterday

Wednesday, 15 March 2017

Egypt was top Middle East target market for inbound M&A last year

TL;DR

What We’re Tracking Today

One of the pleasures of writing to you each morning is the ability to deliver good news on occasion, and this is one of those days. Proving that nice guys finish first (and that being brilliant doesn’t hurt), CIB announced late yesterday the appointment of Hussein Abaza as chief executive officer. He will also join the bank’s board of directors. CIB’s statement notes that his appointment has been approved by the Central Bank of Egypt and was made at the recommendation of the Board. Hussein, who joined the bank in 1985, was CEO (Institutional Banking) at the time of his appointment and is now responsible for strategy and operations across all functions. Our international readers will know Hussein well from his involvement in CIB’s award-winning investor relations program, where he is a fixture of the global circuit. Also yesterday, CIB noted that Amr El Ganainy has been named acting CEO (Institutional Banking) pending regulatory approvals. Read the announcement here (pdf). The news came after the bank’s annual general meeting, held yesterday.

The EGP plunged to its lowest level in a month against the greenback yesterday as rising imports ahead of Ramadan and higher demand for USD continued to put pressure on the currency, forcing the exchange rate to EGP 17.80-18.05 per USD 1, according to Reuters. Finance Minister Amr El Garhy is expected to announce a new fixed USD exchange rate for customs today, with predictions seeing it landing somewhere between EGP 17-17.50 per greenback from EGP 15.75 earlier this month, according to Al Borsa.

There are no Russian special forces units in Sidi Barrani, Russia’s Defense Ministry’s Chief of the Directorate of Media service and Information Igor Konashenkov said, according to Sputnik. Vladimir Dzhabarov, first deputy chairman of the Federation Council’s Committee for International Affairs, had also told Sputnik Russia has not sent military specialists and drones to an airbase in Egypt. Foreign Minister Sergey Lavrov denied any knowledge of the matter, according to TASS. The Russian statements follow a denial by the spokesman for the Egyptian Armed Forces. Andrei Krasov, first deputy head of Russia’s State Duma Defense Committee, said the report, first put forward by Reuters, is “aimed at escalating the situation.”

It’s interest rate day in the US of A: The US Federal Reserve’s Open Markets Committee wraps up a two-day meeting this evening (CLT), with widespread expectation of a rate hike in the pipeline.

Also today: Dutch voters go to the polls in an election that could see anti-Muslim politico Geert Wilders do well. He’s promised to pull out of the euro (among other things) if his party wins.

Why have oil prices fallen about 10% in the last week? KSA has something to do with it, Bloomberg suggests, writing: “Saudi Arabia told OPEC it dialed back on some of its supply cuts last month, pumping more than 10 million barrels a day as it replenished its own storage tanks.” But if you have five extra minutes and you’re a subscriber, go read the Financial Times’ “Five things to watch as oil prices fall,” which looks at the machinations of the US shale industry, OPEC, the outsized impact of US short-term inventory figures, hedge funds scaling back their positions, and the (not so) simple force of demand.

On The Horizon

The Contractor’s Compensation Act will be voted on within 10 days, the House of Representatives’ Housing Committee Chair Alaa Wali said, according to Al Masry Al Youm reports. Contractors had threatened to derail projects and have asked for contract terms to be extended until the act passes.

A World Bank delegation will visit in April to review the pace of economic reform.

The Central Bank of Egypt’s Monetary Policy Committee (MPC) will hold its next meeting on Thursday, 30 March to review rates.

Enterprise+: Last Night’s Talk Shows

The airwaves were mostly dull yet again, as Amr Adib and Lamees Al Hadidi continue to take time off for Adib’s health reasons. Lamees posted a video(runtime: 1:37) saying Adib’s health was improving and that she will be back on the air this Saturday.

MPs want inquiry into IMF loan signing: The Ismail cabinet is getting flak once again from inmates of Egypt’s most expensive mental health facility: MP Alaa Abdel Moneim tells Yahduth fi Masr’s Sherif Amer that a number of parliamentarians believe the move was “unconstitutional.” Abdel Moneim also said the House requested that Prime Minister Sherif Ismail be present during their discussion of how the first payment of the loan is being spent. We’re not quite sold on Mr. Abdel Moneim’s bill of goods: AMAY reports that after talking the issue to death, the House Legislative Committee tabled the issue to a later date. But nice try.

Hona Al Assema aired a pre-recorded episode featuring the EG Bank-sponsored Hona Al Shabab start-up competition, which saw four competitors pitching their business ideas to potential investors and mentors (watch, runtime: 49:17).

DMC’s Osama Kamal discussed the food poisoning of 2,262 children across eight different schools in Sohag due to bad school meals. Health Ministry spokesman Khaled Megahed naturally played down the incident, saying that 800 students were affected and all of the students have been released from hospital (watch, runtime: 5:25). Sohag Governor Ayman Abdel Moneim said the governorate has suspended distributing meals at school until an inspection is complete (watch, runtime: 7:01). We don’t what we find more shocking: An entire governorate held hostage to bad school lunches, or that over 2,000 students can fit in eight schools.

