The job market in the covid age

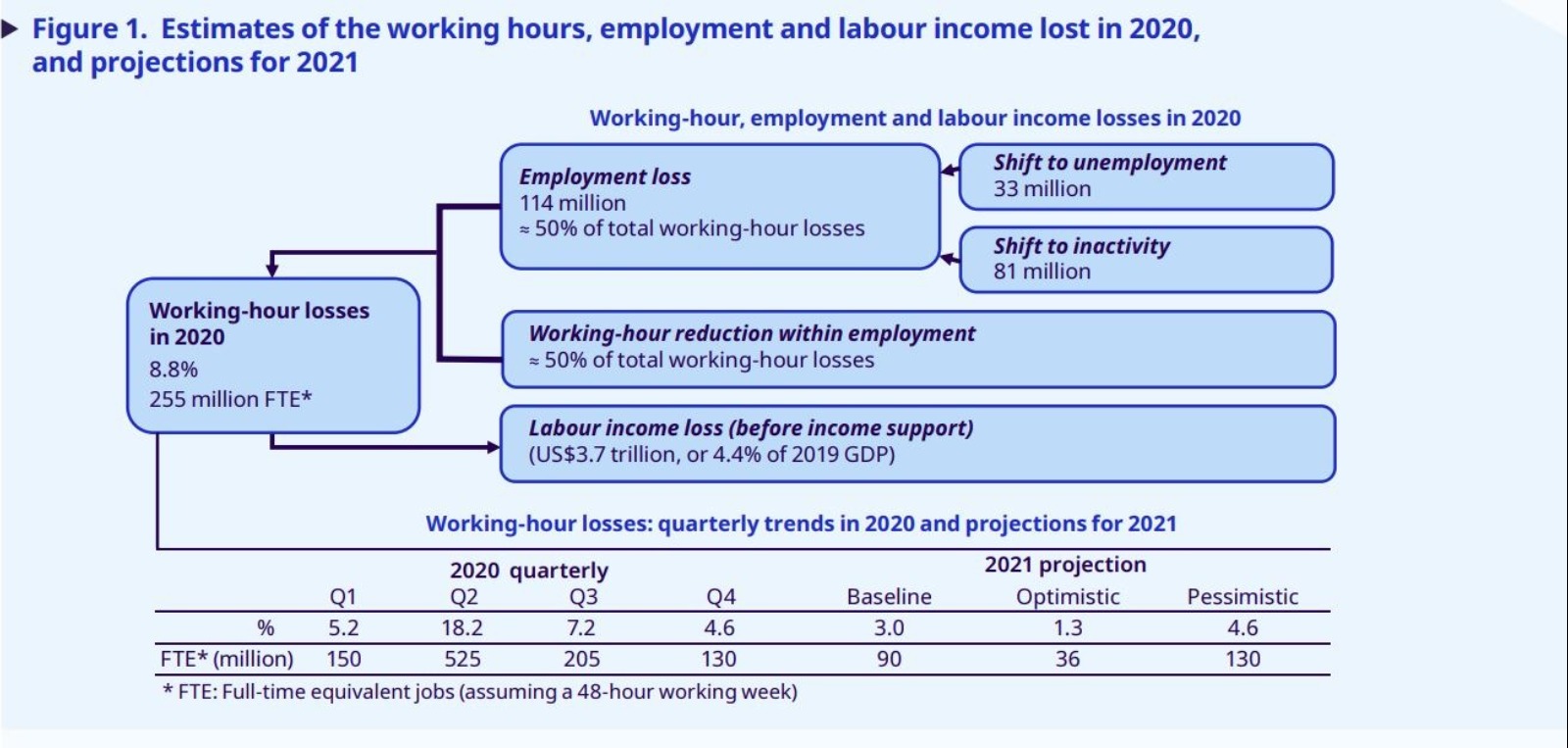

Here’s how much global employment suffered from the pandemic: The global economy lost the equivalent of as many as 255 mn full-time jobs in 2020, the International Labor Organization (ILO) said in a recent report (pdf). That’s around 8.8% of global working hours relative to 4Q2019, creating an unprecedented level of damage that’s four times worse than that caused by the global financial crisis. The damage led to 114 mn in global job losses, fewer hours for those who retained their jobs, and a USD 3.7 tn drop in global labor income (or 4.4% of global GDP), the ILO said.

1H2020 was a bit more of a silver lining: “A stronger than expected rebound in working hours,” particularly in low-middle income countries, played out favorably, the ILO said. The organization revised downward its working-hour loss estimates for 3Q2020 to 7.2%, from a previous expectation of 12.1%. And in 4Q2020, the report says that global working hours dropped 4.6%, which is still significant, but lower than a previous forecast.

Will 2021 see a trend reversal? Maybe, but it won’t be easy: The ILO’s baseline scenario expects 2021 to bring further working hour losses equivalent to 90 mn jobs, or a 3% loss relative to 4Q2019. In a more optimistic scenario, losses will be contained to 1.3% compared to pre-crisis levels (the equivalent of 36 mn jobs). Meanwhile, if things go south and vaccine progress falls behind, losses are projected to come in at 4.6%. That’s to say: 130 mn jobs.

Uneven impact: Certain geographical clusters were more impacted than others, the ILO said. On a regional level, losses were the highest in the Americas and the lowest in Europe and Central Asia — as job schemes, particularly in the EU, helped. There was also disparity in sector impact, with job losses peaking in the hard-hit accommodation and food services, arts and culture, and retail sectors. By way of contrast, the least affected sectors (including ICT and some financial services) made job gains.

In relative terms, job losses were higher among women (5%) and young workers (8.7%) than among men and older employees.

Recovery: “The signs of recovery we see are encouraging, but they are fragile and highly uncertain,” Bloomberg quoted ILO Director-General Guy Ryder as saying. The rebound could also be disproportionate and uneven, and there are “serious concerns” that employees and businesses most affected stand to benefit less from a recovering global economy, the ILO said.

What about Egypt? While the report doesn’t specifically mention us, the drop in working hours across Africa (7.7% drop compared to pre-pandemic levels) was smaller than in other regions. This can be explained by the fact that only one in five African workers live in countries with mandatory workplace restrictions or closures in place, the ILO said. The sharpest drop in working hours was in the southern part of the continent, followed by northern Africa (which includes Egypt), and eastern Africa. In 2021, job losses are expected to remain mild across the region, with an expected 2.5% reduction from pre-pandemic levels under a baseline scenario, a 1.4% drop in a more optimistic turn of events and 4.2% if the effects of covid are prolonged.

Unemployment in Egypt hit a near two-year high of 9.6% in 2Q2020 as the pandemic took hold. The jobless rate promptly returned to pre-pandemic levels in the third quarter of the year, falling to 7.3% after the government eased lockdown restrictions in late June 2020.