Look at banks

Pharos tips banks, NBFS players, fintech and consumer stocks heading into 2020, our friend Radwa El Swaify and her team at Pharos suggest in their 2021 equity strategy out now. You can tap or click here to read the report in full (pdf). It includes solid, deep dives into sectors and shares heading into the new year along with a look at the macro backdrop.

Good news for traders: Pharos sees the market “has potential for 25-30% rerating” as corporate earnings continue to recover in the coming year. The key to bringing foreign investors back? Fresh IPOs. Foreign investors have been net sellers on a monthly basis since 2019 except when they piled into the Fawry IPO, and the trend accelerated during the EM selloff prompted by covid-19.

Worth a close read: Slide 9, which breaks down 19 themes heading into the new year and which shares benefit from them before going deep later in the report.

MACRO PICTURE- Low inflation, a stable EGP and early signs of real GDP growth point to smooth sailing for the remainder of FY2020-2021, the team at Pharos writes, even as a widening budget deficit and sluggish state revenues remain caution signs on the horizon.

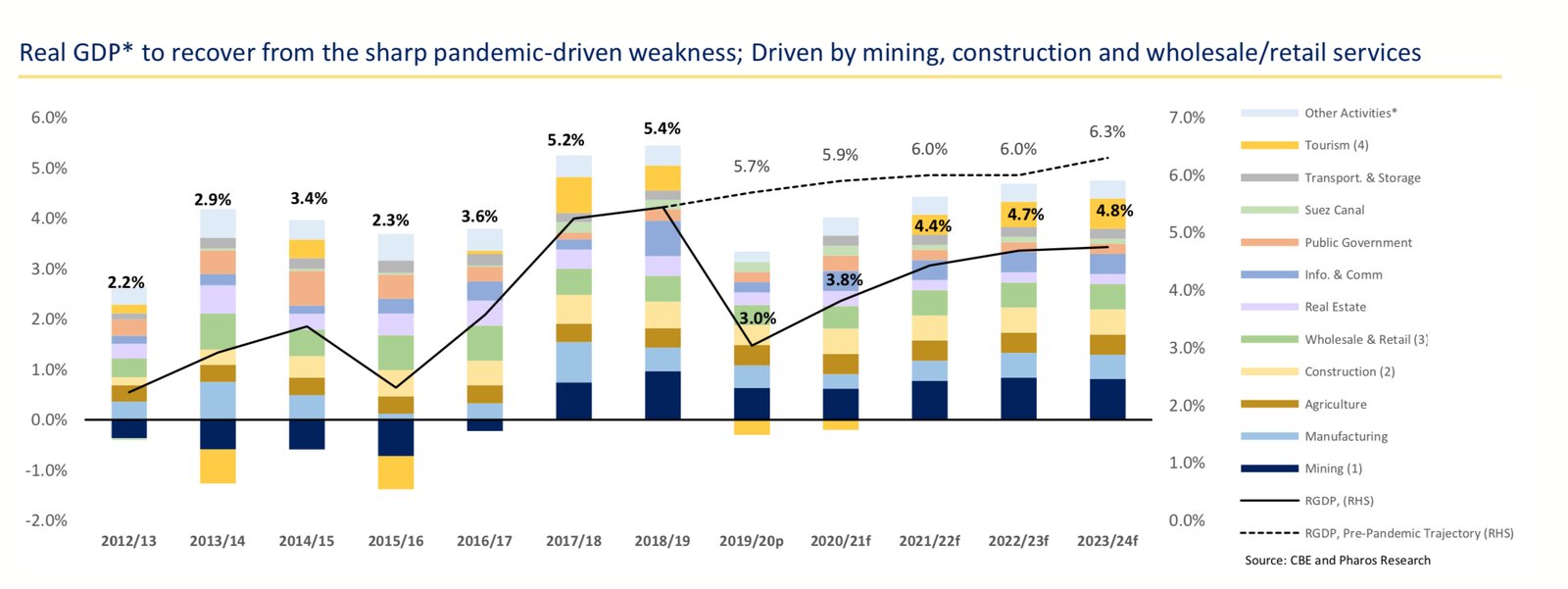

Driving the economy: Resources and construction as oil prices recover and the government continues its large-scale national infrastructure projects, pushing real GDP growth back up to 3.9% in FY2020-2021, up from 3.5% last fiscal year.

The budget deficit will narrow to 7.9% of GDP in FY2020-2021, after having widened to 9.1% last year due to increased spending on fiscal stimulus, Pharos says. Increasing tax receipts will push state revenues up to EGP 1 tn, from EGP 900 bn in FY2019-2020, while spending will increase 4% — its weakest pace ever — to hit EGP 1.5 tn, according to Pharos. This is mainly thanks to a falling subsidy bill and a decreased interest burden.

Foreign debt is on the rise: Although domestic debt has formed the lion’s share of government financing, external debt has more than doubled in the past five years reaching 30% of total debt.

Inflation will remain stubbornly low, averaging 4.9% through to the end of the current fiscal year — more than a percentage point below the lower bound of the central bank’s 9% (+/- 3%) target rate.

This will pave the way for another 200 bps of interest rate cuts during 2021, taking the overnight lending rate down to 7.25% and the deposit rate to 6.25%. The move would still leave “some room for further easing, especially if global monetary conditions and hard currency inflows into Egypt remain as supportive of lower rates,” the research note said.

A stable outlook for the EGP will see the nominal exchange rate reach EGP 16.00 to the USD in FY2020-2021 and maintain the same annual average for the following three years.

Despite further easing, Egyptian treasuries will continue to be attractive to foreign investors relative to other emerging markets. Thanks to the waves of covid stimulus, developed countries are almost universally offering negative yields while rates in most other EMs are now below 5%. In comparison, Egypt currently offers a world-beating 1-year real yield of 7.7%.

Foriegn reserves will continue to tick up, reaching USD 43 bn by the end of the fiscal year, having hit a low of USD 36 bn in May due to the financial panic caused by the pandemic. Reserves stood at USD 39.2 bn at the end of November. BNP Paribas takes a far less generous forecast, putting foreign reserves at USD 38 bn by the end of FY 2020-2021.

The current account deficit will continue to widen in the short term reaching 4.3% of GDP due to falling tourism revenues, lower remittances, weak FDI inflows and low interest rates around the globe.