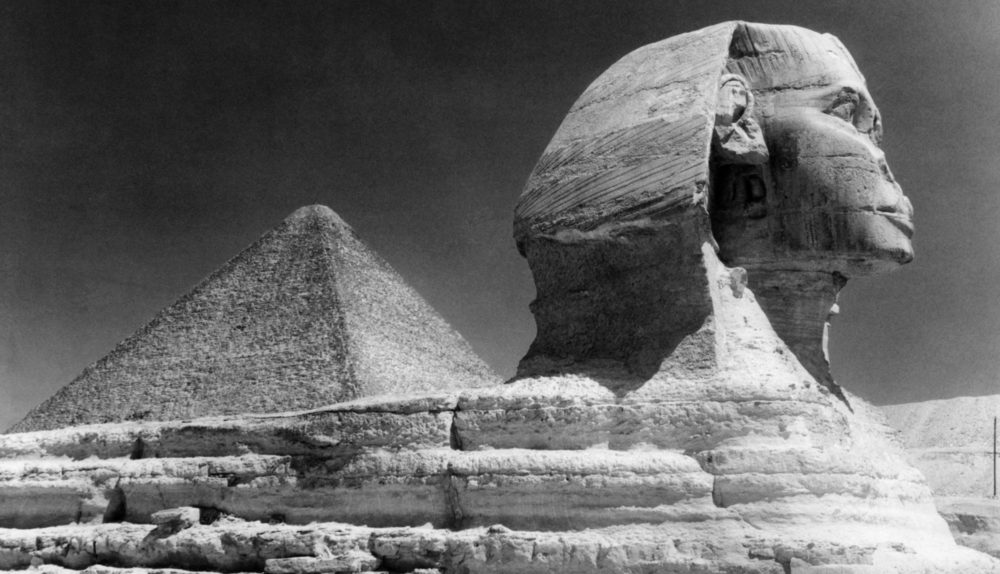

Interim Kol Youm host Ragaa El Geddawy aired a report on Denmark’s Prince Consort Henrik visiting Egypt and getting a tour of the Pyramids courtesy of — you guessed it — the ancient Egyptian deity of tour guides himself, Zahi Hawass (watch, runtime: 3:44). We hope Prince Henrik put in extra smiles and looked really interested.

Speed Round

Egypt’s country risk is “improving” but “remains high in the medium term,” according to an emailed report from BNP Paribas. The report points to economic reforms, including the EGP flotation and fiscal reforms, as moves that have triggered positive momentum. Renewed private capital inflows also “signal a return of confidence among investors.” BNP Paribas says that given scheduled financial support, there is “a better country-risk outlook for the next 18 months. In the medium term, several trends are encouraging: The coming on stream of a new gas field will save a substantial part of the energy bill, some large companies could gain export market shares and the large and growing Egyptian market is a source of substantial economic growth.”

BNP Paribas says medium term risk is “high” because of three factors. First, social pressure exists in a context of the sharp rise in inflation. Second, the continued fiscal and current account deficits, especially external accounts, remain fragile and dependent on foreign capital inflows. The third set of risk factors is external as regional political tensions remain high, exposure to changes in commodity prices, and the vulnerability of capital flows to emerging markets. Assuming the reform process continues, the improvement of country risk in the medium term will depend on “curbing inflation, generating economic growth and external financial support.”

Omm El Donia’s economic reform program unfolding just fine for now, says IMF mission chief for Egypt Chris Jarvis, adding that the Finance Ministry and Central Bank of Egypt have been implementing the policies agreed upon with the Fund. Jarvis’ statements to Al Borsa follows meetings between Finance Minister Amr El Garhy and an IMF team in London over the weekend to discuss the government’s progress on the reforms. An IMF delegation is due to visit in April to review progress on the reforms to which we’ve committed before the fund disburses the second payment of the USD 12 bn bailout package.

2016 wasn’t a bad year for Egypt M&A, ECM flow. With the headwinds presented by an exceptional spread between official and parallel market exchange rates for most of the year, last year was never going to be the same type of banner year for Egyptian merger, acquisition and initial public offering activity as was 2015. But the latest Reuters Deals Intelligence Middle Eastern Investment Banking Analysis suggests it wasn’t a year over which to commit seppuku:

- Egypt was the most-targeted nation for inbound M&A, accounting for 44% of flows into the Middle East.

- EFG Hermes’ advisory on Solb Misr’s USD 1.135 bn sale to the National Service Projects Organization ranked as the sixth-largest Middle East M&A announced last year and the third-largest completed.

- Eni‘s sale of a USD 1.125 bn stake in the Zohr supergiant gasfield to Rosneft was the seventh-largest transaction announced last year (it was completed in early 2017).

- Egypt was the third-most active issuing nation on the equity capital markets front, with USD 245 mn in transactions compared with USD 1.4 bn for the UAE and USD 799 mn in KSA.

- EFG Hermes was ranked fifth on the regional ECM league table with a 6.5% market share, while rival CI Capital eked out a ninth-place finish with a 1.7% share.

