High rates, upcoming passive inflows bode well for Egyptian bonds

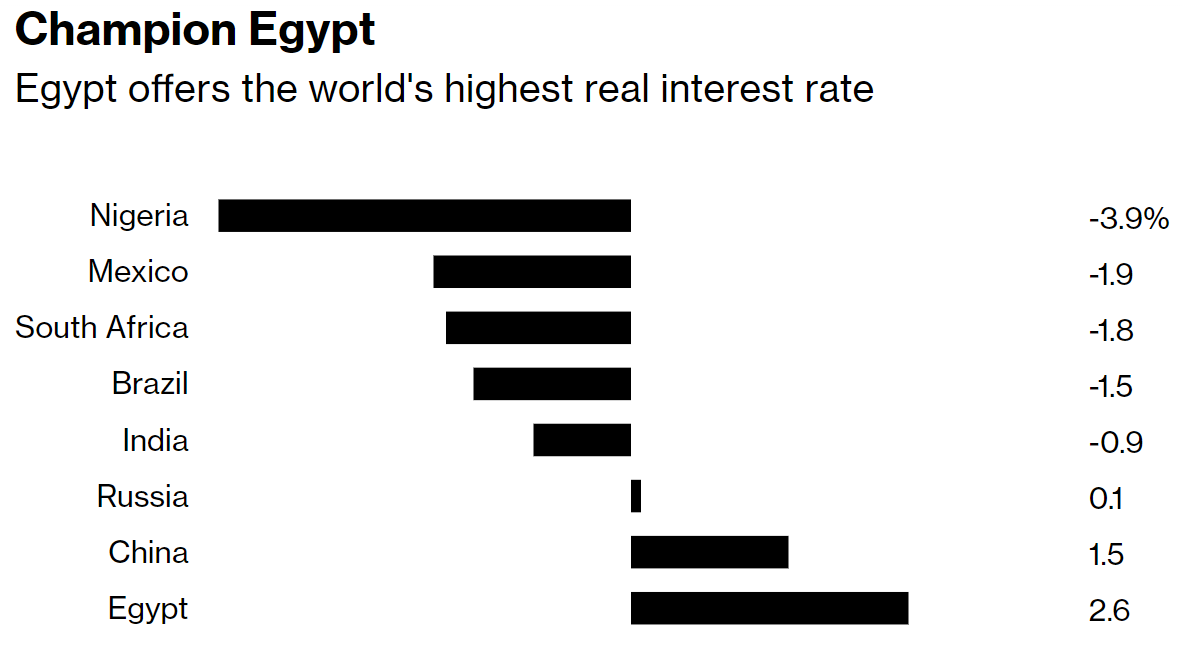

Egypt’s bond market is poised for more gains this year thanks to our attractive interest rate, which is currently the world’s highest after adjusting for inflation, several global asset managers tell Bloomberg. Amid a global bond rout prompted by the Federal Reserve’s decision to accelerate plans to hike rates, analysts and fund managers are bullish on Egyptian debt and are expecting double-digit returns this year, bolstered by the addition of EGP bonds to JPMorgan’s emerging bond index.

Egypt’s local bonds were the world’s second-best performing worldwide last year, with returns reaching 13%, according to Bloomberg data. By comparison, local emerging market debt saw an average loss of 1.2%. Egyptian debt has seen a return of 156% over the past five years, as the IMF-backed reform program and Gulf financing attracted investor inflows — beating out emerging markets’ 26% and the S&P 500’s 133% returns over the same period.

Analysts expect this to continue: PineBridge Investments and Renaissance Capital both see EGP bonds delivering double-digit returns this year, the latter of which expects a 17% gain.

Passive inflows will give us another boost: Already a favorite among emerging market investors, Egypt’s debt market will be bolstered further by joining JPMorgan’s Emerging Markets Bond Index (EMBI) this month — setting the market up for more inflows from passive funds. Egypt currently has USD 26 bn of eligible government bonds.

Will we withstand US interest rate hikes? Egypt has remained attractive for investors, even as the outlook for emerging markets and the global bond market at large has darkened in response to the Federal Reserve’s hawkish turn. We were one of only a few emerging markets to have delivered decent returns since December, when the Fed announced decisive action to combat inflation and hike rates soon in 2022. Egypt’s real interest rate — the rate adjusted for inflation — is 2.35%, as opposed to a negative 6.55% for the US, according to the report. “With real rates that high, we don’t think the Fed raising rates modestly this year will be a key driver for Egypt bonds,” Jim Barrineau, head of emerging-market debt at Schroders, told Bloomberg.

Inflation remains within comfort zone: Egypt’s annual urban inflation rose to 5.9% in December from 5.6% in November, ending a two-month downward trend, but remaining within the lower end of the Central Bank of Egypt’s 7% (±2%) target range by 4Q2022, helping EGP-bonds go against a global trend of negative returns. “The ability to keep inflation relatively contained has been key,” Barrineau said.

And it’s not just us — EM LCY bonds are trending. Local currency bonds saw their biggest inflows in six months on Monday, Bloomberg reports, as investors turn to the long-troubled asset class amid a global rout in USD-denominated debt. US investors poured USD 71 mn into JPMorgan’s EM local bond exchange-traded fund, its biggest daily gain since June. Local bonds have underperformed for a decade and are usually the first to be sold off in a crisis — but high real interest rates in developing nations amid expected Fed tightening, USD weakness and low valuations have helped EM local bonds outperform both US treasuries and corporate debt in recent weeks.