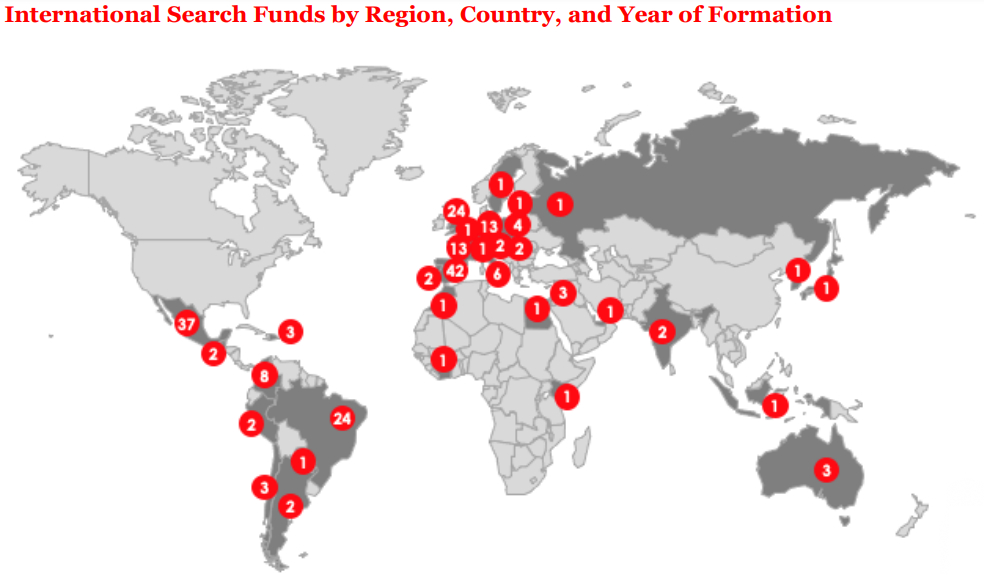

The case for search funds in Egypt: Last week, we took a deep-dive into an alternative investment vehicle that lies somewhere in between VC and private equity funding — search funds. The exciting part: This year is the first time that Egypt was included in the map of global search funds by IESE Business School international search funds report (pdf), as pictured above. So this week, we look at search fund activity in Egypt and the challenges that current and emerging players are facing.

REFRESHER- Search funds are investment outfits that raise funds from investors to acquire a small- or medium-sized business (SME) that is already operating well in the market, to then grow it and ensure return to their investors. Through the acquisition, the CEO of the company is replaced with a seasoned entrepreneur to lead the company for about 6-10 years. It provides investors with a safe, high returns, entrepreneurs with a business to run without struggling with the pains of building a company from scratch, and it gives business owners a safe way to exit their company.

While the concept is still nascent in Egypt, it does exist. “There are two searchers in Egypt right now, which means the path is being set,” managing partner of Spain-based search fund Moonbase Capital Ibrahim Abdel Rahim tells us, referring to Ahmed Raafat’s Giza Capital Partners and searcher Aly Taha (LinkedIn).

Who are the main (and probably only) players in Egypt? Over five months, Giza Capital Partners has raised USD 25 mn in commitments from 23 investors, of which 17 are international and 6 are local investors. Most of those investors are successful entrepreneurs who had previously exited companies. The investment outfit is looking to deploy its fund before January 2024, but is shying away from companies in the real estate, heavy industries, media and F&B sectors. On the other end, Taha is an entrepreneur raising a fund to ultimately acquire a USD 5-30 mn company and manage it.

And it seems like search funds are a good fit for the country: There are a lot of profitable SMEs in Egypt and the story of founders that have been successful but don’t want to continue leading the company and don’t have a clear succession plan in place is very common, Abdel Rahim says. About 85% of Egypt’s businesses are privately-held or family-owned, and there are about 4 mn MSMEs, Raafat explains. But most structured funds in Egypt are targeting ticket sizes of over USD 30 mn, which is too big regarding the size of local SMEs, he adds.

But there are still challenges at hand:

#1- Acquisition debt. Banks in Egypt do not easily provide acquisition debt, like in other countries, our experts concur. Once the company is acquired, debt is definitely easily obtained, but to fund part of the acquisition is somehow limited, they say. If obtained, it also comes with a lot of restrictions, Taha says. “In the US, there is a full ecosystem supporting search funds and there are banks that are specialized in providing search fund financing,” he adds.

However, it is an important part of ensuring returns. Think of it like this: If you buy a villa with a mortgage and rent it out, you pay off your debt with the rent you collect every month. “Once the debt is paid off, you suddenly own 100% of the villa, which doubles its value for you,” Raafat explains. The same thing is true for companies — if search funds have the option to obtain acquisition debt, the debt would be paid off from the acquired companies’ revenues. Once that is paid off, it automatically doubles the value of the money that the investors invested in the company, he adds.

#2- Egypt’s FX rate: While the devaluation of the EGP gives investors abroad a cost advantage, the FX rate risk is a challenge. “Many investors abroad compare the Egyptian market with others, such as Latin America, and if the local currency isn’t stable, it can deter them,” Taha explains.

#3- Regulation: The regulation for search funds is not yet established in Egypt. One way to deal with that is registering the fund as an LLC for instance, and act as a company buying another company. But in the long-term, this isn’t necessarily viable for the whole sector. “We aim to set up a set of regulations that is similar to the ones found abroad for search funds,” Taha explains.

#4- Investor and company awareness: Investors in Egypt are not necessarily shying away from the idea, but they are still unfamiliar with the concept, which comes with reasonable doubt. In light of the global recession and the VC funding squeeze in StartupLand, investors need “a new gig”, Abdel Rahim says. “Investors in Egypt are ready for search funds because they see SMEs as a beautiful asset class,” he adds. However, it is still challenging to convince local investors of the model, Raafat says.

Same goes for companies: Business owners usually do not only place a financial value, but also a sentimental one on their companies. Coming to them with a brand new exit concept that still hasn’t proven itself in the Egyptian market can prove to be challenging, Raafat says. There’s a certain lack of confidence, Taha says, but this is normal once a new investment vehicle is introduced to any market.

Your top stories on future trends for the week:

- Cairo Angels has a new face: Local investor outfit Cairo Angels has rebranded as Acacia Group.

- Saudi auto services startup Morni is looking to acquire local firms and has hired Exits as its buy-side advisor.

- F&B logistics platform OneOrder has closed a USD 3 mn seed round led by local fintech fund Nclude.

- E-commerce platform SideUp (formerly known as VOO) raised USD 1.2 mn in a seed round ahead of moving its HQ from Egypt to Riyadh.