Devaluation: Yes? No? Maybe?

Are we, or are we not? Unless you pulled a Rip van Winkle or were in the High Arctic, you know by now the Central Bank of Egypt did not devalue the EGP on Thursday as its board meeting came and went without a public announcement. Hesitation is the order of the day across the government, Al Masry Al Youm cites government sources as saying, as officials struggle to stem inflation in key commodities. Fear of inflation is reportedly driving the cabinet and the CBE away from a full float and toward a gradual devaluation sometime in November or December, despite statements by IMF managing director Christine Lagarde that a devaluation will need to happen before the IMF board approves a USD 12 bn facility. This dilemma has driven a near-paralysis in decision-making over the devaluation, an unnamed government source tells the newspaper.

The EGP has been gaining strength as major buyers have reportedly sat on the sidelines to send a message that rampant speculation has gone too far. The EGP strengthened to EGP 15.30 on Thursday (from close to EGP 16.00 the day before) and rallied to 15.05-15.20 yesterday, Al Mal reports.

Industry is looking to send a message: Industry associations plan to announce they will stop sourcing FX on the parallel market for 21 days, according to Adel Al Shenwany, a member of the food industries division at the Federation of Egyptian Chambers of Commerce speaking with Ahram Gate. initiative is expected to be widely adopted by industry this week, said Walid Helal, member of the 10th of Ramadan investors association.

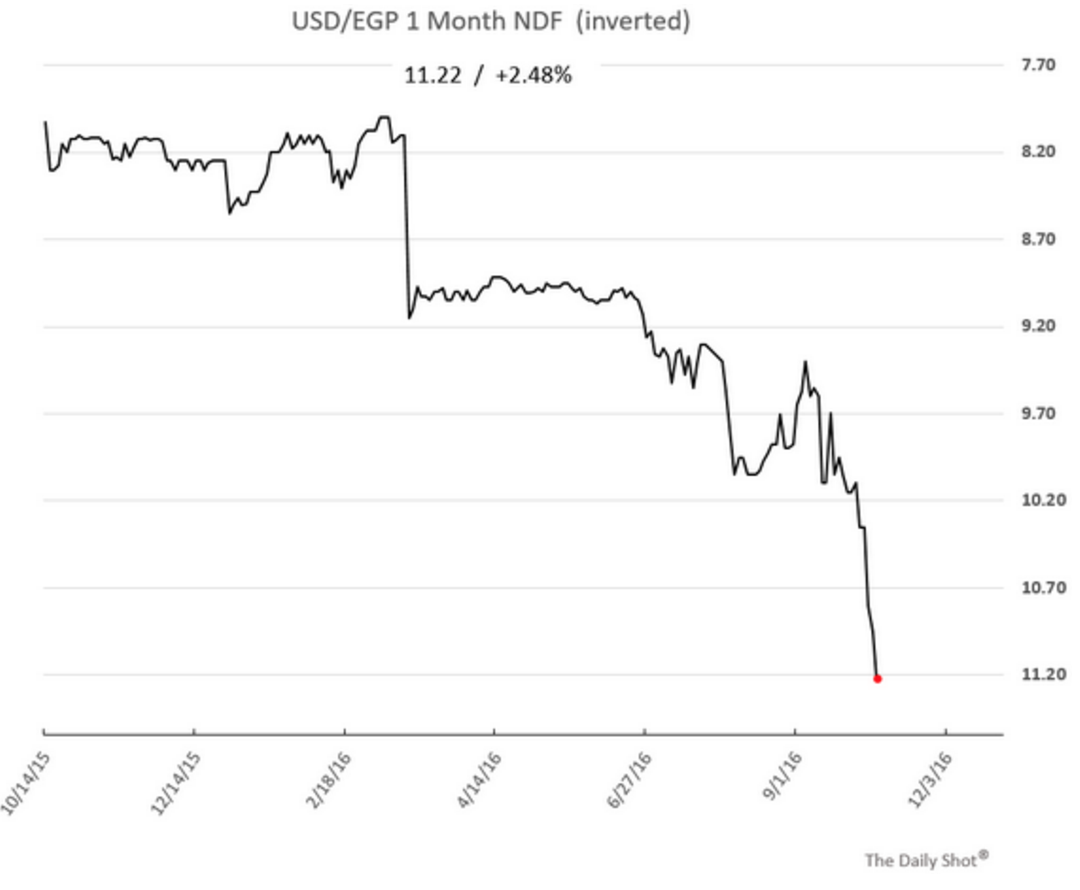

What’s the EGP really worth? Remember our grumbling last week that 16.00 for the EGP is nonsense given what are being quoted in the market are asks and asks alone? Non-deliverable forwards projected on Thursday that the EGP would be at 11.22 a month from now, according the Wall Street Journal’s newly-acquired charts newsletter. That compares with about 10.80 a week earlier.

Meanwhile, the EGX is whipsawing back and forth, and we’re going to play amateur stock picker and suggest rumors (and what little news there is) about devaluation will continue to drive volatility in the days ahead. The EGX rallied 3.9% — its biggest gain in more than two months — on Thursday after the Ismail government announced it had received a USD 2 bn deposit from Saudi Arabia, snapping three-day losing streak.