- EFG Hermes’ IPO of cheesemaker Domty was the eighth-largest ECM transaction last year and the third-largest IPO. CI Capital’s advisory to cheese maker Obour Land was the tenth-largest ECM transaction and fourth-largest IPO.

- The Ismail government’s USD 4 bn eurobond was the fourth-largest debt issue announced last year after competing offerings from Saudi Arabia, Qatar, and Abu Dhabi. Egypt’s eurobond was 3.1x oversubscribed.

Okay, can you put that in context? Total spending on Middle East investment banking fees topped USD 820 mn last year, up 18% year-on-year. Total fees earned on syndicated lending were at a nine-year high, while ECM underwriting fees plunged to a 12-year low and fees generated from M&A were the lowest since 2012. Other highlights:

- The total value of M&A closed last year in the Middle East was down 16% to USD 46.9 bn; the merger of NBAD and FGB in the United Arab Emirates is both the largest domestic MENA M&A of all time and the largest transaction announced last year. Financials accounted for 355 of all M&A activity with at least one Middle East counterparty, followed by energy and power and real estate.

- Equity capital market issuances fell 55% in value to USD 2.6 bn last year, the lowest annual total since 2004. Eight IPOs accounted for 35% of ECM activity in the region, with the lion’s share of activity in the healthcare, financials and media & entertainment industries.

- Debt capital markets activity soared 145% thanks to KSA’s record USD 17.2 bn bond sale, closing the year at USD 77.78 bn.

And before we change gears: EFG Hermes was the only Egyptian firm to make the separate Reuters ranking of financial advisors in its Emerging Markets M&A Review for 2016. EFG Hermes was ranked 21 in the region (ahead of Deutsche Bank and Bank of America Merrill Lynch) with three transactions, up from 51st in 2015. The list was topped by UBS, Crédit Suisse, and JP Morgan.

Speaking of CI Capital: Tiba Group’s Saddiq Afifi says he is now looking to acquire a 10%stake in the investment bank after previously announcing he was backing out of the transaction, Al Borsa reports. He reportedly said that he had wanted to see whether the Egyptian Financial Supervisory Authority would approve the sale, which it did earlier this month. Former Zamalek football club chairman Mamdouh Abbas and Compass Capital’s Shamel Aboulfadl have pulled out, according to sources close to the transaction. The lineup of investors will be finalized today, with the transaction set to be completed this month, the sources added.

UK tour operators selling holidays to Sharm despite gov’t warning: UK tour operators have apparently been selling holiday packages to Sharm El Sheikh, ignoring the Foreign and Commonwealth Office’s warning against travel to the destination, the Sun reports. Thomas Cook and Thomson have now started accepting bookings for the autumn season, despite the fact the trips may not go ahead if the warnings remain in place. Sun reporters found that some booking agencies have barely been mentioning the warning. The UK government, including Foreign Secretary Boris Johnson, has been offering us nothing but platitudes on lifting the warning, despite declarations that the country is safe. Once again, the private sector moves faster than government.

In other tourism news: The House of Representatives will not support raising the price of tourist visas to USD 60 from USDU 25, citing the harm it could cause the still-slumping industry, MPs tell Al Borsa. The House Tourism and Aviation Committee will be hosting the ministers of tourism and foreign affairs today to discuss the proposal, which met with criticism from the international community at the ITB Berlin travel trade show last week. The Ismail cabinet is preparing a study to reassess the impact of a visa fee hike on tourist inflows, Tourism Minister Yahya Rashed said at a press conference, according to Al Mal, adding that he plans to discuss the matter further with the cabinet soon. We rarely applaud our nation’s parliamentarians, but they’re doing the right thing in this case.

Discount minimarket chain Kazyon will invest some EGP 800 mn in growth this year and plans to open 100 new branches, says Mohamed Kharma, according to remarks carried by Al Shorouk. Kharma, executive director at Kazyon parent company Tawfeer for Food Products, says the homegrown chain retails products for 10%-20% below supermarket prices.

Did Disneyland cut off 28 Egyptian textiles exporters? Disneyland isn’t the happiest place on earth for Egyptian textiles exporters after reportedly canceling contracts with 28 of them. The stated reason? Egypt’s political and economic issues, according to government sources. These sources tell low-tier news outlet Masrawy on Monday that the government has requested that Israel intervene as these textiles, which bring in export receipts of some USD 150 mn per annum, are exported through the Qualified Industrial Zones (QIZ) agreement, which allows Egyptian products to enter the US, customs-free, as long as the products include at least 10.5% Israeli content. Color us skeptical until more details emerge, because well, it’s Masrawy.

Was Wael Fakharany told last month he was on his way out? Now-former Careem Egypt managing director Wael Fakharany was allegedly informed last month that he was on the way out, Al Mal claims, citing unnamed sources it claims have knowledge of the matter. Fakharany’s reaction is “perplexing” to the company, the sources add. The clash between Fakharany and top brass at the ride-sharing company had been ongoing for some time and repeated mediation efforts were unsuccessful. News reports on Monday said that Fakharany might be suing Careem.

