Are humans going to be edged out of financial advising? + ESG funds could face a slowdown in 2022

2022 could be a slowdown year for ESG funds: ESG-focused funds are facing pressure from rising research costs and tech stocks — which previously helped bolster the investments’ performance over the past year — falling out of favor, signaling a potentially challenging year for the asset class, the Financial Times reports. The US Federal Reserve’s hawkish turn has put a damper on tech equity rallies, threatening a significant factor aiding the funds’ growth and fueling a sell-off in some specialist ESG-focused companies. Analysts are concerned that if the current shift in the market persists, the sector could suffer a big hit, especially when ESG fund managers are already bearing the brunt of high research costs, which are expected to reach USD 1.3 bn globally this year.

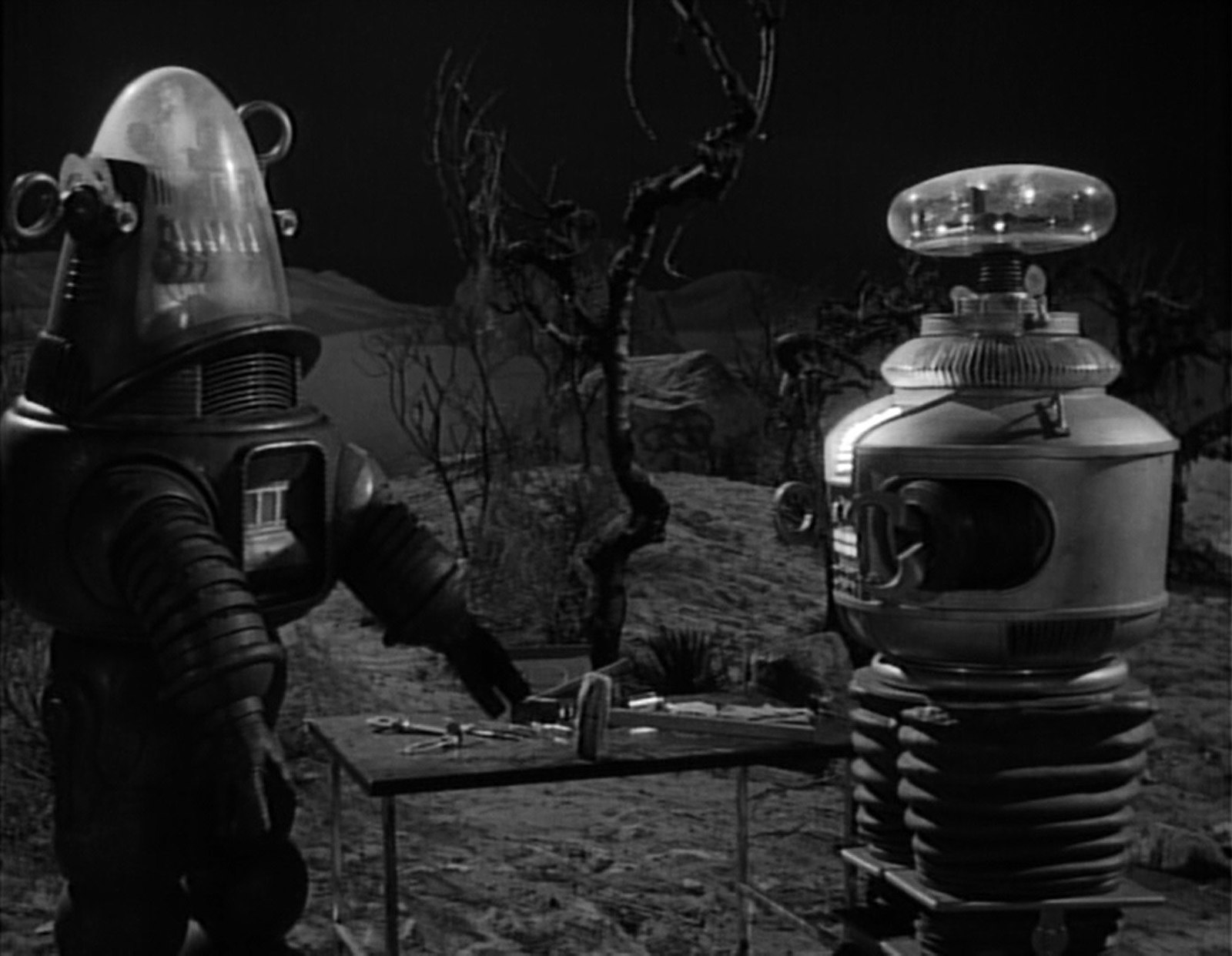

The robots are coming, Chapter XVII: Are humans going to be edged out of financial advising? Robo-advisors, or algorithms developed to automate digital investing, may soon be managing upward of USD 1 tn of wealth in the US, reports CNBC. A decade after they first began appearing in 2008, automated financial services were managing around USD 785 bn. Launched both by independent shops and traditional Wall Street brokerages to engage younger investors interested in online stock trading and crypto, robo-advisors offer a low barrier to entry and are best suited to new investors who want to outsource money management at a low cost. Robo-advisors can move around anything from a few bucks to USD 3k, versus the minimums of USD 250k that traditional firms charge, while charging a fraction of the fees that traditional advisors charge. Robo-advisors still fall short in the “human” aspect of advising, lacking the ability to help clients understand the reasoning behind different strategy recommendations, read body language, measure client satisfaction, or manage clients needs beyond investments.

Who knew taxing the rich could help the poor? A bold wealth tax on the world’s fat cats could help vaccinate everyone on the planet and lift a majority of the population out of poverty, according to an analysis of 66 nations by Oxfam and others. The analysis is based on an initial 2% tax rate on wealth over USD 5 mn, which expands to 5% on wealth over USD 1 bn. The analysis says it would generate USD 2.52 tn — enough to cover the cost of two vaccine shots and a booster for the world’s estimated 8 bn people. World Bank data suggests that as of December, only 4% of citizens in developing countries were vaccinated, compared to more than 80% of citizens of developed nations, Bloomberg reports.

A rare 555.55 carat (yes, you read that correctly) black diamond is going on auction at Sotheby’s in February, where it’s expected to fetch GBP 5 mn or more, CNN reports. The naturally faceted Carbonado Diamond — described as a “cosmic wonder’’ and a “true natural phenomenon” —is believed to have originated in outer space, created either through meteoric impact or through an asteroid that collided with our planet bns of years ago.

Not a 5G conspiracy: Flights are steering clear of the US as 5G technology is being rolled out over concerns from airlines that it could disrupt aircraft radar altimeters and key safety systems, reports Bloomberg. Emirates Airlines, Japan Airlines, British Airways, and Korean Air Lines are among the carriers that have rerouted or canceled flights for the coming days. The concern has led AT&T and Verizon — the companies that are implementing the 5G rollout — to say they would delay turning on the new cell towers around key airports after talks with US government officials, according to Reuters.