S&P says EMs have a long way to go to recovery

Governments in the emerging world have few bullets left in the policy chamber to fight the pandemic, making a speedy vaccine rollout and a swift recovery all the more important, S&P Global has said in its 2021 Global Outlook. “Most EMs have limited flexibility to provide additional fiscal or monetary support without hurting their credit quality,” meaning that reforms will be critical to boost growth, productivity and tax revenues,” the ratings agency writes.

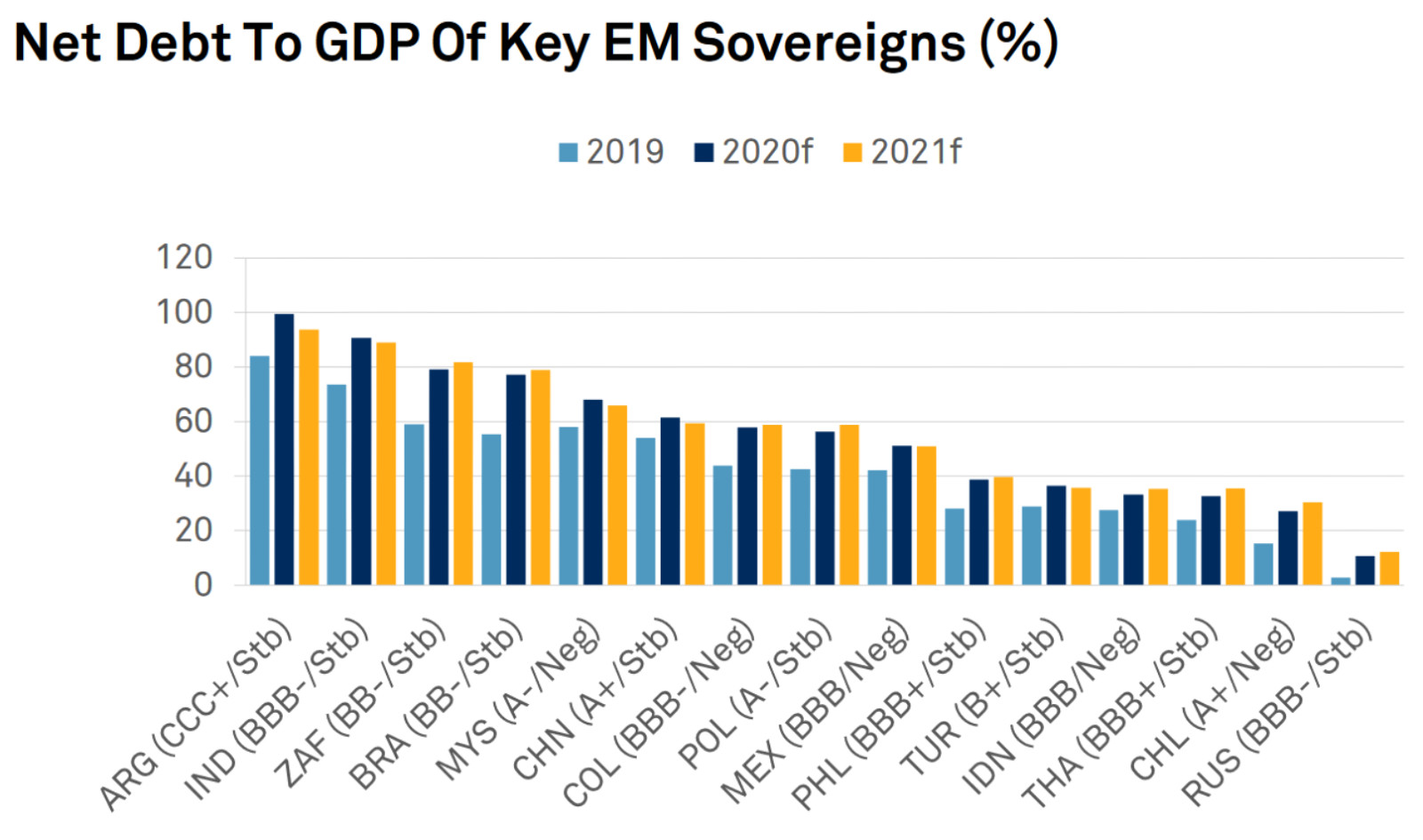

Not many of the 16 biggest EMs have a lot of leeway to accrue more debt: The ratings agency has either downgraded or revised its outlook to negative for eight of the 16 major EMs while five still carry negative outlooks — Chile, Colombia, Mexico, Indonesia, and Malaysia. And because S&P’s methodology doesn’t permit corporate and banking ratings to exceed the sovereign, further downgrades could also mean lower ratings throughout the economy, pushing up debt costs and restricting access to credit.

Where is the corporate recovery going to come from? S&P expects that consumer staples, essential retail, healthcare, telecom and tech companies will see earnings in emerging markets return to pre-pandemic levels this year, while most sectors will stage a complete rebound in 2022.

Other sectors will need to wait another two years to see a full recovery: Hospitality, tourism, airlines and non-essential retail firms won’t recover until 2023, the ratings agency suggests.

Banks have so far been able to minimize damage to their portfolios: Emergency measures taken to ease pressure on borrowers and buffer banks’ capital reserves and liquidity have meant that loan losses have so far been minimal. “Key EM banks have been able to delay the effect of the pandemic on their portfolios mainly by extending payment holidays and adopting more lenient accounting for these loans,” S&P says.

But this will change if things don’t start improving soon: “A deeper and longer economic shock will put additional strain on banks’ asset quality, fueled by mounting SME bankruptcies and unemployment.”

The recovery is slower than anticipated: The recent escalation of the pandemic in many EMs and developed countries will weigh on economic activity through 1Q2021, S&P says.

But China could make all the difference in the second half of the year, particularly to EMs reliant on commodity exports such as Brazil, South Africa and Indonesia.

But what are the key risks?

#1 A slower recovery: A longer, more drawn out global recovery or slow vaccine rollouts will likely result in higher debts and more pressure on public finances, resulting in credit downgrades. Companies could also see their ratings slide should further economic disruption hit earnings, potentially resulting in bankruptcies among those rated B and lower.

#2 Crowds on the streets: Rising levels of poverty, fraying public services and growing frustration with lockdown restrictions could provoke social unrest and political instability should these trends remain unaddressed.