KYC regs for capital markets are tightening: Know-your-client regulations have been tightened up in the latest amendments to the Capital Markets Law’s executive regulations issued by Investment and International Cooperation Minister Sahar Nasr, Al Borsa reports. The amendments, which appear to impact just about every form of capital market transaction, also allow the Egyptian Financial Supervisory Authority (EFSA) to investigate individual investors (whether foreign or local) on M&A transactions, share purchases, or setting up a fund if their stake in it exceeds 25%, said EFSA chief Sherif Samy.

The government will meet constitutional requirements for spending on health and education in the FY2017-18 budget, promised Prime Minister Sherif Ismail in press statements on Tuesday. The constitution mandates that health and education spending amount to 8% of total state expenditures. Ismail did not elaborate, but he had previously stated that total expenditures will surpass EGP 1.1 tn. Deputy Finance Minister Mohamed Maait had said that increased spending on health — likely due to the rollout of the Universal Healthcare Act — and education were behind the rise in expenditures. Ismail added that the budget is still being drafted and will be ready to present before the cabinet’s economic group at its next meeting, Al Masry Al Youm reports.

Critics of the automotive directive are still trying to derail the bill and they’re using Europe as a peg: A number of local auto industry players (cough, importers) are suggesting that discussions on the automotive directive — which would give tax breaks to local manufacturers and protect them against unfair advantages now enjoyed by EU, Turkish and Moroccan imports — should be postponed until the government and industry players can reach consensus over its clauses and to “avoid any squabbles” with European car manufacturers, who had expressed their distaste for the directive, Al Mal says. The automotive directive is currently before the House of Representatives’ Industry Committee and was on track to head to a plenary session vote by mid-March.

MOVES- Wagih Mostafa Amin El Tazi was reappointed as vice chairman of the Egyptian Exchange, Al Masry Al Youm reports. El Tazi’s appointment is effective 18 January 2017 and expires with the end of the current the board of directors’ term on 30 June with the end of the fiscal year.

Investment and International Cooperation Minister Sahar Nasr will run the Public Enterprise Ministry on an interim basis while current minister Ashraf El Sharkawy seeks medical treatment in Germany, the Prime Minister’s Office said yesterday.

Cairo Metro’s financial troubles: Cairo Metro owes overdue electricity bills worth EGP 260 mn and water bills worth EGP 40 mn, Ahram Gate reports. The companies are now calling for their receivables and threatening to take legal action and switch off access to electricity and water, according to Cairo Metro’s spokesperson Ahmed Abdel Hady. Abdel Hady’s remarks come at odds with the Electricity Ministry’s spokesperson, who said the ministry would never cut off power access to such a “vital state institution,” but said there is action to resolve the financial dispute. This follows the news that at least 11 companies are refusing to supply Cairo Metro with spare parts and maintenance services until the company makes good on its debts. The House of Representatives’ Transport Committee is giving Transport Minister Hisham Arafat three weeks to present them with his strategy to revamp sector activities and improve their performance (including the Cairo Metro), a promise he had made after he was sworn in last month, Al Mal says. So far the strategy involved shopping for investors to provide USD 15.2 bn to fund the ministry’s projects. The only way this stuff makes it into the press is if it suits someone’s interests, and our suspicion is that the folks at the Metro are angling for a fat increase in their budget allocation.

The discovery of the Zohr gas field has boosted hopes of other such finds in the eastern Mediterranean that could help meet Europe’s energy needs, Eni’s Chief Exploration Officer Luca Bertelli told the Associated Press. The discovery “has reinvigorated the interest of other major oil and gas companies in the region,” he says. Speaking of potential off the waters of Cyprus, Israel, and Lebanon, he says: “I believe the potential is here, but we need to go step by step … If we don’t drill, we don’t know.”

