Is the SPAC party coming to an end?

Is the SPAC party coming to an end? Blank-check companies have jumped the shark: They’re the topic of rap songs (watch, runtime: 3:09), they’re getting featured in Twitter memes, and promoters are getting bored to a point that one of them named their vehicle “Just Another Acquisition Corp.” Elsewhere, a SPAC is investing in a business that promises people it’ll develop a flying taxi. But it seems like the punch bowl may be finally running dry as the bond selloff has a knock on effect on SPACs.

Boom time: Growth in SPACs — publicly traded shells that promise to merge with actual businesses later down the line — has been nothing short of exponential. Only 59 listed in 2019, raising USD 13.6 bn. In 2020, this almost quadrupled to hit 226, netting a stunning USD 83 bn. And only three months into 2021, 226 SPACs have raised an astonishing USD 73 bn. That, Heather Perlberg writes in an article for Bloomberg Wealth, accounts for more than 70% of the IPO market. All in all, 474 SPACs have made USD 156 bn over the past 15 months, drawing in everyone from Bill Ackman and Paul Ryan to Shaquille O’Neal and Colin Kaepernick. “Nowadays everyone who’s anyone seems to be doing one,” Perlberg writes.

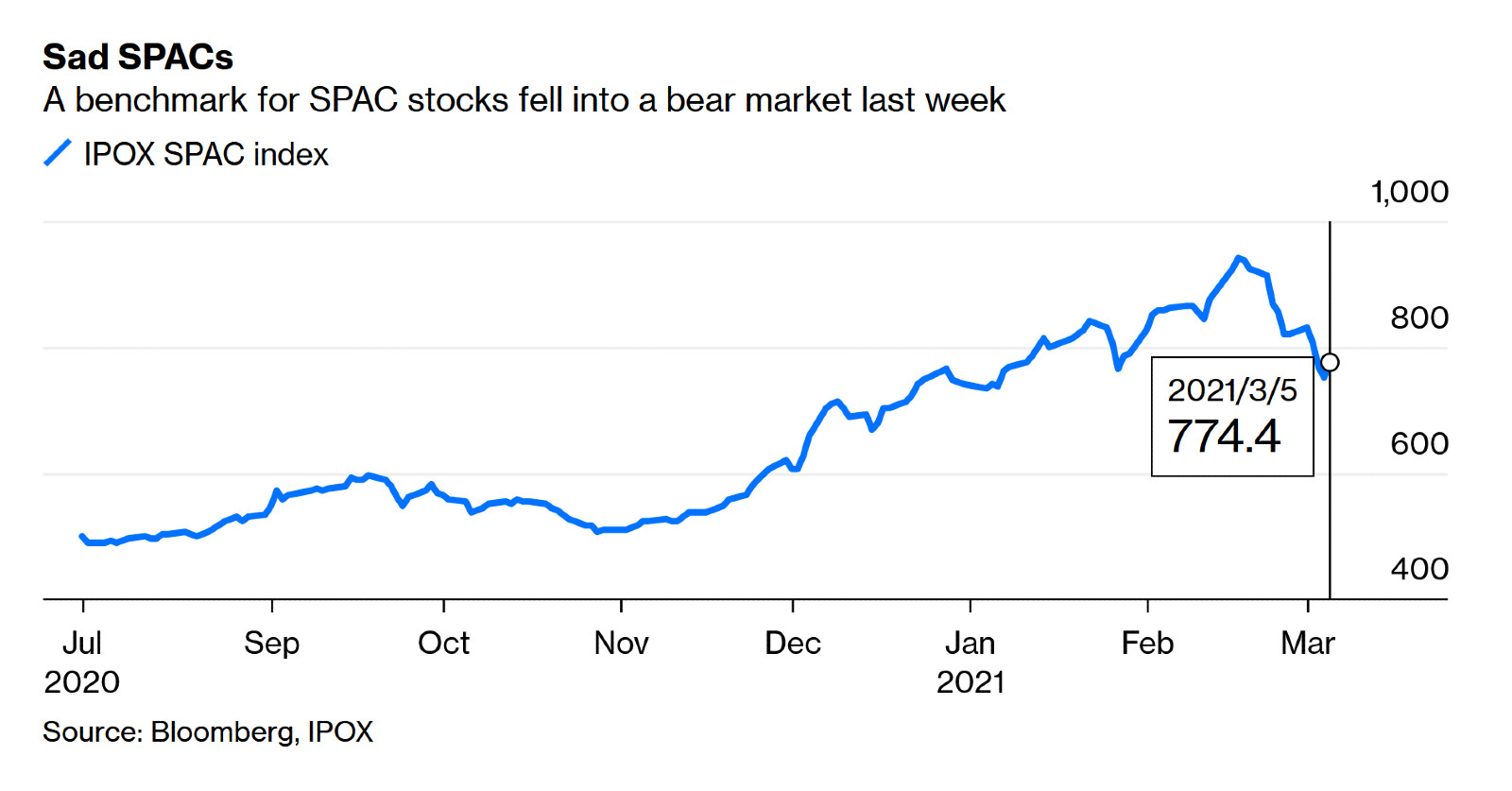

Is the party over? With unease in the US bond market rippling through into stocks, investors have lost their appetite for the highly-speculative risk-on assets offered up by the SPAC aficionados. The recently-launched IPOX SPAC index is down 20% from its peak in February, putting the market in bear territory, Chris Bryant writes in an op-ed for Bloomberg. Many SPACs are no longer trading at a premium, and are now valued below their USD 10 IPO price, a more normal state of affairs, Bryant writes.

Not necessarily: SPACs haven’t yet run into problems raising capital, despite prices falling through the floor, Bryant says. However, lower prices will make it harder for them to finalize acquisitions, and lower subscription rates could raise eyebrows among the hedge fund benefactors that have been so eager to ride the wave. And SPACs could be first on the chopping block when the market rally does come to an end. “Whatever stops this bull market will lay its first sights on SPACs,” said Steven Siesser, a partner with law firm Lowenstein Sandler. “They'll be the first casualty.”

The SEC has been sounding the alarm for months, after having cautioned in September about potential trouble down the road. The regulator has put out a guidance to outline potential conflicts and an exact figure of how much so-called SPAC sponsors can make. Those sponsors usually get paid a 20% bounty known as the “promote,” as well as other benefits which keeps them safe while public investors are out in the cold.

Check out our explainer on SPACS here.