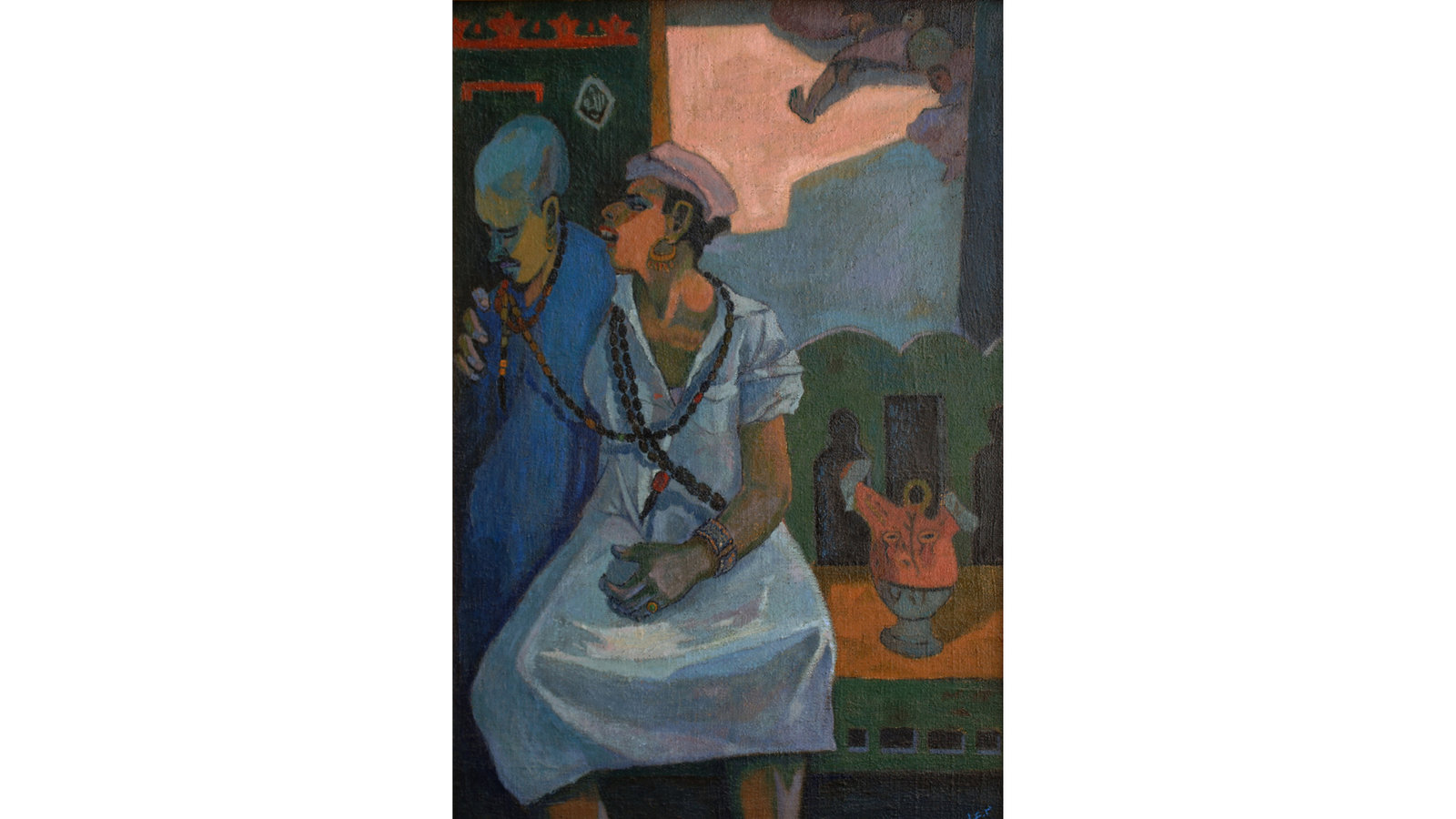

Image of the Day

Fi Rehab El Set, a painting by Egyptian modernist Mamdouh Ammar (1928-2012), will be on display at this year’s Art Dubai art fair. Harper’s Bazaar Arabia says the piece, exhibited by ArtTalks Egypt from Cairo, “was painted in 1952, the year of both the 23 July Revolution and Ammar’s graduation from the Faculty of Fine Arts in Cairo. He then joined the Contemporary Art Group, and became a key figure in the development of a politically engaged Egyptian Folk Realism movement, felt in the Socialist Realist style and subject matter of this oil on canvas.” Art Dubai 2017 runs from 15 to 18 March.

Egypt in the News

Topping coverage of Egypt this morning: Pickups of Reuters’ exclusive on what it claims are Russian special forces operators inEgypt sent to bolster Libya’s Khalifa Haftar. Denials from Russia and Egypt are also being widely picked up.

Frontera News takes a dim view of Egypt’s reform agenda: London-based and EM-focused business analysis firm Frontera News appears to take a less than optimistic view of Egypt’s progress on the economic front, postulating in a series of articles that the country is locked between the proverbial rock and hard place of appeasing the poor and attracting investments. It describes the reform process as slow, with the biggest challenge to its progress being the government backtracking or slowing down the pace of subsidy reform due to a rising inflation rate and public outcry. Frontera noted the public backlash against Supply Minister Ali El Moselhy’s attempt to cut bread rations and the subsequent backtracking. It feels that if more urgency on reform isn’t taken, Egypt risks losing subsequent payments from the IMF’s USD 12 bn facility signed last November.

Frontera expects Egypt’s economic growth to be relatively low, but predicts inflation willfall this year, citing FocusEconomics’ forecast that GDP will grow marginally in FY2017-18 to 3.8% from 3.4%. The challenge for the CBE is choosing between curbing price rise and dampening economic growth. These contrarian views don’t appear to be reflected in its analysis of the EGP float. The strength of the EGP will be used as a barometer by foreign investors: the weaker, the better.

Where have you folks been these past months? The New York Times’ editorial board is back at it again, saying the US should not be “Egypt’s accomplice.” They say Egypt will want the preferential financingthat allows for ordering weapons on credit restored and the modest amount of weapons that is still being withheld disbursed soon. After claiming the government has “persecuted violent and nonviolent Islamist groups with equal zeal and without due process … maligned and harassed human rights activists … And it has smothered what remains of the political opposition.” One notion we won’t quibble with at all: The Times urges that detained humanitarian worker Aya Hijazi be released.

Read the editorial alongside Joshua Hammer’s lengthy piece, published yesterday, for the Times’ Magazine: “How Egypt’s activists became ‘generation jail.’”

Other international coverage worth noting, if you have a moment this morning:

- Sinai has become a “breeding ground for terror,” Maged Atef writes in Foreign Affairs (paywall).

- Egyptian-Canadian metal band Massive Scar Era were denied entry to the US toplay in SXSW for having the wrong type of visa, KQED reports. Band member Cherine Amr had a tourist B-1 visa, but was told she needed a P-2 visa. She says it is political.

- If Pope Francis visits Al Azhar during his proposed trip to Egypt, he will need to make sure that any détente “includes clear insistence that the country’s Christian minority must be protected. Otherwise, local Christians may see the visit as providing cover for their persecution,” John L. Allen Jr. writes in Catholic publication Crux.

- Many in Egypt still see [redacted] harassment as the woman’s fault, but there are some “encouraging” signs of change, Zvi Bar’el writes for Israel’s Haaretz (paywall).

- The Sun Ireland is running a plea by the family of Irish citizen Ibrahim Halawa, who they say is dying in prison in Egypt.

- Reuters is getting in on the “money for garbage” story.

On Deadline

Don’t break out “the dance of joy” every time Egypt gets a positive mention in the global press, Al Shorouk editor-in-chief Emad El Din Hussein writes. A statement (be it positive or negative) coming from entities such as Moody’s or the World Bank should be recognized as far more important than something in an obscure media outlet. Ziad Bahaa El Din largely echoes Hussein’s basic argument, saying that looking at short-term growth indicators is not sufficient, and that more attention should instead be directed towards evaluating sustainable development and living conditions. Bahaa El Din points out that Egypt’s economy has seen significant growth over the past 40 years, particularly during the last five years of Hosni Mubarak’s rule, but that this growth did not translate into improved living conditions because there was no social development happening in tandem.

Worth Watching

WARNING, tear-jerker alert: Every once in a while, Youm7 hits on something heartwarming, profiling Abdel Rahman — a street child whose friendship with a pack of dogs has melted social media’s hearts. But that’s just the cute part of the story: Abdel Rahman’s backstory puts Slumdog Mn’aire to shame. Abandoned by his mother as an infant, Abdel Rahman and his brother were kicked out of the house by his father to appease his stepmother. Separated from his brother, and robbed by grownups, he has found solace tending to a pack of street dogs. Videos (runtime: 8:43) of him dancing with his furry friends (appropriately titled Dances with Dogs) were picked up by the Arab press and even melted the stone cold heart of the bureaucracy, prompting the government to take action.

Do not watch this before your meeting this morning, and hug your kids and pets extra hard tonight.

Diplomacy + Foreign Trade

Irrigation ministers from Egypt, Sudan, Uganda, and Rwanda met on Monday to discuss Egypt’s concerns about the Cooperative Framework Agreement of the Nile Basin Initiative (NBI), Ahram Online reported.

Military Production Minister Mohamed Al Assar discussed with his Belarusian counterpart establishing joint-venture factories to produce tractors, tires, water pumps, steel, and drilling equipment during his visit to Minsk on Monday, Al Borsa reports. Al Assar also met with Belarusian President Alexander Lukashenko to discuss further cooperation, according to Belarus News.

Energy

Saudi-Egypt electricity interconnection project back on?

Trial operations for the Saudi-Egypt electricity interconnection project to exchange up to 3 GW of electricity will begin in 2019, Electricity Ministry spokesman Ayman Hamza tells Al Shorouk. Reports had surfaced last week that the tender for interconnectivity grid with Saudi has been postponed to mid-April.

Empower in talks with Canadian partners to establish new 10 MW waste-to-energy power plant

Energy group Empower is in the final stages of talks with Canadian investors to establish a 10 MW waste-to-energy power plant under the feed-in-tariff (FIT) program, Al Borsa reports. On a related note, The Egyptian Electricity Transmission Company has officially notified FiT companies that the increases under the cost-sharing agreement (reaching EGP 955k per MW from EGP 583k per MW) have been instituted, Al Borsa reports.

Basic Materials + Commodities

Turkish citrus producers facing market slowdowns, unfazed by Egyptian competition

The Turkish citrus season is slowed down by market trends and heavy rain, but producers there are still not worried by Egyptian competition. “European markets aren’t interested in Egyptian citrus because of reliability issues. They prefer Turkish and Spanish citrus instead,” a Turkish exporter tells Fresh Plaza. Producers from Turkey are also focusing on Russia, which still imposes a European food import ban.

Supply Ministry limits private sector’s role in wheat storage

The private sector will see a limited role in storing wheat during this year’s wheat collection harvest, confirmed Supply Minister Ali El Moselhy. In a statement announcing the new the regulations for wheat storage, private silos will only be used if a governorate’s silos are maxed out, and even then, mandate that government employees take over management of the private silo.

CAPMAS releases supply, consumption data on basic goods

Egypt’s wheat supply deficit increased 55.7% to 10 mn tonnes from 6 mn tonnes between 2006 and 2015, according to the state census bureau CAPMAS. In a statement released on Wednesday, CAPMAS said that Egypt’s wheat self-sufficiency ratio (which looks at domestic production as a ratio of available supply) decreased from 56.4% to 49.1% during the period. Average wheat consumption per capita decreased 10% to 173 kg per year from 192.4 kg a year. As for other basic goods, rice supply surplus decreased 85.6% for the period to 141K tonnes from 976k tonnes. This comes despite annual per capita consumption increasing 18% to 57 kg from 48.3 kg. Annual per capita consumption of sugar decreased 37.9% to 53kg from 85.4kg. The report noted that Egypt was ranked 59 out of 118 in the International Food Policy Research’s Global Hunger Index 2016, where the higher the rank, the more susceptible a country is to famine. It also noted that Egypt’s score in the Economist’s Intelligence Unit’s Global Food Security Index 2016 (which you can download from the landing page here), ranking 57 out of 113.

Automotive + Transportation

Saudi King signs MoU with Toyota to launch feasibility study on auto factory

Saudi Arabia’s King Salman signed an MoU with Toyota on Monday night to launch a feasibility study on building an auto factory in Saudi that could potentially source its parts from Egypt and Turkey, Al Borsa reports. Toyota had said it would make a final decision based on whether importing parts from Egypt and Turkey is more profitable than simply exporting finished vehicles to the region as it does now.

Tourism

Companies with overdue payments to TDA for North Coast land to pay bills in USD

Companies with overdue payments to the Tourism Development Authority (TDA) on land in the North Coast will have to pay in USD at an interest rate pegged to the LIBOR rate or risk losing the land, according to TDA boss Serag El Din Saad, Al Borsa reports. The TDA, which typically collects its payments in EGP, had announced in early March that it would not be setting a fixed exchange rate for industry companies with overdue bills, asking them to use the post-float rates to calculate their dues.

Banking + Finance

Bank heads deny not giving adequate funding to small and medium construction contractor companies

Banks have been offering loans to construction contractors of all sizes, banking officials said at the Egypt’s Builders Conference yesterday, Al Borsa reports. Emirates NBD’s Deputy Managing Director Sahar El Damaty denied accusations that banks are holding back from providing adequate funding to contractors, saying that the sector receives the largest percentage of the bank’s credit portfolio. According to El Damaty, medium-sized contractors have received EGP 10.8 bn of funding from banks. Meanwhile, NBE raised the credit ceiling for contractors to EGP 40 bn from EGP 20 bn in 2016, and offered EGP 5 bn in LCs to SMEs, according to the bank’s vice president, Yehia Aboul Fotouh.

Legislation + Policy

House postpones vote on Industrial Permits Act

A vote on the Industrial Permits Act was postponed due to a lack of quorum at yesterday’s plenary session, Ahram Gate reports. The House of Representatives had said it would begin discussing the legislation, which expedites the issuing of permits for factories, last month.

Parliament receives Saudi island transfer agreement

The House of Representatives has received the Tiran and Sanafir sovereignty handover agreement. The agreement will move next to the House Constitutional and Legislative Affairs Committee for review, Al Masry Al Youm reports.

Egypt Politics + Economics

State to fall short on tax revenue target pledged for next year -source

The Finance Ministry’s target for tax collection in the FY2017-18 budget could fall short of the IMF’s target, an unnamed source tells Al Borsa. The IMF reportedly expects Egypt to bring in around EGP 584.4 bn in tax revenues in FY2017-18, but the Ministry is discussing a figure closer to EGP 460 bn, the source says. The ministry sees its figure as “more reasonable” given the projections for economic performance and growth.

National Security

Delivery of Ka-52 helicopters to begin in 2017

Rostec will begin delivering Ka-52 Alligator helicopters to Egypt in 2017, according to FlightGlobal. In total, the order is for 46 helicopters. The Ka-52s will be used on the Mistral-class helicopter carriers Egypt purchased from France. Egypt was said to be considering an offer to buy Ka-52 helicopters at the IDEX exhibition last month.

Egypt’s navy conducts exercises with Bahrain, Cyprus

Egypt’s navy conducted joint military exercises with Bahrain on Tuesday, Ahram Online reports. The navy also took part in joint search and rescue exercises with Cyprus, according to Cyprus’ Famagusta Gazette.

Sports

EFA to appeal Administrative Court’s decision to dissolve its board

The Egyptian Football Association (EFA) will appeal the Administrative Court’s decision last Sunday to dissolve the EFA’s Board of Directors, the EFA announced in a statement picked up by King Fut. The court had ruled in favor of a lawsuit questioning the legitimacy of the board’s elections.

On Your Way Out

Valerie Didier-Hess and Hussam Rashwan are launching a catalogue raisonné ofMahmoud Said’s work in Dubai this week, Anna Seaman writes in The National. Didier-Hess and Rashwan’s catalogue raisonné will be a comprehensive, annotated listing of all the known artworks by Said, and used as a document of authenticity for third parties. It is published by Italian house Skira over two volumes. "Mahmoud Said is so special because he did not have one specific style or recognisable subject matter. It is his use of colour that can characterise him but he doesn’t belong to any group, -ism or trend because he influenced himself so much from many different sources," says Didier-Hess.

The markets yesterday

EGP / USD CBE market average: Buy 17.9488 | Sell 18.0579

EGP / USD at CIB: Buy 18.00 | Sell 18.10

EGP / USD at NBE: Buy 17.90 | Sell 18.00

EGX30 (Tuesday): 12,790 (-1.1%)

Turnover: EGP 1.1 bn (153% above the 90-day average)

EGX 30 year-to-date: +3.6%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 1.1%. CIB, the index heaviest constituent declined by 1.3%. The EGX30’s top performing constituents were: ACC up 1.9%, Ezz Steel up 1.8%, and Egyptian Iron and Steel up 1.7%. Yesterday’s worst performing stocks included Amer Group down 3.3%, Elsewedy Electric down 3.0%, and Telecom Egypt down 2.9%. The market turnover was EGP1.1 billion, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP + 49.7 mn

Regional: Net Short | EGP – 12.1 mn

Domestic: Net Short | EGP – 37.6 mn

Retail: 61.7% of total trades | 64.6% of buyers | 58.8% of sellers

Institutions: 38.3% of total trades | 35.4% of buyers | 41.2% of sellers

Foreign: 19.1% of total | 21.3% of buyers | 16.8% of sellers

Regional: 10.5% of total | 10.0% of buyers | 11.1% of sellers

Domestic: 70.4% of total | 68.7% of buyers | 72.1% of sellers

WTI: USD 48.45 (+1.53%)

Brent: USD 50.92 (-0.84%)

Natural Gas (Nymex, futures prices) USD 2.95 MMBtu, (+0.34%, April 2017 contract)

Gold: USD 1,199.50 / troy ounce (-0.26%)

ADX: 4,388.0 (+0.1%) (YTD: -3.5%)

DFM: 3,468.6 (-0.9%) (YTD: -1.8%)

KSE Weighted Index: 419.7 (+0.1%) (YTD: +10.4%)

QE: 10,314.2 (-0.5%) (YTD: -1.2%)

MSM: 5,697.6 (-0.3%) (YTD: -1.5%)

BB: 1,374.6 (+0.3%) (YTD: +12.6%)

Calendar

15 March (Wednesday): Arab Women Organization’s event: Investing in refugee women, UN General Assembly Building, New York City.

18-19 March (Saturday-Sunday): Delegation of Japanese food industries companies visits Egypt.

20 March (Monday): SWIFT Business Forum Egypt 2017, Cairo.

29-30 March (Wednesday-Thursday): Cityscape Egypt Conference, Nile Ritz-Carlton, Cairo.

29-31 March (Wednesday-Friday): Balanced Development of Siwa Oasis International Tourism Conference, Siwa Oasis.

30 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

31 March – 03 April (Friday-Monday): Cityscape Egypt Exhibition, Cairo International Convention Center, Cairo. Register here.

03-06 April (Monday-Thursday): Agri & Foodex Africa, Khartoum International Fair Ground, Khartoum, Sudan.

04 April (Tuesday): Emirates NBD Egypt PMI reading for March announced. The report will be available here.

08-10 April (Saturday-Monday): Pharmaconex, Cairo International Convention Center, Cairo.

16 April (Sunday): Coptic Easter Sunday.

17 April (Monday): Sham El Nessim, national holiday.

20 April (Thursday): Closing date for the Egyptian Mineral Resources Authority bid round number 1 for 2017 for gold and associated minerals.

24-25 April (Monday-Tuesday): Renaissance Capital’s Egypt Investor Conference, Cape Town, South Africa.

25 April (Tuesday): Sinai Liberation Day, national holiday.

25-26 April (Tuesday-Wednesday): MENA New Energy conference, Hyatt Regency, Dubai.

30 April – 03 May (Sunday-Wednesday): Cement & Concrete 2017, Riyadh International Convention & Exhibition Center, Saudi Arabia.

01 May (Monday): Labor Day, national holiday.

08-09 May (Monday-Tuesday): Third Egypt CSR Forum, Intercontinental Citystars Hotel, Cairo.

16 May (Tuesday): Official expiry date for the decision to suspend capital gains taxes on stock market transactions.

22-23 May (Monday-Tuesday): North Africa Mobile Network Optimisation Conference, Cairo.

27 May (Saturday): First day of Ramadan (TBC).

26-28 June (Monday-Wednesday): Eid Al-Fitr (TBC).

30 June (Friday): 30 June, national holiday.

23 July (Sunday): Revolution Day, national holiday.

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

06 October (Friday): Armed Forces Day, national holiday.

01 December (Friday): Prophet’s Birthday, national holiday.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.